Shenron1226

No content yet

Shenron1226

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AlNCXFBY

- Reward

- 1

- Comment

- Repost

- Share

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/campaigns/4044?ref=AlNCXFBY&ref_type=132

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 4

- 1

- Repost

- Share

ybaser :

:

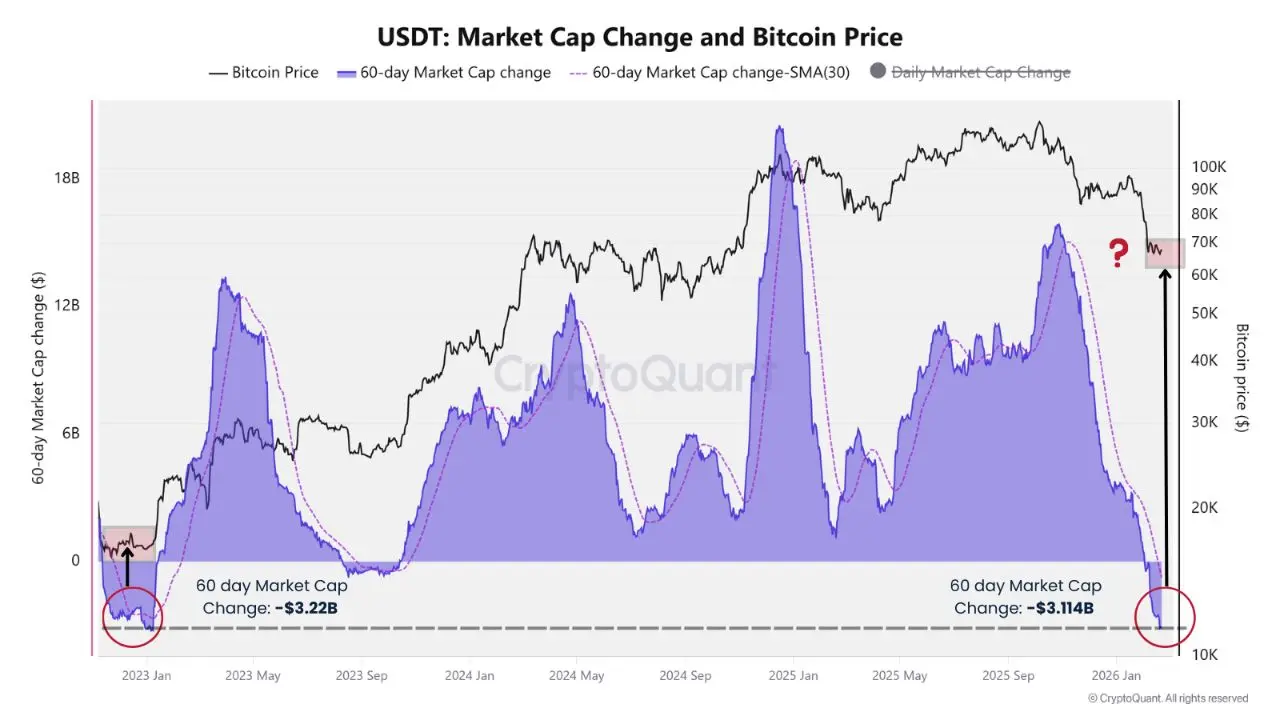

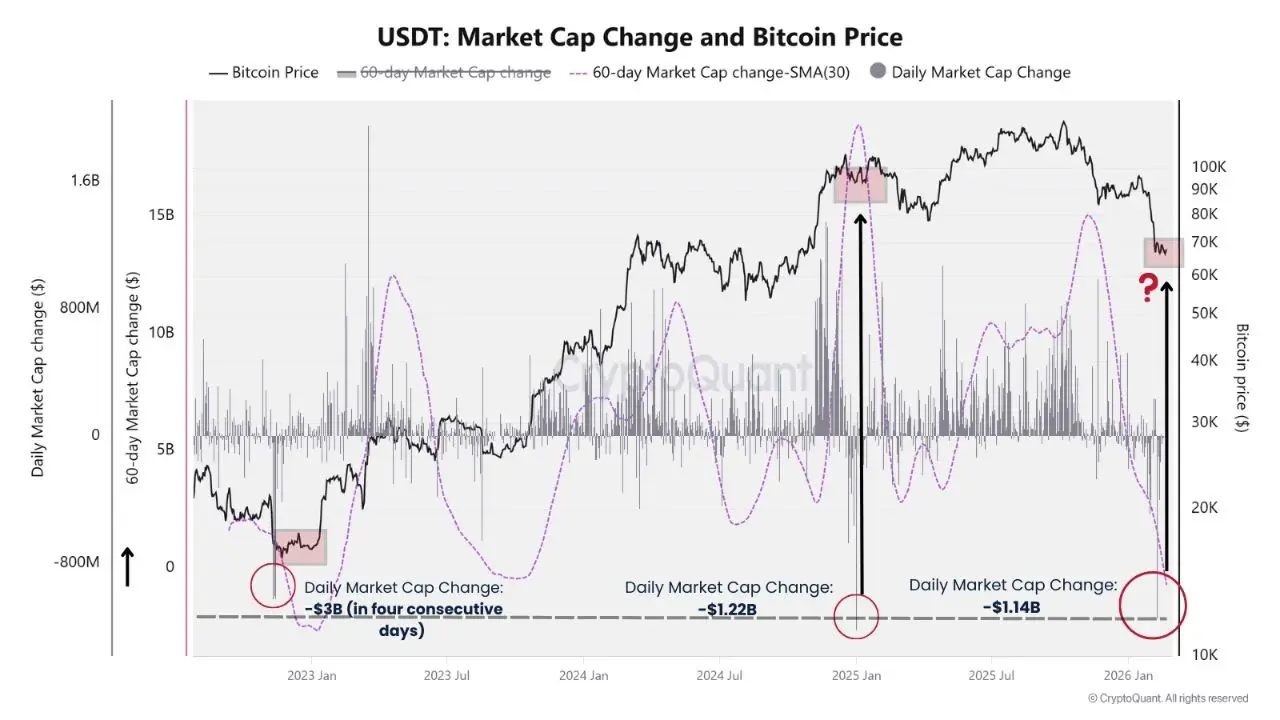

2026 GOGOGO 👊THIS JUST FLASHED THE SAME SIGNAL AS THE 2022 BOTTOM 👀

We’ve only seen this setup twice.

The 60-day $USDT market cap change has now dropped below -$3B, a level last hit in late 2022 right as Bitcoin carved its cycle bottom near $16K. That was peak fear and forced deleveraging.

Now it’s happening again with $BTC still sitting in the mid-$60Ks after a prior ATH run.

On the daily side, we’ve also seen multiple -$1B+ $USDT outflow days. Historically, moves of this size tend to cluster around local exhaustion points or high-volatility flushes, not the clean start of prolonged bear legs.

From a liq

We’ve only seen this setup twice.

The 60-day $USDT market cap change has now dropped below -$3B, a level last hit in late 2022 right as Bitcoin carved its cycle bottom near $16K. That was peak fear and forced deleveraging.

Now it’s happening again with $BTC still sitting in the mid-$60Ks after a prior ATH run.

On the daily side, we’ve also seen multiple -$1B+ $USDT outflow days. Historically, moves of this size tend to cluster around local exhaustion points or high-volatility flushes, not the clean start of prolonged bear legs.

From a liq

BTC-2,14%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊ANALYST BREAKS DOWN SEC STABLECOIN MOVE

