Defioasis

No content yet

defioasis

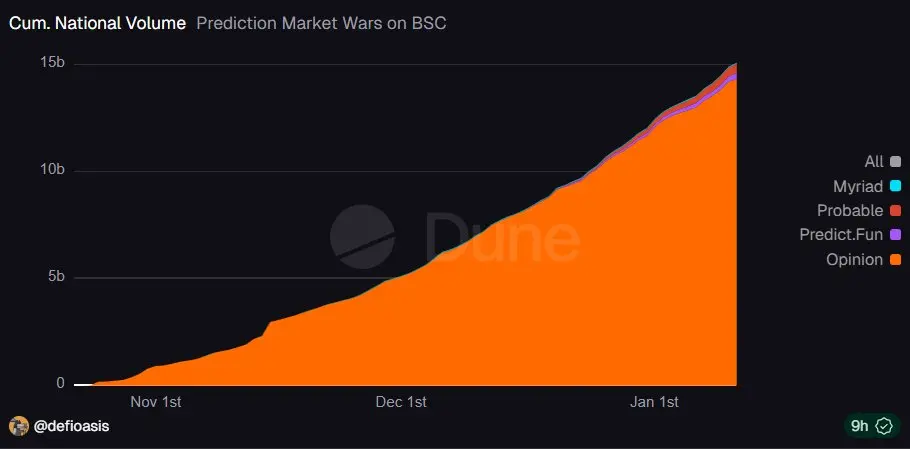

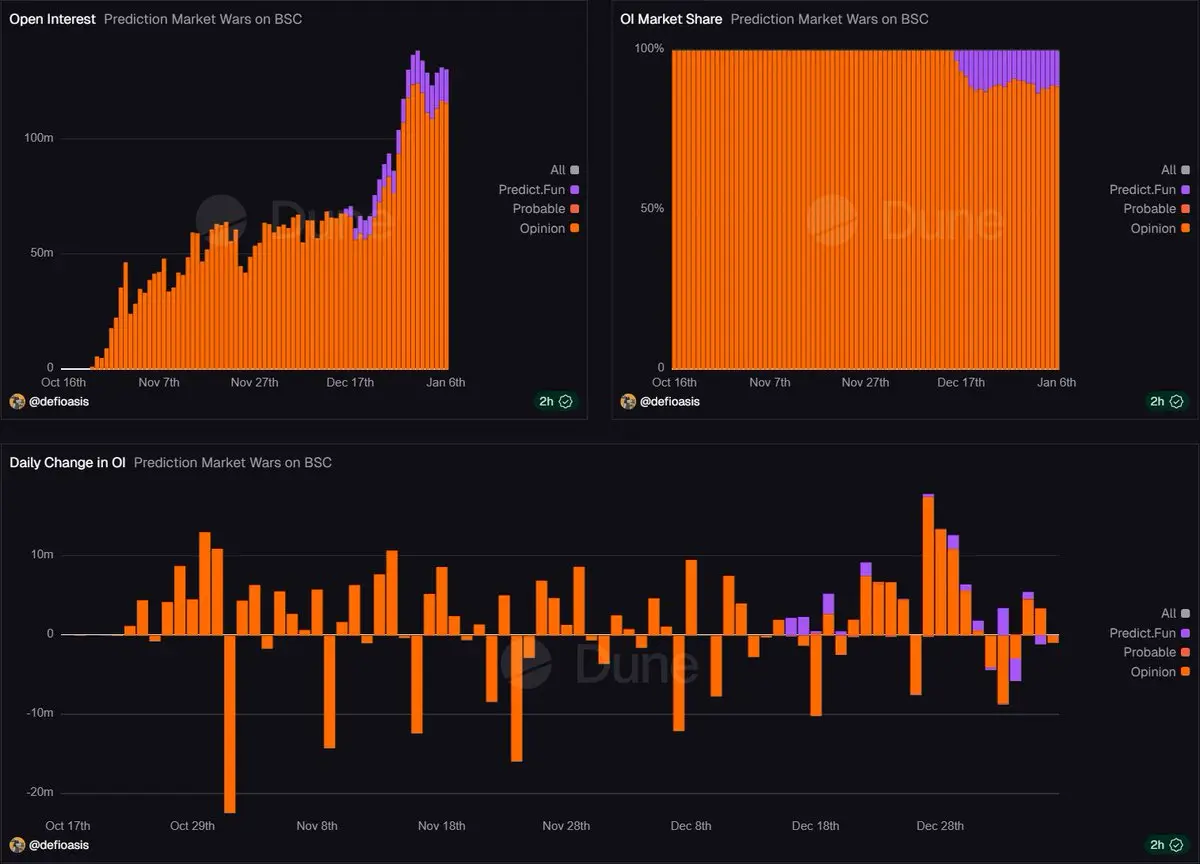

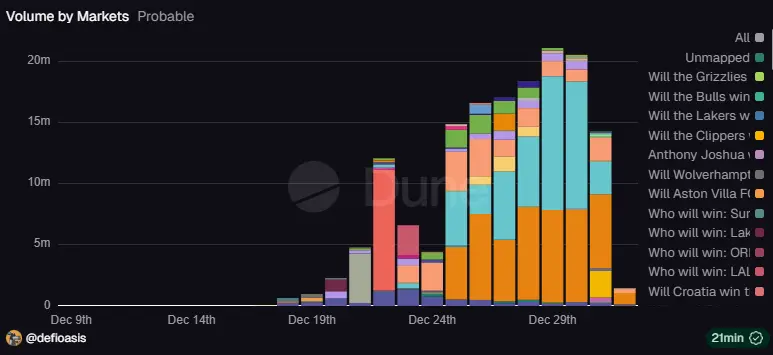

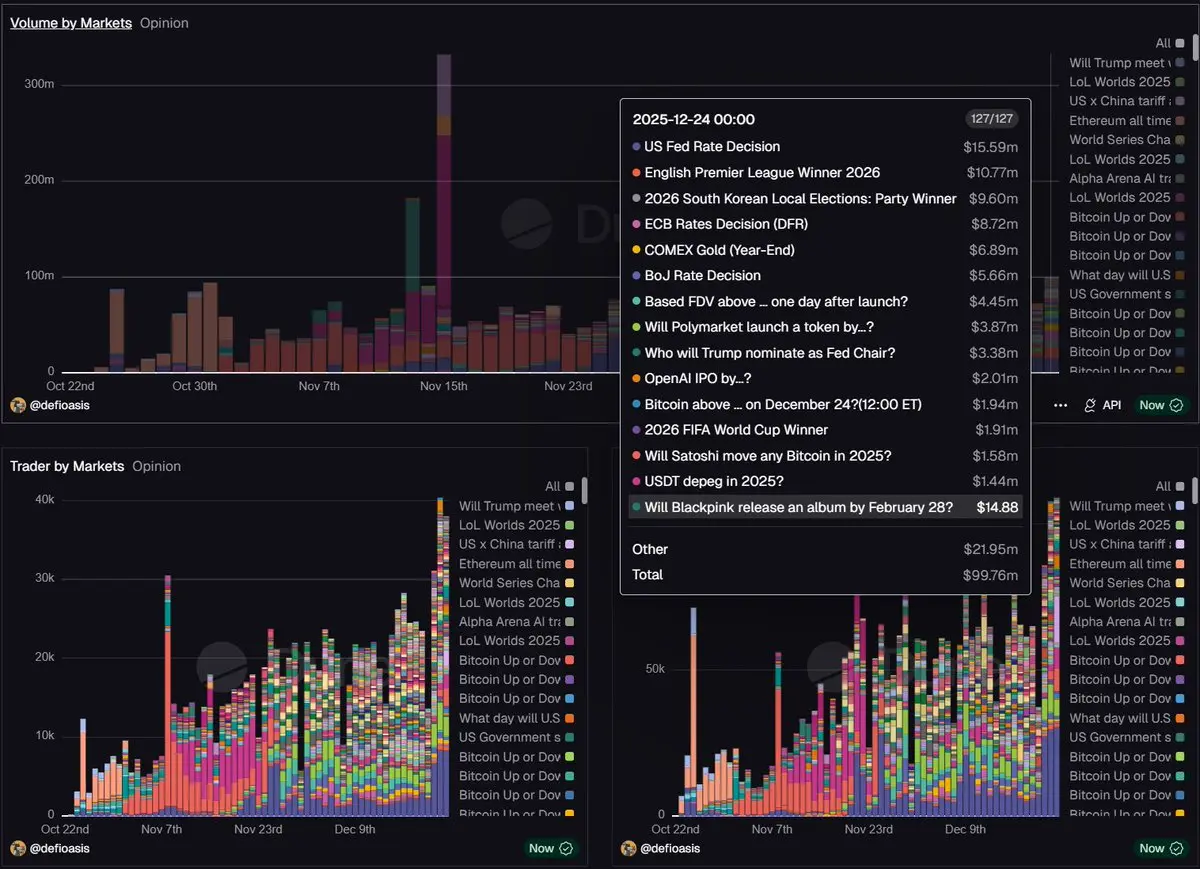

BSC prediction market's cumulative nominal trading volume exceeds $15 billion

Opinion accounts for over $14 billion, and in less than three months, the growth rate is rapid

View OriginalOpinion accounts for over $14 billion, and in less than three months, the growth rate is rapid

- Reward

- like

- Comment

- Repost

- Share

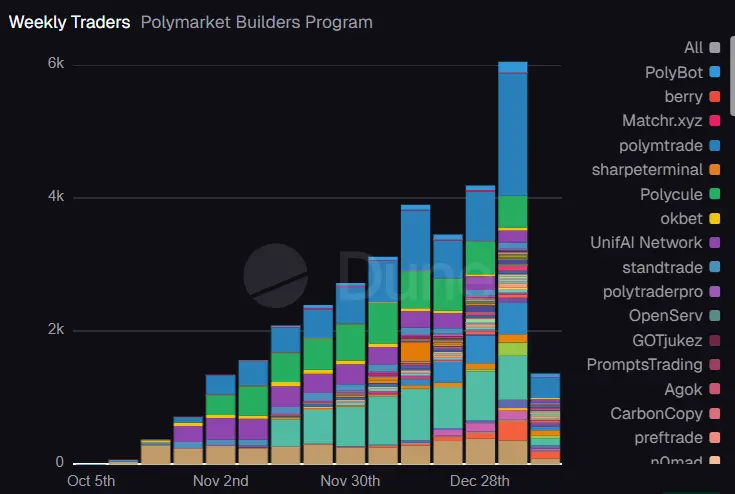

Polymarket Builders' weekly trading users first exceed 6k

Unlike betmoar, which dominates the main market share of Builders' trading volume, there is a fragmented situation among trading users, with multiple different Builders having certain attractive features to attract and retain users.

Currently, there are 4 Builders with over 1,000 cumulative traders, namely Polymtrade, Polycule, Based, and betmoar:

- Leading among trading users is Polymtrade, accounting for about 30% of the market share for the week, and is the first Builder to surpass 4,000 cumulative trading users.

- Based, with rich f

View OriginalUnlike betmoar, which dominates the main market share of Builders' trading volume, there is a fragmented situation among trading users, with multiple different Builders having certain attractive features to attract and retain users.

Currently, there are 4 Builders with over 1,000 cumulative traders, namely Polymtrade, Polycule, Based, and betmoar:

- Leading among trading users is Polymtrade, accounting for about 30% of the market share for the week, and is the first Builder to surpass 4,000 cumulative trading users.

