Tiezhu

No content yet

Tiezhu

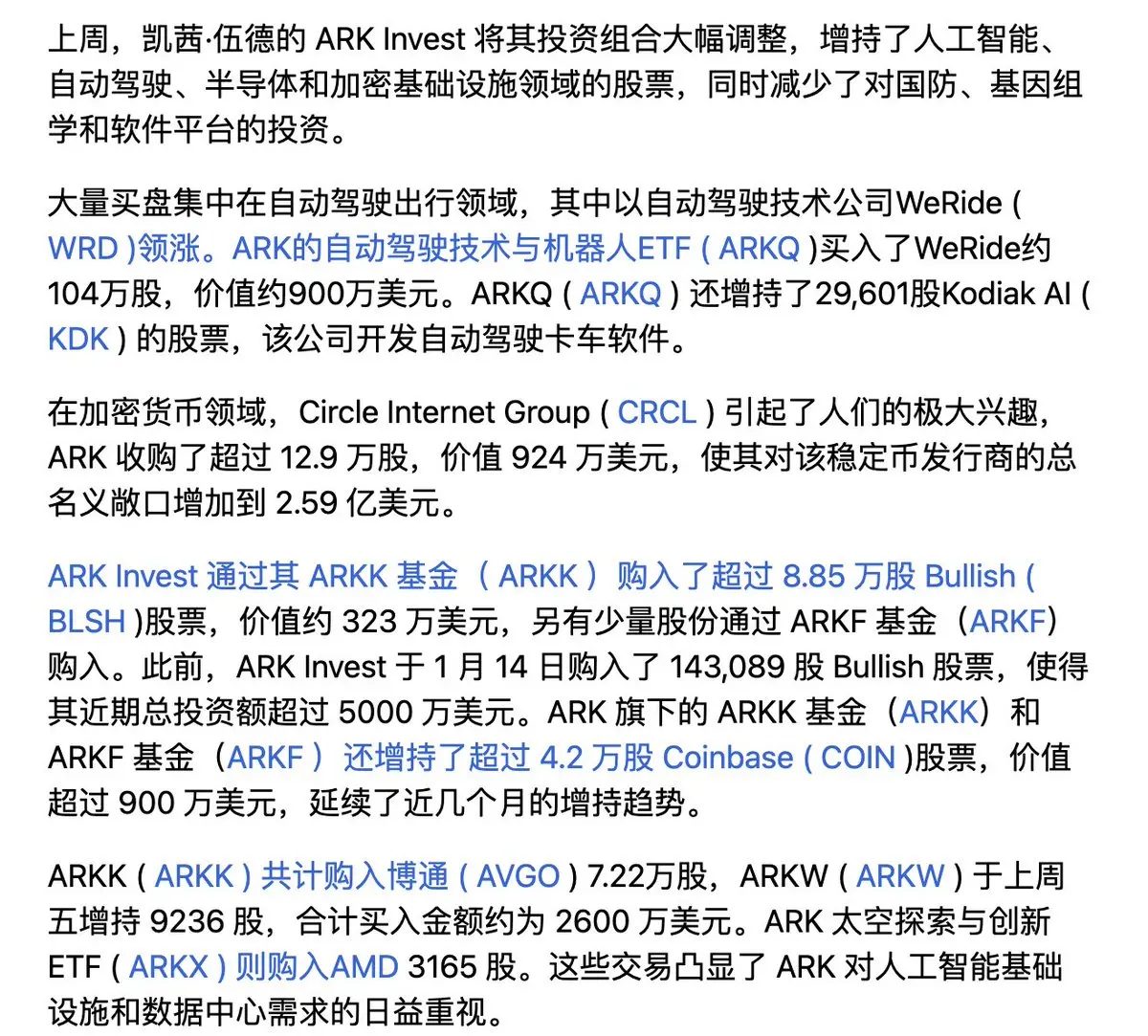

ARK can be considered the fund with the highest risk appetite. It can be compared with the Nasdaq and S&P 500 to observe how the market's funds are currently viewing the situation.

