Satoshitalks

No content yet

Satoshitalks

🚨 BREAKING: Berkshire Hathaway cut its Amazon ($AMZN) stake by 77% in Q4 2025, selling ~$1.7B worth of shares.

What this signals:

Major portfolio reshuffle

Risk reduction at scale

Big tech exposure trimmed

When Buffett moves, markets watch.

What this signals:

Major portfolio reshuffle

Risk reduction at scale

Big tech exposure trimmed

When Buffett moves, markets watch.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: Crypto VC Dragonfly closes a $650M fourth fund.

What this means:

Big capital still backing crypto

Long-term conviction remains

Next cycle startups getting funded

Bear markets build the next winners.

What this means:

Big capital still backing crypto

Long-term conviction remains

Next cycle startups getting funded

Bear markets build the next winners.

- Reward

- 1

- Comment

- Repost

- Share

🚨 JUST IN: Intesa Sanpaolo discloses $100M in Bitcoin ETF holdings.

What this signals:

Major European bank exposure

Institutional allocation continues

BTC ETFs gaining global traction

Traditional finance keeps leaning in.

What this signals:

Major European bank exposure

Institutional allocation continues

BTC ETFs gaining global traction

Traditional finance keeps leaning in.

BTC-0,91%

- Reward

- 1

- Comment

- Repost

- Share

🚨 RWA boom on @BNBCHAIN :

Market cap just crossed $2B

Up ~50,000% from ~$4M a year ago

Now ~20% of total on-chain RWA value

Ranked #2 chain by RWA market share

Momentum is accelerating.

Market cap just crossed $2B

Up ~50,000% from ~$4M a year ago

Now ~20% of total on-chain RWA value

Ranked #2 chain by RWA market share

Momentum is accelerating.

RWA-3,05%

- Reward

- 2

- Comment

- Repost

- Share

🚨 JUST IN: Stablecoin market cap added $5.5B in the past 7 days.

What this could signal:

1. Fresh capital entering crypto

2. Dry powder building

3. Volatility ahead

Liquidity moves first. Price follows.

What this could signal:

1. Fresh capital entering crypto

2. Dry powder building

3. Volatility ahead

Liquidity moves first. Price follows.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

