AxelAdlerJr

No content yet

AxelAdlerJr

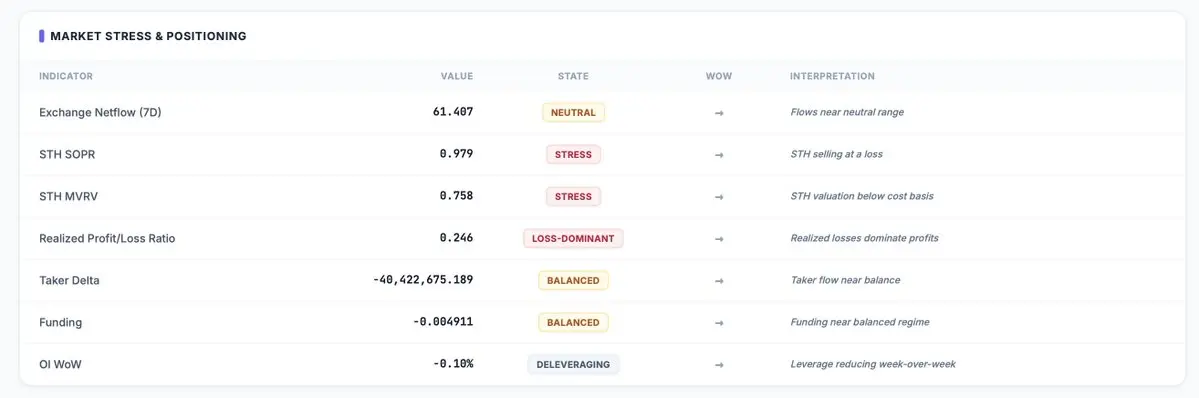

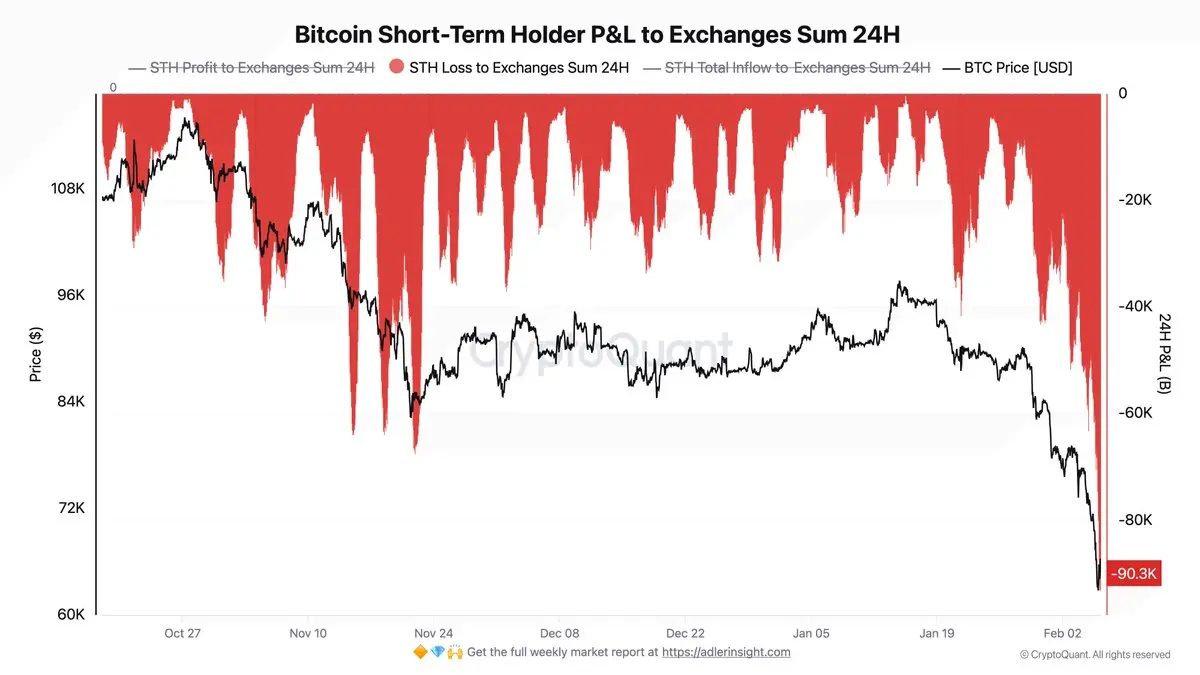

STH SOPR crossed back above 1.0 for the first time in a week: short-term holders are selling at a profit again. But MVRV is still 17% below the norm - the structural overhang hasn't gone anywhere. Every bounce will be met by sellers who just want to break even.

new ☕️ Adler AM👇

new ☕️ Adler AM👇

- Reward

- like

- Comment

- Repost

- Share

New Weekly Engine update + Trader’s Evidence is out.

