Cipher_X

No content yet

Cipher_X

Crypto Fear & Greed Index dropped

Let that sink in 👇

This is lower than:

The tariffs crash

The August 2024 crash

The FTX collapse

The 2020 COVID panic

We are officially in extreme, historic fear territory

But here’s the uncomfortable question:

If fear is worse than during FTX, worse than Luna, worse than a global lockdown…

what exactly is the market pricing in right now?

Capitulation doesn’t happen when people feel a bit nervous.

It happens when confidence is completely gone

Sentiment is at levels that have historically marked major bottoms

Not because the news improves but because s

Let that sink in 👇

This is lower than:

The tariffs crash

The August 2024 crash

The FTX collapse

The 2020 COVID panic

We are officially in extreme, historic fear territory

But here’s the uncomfortable question:

If fear is worse than during FTX, worse than Luna, worse than a global lockdown…

what exactly is the market pricing in right now?

Capitulation doesn’t happen when people feel a bit nervous.

It happens when confidence is completely gone

Sentiment is at levels that have historically marked major bottoms

Not because the news improves but because s

LUNA-0,81%

- Reward

- like

- Comment

- Repost

- Share

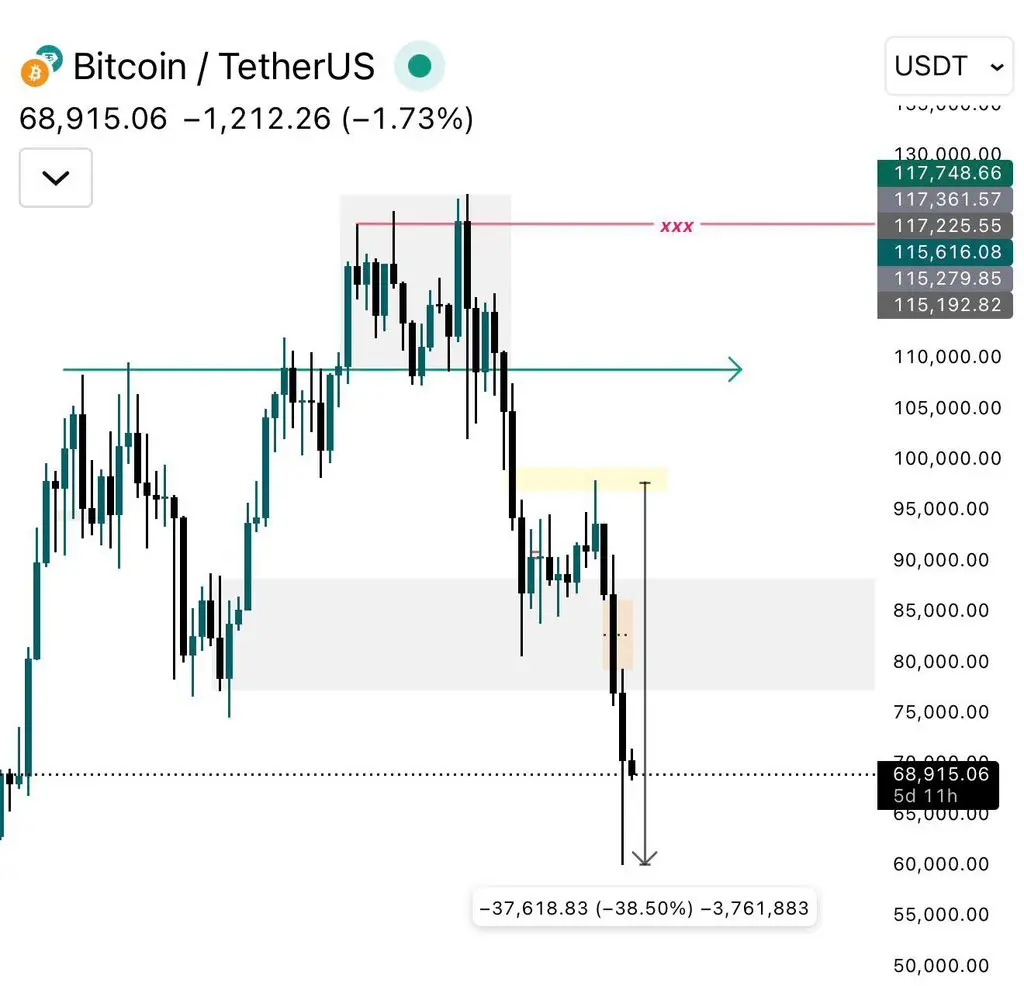

$BTC is compressing right above support 👇

Bitcoin is trading around 66,8K after rejecting the 71–72K resistance and respecting the descending trend-line

Clear lower highs structure

Trendline acting as dynamic resistance

Major support zone: 65.5K–66K

Bigger resistance above: 72K

If 66K holds, I’m expecting a bounce toward 69K first, then another attempt at 71–72K

If 65.5K breaks with momentum, next downside liquidity sits around 63K–64K

