NekoZz

No content yet

NekoZz

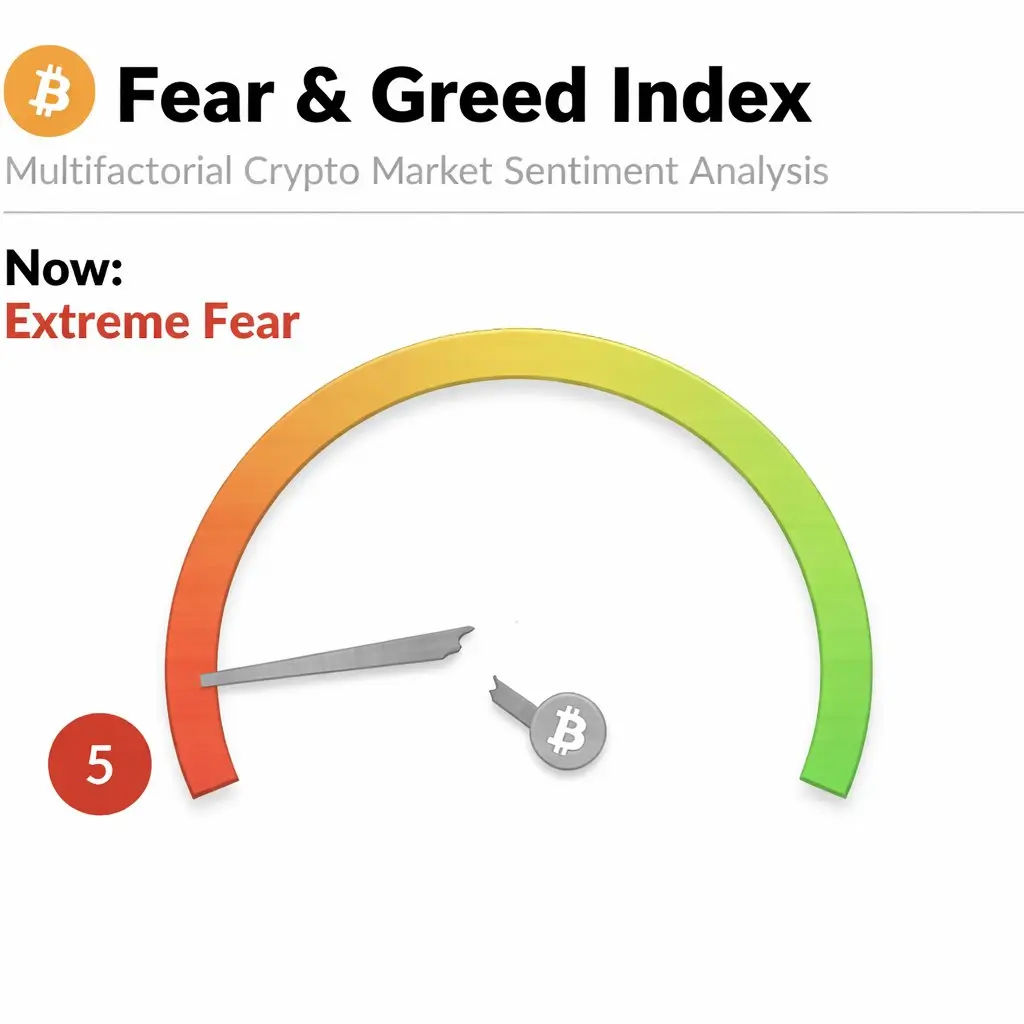

🐋 WHALE WATCH: Retail is crying. Prices are lagging. Meanwhile, the big boys are quietly sweeping the floor. 🧹

If you look closely, the fear factor has already snapped. We are at the stage where the masses are too scared to buy the very bottom they prayed for. Sentiment is a lagging indicator—Institutional flow is the truth.

Positioning > Emotions.

