Resultados de la búsqueda para "CLEAR"

¿La Reserva Federal reducirá las tasas en 2026 para salvar el mercado? El mercado de criptomonedas en "temor extremo" espera un cambio de tendencia

Clear Street director general Owen Lau señaló que la intensidad de la bajada de tasas de la Reserva Federal en 2026 determinará si los inversores minoristas vuelven al mercado de criptomonedas. Actualmente, el índice de miedo y avaricia de las criptomonedas se mantiene en la zona de «miedo extremo» desde el 13 de diciembre, con una puntuación de solo 23 el miércoles. Bitcoin ha caído un 29,3% desde su máximo histórico de 125,100 dólares en octubre y su precio actual ronda los 88,439 dólares.

MarketWhisper·2025-12-31 05:11

El patrocinador de tesorería cripto Clear Street planea una salida a bolsa con una valoración de $12B

La correduría de Nueva York respaldada por empresas de tesorería cripto, Clear Street, espera una salida a bolsa pública de entre 10 y 12 mil millones de dólares. La Oferta Pública Inicial (IPO) se espera para enero de 2026, y Goldman Sachs figura como el principal responsable de la oferta. Cabe destacar que la OPV de Clear Street

BTC-1,81%

BitcoinInsider·2025-12-06 23:16

Clear Street aspira a una OPV de 10–12 mil millones de dólares en medio de desafíos con la tesorería cripto

Clear Street se prepara para una salida a bolsa de 10-12 mil millones de dólares en medio de cambios en la dinámica de tesorería cripto

Clear Street, una destacada correduría con sede en Nueva York conocida por su papel activo en la financiación de tesorerías cripto, se está preparando para una oferta pública inicial que podría valorar la firma entre 10

BTC-1,81%

CryptoBreaking·2025-12-06 10:53

La correduría detrás de importantes acuerdos de tesorería cripto busca una salida a bolsa de $10–12 mil millones: FT

Clear Street, una correduría de Nueva York que se ha convertido en uno de los suscriptores más activos en el auge de los cripto-tesorerías, se está preparando para salir a bolsa con una valoración esperada de $10 mil millones a $12 mil millones.

La OPV podría llegar tan pronto como el próximo mes, con Goldman Sachs a la cabeza de la oferta, la

Cointelegraph·2025-12-06 09:42

¿Son los monederos de criptomonedas sin frase semilla la clave para la autocustodia masiva? Un experto opina

El podcast Clear Crypto analiza el panorama en evolución de la experiencia del usuario en criptomonedas, centrándose en las cuentas inteligentes programables y el alejamiento de las tradicionales frases semilla. Con un enfoque en la usabilidad, la privacidad y la autocustodia, nuevos modelos como Ready buscan simplificar la gestión de criptomonedas para los usuarios convencionales.

BTC-1,81%

Cointelegraph·2025-12-04 14:20

Vea cómo Clear Secure aumenta con los flujos de dinero

YOU ofrece tecnología de identidad segura, incluyendo plataformas de verificación de identidad biométrica, para clientes en planificación de eventos, atención médica, deportes y entretenimiento, y más. Su informe de ganancias del segundo trimestre del año fiscal 2025 mostró ingresos de $219.5 millones ( un aumento anual del 17.5%), 33.5 millones activos

CLEAR-5,09%

YahooFinance·2025-09-05 22:36

Hackensack Meridian se asocia con CLEAR para la identidad del paciente

Hackensack Meridian Health se asocia con CLEAR para mejorar las experiencias de los pacientes a través de soluciones seguras de identidad digital, lo que permite un acceso más fácil a MyChart y el registro de citas mediante verificación biométrica.

CLEAR-5,09%

YahooFinance·2025-08-19 17:42

Clear Street amplía su departamento de banca de inversión en Cadena de bloques y activo digital.