Deleveraging is over - or just a pause before the next wave?

Full report below👇

Deleveraging is over - or just a pause before the next wave?

Full report below👇

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin Basis (%) - 7D SMA has returned to the neutral zone as the spot-futures premium collapsed. This indicates that demand for long exposure via derivatives has weakened, and the market is no longer pricing in an aggressive risk-on scenario. Typically, this signals a decrease in risk appetite, deleveraging, and a shift into wait-and-see mode.

Bulls need more spot demand, as derivatives are currently not pushing the market higher.

Bulls need more spot demand, as derivatives are currently not pushing the market higher.

BTC-2,44%

- Reward

- like

- Comment

- Repost

- Share

Satoshi Nakamoto is a single individual, not a group.

At the time of Bitcoin's creation, he was likely in his 30s or older. His references to Hashcash, b-money, and DigiCash were not random citations, they represented his actual working context. He possessed deep expertise in applied cryptography and financial systems.

He was a person for whom solving the problem was more important than owning the solution. It is highly probable that he still holds the keys, which makes him a potential target for criminal activity.

The world does not need to know his identity, as a Patoshi coin dump could tri

At the time of Bitcoin's creation, he was likely in his 30s or older. His references to Hashcash, b-money, and DigiCash were not random citations, they represented his actual working context. He possessed deep expertise in applied cryptography and financial systems.

He was a person for whom solving the problem was more important than owning the solution. It is highly probable that he still holds the keys, which makes him a potential target for criminal activity.

The world does not need to know his identity, as a Patoshi coin dump could tri

BTC-2,44%

- Reward

- like

- Comment

- Repost

- Share

Realized Price Under Threat: Market Approaching Critical Support Zone

The market is falling, but long-term support remains intact: LTH Cost Basis is rising (~$38.2K), Realized Price is declining (~$55.0K), and at current rates they will form a critical corridor of $43K-$51K within a quarter.

☕️ Adler AM 👇

The market is falling, but long-term support remains intact: LTH Cost Basis is rising (~$38.2K), Realized Price is declining (~$55.0K), and at current rates they will form a critical corridor of $43K-$51K within a quarter.

