Glassnode

No content yet

glassnode

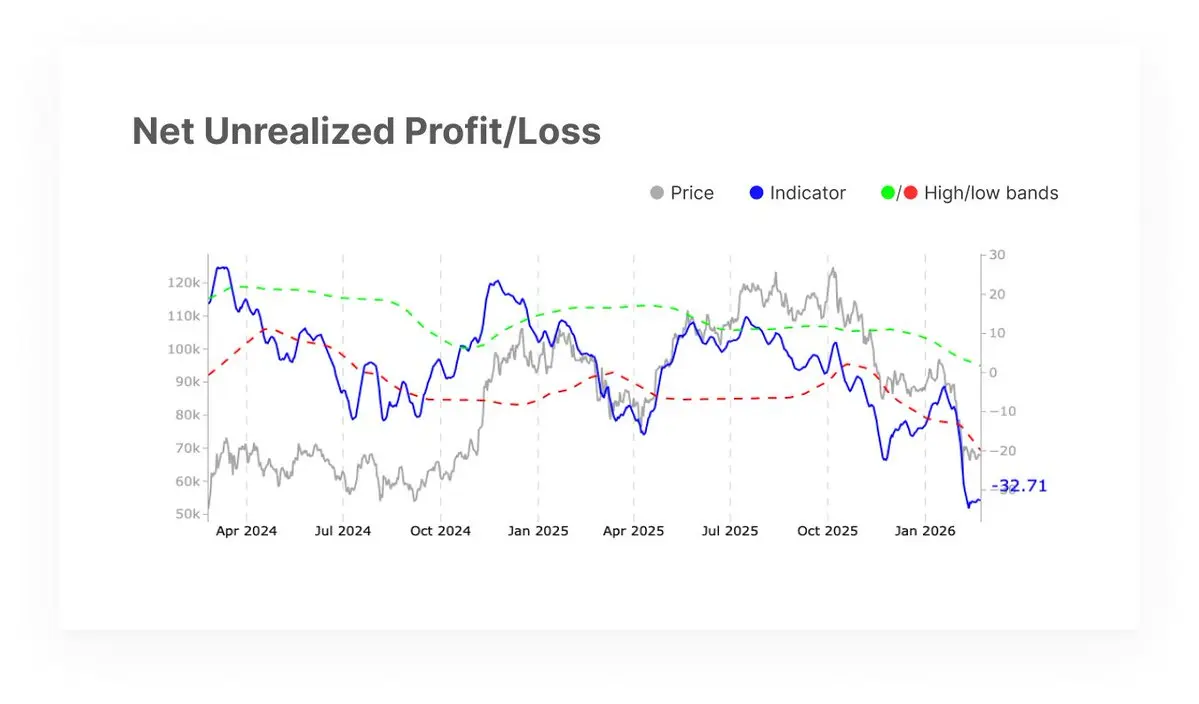

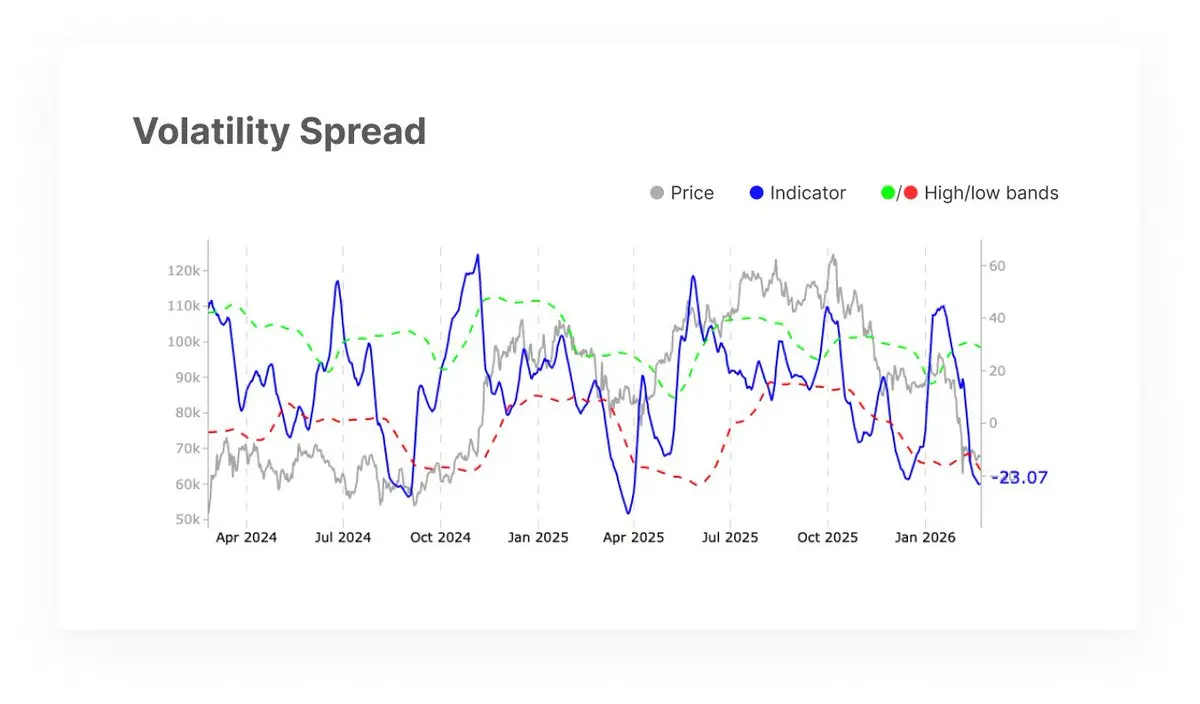

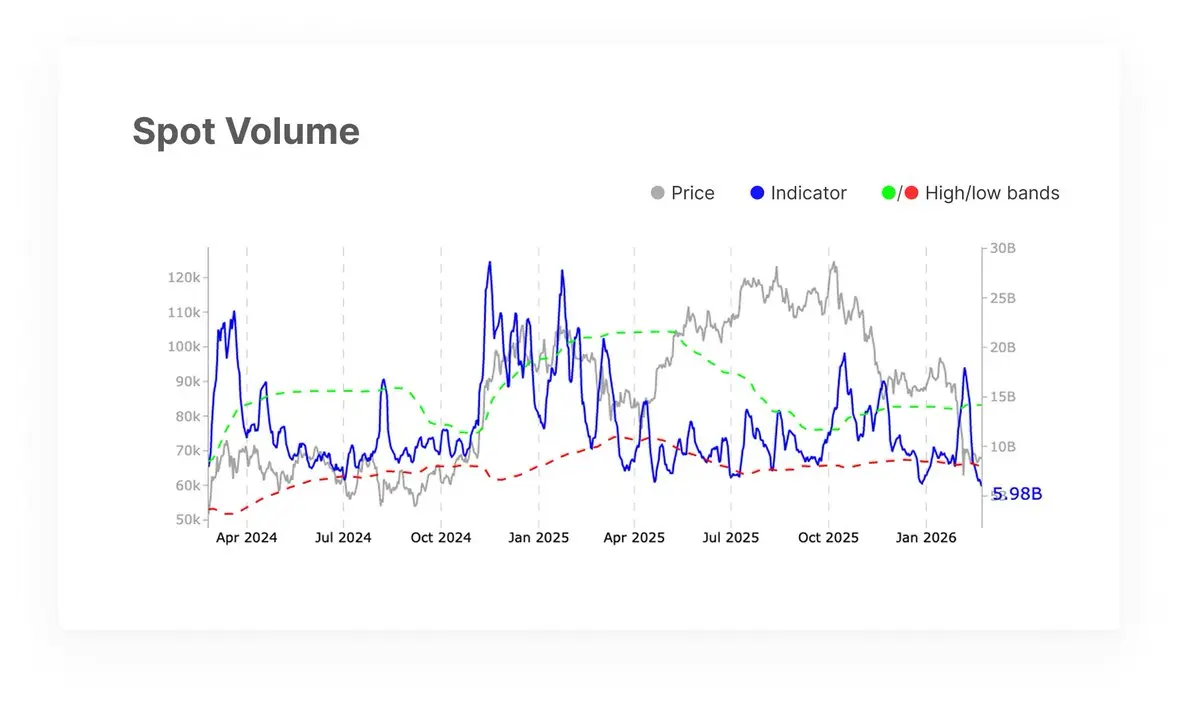

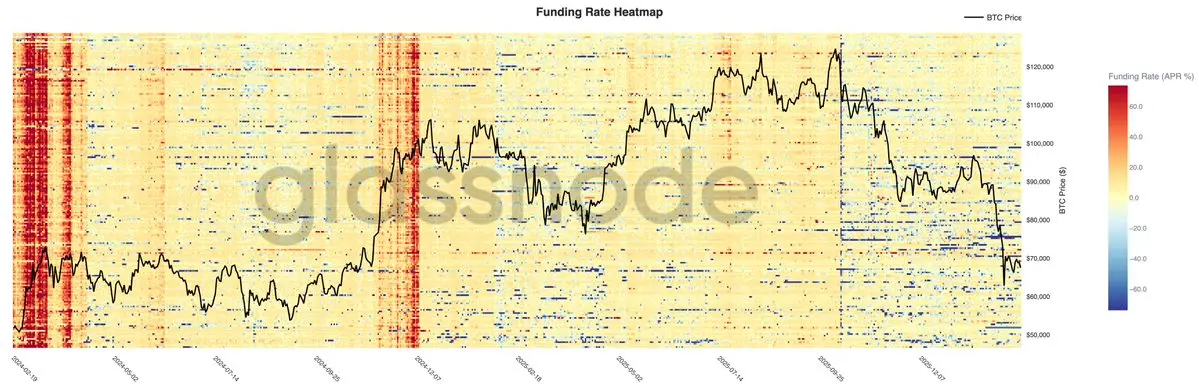

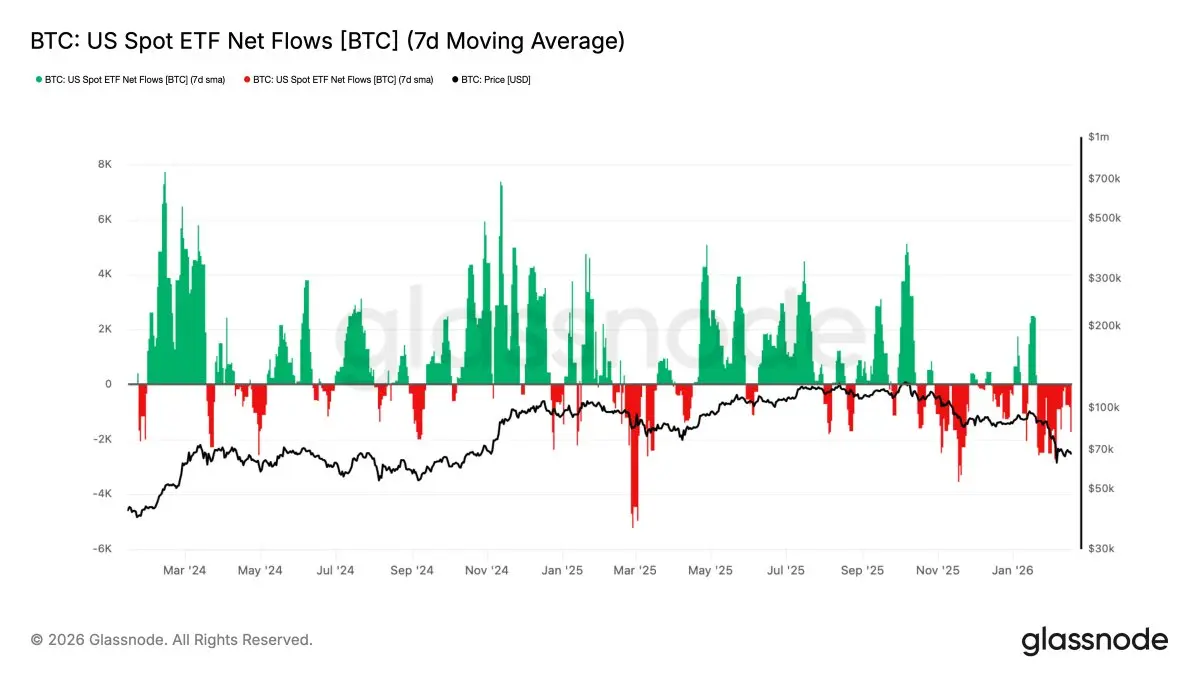

