#ApollotoBuy90MMORPHOin4Years Institutional DeFi Adoption Accelerates: Apollo Targets Morpho Governance Tokens

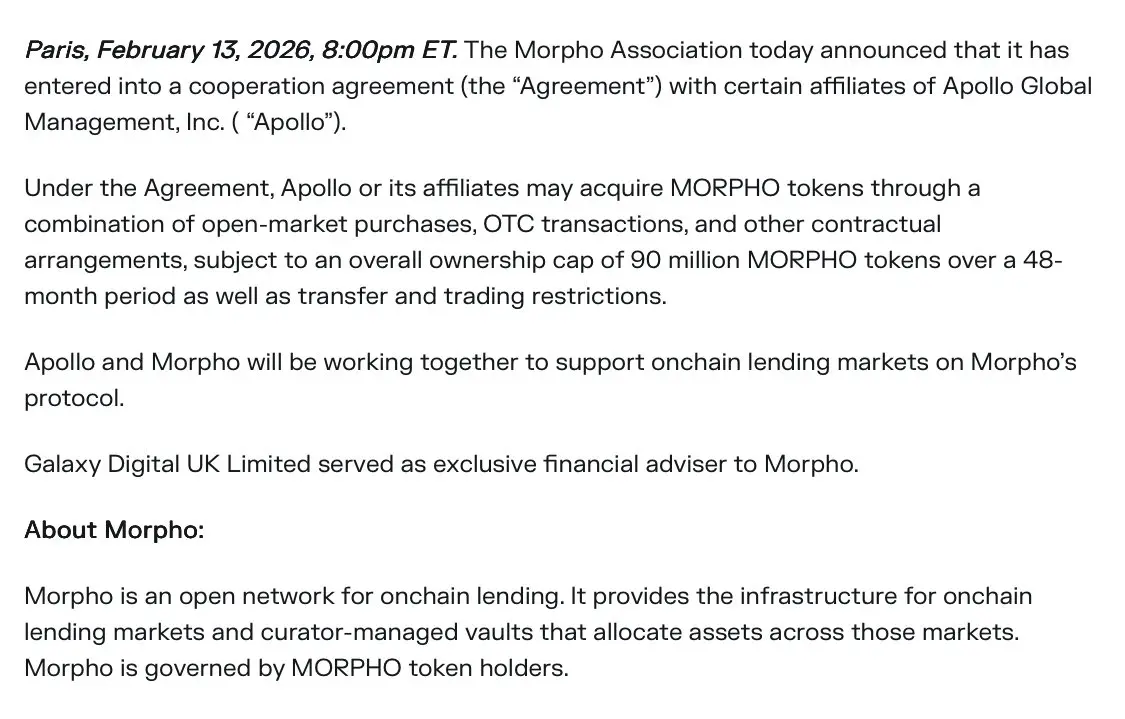

Global alternative investment powerhouse Apollo Global Management has reportedly unveiled plans to acquire $90 million in MORPHO tokens over a four-year horizon, signaling a major institutional step into decentralized finance (DeFi) governance. While traditional crypto allocations have largely focused on Bitcoin, Ethereum, and other liquid assets, Apollo’s strategy represents a sophisticated approach—directly participating in the governance and utility layers of emerging DeFi protocols.