☕️ Adler AM 👇

- Reward

- like

- Comment

- 1

- Share

Market Back to Risk-Off: Stablecoins Confirm BTC Weakness

new ☕️Adler AM 👇

new ☕️Adler AM 👇

BTC-2,44%

- Reward

- like

- Comment

- Repost

- Share

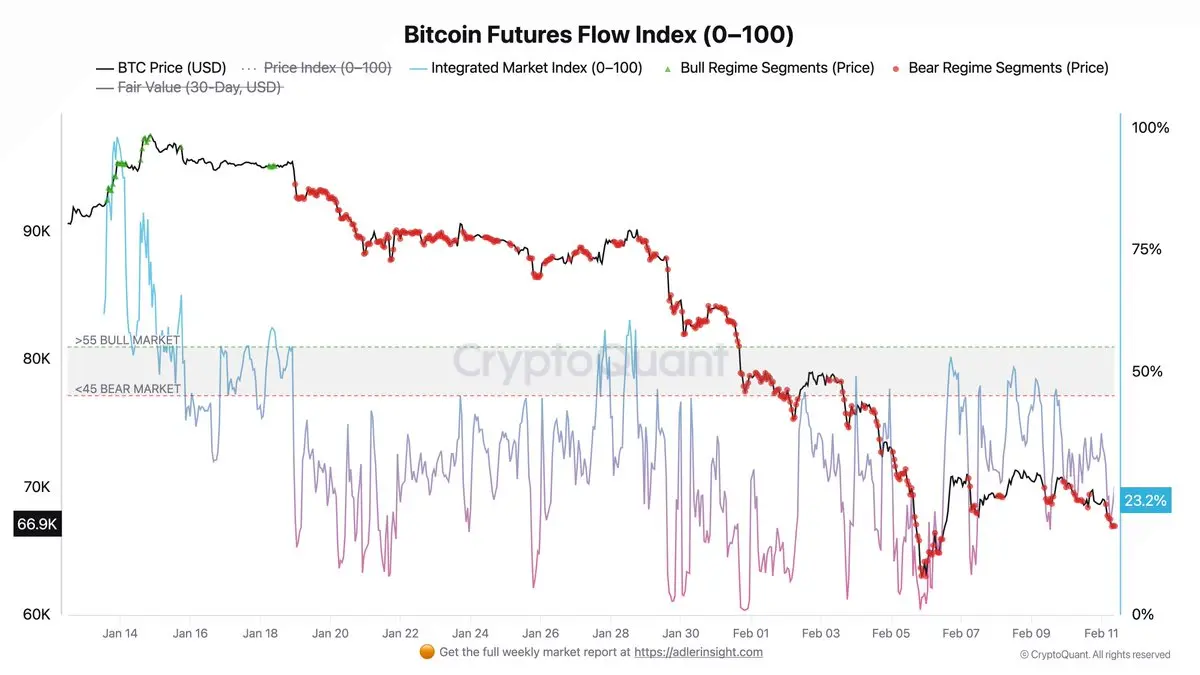

I’m checking the LTF futures charts every other day, hoping for some signs of improvement, but I don't see any yet.

- Reward

- like

- Comment

- Repost

- Share

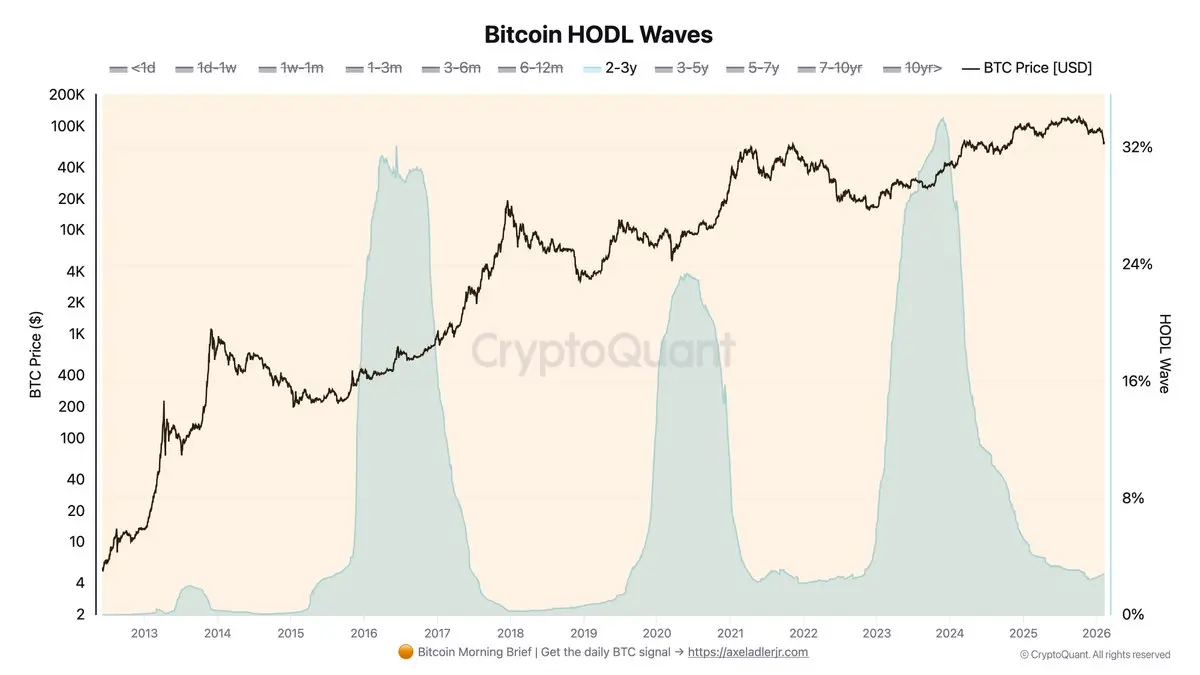

Who actually holds the supply? This lesson shows how STH/LTH Supply and HODL Waves reveal whether a rally has strong support - or is just weak hands chasing price.

- Reward

- like

- Comment

- Repost

- Share

True Diamond Hands Spectrum💎🙌

- Reward

- like

- Comment

- Repost

- Share

These three lessons will give you a basic understanding of one of the key pillars of on-chain analysis - unrealized profit/loss and the psychology of market cycles.

Save them to your bookmarks and set aside 2-3 hours over the weekend to calmly go through them and understand how it works.

Save them to your bookmarks and set aside 2-3 hours over the weekend to calmly go through them and understand how it works.