View Original

- Reward

- like

- Comment

- Repost

- Share

What's going on? Are they now starting to promote the Mac Mini? The information gap between the English and Chinese communities is indeed quite significant.

View Original- Reward

- like

- Comment

- Repost

- Share

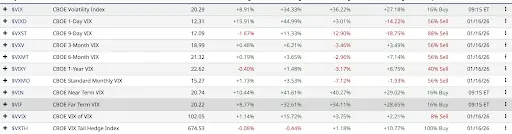

VIX has once again broken above 20. The market has clearly entered a short-term risk-averse mode rather than a long-term uncertain rally.

It will come back.

View OriginalIt will come back.

- Reward

- like

- Comment

- Repost

- Share

Google will be very impressive; the earnings report will be announced in early February.

Previously, Gemini2.5 was profitable (excluding basic model development), so 3 should also be positive. These are under the assumption of not considering the partnership with Apple.

View OriginalPreviously, Gemini2.5 was profitable (excluding basic model development), so 3 should also be positive. These are under the assumption of not considering the partnership with Apple.

- Reward

- like

- Comment

- Repost

- Share

I don't necessarily think it's Europe's retaliatory tariffs. The main reason might still be the overall market expectations of rate cuts and concerns about increasing uncertainty.

1. The US Treasury yield curve has become steeper. The primary reason is that dovish Harker has explicitly not participated in the Federal Reserve Chair race, increasing the probability of hawkish Waller. Another piece of news is that the Treasury Department plans to reopen the 7-year Treasury auction. The concern in the bond market is that this could be a signal that the Treasury Department may increase long-term de

View Original1. The US Treasury yield curve has become steeper. The primary reason is that dovish Harker has explicitly not participated in the Federal Reserve Chair race, increasing the probability of hawkish Waller. Another piece of news is that the Treasury Department plans to reopen the 7-year Treasury auction. The concern in the bond market is that this could be a signal that the Treasury Department may increase long-term de

- Reward

- like

- Comment

- Repost

- Share

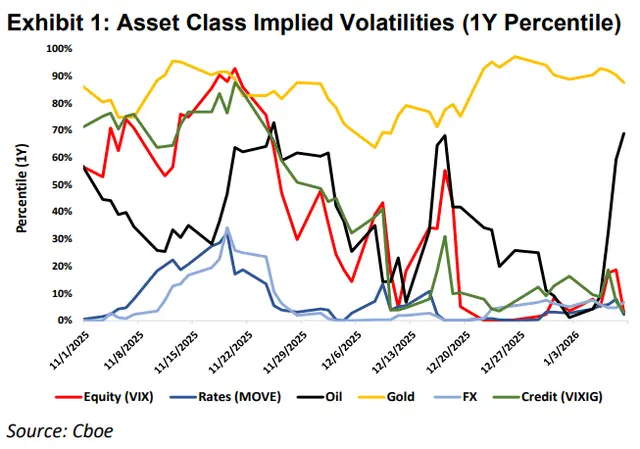

An article published today by CBOE. About volatility. Here's a summary:

1. From a cross-asset perspective, most are at lows, with crude oil volatility rising significantly and being extremely bullish.

2. The VIX index measuring stocks, despite its low reading, has undergone structural changes, with more puts being bought, and defensive positions still trending upward. The gap between index volatility and individual stock volatility exceeds the 90% percentile. In other words, as earnings season approaches, the market remains more focused on fundamentals rather than macro factors.

3. Despite Tru

View Original1. From a cross-asset perspective, most are at lows, with crude oil volatility rising significantly and being extremely bullish.

2. The VIX index measuring stocks, despite its low reading, has undergone structural changes, with more puts being bought, and defensive positions still trending upward. The gap between index volatility and individual stock volatility exceeds the 90% percentile. In other words, as earnings season approaches, the market remains more focused on fundamentals rather than macro factors.

