方片九

No content yet

Pin

方片九

This is an experience where I turned the tide against adversity in my life. Three years ago, I was jolted awake in the middle of the night by a red liquidation alert from a certain exchange. In just three hours, my account with over 1 million USDT was wiped out. Staring at the negative balance, I felt as if I was nailed to the cross of reality.

Afterwards, I began to reflect, summarize, and consult all my relatives and friends. With a borrowed 200,000, I started over. In 90 days, using a method with a 78% win rate, I grew my principal to 20 million. The process was extremely tough, but it resu

Afterwards, I began to reflect, summarize, and consult all my relatives and friends. With a borrowed 200,000, I started over. In 90 days, using a method with a 78% win rate, I grew my principal to 20 million. The process was extremely tough, but it resu

BTC-4.48%

- Reward

- 13

- 8

- Repost

- Share

方片九 :

:

Experience determines cognition, and I look forward to everyone winning~View More

Crypto Circle Passive Income in 4 Steps to Trade Coins with Zero Liquidation

If your funds are within 10,000 USDT, I’ll teach you a common trader’s method—one that ensures never to get liquidated and keeps earning USDT.

Many followers have gone from five figures to seven figures using it.

The core is only four steps— the simpler, the more ruthless, the more profitable.

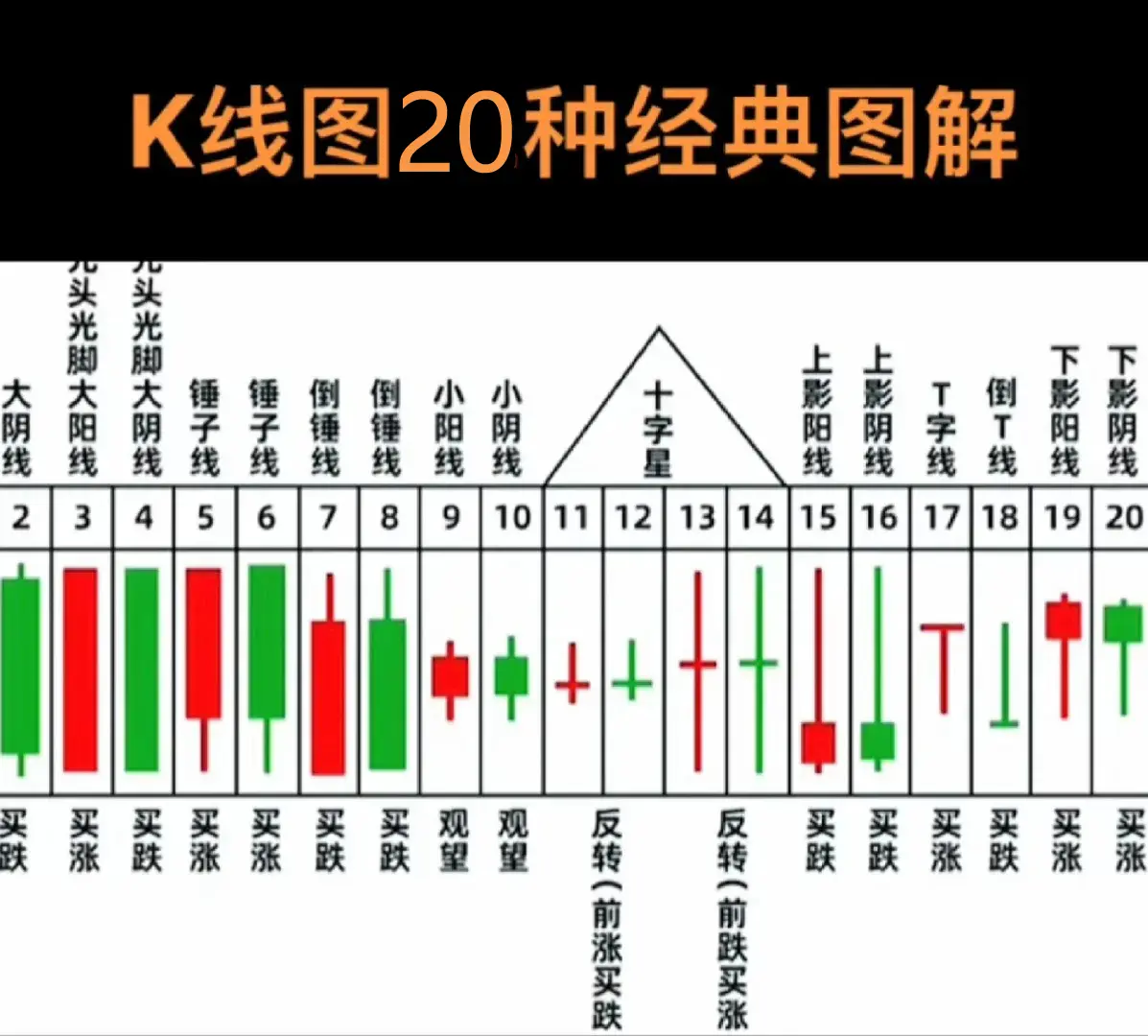

① Only choose “coins that will rise” — MACD Golden Cross

Open the daily chart and focus on one thing: MACD Golden Cross.

Preferably above the zero line for the golden cross, the most stable.

No mysticism, no news analysis, purel

If your funds are within 10,000 USDT, I’ll teach you a common trader’s method—one that ensures never to get liquidated and keeps earning USDT.