🔹 Understanding MORPHO

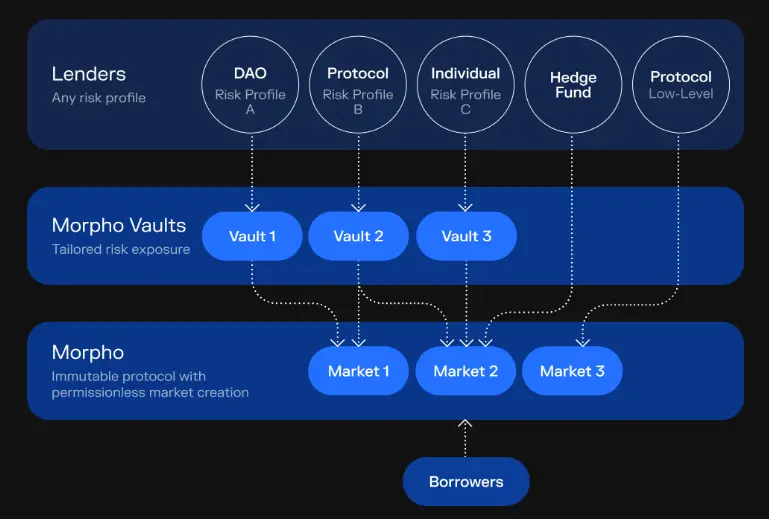

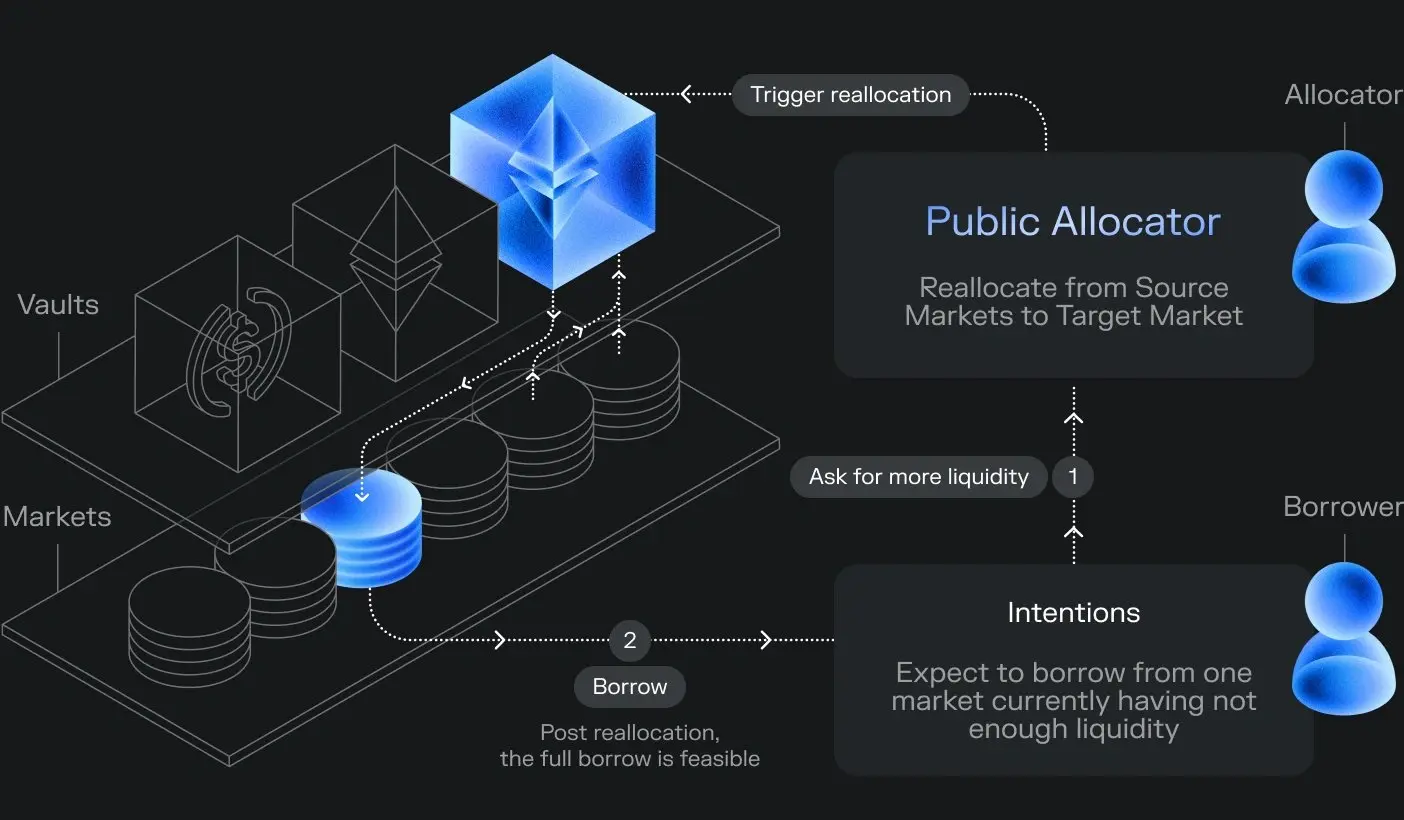

MORPHO is the native token of Morpho, a protocol designed to optimize capital efficiency within existing lending markets. Acting as a peer-to-peer overlay on top of major on-chain liquidity pools, Morpho matches lenders and borrowers more directly to:

Reduce inefficiencies in lending markets

Improve yields for lenders

Lower borrowing costs for borrowers

Holders of MORPHO gain governance rights, influencing protocol parameters, upgrades, and ecosystem incentives. The token also provides potential access to protocol fee distributions and other incentive mechanisms.

📈 Apollo’s Multi-Year Strategy

Apollo’s approach is notable for both its scale and deliberate pacing:

$90M total allocation spread over 4 years

Mitigates market impact and volatility

Signals long-term confidence in protocol growth

Enables strategic governance participation rather than speculative trading

This aligns with institutional best practices, emphasizing steady accumulation, active governance, and long-term structural influence within DeFi ecosystems.

🌐 Institutional Implications

Apollo’s entry into Morpho governance is emblematic of a broader convergence between traditional finance and decentralized systems:

Operational Influence: Institutions may shape protocol upgrades, risk parameters, and incentive structures

Market Credibility: Institutional backing can attract liquidity, professional market makers, and partnerships

Regulatory Signaling: Demonstrates to regulators that governance tokens are being managed responsibly by sophisticated actors

Acceleration of Adoption: Other institutions may follow suit, legitimizing governance token investment as part of mainstream portfolios

This integration highlights the growing intersection between DeFi’s programmable infrastructure and the capital, compliance, and risk management frameworks of traditional finance.