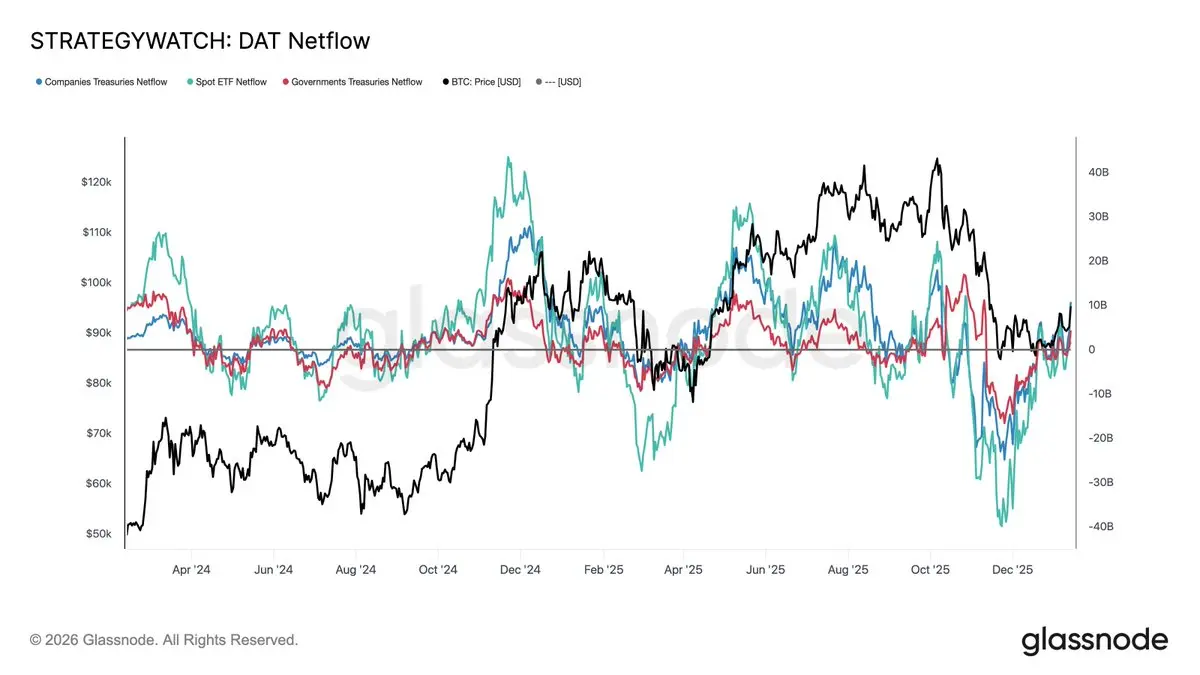

#Bitcoin stayed range-bound around ~$64–68K, momentum modestly improving but participation weak. Sell pressure eased slightly yet spot, derivatives, ETF, and on-chain indicators remain defensive.