If you look closely, the fear factor has already snapped. We are at the stage where the masses are too scared to buy the very bottom they prayed for. Sentiment is a lagging indicator—Institutional flow is the truth.

Positioning > Emotions.

- Reward

- 1

- Comment

- Repost

- Share

🐋 WHALE WATCH: Everyone is calling for $100k, but the tape says different.

The plan is simple:

1. Range-bound chop to bore you out.

2. A god candle to $76k to FOMO you back in.

3. A nuking Distribution to $45k to wipe you out.

This is how the game is played. If you don't see the setup, you are the setup.

The plan is simple:

1. Range-bound chop to bore you out.

2. A god candle to $76k to FOMO you back in.

3. A nuking Distribution to $45k to wipe you out.

This is how the game is played. If you don't see the setup, you are the setup.

- Reward

- 2

- Comment

- Repost

- Share

🐋 WHALE WATCH: $ETH is at a MASSIVE crossroads right now.

We saw the trend line snap and that -41% flush was absolutely brutal.

Now we are sitting right on the CRITICAL POINT around $1,750. If this level fails, the floor is gone and we're looking at a deep dive into March.

Liquidity is thin and the bears are hungry. Guard your capital.

Is this a bounce for ants or the start of the final capitulation ?

We saw the trend line snap and that -41% flush was absolutely brutal.

Now we are sitting right on the CRITICAL POINT around $1,750. If this level fails, the floor is gone and we're looking at a deep dive into March.

Liquidity is thin and the bears are hungry. Guard your capital.

Is this a bounce for ants or the start of the final capitulation ?

ETH-2,53%

- Reward

- 2

- Comment

- Repost

- Share

🐋 WHALE WATCH: $373M WIPED.

The leverage is officially nuked. The "moon boys" just became exit liquidity for the institutions.

We just saw a 4-hour flush that usually takes a week. If you’re still standing, you’re the 1%.

Weak hands out. Smart money in.

THE BOUNCE WILL BE VIOLENT.

The leverage is officially nuked. The "moon boys" just became exit liquidity for the institutions.

We just saw a 4-hour flush that usually takes a week. If you’re still standing, you’re the 1%.

Weak hands out. Smart money in.

THE BOUNCE WILL BE VIOLENT.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 3

- Comment

- Repost

- Share

🐋 WHALE WATCH: : The setup for $BTC is becoming historically asymmetric.

Liquidation Map Update:

1. Total Short Liquidations: $13.2B+

2. Trigger Price: $90,000

As we approach this level, the "forced buying" from liquidated shorts will likely create a feedback loop, sending us well into price discovery.

We’re witnessing a massive transfer of wealth from the over-leveraged to the patient.

Liquidation Map Update:

1. Total Short Liquidations: $13.2B+

2. Trigger Price: $90,000

As we approach this level, the "forced buying" from liquidated shorts will likely create a feedback loop, sending us well into price discovery.

We’re witnessing a massive transfer of wealth from the over-leveraged to the patient.

BTC-2,78%

- Reward

- 2

- Comment

- Repost

- Share

$ASTER: The Retest is in.

It doesn't get much cleaner than this. We rejected off the trendline at "Retest 2," found a local bottom at $0.48, and have now reclaimed the trendline as support.

I’m watching the 0.5 Fib ($0.91) closely. That's the mid-range pivot. Once we flip that, the path to $1.10 is wide open. Volume profile is starting to confirm the move.

Patience pays, and the setup is finally ripe.

It doesn't get much cleaner than this. We rejected off the trendline at "Retest 2," found a local bottom at $0.48, and have now reclaimed the trendline as support.

I’m watching the 0.5 Fib ($0.91) closely. That's the mid-range pivot. Once we flip that, the path to $1.10 is wide open. Volume profile is starting to confirm the move.

Patience pays, and the setup is finally ripe.