Clear Street Investment Bank anuncia la expansión de su negocio de Cadena de bloques y activo digital, incorporando a los talentos senior Nakul Mehta y Collin Finnerty. Ellos liderarán los negocios de Activos Cripto, Cadena de bloques, infraestructura encriptada, entre otros. La empresa ofrecerá estrategias de salida a bolsa, estrategias financieras de Activos Cripto, y otros servicios, y ya ha brindado consultoría para transacciones por un valor superior a 2.350 millones de dólares, incluyendo proyectos de IPO.

CLEAR-5,09%

DeepFlowTech·2025-05-24 05:03

Mejor Cripto para Comprar Ahora Mientras los Italianos Presionan para Que el BTC Esté en los Bancos en la Cumbre Clear 2025

En la Cumbre Clear 2025 en Milán, Italia, el impulso cripto ocupó el centro del escenario. Una nueva encuesta revela que el 68% de los inversores italianos quiere que sus bancos ofrezcan servicios de Bitcoin y cripto—marcando un cambio histórico en el sentimiento público hacia los activos digitales.

Con el 24% de los encuestados ya invertidos en cript

CryptoDaily·2025-04-19 08:33

Sui anunció la integración nativa con Ledger Live, los usuarios de Ledger pueden acceder directamente a los Token del ecosistema Sui y SUI.

Sui y Ledger anuncian una integración nativa, los usuarios pueden gestionar de manera segura los tokens de la ecosistema Sui en Ledger Live. Los usuarios de Sui pueden mejorar la verificabilidad de las transacciones a través de Clear Signing, y los dispositivos Ledger protegen la llave privada de amenazas. Ledger protege el 20% del mercado global de activos cripto, esta integración es un hito importante en el desarrollo de las Finanzas descentralizadas de Sui.

DeepFlowTech·2025-04-10 08:04

Hut 8 podría deshacerse de su filial y considerar la adquisición de empresas de centros de datos de gran escala.

Clear Street en su último informe señala que la empresa minera de Bitcoin Hut 8 podría desprenderse de la subsidiaria American Bitcoin Corp, establecida en colaboración con la familia Trump, para centrarse en el negocio de alojamiento de centros de datos de alta rentabilidad y considerar la adquisición de un proveedor de servicios de computación a gran escala (Hyperscaler). La institución otorgó a Hut 8 una calificación de "compra" y un precio objetivo de 23 dólares. (CoinDesk)

MarsBitNews·2025-04-01 13:18

Corredor Clear Street: Hut 8 podría desprenderse de su filial American Bitcoin y centrarse en el negocio de alojamiento de centros de datos.

La empresa minera de Bitcoin Hut 8 podría deshacerse de su filial American Bitcoin, que colabora con la familia Trump, para centrarse en el negocio de alojamiento de centros de datos. Al mismo tiempo, podría considerar la adquisición de un distribuidor mayorista.

TechubNews·2025-04-01 13:01

El banco de encriptación en el que Buffett invirtió obtuvo ganancias de más de 200 millones de dólares

Al mencionar a los opositores de la encriptación en la industria, el famoso Warren Buffett es sin duda uno de los más destacados.

Warren Buffett, who has always adhered to the value investment methodology, has a clear aversion to elusive digital currencies. Famous quotes abound, at the 2018 Berkshire Hathaway annual shareholders meeting, Buffett referred to Bitcoin and digital currencies as "square rat poison."

En una entrevista con CNBC en 2018, fue aún más claro al afirmar: "En cuanto a la criptomoneda, en general, puedo decir con bastante seguridad que su destino será desastroso. No poseemos ninguna criptomoneda ni apostamos en contra de ninguna criptomoneda, y nunca lo haremos."

Incluso en la junta de accionistas de 2022, la actitud de Buffett no ha cambiado en absoluto, todavía dice 'Si me dices que tienes todos los bitcoins del mundo y los tienes en [], no tendré interés en ellos'.

金色财经_·2025-01-30 02:54

Buffett once referred to Bitcoin as 'rat poison', while his company invested $1.2 billion in the cryptocurrency market

Título original: Berkshire Hathaway de Warren Buffett prueba un poco del cripto 『veneno de rata』 que alguna vez dijo que nunca tocaría

Fuente original: fortune

Traducción del texto original: Ted Wu

Warren Buffett has always been clear about his dislike for cryptocurrency. However, Berkshire Hathaway has invested millions of dollars in a Brazilian bank, Nu Holdings Ltd., which is related to cryptocurrency, and the company's stock has risen 34% annually.