Bitcoin is trading around 66,8K after rejecting the 71–72K resistance and respecting the descending trend-line

Clear lower highs structure

Trendline acting as dynamic resistance

Major support zone: 65.5K–66K

Bigger resistance above: 72K

If 66K holds, I’m expecting a bounce toward 69K first, then another attempt at 71–72K

If 65.5K breaks with momentum, next downside liquidity sits around 63K–64K

BTC-2,79%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

BIG WEEK 🚨

Feb 10: White House discussions around the Crypto Market Structure / Clarity Act

Feb 11: U.S. unemployment figures

Feb 12: Fresh jobless claims data

Feb 13: CPI and Core CPI inflation prints

Policy clarity, labor conditions, and inflation are all in play at the same time

Together, they shape risk appetite and the Fed’s policy path

This is the kind of week where positioning matters more than opinions.

Feb 10: White House discussions around the Crypto Market Structure / Clarity Act

Feb 11: U.S. unemployment figures

Feb 12: Fresh jobless claims data

Feb 13: CPI and Core CPI inflation prints

Policy clarity, labor conditions, and inflation are all in play at the same time

Together, they shape risk appetite and the Fed’s policy path

This is the kind of week where positioning matters more than opinions.

- Reward

- like

- Comment

- Repost

- Share

China has reportedly instructed banks to cut exposure to US Treasuries 🚨\nThat means sustained selling pressure on Treasuries and a continued rotation into hard assets\nLess confidence in US debt, more demand for Gold and Silver\nAnd this is a structural shift\nThe signal is clear 👇\nreserve diversification is accelerating, and safe-haven metals remain the primary beneficiaries.