- Reward

- like

- Comment

- Repost

- Share

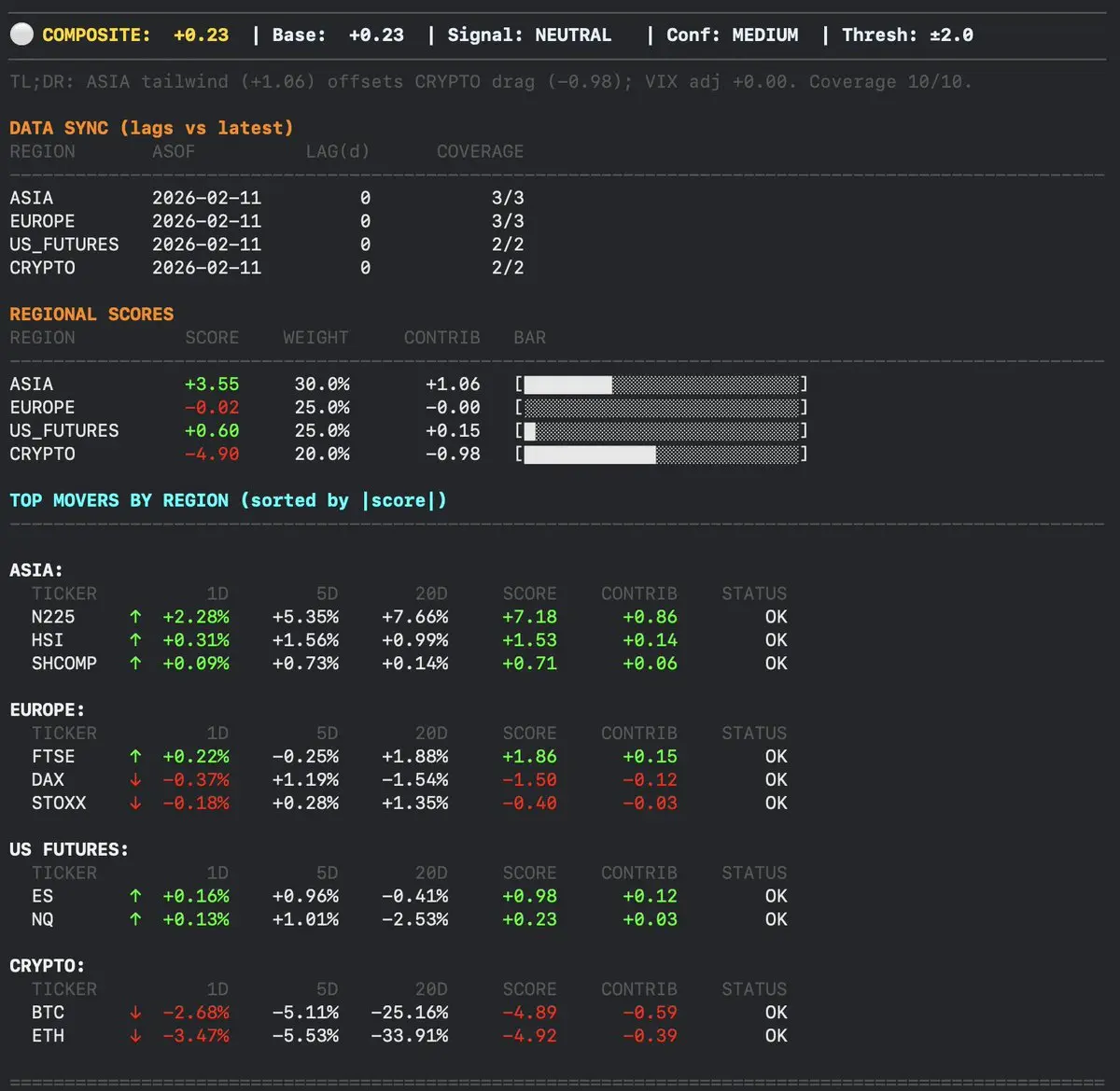

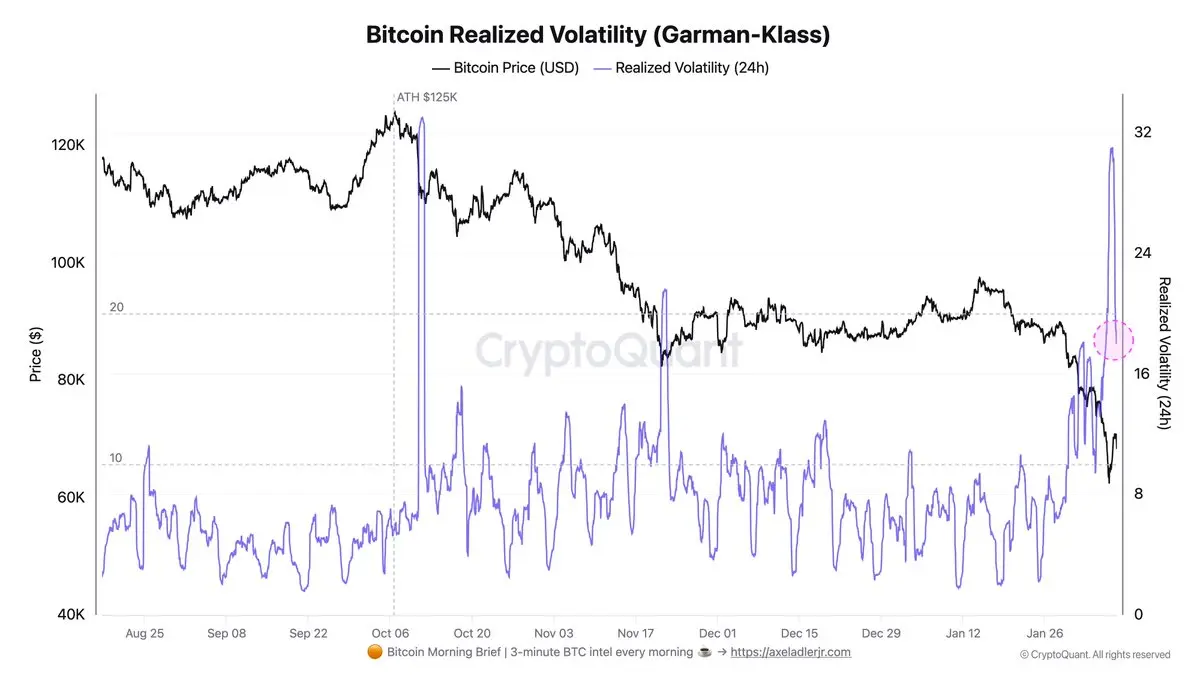

Overall morning sentiment is neutral, but rising VIX and MOVE are strengthening a defensive bias and increasing the likelihood of a risk-off shift.

- Reward

- like

- Comment

- Repost