⚠️ Risks and Considerations

Despite the strategic upside, several risks remain:

Governance tokens are inherently volatile and tied to protocol success

Smart contract vulnerabilities and DeFi exploits

Liquidity risks in rapidly evolving lending markets

Regulatory uncertainty regarding token classification and cross-border compliance

Institutional influence may conflict with decentralized governance ideals

Apollo’s strategy must balance financial return with fiduciary and operational standards while navigating these complexities.

🔮 Strategic Outlook

The acquisition positions Apollo for potential long-term upside in decentralized credit markets. As DeFi lending matures and integrates with tokenized real-world assets, MORPHO could serve as foundational infrastructure for next-generation financial products. Governance participation provides:

Economic upside via fees or token accrual

Structural influence over protocol evolution

Market leadership in institutional DeFi engagement

Over the next four years, the execution of this $90M strategy will serve as a benchmark for institutional confidence in governance-layer participation, demonstrating how traditional asset managers can meaningfully shape blockchain-based financial systems.

📌 Broader Significance

Apollo’s planned investment reflects several macro trends in 2026:

DeFi protocols are maturing with professional-grade governance and scalable liquidity

Institutional capital is increasingly entering governance layers, not just speculative markets

Traditional finance and decentralized systems are converging into hybrid, programmable ecosystems

Retail and institutional adoption may accelerate as governance tokens become investable assets

In short, Apollo’s MORPHO acquisition is more than a large purchase — it signals the next evolution of institutional DeFi participation, bridging the gap between professional investors and decentralized financial infrastructure.