3. Despite Tru

- Reward

- like

- Comment

- Repost

- Share

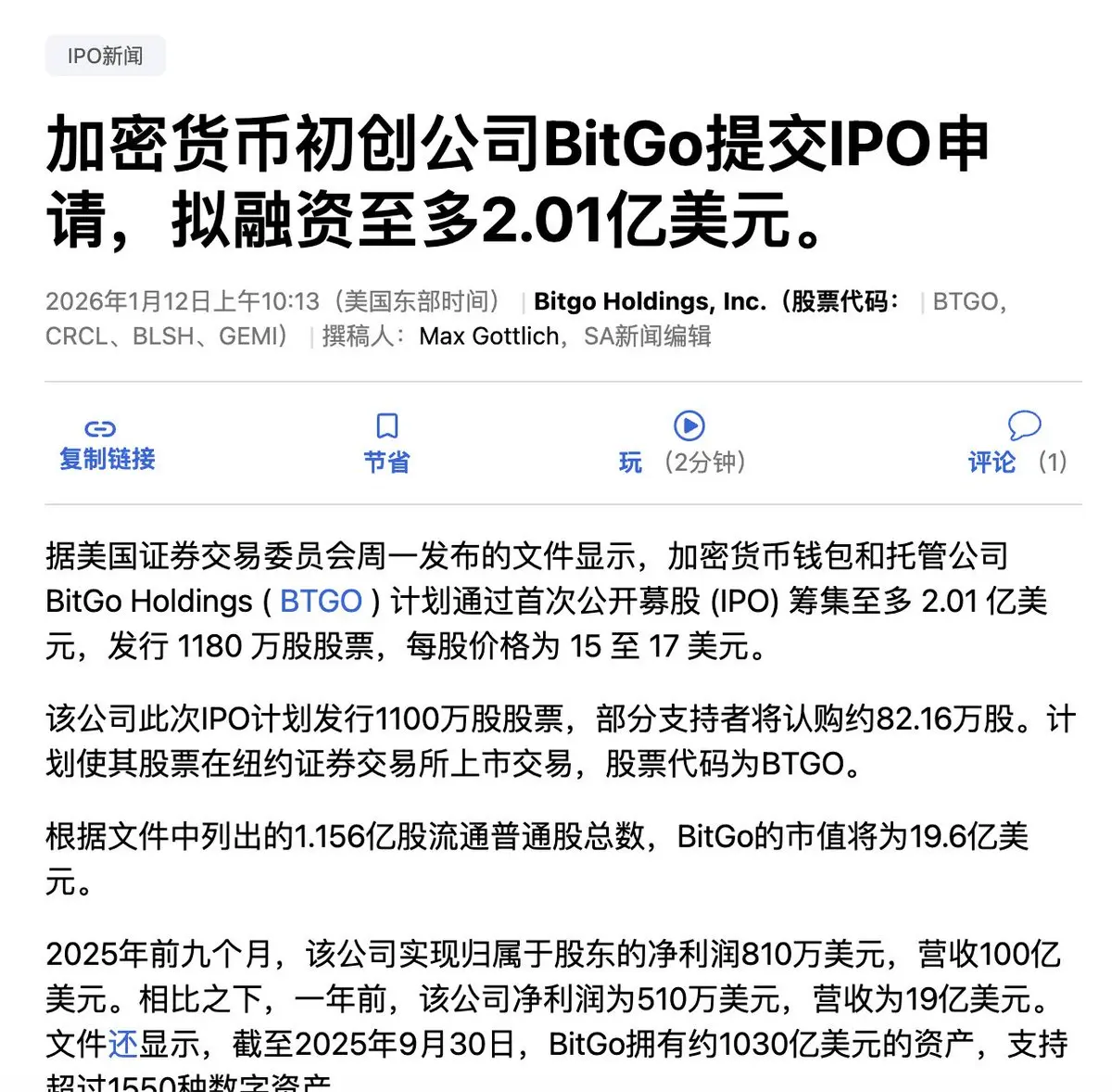

Is this the year of a big crypto IPO boom?

