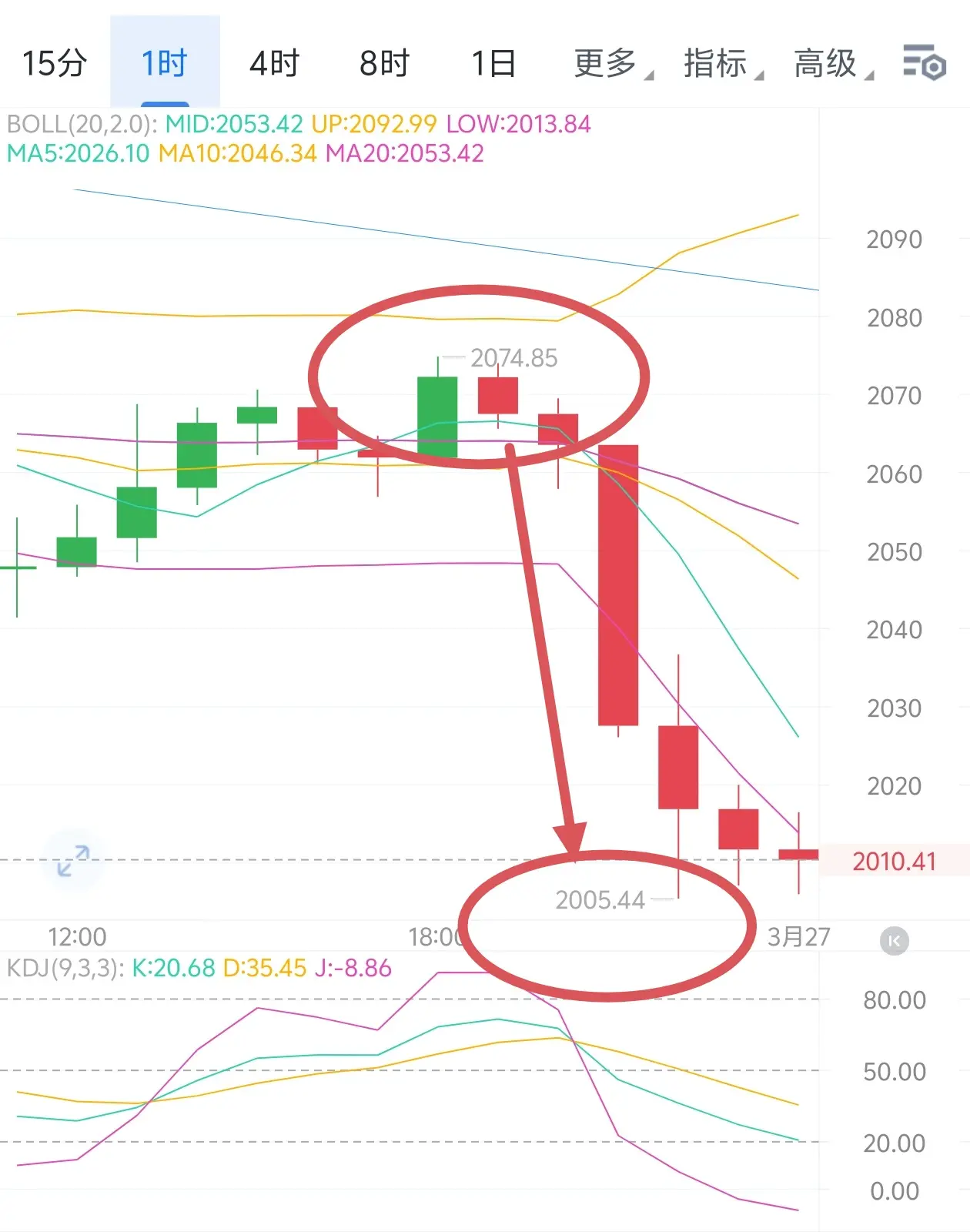

The short positions trend is accompanied by a volume stagnation fall, which indicates an oversold market.

Oversold generally has a rebound, so we don't need to rush to short positions. It's also not suitable to go long now. Because it is supply-controlled, to go long, we need to confirm that supply is exhausted and demand is actively expanding for it to be safe.