ASTER-1,15%

- Reward

- 1

- Comment

- Repost

- Share

🐋 WHALE WATCH: : $BTC is finally showing some teeth.

We’ve officially broken the 15m downtrend line with a clean retest. Fibonacci levels are primed and the path of least resistance is looking decidedly UP.

Targets in sight:

=> Target 1: $68,150

=> Target 2: $68,380

=> Target 3: $68,500+

Stop loss tucked below the recent swing low. Let the trend be your friend.

We’ve officially broken the 15m downtrend line with a clean retest. Fibonacci levels are primed and the path of least resistance is looking decidedly UP.

Targets in sight:

=> Target 1: $68,150

=> Target 2: $68,380

=> Target 3: $68,500+

Stop loss tucked below the recent swing low. Let the trend be your friend.

BTC-2,78%

- Reward

- 1

- Comment

- Repost

- Share

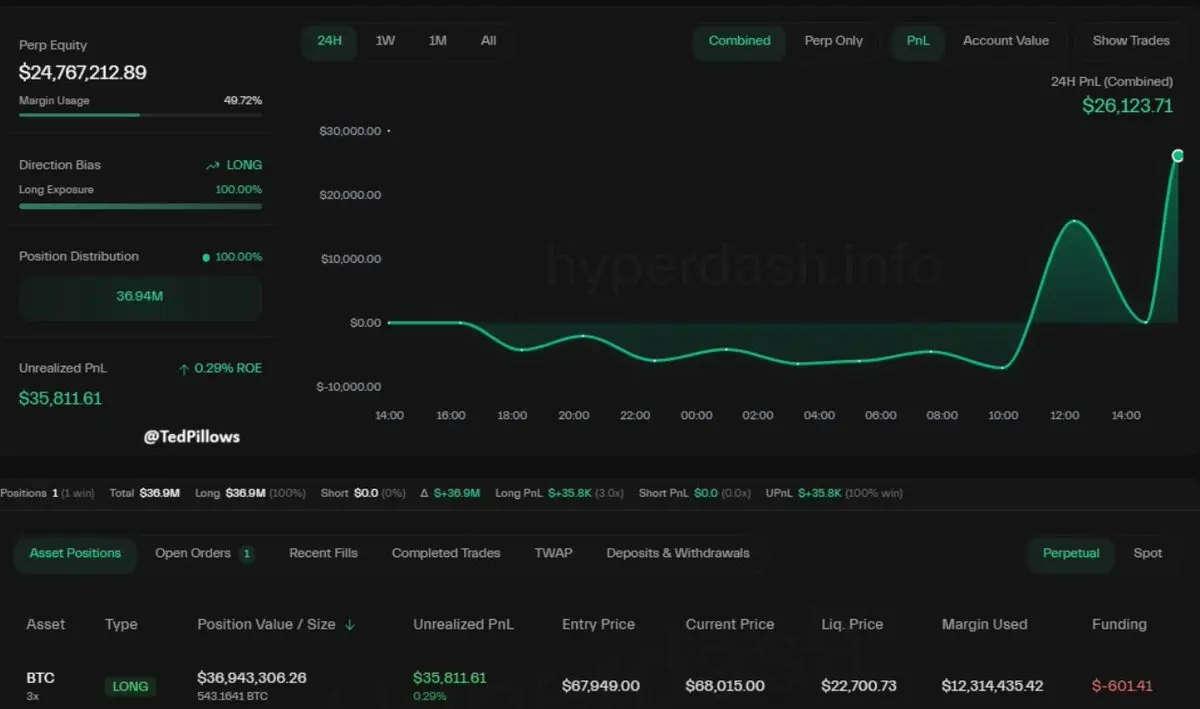

🐋 WHALE WATCH: : A MASSIVE $36.9M LONG JUST OPENED!

One of the big players just stepped in with a $36,943,000 $BTC long position at 3x leverage. This is high-conviction buying in the middle of the range.