View Original

- Reward

- like

- Comment

- Repost

- Share

CPI is about to be announced, but overall, the impact is not significant. The main focus is on changes in food and housing.

View Original- Reward

- like

- Comment

- Repost

- Share

It looks like this year, the US stock market and real estate are probably going to see a surge.

View Original- Reward

- like

- Comment

- Repost

- Share

These past few days, I took some time to write the USD series outlook for the new year. Understanding the currency itself is at the core of understanding the modern financial system. The main points are:

1. Currently, all transactions are conducted in fiat currency or based on fiat equivalents (such as stablecoins).

2. The rise and fall of all assets, on a larger scale, are changes in the numerator. If the denominator used as currency changes, then the nominal value will fluctuate more intensely.

3. Any newly created currency will not flow evenly into the financial system. Newly created funds

View Original1. Currently, all transactions are conducted in fiat currency or based on fiat equivalents (such as stablecoins).

2. The rise and fall of all assets, on a larger scale, are changes in the numerator. If the denominator used as currency changes, then the nominal value will fluctuate more intensely.

3. Any newly created currency will not flow evenly into the financial system. Newly created funds

- Reward

- like

- Comment

- Repost

- Share

NotebookLm's improvement in learning efficiency is revolutionary. The fundamental reason is that you can choose the data source as the starting point for analysis.

In human learning models, the biggest bottleneck is input quality. Once the input quality is locked in, your interaction with AI essentially becomes a significant improvement in the thinking environment, making it obvious that your efficiency will increase exponentially.

View OriginalIn human learning models, the biggest bottleneck is input quality. Once the input quality is locked in, your interaction with AI essentially becomes a significant improvement in the thinking environment, making it obvious that your efficiency will increase exponentially.

- Reward

- like

- Comment

- Repost

- Share

Wenxin Du's latest article discusses many phenomena in financial markets from an academic perspective, but its greatest value lies in the insights it provides on the pricing of U.S. Treasury bonds.

View Original

- Reward

- like

- Comment

- Repost

- Share

Around this topic, some viewpoints were provided to Bloomberg, with the opportunity to open a column later.

View Original

- Reward

- like

- Comment

- Repost

- Share

There is only one conclusion from the data: mildly bullish.

View Original- Reward

- like

- Comment

- Repost

- Share

When it rises too much, you sell; when it falls too much, you buy. That's just the way it is.

The only thing you might need to overcome in the middle is that maybe your buying or selling is on a slope, but at the same time, one thing to be firm about is that the act of printing money is an unstoppable primal urge for the entire world.

The long-term upward slope of currency won't change.

View OriginalThe only thing you might need to overcome in the middle is that maybe your buying or selling is on a slope, but at the same time, one thing to be firm about is that the act of printing money is an unstoppable primal urge for the entire world.

The long-term upward slope of currency won't change.

- Reward

- like

- Comment

- Repost

- Share

If there is no drop in interest rates in December, then lowering the IORB interest rate may be an important option. The shadow interest rate model alleviates liquidity. Each has its explanation.

View Original

- Reward

- like

- Comment

- Repost

- Share

Let’s briefly talk about a few points:

1. Why has Trump recently shown greater tolerance towards hawks? The midterm elections in 2026 cannot afford to fail. So why this tolerance at this time?

2. I think December will still be a time for interest rate cuts.

3. In the American industry, relying on AI? But AI is currently insensitive to interest rates. So in the possibility of stagflation, is lowering interest rates a more realistic path?

4. The weakening of employment will continue until 2026.

View Original1. Why has Trump recently shown greater tolerance towards hawks? The midterm elections in 2026 cannot afford to fail. So why this tolerance at this time?

2. I think December will still be a time for interest rate cuts.

3. In the American industry, relying on AI? But AI is currently insensitive to interest rates. So in the possibility of stagflation, is lowering interest rates a more realistic path?

4. The weakening of employment will continue until 2026.

- Reward

- like

- Comment

- Repost

- Share

JPMorgan's price forecast for commodities.

View Original

- Reward

- like

- Comment

- Repost

- Share