Berserker_09

No content yet

Berserker_09

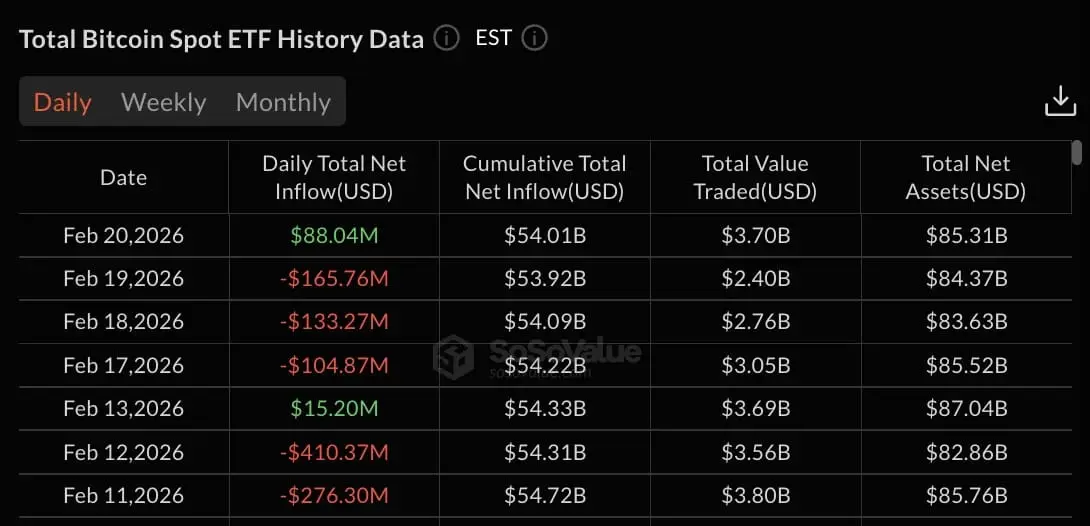

Bitcoin ETF inflows reach $88M as BTC price struggles at $67K

Bitcoin ETFs recorded $88.04 million in net inflows on February 20, breaking a three-day outflow streak that drained $403.90 million.

BlackRock’s IBIT led with $64.46 million while Fidelity’s FBTC attracted $23.59 million, with remaining funds posting zero flows.

Bitcoin ( $BTC ) traded at $67,800 with minimal 24-hour movement after touching a low of $66,452 during the session.

Total net assets reached $85.31 billion while cumulative total net inflow stood at $54.01 billion.

Three-day Bitcoin ETF outflow streak totaled $403 million

Bitcoin ETFs recorded $88.04 million in net inflows on February 20, breaking a three-day outflow streak that drained $403.90 million.

BlackRock’s IBIT led with $64.46 million while Fidelity’s FBTC attracted $23.59 million, with remaining funds posting zero flows.

Bitcoin ( $BTC ) traded at $67,800 with minimal 24-hour movement after touching a low of $66,452 during the session.

Total net assets reached $85.31 billion while cumulative total net inflow stood at $54.01 billion.

Three-day Bitcoin ETF outflow streak totaled $403 million

BTC0,96%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕Top 3 reasons why the Ethereum price may crash to $1,500 soon

Ethereum ( $ETH ) token dropped to $1,937, down sharply from the all-time high of $4,943, and key factors suggest that it has more downside, potentially to the key support level at $1,500.

Ethereum price technical points to more downside

The weekly timeframe chart shows that the ETH price has remained under pressure in the past few months. It has dropped in the last five consecutive weeks, and is hovering near its lowest level since May last year.

The coin has dropped below the key support level at $2,145, invalidating the inverted

Ethereum ( $ETH ) token dropped to $1,937, down sharply from the all-time high of $4,943, and key factors suggest that it has more downside, potentially to the key support level at $1,500.

Ethereum price technical points to more downside

The weekly timeframe chart shows that the ETH price has remained under pressure in the past few months. It has dropped in the last five consecutive weeks, and is hovering near its lowest level since May last year.

The coin has dropped below the key support level at $2,145, invalidating the inverted

ETH0,79%

- Reward

- 4

- 5

- Repost

- Share

GateUser-da2855ad :

