Kan_0xGemi

No content yet

Kan_0xGemi

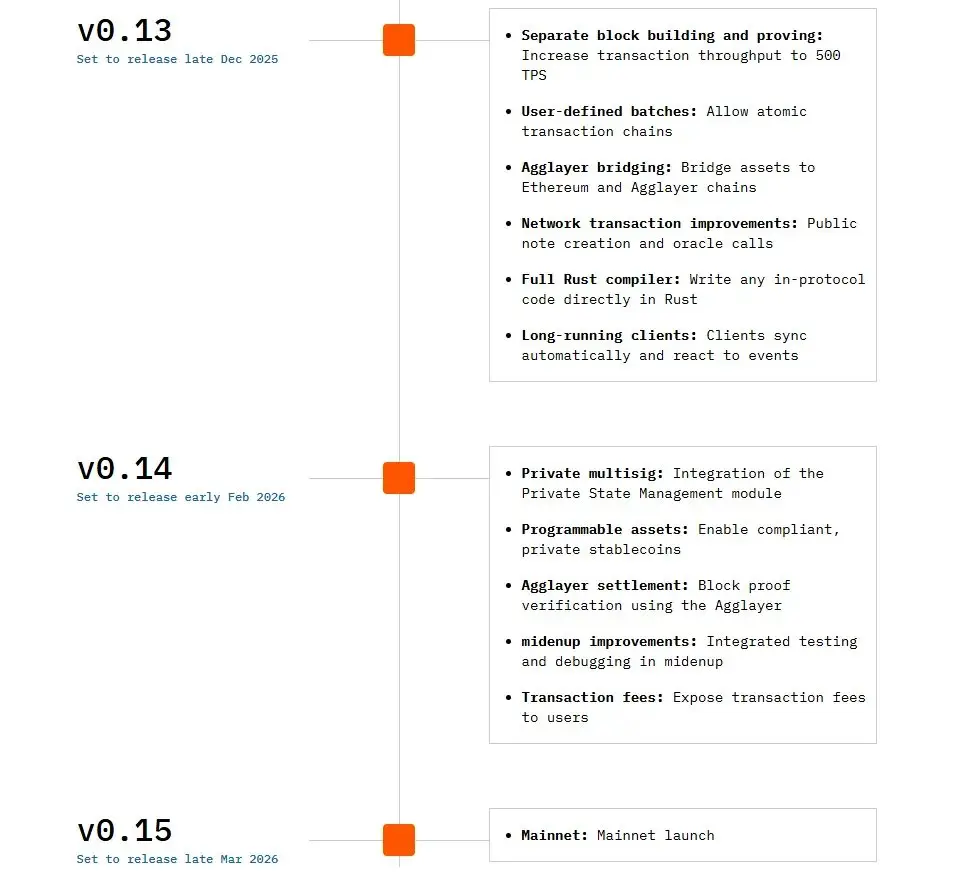

. @0xMiden roadmap entering the final sprint.

Mainnet ~6-8 weeks away and there's still serious alpha left to deliver.

> Native Rust compiler → dapps built directly in Rust, no compromises.

> AggLayer integration → seamless asset flow, no more isolated silos.

> Private multisigs + programmable private assets → the real home for compliant stablecoins and institutional flows.

You stacking those testnet transactions like they matter?

Because they probably do.

Mainnet ~6-8 weeks away and there's still serious alpha left to deliver.

> Native Rust compiler → dapps built directly in Rust, no compromises.

> AggLayer integration → seamless asset flow, no more isolated silos.

> Private multisigs + programmable private assets → the real home for compliant stablecoins and institutional flows.

You stacking those testnet transactions like they matter?

Because they probably do.

- Reward

- like

- Comment

- Repost

- Share

Not everything needs to be visibleEspecially finance on-chainMost privacy leaks don’t start with exploitsThey start with ledgers that sit still and show everything by defaultMiden, built by @0xMiden keeps financial state moving instead of exposedNo permanent public balances, no fixed transaction trails and disclosure exists only when it’s needed.Good privacy is quiet.

- Reward

- like

- Comment

- Repost

- Share

. @CodeXero_xyz start a new era of onchain building!\n\nProduce full dApps from plain English prompts in minutes with instant @SeiNetwork deployment and AI agent orchestration.\n\nLess friction. More speed. Impressive onchain results.

- Reward

- 1

- Comment

- Repost

- Share

A lot of chains feel secure until real regulations hit them.

@ADIChain_ was designed assuming compliance, governments, and institutions are normal conditions, not edge cases.

ZKsync Airbender, programmable compliance and sovereign L3s aren’t marketing features; they’re survival traits

@ADIChain_ was designed assuming compliance, governments, and institutions are normal conditions, not edge cases.

ZKsync Airbender, programmable compliance and sovereign L3s aren’t marketing features; they’re survival traits

ZK-0,25%

- Reward

- like

- Comment

- Repost

- Share

What happens when token holders commit to each other, not just to price?

TVS Marketplace shows a new phase of Web3. Autonomous commitments with memory, weight, and incentives interacting freely. Built on AlignerZ’s Tokenized Vesting infrastructure, these holdings don’t just sit. They trade, stake, vote, and compound in real time.

This is the shift from tokens as assets to tokens as social actors.

@AlignerZ_Labs is where alignment becomes verifiable, persistent, and alive onchain.

g26 💜⚡️

TVS Marketplace shows a new phase of Web3. Autonomous commitments with memory, weight, and incentives interacting freely. Built on AlignerZ’s Tokenized Vesting infrastructure, these holdings don’t just sit. They trade, stake, vote, and compound in real time.

This is the shift from tokens as assets to tokens as social actors.

@AlignerZ_Labs is where alignment becomes verifiable, persistent, and alive onchain.

g26 💜⚡️

- Reward

- like

- Comment

- Repost

- Share