Many followers have gone from five figures to seven figures using it.

The core is only four steps— the simpler, the more ruthless, the more profitable.

① Only choose “coins that will rise” — MACD Golden Cross

Open the daily chart and focus on one thing: MACD Golden Cross.

Preferably above the zero line for the golden cross, the most stable.

No mysticism, no news analysis, purel

FHE78.93%

- Reward

- 2

- 1

- Repost

- Share

GateUser-280dc57c :

:

UsefulAlmost all greed and fear in the market fundamentally stem from two words: ignorance and the incompetence caused by ignorance.

When you lack a clear judgment system,

no repeatable technical basis,

and no understanding of trends, positions, or rhythm,

every buy and sell becomes a psychological game of emotions.

Thus, the two most typical fears emerge:

• Not daring to sell when in profit, afraid of "selling too early,"

• Not daring to cut losses when in loss, afraid of "cutting too deep."

On the surface, it appears that greed and fear are dominating the operations;

in reality, you simply don't k

View OriginalWhen you lack a clear judgment system,

no repeatable technical basis,

and no understanding of trends, positions, or rhythm,

every buy and sell becomes a psychological game of emotions.

Thus, the two most typical fears emerge:

• Not daring to sell when in profit, afraid of "selling too early,"

• Not daring to cut losses when in loss, afraid of "cutting too deep."

On the surface, it appears that greed and fear are dominating the operations;

in reality, you simply don't k

- Reward

- 1

- Comment

- Repost

- Share

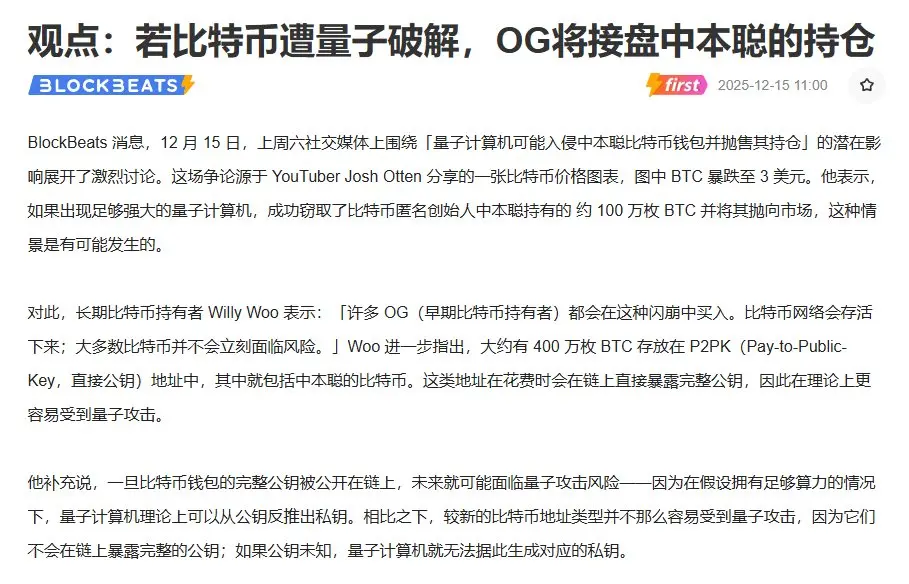

🚨 Recently, a new perspective has emerged on the often-discussed issue of quantum computing: Will Satoshi Nakamoto's 1 million $BTC be cracked and sold off?

