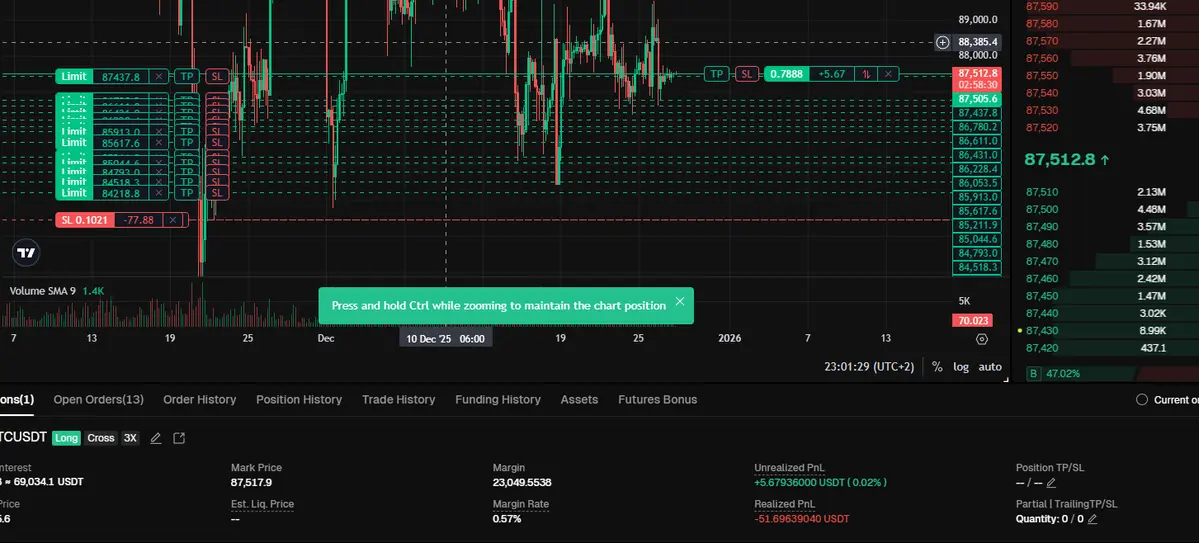

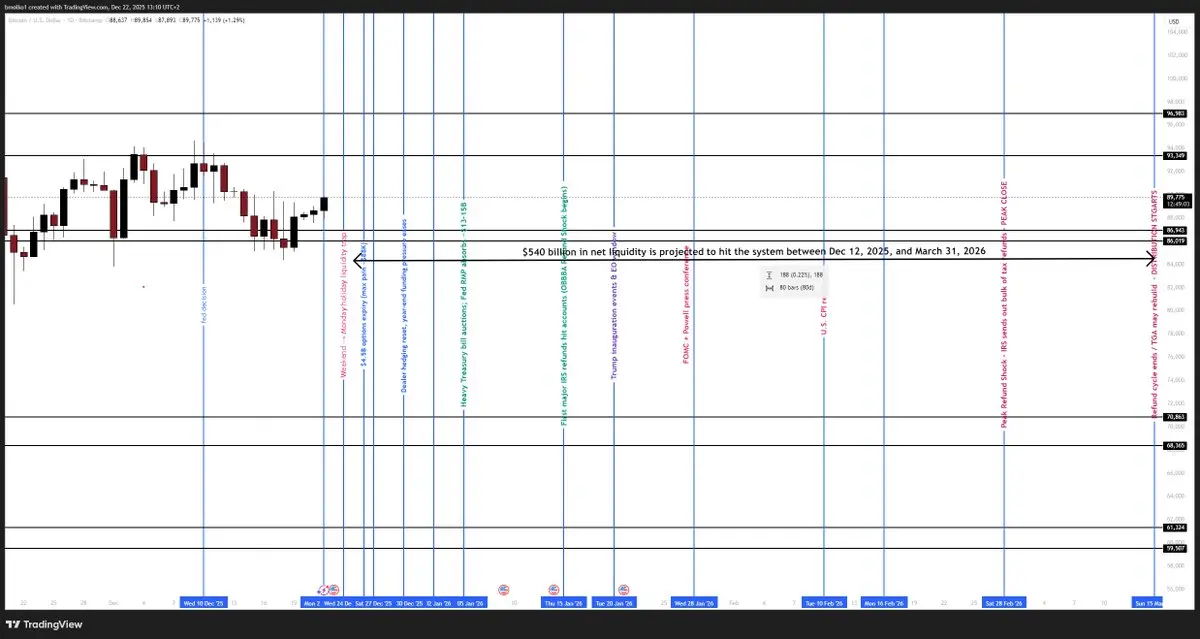

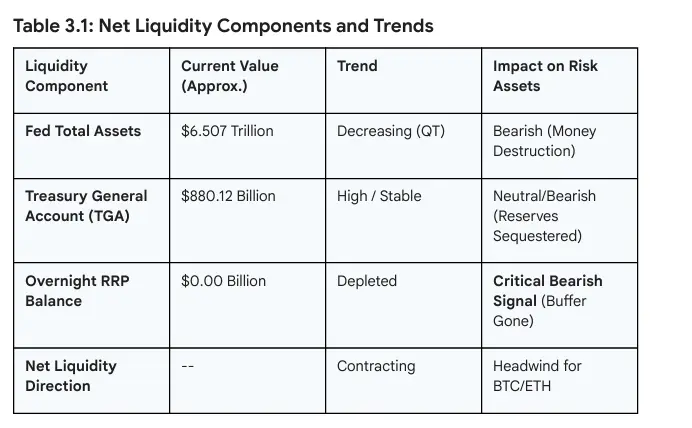

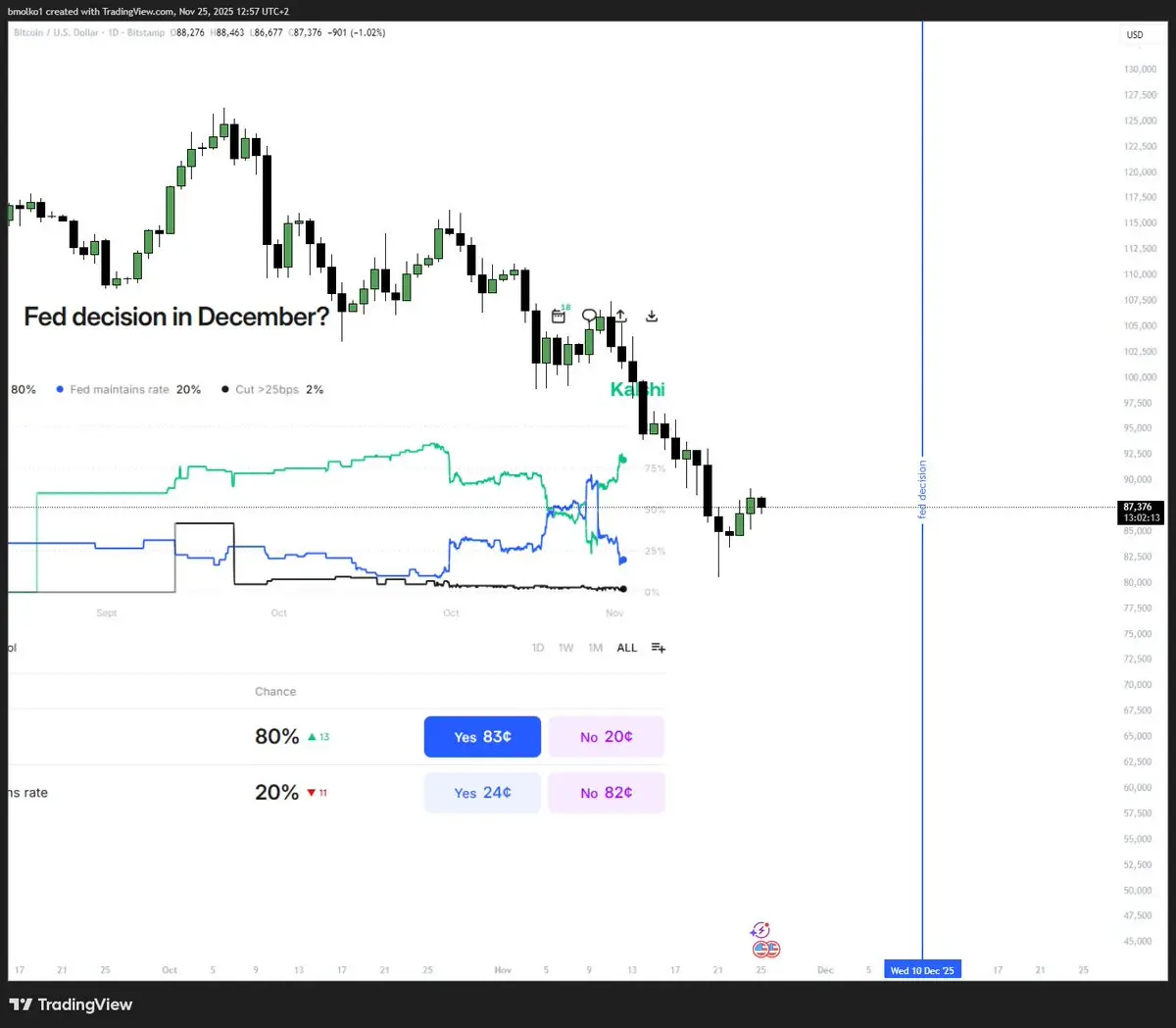

On December 10, 2025, the Federal Reserve announced it will begin Reserve Management Purchases (RMPs) starting December 12, injecting approximately $40 billion in Treasury bills into the system to maintain ample banking reserves. These monthly purchases, focused on short-term Treasuries, aim to offset upcoming liquidity drains such as tax payments and shifts in non-reserve liabilities, with schedules released each month around the 9th business day. While not outright QE, this move effectively adds liquidity, supporting market functioning and risk assets. The Fed anticipates the elevated pace t

BTC0,17%