#SOLStandsStrong

Solana Technical Outlook: Holding Above Macro Base After 0.236 Breakdown

Solana remains inside a sustained corrective structure after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone). The breakdown below $138 (0.382) and later $111 (0.236) confirmed structural weakness and accelerated downside momentum. That sequence shifted market structure from distribution to active markdown.

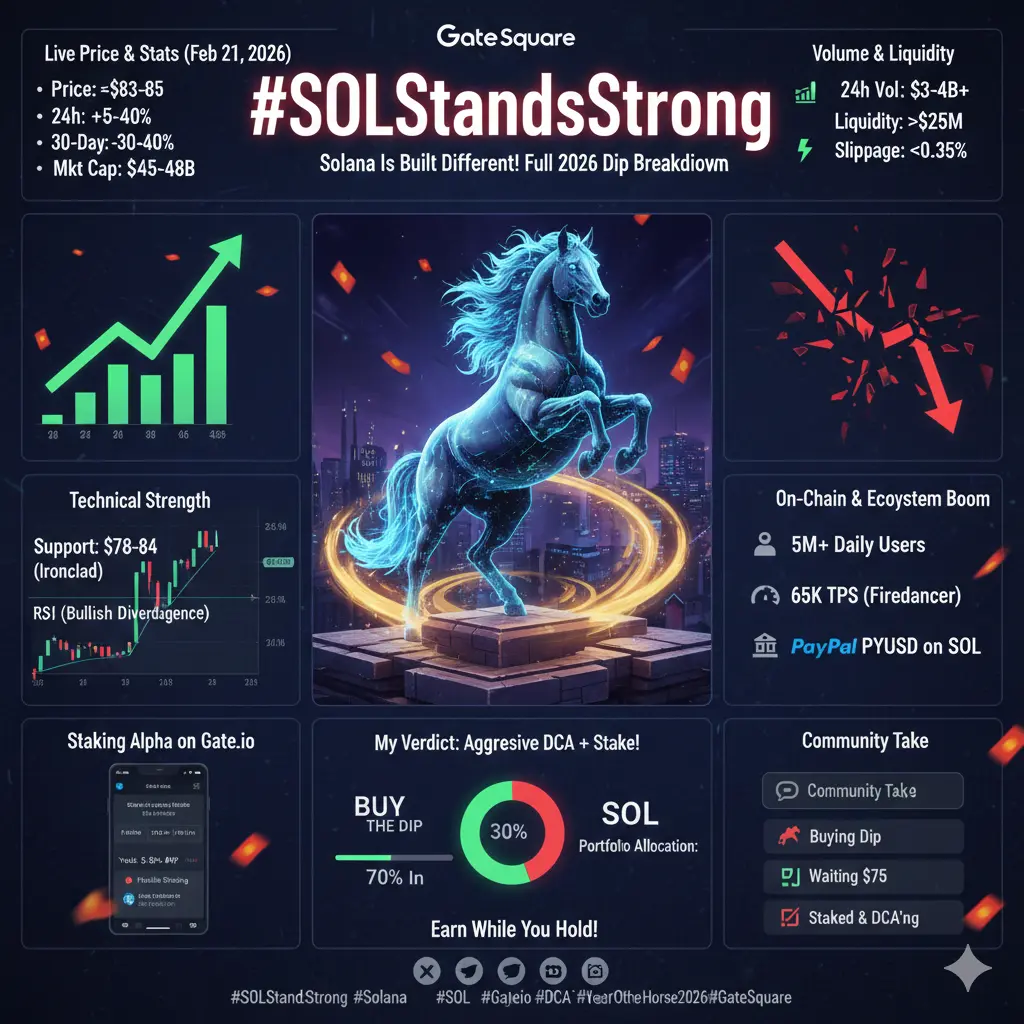

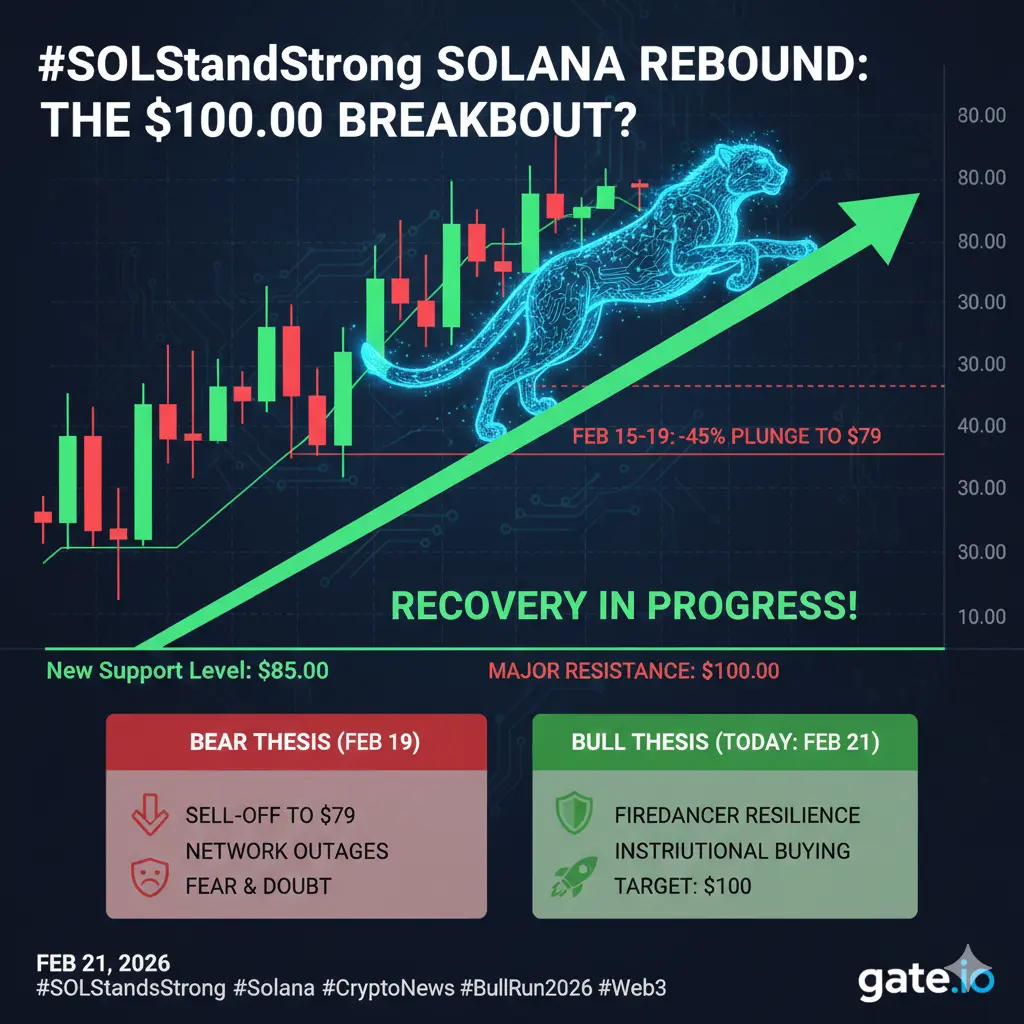

Price is now consolidating between $84–$90, just above the macro Fibonacci base at $67.14. This zone represents a critical inflection area where sell pressure is being temporarily absorbed. The market is attempting short-term stabilization, but broader trend control remains with sellers unless key reclaim levels are achieved.

EMA Structure – Bearish Alignment

20 EMA: $90.72

50 EMA: $106.77

100 EMA: $124.25

200 EMA: $142.90

SOL is trading below all major EMAs, confirming full bearish alignment across short-, mid-, and long-term timeframes. The $90–$107 region (20 & 50 EMA cluster) acts as immediate dynamic resistance. Any upside into this band is likely corrective unless accompanied by strong volume expansion and daily acceptance above it.

