MarketMaestro

No content yet

MarketMaestro

$EOSE

After starting the rally, despite everything that happened, the support band always worked as the bottom 🤞

After starting the rally, despite everything that happened, the support band always worked as the bottom 🤞

- Reward

- 2

- Comment

- Repost

- Share

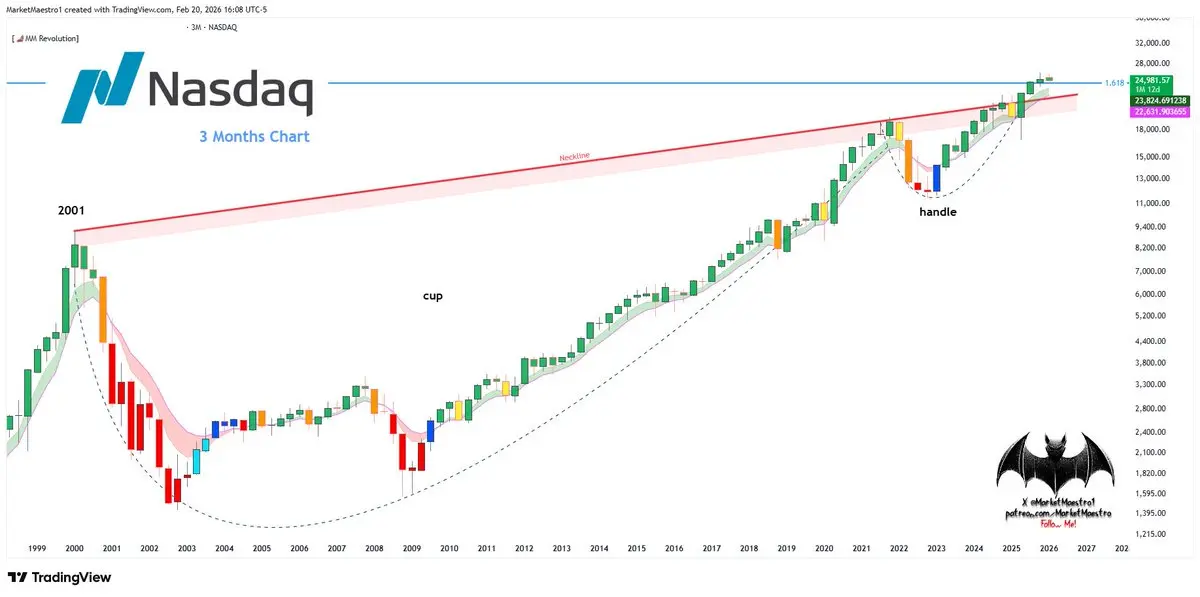

$NDX

I turned Nasdaq into a chart adjusted for real inflation.

Why? Nominal charts only show that the number on the screen is going up. While the $SPX or Nasdaq may be making new highs in nominal terms, the currency may also be being devalued in the background. An inflation adjusted chart shows us real growth.

In short, I wanted a smoother and better view. The index is at the important fibo1.618 resistance zone, and for that reason it is struggling. Also, there is a very obvious cup+handle setup on the index, and it tells us the future will be bullish 💯

On the other hand, if the ... support z

I turned Nasdaq into a chart adjusted for real inflation.

Why? Nominal charts only show that the number on the screen is going up. While the $SPX or Nasdaq may be making new highs in nominal terms, the currency may also be being devalued in the background. An inflation adjusted chart shows us real growth.

In short, I wanted a smoother and better view. The index is at the important fibo1.618 resistance zone, and for that reason it is struggling. Also, there is a very obvious cup+handle setup on the index, and it tells us the future will be bullish 💯

On the other hand, if the ... support z

SPX-2,03%

- Reward

- 2

- 1

- Repost

- Share

Crypt_Panda :

:

2026 GOGOGO 👊$SMR

Now it’s down to miracles. $.., the last price, is the final defensive line. If it can’t see a recovery like the one in the boxed area, the chart will break. .. It’s in an extremely risky situation

Now it’s down to miracles. $.., the last price, is the final defensive line. If it can’t see a recovery like the one in the boxed area, the chart will break. .. It’s in an extremely risky situation

- Reward

- 2

- Comment

- Repost

- Share

$KTOS

It’s benefiting positively from the U.S.–Iran tension. But the risk hasn’t passed. After hitting the correction band, could you look at the RSI? An H+S setup formed. .. If you look at the weekly view, there’s a very similar setup to $ONDS. .

