# CryptoStrategy

21.92K

MissCrypto

🚨 Crypto Survival Guide: How to Navigate the Market Like a Pro

The crypto market moves fast — and without the right strategy, it can move against you just as quickly. Whether you're a beginner or an experienced trader, survival in crypto isn’t about luck; it’s about discipline, risk management, and staying informed.

First, always prioritize risk management over hype. Never invest more than you can afford to lose, and avoid emotional decisions driven by FOMO or panic. Smart investors set clear entry and exit plans before entering any trade.

Second, diversification is your shield. Putting all y

The crypto market moves fast — and without the right strategy, it can move against you just as quickly. Whether you're a beginner or an experienced trader, survival in crypto isn’t about luck; it’s about discipline, risk management, and staying informed.

First, always prioritize risk management over hype. Never invest more than you can afford to lose, and avoid emotional decisions driven by FOMO or panic. Smart investors set clear entry and exit plans before entering any trade.

Second, diversification is your shield. Putting all y

- Reward

- 6

- 7

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#CryptoSurvivalGuide 🛡️ #CryptoSurvivalGuide 🛡️

Crypto isn’t just about quick gains—it’s about surviving the waves and thriving long-term. Here’s your essential checklist:

🔹 Stay Informed: Follow market trends, news, and regulatory updates. Knowledge is your first shield.

🔹 Diversify Smartly: Mix large-cap, mid-cap, and a few promising small-cap assets. Don’t put all eggs in one basket.

🔹 Manage Risk: Use stop-losses, set limits, and avoid emotional trading.

🔹 Think Long-Term: Market dips and surges are normal. Patience pays off more than panic.

🔹 Secure Your Assets: Use hardware wallet

Crypto isn’t just about quick gains—it’s about surviving the waves and thriving long-term. Here’s your essential checklist:

🔹 Stay Informed: Follow market trends, news, and regulatory updates. Knowledge is your first shield.

🔹 Diversify Smartly: Mix large-cap, mid-cap, and a few promising small-cap assets. Don’t put all eggs in one basket.

🔹 Manage Risk: Use stop-losses, set limits, and avoid emotional trading.

🔹 Think Long-Term: Market dips and surges are normal. Patience pays off more than panic.

🔹 Secure Your Assets: Use hardware wallet

- Reward

- 8

- 7

- Repost

- Share

Discovery :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow?

🔥 BUY THE DIP OR WAIT NOW? 🔥

The market pulls back… and pressure builds.

Red candles trigger fear. Green candles trigger FOMO.

But smart traders don’t react — they calculate.

📉 A dip can offer discounted entries.

📊 Waiting can provide confirmation and structure.

🛡 Risk management always comes first.

Buying blindly is gambling.

Waiting without analysis is hesitation.

Winning comes from having a predefined plan.

Ask yourself:

Is this a healthy pullback?

Is support holding?

Is volume confirming strength?

The best move isn’t emotional —

it’s strategic.

In volatile market

🔥 BUY THE DIP OR WAIT NOW? 🔥

The market pulls back… and pressure builds.

Red candles trigger fear. Green candles trigger FOMO.

But smart traders don’t react — they calculate.

📉 A dip can offer discounted entries.

📊 Waiting can provide confirmation and structure.

🛡 Risk management always comes first.

Buying blindly is gambling.

Waiting without analysis is hesitation.

Winning comes from having a predefined plan.

Ask yourself:

Is this a healthy pullback?

Is support holding?

Is volume confirming strength?

The best move isn’t emotional —

it’s strategic.

In volatile market

- Reward

- 12

- 17

- Repost

- Share

ShainingMoon :

:

To The Moon 🌕View More

#WhenisBestTimetoEntertheMarket

⏰📉 #WhenIsBestTimeToEnterTheMarket

The best time to enter the market

is not when everyone feels confident.

It’s when risk is clear

and your plan is ready.

📊 Entry isn’t about timing the exact bottom.

It’s about:

✔️ Entering near strong support — not random price levels

✔️ Buying when sentiment is fearful — not euphoric

✔️ Waiting for confirmation — not chasing green candles

✔️ Having defined risk before defined profit

🧠 Smart Traders Don’t Ask:

“Is this the bottom?”

They ask:

“Is my downside controlled?”

🎯 Real Strategy

• Use DCA in volatile conditions

• In

⏰📉 #WhenIsBestTimeToEnterTheMarket

The best time to enter the market

is not when everyone feels confident.

It’s when risk is clear

and your plan is ready.