Very interesting! The market always tends to enter a phase where "risk is priced based on imagination" at some point.

But even more interesting is that, throughout Bitcoin's history, all the reasons for its death sentence have ultimately turned into nodes of evolution.

Many discussions start with the question: Can quantum computers crack BTC? How long would that take?

This question itself tends to be somewhat media-driven. A more realist

Very interesting! The market always tends to enter a phase where "risk is priced based on imagination" at some point.

But even more interesting is that, throughout Bitcoin's history, all the reasons for its death sentence have ultimately turned into nodes of evolution.

Many discussions start with the question: Can quantum computers crack BTC? How long would that take?

This question itself tends to be somewhat media-driven. A more realist

BTC-4.48%

- Reward

- like

- Comment

- Repost

- Share

Features of a bear market:

1. Increasing number of confrontations between people

2. More frequent public relations incidents involving project teams and exchanges

3. A large number of content creators experimenting with Web2

4. Frequent news of major companies laying off employees

5. Large projects expected to experience a significant secondary decline

6. However, there are still daily reports of whales and institutions accumulating coins

7. There are still great trading opportunities, but the growth window is getting smaller

These occurred in March 2019, 2022, and 2025.

But sometimes, when al

View Original1. Increasing number of confrontations between people

2. More frequent public relations incidents involving project teams and exchanges

3. A large number of content creators experimenting with Web2

4. Frequent news of major companies laying off employees

5. Large projects expected to experience a significant secondary decline

6. However, there are still daily reports of whales and institutions accumulating coins

7. There are still great trading opportunities, but the growth window is getting smaller

These occurred in March 2019, 2022, and 2025.

But sometimes, when al

- Reward

- like

- Comment

- Repost

- Share

When your toy is worth 450 million dollars, you think you will be happy, but Sergey Brin tells you: you will get bored.

This is Google co-founder Sergey Brin's super yacht. It was here that he felt an unprecedented sense of boredom. Extreme luxury often comes with extreme emptiness.

So he chose to disembark, return to his workstation, and start coding again, refining AI.

At this moment, he proved the deepest desire inherent in human genes: we are not evolved for "enjoyment," but for "creation."

True dopamine isn't in what you own, but in what you are nurturing—whether it's a piece of code that

View OriginalThis is Google co-founder Sergey Brin's super yacht. It was here that he felt an unprecedented sense of boredom. Extreme luxury often comes with extreme emptiness.

So he chose to disembark, return to his workstation, and start coding again, refining AI.

At this moment, he proved the deepest desire inherent in human genes: we are not evolved for "enjoyment," but for "creation."

True dopamine isn't in what you own, but in what you are nurturing—whether it's a piece of code that

- Reward

- 2

- Comment

- Repost

- Share

Ultimate Investment Guide??

1. Have a job (company) that guarantees continuous income.

2. For every income, whether it's one dollar or ten thousand, allocate 20-30% to your investment account.

3. The core is to reasonably allocate the money in your investment account into global assets (currently personal holdings include gold, S&P 500, BTC), and into resilient assets.

Don't fear unrealized losses during bear markets when buying, and don't fear missing out on gains during bull markets when selling—maintain dynamic balance.

Until it's a life-or-death situation, do not withdraw any money from th

1. Have a job (company) that guarantees continuous income.

2. For every income, whether it's one dollar or ten thousand, allocate 20-30% to your investment account.

3. The core is to reasonably allocate the money in your investment account into global assets (currently personal holdings include gold, S&P 500, BTC), and into resilient assets.

Don't fear unrealized losses during bear markets when buying, and don't fear missing out on gains during bull markets when selling—maintain dynamic balance.