:

goodView More

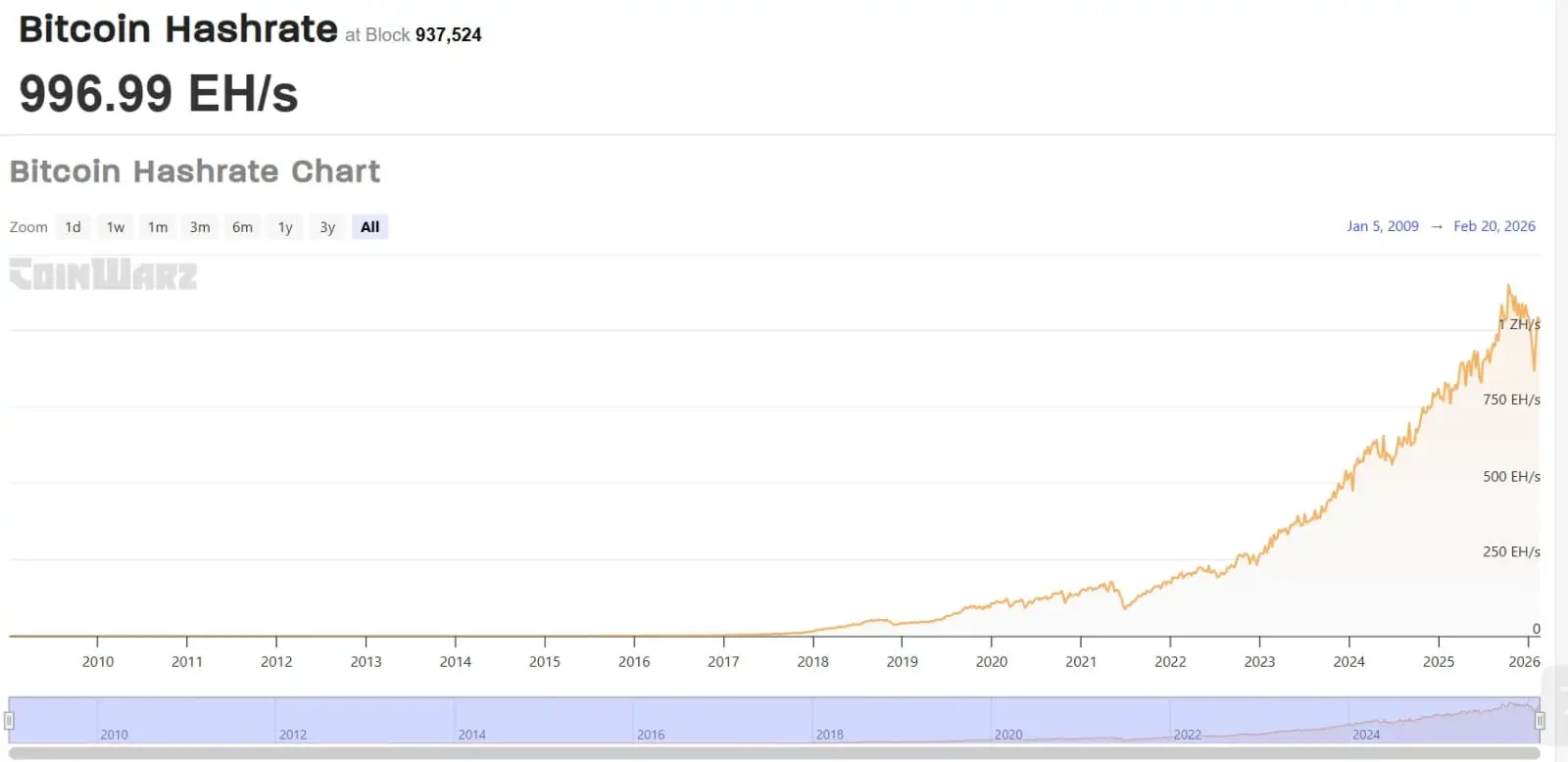

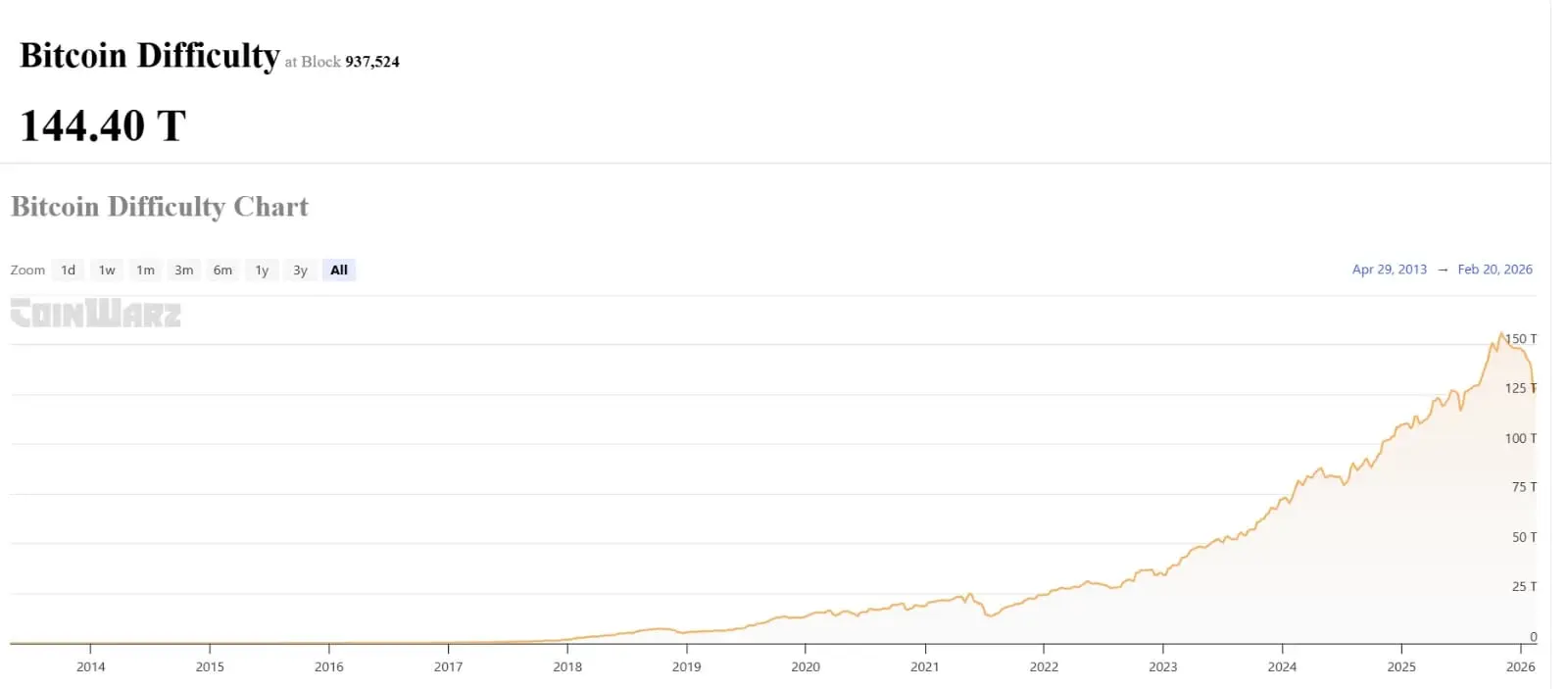

Why is Bitcoin difficulty surging at its fastest pace since 2021?

Bitcoin’s mining difficulty has climbed to 144.40 trillion (T) at block 937,524, marking one of the sharpest accelerations in network competition since the 2021 bull cycle.

At the same time, Bitcoin’s ( $BTC ) total hashrate has surged to 996.99 EH/s, hovering just below the symbolic 1 zettahash per second (ZH/s) milestone.

For context, Bitcoin difficulty is an adjustment mechanism that ensures blocks are mined roughly every 10 minutes. When more computing power joins the network and hashrate rises, the protocol automatically in

Bitcoin’s mining difficulty has climbed to 144.40 trillion (T) at block 937,524, marking one of the sharpest accelerations in network competition since the 2021 bull cycle.

At the same time, Bitcoin’s ( $BTC ) total hashrate has surged to 996.99 EH/s, hovering just below the symbolic 1 zettahash per second (ZH/s) milestone.

For context, Bitcoin difficulty is an adjustment mechanism that ensures blocks are mined roughly every 10 minutes. When more computing power joins the network and hashrate rises, the protocol automatically in

BTC0,96%

- Reward

- 1

- Comment

- Repost

- Share

XRP price breaks local bearish structure as rising volume targets $1.70

XRP price breaks local bearish market structure, shifting momentum, with price now testing a key volume support zone that could establish a higher low for higher prices.

$XRP Price action has begun to show early signs of recovery after breaking its local bearish market structure. Following a period of sustained downside pressure, the market has transitioned back into a technically significant support region where buyers are attempting to regain control. This development suggests that the corrective phase may be nearing com

XRP price breaks local bearish market structure, shifting momentum, with price now testing a key volume support zone that could establish a higher low for higher prices.

$XRP Price action has begun to show early signs of recovery after breaking its local bearish market structure. Following a period of sustained downside pressure, the market has transitioned back into a technically significant support region where buyers are attempting to regain control. This development suggests that the corrective phase may be nearing com

XRP1,12%

- Reward

- 6

- 6

- Repost

- Share

RjHaroon :

:

jhaggsjsjdhdbdbxhdyView More

Solana price confirms bull trap as local structure shifts bearish

Solana’s price invalidated its recent breakout attempt after failing to hold above key resistance, confirming a bull trap and shifting the short-term market structure back to bearish.

Solana ( $SOL ) price has entered a critical corrective phase after recent price action failed to sustain acceptance above major resistance levels. What initially appeared to be a bullish continuation has now revealed itself as a classic bull trap, catching late buyers before the price reversed sharply lower.