- Reward

- like

- Comment

- Repost

- Share

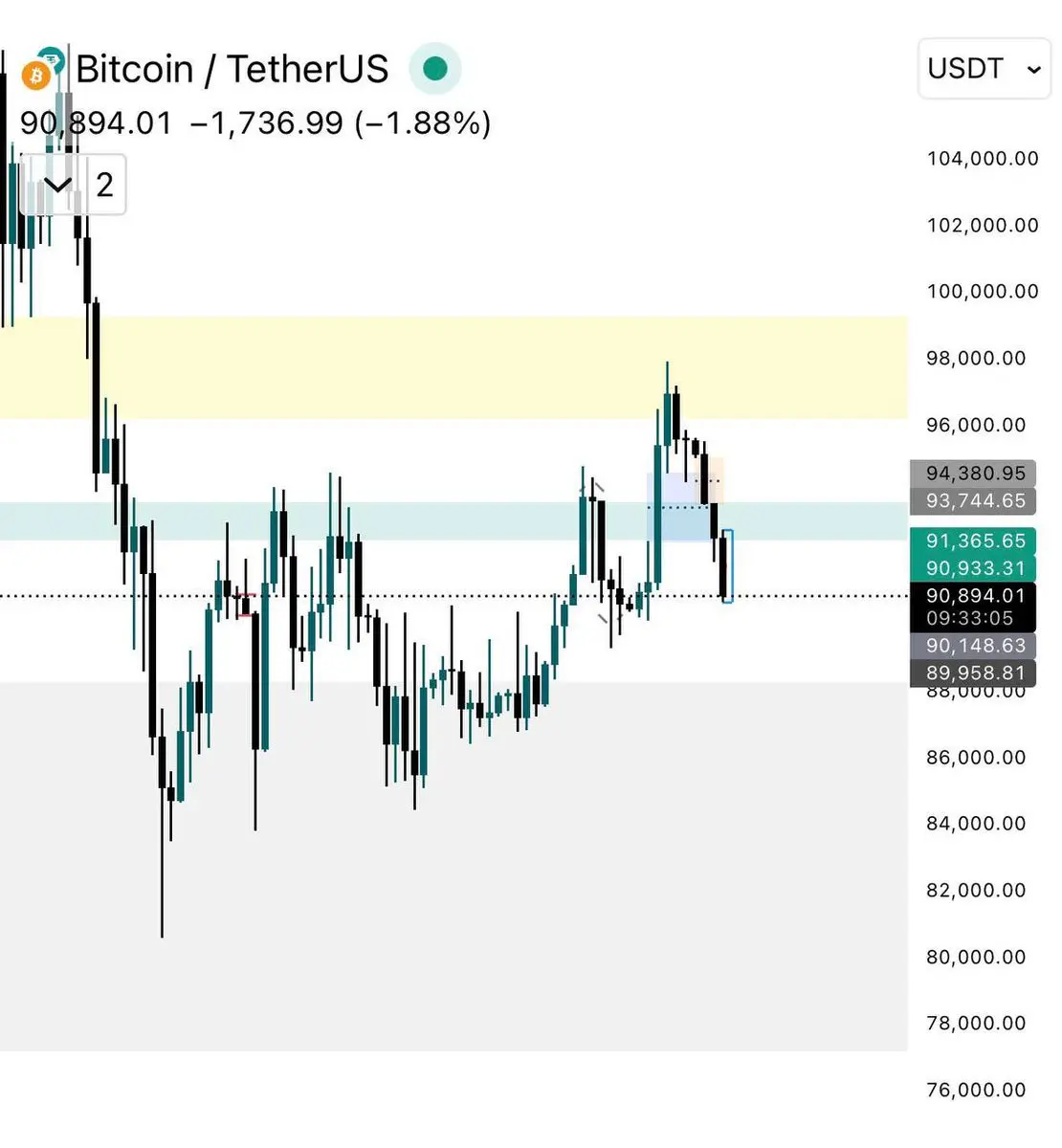

OVER $98M IN CRYPTO LONGS LIQUIDATED 🚨$90B wiped from total market cap in under 4 hoursStay Safe.

- Reward

- 1

- 1

- Repost

- Share

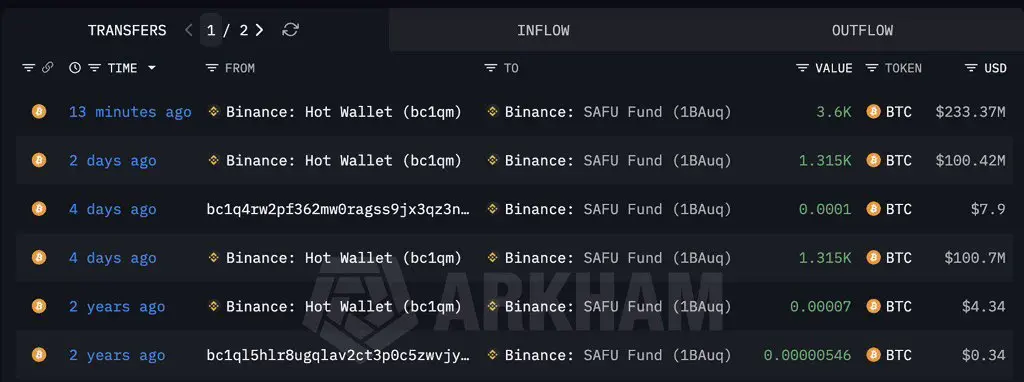

Xerodollar :

:

Stay safeFear usually shows up before balance sheets do 👇While traders panic @ just added 3,600 BTC to its SAFU reserve A $233M vote of confidence during market stress That brings the SAFU Fund to over 6,200 BTC, sitting quietly as downside insurance.Big players don’t prepare for sunny daysThey prepare for volatility That should tell you everything about where we are in the cycle.

