# DecemberRateCutForecast,

713

HighAmbition

#DecemberRateCutForecast

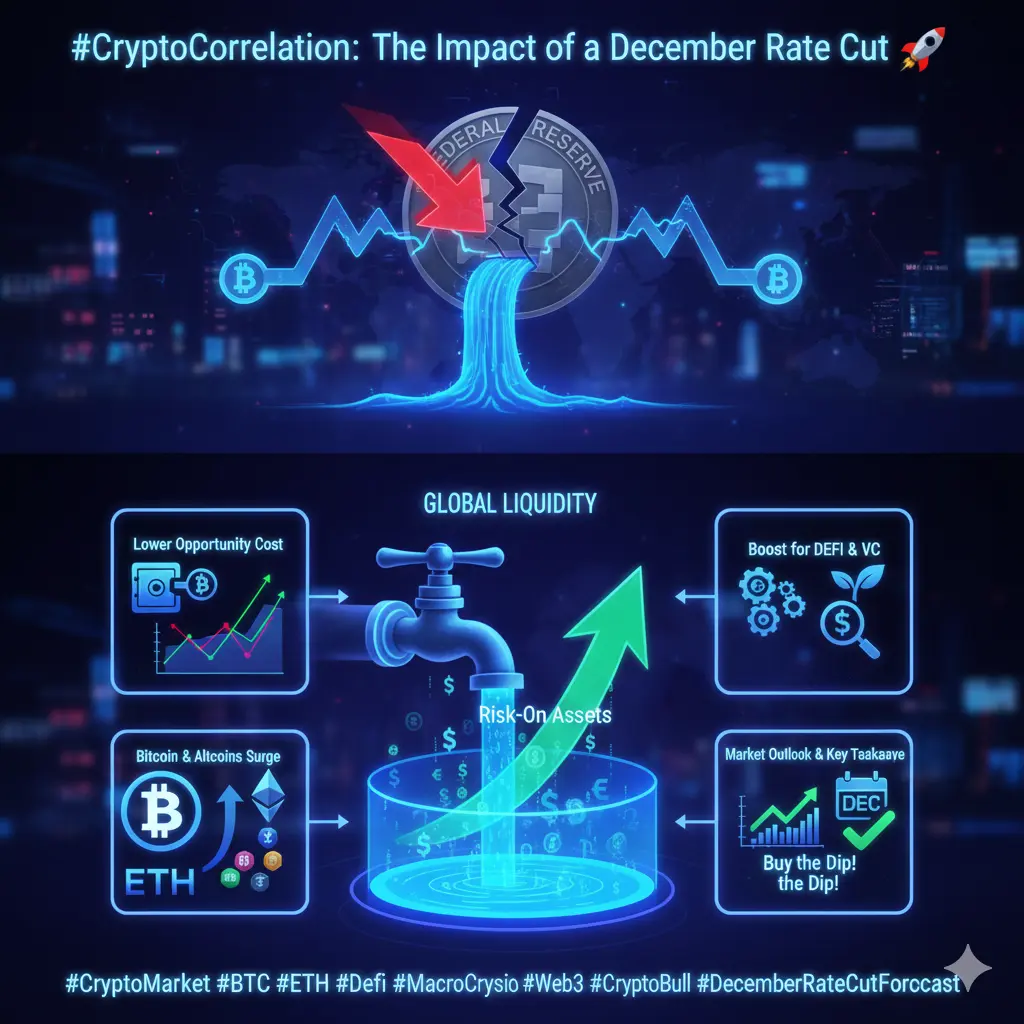

The crypto market, led by Bitcoin (BTC) and Ethereum (ETH), operates as a risk-on asset class. This means its performance is inversely correlated with the cost of capital and global liquidity. When the Federal Reserve pivots from tightening (raising rates) to easing (cutting rates), it fundamentally changes the incentive structure for investors, creating a powerful tailwind for digital assets.

1. Lower Opportunity Cost of Holding Crypto

High interest rates make cash and Treasury bills attractive, offering “risk-free” yields (e.g., 5%). This creates a high opportunity

The crypto market, led by Bitcoin (BTC) and Ethereum (ETH), operates as a risk-on asset class. This means its performance is inversely correlated with the cost of capital and global liquidity. When the Federal Reserve pivots from tightening (raising rates) to easing (cutting rates), it fundamentally changes the incentive structure for investors, creating a powerful tailwind for digital assets.

1. Lower Opportunity Cost of Holding Crypto

High interest rates make cash and Treasury bills attractive, offering “risk-free” yields (e.g., 5%). This creates a high opportunity

- Reward

- 25

- 13

- Repost

- Share

BeautifulDay :

:

1000x Vibes 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

22.32K Popularity

60.95K Popularity

366.32K Popularity

44.66K Popularity

60.92K Popularity

17.63K Popularity

25.22K Popularity

18.7K Popularity

92.16K Popularity

36.46K Popularity

32.1K Popularity

28.73K Popularity

16.54K Popularity

23.01K Popularity

213.86K Popularity

News

View MoreThe market still expects the Federal Reserve to cut interest rates twice in 2026, and Wash's nomination has limited impact.

1 h

Sanae Takashi clarifies weak yen remarks, stating the focus is on strengthening economic resilience

1 h

Billionaire Grant Cardone increases BTC holdings at the $76,000 price point

1 h

A certain whale closed its long position in $LIT completely after 34 days, incurring a loss of $3.7 million.

2 h

CZ: The global situation is tense, making it the best time to promote cryptocurrencies.

2 h

Pin