Broader structural resistance remains concentrated between $124–$143 (100 & 200 EMA). A macro trend shift would require reclaiming this zone — otherwise rallies remain relief bounces within a larger corrective cycle.

Fibonacci Structure

0.786: $213.60

0.618: $182.29

0.5: $160.31

0.382: $138.32

0.236: $111.11

Fib 0 (Macro Base): $67.14

Failure to hold above the 0.382–0.5 region and the decisive loss of 0.236 confirmed bearish continuation. Current consolidation suggests temporary equilibrium, but structural repair begins only above $111.

Momentum (RSI 14)

RSI is around 37 — weak but stabilizing. Momentum remains below the 50 equilibrium level, signaling that the broader trend is still corrective rather than reversing. A bullish shift would require RSI reclaiming 50 with expanding price strength.

---

📊 Key Levels

Resistance:

• $90–$107 (EMA cluster)

• $111 (0.236 Fib reclaim trigger)

• $138 (0.382 Fib structural pivot)

• $160 (0.5 Fib macro shift zone)

Support:

• $84–$85 (local demand)

• $67 (macro base / Fib 0)

---

📌 Summary

Solana is stabilizing above macro support after a sharp corrective breakdown. Downside momentum has slowed near $84, but the broader structure remains bearish below $111–$124.

A sustained recovery requires reclaiming $111 and holding above the EMA cluster with strong participation. Failure to defend $84 increases probability of continuation toward the $67 macro base.

$SOL #SOLStandsStrong

Solana Technical Outlook: Holding Above Macro Base After 0.236 Breakdown

Solana remains inside a sustained corrective structure after rejecting from the $160–$182 resistance cluster (0.5–0.618 Fibonacci zone). The breakdown below $138 (0.382) and later $111 (0.236) confirmed structural weakness and accelerated downside momentum. That sequence shifted market structure from distribution to active markdown.

Price is now consolidating between $84–$90, just above the macro Fibonacci base at $67.14. This zone represents a critical inflection area where sell pressure is being temporarily absorbed. The market is attempting short-term stabilization, but broader trend control remains with sellers unless key reclaim levels are achieved.

EMA Structure – Bearish Alignment

20 EMA: $90.72

50 EMA: $106.77

100 EMA: $124.25

200 EMA: $142.90

SOL is trading below all major EMAs, confirming full bearish alignment across short-, mid-, and long-term timeframes. The $90–$107 region (20 & 50 EMA cluster) acts as immediate dynamic resistance. Any upside into this band is likely corrective unless accompanied by strong volume expansion and daily acceptance above it.

Broader structural resistance remains concentrated between $124–$143 (100 & 200 EMA). A macro trend shift would require reclaiming this zone — otherwise rallies remain relief bounces within a larger corrective cycle.

Fibonacci Structure

0.786: $213.60

0.618: $182.29

0.5: $160.31

0.382: $138.32

0.236: $111.11

Fib 0 (Macro Base): $67.14

Failure to hold above the 0.382–0.5 region and the decisive loss of 0.236 confirmed bearish continuation. Current consolidation suggests temporary equilibrium, but structural repair begins only above $111.

Momentum (RSI 14)

RSI is around 37 — weak but stabilizing. Momentum remains below the 50 equilibrium level, signaling that the broader trend is still corrective rather than reversing. A bullish shift would require RSI reclaiming 50 with expanding price strength.

---

📊 Key Levels

Resistance:

• $90–$107 (EMA cluster)

• $111 (0.236 Fib reclaim trigger)

• $138 (0.382 Fib structural pivot)

• $160 (0.5 Fib macro shift zone)

Support:

• $84–$85 (local demand)

• $67 (macro base / Fib 0)

---

📌 Summary

Solana is stabilizing above macro support after a sharp corrective breakdown. Downside momentum has slowed near $84, but the broader structure remains bearish below $111–$124.

A sustained recovery requires reclaiming $111 and holding above the EMA cluster with strong participation. Failure to defend $84 increases probability of continuation toward the $67 macro base.

$SOL #SOLStandsStrong