It’s benefiting positively from the U.S.–Iran tension. But the risk hasn’t passed. After hitting the correction band, could you look at the RSI? An H+S setup formed. .. If you look at the weekly view, there’s a very similar setup to $ONDS. .

- Reward

- 2

- Comment

- Repost

- Share

$RBRK

It looks bad. There’s no stabilization or consolidation. .. It’s in an extremely risky position. ..

It looks bad. There’s no stabilization or consolidation. .. It’s in an extremely risky position. ..

- Reward

- 3

- Comment

- Repost

- Share

$QS

Pre revenue companies like QS regularly need external financing to keep operations going. When risk appetite is strong, they can usually raise this funding relatively cheaply through equity sales (secondary offerings/ATM programs) or more flexible, equity like instruments. Right now, risk appetite is weak. But if liquidity tightens and capital markets close to these kinds of companies, the option set deteriorates quickly: as access to capital worsens, the company either turns to more expensive and more tightly structured financings (like converts/PIPE/structured equity), or it increases di

Pre revenue companies like QS regularly need external financing to keep operations going. When risk appetite is strong, they can usually raise this funding relatively cheaply through equity sales (secondary offerings/ATM programs) or more flexible, equity like instruments. Right now, risk appetite is weak. But if liquidity tightens and capital markets close to these kinds of companies, the option set deteriorates quickly: as access to capital worsens, the company either turns to more expensive and more tightly structured financings (like converts/PIPE/structured equity), or it increases di

- Reward

- 2

- Comment

- Repost

- Share

$OKLO

I’m basing it on the previous cycle, and I’m hopeful for the no4 bottom! 🤞

I’m basing it on the previous cycle, and I’m hopeful for the no4 bottom! 🤞

- Reward

- like

- Comment

- Repost

- Share

$CPNG

If I base it on the behavior of the old FVG zone (the blue area), this area may have bottomed 🤞

If I base it on the behavior of the old FVG zone (the blue area), this area may have bottomed 🤞

