阿龙策略论A

No content yet

阿龙策略论A

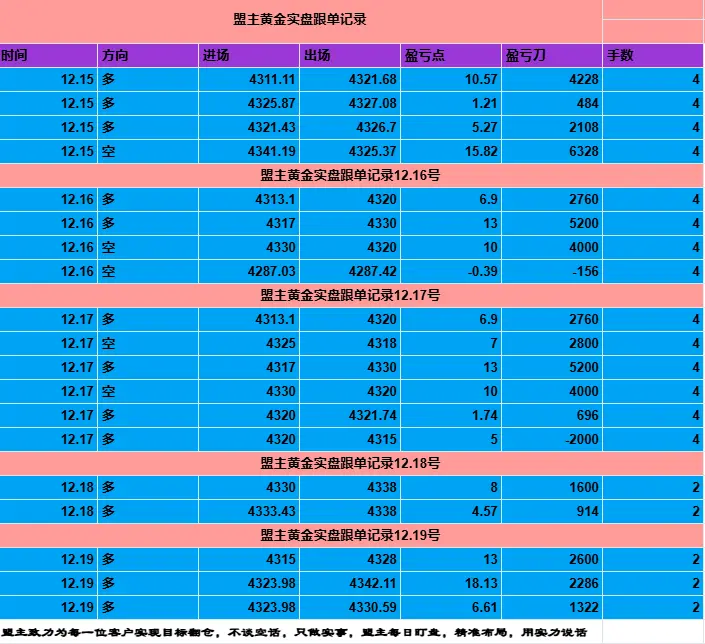

Weekly Summary | Gold Trading Wrap-up for the Third Week of December

This week, gold surged strongly. Our 19-wave trading entries were precisely timed, relying on key support and resistance levels for prediction + trend rhythm control to capture upward gains!

Trading involves both profits and losses as normal, but with precise entry points + decisive take-profit and stop-loss, the profit curve steadily rises. The core of this market move is to pre-define the bullish and bearish boundary points, enter without hesitation when appropriate, exit without ambiguity when necessary, and avoid blindly

View OriginalThis week, gold surged strongly. Our 19-wave trading entries were precisely timed, relying on key support and resistance levels for prediction + trend rhythm control to capture upward gains!

Trading involves both profits and losses as normal, but with precise entry points + decisive take-profit and stop-loss, the profit curve steadily rises. The core of this market move is to pre-define the bullish and bearish boundary points, enter without hesitation when appropriate, exit without ambiguity when necessary, and avoid blindly

- Reward

- like

- Comment

- Repost

- Share

12.18 Gold Morning Review: Wide-range Fluctuation Does Not Change the Bottoming and Rebound Trend, Focus on Buying on Dips and Not Chasing Highs

On Wednesday, gold continued its wide-range fluctuation trend, but the bottoming and rebound rhythm remained unchanged. Currently, 4350 remains a key short-term resistance level. Once a volume breakout occurs, the next target could be around the previous high near 4380; however, this level previously formed a double top that triggered a pullback. If it is touched again, caution is advised regarding the "three-top" resistance. Overall, all moving avera

View OriginalOn Wednesday, gold continued its wide-range fluctuation trend, but the bottoming and rebound rhythm remained unchanged. Currently, 4350 remains a key short-term resistance level. Once a volume breakout occurs, the next target could be around the previous high near 4380; however, this level previously formed a double top that triggered a pullback. If it is touched again, caution is advised regarding the "three-top" resistance. Overall, all moving avera

- Reward

- like

- Comment

- Repost

- Share

12.17 Gold Morning Review

Yesterday, the gold market showed a strong "bottoming out and rebounding" pattern. Gold prices dipped to around 4271 and then quickly rebounded. Despite the negative impact of non-farm payroll data, the price did not break through the key support level, ultimately completing a V-shaped reversal, demonstrating strong buying pressure below.

From a technical perspective, all indicators continue to rise, and the bullish trend structure remains intact. Therefore, today's trading strategy continues from yesterday's approach, with the core logic still focused on "buying afte

View OriginalYesterday, the gold market showed a strong "bottoming out and rebounding" pattern. Gold prices dipped to around 4271 and then quickly rebounded. Despite the negative impact of non-farm payroll data, the price did not break through the key support level, ultimately completing a V-shaped reversal, demonstrating strong buying pressure below.