Analyst Phyrex Ni says the SEC’s latest move on stablecoins could ease capital restrictions on brokerages, making them more efficient and practical for institutions to hold.

Analyst Phyrex Ni says the SEC’s latest move on stablecoins could ease capital restrictions on brokerages, making them more efficient and practical for institutions to hold.

- Reward

- like

- Comment

- Repost

- Share

🏛️ Arizona's Digital Assets Strategic Reserve Fund bill advanced in a 4-2 vote this week.

Eligible digital assets to include $BTC, DigiByte, $XRP, "stablecoin, a non-fungible token and any other digital-only assets that confer economic, proprietary or access rights or powers."

Eligible digital assets to include $BTC, DigiByte, $XRP, "stablecoin, a non-fungible token and any other digital-only assets that confer economic, proprietary or access rights or powers."

- Reward

- 3

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕⚡ INSIGHT: Crypto investors are ditching tokens for regulated crypto stocks as most new launches quickly sink below their listing price, per DWF.

- Reward

- 2

- Comment

- Repost

- Share

🚨 dflow launches DFlow MCP, a universal trading tool for AI agents on Solana.

The new MCP enables OpenClaw, Claude, Cursor, and other AI workstations to execute trades with precise, production-ready integrations.

By grounding agents in live specifications, DFlow aims to ensure AI-driven trading on Solana is accurate and execution-optimized.

The new MCP enables OpenClaw, Claude, Cursor, and other AI workstations to execute trades with precise, production-ready integrations.

By grounding agents in live specifications, DFlow aims to ensure AI-driven trading on Solana is accurate and execution-optimized.