BTC-2,79%

- Reward

- 1

- Comment

- Repost

- Share

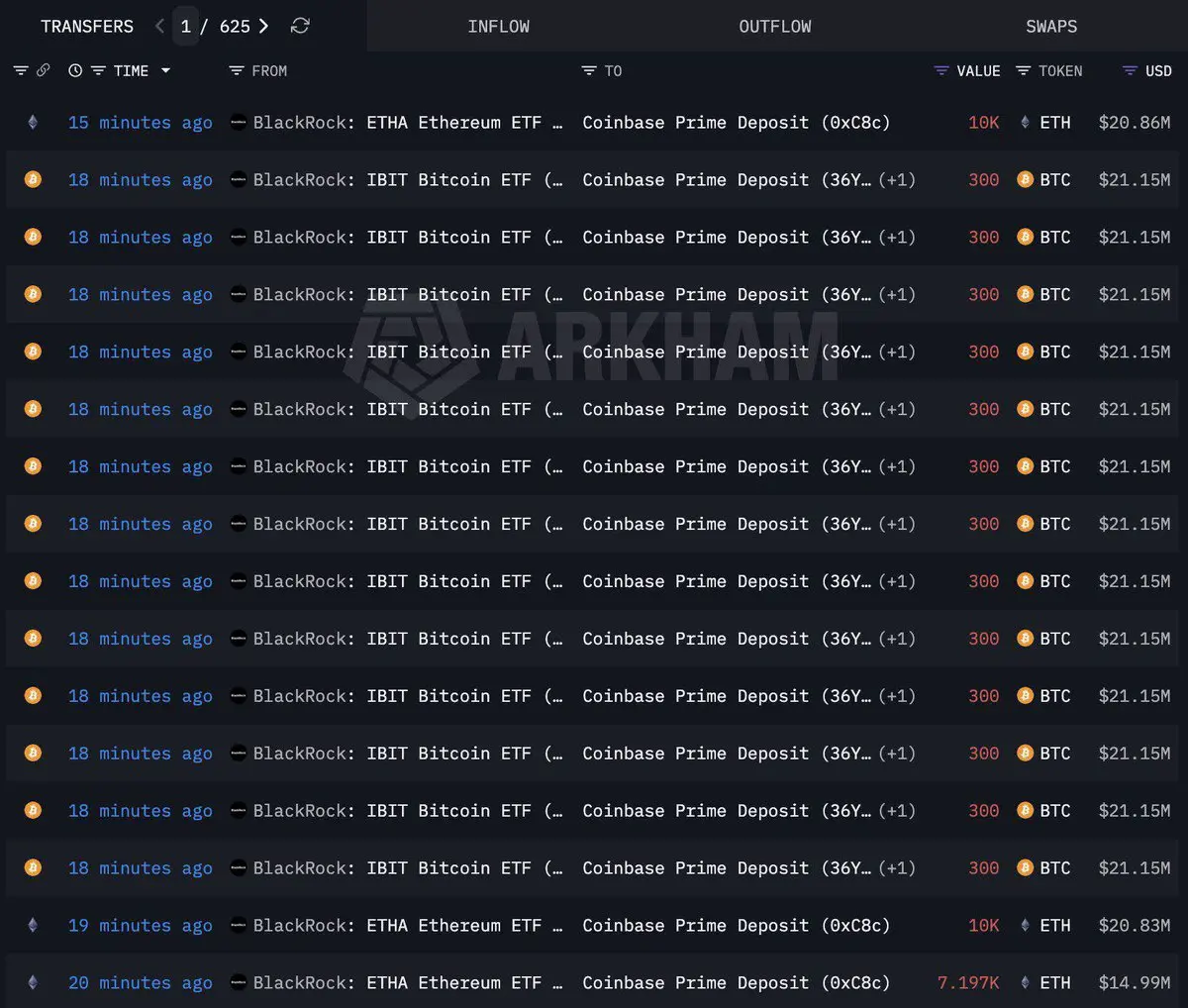

BlackRock has just deposited 3,900 BTC and 27,197 ETH to Coinbase That’s not a neutral moveLarge transfers to exchanges usually signal distributionThis lines up with what we’ve been seeing lately:• Big players reducing exposure• Liquidity being used to sell into strength• Pressure staying on the market short termPrice follows what institutions do, not what they say.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