=> Liq Price: $22,700

=> Leverage: 3x (Conservative but heavy)

The whales aren't scared. Are you? Keep an eye on that $22.7k level—it’s officially the line in the sand for this player.

One of the big players just stepped in with a $36,943,000 $BTC long position at 3x leverage. This is high-conviction buying in the middle of the range.

=> Liq Price: $22,700

=> Leverage: 3x (Conservative but heavy)

The whales aren't scared. Are you? Keep an eye on that $22.7k level—it’s officially the line in the sand for this player.

BTC-2,78%

- Reward

- like

- Comment

- Repost

- Share

🐋 WHALE WATCH: OpenClaw is cleaning house.

Just got word: Mentions of $BTC or any Crypto = INSTANT BAN in the Discord.

Devs are officially cutting the fluff. They want 100% focus on AI development, not "When Moon?" chatter. This is how you build a real product, not a pump.

The signal just got a lot clearer. Are you watching the tech, or just the ticker ?

Just got word: Mentions of $BTC or any Crypto = INSTANT BAN in the Discord.

Devs are officially cutting the fluff. They want 100% focus on AI development, not "When Moon?" chatter. This is how you build a real product, not a pump.

The signal just got a lot clearer. Are you watching the tech, or just the ticker ?

BTC-2,78%

- Reward

- 3

- Comment

- Repost

- Share

🐋 WHALE WATCH: The $TRUMP & $MELANIA memecoin report just dropped and it is UGLY.

=> $4.3 Billion lost by retail.

=> $600 Million cashed out by insiders.

=> 2 Million wallets currently in the red.

"The damage to retail investors has been staggering." — CryptoRank

The biggest "official" rug in history? Let’s talk in the comments.

=> $4.3 Billion lost by retail.

=> $600 Million cashed out by insiders.

=> 2 Million wallets currently in the red.

"The damage to retail investors has been staggering." — CryptoRank

The biggest "official" rug in history? Let’s talk in the comments.

TRUMP0,26%

- Reward

- 1

- Comment

- Repost

- Share

🐋 WHALE WATCH: $BNB is finally waking up.

That 4H descending trendline has been a headache for weeks, but the breakout is officially confirmed. We just flipped $625 into support and the volume is starting to pour in.

=> Target 1: $715 (Easy work)

=> Target 2: $785

=> Target 3: $830+

Don't be the one chasing the green candles at $800. The entry is now.

That 4H descending trendline has been a headache for weeks, but the breakout is officially confirmed. We just flipped $625 into support and the volume is starting to pour in.

=> Target 1: $715 (Easy work)

=> Target 2: $785

=> Target 3: $830+

Don't be the one chasing the green candles at $800. The entry is now.

BNB-1,62%

- Reward

- 2

- 2

- Repost

- Share

GateUser-2bb2383a :

:

Wishing you great wealth in the Year of the Horse 🐴View More

Cleanest chart in the market right now: $GOLD.

1. Huge accumulation phase

2. Descending resistance snapped

3. Confirmed breakout above $5,000

The target is set for $5,400 and beyond. Bears are getting absolutely toasted here. Don't fight the trend when it's this obvious.

Send it.

1. Huge accumulation phase

2. Descending resistance snapped

3. Confirmed breakout above $5,000

The target is set for $5,400 and beyond. Bears are getting absolutely toasted here. Don't fight the trend when it's this obvious.

Send it.