From a technical perspective, all indicators continue to rise, and the bullish trend structure remains intact. Therefore, today's trading strategy continues from yesterday's approach, with the core logic still focused on "buying afte

- Reward

- like

- Comment

- Repost

- Share

Last week, the gold market showed a “rally and pullback, range-bound consolidation” pattern. After opening at 4220.7 at the beginning of the week, gold quickly surged to the weekly high of 4265.1 driven by short-term bullish momentum. However, insufficient buying support at the high triggered a strong pullback, with the lowest point touching the key support at 4162. The week ultimately closed at 4196.3, forming a spinning top candlestick with a slightly longer upper shadow. This pattern directly reflects intensified short-term bullish and bearish battles, and indicates that the pressure for a

View Original

- Reward

- like

- Comment

- Repost

- Share

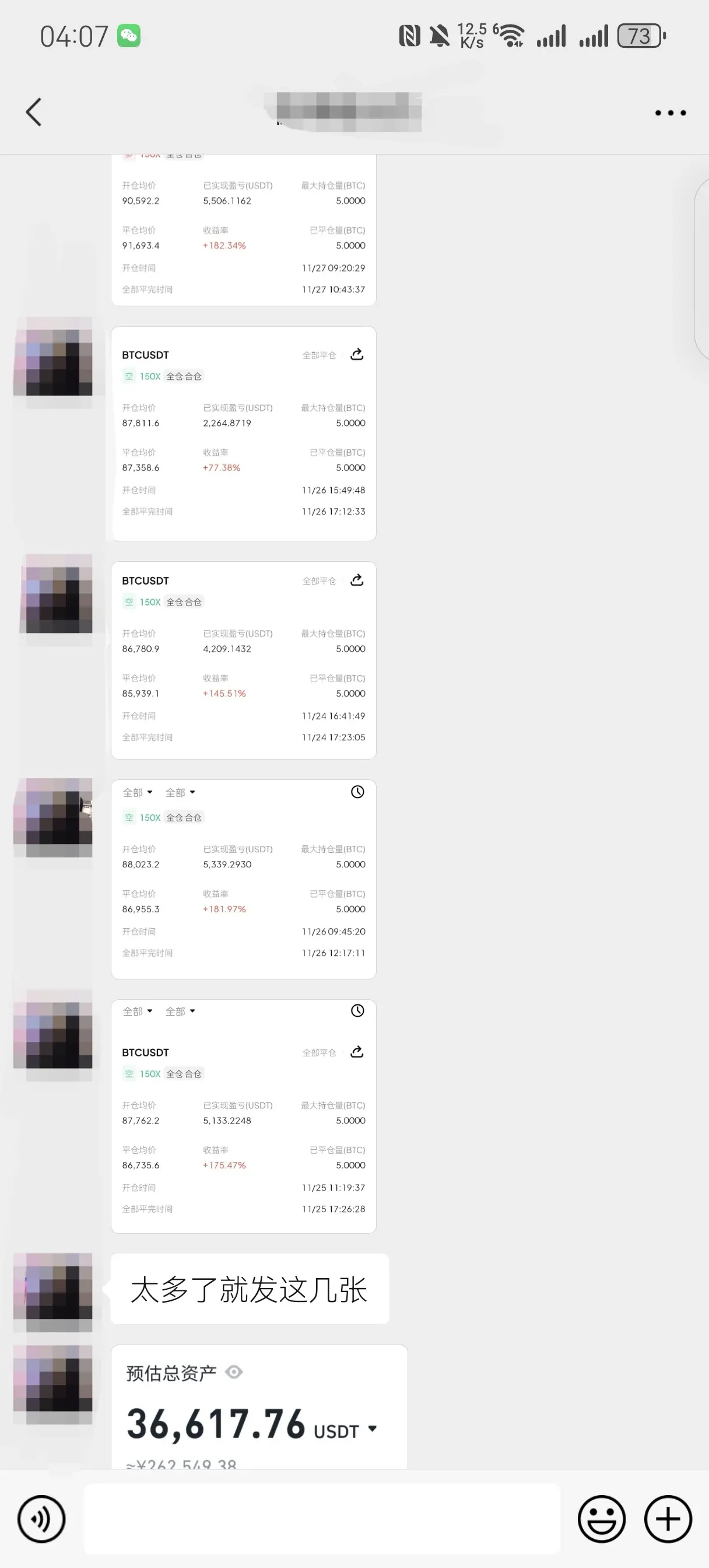

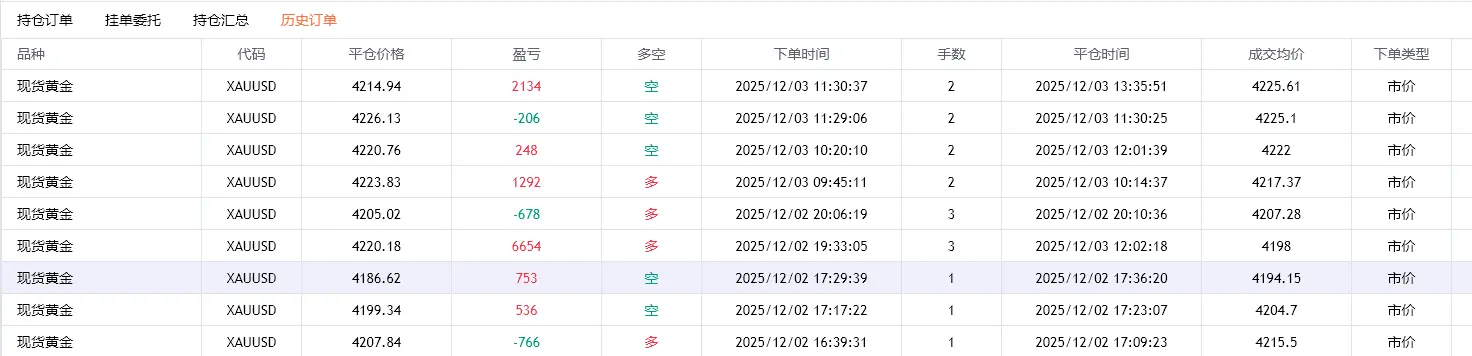

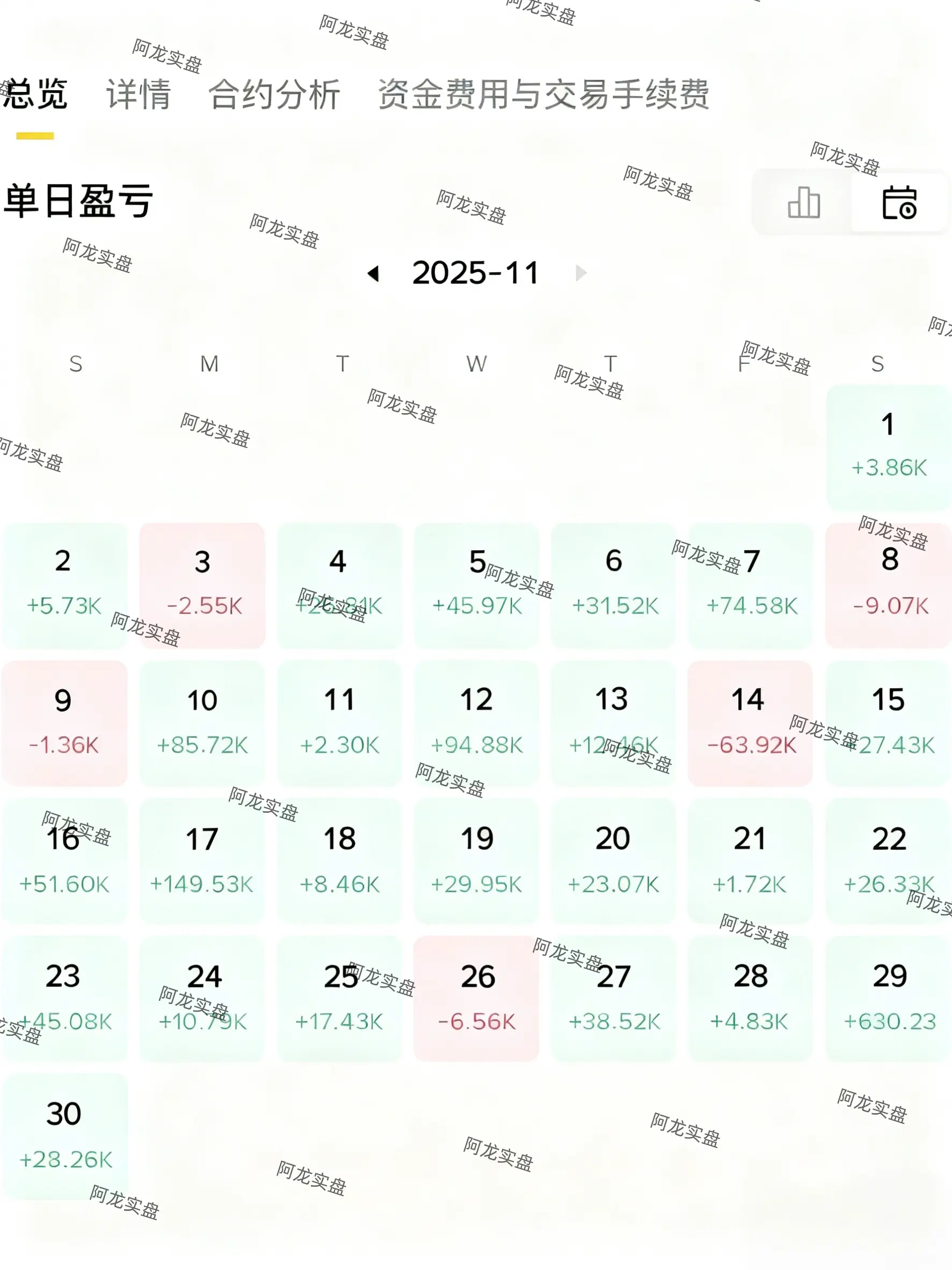

The current live trading record stands at 9 trades with 6 wins and 3 losses, with profitable momentum continuing!