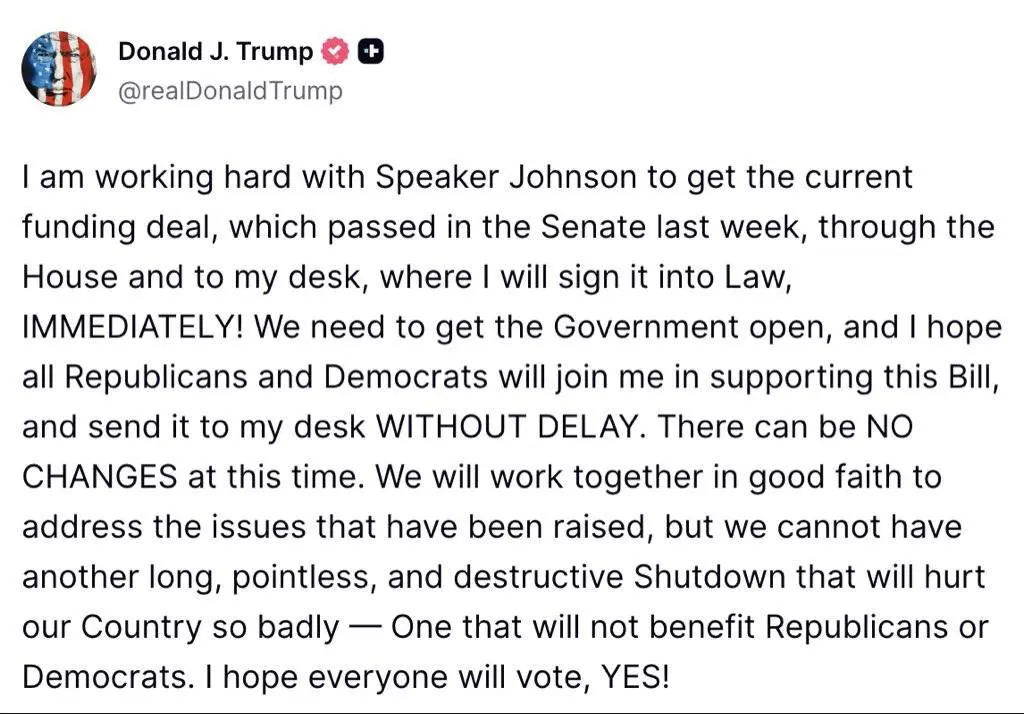

Trump just fired a very loud signal 🚨“Government must open IMMEDIATELY” isn’t political noise it’s a liquidity message.What this really implies: - Forced shutdown risk gets pulled off the table - Emergency repricing scenarios are avoided - Volatility pressure on risk assets easesMarkets hate uncertainty more than bad newsRemoving the shutdown tail risk is a green light.