Read more in this week’s Market Pulse👇

Read more in this week’s Market Pulse👇

BTC-3,99%

- Reward

- like

- Comment

- Repost

- Share

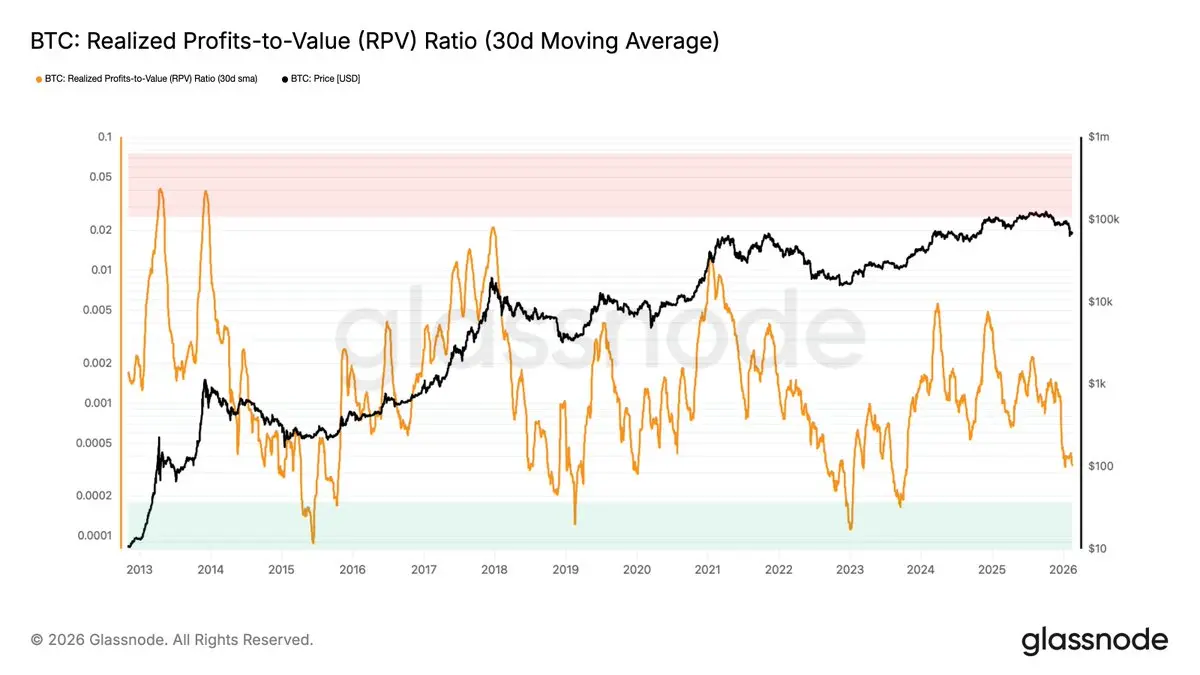

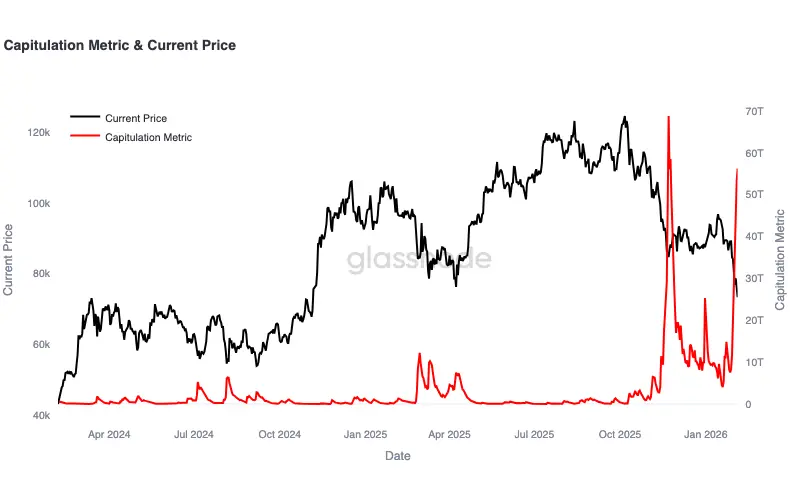

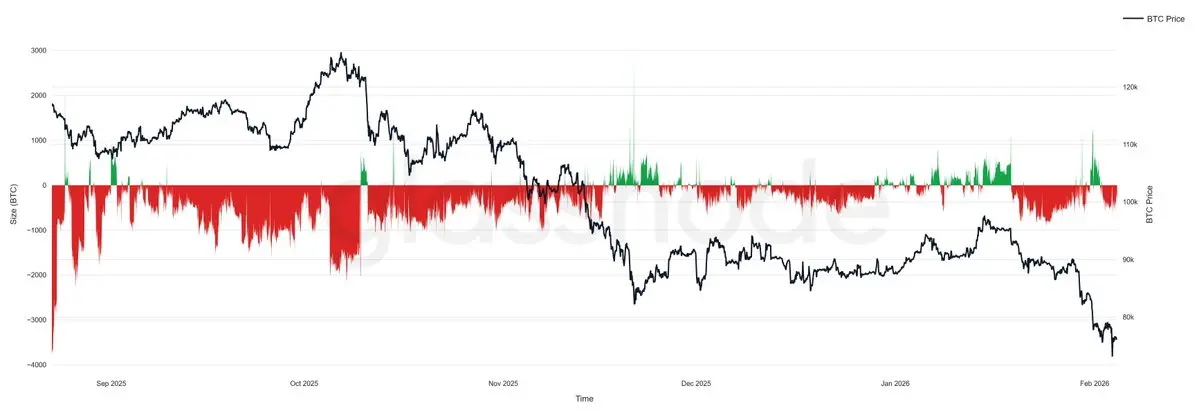

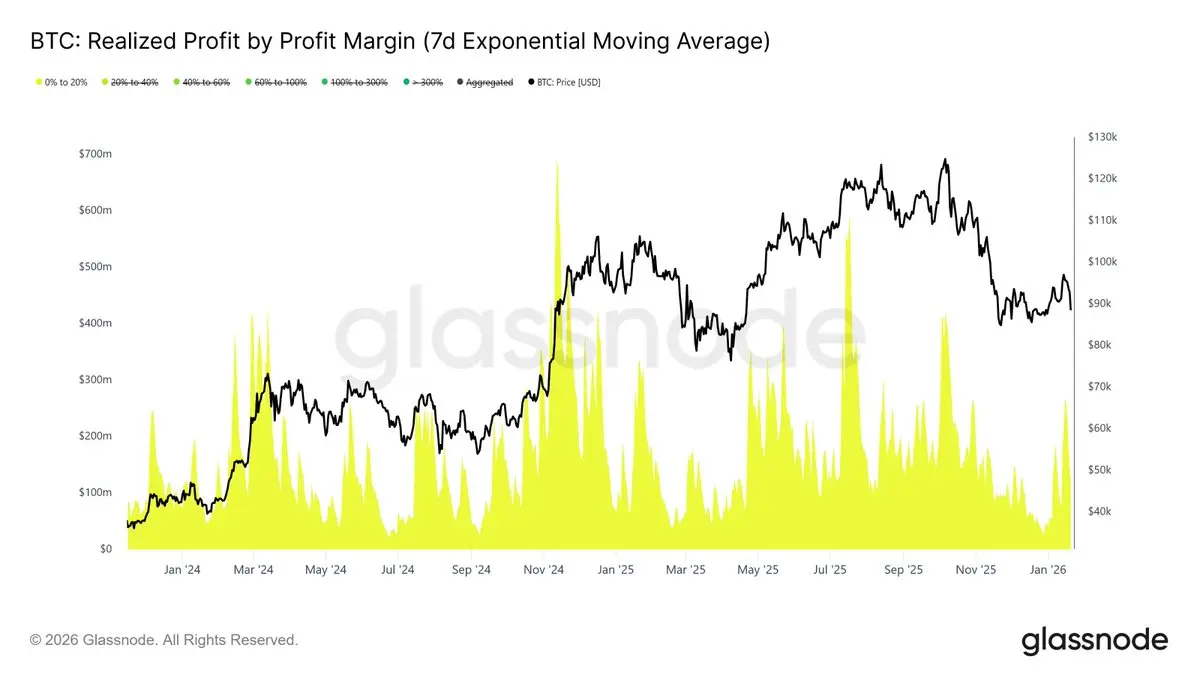

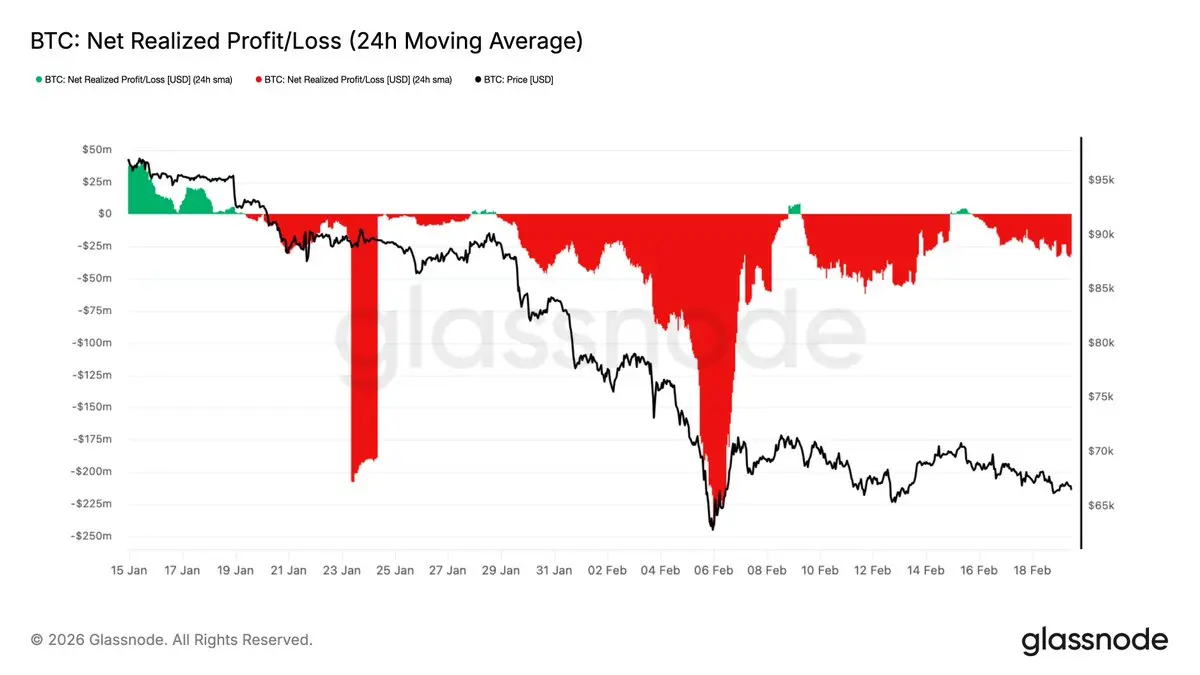

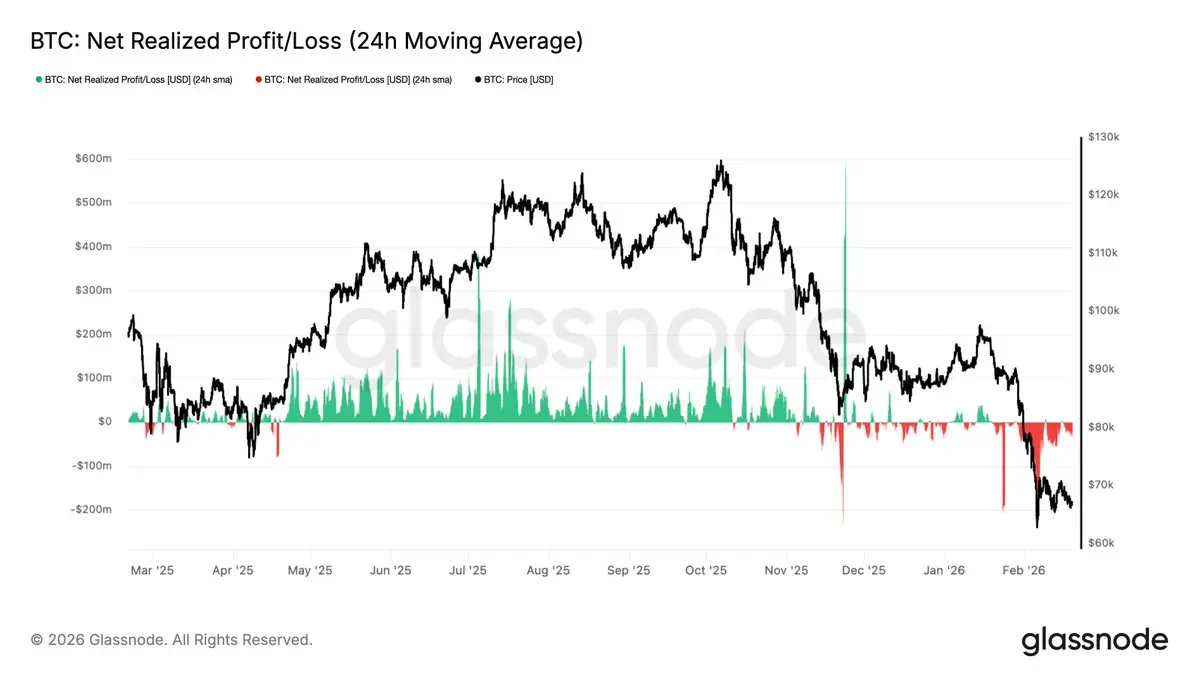

Since early February, every attempt to reclaim $70k has met demand exhaustion, with even >$5M/hour in net realized profit triggering rejection.

Contrast that with Q3 2025’s euphoric phase, when profit realization surged to $200–350M/hour.

Ongoing regime of thin liquidity makes a sustained recovery into the $70–80k range structurally challenging.

📉

Contrast that with Q3 2025’s euphoric phase, when profit realization surged to $200–350M/hour.

Ongoing regime of thin liquidity makes a sustained recovery into the $70–80k range structurally challenging.