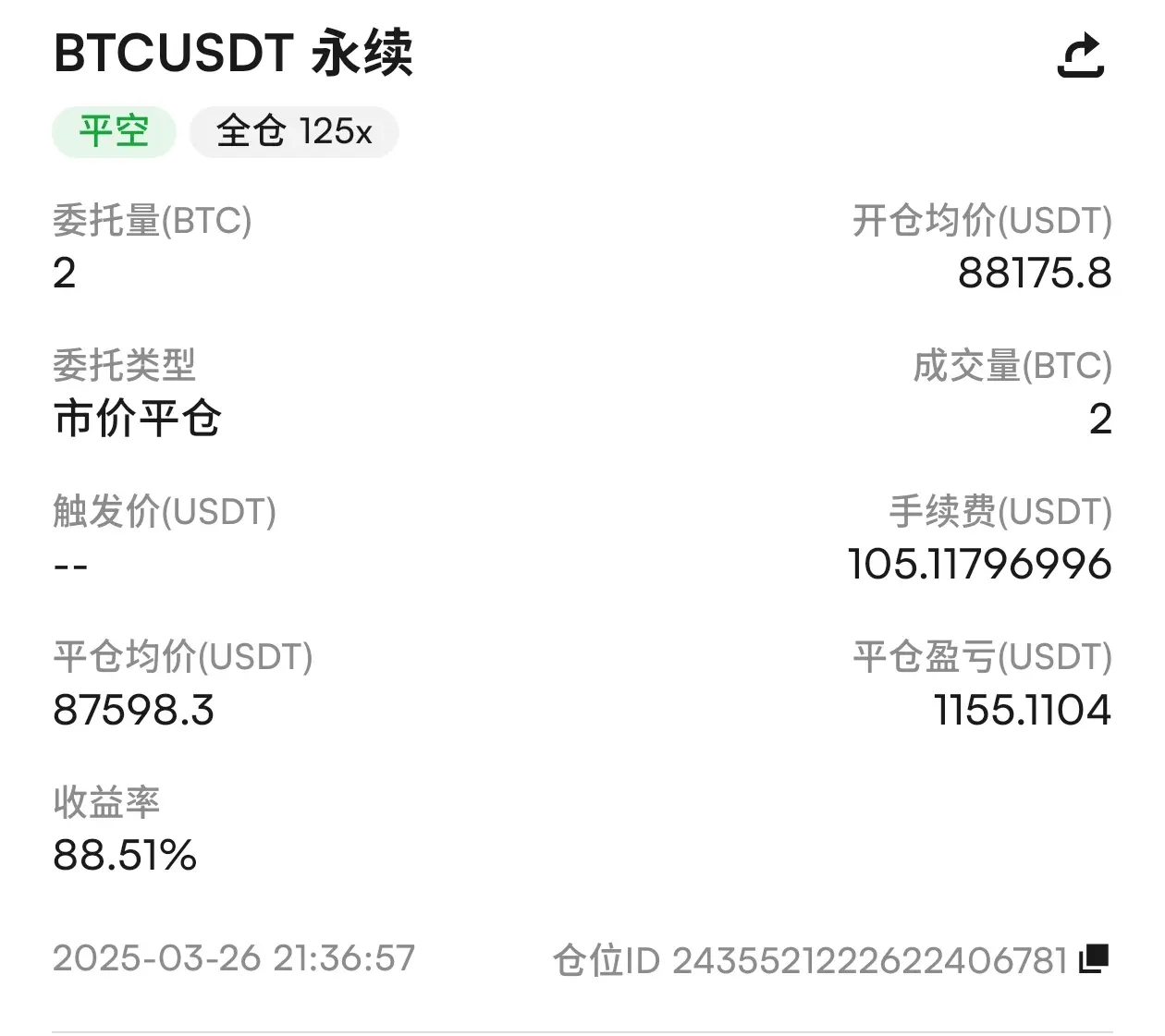

Based on the current trend, rebound and go short, just set the stop loss above the previous high or resistance level. The first target is the original support level. If being conservative, one can choose to reduce positions at the rece

View OriginalOversold generally has a rebound, so we don't need to rush to short positions. It's also not suitable to go long now. Because it is supply-controlled, to go long, we need to confirm that supply is exhausted and demand is actively expanding for it to be safe.

Based on the current trend, rebound and go short, just set the stop loss above the previous high or resistance level. The first target is the original support level. If being conservative, one can choose to reduce positions at the rece