- Reward

- 1

- Comment

- Repost

- Share

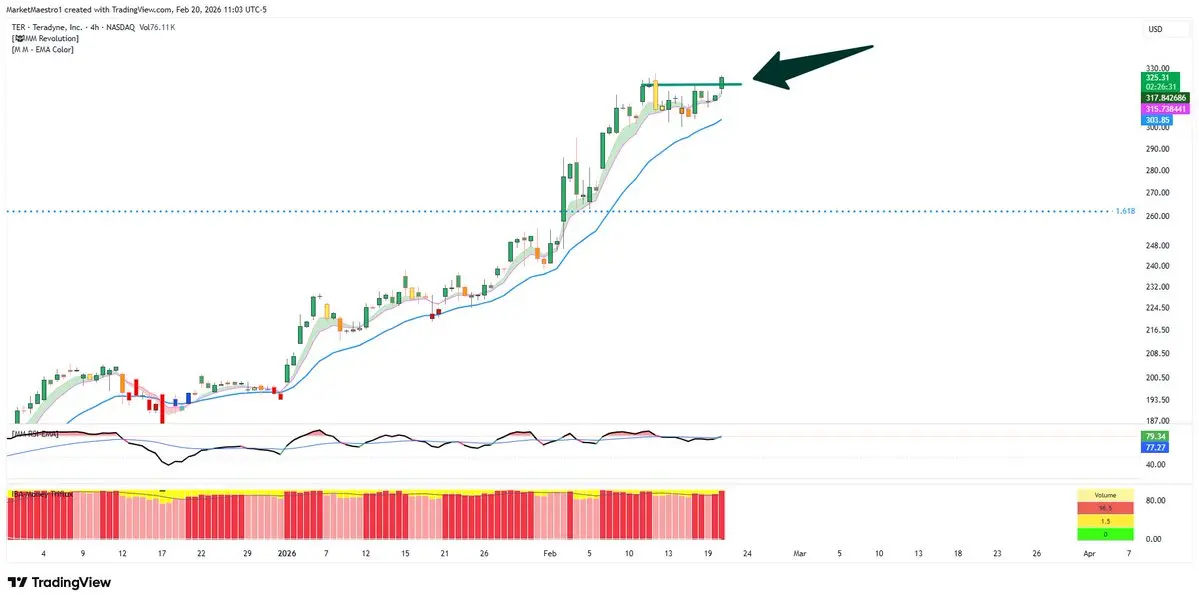

$TER breakout 💥

- Reward

- like

- Comment

- Repost

- Share

The Supreme Court found Trump’s tariffs illegal and canceled them. So what will Trump do? What could we see in the future? 👇

Trump may shift away from a broad tariff shock and move back to targeted tariff packages: Section 232 (national security tariffs), Section 301 (unfair trade practices), Section 201 (safeguard / sudden import surge protection), Section 122 (short-term, time-limited broad tariff).

He may want to bring Congress into the game. He may want to make a regulation that clarifies IEEPA in a way that grants tariff authority, or he may want a new, clearer emergency tariff authority

Trump may shift away from a broad tariff shock and move back to targeted tariff packages: Section 232 (national security tariffs), Section 301 (unfair trade practices), Section 201 (safeguard / sudden import surge protection), Section 122 (short-term, time-limited broad tariff).

He may want to bring Congress into the game. He may want to make a regulation that clarifies IEEPA in a way that grants tariff authority, or he may want a new, clearer emergency tariff authority

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

$INOD

The market’s view of LLM-focused data and AI companies like INOD is going through a transition period. The unconditional euphoria of 2023 and 2024 is over. On the other hand, INOD has started moving its projects with Big Tech customers out of the pilot stage and into full scale contracts. Especially the recent partnership with Palantir and the aggressive growth on the public/defense side signaled to the market that the company is moving beyond being an ordinary data labeling subcontractor and turning into a strategic pre training data platform.

It fell to the $43 monthly EMA21. Below tha

The market’s view of LLM-focused data and AI companies like INOD is going through a transition period. The unconditional euphoria of 2023 and 2024 is over. On the other hand, INOD has started moving its projects with Big Tech customers out of the pilot stage and into full scale contracts. Especially the recent partnership with Palantir and the aggressive growth on the public/defense side signaled to the market that the company is moving beyond being an ordinary data labeling subcontractor and turning into a strategic pre training data platform.

It fell to the $43 monthly EMA21. Below tha

- Reward

- 1

- Comment

- Repost

- Share

negative for $RKLB

Mynaric is a German company that has a highly critical technology. It’s highly likely that the German government or local industry (like Rheinmetall) would not want such a sensitive military/space technology to move to a U.S. company (Rocket Lab). Getting into a potential bidding war with Rheinmetall could create a serious financial burden for RKLB. If Mynaric is lost, RKLB may either have to become Rheinmetall’s customer for laser communication terminals or turn to other (and limited) suppliers in the market, which could cause delays in satellite manufacturing programs.

Mynaric is a German company that has a highly critical technology. It’s highly likely that the German government or local industry (like Rheinmetall) would not want such a sensitive military/space technology to move to a U.S. company (Rocket Lab). Getting into a potential bidding war with Rheinmetall could create a serious financial burden for RKLB. If Mynaric is lost, RKLB may either have to become Rheinmetall’s customer for laser communication terminals or turn to other (and limited) suppliers in the market, which could cause delays in satellite manufacturing programs.