📉

- Reward

- 1

- Comment

- Repost

- Share

Range-Bound Under Pressure

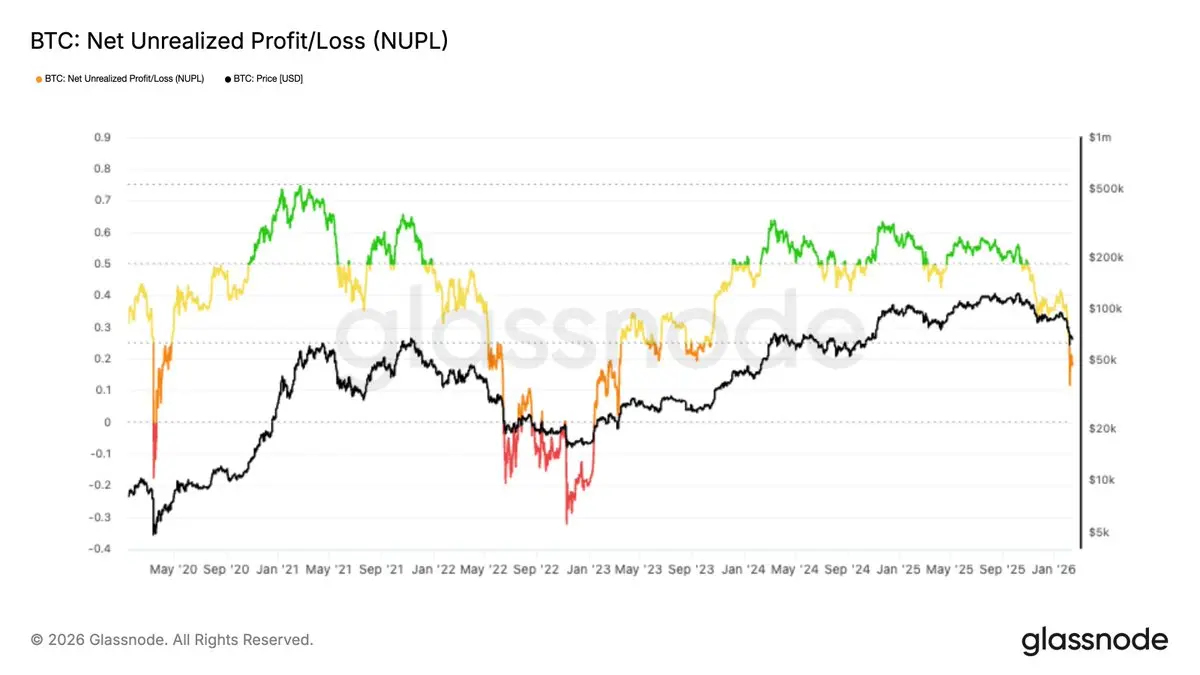

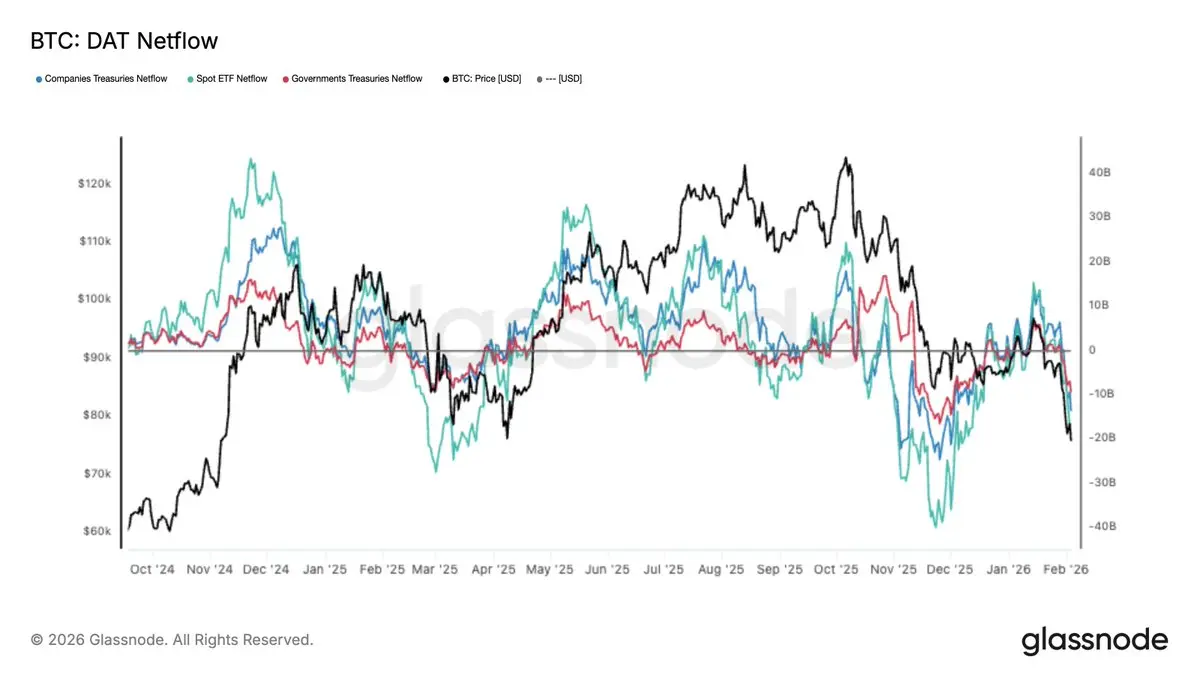

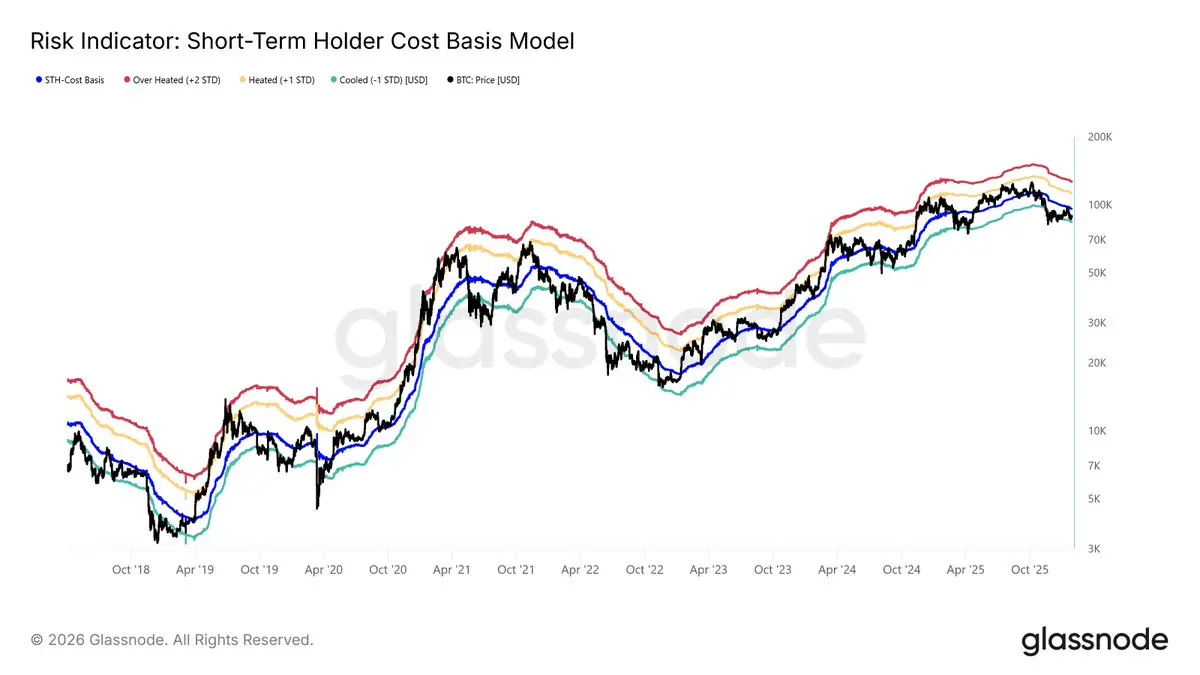

Bitcoin has broken below the True Market Mean, slipping into a defensive range toward the Realized Price (~$54.9k). Spot and ETF demand remain weak, and panic hedging has eased.

Read the full Week On-Chain👇

Bitcoin has broken below the True Market Mean, slipping into a defensive range toward the Realized Price (~$54.9k). Spot and ETF demand remain weak, and panic hedging has eased.

Read the full Week On-Chain👇

BTC-3,99%

- Reward

- like

- 1

- Repost

- Share

Dewotocengkar :

:

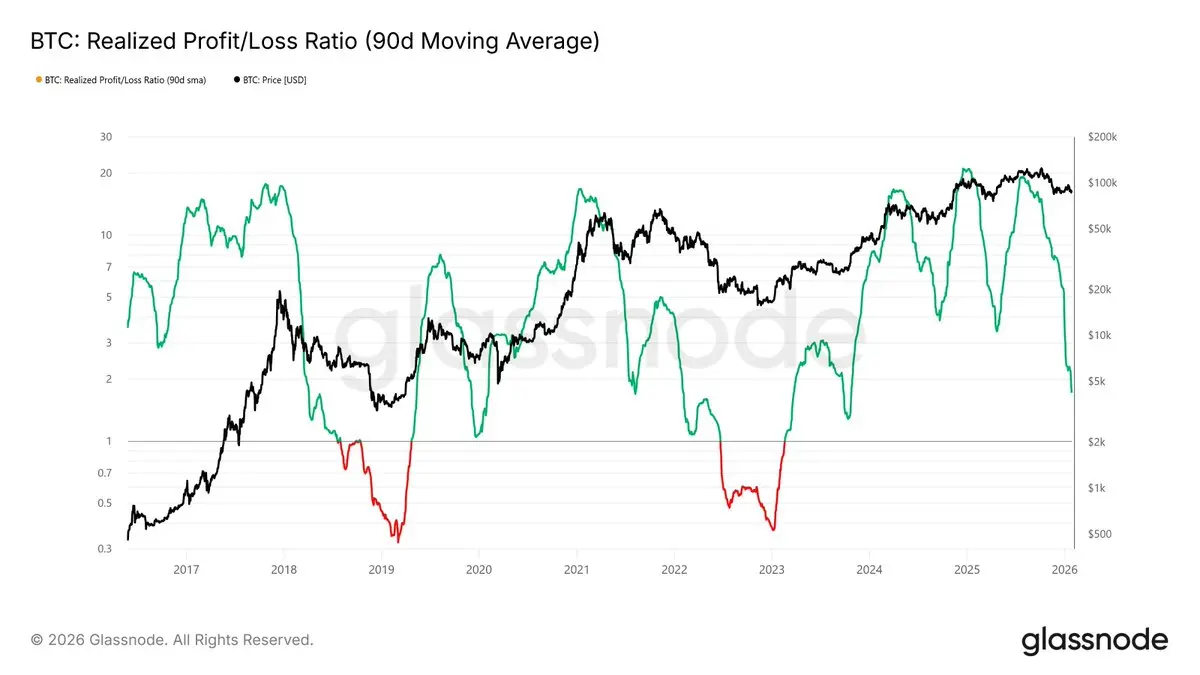

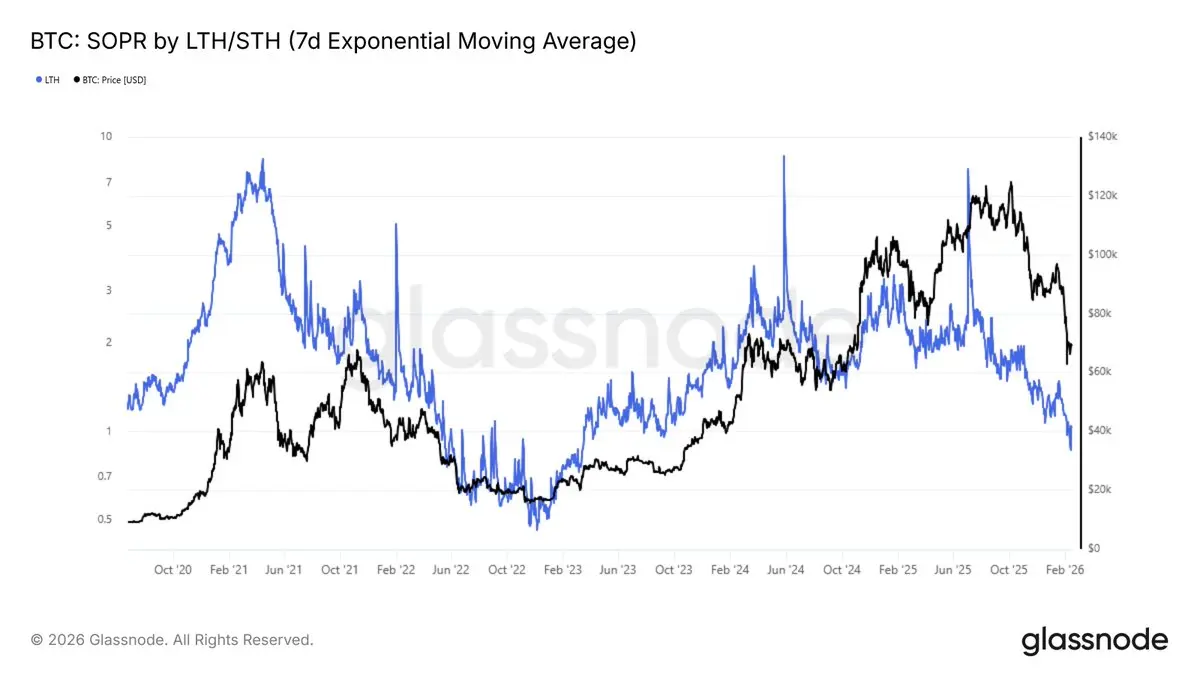

A little accumulation, just in case there's a dip.The recent drop to $60k imposed drastic psychological pressure on “diamond hands,” comparable to the May 2022 LUNA crash.

In both cases, the 7D EMA of Long-Term Holder SOPR fell below 1 after trading for 1-2 years above it.

Simply put, long-term holders realized significant losses—a rare shift in conviction typically seen in deeper stages of bear markets.

📈

In both cases, the 7D EMA of Long-Term Holder SOPR fell below 1 after trading for 1-2 years above it.

Simply put, long-term holders realized significant losses—a rare shift in conviction typically seen in deeper stages of bear markets.