- Reward

- like

- Comment

- Repost

- Share

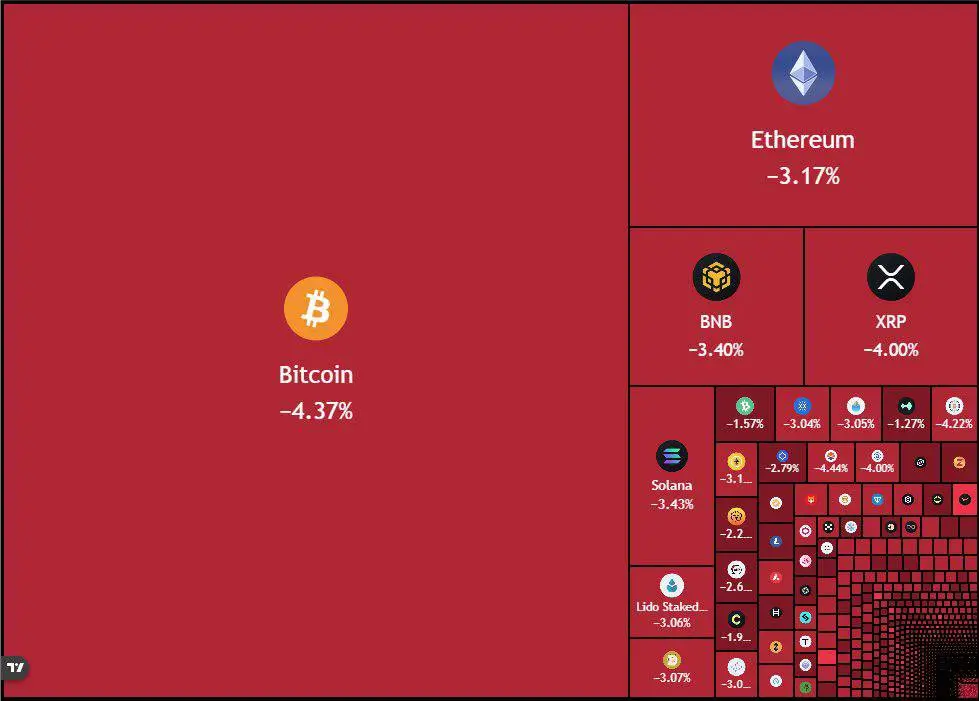

Every major market is pulling back at the same time 🚨Metals, equities, crypto all redFear is loudConfidence is disappearingThis is the phase where people swear they’re “done” and rush for the exit.I’m not rushing anywhereNo excitement. No panic.Just waiting for prices to come to me.Big gains are built in silence not during euphoria.

- Reward

- like

- Comment

- Repost

- Share

Dollar is downGold is downSilver is downBitcoin is downETH is downBNB is downEverything is bleeding at the same time. You know what that usually means, right?Liquidity is being pulledRisk is being resetAnd the market is shaking out weak hands before the next real move. 🤝

- Reward

- like

- Comment

- Repost

- Share

🚨 FED DECISION DAY 2:30 PM ETSmall cut <25 bps → Risk assets ignite, Bitcoin leads the chargeLarger cut ~50 bps → Liquidity spills into alts, rotation beginsNo cut → Expect the printer: ~$1.5T liquidity injection incomingEither way, liquidity is comingThe Fed speaksMarkets reactCrypto doesn’t stay quiet.

BTC-2,79%

- Reward

- like

- Comment

- Repost

- Share

This is a big deal 🚨The U.S. Dollar Index has broken below a 14-year support levelThat’s not a normal pullback that’s a structural shift.When a currency loses a level it’s respected for over a decade, confidence cracksHistorically, this kind of breakdown fuels hard assets and risk assets.Weak dollar → stronger gold, commodities, and eventually BitcoinThe market is quietly telling you something changed.

- Reward

- like

- Comment

- Repost

- Share

Next week 🚨▸ Fresh GDP data sets the macro tone▸ $8.3B in liquidity enters the system▸ Rate decision drops▸ U.S. balance sheet update▸ FOMC voices hit the marketThis is how inflection points formLiquidity, policy, and expectations collide and that’s usually where major trends are born.

