🚨 GT/USDT Market Analysis – Signals & Positioning

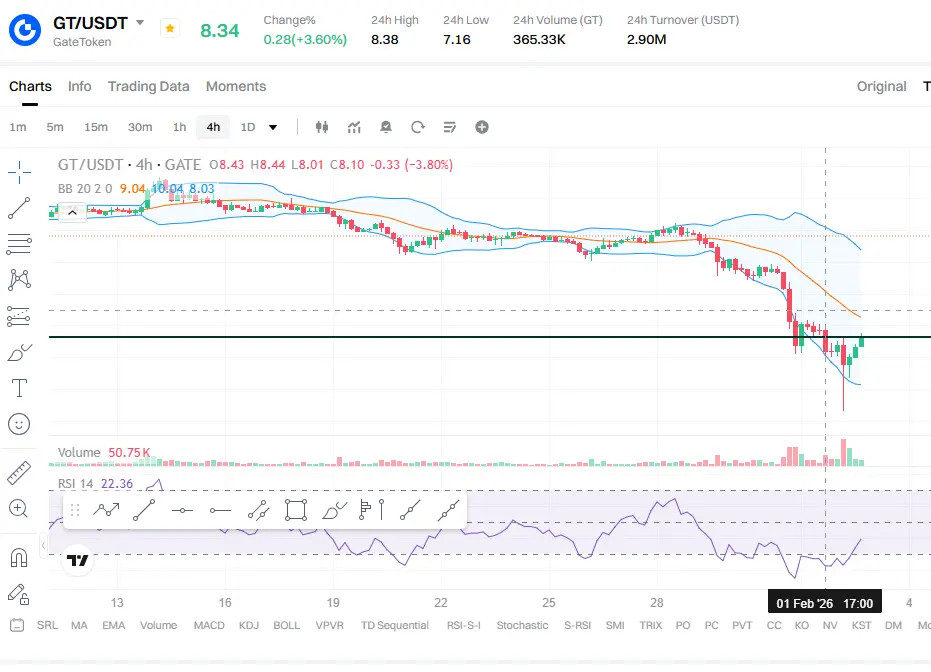

GT (GateToken), the native token of the Gate ecosystem, is currently showing mixed and choppy price action with structural weakness but also some emerging areas worth watching for potential opportunities.

GT trades around $8–$10 range after a sustained downtrend and price weakening over recent weeks.

📉 Current Technical Signals – Dragon Fly Official’s View

Bearish Momentum Dominates:

Most major technical indicators on daily timeframes currently signal Sell, with GT trading below key moving averages. RSI readings are in bearish or neutral territory, and oscillators skew downside. Dragon Fly Official sees this as a signal to remain cautious before committing heavily to long positions.

Neutral/Mixed Threads:

Some neutral momentum readings around RSI ~48–50 suggest that GT isn’t deeply oversold yet. Dragon Fly Official notes that trend sellers still control the market, and bulls need confirmation before entering aggressively.

📌 Support & Resistance to Watch

Immediate Resistance: ~$10.30–$10.70 — a decisive break above this zone could shift sentiment.

Strong Support: Falling below the current range could open the path toward lower levels near prior pivot zones.

Dragon Fly Official highlights these zones as critical checkpoints for anyone looking to enter strategically.

📊 Why Caution Still Reigns – Dragon Fly Official Insight

Price remains under moving averages — a classic sign of downtrend continuation.

Neutral RSI without strong divergence implies sellers may retain the edge.

Market sentiment remains cautious, keeping capital on the sidelines.

Dragon Fly Official emphasizes: avoid aggressive positions until the trend shows clear signs of reversal.

💡 Bullish Signals (Emerging Areas) – Dragon Fly Official Perspective

Close Above Key Resistance: A decisive break above ~$10.30 with volume could signal early trend shift.

MACD Cross Support: A bullish MACD turn on shorter timeframes may indicate momentum is building.

Oversold Bounce Potential: If RSI dips toward deep oversold with divergence, it could offer a rebound entry.

Dragon Fly Official advises monitoring these emerging signals carefully before scaling in.

📌 Strategic Positioning Advice – Dragon Fly Official

Cautious Core Stance:

Avoid full-size long positions until price shows a break above key resistance with confirmation.

Focus on recovery signals like sustained strength above the 20/50 SMA with volume.

Tactical Entry Zones:

Dip buyers could watch support tests near lower range with clear rejection wicks.

Scale in gradually after multiple confirmation signals — higher lows, stronger momentum, stronger volume.

Risk Management:

Use tight stop-loss levels in volatile zones.

Trade smaller sizes on early bounces until trend clarity improves.

⚠️ Risk Warning

Cryptocurrency trading is highly volatile. GT/USDT can swing aggressively. Nothing is guaranteed — trade only with capital you can afford to lose, and use proper risk management. Past performance does not guarantee future results. #gt

#GTUSDT #GateToken #CryptoAnalysis

GT (GateToken), the native token of the Gate ecosystem, is currently showing mixed and choppy price action with structural weakness but also some emerging areas worth watching for potential opportunities.

GT trades around $8–$10 range after a sustained downtrend and price weakening over recent weeks.

📉 Current Technical Signals – Dragon Fly Official’s View

Bearish Momentum Dominates:

Most major technical indicators on daily timeframes currently signal Sell, with GT trading below key moving averages. RSI readings are in bearish or neutral territory, and oscillators skew downside. Dragon Fly Official sees this as a signal to remain cautious before committing heavily to long positions.

Neutral/Mixed Threads:

Some neutral momentum readings around RSI ~48–50 suggest that GT isn’t deeply oversold yet. Dragon Fly Official notes that trend sellers still control the market, and bulls need confirmation before entering aggressively.

📌 Support & Resistance to Watch

Immediate Resistance: ~$10.30–$10.70 — a decisive break above this zone could shift sentiment.

Strong Support: Falling below the current range could open the path toward lower levels near prior pivot zones.

Dragon Fly Official highlights these zones as critical checkpoints for anyone looking to enter strategically.

📊 Why Caution Still Reigns – Dragon Fly Official Insight

Price remains under moving averages — a classic sign of downtrend continuation.

Neutral RSI without strong divergence implies sellers may retain the edge.

Market sentiment remains cautious, keeping capital on the sidelines.

Dragon Fly Official emphasizes: avoid aggressive positions until the trend shows clear signs of reversal.

💡 Bullish Signals (Emerging Areas) – Dragon Fly Official Perspective

Close Above Key Resistance: A decisive break above ~$10.30 with volume could signal early trend shift.

MACD Cross Support: A bullish MACD turn on shorter timeframes may indicate momentum is building.

Oversold Bounce Potential: If RSI dips toward deep oversold with divergence, it could offer a rebound entry.

Dragon Fly Official advises monitoring these emerging signals carefully before scaling in.

📌 Strategic Positioning Advice – Dragon Fly Official

Cautious Core Stance:

Avoid full-size long positions until price shows a break above key resistance with confirmation.

Focus on recovery signals like sustained strength above the 20/50 SMA with volume.

Tactical Entry Zones:

Dip buyers could watch support tests near lower range with clear rejection wicks.

Scale in gradually after multiple confirmation signals — higher lows, stronger momentum, stronger volume.

Risk Management:

Use tight stop-loss levels in volatile zones.

Trade smaller sizes on early bounces until trend clarity improves.

⚠️ Risk Warning

Cryptocurrency trading is highly volatile. GT/USDT can swing aggressively. Nothing is guaranteed — trade only with capital you can afford to lose, and use proper risk management. Past performance does not guarantee future results. #gt

#GTUSDT #GateToken #CryptoAnalysis