Until it's a life-or-death situation, do not withdraw any money from th

BTC-4.48%

- Reward

- 1

- Comment

- Repost

- Share

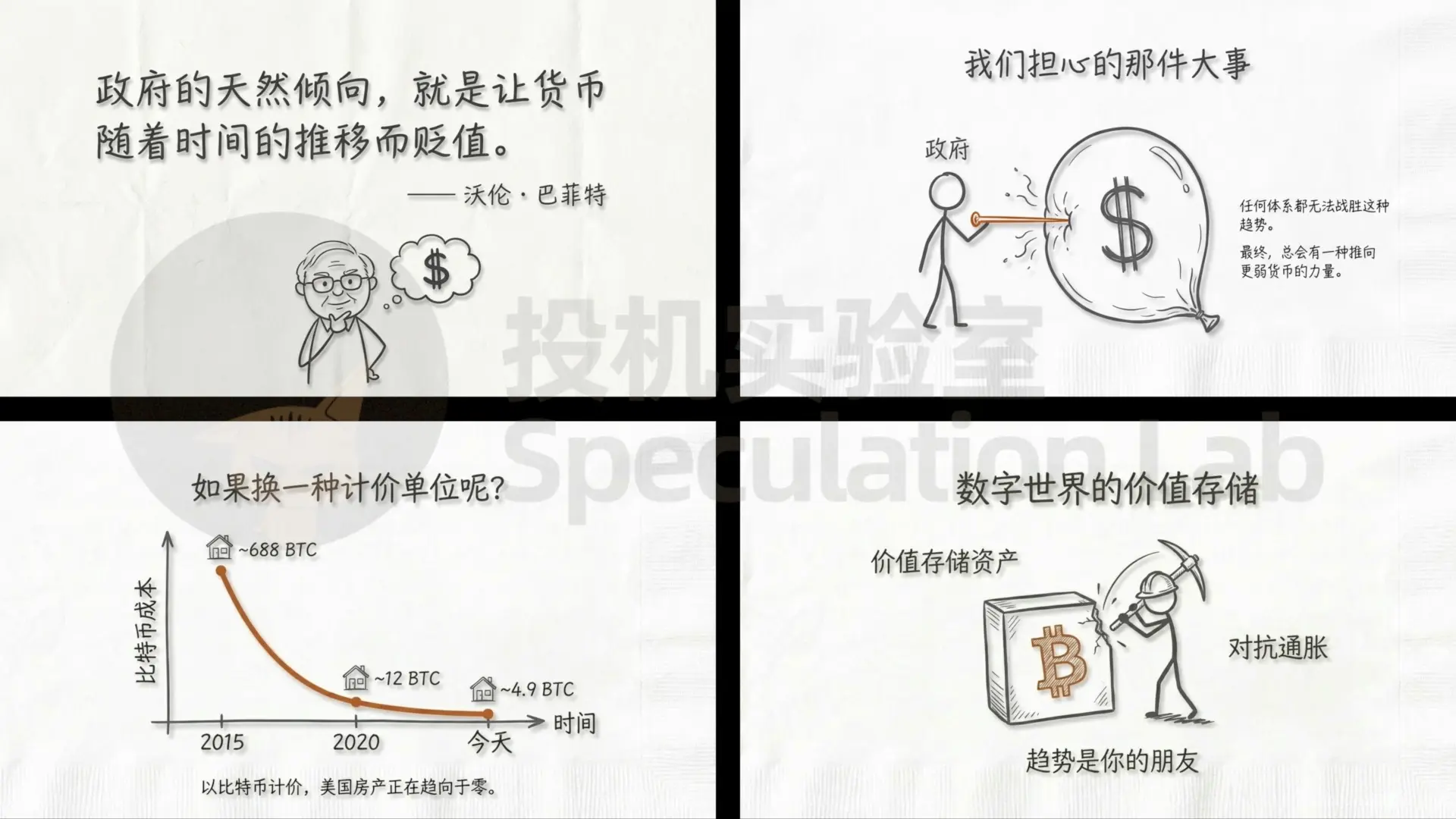

Assets valued in Bitcoin, such as houses, will increasingly approach zero, meaning that housing priced in Bitcoin is becoming more and more affordable. In 2015, buying a house required approximately 688 Bitcoins; in 2020, it required about 12🤔.