- Reward

- like

- Comment

- Repost

- Share

$ROK

hit the RSI band and lost momentum. There’s a small double top on RSI, but it’s not scary

hit the RSI band and lost momentum. There’s a small double top on RSI, but it’s not scary

- Reward

- like

- Comment

- Repost

- Share

#Nikkei $EWY

Japan’s stock market looks pretty good! It broke out of the cup that started in 1989 💥

Japan’s stock market looks pretty good! It broke out of the cup that started in 1989 💥

- Reward

- like

- Comment

- Repost

- Share

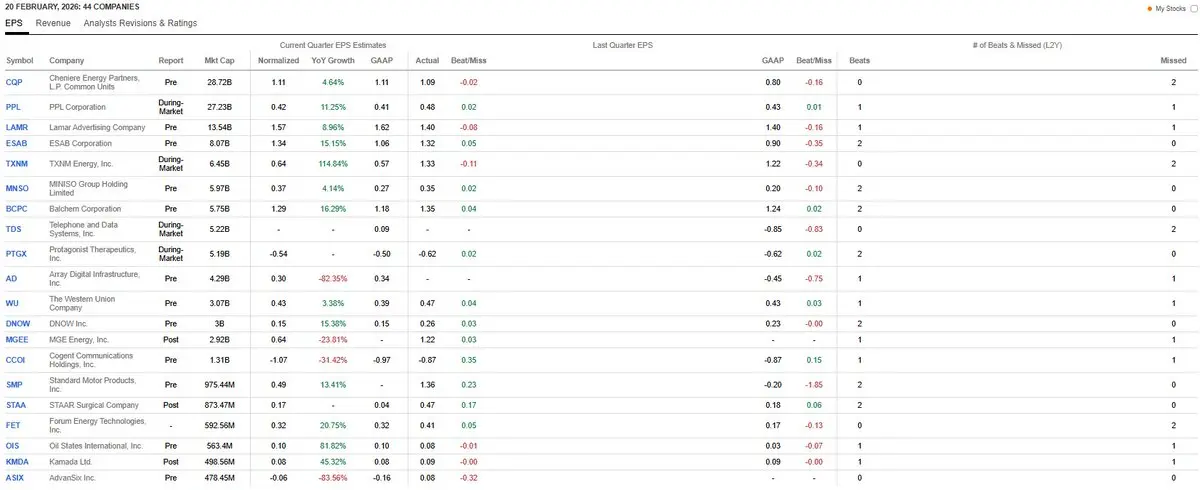

Today's ERs 👇

- Reward

- like

- Comment

- Repost

- Share

Friday's Economic Calendar Feb. 20, 2026

8:30 AM GDP

Gross Domestic Product represents the total value of the country's production during the period and consists of the purchases of domestically produced goods and services by individuals, businesses, foreigners, and government entities.

The initial estimate for Q4 is seen at a growth rate of 2.8 percent after 4.4 percent in Q3. PCE is expected at 2.4 percent after 3.5 percent in Q3.

8:30 AM Personal Income and Outlays

Personal income represents the income that households receive from all sources, including wages and salaries, fringe benefits s

8:30 AM GDP

Gross Domestic Product represents the total value of the country's production during the period and consists of the purchases of domestically produced goods and services by individuals, businesses, foreigners, and government entities.

The initial estimate for Q4 is seen at a growth rate of 2.8 percent after 4.4 percent in Q3. PCE is expected at 2.4 percent after 3.5 percent in Q3.

8:30 AM Personal Income and Outlays

Personal income represents the income that households receive from all sources, including wages and salaries, fringe benefits s