This type of failed breakout often mark

Solana’s price invalidated its recent breakout attempt after failing to hold above key resistance, confirming a bull trap and shifting the short-term market structure back to bearish.

Solana ( $SOL ) price has entered a critical corrective phase after recent price action failed to sustain acceptance above major resistance levels. What initially appeared to be a bullish continuation has now revealed itself as a classic bull trap, catching late buyers before the price reversed sharply lower.

This type of failed breakout often mark

SOL0,69%

- Reward

- 4

- Comment

- Repost

- Share

XRP price eyes $2.00 as failed auction confirms bullish shift

XRP price has formed a potential failed auction at $1.58, signaling demand at range lows and increasing the probability of a recovery move toward $2.00 upside.

Summary

$XRP failed to gain acceptance below the $1.58 range low, highlighting buyer demand

Holding above $1.58 preserves the broader range structure

A rotation toward the $2.00 value area low becomes more likely if support holds

XRP (XRP) price action has begun to stabilize after a sharp corrective move, with recent trading behavior offering important insight into market pos

XRP price has formed a potential failed auction at $1.58, signaling demand at range lows and increasing the probability of a recovery move toward $2.00 upside.

Summary

$XRP failed to gain acceptance below the $1.58 range low, highlighting buyer demand

Holding above $1.58 preserves the broader range structure

A rotation toward the $2.00 value area low becomes more likely if support holds

XRP (XRP) price action has begun to stabilize after a sharp corrective move, with recent trading behavior offering important insight into market pos

XRP1,12%

- Reward

- 2

- 1

- Repost

- Share

GateUser-850a7985 :

:

Happy New Year 🧨Ethereum Stabilizes Near $2000 as Analysts Outline 2026 Recovery Scenarios

Ethereum ( $ETH ) is trading around $2,060, consolidating after rebounding from recent lows near $1,850–$1,880.

The 1-hour structure shows a recovery attempt into resistance rather than a confirmed breakout, with price compressing beneath the $2,080–$2,120 region.

While near-term expectations point toward range-bound movement, broader projections for 2026 remain constructive, driven by institutional positioning, regulatory clarity, and network upgrades.

Short-Term Structure (February – March 2026)

On the 1-hour ETH/USDT

Ethereum ( $ETH ) is trading around $2,060, consolidating after rebounding from recent lows near $1,850–$1,880.

The 1-hour structure shows a recovery attempt into resistance rather than a confirmed breakout, with price compressing beneath the $2,080–$2,120 region.

While near-term expectations point toward range-bound movement, broader projections for 2026 remain constructive, driven by institutional positioning, regulatory clarity, and network upgrades.

Short-Term Structure (February – March 2026)

On the 1-hour ETH/USDT

ETH0,79%

- Reward

- 3

- 2

- Repost

- Share

GateUser-28ddfd4d :

:

Thank you for this information.View More

Bitcoin Breaks $70,000: Can Meme Coins Keep the Momentum?

Bitcoin has reversed its recent dip, climbing above the $70,000 mark within the last 24 hours, amidst a bustling digital asset weekend. Notably, meme coins outshone other altcoins, recording significant surges and gaining investor interest. By morning, Bitcoin stood firm at approximately $69,400, while several meme coins leaped, showing over 5% gains.

How Do Bitcoin ETF Flows Reflect Market Uncertainty?

US-listed Bitcoin exchange-traded funds experienced net outflows exceeding $600 million over the past trading week, with some minor off

Bitcoin has reversed its recent dip, climbing above the $70,000 mark within the last 24 hours, amidst a bustling digital asset weekend. Notably, meme coins outshone other altcoins, recording significant surges and gaining investor interest. By morning, Bitcoin stood firm at approximately $69,400, while several meme coins leaped, showing over 5% gains.

How Do Bitcoin ETF Flows Reflect Market Uncertainty?

US-listed Bitcoin exchange-traded funds experienced net outflows exceeding $600 million over the past trading week, with some minor off

- Reward

- 2

- Comment

- Repost

- Share

Ethereum price resembles adam and eve pattern, bottom forming?

Ethereum price is showing early signs of a potential macro bottom, with price action forming an Adam and Eve reversal pattern that could trigger a rally if key resistance is reclaimed.

Ethereum ( $ETH ) price action is beginning to show characteristics commonly associated with bottoming formations as the market stabilizes after a prolonged corrective phase.

Following a sharp sell-off, ETH has produced a strong initial rebound and is now consolidating near key value levels. This behavior aligns closely with an Adam and Eve reversal

Ethereum price is showing early signs of a potential macro bottom, with price action forming an Adam and Eve reversal pattern that could trigger a rally if key resistance is reclaimed.