On Tuesday, a strong start with 2 wins and 1 loss kicked off the week’s gains. On Wednesday, another 4 wins and 2 losses further expanded the results. Despite high-frequency operations over two days, the accuracy of predictions has remained solid, with every trade decision aimed at certain returns! #XAU

View OriginalOn Tuesday, a strong start with 2 wins and 1 loss kicked off the week’s gains. On Wednesday, another 4 wins and 2 losses further expanded the results. Despite high-frequency operations over two days, the accuracy of predictions has remained solid, with every trade decision aimed at certain returns! #XAU

- Reward

- like

- Comment

- Repost

- Share

Analysis of the Core Reasons for the Morning Crypto Assets Big Dump

This morning's big dump of Bitcoin and Ethereum is essentially a resonance of three factors: "realization of previous gains + impact of false news + market expectation fluctuation."

1. The main reason is the pullback in gains: Previously, Bitcoin and Ethereum had approached recent highs, and many investors had already planned to "take profit," with some cashing out early, leading to follow-up sell-offs and creating a chain reaction.

2. False news becomes the fuse: The morning’s fake news about "the Federal Reserve Ch

View OriginalThis morning's big dump of Bitcoin and Ethereum is essentially a resonance of three factors: "realization of previous gains + impact of false news + market expectation fluctuation."

1. The main reason is the pullback in gains: Previously, Bitcoin and Ethereum had approached recent highs, and many investors had already planned to "take profit," with some cashing out early, leading to follow-up sell-offs and creating a chain reaction.

2. False news becomes the fuse: The morning’s fake news about "the Federal Reserve Ch

- Reward

- like

- Comment

- Repost

- Share

ZEC has dipped in sync with the overall market, first falling near the key support level of 370, and the smaller time frame movements have shown signs of the support at 370 being unstable; in the afternoon, it broke down directly and is currently oscillating around 359, with a clear short-term weak pattern.

Action suggestion: Pay attention to the 360-370 range for light short positions, with a target towards the 330-320 area.

View OriginalAction suggestion: Pay attention to the 360-370 range for light short positions, with a target towards the 330-320 area.