El CEO y presidente de Berkshire Hathaway, Warren Buffett, ha dejado en claro en varias ocasiones su postura sobre las criptomonedas: no le gustan.

en 2018

TechubNews·2025-01-24 04:30

El CEO de Franklin anuncia un plan para que Trump una finanzas tradicionales y criptomonedas con Clear ...

Jenny Johnson, CEO de Franklin Templeton, llamó a la claridad regulatoria en el espacio cripto, alentando a los reguladores y líderes de la industria a unirse. Enfatizó la importancia de directrices claras para proteger a los inversores y consumidores mientras fomenta la innovación. Johnson también destacó el impacto de las políticas gubernamentales en el mercado de criptomonedas y abogó por un enfoque más colaborativo para abordar los desafíos regulatorios.

CryptoBreaking·2025-01-22 04:52

Michael Saylor propone establecer un marco de activos digitales y una reserva estratégica de BTC en los Estados Unidos.

MicroStrategy, which claims to be a BTC development company, has released a report on the 'Digital Asset Framework' by its founder Michael Saylor. He believes that through the establishment of clear classification, legal rights framework, and practical compliance obligations, the United States can lead the global digital economy. The report also supports the idea of creating strategic BTC reserves to help neutralize national debt.

Categoría de activos digitales

Saylor primero divide la clase de activos digitales en las siguientes categorías:

Activos digitales: activos sin emisor respaldados por energía digital, como BTC

Valores digitales: Activos emitidos respaldados por valores, como acciones, bonos, derivados

Moneda digital: un activo emitido respaldado por moneda fiduciaria

Token digital: activo fungible con emisor, proporcionando utilidad digital

digital

ChainNewsAbmedia·2024-12-23 01:33

Un juez federal acaba de darle un golpe en la barbilla a la SEC. Esto es lo que significa. - BlockTelegraph

*

*

*

*

*

If the SEC were a sports team measured by its “win” rate, it would be a runaway champ.

But that win-loss record suffered a mild hit — and its first ever loss in an “ICO” case — one that refers to the controversial method of crowd fundraising and that borrows from the public company “IPO” or initial public offering.

A federal judge denied the SEC a preliminary injunction against Blockvest after he granted a temporary restraining order on the same issue. We chat with Amit Singh, attorney and shareholder in Stradling’s corporate and securities practice group about the SEC’s fresh loss.

His take? They’ll be out for blood, next.

**For those not in the know, share the legal background leading up to this case.**

In October of this year, the Securities Exchange Commission filed a complaint against Blockvest LLC and its founder, Reginald Buddy Ringgold III. According to the complaint, Blockvest falsely claimed its planned December initial coin offering was “registered” and “approved” by the SEC and created a fake regulatory agency, the Blockchain Exchange Commission, which included a phony logo that was nearly identical to that of the SEC. The SEC also alleged Blockvest conducted pre-sales of its digital token, BLV, ahead of the ICO and raised more than $2.5 million.

The SEC’s complaint alleged violations of the anti-fraud provisions of the Securities Exchange and the Securities Act and violations of the Securities Act’s prohibitions against the offer and sale of unregistered securities in the absence of an exemption from the registration requirements.

U.S. District Judge Gonzalo Curiel issued a temporary restraining order “freezing assets, prohibiting the destruction of documents, granting expedited discovery, requiring accounting and order to show cause why a preliminary injunction should not be granted” on October 5, 2018.