📊 Entry isn’t about timing the exact bottom.

It’s about:

✔️ Entering near strong support — not random price levels

✔️ Buying when sentiment is fearful — not euphoric

✔️ Waiting for confirmation — not chasing green candles

✔️ Having defined risk before defined profit

🧠 Smart Traders Don’t Ask:

“Is this the bottom?”

They ask:

“Is my downside controlled?”

🎯 Real Strategy

• Use DCA in volatile conditions

• In

- Reward

- 2

- 2

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

#WhenisBestTimetoEntertheMarket

📈 Entering the market at the right time is key to maximizing potential gains and minimizing risks. Here’s what to consider before taking the step:

1️⃣ Market Trends – Identify if the market is bullish or bearish. Waiting for confirmation in a rising market or looking for “buy the dip” opportunities in a downtrend can make a difference.

2️⃣ Technical Signals – Use support & resistance levels, moving averages, and RSI to find safer entry points.

3️⃣ Fundamentals – Strong fundamentals, growth potential, and positive news can indicate a good long-term entry.

4️⃣ R

📈 Entering the market at the right time is key to maximizing potential gains and minimizing risks. Here’s what to consider before taking the step:

1️⃣ Market Trends – Identify if the market is bullish or bearish. Waiting for confirmation in a rising market or looking for “buy the dip” opportunities in a downtrend can make a difference.

2️⃣ Technical Signals – Use support & resistance levels, moving averages, and RSI to find safer entry points.

3️⃣ Fundamentals – Strong fundamentals, growth potential, and positive news can indicate a good long-term entry.

4️⃣ R

- Reward

- 7

- 13

- Repost

- Share

QueenOfTheDay :

:

To The Moon 🌕View More

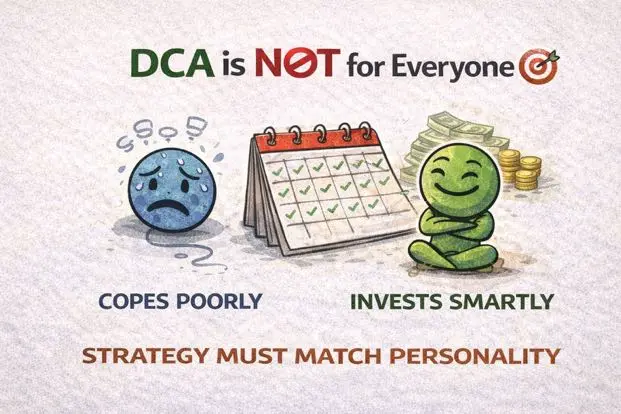

DCA Is NOT for Everyone 🎯

DCA (Dollar Cost Averaging) sounds safe.

Buy regularly. Ignore the noise. Sleep peacefully.

But here’s the truth:

DCA only works if 👇

– You believe in the long-term thesis

– You can handle drawdowns

– You have consistent cash flow

– You’re patient

If you panic every dip…

DCA won’t save you.

If you DCA into weak projects…

Time won’t fix it.

If you need quick profits…

DCA will feel “too slow.”

DCA is a strategy.

Not a magic button.

It rewards discipline.

It punishes impatience.

Before you DCA, ask yourself:

Are you investing… or just coping?

In crypto,

strategy must m

DCA (Dollar Cost Averaging) sounds safe.

Buy regularly. Ignore the noise. Sleep peacefully.

But here’s the truth:

DCA only works if 👇

– You believe in the long-term thesis

– You can handle drawdowns

– You have consistent cash flow

– You’re patient

If you panic every dip…

DCA won’t save you.

If you DCA into weak projects…

Time won’t fix it.

If you need quick profits…

DCA will feel “too slow.”

DCA is a strategy.

Not a magic button.

It rewards discipline.

It punishes impatience.

Before you DCA, ask yourself:

Are you investing… or just coping?

In crypto,

strategy must m

- Reward

- 1

- Comment

- Repost

- Share

Crypto Education: Stop Chasing Every Hype Coin

Most new traders make the same mistake: they jump on every “next big thing” because of hype.

Here’s the reality:

90% of coins fade within months

80% of “hot trends” are overhyped or manipulated

Only projects with real adoption, clear utility, and liquidity survive long-term

Smart traders focus on quality, not quantity.

Owning a few solid projects is far better than spreading thin across dozens.

💡 Rule of thumb:

Utility + adoption + liquidity _ potential staying power

Ask yourself before buying:

1️⃣ Is anyone actually using this project?