- Based, with rich f

- Reward

- like

- Comment

- Repost

- Share

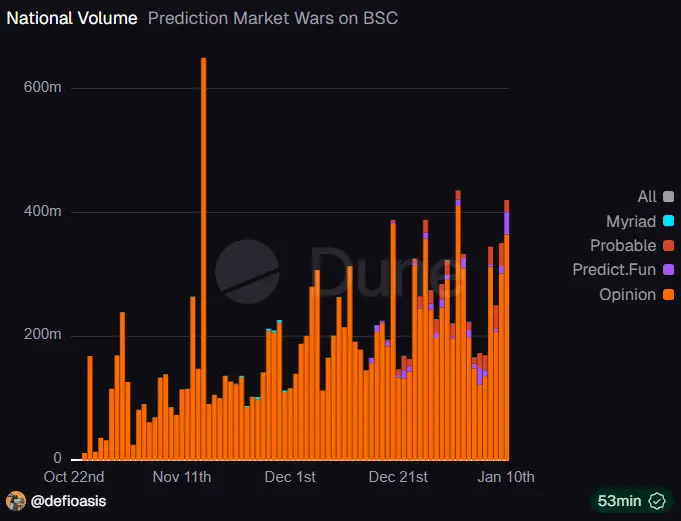

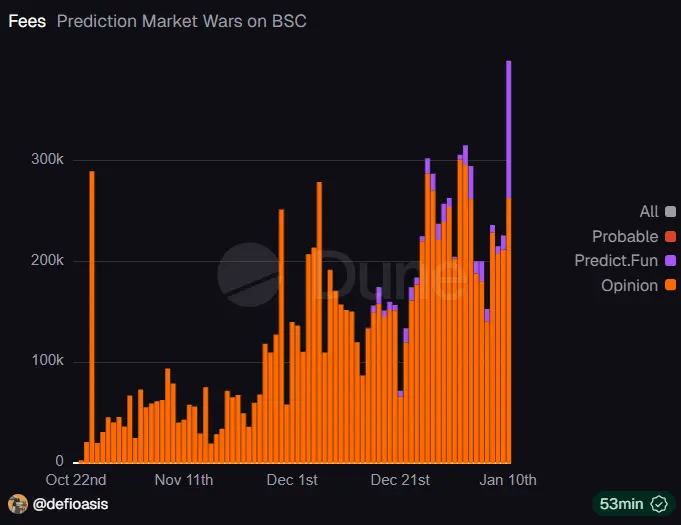

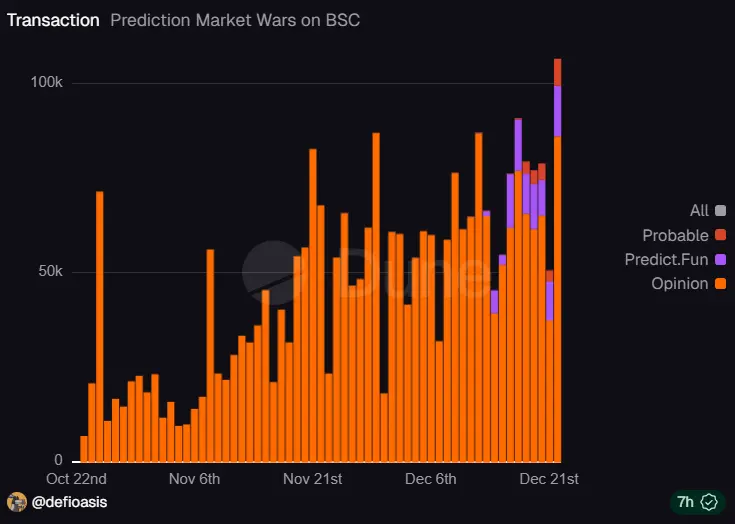

BSC prediction market's nominal trading volume exceeded $400 million for the third consecutive day, with Opinion accounting for 86.7% of the share; Predict Fun reached a new high of $37 million in nominal trading volume, and daily fee income also hit a record of $136,000.

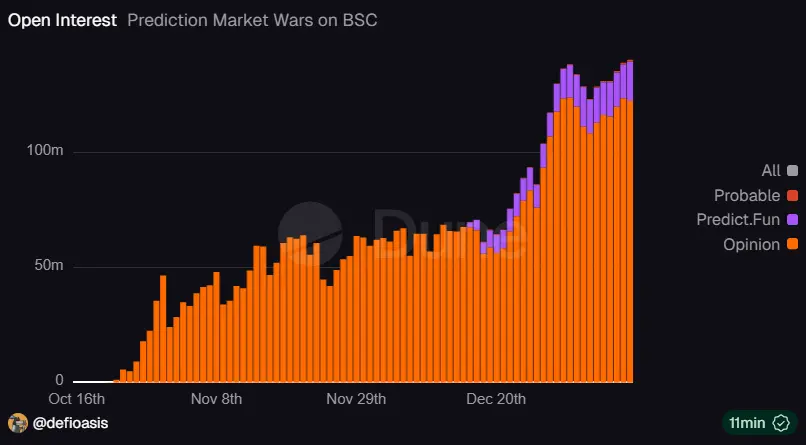

The holdings of the three major BSC prediction markets continue to reach new highs, with a total scale of $150 million, still about half of Polymarket and Kalshi.

It is worth mentioning that after the Double Christmas event ended, Opinion's trading users and trading volume experienced a sharp decline, but both have now begun

View OriginalThe holdings of the three major BSC prediction markets continue to reach new highs, with a total scale of $150 million, still about half of Polymarket and Kalshi.

It is worth mentioning that after the Double Christmas event ended, Opinion's trading users and trading volume experienced a sharp decline, but both have now begun

- Reward

- like

- Comment

- Repost

- Share

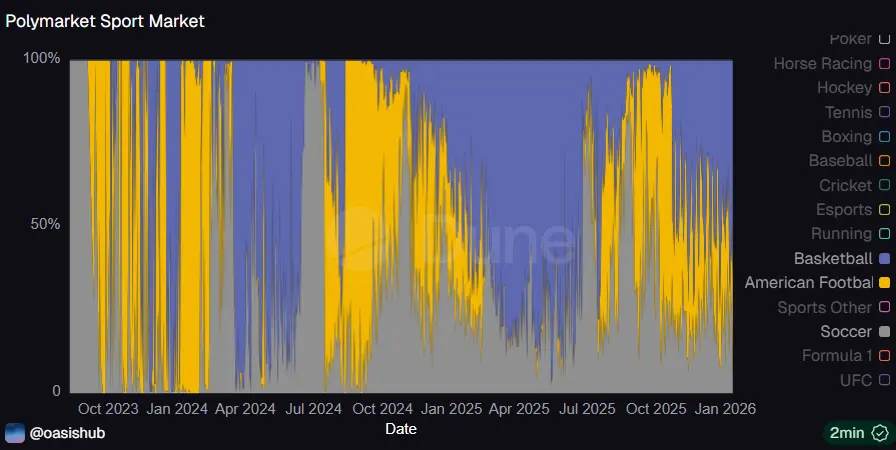

In Kalshi's trading volume, sports events account for over 90%. Looking into specific sports, American users clearly favor football and basketball the most, while trading volume for soccer is much lower.

In contrast, Polymarket has a relatively balanced distribution of sports events, with basketball slightly leading, and the trading volumes for soccer and football are not significantly different, leaning more towards internationalization.

View OriginalIn contrast, Polymarket has a relatively balanced distribution of sports events, with basketball slightly leading, and the trading volumes for soccer and football are not significantly different, leaning more towards internationalization.