SOL-4,17%

- Reward

- 2

- Comment

- Repost

- Share

BREAKING: SBI Ripple Asia SIGNS DEAL to EXPAND XRPL Adoption in Japan 👀🔥

SBI Ripple Asia (joint venture between SBI Holdings and Ripple) has OFFICIALLY SIGNED AN AGREEMENT (MoU) with Asia Web3 Alliance Japan (AWAJ) to ACCELERATE XRP Ledger adoption in Japan. 👀

XRPL IS ENTERING JAPAN’S 3 TRILLION-DOLLAR FINANCIAL SYSTEM. 🚀

Under the agreement, SBI Ripple Asia will provide hands-on technical support to startups building financial applications using blockchain on XRP Ledger. 😳📈

JAPAN becomes BIGGEST hub for regulated, institutional-grade XRPL adoption. 🤑🇯🇵

SBI Ripple Asia (joint venture between SBI Holdings and Ripple) has OFFICIALLY SIGNED AN AGREEMENT (MoU) with Asia Web3 Alliance Japan (AWAJ) to ACCELERATE XRP Ledger adoption in Japan. 👀

XRPL IS ENTERING JAPAN’S 3 TRILLION-DOLLAR FINANCIAL SYSTEM. 🚀

Under the agreement, SBI Ripple Asia will provide hands-on technical support to startups building financial applications using blockchain on XRP Ledger. 😳📈

JAPAN becomes BIGGEST hub for regulated, institutional-grade XRPL adoption. 🤑🇯🇵

XRP-0,5%

- Reward

- 4

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊🚨TETHER GOLD MOVES 94 TONNES OF GOLD ON CHAIN

Tether CEO Paolo Ardoino says 94 tonnes of Tether Gold were transferred on-chain in six months at just 0.0016% in fees.

Tether holds 148 tonnes backing a $2.66B market cap, with tokenized gold now exceeding $6B as adoption grows.

Tether CEO Paolo Ardoino says 94 tonnes of Tether Gold were transferred on-chain in six months at just 0.0016% in fees.

Tether holds 148 tonnes backing a $2.66B market cap, with tokenized gold now exceeding $6B as adoption grows.

XAUT1,12%

- Reward

- like

- Comment

- Repost

- Share

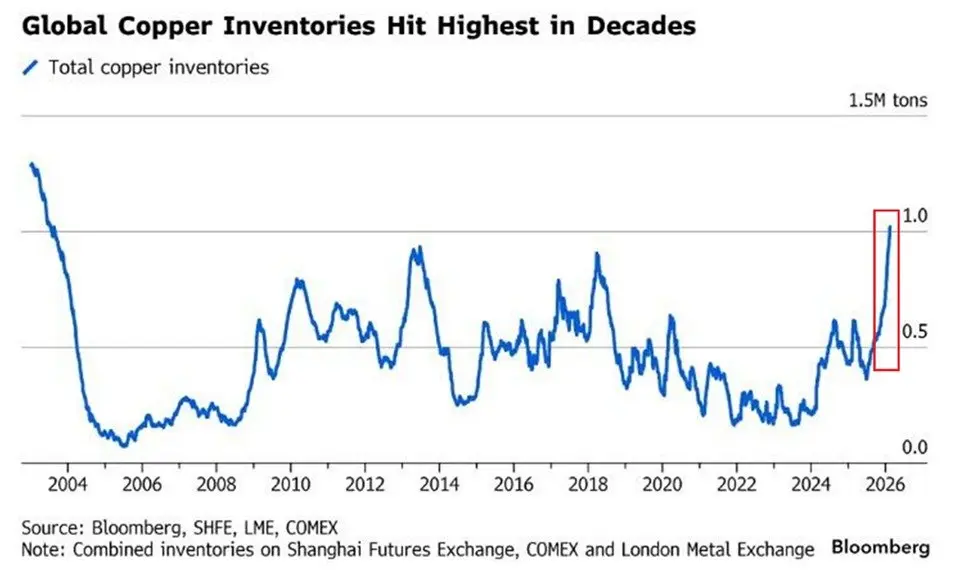

The global rush for copper shows no signs of slowing:

Copper inventories at Comex, Shanghai Futures Exchange, and London Metal Exchange are up to 1.02 million tons, the highest in 23 years.

Copper stockpiles have DOUBLED since September.

Since 2024, inventories have soared +380%, one of the most rapid increases in history.

Copper inventories at Comex alone surged to a record 534,405 tons in the first week of February.

Copper inventories in warehouses tracked by the London Metal Exchange have surged for 27 consecutive days, the longest streak since 2009.