Ethereum ( $ETH ) price action is beginning to show characteristics commonly associated with bottoming formations as the market stabilizes after a prolonged corrective phase.

Following a sharp sell-off, ETH has produced a strong initial rebound and is now consolidating near key value levels. This behavior aligns closely with an Adam and Eve reversal

ETH0,79%

- Reward

- 3

- 1

- Repost

- Share

YingjinPavilion :

:

2026 Go Go Go 👊Why Bitcoin price could bottom at $65,000 before a major relief rally

Bitcoin price is approaching a critical $65,000 support zone where Fibonacci and channel confluence suggest a potential local bottom may form before a strong relief rally unfolds.

Bitcoin ( $BTC ) price action remains corrective in the near term, with the market continuing to rotate lower within a broader rising channel. After failing to hold the channel midpoint, BTC has slipped into a weaker internal trend, putting downward pressure on the price as sellers remain in control.

Despite this weakness, the broader structure doe

Bitcoin price is approaching a critical $65,000 support zone where Fibonacci and channel confluence suggest a potential local bottom may form before a strong relief rally unfolds.

Bitcoin ( $BTC ) price action remains corrective in the near term, with the market continuing to rotate lower within a broader rising channel. After failing to hold the channel midpoint, BTC has slipped into a weaker internal trend, putting downward pressure on the price as sellers remain in control.