📈

LUNA-3,04%

- Reward

- like

- Comment

- Repost

- Share

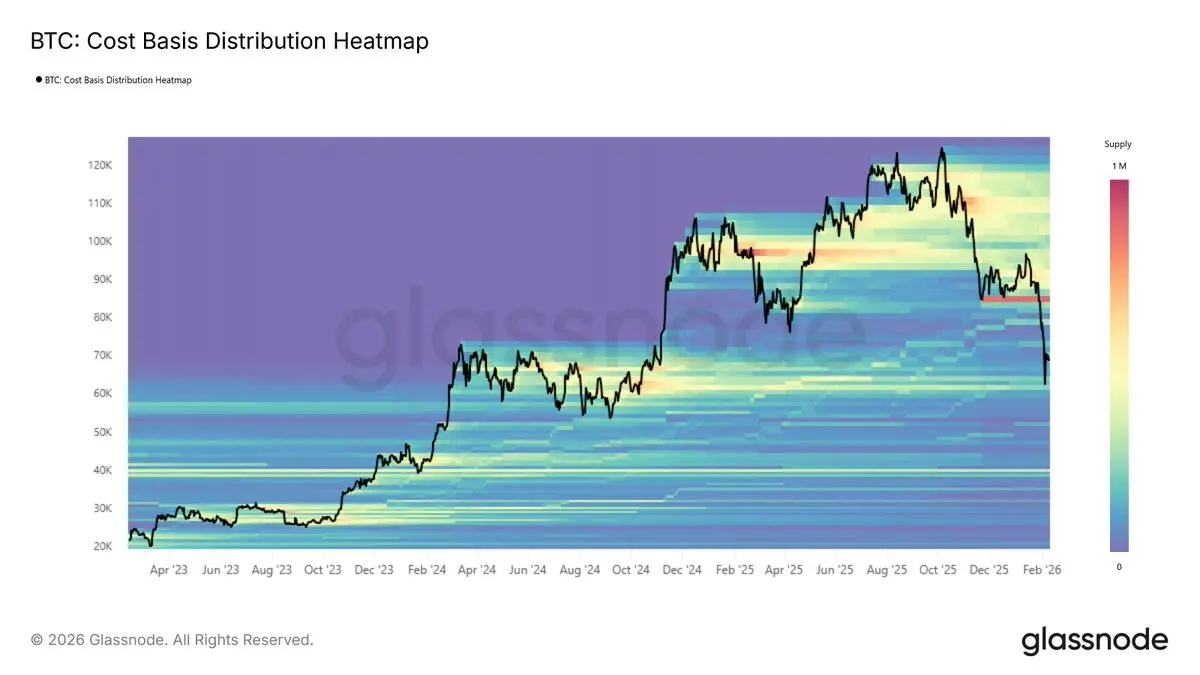

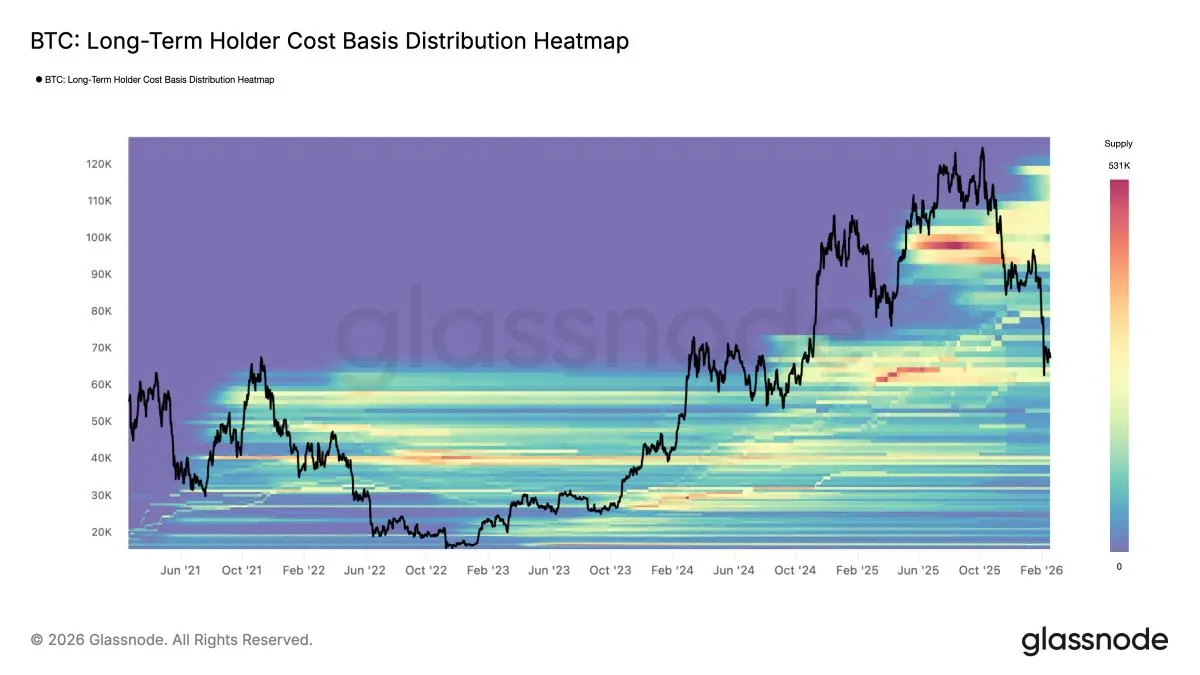

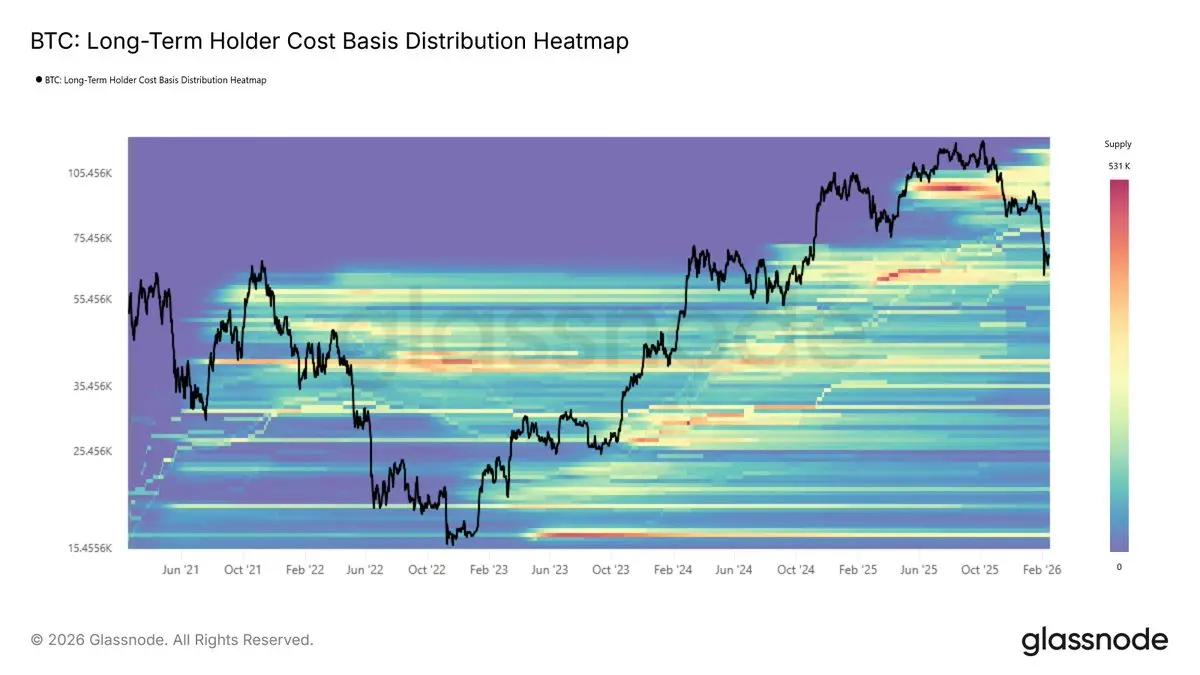

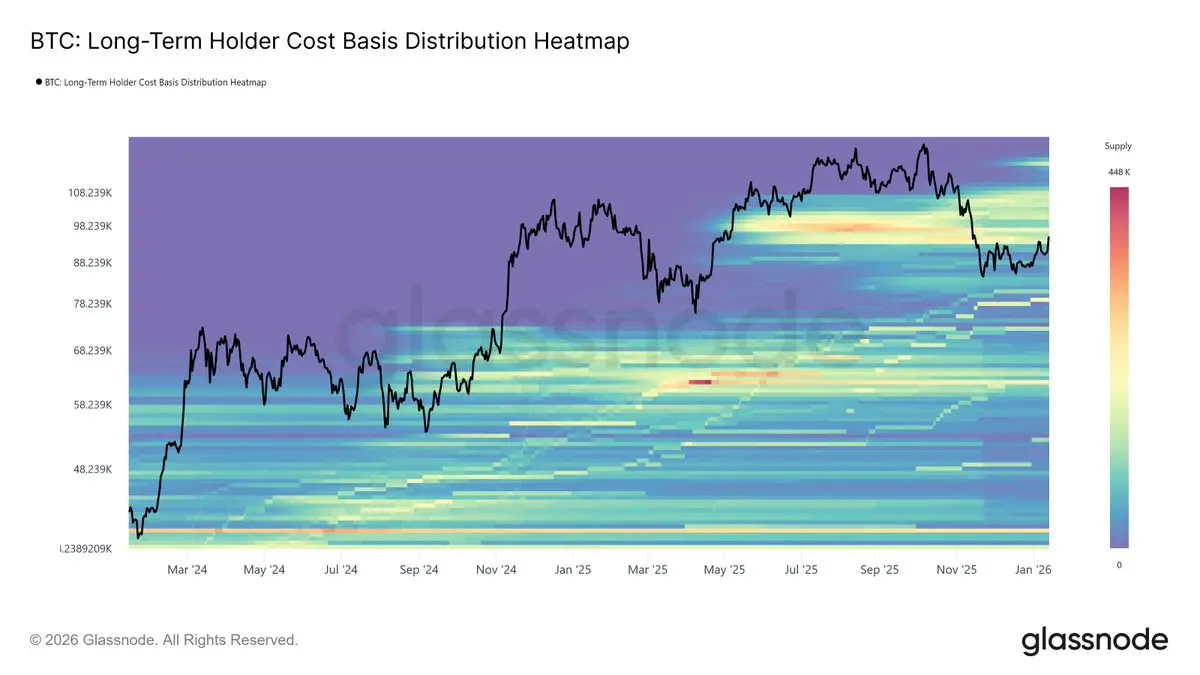

The LTH Cost Basis Distribution (CBD) Heatmap maps supply density across price levels.

The recent support above $65k is anchored in the 2024 H1 accumulation range. This demand zone has absorbed recent sell pressure.

A decisive break would likely open the path toward Realized Price (~$54k).

📈

The recent support above $65k is anchored in the 2024 H1 accumulation range. This demand zone has absorbed recent sell pressure.

A decisive break would likely open the path toward Realized Price (~$54k).

📈

- Reward

- like

- Comment

- Repost

- Share

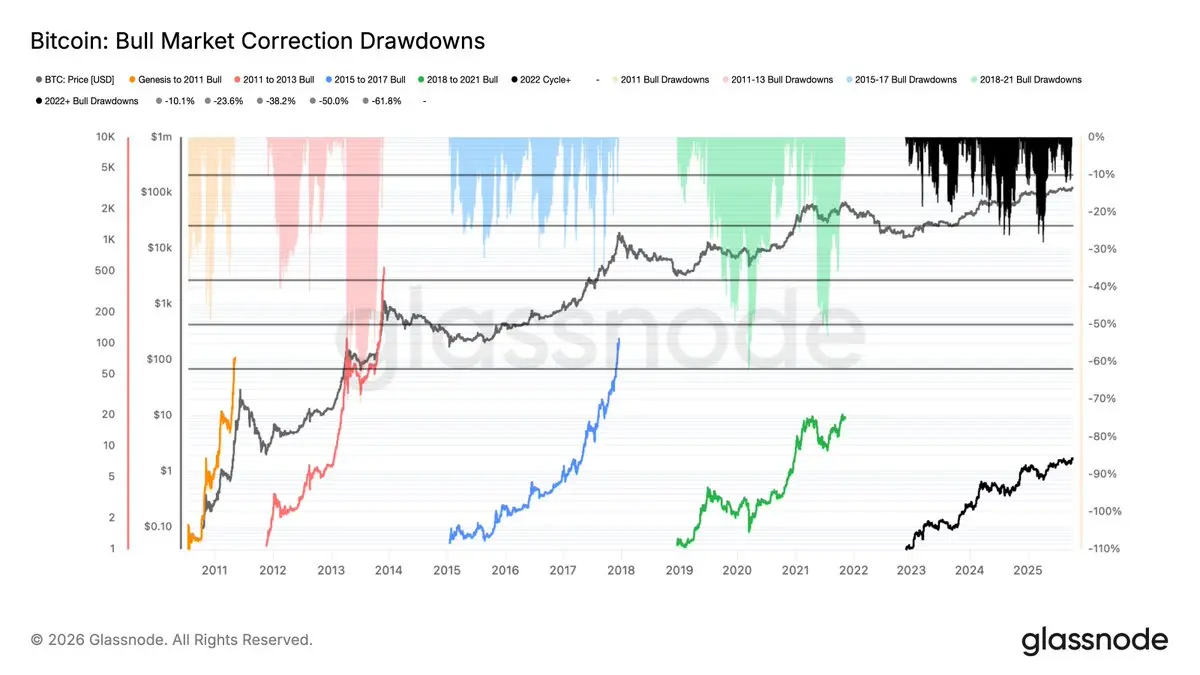

Assuming the early October ATH marked the end of the recent bull market, this cycle saw very modest drawdowns, similar to the 2015–2017 market.

📈

📈

- Reward

- like

- Comment

- Repost

- Share

At $67.4k, more than 9.3M bitcoins are underwater. This is the highest level since January 2023.📉

