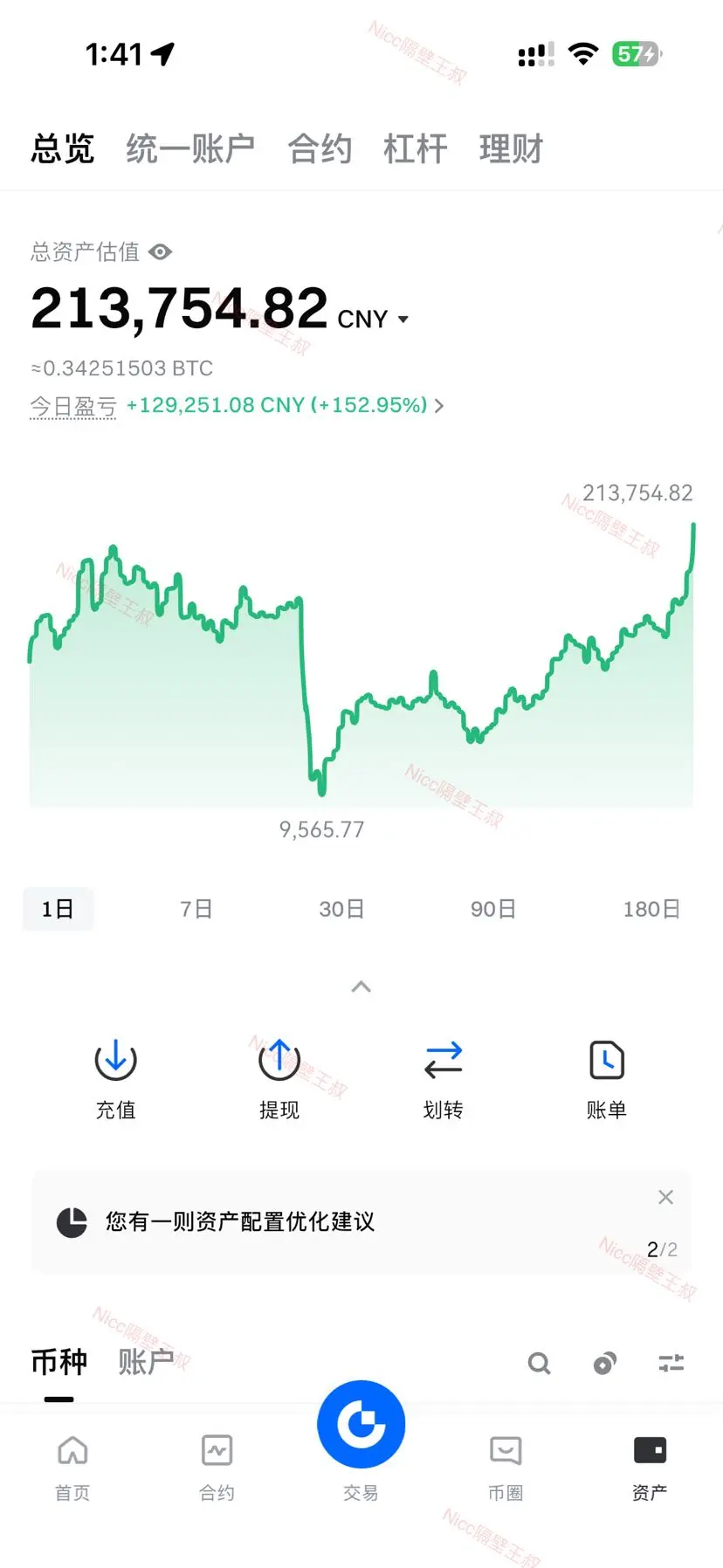

The upward momentum over the past 4 hours still exists, but it has entered a deep zone of "high-level consolidation" and "bull-bear struggle."

Here is an in-depth analysis:

1. Is the momentum still there? — "At the end of a strong bow" or "Gathering strength for a move"?

• The upward momentum remains solid:

• Moving average support: On the 4-hour chart, the EMA short-term moving averages still maintain a bullish arrangement, with the price consistently staying above 3,120 (Bollinger middle band).