Global copper stockpiles are skyrocketin

Copper inventories at Comex, Shanghai Futures Exchange, and London Metal Exchange are up to 1.02 million tons, the highest in 23 years.

Copper stockpiles have DOUBLED since September.

Since 2024, inventories have soared +380%, one of the most rapid increases in history.

Copper inventories at Comex alone surged to a record 534,405 tons in the first week of February.

Copper inventories in warehouses tracked by the London Metal Exchange have surged for 27 consecutive days, the longest streak since 2009.

Global copper stockpiles are skyrocketin

- Reward

- 2

- Comment

- Repost

- Share

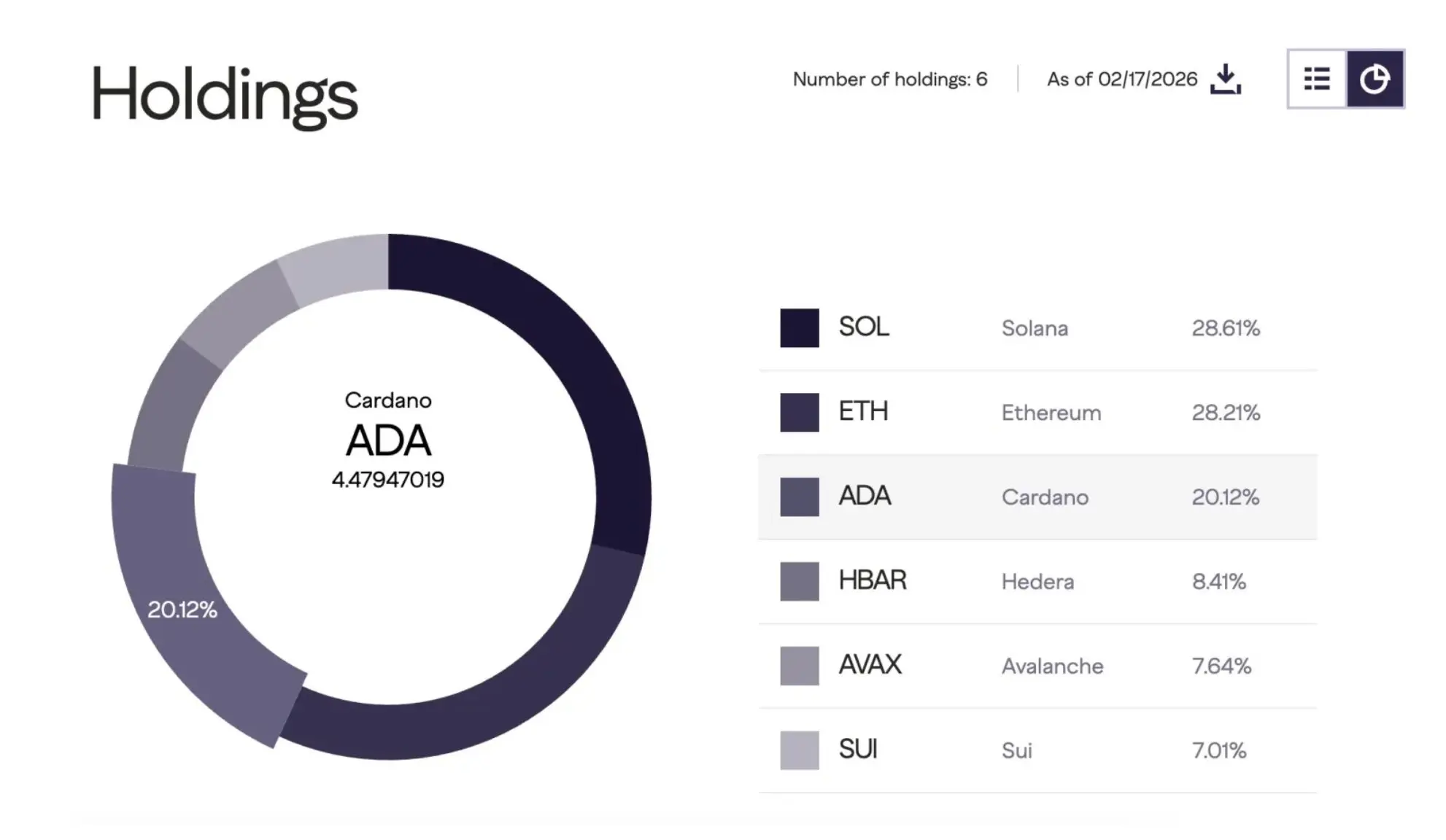

GRAYSCALE INCREASES ADA HOLDINGS

Grayscale Investments raised ADA’s weighting in its Smart Contract Fund to 20.12%, up from 19.50%.