- Reward

- like

- Comment

- Repost

- Share

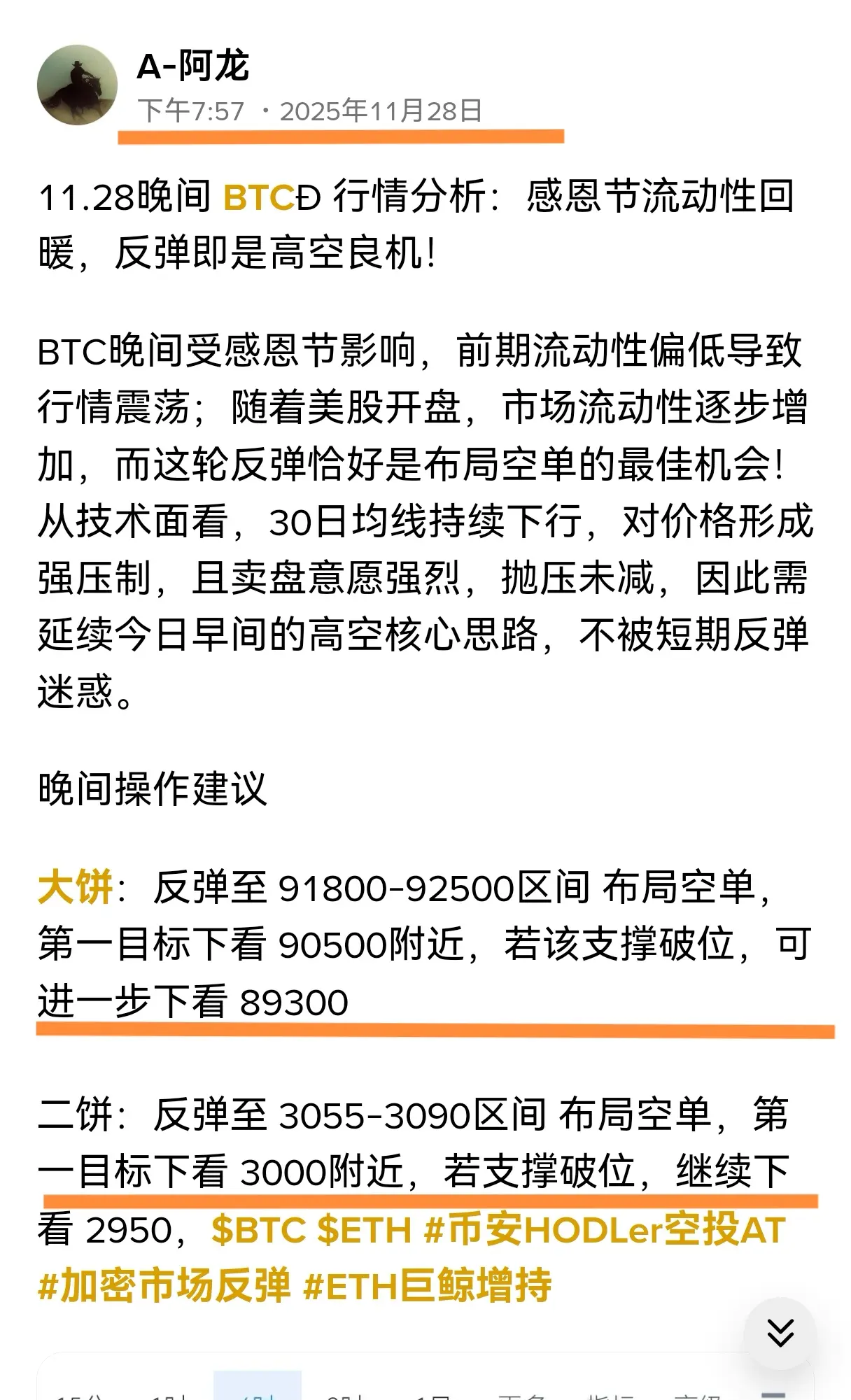

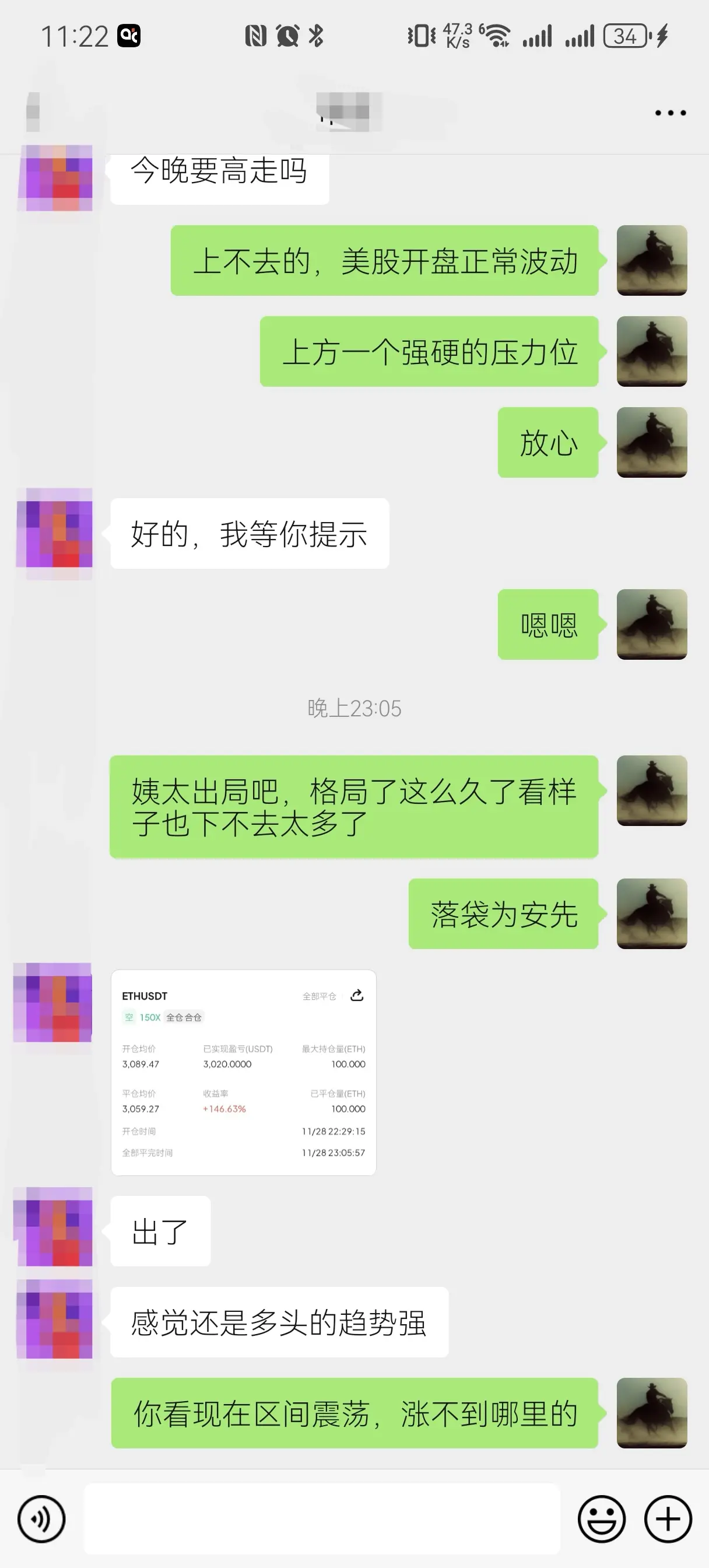

The BTC and ETH layout ideas provided in advance on 11.28 are by no means hindsight wisdom - from the strategy release to the market evolution on 12.1, everything strictly followed the preset rhythm, with trend predictions highly synchronized with actual movements, confirming the certainty of technical analysis through results.

The current market situation has fully validated the effectiveness of the previous strategy. Moving forward, we can still anchor this trend logic, grasping the key nodes during pullbacks or rebounds, allowing each operation to have clear directional support.

View OriginalThe current market situation has fully validated the effectiveness of the previous strategy. Moving forward, we can still anchor this trend logic, grasping the key nodes during pullbacks or rebounds, allowing each operation to have clear directional support.

- Reward

- like

- Comment

- Repost

- Share

These well-known pro in the crypto world mostly make their ill-gotten gains quickly, and they also go just as fast. The so-called wealth in the crypto world is often earned with a life on the line, and not necessarily spent with one. You might be living it up today, but tomorrow could leave you with nothing but a mess. What goes around, comes around!