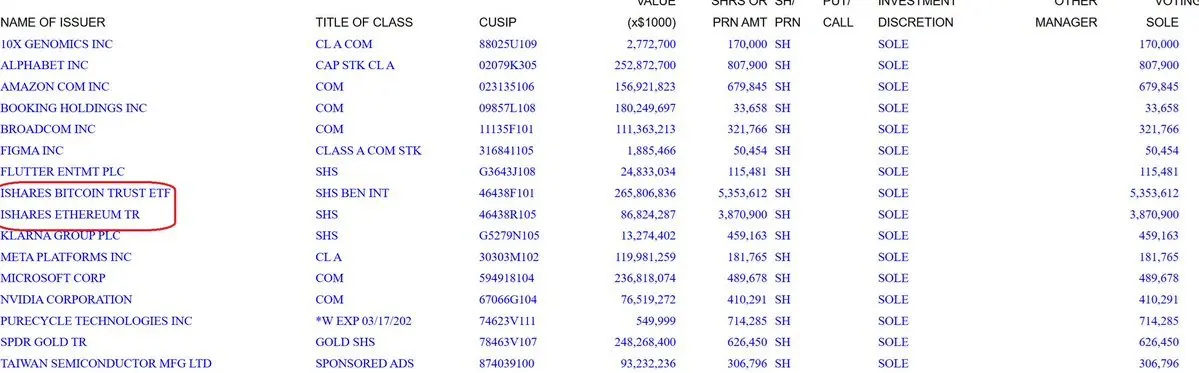

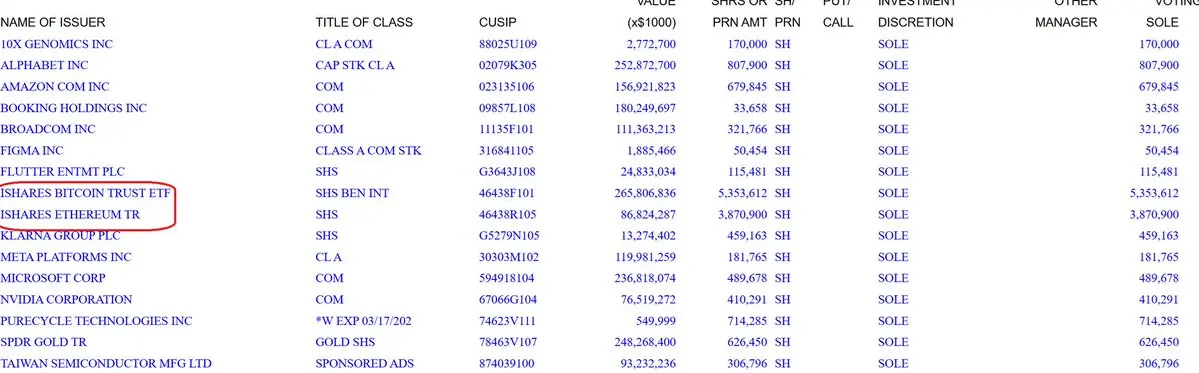

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

👇

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

🚨 JUST IN: Harvard trims Bitcoin, adds Ethereum.

Harvard Management Company cut its #Bitcoin ETF exposure by over 20% in Q4 and initiated its first position in an #Ether ETF.

End-of-quarter exposure (~$352.6M total):

• $265.8M in Bitcoin #ETFs

• $86.8M in #BlackRock’s spot Ether ETF

Rotation… or diversification?

- Reward

- like

- Comment

- Repost

- Share

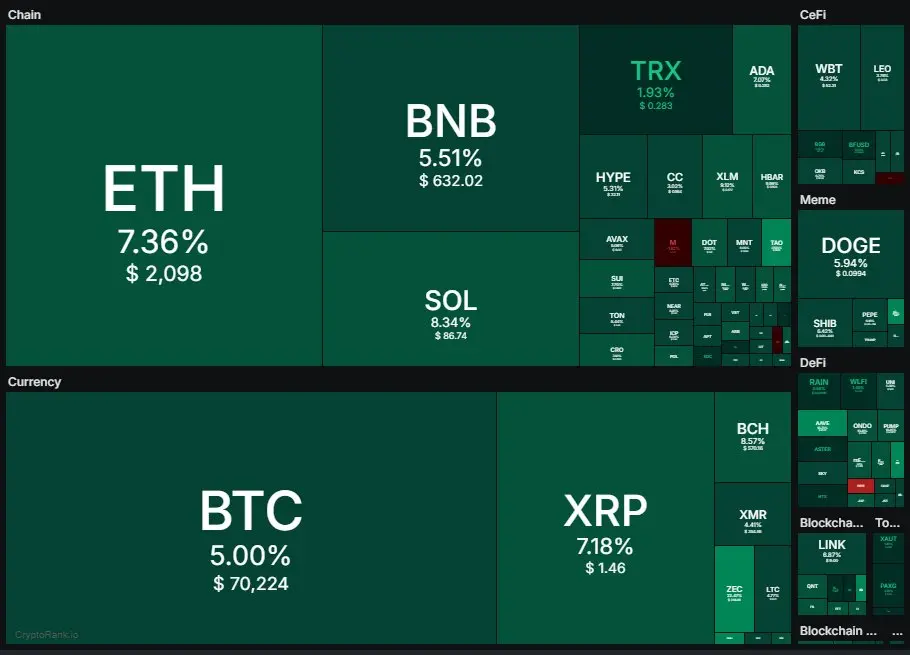

Happy Monday.

Markets opened… and crypto is red.

Liquidity sweep or deeper pullback?

This week should be interesting.

Markets opened… and crypto is red.

Liquidity sweep or deeper pullback?

This week should be interesting.

- Reward

- like

- Comment

- Repost

- Share

💰 FUN FACT: 🇺🇸 The U.S. government is accepting donations to help reduce its $38T national debt.

Yes — you can literally send money to the Treasury.

At $38 trillion, every dollar counts… right?

Yes — you can literally send money to the Treasury.

At $38 trillion, every dollar counts… right?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 JUST IN: X is set to launch “Smart Cashtags” in the coming weeks.

Users will reportedly be able to trade stocks and crypto directly from the timeline.

Social media → Trading terminal.

The lines keep blurring.

Big move for fintech.

Users will reportedly be able to trade stocks and crypto directly from the timeline.

Social media → Trading terminal.

The lines keep blurring.

Big move for fintech.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share