2️⃣ Does

Most new traders make the same mistake: they jump on every “next big thing” because of hype.

Here’s the reality:

90% of coins fade within months

80% of “hot trends” are overhyped or manipulated

Only projects with real adoption, clear utility, and liquidity survive long-term

Smart traders focus on quality, not quantity.

Owning a few solid projects is far better than spreading thin across dozens.

💡 Rule of thumb:

Utility + adoption + liquidity _ potential staying power

Ask yourself before buying:

1️⃣ Is anyone actually using this project?

2️⃣ Does

BTC0,86%

- Reward

- like

- Comment

- Repost

- Share

# ETHUnderPressure

The Ethereum Paradox: Price Pressure vs. Fundamental

Strength 🐘⚖️

We are currently seeing a sharp divergence in the

Ethereum ecosystem. While the price of ETH faces downward pressure, the

underlying fundamentals tell a different story. Development activity is

accelerating, and the Layer-2 ecosystem is booming with transactions and

innovation.

This creates a complex scenario for investors. When the

market price detaches from on-chain utility and technical progress, strategy

becomes paramount.

Do you view this pressure as a discount on future

utility, or a reflection o

ETH1,17%

- Reward

- like

- Comment

- Repost

- Share

# ETHUnderPressure

📉 ETH Under

Pressure: The Great Divergence?

Ethereum is facing some heavy headwinds in the market

right now, with the price coming under scrutiny. Yet, beneath the surface, the

ecosystem is bustling—network upgrades are progressing and Layer-2 activity is

booming. 🛠️⚡

It presents a tricky scenario: Price is

dipping, but fundamentals seem to be climbing.

💬 How do you

navigate this divergence?

• 🛡️ Stay Safe:

Do you wait for price action to stabilize before entering? • 💎

The Believer: Do you see this as a discount accumulation

opportunity despite the chart? • 🔄 Rota

📉 ETH Under

Pressure: The Great Divergence?

Ethereum is facing some heavy headwinds in the market

right now, with the price coming under scrutiny. Yet, beneath the surface, the

ecosystem is bustling—network upgrades are progressing and Layer-2 activity is

booming. 🛠️⚡

It presents a tricky scenario: Price is

dipping, but fundamentals seem to be climbing.

💬 How do you

navigate this divergence?

• 🛡️ Stay Safe:

Do you wait for price action to stabilize before entering? • 💎

The Believer: Do you see this as a discount accumulation

opportunity despite the chart? • 🔄 Rota

ETH1,17%

- Reward

- 1

- Comment

- Repost

- Share

#MyWeekendTradingPlan #MyWeekendTradingPlan

Weekend Trading Plan: Building Discipline Today for Tomorrow’s Profits

Weekends are not just for rest — they are for preparation. While markets slow down and volatility compresses, smart traders use this time to reset their mindset, refine strategies, and prepare for the next high-probability opportunities.

This weekend, my focus is not on chasing candles. It’s on building structure.

The goal is simple: enter the new week with clarity, confidence, and a data-driven plan.

Market Review & Higher Timeframe Analysis

First, I’m starting with a full top-do

Weekend Trading Plan: Building Discipline Today for Tomorrow’s Profits

Weekends are not just for rest — they are for preparation. While markets slow down and volatility compresses, smart traders use this time to reset their mindset, refine strategies, and prepare for the next high-probability opportunities.

This weekend, my focus is not on chasing candles. It’s on building structure.

The goal is simple: enter the new week with clarity, confidence, and a data-driven plan.

Market Review & Higher Timeframe Analysis

First, I’m starting with a full top-do

- Reward

- 6

- 6

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

280.29K Popularity

88.26K Popularity

410.66K Popularity

107.44K Popularity

14.53K Popularity

304.24K Popularity

66.95K Popularity

577.66K Popularity

33.02K Popularity

31.32K Popularity

31.16K Popularity

27.65K Popularity

30.31K Popularity

58.25K Popularity

News

View MoreA wallet associated with Pump.fun has sold a total of 3.376 billion PUMP tokens so far.

11 m

Data: Ethereum spot ETF had a total net inflow of $17,200 yesterday, with BlackRock's ETHA leading with a net inflow of $1,782,600.

19 m

Bitcoin ETF experienced a net inflow of $88.10 million yesterday.

31 m

Dubai Land Department and Ctrl Alt Launch Secondary Market for Real Estate Tokens

56 m

U.S. SOL spot ETF had a total net inflow of $3,777,400 in a single day

1 h

Pin