# MarketVolatility

5.63K

cryptochashman

📉📈 #BuyTheDipOrWaitNow? – Strategy Matters 🤔

Market volatility ke dauran sabse bada sawal hota hai:

Dip buy karein ya confirmation ka wait karein?

✨ Things to Consider:

Dips kabhi kabhi strong entry opportunities provide karti hain 🛒

Trend confirmation risk ko better manage karta hai ⏳

Proper technical analysis & risk management har decision ka base hona chahiye 📊🛡️

⚖️ Har trader ki strategy different hoti hai — short-term scalping ho ya long-term accumulation.

💡 Gate.io Insight:

Use real-time charts, advanced indicators, and market analytics on Gate.io to make data-driven decisions ins

Market volatility ke dauran sabse bada sawal hota hai:

Dip buy karein ya confirmation ka wait karein?

✨ Things to Consider:

Dips kabhi kabhi strong entry opportunities provide karti hain 🛒

Trend confirmation risk ko better manage karta hai ⏳

Proper technical analysis & risk management har decision ka base hona chahiye 📊🛡️

⚖️ Har trader ki strategy different hoti hai — short-term scalping ho ya long-term accumulation.

💡 Gate.io Insight:

Use real-time charts, advanced indicators, and market analytics on Gate.io to make data-driven decisions ins

- Reward

- 1

- Comment

- Repost

- Share

#CryptoSurvivalGuide This market isn’t for the emotional.

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

BTC1,26%

- Reward

- 9

- 13

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#CryptoSurvivalGuide This market isn’t for the emotional.

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

BTC1,26%

- Reward

- 8

- 6

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

Global Tech Sell-Off Hits Risk Assets: What Investors Need to Know

Global financial markets are facing renewed pressure as a broad-based sell-off in technology stocks ripples across risk assets. What began as a pullback in high-growth tech names has evolved into a wider market recalibration, highlighting how deeply interconnected equities, crypto, and emerging markets have become.

At the core of this move is a shift in macro expectations. Persistent inflation, a higher-for-longer interest rate outlook, and tighter financial conditions are forcing investors to reassess valuations—particularly f

Global financial markets are facing renewed pressure as a broad-based sell-off in technology stocks ripples across risk assets. What began as a pullback in high-growth tech names has evolved into a wider market recalibration, highlighting how deeply interconnected equities, crypto, and emerging markets have become.

At the core of this move is a shift in macro expectations. Persistent inflation, a higher-for-longer interest rate outlook, and tighter financial conditions are forcing investors to reassess valuations—particularly f

BTC1,26%

- Reward

- 1

- 1

- Repost

- Share

Lock_433 :

:

Buy To Earn 💎Global Tech Sell-Off Hits Risk Assets: What Investors Need to Know

Global financial markets are facing renewed pressure as a broad-based sell-off in technology stocks ripples across risk assets. What began as a pullback in high-growth tech names has evolved into a wider market recalibration, highlighting how deeply interconnected equities, crypto, and emerging markets have become.

At the core of this move is a shift in macro expectations. Persistent inflation, a higher-for-longer interest rate outlook, and tighter financial conditions are forcing investors to reassess valuations—particularly f

Global financial markets are facing renewed pressure as a broad-based sell-off in technology stocks ripples across risk assets. What began as a pullback in high-growth tech names has evolved into a wider market recalibration, highlighting how deeply interconnected equities, crypto, and emerging markets have become.

At the core of this move is a shift in macro expectations. Persistent inflation, a higher-for-longer interest rate outlook, and tighter financial conditions are forcing investors to reassess valuations—particularly f

BTC1,26%

- Reward

- 8

- 14

- Repost

- Share

CryptoFiler :

:

Buy To Earn 💎View More

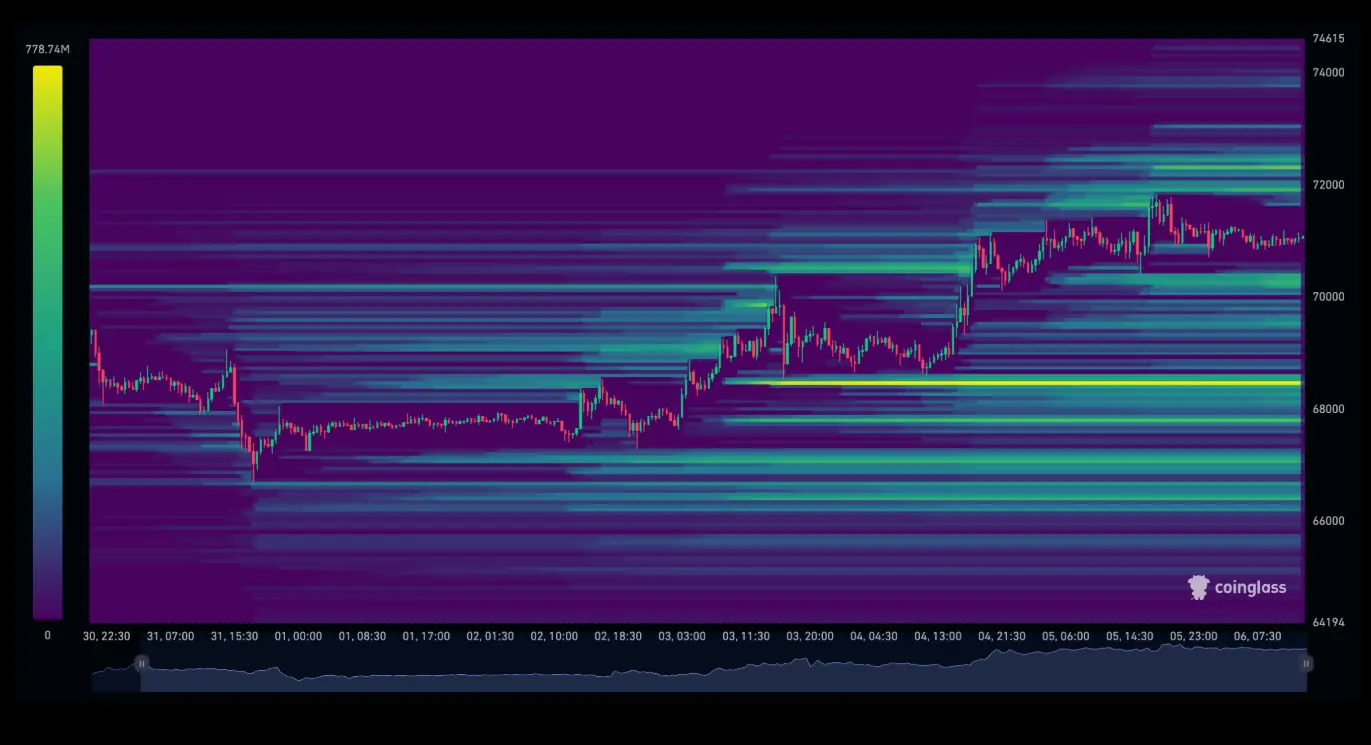

#CryptoMarketWatch 📊 Market Volatility Intensifies: Bulls vs. Bears

Recent market action has heightened volatility, creating a clear divide between bullish and bearish sentiment. Traders and investors are closely monitoring price action, risk metrics, and broader macro signals to decide how to navigate the turbulence.

💡 Key Observations:

Diverging Sentiment:

Some participants are leaning bullish, looking for buying opportunities on dips.

Others remain cautious, prioritizing risk management and drawdown control amid uncertainty.

Signals to Watch:

Price action: Key support and resistance level

Recent market action has heightened volatility, creating a clear divide between bullish and bearish sentiment. Traders and investors are closely monitoring price action, risk metrics, and broader macro signals to decide how to navigate the turbulence.

💡 Key Observations:

Diverging Sentiment:

Some participants are leaning bullish, looking for buying opportunities on dips.

Others remain cautious, prioritizing risk management and drawdown control amid uncertainty.

Signals to Watch:

Price action: Key support and resistance level

- Reward

- 7

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

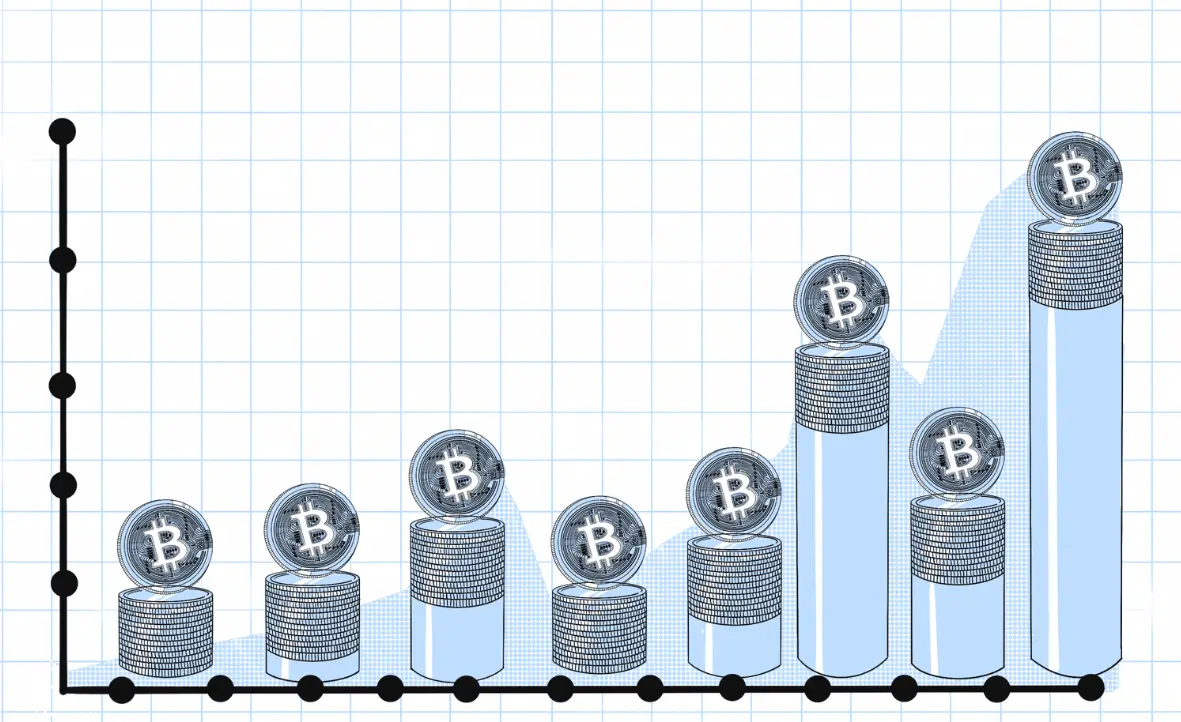

The crypto market is currently navigating one of its most intense periods of volatility in early 2026. Bitcoin (BTC) has experienced a sharp correction, dipping below $80,000 and briefly touching lows around $75,000–$78,000 in recent trading sessions—the weakest levels since mid-2025. Ethereum (ETH) has followed suit, sliding toward the $2,400 range amid broader sell-offs. Over the past weekend alone, liquidations surged dramatically, with billions in leveraged positions wiped out as panic selling intensified. The Fear & Greed Index has plunged into extreme fear territory, prompting the age-ol

- Reward

- 3

- Comment

- Repost

- Share

The crypto market is currently navigating one of its most intense periods of volatility in early 2026. Bitcoin (BTC) has experienced a sharp correction, dipping below $80,000 and briefly touching lows around $75,000–$78,000 in recent trading sessions—the weakest levels since mid-2025. Ethereum (ETH) has followed suit, sliding toward the $2,400 range amid broader sell-offs. Over the past weekend alone, liquidations surged dramatically, with billions in leveraged positions wiped out as panic selling intensified. The Fear & Greed Index has plunged into extreme fear territory, prompting the age-ol

- Reward

- 4

- 4

- Repost

- Share

HighAmbition :

:

thanks for the updateView More

#USGovernmentShutdownRisk

As we move into the coming weeks, the growing risk of a U.S. government shutdown is becoming one of the most important macro factors markets cannot ignore. While headlines may change daily, the underlying issue remains the same: political gridlock continues to threaten economic stability, investor confidence, and global market sentiment.

A potential shutdown doesn’t just affect federal workers — it ripples through the entire financial system. Delayed economic data, paused government services, and uncertainty around fiscal policy can increase volatility across equitie

As we move into the coming weeks, the growing risk of a U.S. government shutdown is becoming one of the most important macro factors markets cannot ignore. While headlines may change daily, the underlying issue remains the same: political gridlock continues to threaten economic stability, investor confidence, and global market sentiment.

A potential shutdown doesn’t just affect federal workers — it ripples through the entire financial system. Delayed economic data, paused government services, and uncertainty around fiscal policy can increase volatility across equitie

BTC1,26%

- Reward

- 9

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

🚨 $60M Short Liquidated Amid Market Spike

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

According to BlockBeats News (Jan 24) and EmberCN monitoring, crypto market volatility struck again:

At around 1:00 a.m., Bitcoin briefly surged above $91,000 and Ethereum climbed past $3,000, triggering the liquidation of a massive short position held by “Rolling Trader 0xD83…Fd7”.

🔻 Key Details:

• Liquidation size: ~$60 million

• Total short position reduced from $300M → $238M

• Unrealized gains fell from $24M (2 days ago) to ~$4M

⚠️ This move once again highlights how high leverage + sudden volatility can quickly wipe out even large positions.

💬

- Reward

- 22

- 17

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

82.34K Popularity

7.01K Popularity

7.03K Popularity

53.49K Popularity

4K Popularity

263.66K Popularity

246.46K Popularity

16.01K Popularity

4.12K Popularity

3.3K Popularity

2.91K Popularity

3.5K Popularity

3.59K Popularity

32.35K Popularity

News

View MoreData: If ETH drops below $1,977, the total long liquidation strength on major CEXs will reach $700 million.

1 h

The probability that the Federal Reserve will keep interest rates unchanged in March is currently reported at 90.8%.

4 h

In the past 24 hours, the entire network's contract liquidations reached $144 million, mainly from short positions.

4 h

Roundhill has submitted multiple "prediction market event contract" election ETF applications

4 h

Polymarket launches a new 5-minute cryptocurrency price fluctuation trading market, powered by Chainlink

4 h

Pin