- Share

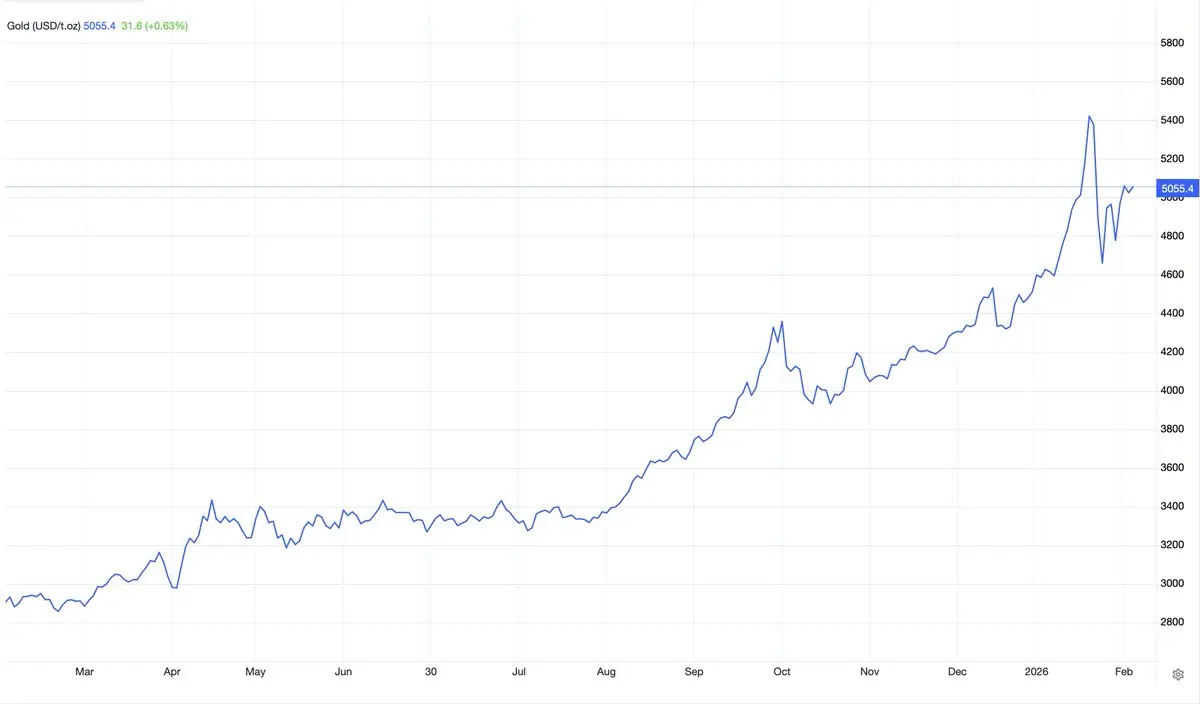

Gold recovered above $5,055 per ounce on Wednesday, approaching a nearly two-week high. The move followed weak U.S. data, as December retail sales fell short of expectations, signaling a slowdown in consumer spending and heightening concerns about moderating economic growth.