- Reward

- like

- Comment

- Repost

- Share

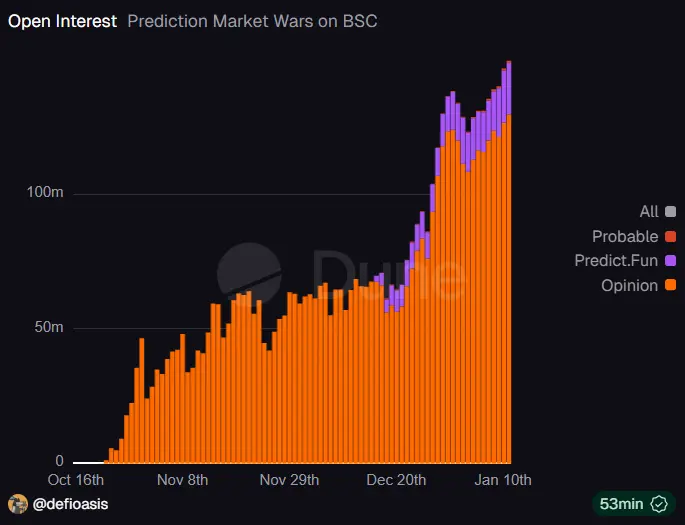

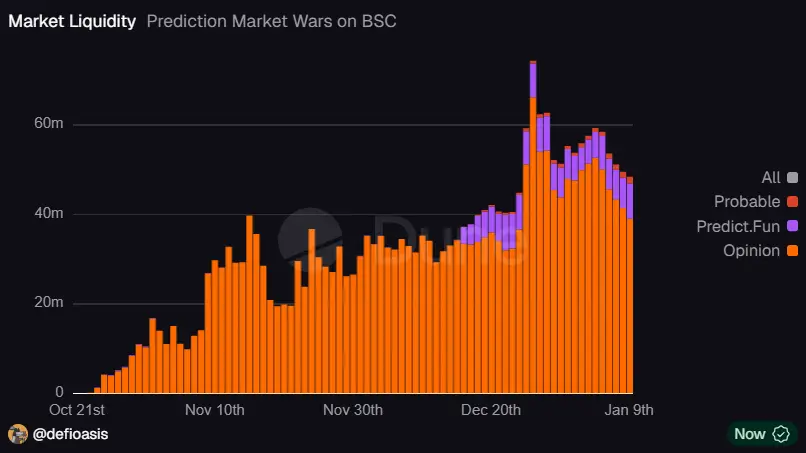

BSC Prediction Market OI and Potential Liquidity Situation

Open Positions

Opinion – $123 million

Predict Fun – $17.21 million

Probable – $768,000

Market Potential Liquidity

Opinion – $39 million

Predict Fun – $7.91 million

Probable – $152,000

Overall, Opinion users' funds remain highly active, with a stable core group; Predict Fun funds are at a relatively reasonable level; Probable user wallets hold twice as much funds as open positions, with a trading rhythm focused on short, quick trades, lacking long-term events to attract funds to stay.

View OriginalOpen Positions

Opinion – $123 million

Predict Fun – $17.21 million

Probable – $768,000

Market Potential Liquidity

Opinion – $39 million

Predict Fun – $7.91 million

Probable – $152,000

Overall, Opinion users' funds remain highly active, with a stable core group; Predict Fun funds are at a relatively reasonable level; Probable user wallets hold twice as much funds as open positions, with a trading rhythm focused on short, quick trades, lacking long-term events to attract funds to stay.

- Reward

- like

- Comment

- Repost

- Share

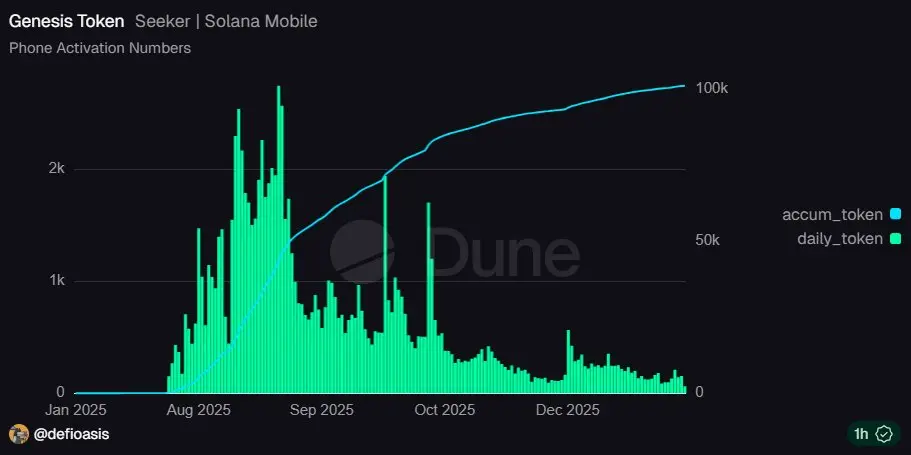

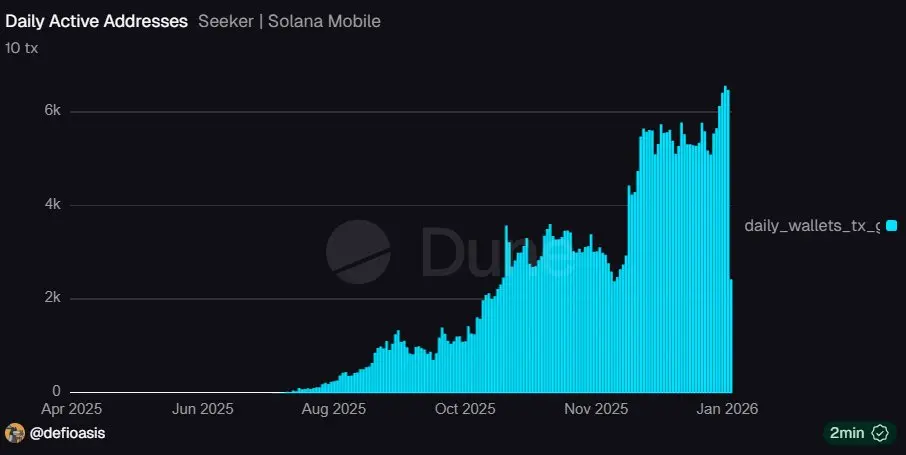

The total number of users eligible for the Solana mobile Seeker airdrop is approximately 101,000, which is the total number of devices that have received the Genesis Token and activated Seeker.

Since the SKR airdrop was hinted at in early December last year, the daily active users completing at least 10 transactions using the built-in address on Seeker mobile have been between 4,000 and 6,500, whereas before that, it was only around 3,000.

View OriginalSince the SKR airdrop was hinted at in early December last year, the daily active users completing at least 10 transactions using the built-in address on Seeker mobile have been between 4,000 and 6,500, whereas before that, it was only around 3,000.