View Original- Reward

- 1

- Comment

- Repost

- Share

The Bear Market is not a dead end; it is a power accumulation field for opportunities! The doubling window in the crypto world has clearly opened, so don't let hesitation cause you to miss out on profits. We sincerely invite like-minded traders to seize the next wave of wealth bonuses together.

Strength never relies on empty talk - past strategies are 100% public and traceable, with every point judgment and every round of position planning recorded, breaking doubts with results and proving professionalism with profits.

Asset allocation, precise layout:

- 3000-5000U: Use volatility as

View OriginalStrength never relies on empty talk - past strategies are 100% public and traceable, with every point judgment and every round of position planning recorded, breaking doubts with results and proving professionalism with profits.

Asset allocation, precise layout:

- 3000-5000U: Use volatility as

- Reward

- like

- Comment

- Repost

- Share

SOL has followed the mainstream coins in a decline this morning, dropping from a high of 137 to a support level of 127. Currently, it is stabilizing and fluctuating around 128, but the price continues to operate within the middle and lower bands of the Bollinger Bands. This pattern directly reflects the short-term weakness of buyers and significant pressure, with a lack of rebound momentum. The core strategy for the day should firmly focus on shorting on rallies.

Morning trading suggestion: Wait for the market to pull back to the 129-130 range to set up short positions, with a target lower a

View OriginalMorning trading suggestion: Wait for the market to pull back to the 129-130 range to set up short positions, with a target lower a

- Reward

- like

- Comment

- Repost

- Share

Sunday evening BTC/ETH trading strategy: In a fluctuating upward trend, focus on pullback long orders.

From the daily level, BTC/ETH continues to oscillate upwards, repeatedly challenging the middle band pressure of the Bollinger Bands while the highs keep rising, forming a healthy upward pattern. Yesterday's bearish close did not break the upward trend, which is actually a healthy correction in the trend progression, representing a normal technical adjustment, and the upward structure on the daily chart remains solid.

The 4-hour level shows stronger performance, having consecutively c

View OriginalFrom the daily level, BTC/ETH continues to oscillate upwards, repeatedly challenging the middle band pressure of the Bollinger Bands while the highs keep rising, forming a healthy upward pattern. Yesterday's bearish close did not break the upward trend, which is actually a healthy correction in the trend progression, representing a normal technical adjustment, and the upward structure on the daily chart remains solid.

The 4-hour level shows stronger performance, having consecutively c

- Reward

- like

- Comment

- Repost

- Share

"In a volatile market, seize short-term opportunities, and when the trend is clear, take a single-sided position"—this is a well-known trading rule in the encryption circle, but most people fall into the gap of "knowing is easy, doing is hard."

Don't miss the clear opportunity tonight: the key level of Ethereum (Auntie) 3020 has emerged. Whether it's relying on this level for oscillation trading or waiting for a breakthrough signal to follow up, both are practical choices that align with the current market situation, accurately locking in short-term profit windows.

View OriginalDon't miss the clear opportunity tonight: the key level of Ethereum (Auntie) 3020 has emerged. Whether it's relying on this level for oscillation trading or waiting for a breakthrough signal to follow up, both are practical choices that align with the current market situation, accurately locking in short-term profit windows.

- Reward

- like

- Comment

- Repost

- Share

Shock! The world's largest exchange "unplugs the network cable", gold goes crazy with Long Wick Candle, brokers are collectively headaching.

On November 28th, the world's top exchange, CME, experienced a massive outage, causing a complete halt of its core products including forex, gold, and US stock futures. The cause was a failure in the data center's cooling system, which directly disrupted the global financial markets!

The gold, which originally lacked liquidity due to Thanksgiving, instantly fell into a "roller coaster": plummeting from 4190 to break through 4155 with no ch

View OriginalOn November 28th, the world's top exchange, CME, experienced a massive outage, causing a complete halt of its core products including forex, gold, and US stock futures. The cause was a failure in the data center's cooling system, which directly disrupted the global financial markets!

The gold, which originally lacked liquidity due to Thanksgiving, instantly fell into a "roller coaster": plummeting from 4190 to break through 4155 with no ch

- Reward

- 1

- Comment

- Repost

- Share