- Reward

- like

- Comment

- Repost

- Share

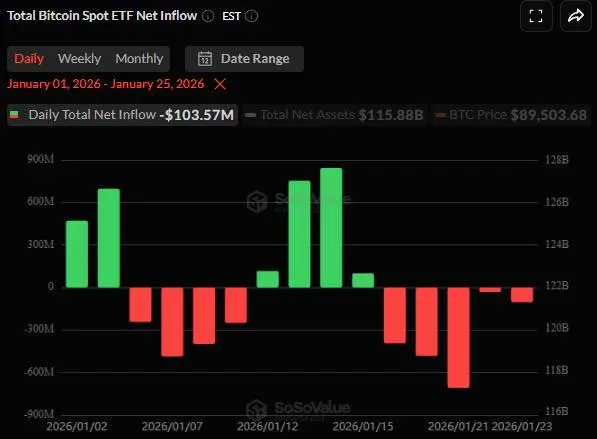

BITCOIN ETF FLOWS TURN NEGATIVE 🚨Bitcoin Spot ETFs have recorded consistent outflows, with investors pulling over $100M+ during the recent sessions ETF demand cooling while price holds steady shows cautious positioning, not panicRisk-off sentiment is creeping in as institutions rebalance exposure.

BTC-2,79%

- Reward

- like

- Comment

- Repost

- Share

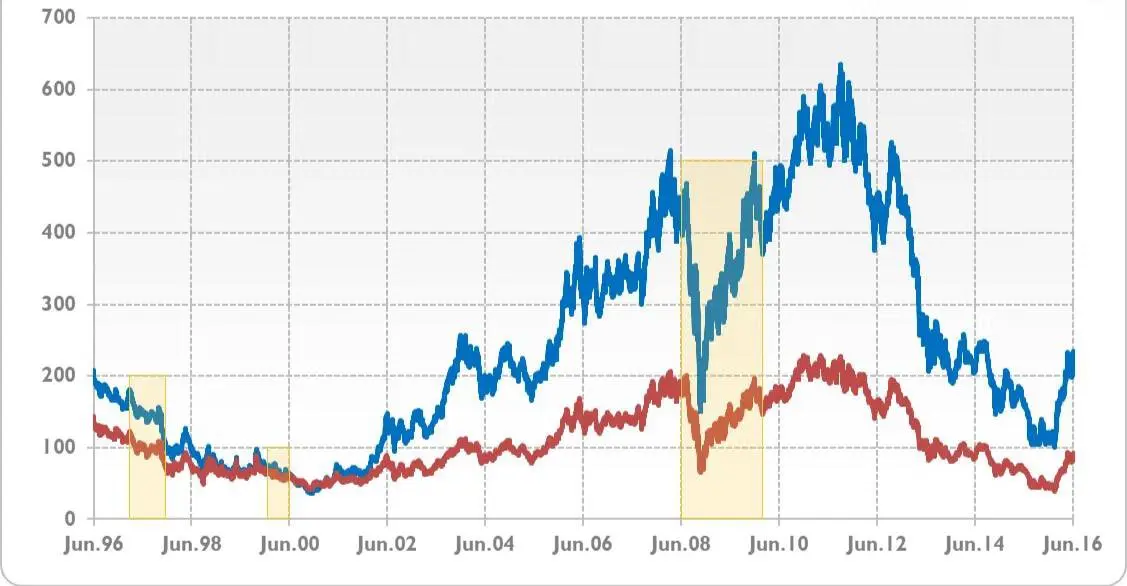

Gold mining stocks aren’t the hedge people think they are 👇\n\nHistory shows they drop hard during crises much harder than gold or silver and recover far slower. \n\nAfter Lehman → miners crashed deeper and many still sit below pre-crisis levels \n\nWhy? \n\nThey’re equities\n\nMargins, costs and economic cycles matter\n\nGold and silver have centuries of monetary history\n\nMining stocks don’t.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More21.12K Popularity

9.37K Popularity

3.98K Popularity

35.83K Popularity

246.91K Popularity

Pin