- Reward

- like

- Comment

- Repost

- Share

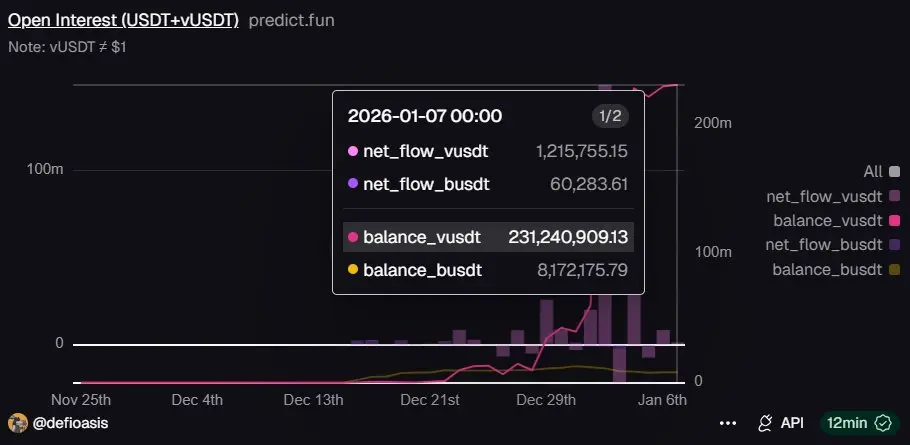

Venus has started to push Probable prediction markets, and it seems that the two have reached a cooperation. I wonder if Probable will also introduce interest-bearing features.

Another BSC prediction market, Predict Fun, earns interest on holdings by depositing funds into Venus – vUSDT.

Currently, Predict Fun has deposited about 5.85 million USD (equivalent to 231 million vUSDT) into Venus, accounting for approximately 40% of its total holdings.

View OriginalAnother BSC prediction market, Predict Fun, earns interest on holdings by depositing funds into Venus – vUSDT.

Currently, Predict Fun has deposited about 5.85 million USD (equivalent to 231 million vUSDT) into Venus, accounting for approximately 40% of its total holdings.

- Reward

- like

- Comment

- Repost

- Share

On the first full trading day after the conclusion of the Double Egg event, Opinion trading users, trading volume, and trading fee contributions all experienced some decline.

Compared to the last full trading day of the event (January 3rd):

- Trading users decreased by 38.2%

- Trading volume decreased by 52.6%

- Trading fee contribution decreased by 31.1%

However, in terms of holdings, the changes are minimal, with inflows and outflows remaining within a reasonable range, maintaining at $115 million. This also indicates that after the significant incentives fade, the fundamental aspects become

View OriginalCompared to the last full trading day of the event (January 3rd):

- Trading users decreased by 38.2%

- Trading volume decreased by 52.6%

- Trading fee contribution decreased by 31.1%

However, in terms of holdings, the changes are minimal, with inflows and outflows remaining within a reasonable range, maintaining at $115 million. This also indicates that after the significant incentives fade, the fundamental aspects become

- Reward

- like

- Comment

- Repost

- Share

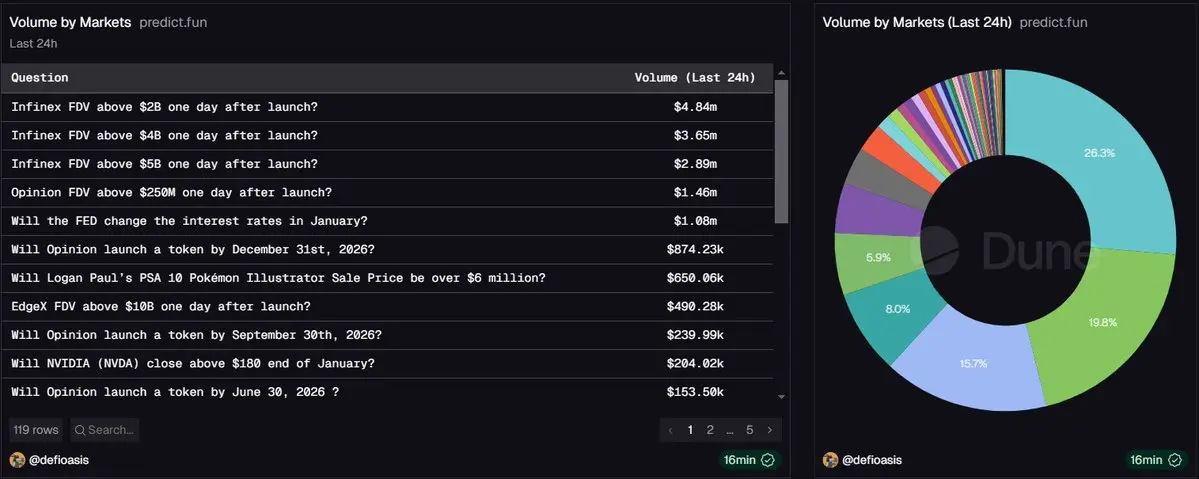

Infinex public sale has been open for two days, only raising 12% of the target, just over 6 million USD…

This is good, Infinex TGE valuation has directly become the first choice for prediction market Predict Fun scoring and interaction.

In the past 24 hours, three different valuation event predictions of Infinex have occupied the top three spots in Predict Fun trading volume, accounting for over 60% of the platform's trading volume.

It is worth mentioning that the fourth largest trading volume event on Predict Fun is a prediction of Opinion TGE valuation, which is a straightforward business ba

View OriginalThis is good, Infinex TGE valuation has directly become the first choice for prediction market Predict Fun scoring and interaction.

In the past 24 hours, three different valuation event predictions of Infinex have occupied the top three spots in Predict Fun trading volume, accounting for over 60% of the platform's trading volume.

It is worth mentioning that the fourth largest trading volume event on Predict Fun is a prediction of Opinion TGE valuation, which is a straightforward business ba

- Reward

- like

- Comment

- Repost

- Share

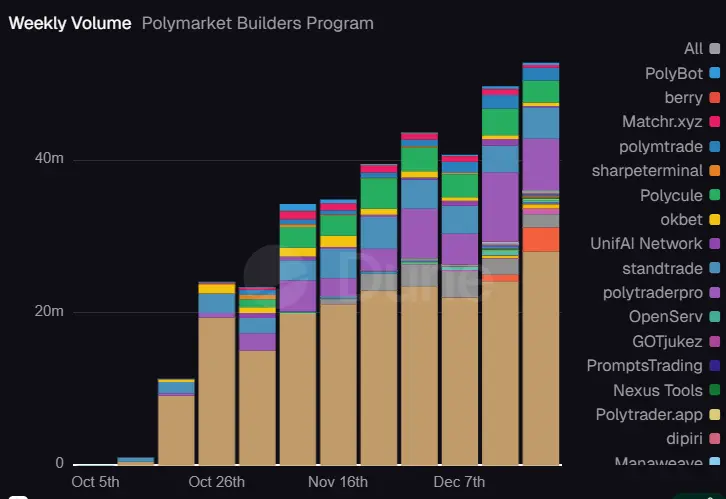

Polymarket Builders weekly trading volume reaches a new high of $80 million, a 50% increase week-over-week.