- Reward

- 4

- Comment

- Repost

- Share

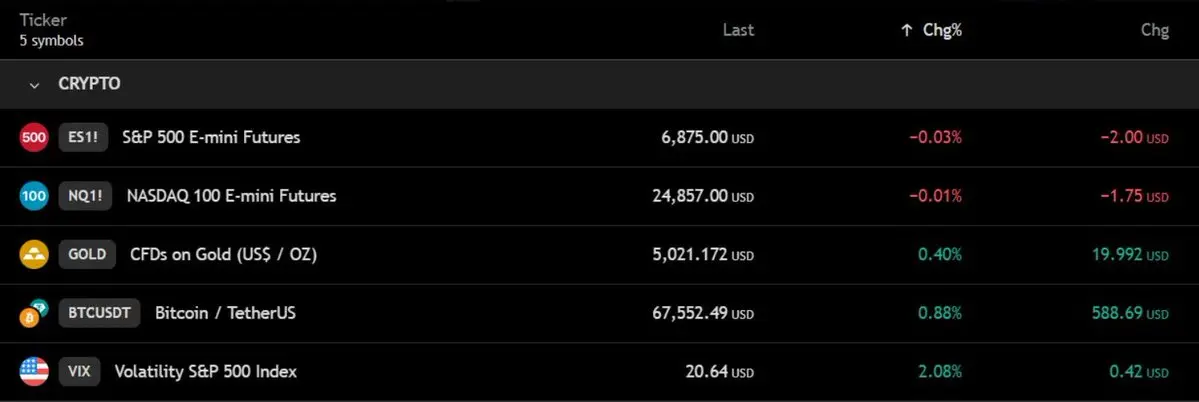

🐋 WHALE WATCH: $BTC is a coiled spring right now.

We’ve been ranging sideways for days, but the "Macro Friday" data deluge is about to hit. With the shutdown backlog clearing, we get Q4 GDP and PCE at the same time.

=> Nasdaq/S&P futures slightly red

=> Market waiting for that inflation print

If PCE comes in hot, expect a sweep of the $65k lows. If we cool, $70k is the first stop. Buckle up.

We’ve been ranging sideways for days, but the "Macro Friday" data deluge is about to hit. With the shutdown backlog clearing, we get Q4 GDP and PCE at the same time.

=> Nasdaq/S&P futures slightly red

=> Market waiting for that inflation print

If PCE comes in hot, expect a sweep of the $65k lows. If we cool, $70k is the first stop. Buckle up.

BTC-2,78%

- Reward

- 2

- Comment

- Repost

- Share

🐋 WHALE WATCH: TODAY. IS. THE. DAY.

After months of anticipation, SCOTUS is expected to rule on the Trump Tariff case. 🇺🇸

Trump says he’s been “waiting forever” for this decision. We’re about to find out if the most aggressive trade policy in US history stands or falls.

$129 Billion in collected duties.

Global supply chains on the edge.

A redefined Presidency.

Stay tuned. We go live with the results the second they drop.

After months of anticipation, SCOTUS is expected to rule on the Trump Tariff case. 🇺🇸

Trump says he’s been “waiting forever” for this decision. We’re about to find out if the most aggressive trade policy in US history stands or falls.

$129 Billion in collected duties.

Global supply chains on the edge.

A redefined Presidency.

Stay tuned. We go live with the results the second they drop.