Despite this weakness, the broader structure doe

BTC0,96%

- Reward

- 2

- Comment

- Repost

- Share

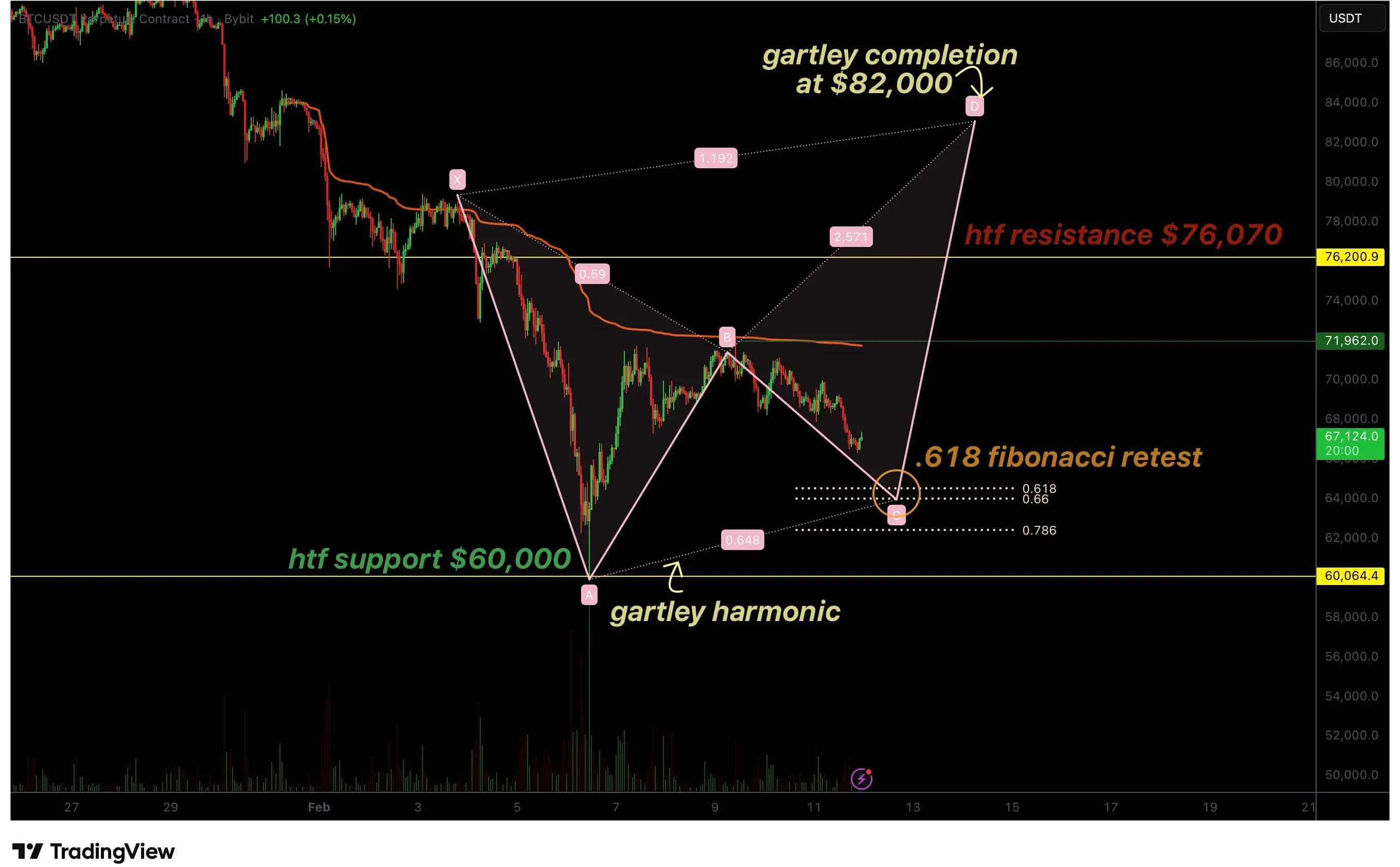

Why Bitcoin price gartley pattern signals potential move toward $80,000

Bitcoin price action is beginning to resemble a developing Gartley harmonic pattern, raising the probability of a technical reversal toward the $80,000–$82,000 region if key Fibonacci support holds.

Bitcoin ( $BTC ) has spent recent sessions consolidating after a sharp corrective move, with price behavior on the intraday timeframe beginning to form a recognizable harmonic structure. While broader market sentiment remains cautious, technical conditions suggest that Bitcoin may be entering a potential reversal zone.

The deve

Bitcoin price action is beginning to resemble a developing Gartley harmonic pattern, raising the probability of a technical reversal toward the $80,000–$82,000 region if key Fibonacci support holds.

Bitcoin ( $BTC ) has spent recent sessions consolidating after a sharp corrective move, with price behavior on the intraday timeframe beginning to form a recognizable harmonic structure. While broader market sentiment remains cautious, technical conditions suggest that Bitcoin may be entering a potential reversal zone.

The deve

BTC0,96%

- Reward

- 1

- Comment

- Repost

- Share

Ethereum price faces sub-$1,000 risk as liquidity remains lower

From a broader market-structure perspective, the ongoing consolidation appears less like accumulation and more like a pause before a continuation. Unless buyers can decisively reclaim control, the risk of a deeper corrective move below $1,000 remains firmly in play.

Ethereum ( $ETH ) price key technical points

Ethereum is trading at the point of control, a critical balance level

Low-volume bounces signal weak demand, raising bull trap risk

Untapped liquidity sits below range lows, increasing downside probability

Ethereum’s recent

From a broader market-structure perspective, the ongoing consolidation appears less like accumulation and more like a pause before a continuation. Unless buyers can decisively reclaim control, the risk of a deeper corrective move below $1,000 remains firmly in play.

Ethereum ( $ETH ) price key technical points

Ethereum is trading at the point of control, a critical balance level

Low-volume bounces signal weak demand, raising bull trap risk

Untapped liquidity sits below range lows, increasing downside probability

Ethereum’s recent

ETH0,79%

- Reward

- 3

- Comment

- 1

- Share

Is Solana headed to $50? These charts show a textbook bear pattern

Solana’s SOL ( $SOL ) has dropped 38% over the last 30 days, falling to a two-year low of $67 on Friday. Multiple analysts believe that the downside is not over for the seventh-placed cryptocurrency, with downward targets extending as low as $30.

Key takeaways:

Solana’s head-and-shoulders pattern targets a SOL price of $50 or lower.

MVRV bands point to a potential bottom, but support at $75 must hold.

Solana targets $42 after bearish confirmation

SOL price has already lost over 72% of its value since a cycle top of around $295

Solana’s SOL ( $SOL ) has dropped 38% over the last 30 days, falling to a two-year low of $67 on Friday. Multiple analysts believe that the downside is not over for the seventh-placed cryptocurrency, with downward targets extending as low as $30.

Key takeaways:

Solana’s head-and-shoulders pattern targets a SOL price of $50 or lower.

MVRV bands point to a potential bottom, but support at $75 must hold.

Solana targets $42 after bearish confirmation

SOL price has already lost over 72% of its value since a cycle top of around $295

SOL0,69%

- Reward

- 1

- Comment

- Repost

- Share

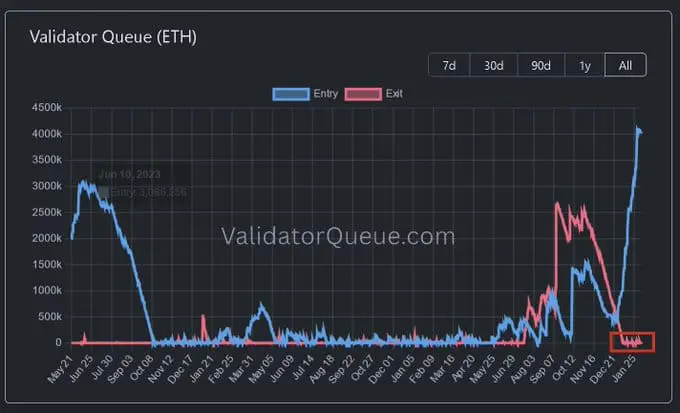

Ethereum price confirms inverted H&S as staking queue soars

Ethereum price could be preparing a strong rebound after forming a giant hammer candle and confirming the inverted head-and-shoulders chart pattern as the staking queue jumps to a record high.