This is mainly due to the efforts of industry leader betmoar, whose weekly trading volume reached $50 million, with the past two days' trading volume exceeding $10 million for two consecutive days.

Currently, Polymarket Builders has 80 members, but betmoar's approximately 60% market dominance remains difficult to shake, and product strength remains unmatched.

View OriginalThis is mainly due to the efforts of industry leader betmoar, whose weekly trading volume reached $50 million, with the past two days' trading volume exceeding $10 million for two consecutive days.

Currently, Polymarket Builders has 80 members, but betmoar's approximately 60% market dominance remains difficult to shake, and product strength remains unmatched.

- Reward

- like

- Comment

- Repost

- Share

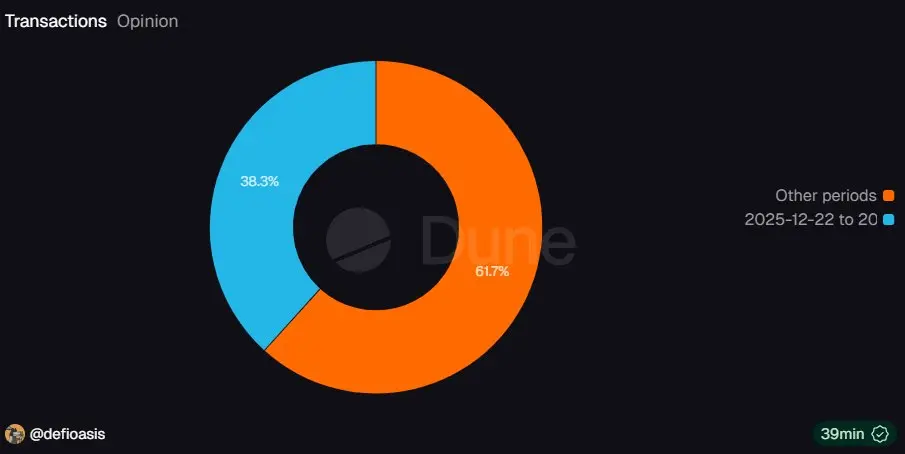

Opinion's Double Holiday Event is coming to an end

Over 48,000 new user addresses made their first transaction during the event, accounting for over 30% of Opinion's total users

Meanwhile, these new users conducted over 2.1 million transactions, representing 38.3% of the total transaction count

Let's see how the retention rate looks after the event ends🤔

View OriginalOver 48,000 new user addresses made their first transaction during the event, accounting for over 30% of Opinion's total users

Meanwhile, these new users conducted over 2.1 million transactions, representing 38.3% of the total transaction count