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

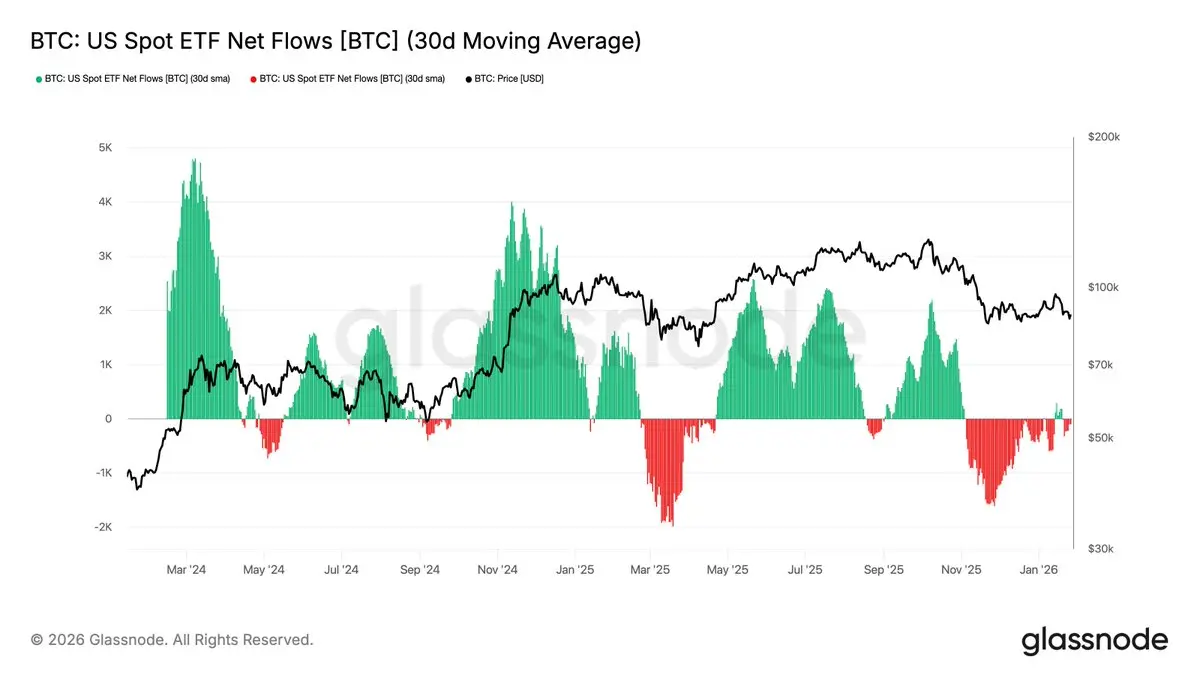

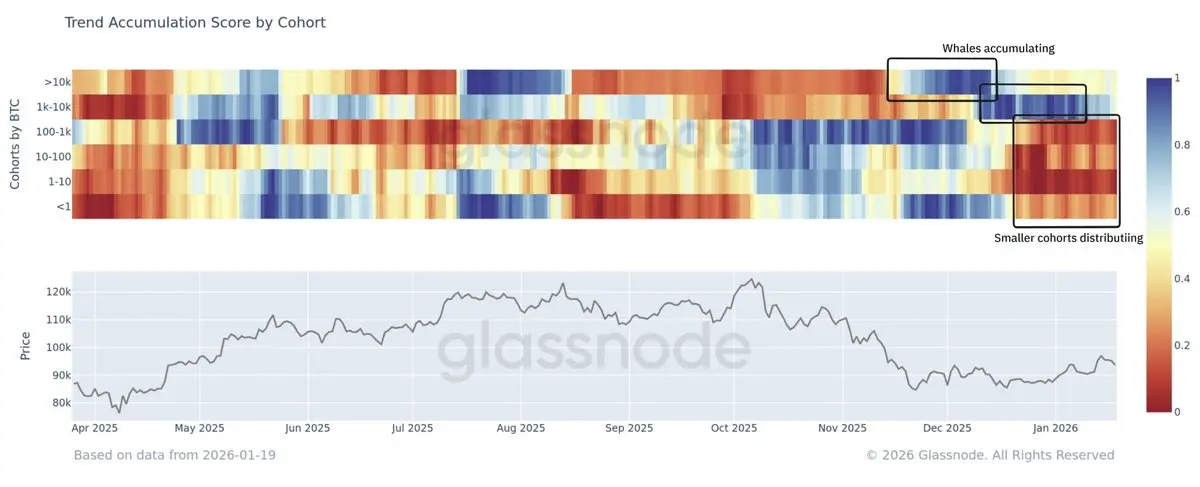

During the November–December bottoming phase, supply accumulation was primarily driven by larger entities, while smaller cohorts were distributing.

This divergence appears to be driven in part by exchange-related wallet reshuffling, and also by large holders buying the dip.

📉

This divergence appears to be driven in part by exchange-related wallet reshuffling, and also by large holders buying the dip.

📉

- Reward

- like

- Comment

- Repost

- Share

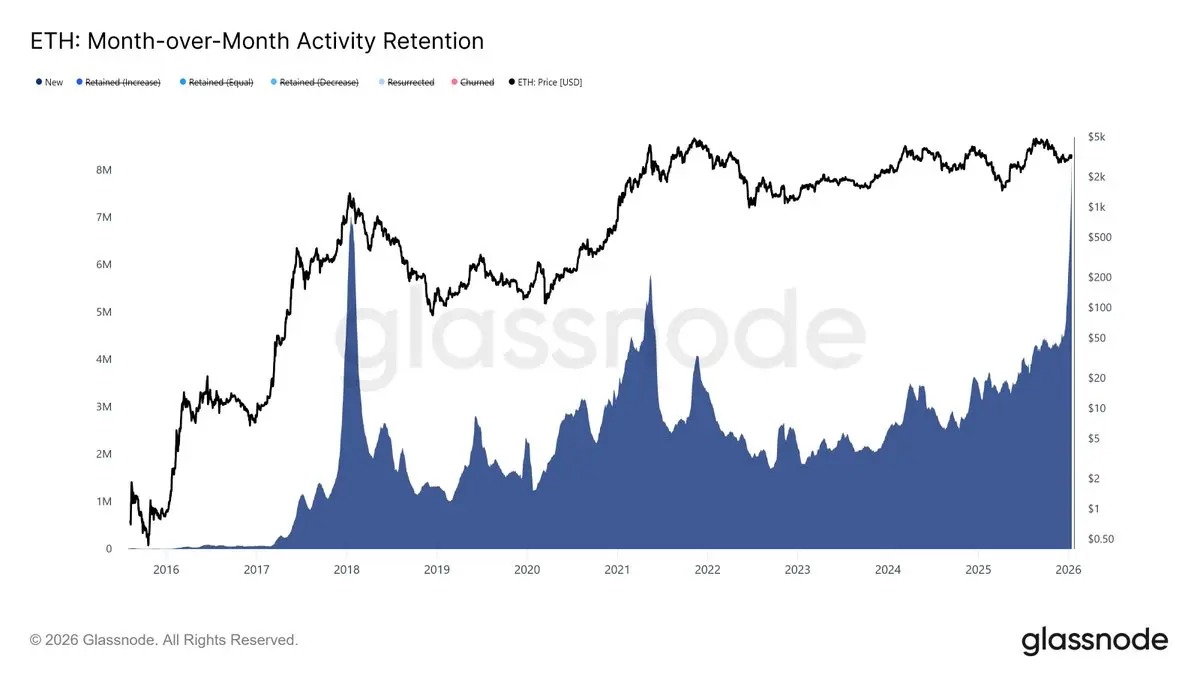

Ethereum’s Month-over-Month Activity Retention shows a sharp spike in the “New” cohort, indicating a surge in first-time interacting addresses over the past 30 days.

This reflects a notable influx of new wallets engaging with the Ethereum network, rather than activity being driven solely by existing participants.

📈

This reflects a notable influx of new wallets engaging with the Ethereum network, rather than activity being driven solely by existing participants.