• Higher lows: After today’s Asian session opened, ETH successfully rose from 3,144 to 3,190, and a quick pullback to around 3,160 was immediately supported. This "not breaking previous highs on pullback" characteristic indicates bulls still have confidence.

• Signs of weakening (be alert):

• MACD divergence risk: Although the fast and slow lines are above zero, the growth rate of the energy bars has started to slow down, indicating that the "explosive power" is weakening, and the market may shift from "one-sided surge" to "oscillating upward."

• 3,200 resistance mountain: The price repeatedly tests around 3,190, and trading volume begins to decrease in this zone, indicating increasing selling pressure from bears and cautiousness from bulls.

2. Short position setup: short-term vs mid-term

Since you want to bet on short positions, currently it’s a "counter-trend top-fishing" scenario, requiring precise stop-loss:

【Short-term short: betting on a false breakout】

• Logic: Use the psychological pressure of the 3,200 integer level to capture a quick pullback.

• Entry point: 3,198 - 3,205 (place orders slightly above 3,200 to catch the spike).

• Small stop-loss: 3,218.

• Logic: If the 15-minute candlestick closes above 3,215, indicating that 3,200 has been effectively stabilized, the short must be stopped out.

• Target: 3,155 - 3,165.

【Mid-term short: betting on a phase top】

• Logic: The wave of price recovery early 2026 has accumulated a large amount of profit-taking, and if BTC encounters resistance at 91,000, ETH will experience a deep correction.

• Entry point: 3,250 - 3,280 (this is an important previous dense trading zone).

• Stop-loss: 3,310.

• Target: 3,000 - 3,050.

Key points:

Current conclusion: Long positions are still safer than short positions.

• Short squeeze environment: In this market condition, short stop-loss orders will turn into fuel for bulls. If volume breaks through 3,200, it will trigger a large number of "short squeezes," causing the price to spike instantly to 3,250.

• Trend protection: As long as the 4-hour level does not fall below 3,120, the trend remains upward.

Here is an in-depth analysis:

1. Is the momentum still there? — "At the end of a strong bow" or "Gathering strength for a move"?

• The upward momentum remains solid:

• Moving average support: On the 4-hour chart, the EMA short-term moving averages still maintain a bullish arrangement, with the price consistently staying above 3,120 (Bollinger middle band).

• Higher lows: After today’s Asian session opened, ETH successfully rose from 3,144 to 3,190, and a quick pullback to around 3,160 was immediately supported. This "not breaking previous highs on pullback" characteristic indicates bulls still have confidence.

• Signs of weakening (be alert):

• MACD divergence risk: Although the fast and slow lines are above zero, the growth rate of the energy bars has started to slow down, indicating that the "explosive power" is weakening, and the market may shift from "one-sided surge" to "oscillating upward."

• 3,200 resistance mountain: The price repeatedly tests around 3,190, and trading volume begins to decrease in this zone, indicating increasing selling pressure from bears and cautiousness from bulls.

2. Short position setup: short-term vs mid-term

Since you want to bet on short positions, currently it’s a "counter-trend top-fishing" scenario, requiring precise stop-loss:

【Short-term short: betting on a false breakout】

• Logic: Use the psychological pressure of the 3,200 integer level to capture a quick pullback.

• Entry point: 3,198 - 3,205 (place orders slightly above 3,200 to catch the spike).

• Small stop-loss: 3,218.

• Logic: If the 15-minute candlestick closes above 3,215, indicating that 3,200 has been effectively stabilized, the short must be stopped out.

• Target: 3,155 - 3,165.

【Mid-term short: betting on a phase top】

• Logic: The wave of price recovery early 2026 has accumulated a large amount of profit-taking, and if BTC encounters resistance at 91,000, ETH will experience a deep correction.

• Entry point: 3,250 - 3,280 (this is an important previous dense trading zone).

• Stop-loss: 3,310.

• Target: 3,000 - 3,050.

Key points:

Current conclusion: Long positions are still safer than short positions.

• Short squeeze environment: In this market condition, short stop-loss orders will turn into fuel for bulls. If volume breaks through 3,200, it will trigger a large number of "short squeezes," causing the price to spike instantly to 3,250.

• Trend protection: As long as the 4-hour level does not fall below 3,120, the trend remains upward.