- Reward

- 1

- Comment

- Repost

- Share

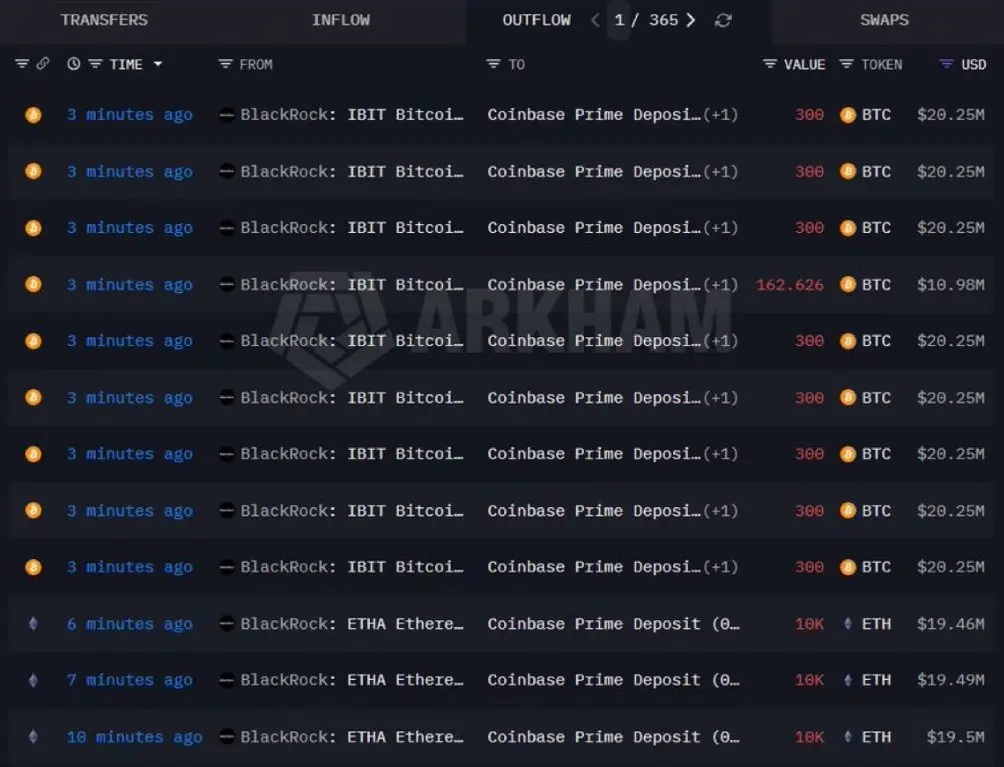

🐋 WHALE WATCH: BLACKROCK MOVING BIG

The world’s largest asset manager isn't slowing down. Just tracked another massive deposit to Coinbase:

=> 2,563 $BTC ($172.94M)

=> 49,852 $ETH ($97.19M)

With ETF redemptions hitting record highs this February, the selling pressure is REAL. Are we heading for a deeper correction, or is this the final shakeout ?

Watch the order books. This is where the big insitution play.

The world’s largest asset manager isn't slowing down. Just tracked another massive deposit to Coinbase:

=> 2,563 $BTC ($172.94M)

=> 49,852 $ETH ($97.19M)

With ETF redemptions hitting record highs this February, the selling pressure is REAL. Are we heading for a deeper correction, or is this the final shakeout ?

Watch the order books. This is where the big insitution play.

- Reward

- 1

- Comment

- Repost

- Share

🐋 WHALE WATCH: The math is getting impossible to ignore.

=> 2015-2017: 1064 days (Bottom to Top)

=> 2018-2021: 1064 days (Bottom to Top)

=> 2022-2025: 1064 days...

We are currently 1,064 days out from the 2022 local bottom. History doesn't just repeat; it rhymes with mathematical precision.

The script is written. Are you positioned, or are you still doubting the code ?

=> 2015-2017: 1064 days (Bottom to Top)

=> 2018-2021: 1064 days (Bottom to Top)

=> 2022-2025: 1064 days...

We are currently 1,064 days out from the 2022 local bottom. History doesn't just repeat; it rhymes with mathematical precision.

The script is written. Are you positioned, or are you still doubting the code ?

- Reward

- 1

- Comment

- Repost

- Share

🐋 WHALE WATCH: Don’t say I didn't warn you about $BCH.

The weekly chart is a literal pressure cooker. We’ve tested the floor, flipped the mid-level, and now we’re eyeing that $750 breakout.

Accumulation is over. The vertical move is coming.

Are you positioned or are you going to buy my bags at the top ?

The weekly chart is a literal pressure cooker. We’ve tested the floor, flipped the mid-level, and now we’re eyeing that $750 breakout.

Accumulation is over. The vertical move is coming.

Are you positioned or are you going to buy my bags at the top ?

BCH-5,75%

- Reward

- 1

- Comment

- Repost

- Share