Bottom Line:

$90M over four years → governance influence + long-term economic upside → institutional validation of DeFi lending infrastructure. Apollo is shaping the future of decentralized credit markets, and Morpho is at the center of this evolution. 🚀📊

Global alternative investment powerhouse Apollo Global Management has reportedly unveiled plans to acquire $90 million in MORPHO tokens over a four-year horizon, signaling a major institutional step into decentralized finance (DeFi) governance. While traditional crypto allocations have largely focused on Bitcoin, Ethereum, and other liquid assets, Apollo’s strategy represents a sophisticated approach—directly participating in the governance and utility layers of emerging DeFi protocols.

🔹 Understanding MORPHO

MORPHO is the native token of Morpho, a protocol designed to optimize capital efficiency within existing lending markets. Acting as a peer-to-peer overlay on top of major on-chain liquidity pools, Morpho matches lenders and borrowers more directly to:

Reduce inefficiencies in lending markets

Improve yields for lenders

Lower borrowing costs for borrowers

Holders of MORPHO gain governance rights, influencing protocol parameters, upgrades, and ecosystem incentives. The token also provides potential access to protocol fee distributions and other incentive mechanisms.

📈 Apollo’s Multi-Year Strategy

Apollo’s approach is notable for both its scale and deliberate pacing:

$90M total allocation spread over 4 years

Mitigates market impact and volatility

Signals long-term confidence in protocol growth

Enables strategic governance participation rather than speculative trading

This aligns with institutional best practices, emphasizing steady accumulation, active governance, and long-term structural influence within DeFi ecosystems.

🌐 Institutional Implications

Apollo’s entry into Morpho governance is emblematic of a broader convergence between traditional finance and decentralized systems:

Operational Influence: Institutions may shape protocol upgrades, risk parameters, and incentive structures

Market Credibility: Institutional backing can attract liquidity, professional market makers, and partnerships

Regulatory Signaling: Demonstrates to regulators that governance tokens are being managed responsibly by sophisticated actors

Acceleration of Adoption: Other institutions may follow suit, legitimizing governance token investment as part of mainstream portfolios

This integration highlights the growing intersection between DeFi’s programmable infrastructure and the capital, compliance, and risk management frameworks of traditional finance.

⚠️ Risks and Considerations

Despite the strategic upside, several risks remain:

Governance tokens are inherently volatile and tied to protocol success

Smart contract vulnerabilities and DeFi exploits

Liquidity risks in rapidly evolving lending markets

Regulatory uncertainty regarding token classification and cross-border compliance

Institutional influence may conflict with decentralized governance ideals

Apollo’s strategy must balance financial return with fiduciary and operational standards while navigating these complexities.

🔮 Strategic Outlook

The acquisition positions Apollo for potential long-term upside in decentralized credit markets. As DeFi lending matures and integrates with tokenized real-world assets, MORPHO could serve as foundational infrastructure for next-generation financial products. Governance participation provides:

Economic upside via fees or token accrual

Structural influence over protocol evolution

Market leadership in institutional DeFi engagement

Over the next four years, the execution of this $90M strategy will serve as a benchmark for institutional confidence in governance-layer participation, demonstrating how traditional asset managers can meaningfully shape blockchain-based financial systems.

📌 Broader Significance

Apollo’s planned investment reflects several macro trends in 2026:

DeFi protocols are maturing with professional-grade governance and scalable liquidity

Institutional capital is increasingly entering governance layers, not just speculative markets

Traditional finance and decentralized systems are converging into hybrid, programmable ecosystems

Retail and institutional adoption may accelerate as governance tokens become investable assets

In short, Apollo’s MORPHO acquisition is more than a large purchase — it signals the next evolution of institutional DeFi participation, bridging the gap between professional investors and decentralized financial infrastructure.

Bottom Line:

$90M over four years → governance influence + long-term economic upside → institutional validation of DeFi lending infrastructure. Apollo is shaping the future of decentralized credit markets, and Morpho is at the center of this evolution. 🚀📊