# CentralBanksBuyMoreGold

5.16K

Mr_Desoza

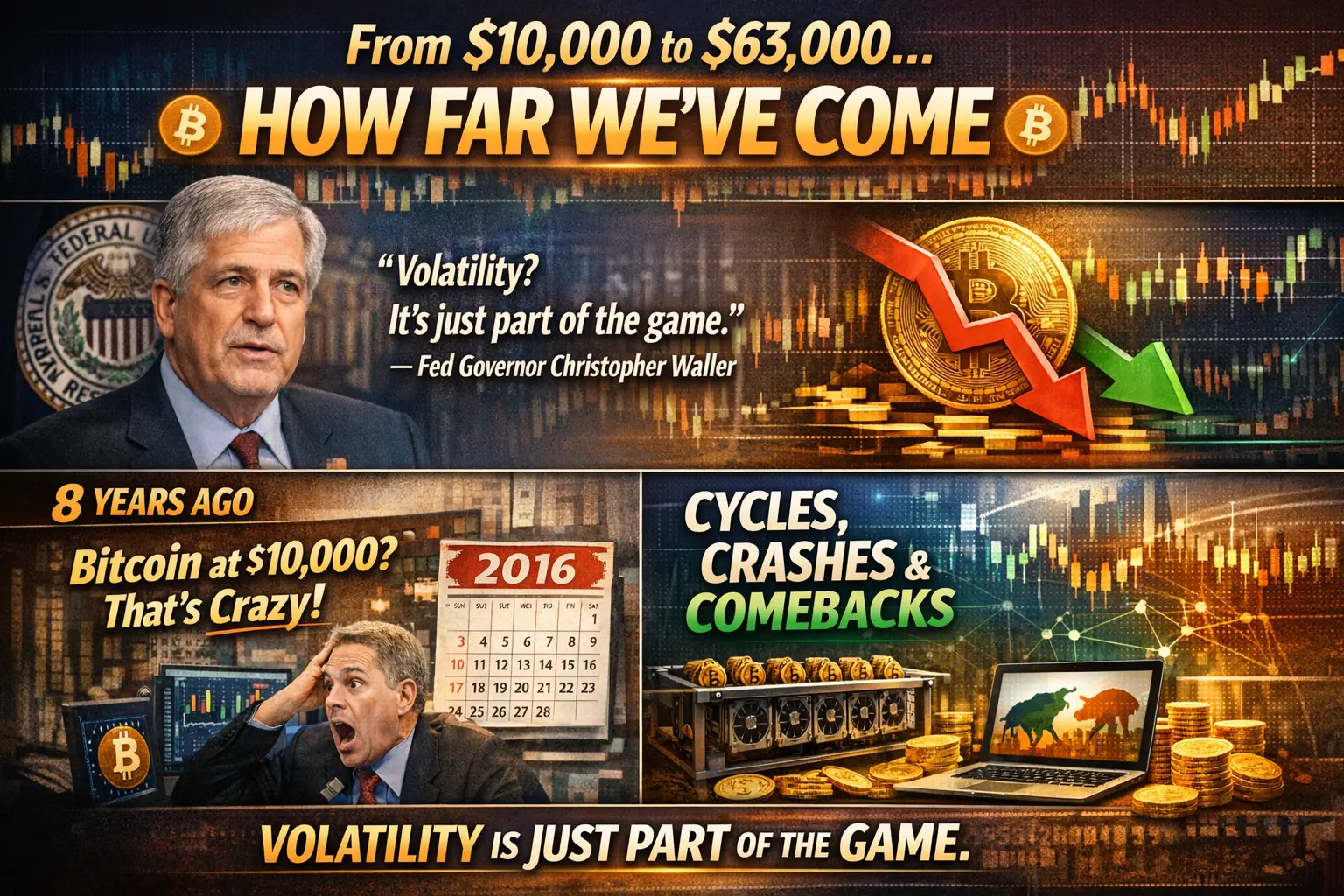

When Christopher Waller, a sitting U.S. Federal Reserve Governor, casually shrugs off Bitcoin’s swings and calls volatility “part of the game,” it says a lot about how far this asset has traveled. Not long ago, Bitcoin’s price movements were treated as proof that it was unstable, experimental, or destined to fade. Today, even policymakers who spend their careers thinking about monetary stability acknowledge that sharp moves are not an anomaly for Bitcoin—they are embedded in its nature.

Waller’s comparison is especially striking. At around $63,000, Bitcoin is being discussed as if it is merely

Waller’s comparison is especially striking. At around $63,000, Bitcoin is being discussed as if it is merely

BTC-0,95%

- Reward

- like

- Comment

- Repost

- Share

$BTC /USDT ANALYSIS

BTC is reacting exactly where it should—rejection from supply after the broadening wedge breakout. Cloud support is holding price up. If bulls reclaim the supply zone, momentum flips fast. Until then, patience and confirmation matter.$BTC #USIranNuclearTalksTurmoil #CentralBanksBuyMoreGold

BTC is reacting exactly where it should—rejection from supply after the broadening wedge breakout. Cloud support is holding price up. If bulls reclaim the supply zone, momentum flips fast. Until then, patience and confirmation matter.$BTC #USIranNuclearTalksTurmoil #CentralBanksBuyMoreGold

BTC-0,95%

- Reward

- like

- Comment

- Repost

- Share

# CentralBanksBuyMoreGold

he "Crypto & Gold" Parallel (For the Web3 Community)

Caption: First they buy Gold. Next

they buy...? 🥇➡️₿

It’s fascinating to watch #CentralBanksBuyMoreGold

while the crypto market matures. Both assets represent the same fundamental

desire: Hard money that cannot be printed at will by a government.

Central banks are digitizing their gold buying, while

retail is digitizing their savings with Bitcoin. The narrative is the same: Trust

in institutions is fading; trust in hard assets is rising.

If Gold is the insurance of the elite, what is yours? 🤔🛡️

#Bitcoin #C

he "Crypto & Gold" Parallel (For the Web3 Community)

Caption: First they buy Gold. Next

they buy...? 🥇➡️₿

It’s fascinating to watch #CentralBanksBuyMoreGold

while the crypto market matures. Both assets represent the same fundamental

desire: Hard money that cannot be printed at will by a government.

Central banks are digitizing their gold buying, while

retail is digitizing their savings with Bitcoin. The narrative is the same: Trust

in institutions is fading; trust in hard assets is rising.

If Gold is the insurance of the elite, what is yours? 🤔🛡️

#Bitcoin #C

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

172.28K Popularity

34.99K Popularity

31.84K Popularity

76.63K Popularity

15.09K Popularity

277.23K Popularity

377.7K Popularity

27.45K Popularity

16.68K Popularity

14.82K Popularity

15.01K Popularity

13.7K Popularity

13.58K Popularity

41K Popularity

News

View MoreBank of America: Market sentiment remains "extremely optimistic," with the AI bubble becoming investors' top concern for tail risk

4 m

Trump says Hillary is mentally deranged

15 m

BVNK obtains Malta MiCA license, will expand stablecoin services throughout Europe

21 m

Data: EtherFi's single-user revenue reaches $256, far surpassing payment platforms such as Revolut, Wise, and SoFi

45 m

Data: The total market value of RWA assets on the Ethereum blockchain surpasses $15 billion

49 m

Pin