📈

ETH-4,61%

- Reward

- like

- Comment

- Repost

- Share

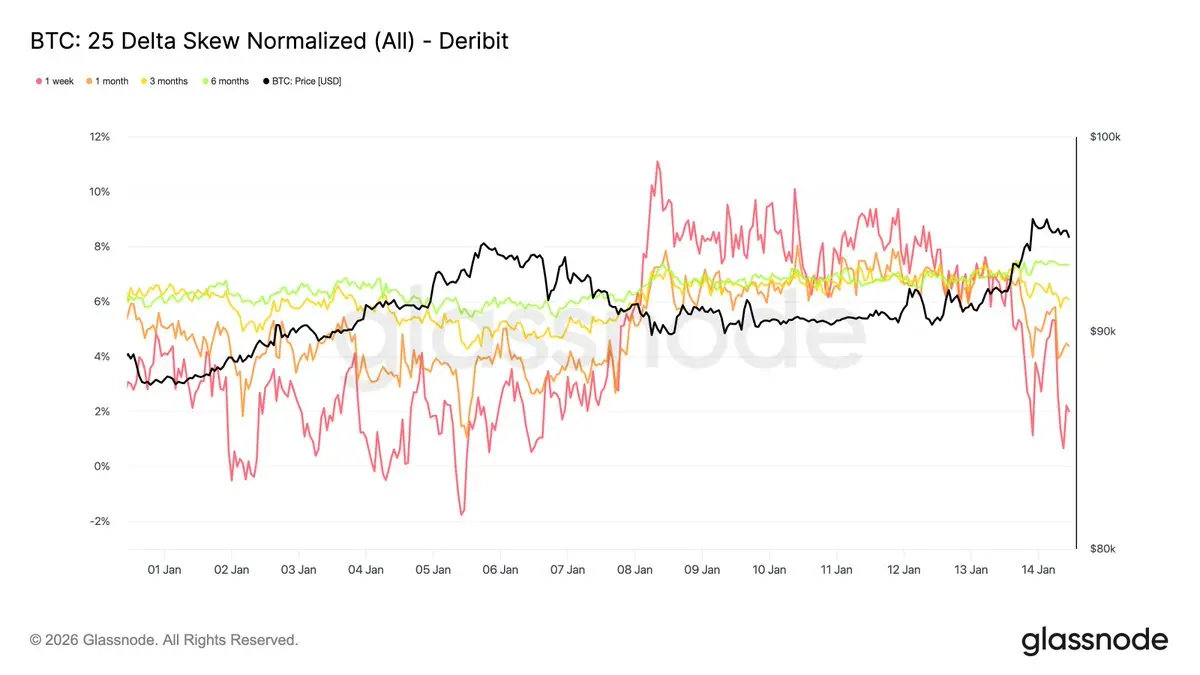

Bouncing Into Supply

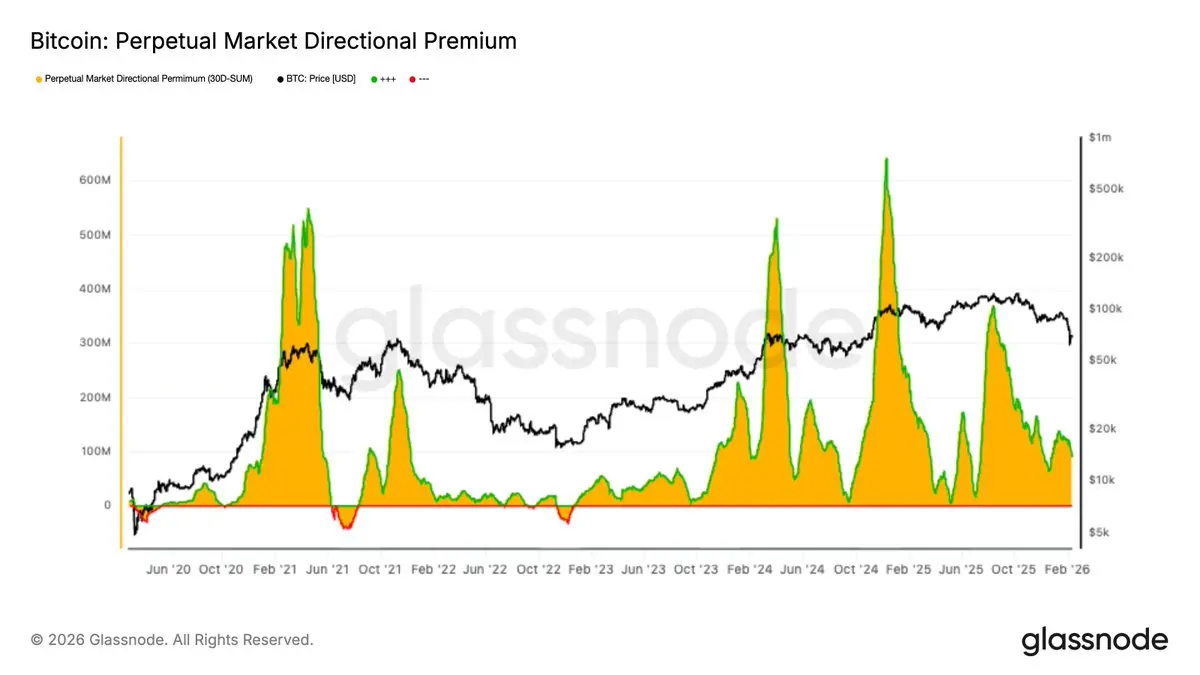

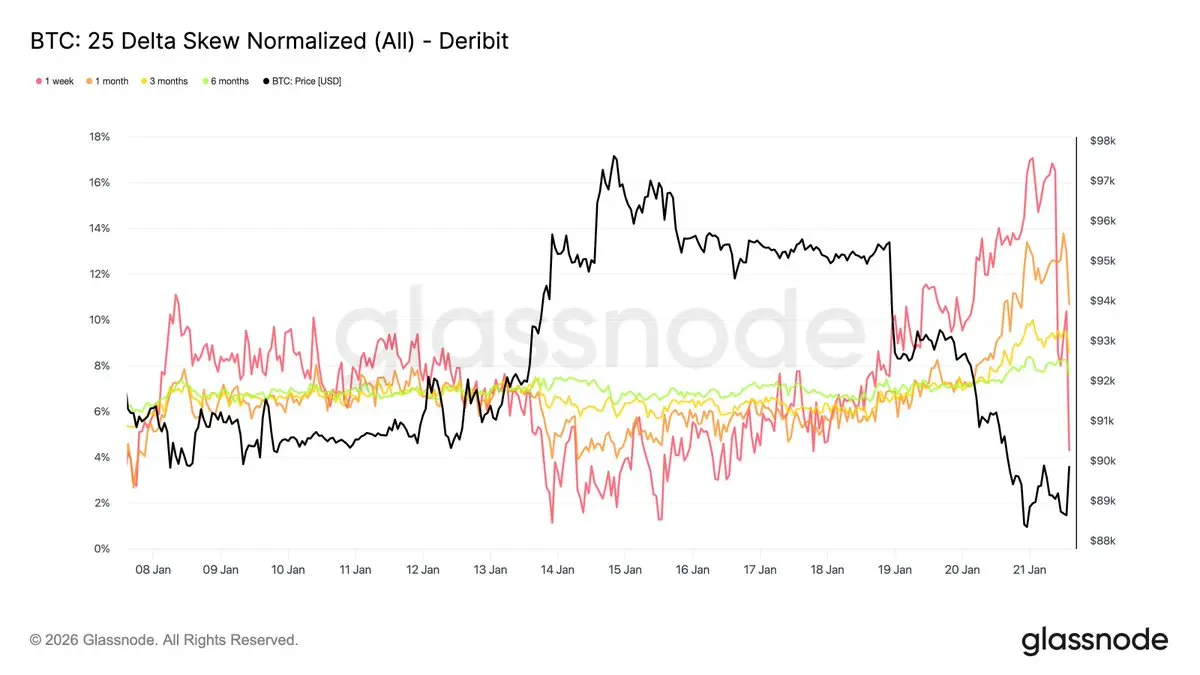

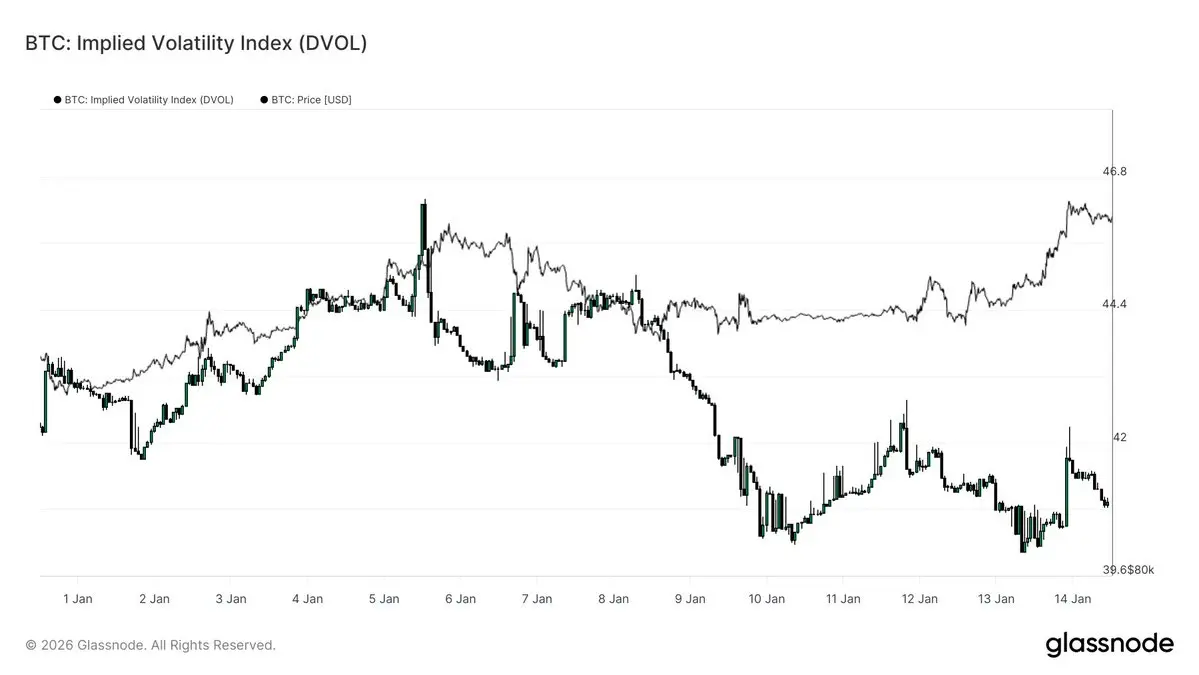

#Bitcoin has entered the new year with constructive momentum, printing two higher highs and extending price to $98k, but the advance now runs directly into a historically significant supply zone.

Read the full Week On-Chain👇

#Bitcoin has entered the new year with constructive momentum, printing two higher highs and extending price to $98k, but the advance now runs directly into a historically significant supply zone.

Read the full Week On-Chain👇

BTC-3,99%

- Reward

- 1

- 1

- Repost

- Share

PumpSpreeLive :

:

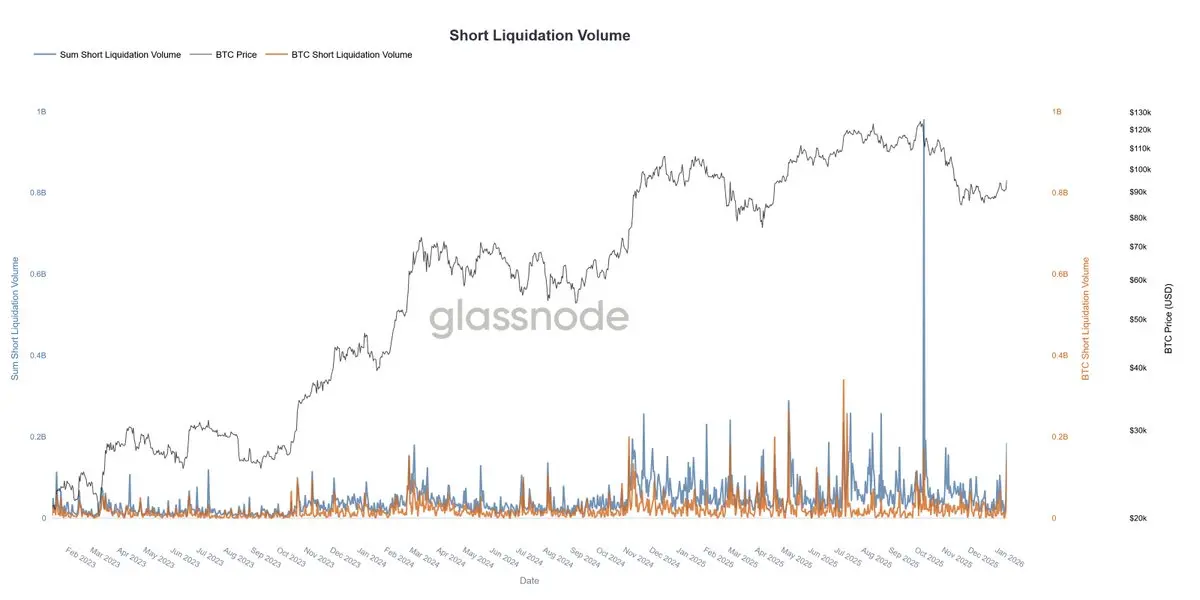

HODL Tight 💪Across the top 500 cryptocurrencies, the latest move triggered the largest short-liquidation event since 10/10.

📉

📉

- Reward

- like

- Comment

- Repost

- Share