- Reward

- 1

- Comment

- Repost

- Share

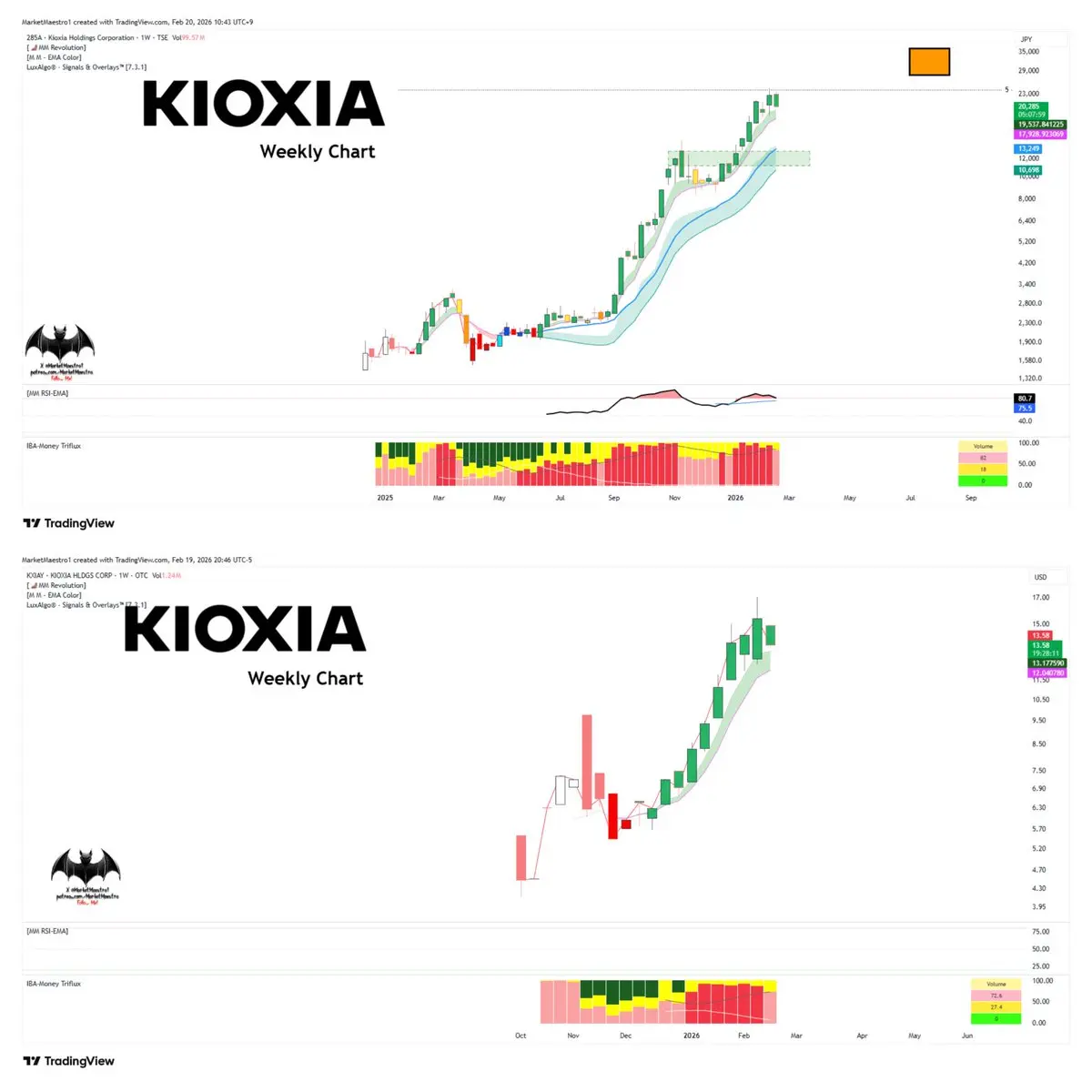

$KXIAY 285A 🇯🇵

Takaichi has a market friendly approach. Nikkei is having a strong rally. It broke the cup it had formed since 1989 and started a new rally.

Kioxia reached record levels in its FY2025 Q3 earnings. Revenue rose to 543.6B¥, while net profit came in at 89.5B¥. The most critical detail here is demand created by massive investments aimed at AI and data center buildouts. Kioxia management announced that all of its NAND production capacity for 2026 has already been fully sold out due to strong infrastructure needs on the data center side. It’s a competitor to $MU and Samsung.

..

The

Takaichi has a market friendly approach. Nikkei is having a strong rally. It broke the cup it had formed since 1989 and started a new rally.

Kioxia reached record levels in its FY2025 Q3 earnings. Revenue rose to 543.6B¥, while net profit came in at 89.5B¥. The most critical detail here is demand created by massive investments aimed at AI and data center buildouts. Kioxia management announced that all of its NAND production capacity for 2026 has already been fully sold out due to strong infrastructure needs on the data center side. It’s a competitor to $MU and Samsung.

..

The

- Reward

- like

- Comment

- Repost

- Share