On Tuesday, November 27, in the SEC’s first loss in stopping an ICO, judge Gonzalo Curiel stated that the SEC had not shown at this stage of the case that the BLV tokens were securities under the Howey Test, a decades-old test established by the U.S. Supreme Court for determining whether certain transactions are investment contracts and thus securities. If the tokens weren’t securities, all the SEC’s other allegations automatically fail Under the Howey Test, a transaction is an investment contract (or security) if:

– It is an investment of money;

– There is an expectation of profits from the investment;

– The investment of money is in a common enterprise; and

– Any profit comes from the efforts of a promoter or third party

Later cases have expanded the term “money” in the Howey Test to include investment assets other than money.

The judge said that the SEC failed to show investors had an expectation of profits. “While defendants claim that they had an expectation in Blockvest’s future business, no evidence is provided to support the test investors’ expectation of profits,” the judge wrote. Blockvest argued that the pre-ICO money came from 32 “test investors” and said the BLV tokens were only designed for testing its platform. It presented statements from several investors who said they either did not buy BLV tokens or rely on any representations that the SEC has alleged are false. The SEC responded by noting that various individuals wrote “Blockvest” or “coins” on their checks and were provided with a Blockvest ICO white paper describing the project and the terms of the ICO. Judge Curiel said that evidence, by itself, wasn’t enough: “Merely writing ‘Blockvest or coins’ on their checks is not sufficient to demonstrate what promotional materials or economic inducements these purchasers were presented with prior to their investments. Accordingly, plaintiff has not demonstrated that ‘securities’ were sold to [these] individuals.”

**Won’t the case proceed? Why is the denial of an injunction important here?**

This does not mean that the SEC cannot pursue an action against the defendants Rather it just means that the SEC didn’t meet the high burden required to receive a preliminary injunction of proving “(1) a prima facie case of previous violations of federal securities laws, and (2) a reasonable likelihood that the wrong will be repeated.”

The court determined that, at this stage, without full discovery and disputed issues of material facts, the Court could not decide whether the BLV token were securities. Since the SEC didn’t meet its burden of proving the tokens were securities in the first place, it couldn’t have shown that there was a previous violation of the federal securities laws So, the first prong was not met Further, the defendants agreed to stop the ICO and provide 30 days’ prior notice to the SEC if they intend to move forward with the ICO So, the court determined that there was not a reasonable likelihood that the wrong will be repeated As a result, the SEC’s motion for a preliminary injunction was denied.

Nonetheless, this is an important case as it is the first time the SEC went after an ICO issuer and the issuer pushed back and won (if only temporarily) It reminds us that, though most people think of the SEC as judge and jury in securities actions, that isn’t the case Ultimately, an issuer that pushes back may have a chance if it has the wherewithal to fight and if it has good arguments However, this does not mean that the SEC is done with them and we may very well see this case continue.

**Won’t media coverage of this case ultimately impair Blockvest’s ability to raise funds — its ultimate goal?**

That may very well be the case.

Unfortunately, unsophisticated investors could ultimately merely remember the Blockvest name and decide that it must be a good investment since they’ve heard of it (ala PT Barnum – “I don’t care what the newspapers say about me as long as they spell my name right.”). But I may be too cynical (hopefully I am). In any case, I would be surprised if Blockvest attempts to pursue an ICO without either registering the tokens or utilizing an exemption from the registration requirements. They clearly have a target on their back, so the SEC would love another crack at them I’m sure.

Plus, even though a preliminary injunction was denied here, the SEC still got what it wanted as Blockvest agreed not to pursue the ICO without giving the SEC 30 days’ prior notice of its intent to do so. So, the investing public was ultimately protected.

**What is the SEC’s current stance on what constitutes a security based on this case?**

The SEC will still point to the Howey Test Further, as stated in recent speeches by Hinman and others, the SEC seems to be focused not only on the utility of any tokens (i.e., they can be used on the platform for which they were created), but also on decentralization (that the efforts of the promoters are no longer required to maintain the value/utility of the tokens/platform).

However, the court in this case looked at the investment of money prong differently than has historically been the case Normally, the investment of money prong is assumed with little analysis as any consideration is considered “money” for purposes of the test But this case looked at the investment not from the purchaser’s subjective intent when committing funds, but instead based the analysis on what was offered to prospective purchasers and what information they relied on So, issuers are well advised to be very careful in how they advertise an offering.