Today, buying a house only requires about 4.9 Bitcoins.

Buffett said that devaluing currency is a natural practice of governments worldwide, and no system can overcome this, not even the US dollar. The entire world is the same, and some places even experience frequent out-of-control situations. His company Berkshire Hathaway has more cash than at any t

Today, buying a house only requires about 4.9 Bitcoins.

Buffett said that devaluing currency is a natural practice of governments worldwide, and no system can overcome this, not even the US dollar. The entire world is the same, and some places even experience frequent out-of-control situations. His company Berkshire Hathaway has more cash than at any t

BTC-4.48%

- Reward

- 1

- Comment

- Repost

- Share

Gate compliance has taken another step forward!

Just obtained a license in Idaho, USA, and now holding 32 state-level licenses across the US, covering 43 jurisdictions. In a country like the US where each state has different regulations, acquiring these one by one is no easy feat, showing a strong commitment to long-term operation.

Personally, I feel that Gate is now more like preparing for the next phase in advance. Putting aside whether the market is good or not, it's essential to first address compliance and risk control—things that are often overlooked but are the most important—so that ev

View OriginalJust obtained a license in Idaho, USA, and now holding 32 state-level licenses across the US, covering 43 jurisdictions. In a country like the US where each state has different regulations, acquiring these one by one is no easy feat, showing a strong commitment to long-term operation.

Personally, I feel that Gate is now more like preparing for the next phase in advance. Putting aside whether the market is good or not, it's essential to first address compliance and risk control—things that are often overlooked but are the most important—so that ev

- Reward

- 1

- Comment

- Repost

- Share

From 5,000 to 10 million: The real path — I used these three tricks to turn around debt, and the last one most people can't do

When I first entered the crypto world, I only had 2,000 yuan in living expenses. Now, my account holds over 20 million. It's not luck, but a relentless pursuit of a "violent stacking method."

Phase One: Wild Growth with 300U (Key: Avoid greed)

A common mistake for newcomers is "wanting to turn 10,000 yuan into 1 million," but they go broke in three days. My starting strategy is extremely counterintuitive:

100U Sniper Strategy: Only chase coins with top 10 trading volum

View OriginalWhen I first entered the crypto world, I only had 2,000 yuan in living expenses. Now, my account holds over 20 million. It's not luck, but a relentless pursuit of a "violent stacking method."

Phase One: Wild Growth with 300U (Key: Avoid greed)

A common mistake for newcomers is "wanting to turn 10,000 yuan into 1 million," but they go broke in three days. My starting strategy is extremely counterintuitive:

100U Sniper Strategy: Only chase coins with top 10 trading volum

- Reward

- 1

- Comment

- Repost

- Share

Last night, a corn seller caused 20 million people to have insomnia collectively.

It's not about a failed product launch. On National Memorial Day, he held a copy of "The Nanjing Massacre" and spoke for four hours. The number in the top left corner of the screen kept climbing to 20 million. You watched as the barrage changed from "Buy the book" to a silent "Remember."

As he spoke, he suddenly paused, looked into the camera, and said, "Sorry, I need a thirty-second pause." Then he took off his glasses, and only a blurry halo remained in the lens.

That thirty seconds was the deafening sile

View OriginalIt's not about a failed product launch. On National Memorial Day, he held a copy of "The Nanjing Massacre" and spoke for four hours. The number in the top left corner of the screen kept climbing to 20 million. You watched as the barrage changed from "Buy the book" to a silent "Remember."

As he spoke, he suddenly paused, looked into the camera, and said, "Sorry, I need a thirty-second pause." Then he took off his glasses, and only a blurry halo remained in the lens.