- Reward

- like

- Comment

- Repost

- Share

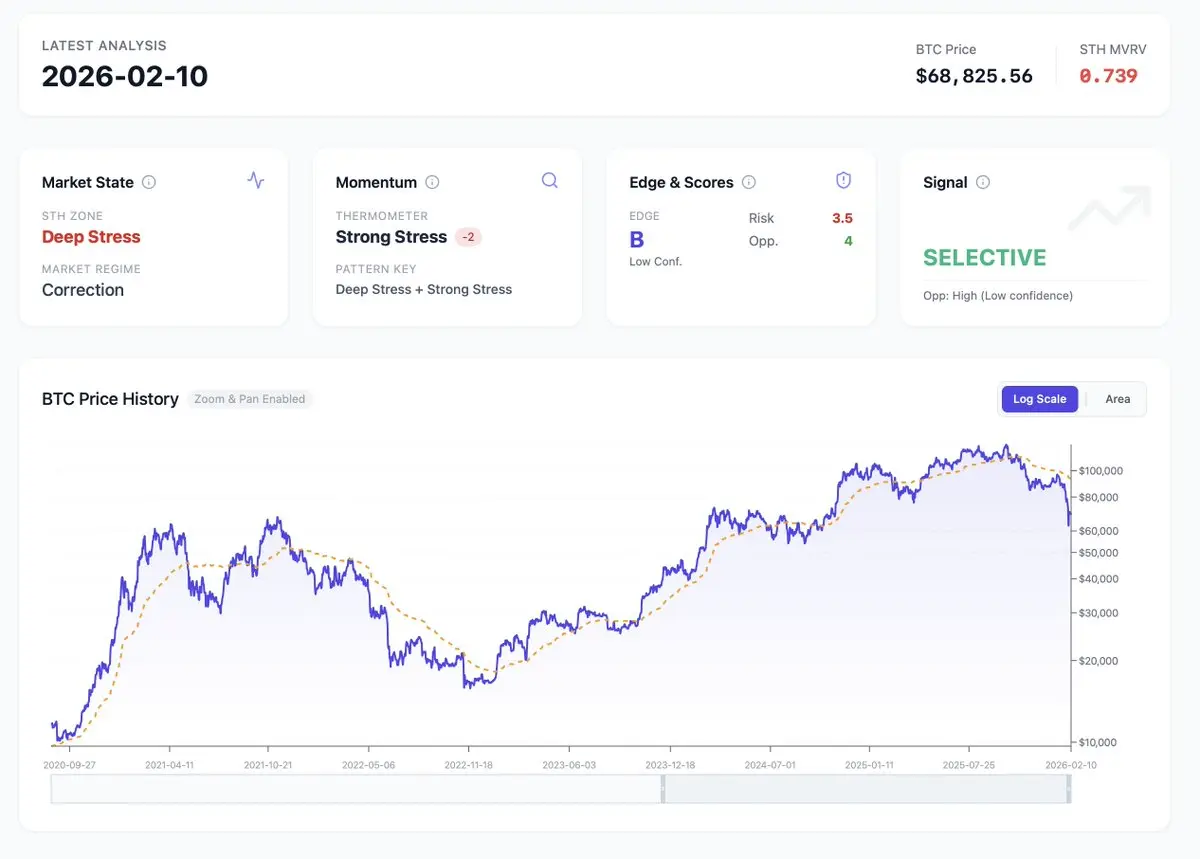

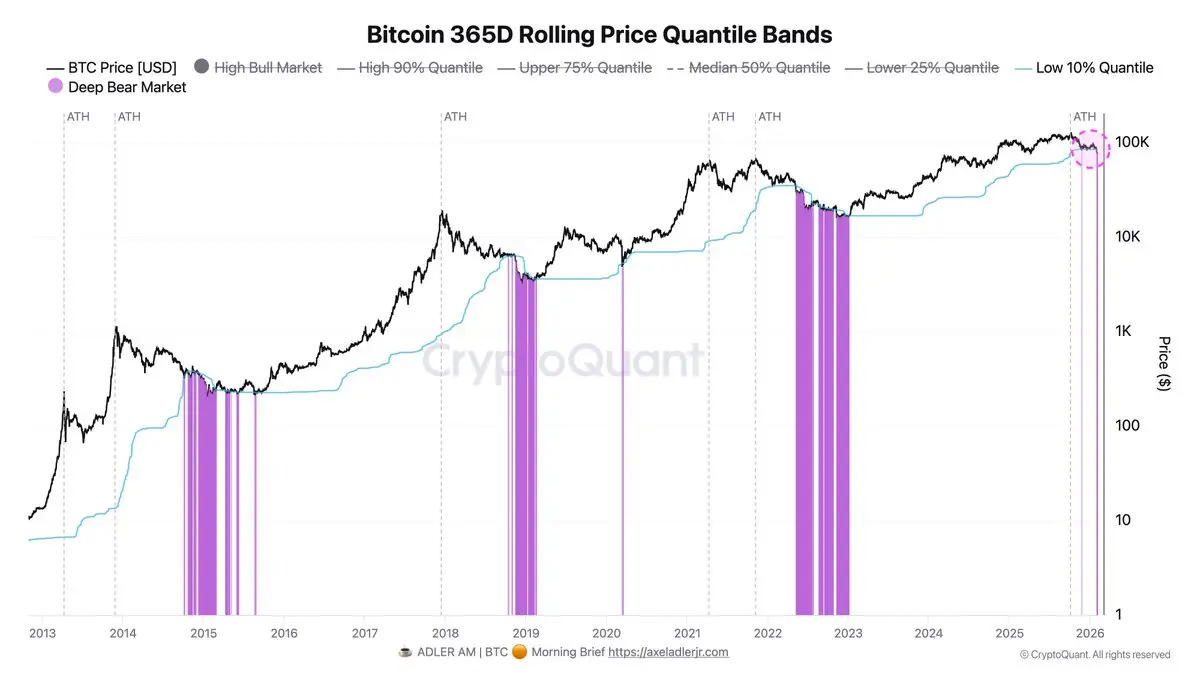

You can say all you want that BTC is fine, but the data tells a different story: the model classifies the current regime for STH as Deep Stress.