Further, the expectation of profits prong wasn’t met because, according to Blockvest, these were just test investors So, it wasn’t clear these folks invested for a profit The tokens were never even used or sold outside the platform.

**Where does the Ninth Circuit sit in regards to what is a security?**

The Ninth Circuit follows the Howey Test.

However, the common enterprise element has received extensive and varied analysis in the federal circuit courts For example, while all circuits accept “horizontal” commonality as satisfying the common enterprise prong of the Howey Test, a minority of circuits (including the ninth) also accept “vertical” commonality in this analysis.

Horizontal commonality involves the pooling of assets, profits and risks in a unitary enterprise, while vertical commonality requires that profits of investors be “interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties” (narrow verticality), or “that the well-being of all investors be dependent upon the promoter’s expertise” (broad commonality). SEC v. SG Ltd., 265 F.3d 42, 49 (1st Cir. 2001).

The Ninth Circuit is the only one to accept the narrow vertical approach (though it also accepts horizontal commonality), which finds a common enterprise if there is a correlation between the fortunes of an investor and a promoter.” Sec. & Exch. Comm’n v. Eurobond Exchange, Ltd., 13 F.3d 1334, 1339 (9th Cir., 1994). Under this approach a common enterprise is a venture “in which the ‘fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment….'” Investors’ funds need not be pooled; rather the fortunes of the investors must be linked with those of the promoters, which suffices to establish vertical commonality. So, a common enterprise exists if a direct correlation has been established between success or failure of the promoter’s efforts and success or failure of the investment.

**Which Federal Circuits might offer an equal or even bigger split with the SEC?**

I wouldn’t really say that any courts split with the SEC as the SEC’s decisions take precedent over any decisions of those courts. However, there is a split among the circuits as described above with respect to what type of commonality is sufficient to find a common enterprise.

**What impact could the outcome of this case have on ICOs at large?**

This case may embolden companies who have already conducted ICOs to push back on any SEC actions that they might not otherwise fight as it shows that the SEC will always have to meet the burden of proving all factors of the Howey Test are met before the SEC has jurisdiction over the offering in the first place.

**Has the Supreme Court addressed anything crypto, crypto related, or analogous?**

The only case I know of where the Supreme court has addressed crypto currencies is Wisconsin Central Ltd. v. United States.

That was a case about whether stock counts as “money remuneration” The dissent in that case talked about how our concept of money has changed over time and said that perhaps “one day employees will be paid in bitcoin or some other type of cryptocurrency.” This goes against the IRS’s position that cryptocurrencies are property and should be taxed as such But, it was just a passing comment in the dissent. So, it has no precedential value. But, it may embolden someone to fight the IRS’s position.

BlockTelegraph·2024-12-19 05:53

No es solo un simple intercambio de monedas, analizando la actualización más reciente del protocolo de liquidación Everclear

El protocolo de liquidación de capa cruzada Interacción anuncia la actualización de su token NEXT a CLEAR e introduce el mecanismo de votación vbCLEAR. En un diseño jerárquico, se mejora la eficiencia mediante la especialización de tareas. El mecanismo vbCLEAR permite a los stakers votar y distribuir incentivos, resolviendo la falta de liquidez en la interacción cross-chain y proporcionando más formas de participación. Esta actualización es parte de la estrategia futura de Everclear y tiene un valor a largo plazo para la subdivisión de la capa de liquidación.

MEME-3,11%

DeepFlowTech·2024-12-04 11:10

Buena oportunidad en el mercado alcista no debe ser desaprovechada

Connext se actualiza a Everclear y se convierte en la primera capa de liquidación multi-cadena. La Token $NEXT se migrará a $CLEAR y se introducirá un sistema de votación vinculado a vbCLEAR para la gobernanza on-chain, lo que permitirá a los stakeholders participar en la gobernanza on-chain y ganar recompensas a través de protocolo. Los poseedores de $NEXT necesitarán convertir manualmente su token en $CLEAR y participar en stake. ¡No pierdas esta oportunidad de inversión!