That thirty seconds was the deafening sile

- Reward

- 1

- Comment

- Repost

- Share

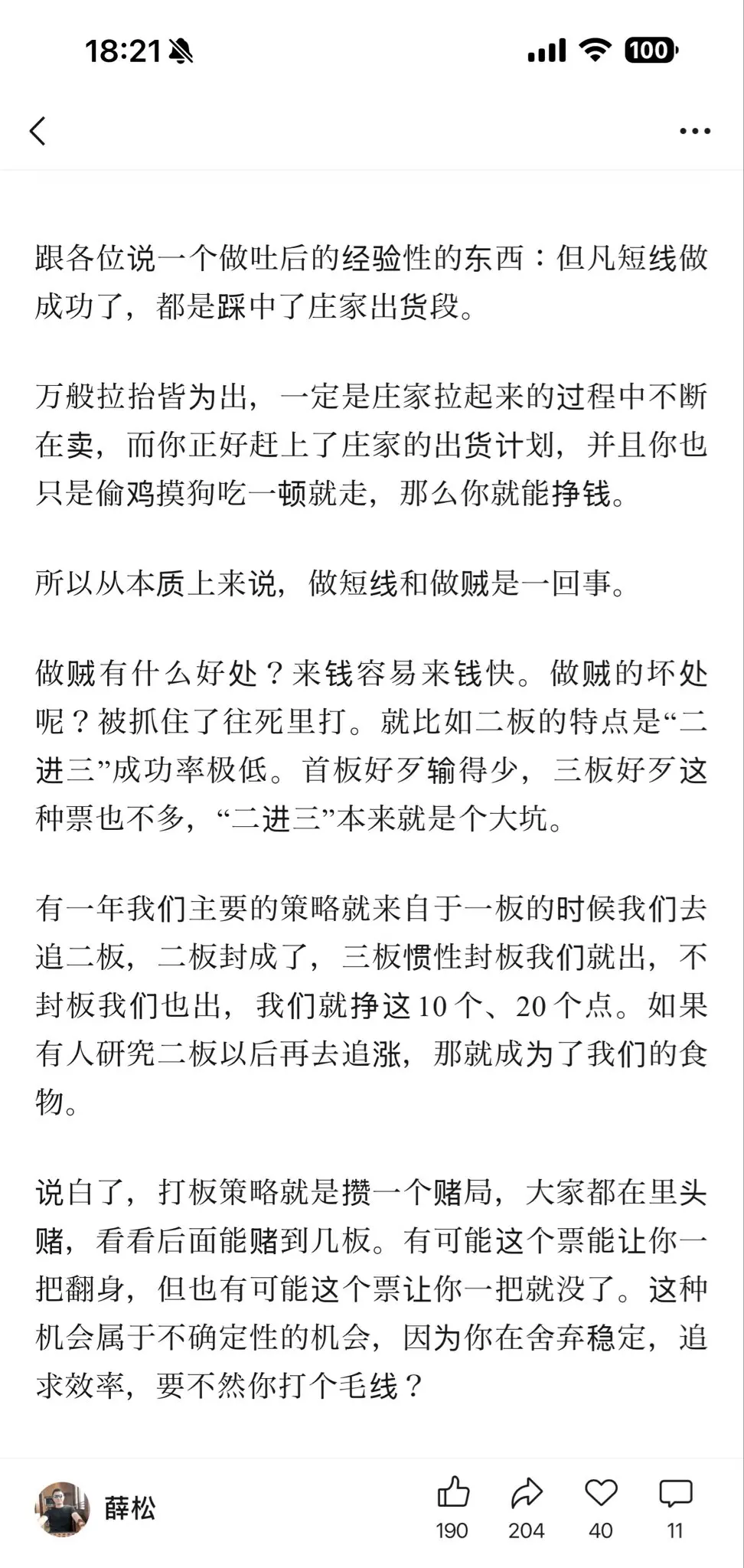

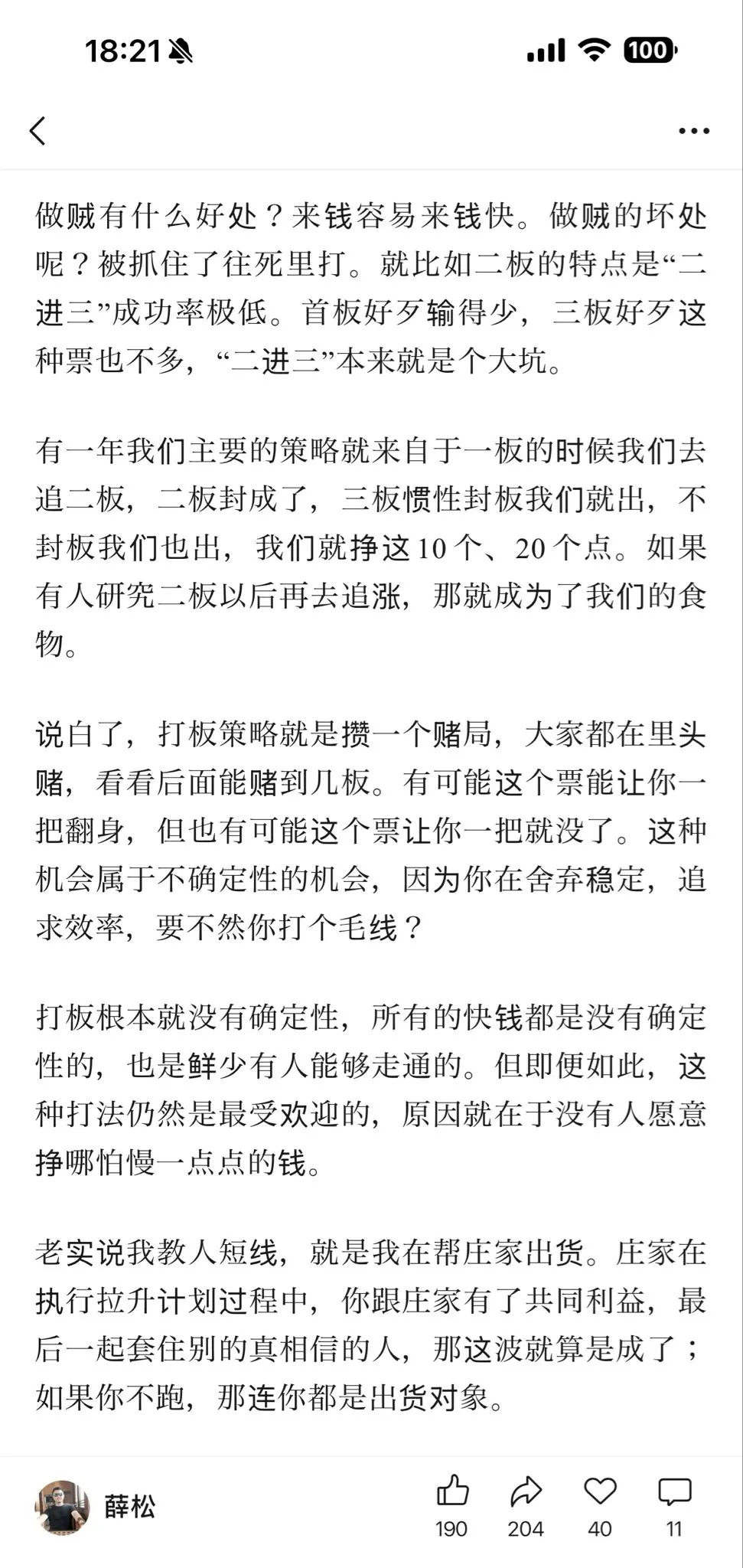

Xue Song said what I wanted to say — the essence of trading is to stick to the most probable correct direction, using 80% of the time for restraint and patience, to capture that 20% of the most certain opportunities, ultimately taking 80% of the profits.

View Original

- Reward

- 1

- Comment

- Repost

- Share

It is very necessary to regularly reflect each year on where the major technological trends will be in the next five years, where the potential investment opportunities lie, and then review one’s own investment strategies and targets.

Major technological trends and opportunities in the next five years:

1. The US financial market goes on-chain, the US dollar goes on-chain (stablecoins), US stocks (stocks or ETFs) go on-chain for direct trading, and US Treasury bonds go on-chain.

2. AI:

2.1 Transition from AI infrastructure construction to foundational and application layers. Over the next five

View OriginalMajor technological trends and opportunities in the next five years:

1. The US financial market goes on-chain, the US dollar goes on-chain (stablecoins), US stocks (stocks or ETFs) go on-chain for direct trading, and US Treasury bonds go on-chain.

2. AI:

2.1 Transition from AI infrastructure construction to foundational and application layers. Over the next five

- Reward

- 1

- Comment

- Repost

- Share

Starting from 2027, the largest "unemployment wave" in history may occur.