A detailed breakdown of the framework is here:

A detailed breakdown of the framework is here:

BTC-2,44%

- Reward

- like

- Comment

- Repost

- Share

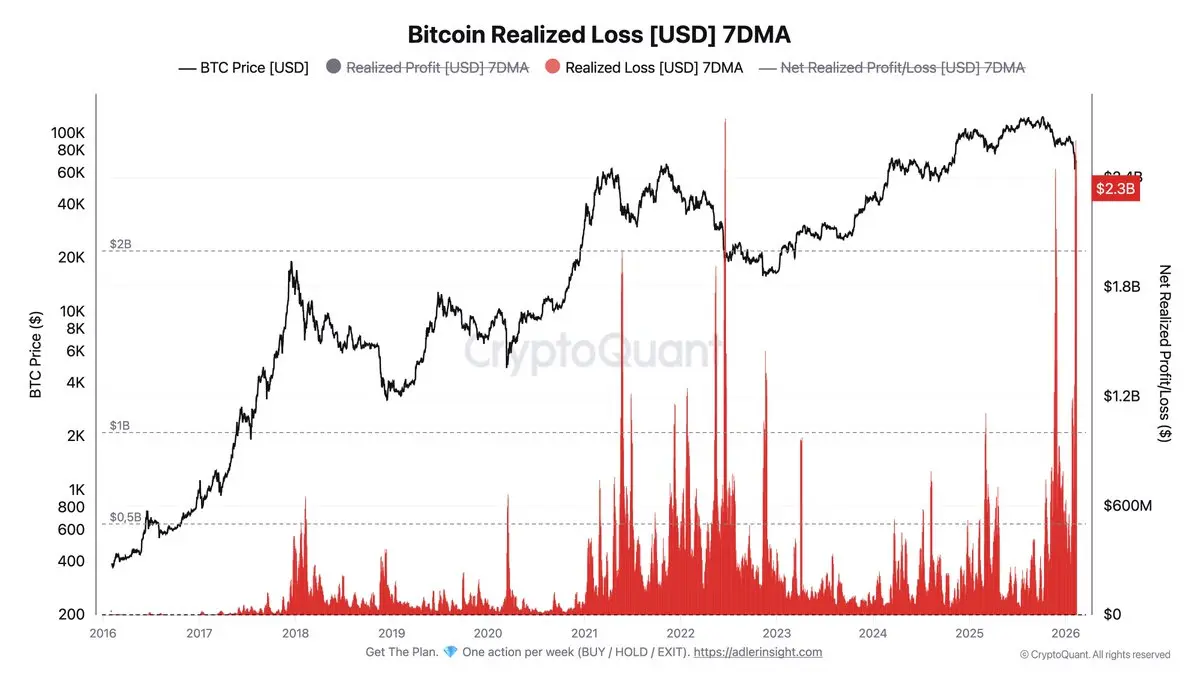

Bitcoin Realized Loss (7DMA) hit $2.3B - a level exceeded only once: during the Luna crash in June 2022.