Another consecutive

Grayscale Investments raised ADA’s weighting in its Smart Contract Fund to 20.12%, up from 19.50%.

Another consecutive

ADA-0,81%

- Reward

- 3

- 2

- Repost

- Share

GateUser-4a8b4621 :

:

2026 GOGOGO 👊View More

🔥TIM DRAPER: BITCOIN COULD 4X BY 2028

VC investor Tim Draper says Bitcoin could quadruple by 2028, doubling down on his long-standing bullish stance.

He’s even inviting skeptics to bet against him on Polymarket.

VC investor Tim Draper says Bitcoin could quadruple by 2028, doubling down on his long-standing bullish stance.

He’s even inviting skeptics to bet against him on Polymarket.

BTC-2,14%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

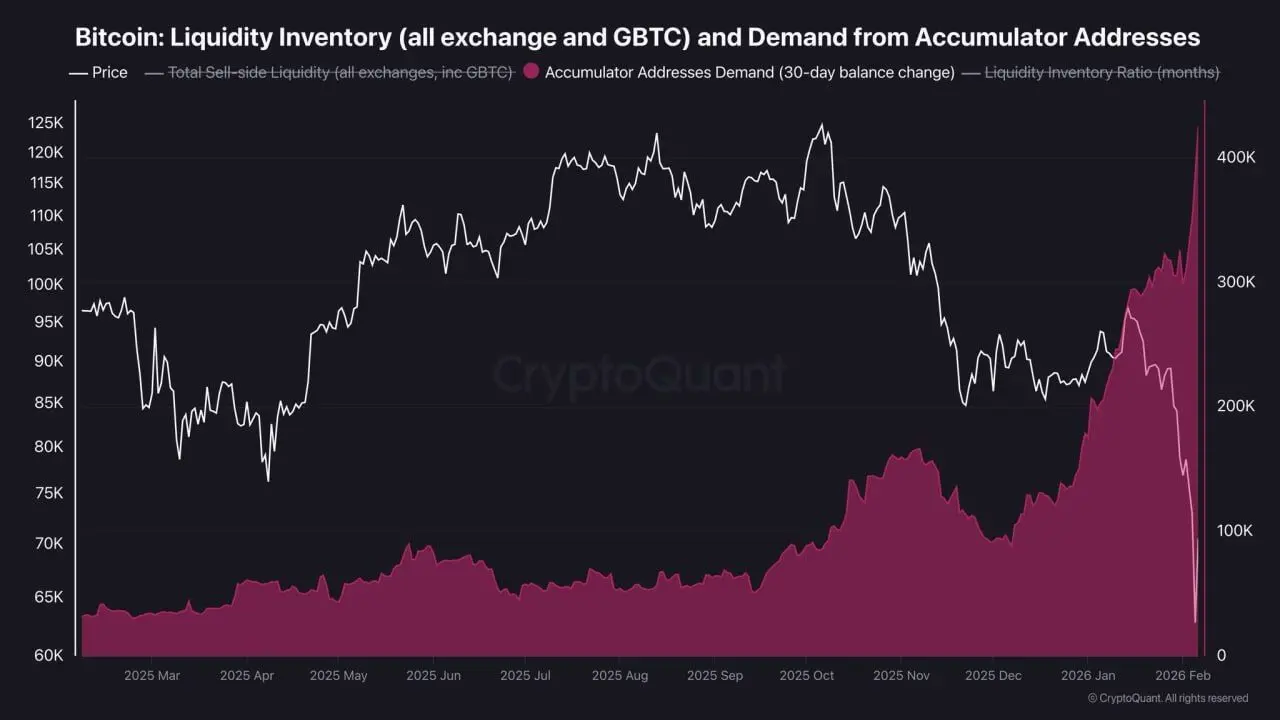

BIG: Demand from accumulator addresses spike in the past 7 days.

- Reward

- 1

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AlNCXFBY

- Reward

- 2

- Comment

- Repost

- Share

Precious Metals are SURGING again.

Gold is up 2.6% and has reclaimed $5,100, adding $900 Billion today.

Silver is up 9.42%% and has reclaimed $85, adding $400 Billion today.

Gold is up 2.6% and has reclaimed $5,100, adding $900 Billion today.

Silver is up 9.42%% and has reclaimed $85, adding $400 Billion today.

- Reward

- 2

- Comment

- Repost

- Share

Trending Topics

View More378.23K Popularity

124.91K Popularity

436.17K Popularity

17.27K Popularity

136.24K Popularity

Pin