AICoinOfficial·2024-12-04 10:28

Advertencia crucial de SHIB 'Clear Warning' proviene del equipo de Shiba Inu: Detalles

Anuncio

SHIB-3,08%

UToday·2024-11-23 20:06

Una descripción clara de la política hacia China de "MAGA"

Vivek Ramaswamy is one of the core figures around Trump, and his views on US foreign policy are deeply aligned with Trump/MAGA's core ideology. He has outlined several key points on the China-US relationship: avoiding a hot war between China and the US, avoiding the "Thucydides Trap," adopting a strategic and clear approach to China's political/diplomatic and economic trade relations, believing that the US must depeg from China to reduce conflicts, strengthening relations with allies to weaken the China-Russia alliance, and breaking free from the constraints of traditional international relations theory.

MAGA-3,02%

金色财经_·2024-11-13 06:27

解锁即dump?encriptación行业的激励错位问题如何解决?

Título original: 'El problema de desalineación de incentivos de Crypto'

Autor original: Sergio Gallardo

原文编译:zhouzhou,BlockBeats

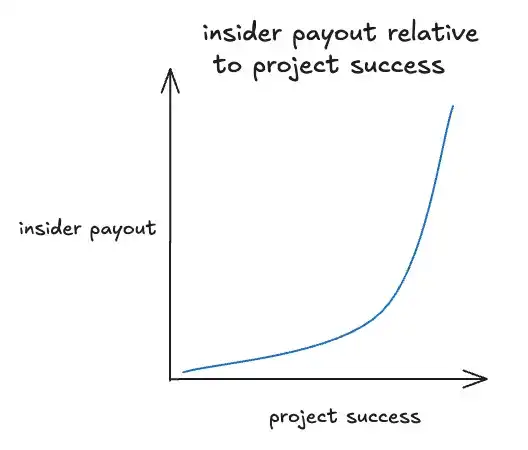

Editor's note: This article discusses the problem of incentive mismatch in the cryptocurrency industry, pointing out that many market participants overlook the long-term success of projects due to short-term gains, which leads to improper allocation of capital and resources and weakens industry credibility. To solve this problem, the article suggests increasing transparency, strengthening self-regulation, optimizing Tokenvesting design, and setting clear project goals and incentive mechanisms to promote sustainable development of the industry.

A continuación se presenta el contenido original (para facilitar la comprensión de lectura, el contenido original ha sido editado):

1. Introducción

En la Web2 tradicional

星球日报·2024-10-28 12:01

¿Desbloqueo significa dumping? Interpretación de la profundidad de la industria de la encriptación en desajuste de incentivos

Editor's note: This article discusses the problem of incentive misalignment in the Criptomoneda industry, pointing out that many market participants overlook long-term project success for short-term gains, leading to improper allocation of capital and resources and weakening industry credibility. To address this issue, the article suggests increasing transparency, strengthening self-regulation, and optimizing Tokenvesting design to promote sustainable industry development by setting clear project goals and incentive mechanisms.

A continuación se muestra el contenido original (se ha editado para facilitar la comprensión de la lectura):

1. Introducción

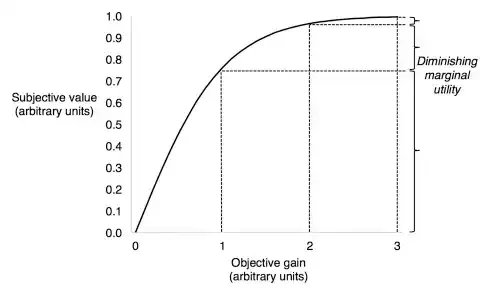

En las empresas tradicionales de Web2, las ganancias significativas suelen estar estrechamente relacionadas con el éxito a largo plazo de la empresa. Los fundadores e inversores iniciales están motivados para construir un negocio sostenible, ya que su rentabilidad está estrechamente vinculada al desempeño a largo plazo de la empresa. Sin embargo, en contraste, Web3

律动·2024-10-28 02:35

Cargar más