Let's see how the retention rate looks after the event ends🤔

- Reward

- like

- Comment

- Repost

- Share

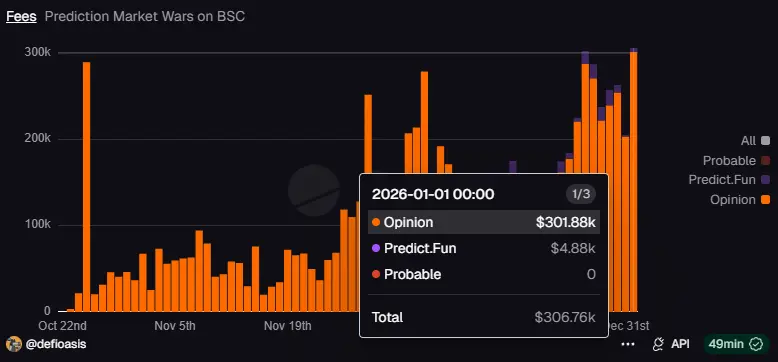

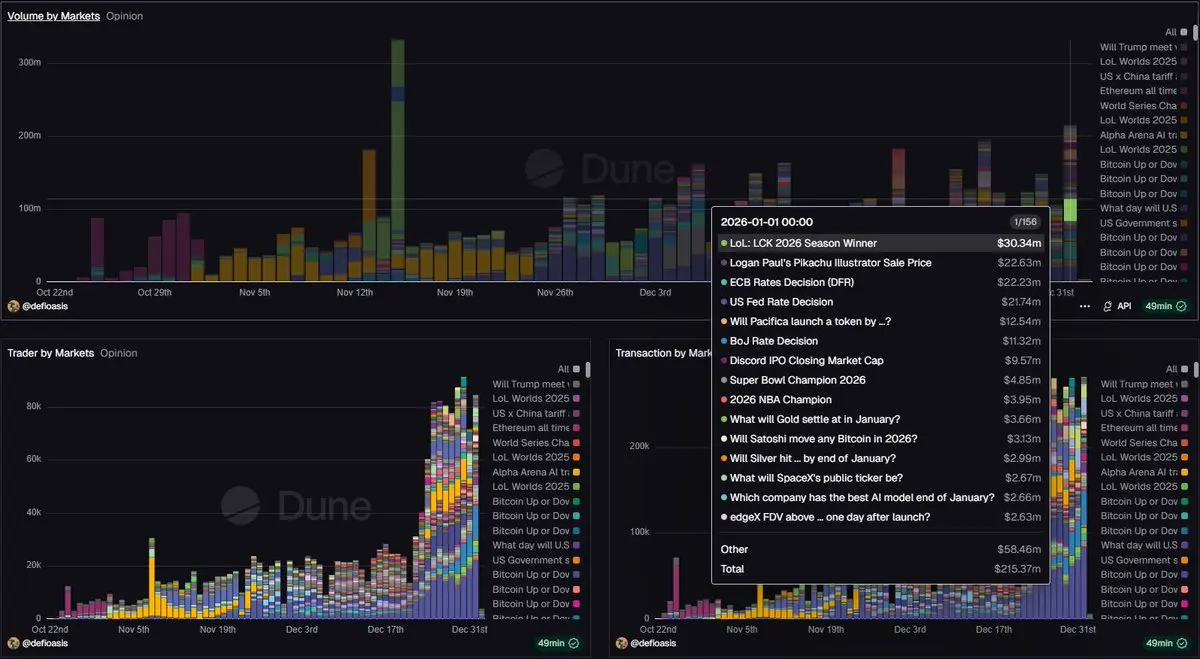

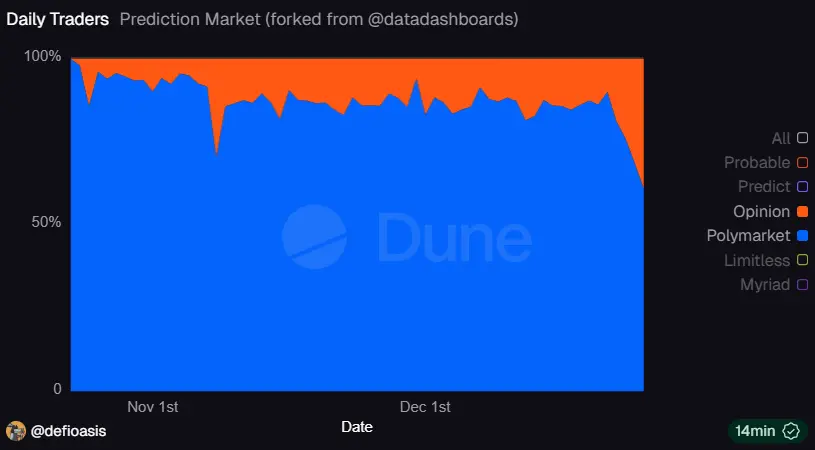

On the first day of the new year, Opinion's fee revenue hit a new high of over $300,000 in a single day

Since the launch of the Opinion Christmas special event

- Daily traders consistently exceeded 45,000, with a Polymarket daily trader ratio of 45% : 55%

- Daily transaction count exceeded 250,000, with a cumulative transaction count surpassing 5 million

- The composition of trading volume has become more diversified. Taking January 1st as an example, the top three events by trading volume come from different sectors:

1. Sports - LOL: LCK 2026 Season Champion

2. Culture - Logan Paul’s “Pikachu

View OriginalSince the launch of the Opinion Christmas special event

- Daily traders consistently exceeded 45,000, with a Polymarket daily trader ratio of 45% : 55%

- Daily transaction count exceeded 250,000, with a cumulative transaction count surpassing 5 million

- The composition of trading volume has become more diversified. Taking January 1st as an example, the top three events by trading volume come from different sectors:

1. Sports - LOL: LCK 2026 Season Champion

2. Culture - Logan Paul’s “Pikachu

- Reward

- like

- Comment

- Repost

- Share

As a zero-fee platform, Probable's trading volume growth rate is faster than Predict Fun, accounting for approximately 10%–15% of the trading volume in the BNB Chain prediction market.

In terms of trading composition, Probable's trading volume is mainly driven by two markets:

1. Will BNB fall to $700

2 by December 31, 2025?

2. Will Bitcoin reach $100,000 by December 31, 2025?

Both of these events have significantly higher market trading volume and liquidity compared to other markets on the platform. As these two markets mature, everyone is curious about what they will choose to bet on next.

It

View OriginalIn terms of trading composition, Probable's trading volume is mainly driven by two markets:

1. Will BNB fall to $700

2 by December 31, 2025?

2. Will Bitcoin reach $100,000 by December 31, 2025?

Both of these events have significantly higher market trading volume and liquidity compared to other markets on the platform. As these two markets mature, everyone is curious about what they will choose to bet on next.

It

- Reward

- like

- Comment

- Repost

- Share

Among over 1.7 million Polymarket trading addresses, the proportion of addresses with realized profits is close to 30%; conversely, approximately 70% of trading addresses have realized losses.

A more sobering reality is that less than 0.04% of addresses have achieved over 70% of the total realized profits, with these top addresses accumulating a total realized profit of up to $3.7 billion.

The majority of profitable trading addresses have a profit range of $0 - $1,000, accounting for 24.56% of all addresses, but only capturing 0.86% of the total realized profits. To earn more than $1,000, one

View OriginalA more sobering reality is that less than 0.04% of addresses have achieved over 70% of the total realized profits, with these top addresses accumulating a total realized profit of up to $3.7 billion.

The majority of profitable trading addresses have a profit range of $0 - $1,000, accounting for 24.56% of all addresses, but only capturing 0.86% of the total realized profits. To earn more than $1,000, one

- Reward

- like

- Comment

- Repost

- Share

Every weekend, I count the number of Polymarket Builders. Today, I saw that it has already exceeded 70, maintaining a weekly increase of 10-20 over the past few weeks; at the same time, the number has also surpassed the Hyperliquid Builders counted by Flowscan.

The increase in the number of Builders is gradually reflected in trading volume: Polymarket Builders' weekly trading volume has for the first time exceeded $50 million.

Now, the Builders landscape is quite clear: betmoar firmly holds half the market share; PolyTraderPro, Stand trade, and Polycule are competing for second place. Of cours

View OriginalThe increase in the number of Builders is gradually reflected in trading volume: Polymarket Builders' weekly trading volume has for the first time exceeded $50 million.

Now, the Builders landscape is quite clear: betmoar firmly holds half the market share; PolyTraderPro, Stand trade, and Polycule are competing for second place. Of cours

- Reward

- like

- Comment

- Repost

- Share

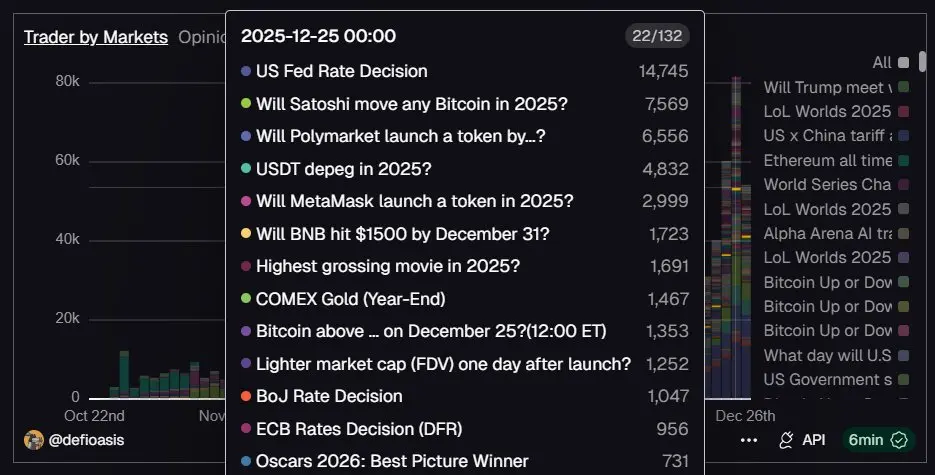

Opinion Daily and Japanese independent traders hit a new high, surpassing 42,000

At the same time, Opinion set a record for the highest share of Japanese traders on Polymarket, with a 4:6 opening ratio with Polymarket