Ethereum ( $ETH ) token was trading at $2,080, up sharply from last week’s low of $1,738. This price is much lower than the all-time high of nearly $5,000.

The ongoing Ethereum crash is notable as it is happening when the token has some of the best fundamentals ever. For example, more investors are delegating their coins to staking. Data shows

Ethereum price could be preparing a strong rebound after forming a giant hammer candle and confirming the inverted head-and-shoulders chart pattern as the staking queue jumps to a record high.

Ethereum ( $ETH ) token was trading at $2,080, up sharply from last week’s low of $1,738. This price is much lower than the all-time high of nearly $5,000.

The ongoing Ethereum crash is notable as it is happening when the token has some of the best fundamentals ever. For example, more investors are delegating their coins to staking. Data shows

ETH0,79%

- Reward

- 2

- Comment

- Repost

- Share

BlackRock’s Bitcoin ETF Sees $231.6M Inflows After Two Days of Record Outflows

Why Did IBIT See Inflows After Heavy Redemptions?

BlackRock’s spot Bitcoin ( $BTC ) exchange-traded fund recorded $231.6 million in inflows on Friday, reversing part of the damage from earlier in the week as Bitcoin prices swung sharply. The rebound followed two consecutive sessions of large redemptions, when the iShares Bitcoin Trust ETF shed a combined $548.7 million on Wednesday and Thursday, according to the data.

Those outflows coincided with a sharp sell-off across crypto markets. Bitcoin briefly fell to $60,0

Why Did IBIT See Inflows After Heavy Redemptions?

BlackRock’s spot Bitcoin ( $BTC ) exchange-traded fund recorded $231.6 million in inflows on Friday, reversing part of the damage from earlier in the week as Bitcoin prices swung sharply. The rebound followed two consecutive sessions of large redemptions, when the iShares Bitcoin Trust ETF shed a combined $548.7 million on Wednesday and Thursday, according to the data.

Those outflows coincided with a sharp sell-off across crypto markets. Bitcoin briefly fell to $60,0