But here's the key difference: back then it was $19K and a systemic collapse. Now it's $67K and a correction from ATH. Same scale of pain, completely different context.

new ☕️ Adler AM 👇

But here's the key difference: back then it was $19K and a systemic collapse. Now it's $67K and a correction from ATH. Same scale of pain, completely different context.

new ☕️ Adler AM 👇

- Reward

- like

- Comment

- Repost

- Share

Most traders don’t lose because of bad TA. They lose because they misread the regime.

This Sunday: Trader’s Evidence 1-page companion to the Weekly Engine.

On-chain + derivatives snapshot.

LLM-ready (prompt included): instant interpretation of stress, positioning, bias, and invalidation.

Get access:

This Sunday: Trader’s Evidence 1-page companion to the Weekly Engine.

On-chain + derivatives snapshot.

LLM-ready (prompt included): instant interpretation of stress, positioning, bias, and invalidation.

Get access:

- Reward

- like

- Comment

- Repost

- Share

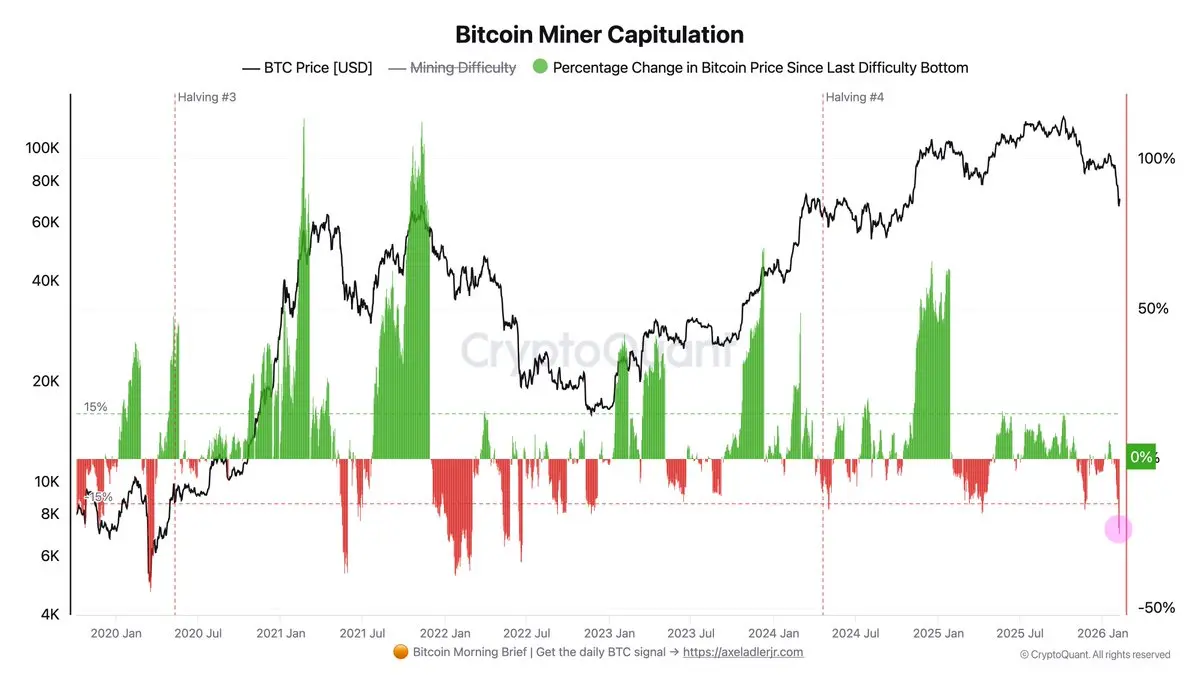

Cango sold 4,451 BTC for $305M - panic or deleveraging?

Difficulty is down 14%, Puell <0.8, but miner exchange flows remain stable.

Full breakdown in ☕️Adler AM #102 👇

Difficulty is down 14%, Puell <0.8, but miner exchange flows remain stable.

Full breakdown in ☕️Adler AM #102 👇

- Reward

- like

- Comment

- Repost

- Share

Weekly Engine starts tomorrow. Stop guessing and get one clear BTC action per week: BUY / HOLD / EXIT.

BTC-2,44%

- Reward

- like

- Comment

- Repost

- Share

Market volatility will remain elevated for some time.

- Reward

- like

- Comment

- Repost

- Share

Welcome to the deep bear market.

- Reward

- like

- Comment

- Repost

- Share

The drop from $72K to $59K triggered the largest cascade of long liquidations since the start of the year. Short-term holders sent a record volume of losses to exchanges this year.new☕️Adler AM 👇

- Reward

- like

- Comment

- Repost

- Share