There are 11 markets with over 1k+ traders, including 3 markets with over 5k+ traders:

1. US Fed Rate Decision

2. Will Satoshi transfer any Bitcoin in 2025?

3. Will Polymarket launch a token before…?

At the same time, Opinion set a record for the highest share of Japanese traders on Polymarket, with a 4:6 opening ratio with Polymarket

There are 11 markets with over 1k+ traders, including 3 markets with over 5k+ traders:

1. US Fed Rate Decision

2. Will Satoshi transfer any Bitcoin in 2025?

3. Will Polymarket launch a token before…?

BTC0,79%

- Reward

- like

- Comment

- Repost

- Share

Opinion Not sure what to trade during the Christmas event? See what markets everyone is trading

Top 5 daily trading volumes:

1. US Fed Rate Decision

2. 2026 Premier League Champion

3. 2026 South Korean Local Elections: Party Winners

4. ECB Rates Decision (DFR)

5. COMEX Gold (Year-End)

Top 5 daily trading users:

1. US Fed Rate Decision

2. Will Polymarket launch a token before…?

3. Will Satoshi transfer any Bitcoin in 2025?

4. Will Kraken IPO in 2025?

5. Will USDT depeg in 2025?

Top 5 daily trading transactions:

1. US Fed Rate Decision

2. Will Kraken IPO in 2025?

3. Will Satoshi transfer any Bit

Top 5 daily trading volumes:

1. US Fed Rate Decision

2. 2026 Premier League Champion

3. 2026 South Korean Local Elections: Party Winners

4. ECB Rates Decision (DFR)

5. COMEX Gold (Year-End)

Top 5 daily trading users:

1. US Fed Rate Decision

2. Will Polymarket launch a token before…?

3. Will Satoshi transfer any Bitcoin in 2025?

4. Will Kraken IPO in 2025?

5. Will USDT depeg in 2025?

Top 5 daily trading transactions:

1. US Fed Rate Decision

2. Will Kraken IPO in 2025?

3. Will Satoshi transfer any Bit

US0,35%

- Reward

- like

- Comment

- Repost

- Share

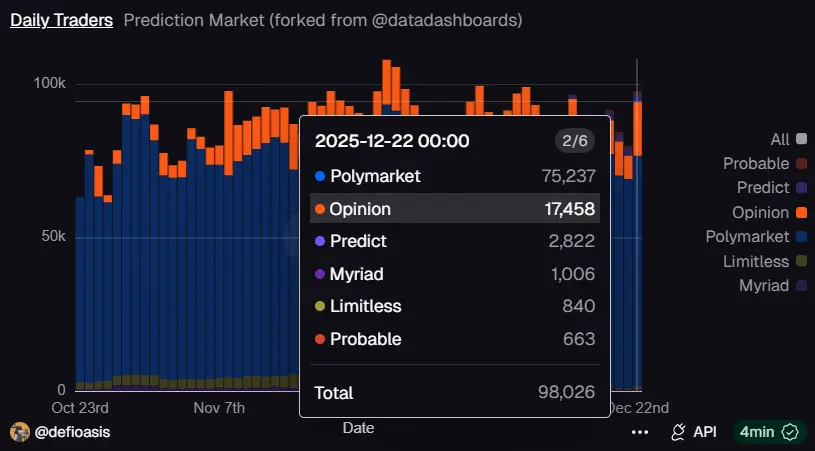

Christmas Points Event First Day

Opinion day traders reached 17,500, setting a historical second-high record, accounting for 23.2% of Polymarket's same-day traders.

The number of daily trades on Opinion reached 86,000, driving the daily trading volume of the BSC prediction market to break the 100,000 transaction barrier for the first time.

However, the number of transactions is a significant area where competitors differ from Polymarket and Kalshi, as the latter two can exceed one million transactions per day recently.

View OriginalOpinion day traders reached 17,500, setting a historical second-high record, accounting for 23.2% of Polymarket's same-day traders.

The number of daily trades on Opinion reached 86,000, driving the daily trading volume of the BSC prediction market to break the 100,000 transaction barrier for the first time.

However, the number of transactions is a significant area where competitors differ from Polymarket and Kalshi, as the latter two can exceed one million transactions per day recently.

- Reward

- like

- Comment

- Repost

- Share

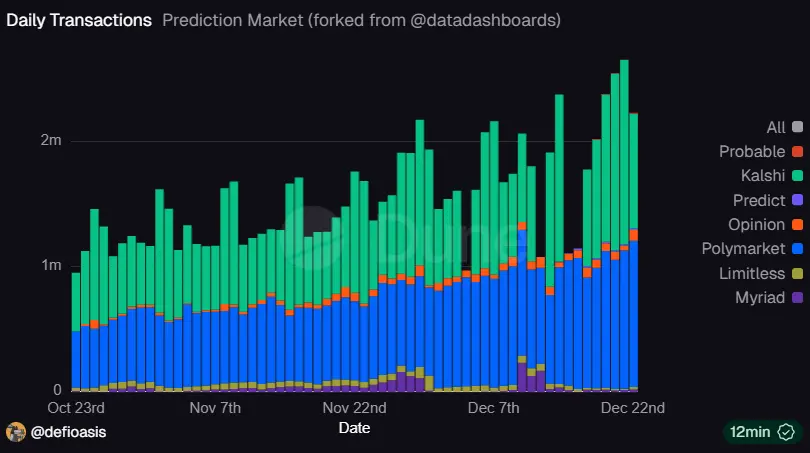

Open interest may be a better indicator of the influence of the prediction market, as it reflects the participants' risk-taking and capital commitment.

Currently, Kalshi and Polymarket together account for nearly 90% of the open interest share.

Of the remaining 10%, Opinion accounts for 8 points, and Predict Fun accounts for 1 point.

As a challenger, Predict Fun introduces the open interest earning feature, not sure if this will become a future industry standard🤔

View OriginalCurrently, Kalshi and Polymarket together account for nearly 90% of the open interest share.

Of the remaining 10%, Opinion accounts for 8 points, and Predict Fun accounts for 1 point.

As a challenger, Predict Fun introduces the open interest earning feature, not sure if this will become a future industry standard🤔

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More12.63K Popularity

17.12K Popularity

55.57K Popularity

14.95K Popularity

94.24K Popularity

Pin