BTC0,96%

- Reward

- 1

- Comment

- Repost

- Share

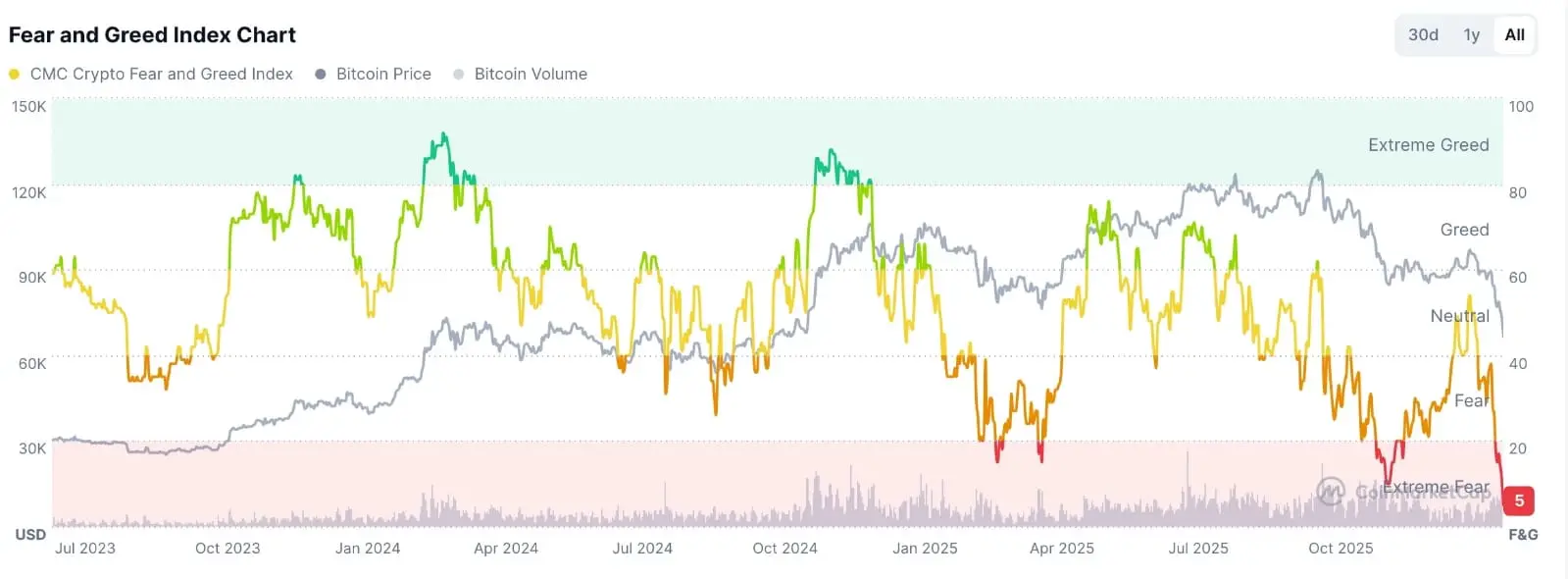

Crypto crash to end soon? Recovery possible, key indicators show

The crypto crash accelerated this week, with Bitcoin ( $BTC ) price plunging to $60,500, its lowest level since October 2024, and the market capitalization of all coins moving to $2.2 trillion.

Why the crypto crash is happening

The ongoing crypto market retreat is influenced by a mix of global economic concerns and investor sentiment. Rising tensions between the U.S. and Iran have added uncertainty, with both sides issuing warnings that any escalation could impact the region and potentially affect oil prices. However, there are n

The crypto crash accelerated this week, with Bitcoin ( $BTC ) price plunging to $60,500, its lowest level since October 2024, and the market capitalization of all coins moving to $2.2 trillion.

Why the crypto crash is happening

The ongoing crypto market retreat is influenced by a mix of global economic concerns and investor sentiment. Rising tensions between the U.S. and Iran have added uncertainty, with both sides issuing warnings that any escalation could impact the region and potentially affect oil prices. However, there are n

BTC0,96%

- Reward

- 2

- Comment

- Repost

- Share

Ethereum price crash: What can investors expect in February 2026?

Ethereum’s price crash leaves $ETH stuck in a firm downtrend, with negative flows and weak momentum making a sustained reclaim of $3,000 in February increasingly unlikely.

Ethereum’s price and latest selloff has left investors nursing losses and staring down a February defined more by damage control than euphoria. The core message from market structure and on‑chain signals is blunt: a swift return to $3,000 is, for now, fantasy rather than base case.

Structure of the crash

Ethereum rebounded toward $2,300 after one of its sharpe

Ethereum’s price crash leaves $ETH stuck in a firm downtrend, with negative flows and weak momentum making a sustained reclaim of $3,000 in February increasingly unlikely.

Ethereum’s price and latest selloff has left investors nursing losses and staring down a February defined more by damage control than euphoria. The core message from market structure and on‑chain signals is blunt: a swift return to $3,000 is, for now, fantasy rather than base case.

Structure of the crash

Ethereum rebounded toward $2,300 after one of its sharpe

ETH0,79%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin price faces bearish breakdown: Is $54,860 the next big test?

Bitcoin price has deteriorated over recent weeks, with repeated bearish daily closes below key support increasing downside risk toward $54,860.

Bitcoin ( $BTC ) price has entered a vulnerable phase after failing to hold several critical technical levels that previously supported price action. Over the past few weeks, the market has shifted from consolidation into sustained weakness, with sellers gaining control across multiple timeframes. This transition has been reinforced by consecutive bearish daily candle closes, signalin

Bitcoin price has deteriorated over recent weeks, with repeated bearish daily closes below key support increasing downside risk toward $54,860.

Bitcoin ( $BTC ) price has entered a vulnerable phase after failing to hold several critical technical levels that previously supported price action. Over the past few weeks, the market has shifted from consolidation into sustained weakness, with sellers gaining control across multiple timeframes. This transition has been reinforced by consecutive bearish daily candle closes, signalin

BTC0,96%

- Reward

- 1

- Comment

- Repost

- Share

Bitcoin price prediction: How low can BTC go in the first week of February?

Geopolitical risks, fears of a U.S. government shutdown, and slow-moving crypto regulations are weighing on market sentiment, keeping speculative bets muted.

Despite a brief lift, the path ahead for Bitcoin ( $BTC ) remains volatile, with key technical levels likely to dictate its next move in early February 2026.

In this Bitcoin price prediction, we look at where the market stands right now, the main downside levels to watch, and where BTC could go next if buyers step in.

Current market scenario

At the time of writing

Geopolitical risks, fears of a U.S. government shutdown, and slow-moving crypto regulations are weighing on market sentiment, keeping speculative bets muted.

Despite a brief lift, the path ahead for Bitcoin ( $BTC ) remains volatile, with key technical levels likely to dictate its next move in early February 2026.

In this Bitcoin price prediction, we look at where the market stands right now, the main downside levels to watch, and where BTC could go next if buyers step in.

Current market scenario

At the time of writing

BTC0,96%

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

Great