Recently, a very harsh judgment has been circulating in Silicon Valley:

Humanity is about to enter a 15-year-long "hell mode."

This statement comes from former Google executive Mo Gawdat.

He once led Google X Laboratory,

became a millionaire at 29,

and has almost fully experienced and driven

the entire explosion cycle from the Internet to AI.

The focus is not on how "successful" he is,

but on the fact that

he is someone who has personally opened Pandora's box.

When someone like him tells you:

"Hell is coming"

this warnin

View OriginalRecently, a very harsh judgment has been circulating in Silicon Valley:

Humanity is about to enter a 15-year-long "hell mode."

This statement comes from former Google executive Mo Gawdat.

He once led Google X Laboratory,

became a millionaire at 29,

and has almost fully experienced and driven

the entire explosion cycle from the Internet to AI.

The focus is not on how "successful" he is,

but on the fact that

he is someone who has personally opened Pandora's box.

When someone like him tells you:

"Hell is coming"

this warnin

- Reward

- 1

- Comment

- Repost

- Share

I came across an article that made me feel quite emotional. Someone achieved financial freedom at 30 and started a laid-back life, but they passed away in their early 50s.

They relaxed for 10 years, became lazy for 10 years, did no housework, no exercise, didn't drink water, just cola and gaming, slept during the day, played all night, ate two meals a day, and at 40, developed uremia. They left this world in their early 50s.

In the crypto circle, no one has discussed average lifespan, but there are no shortage of sudden death cases around us.

Staying up late, sexual repression, anxiety, hypert

View OriginalThey relaxed for 10 years, became lazy for 10 years, did no housework, no exercise, didn't drink water, just cola and gaming, slept during the day, played all night, ate two meals a day, and at 40, developed uremia. They left this world in their early 50s.

In the crypto circle, no one has discussed average lifespan, but there are no shortage of sudden death cases around us.

Staying up late, sexual repression, anxiety, hypert

- Reward

- 1

- Comment

- Repost

- Share

It's terrifying:

Recently, there has been a surge in cryptocurrency kidnapping incidents, mainly because crypto assets naturally amplify the cost-effectiveness of violence.

Bank assets can be frozen, but crypto assets can be quickly transferred away and laundered.

When the attack vector shifts from "technology" to "people,"

and kidnappers find a physical entry point to access assets, the consequences are truly unimaginable!

Crypto assets solve the "trust issue," but they also redefine the risk structure.

Once again, stay safe!

View OriginalRecently, there has been a surge in cryptocurrency kidnapping incidents, mainly because crypto assets naturally amplify the cost-effectiveness of violence.

Bank assets can be frozen, but crypto assets can be quickly transferred away and laundered.

When the attack vector shifts from "technology" to "people,"

and kidnappers find a physical entry point to access assets, the consequences are truly unimaginable!

Crypto assets solve the "trust issue," but they also redefine the risk structure.

Once again, stay safe!

- Reward

- 1

- Comment

- Repost

- Share

Finance professionals must see: Top 10 Master Investors

1. John D. Rockefeller

- Title: "Father of Global Investment"

- Characteristics: Contrarian value investor, bottomed during WWII in European and American stock markets, with an annualized return of 14.5%

2. Benjamin Graham

- Title: "Father of Securities Analysis"

- Contribution: Proposed the three methods of stock investment, namely the Cross-Sectional Method, Expectation Method, and Margin of Safety Method

3. Philip Fisher

- Title: "King of Growth Stocks"

- Status: Pioneer of modern investment theory, skilled at discovering and holding s

View Original1. John D. Rockefeller

- Title: "Father of Global Investment"

- Characteristics: Contrarian value investor, bottomed during WWII in European and American stock markets, with an annualized return of 14.5%

2. Benjamin Graham

- Title: "Father of Securities Analysis"

- Contribution: Proposed the three methods of stock investment, namely the Cross-Sectional Method, Expectation Method, and Margin of Safety Method

3. Philip Fisher

- Title: "King of Growth Stocks"

- Status: Pioneer of modern investment theory, skilled at discovering and holding s

- Reward

- 1

- Comment

- Repost

- Share