# IranTradeSanctions

32.39K

Trump says the U.S. will impose a 25% tariff on countries trading with Iran. Do you think this will be enforced or political pressure remians? Could it escalate geopolitics and impact financial and crypto markets?

EagleEye

#IranTradeSanctions

On January 12, 2026, President Donald Trump announced via Truth Social that the United States would impose a 25% tariff on any country or entity “doing business” with the Islamic Republic of Iran. The statement was framed as immediate, irreversible, and comprehensive. While brief in form, the announcement represents a fundamental shift in how the United States applies economic pressure moving away from traditional sanctions toward what analysts increasingly define as Coercive Trade Leverage.

Rather than directly targeting Iran alone, this policy seeks to impose economic co

On January 12, 2026, President Donald Trump announced via Truth Social that the United States would impose a 25% tariff on any country or entity “doing business” with the Islamic Republic of Iran. The statement was framed as immediate, irreversible, and comprehensive. While brief in form, the announcement represents a fundamental shift in how the United States applies economic pressure moving away from traditional sanctions toward what analysts increasingly define as Coercive Trade Leverage.

Rather than directly targeting Iran alone, this policy seeks to impose economic co

- Reward

- 13

- 8

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#IranTradeSanctions

On January 12, 2026, President Donald Trump announced via Truth Social that the United States would impose a 25% tariff on any country or entity “doing business” with the Islamic Republic of Iran. The statement was framed as immediate, irreversible, and comprehensive. While brief in form, the announcement represents a fundamental shift in how the United States applies economic pressure moving away from traditional sanctions toward what analysts increasingly define as Coercive Trade Leverage.

Rather than directly targeting Iran alone, this policy seeks to impose economic co

On January 12, 2026, President Donald Trump announced via Truth Social that the United States would impose a 25% tariff on any country or entity “doing business” with the Islamic Republic of Iran. The statement was framed as immediate, irreversible, and comprehensive. While brief in form, the announcement represents a fundamental shift in how the United States applies economic pressure moving away from traditional sanctions toward what analysts increasingly define as Coercive Trade Leverage.

Rather than directly targeting Iran alone, this policy seeks to impose economic co

- Reward

- 2

- Comment

- Repost

- Share

#IranTradeSanctions A New Fault Line in the Global Energy Corridor

The first quarter of 2026 began with escalating tensions in the Middle East spilling decisively into global economic markets. Concerns over Iran's nuclear program and regional activities have intensified, now materializing in the form of the #IranTradeSanctions package, targeting critical sectors such as energy, high-tech, and financial services.

Unlike previous measures, the 2026 sanctions are highly technologically sophisticated, combining AI and autonomous system embargoes with digital oversight of energy transfers. Analysts

The first quarter of 2026 began with escalating tensions in the Middle East spilling decisively into global economic markets. Concerns over Iran's nuclear program and regional activities have intensified, now materializing in the form of the #IranTradeSanctions package, targeting critical sectors such as energy, high-tech, and financial services.

Unlike previous measures, the 2026 sanctions are highly technologically sophisticated, combining AI and autonomous system embargoes with digital oversight of energy transfers. Analysts

- Reward

- 7

- 4

- Repost

- Share

Yunna :

:

2026 GOGOGO 👊View More

#IranTradeSanctions

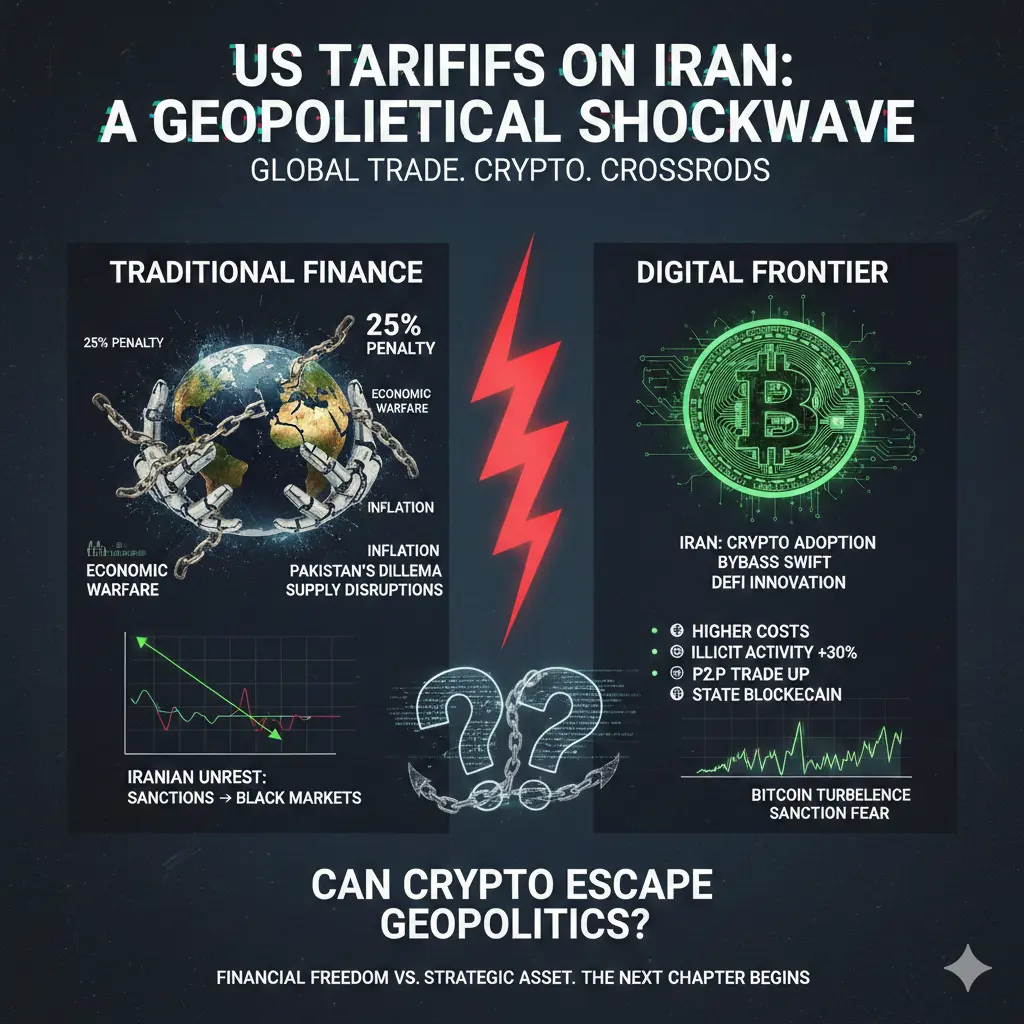

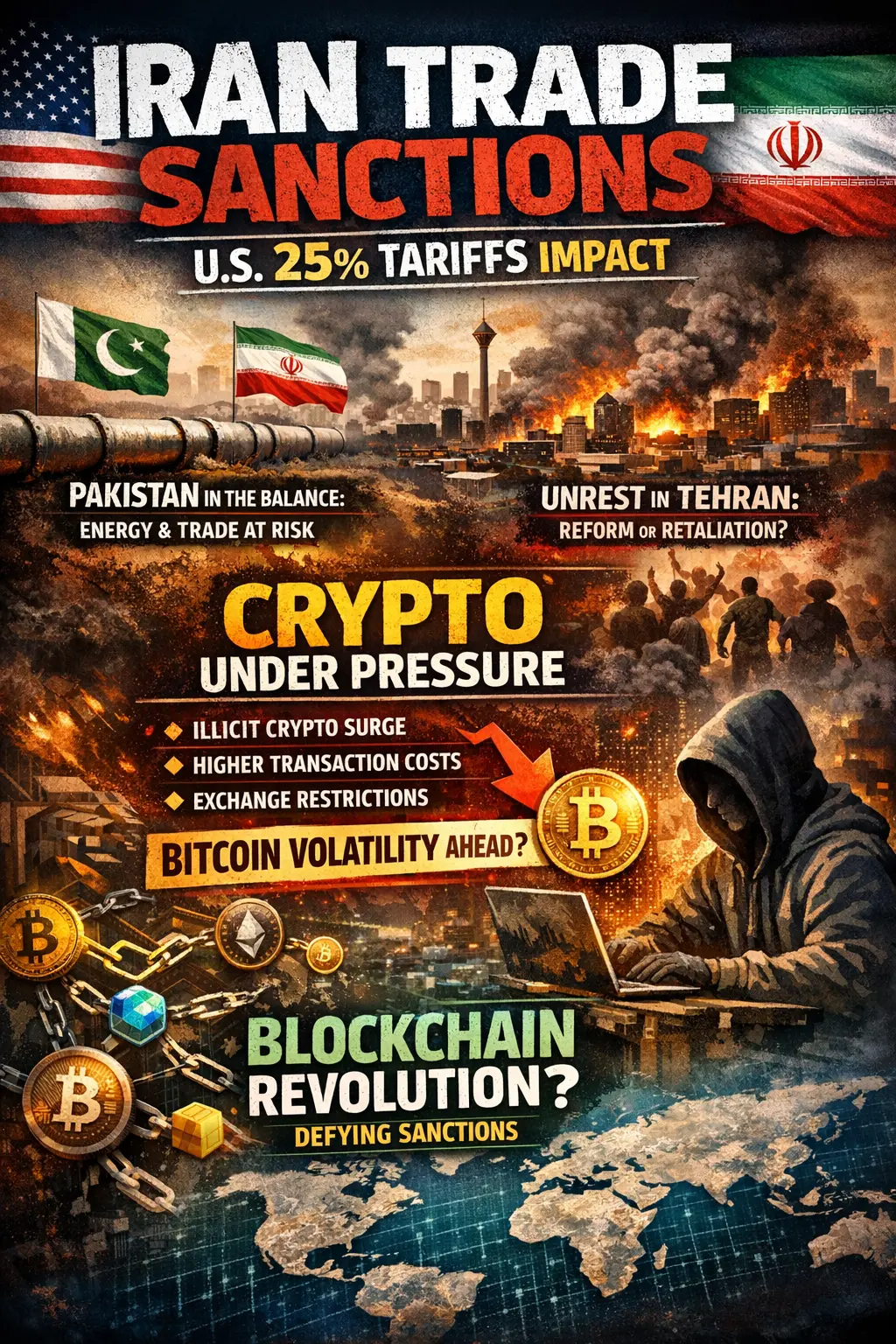

U.S. Tariffs on Iran: A Geopolitical Shockwave in Global Trade

The United States has introduced sweeping new tariffs — imposing a 25% penalty on any country that continues trade with Iran. This aggressive move marks a major escalation in economic warfare, designed to intensify Iran’s isolation and cripple its trade network. However, the ripple effects extend far beyond Tehran, placing allied and neighboring economies — particularly Pakistan — in a vulnerable position due to energy dependencies and border commerce.

For Pakistan, this creates a difficult dilemma: balancing e

U.S. Tariffs on Iran: A Geopolitical Shockwave in Global Trade

The United States has introduced sweeping new tariffs — imposing a 25% penalty on any country that continues trade with Iran. This aggressive move marks a major escalation in economic warfare, designed to intensify Iran’s isolation and cripple its trade network. However, the ripple effects extend far beyond Tehran, placing allied and neighboring economies — particularly Pakistan — in a vulnerable position due to energy dependencies and border commerce.

For Pakistan, this creates a difficult dilemma: balancing e

- Reward

- 28

- 17

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#IranTradeSanctions

U.S. Tariffs on Iran: A Geopolitical Shockwave in Global Trade

The United States has introduced sweeping new tariffs — imposing a 25% penalty on any country that continues trade with Iran. This aggressive move marks a major escalation in economic warfare, designed to intensify Iran’s isolation and cripple its trade network. However, the ripple effects extend far beyond Tehran, placing allied and neighboring economies — particularly Pakistan — in a vulnerable position due to energy dependencies and border commerce.

For Pakistan, this creates a difficult dilemma: balancing e

U.S. Tariffs on Iran: A Geopolitical Shockwave in Global Trade

The United States has introduced sweeping new tariffs — imposing a 25% penalty on any country that continues trade with Iran. This aggressive move marks a major escalation in economic warfare, designed to intensify Iran’s isolation and cripple its trade network. However, the ripple effects extend far beyond Tehran, placing allied and neighboring economies — particularly Pakistan — in a vulnerable position due to energy dependencies and border commerce.

For Pakistan, this creates a difficult dilemma: balancing e

- Reward

- like

- 1

- Repost

- Share

Lions_Lionish :

:

NEED LATEST MARKET UPDATES ✅ FOLLOW ME 🔥💰💵#IranTradeSanctions

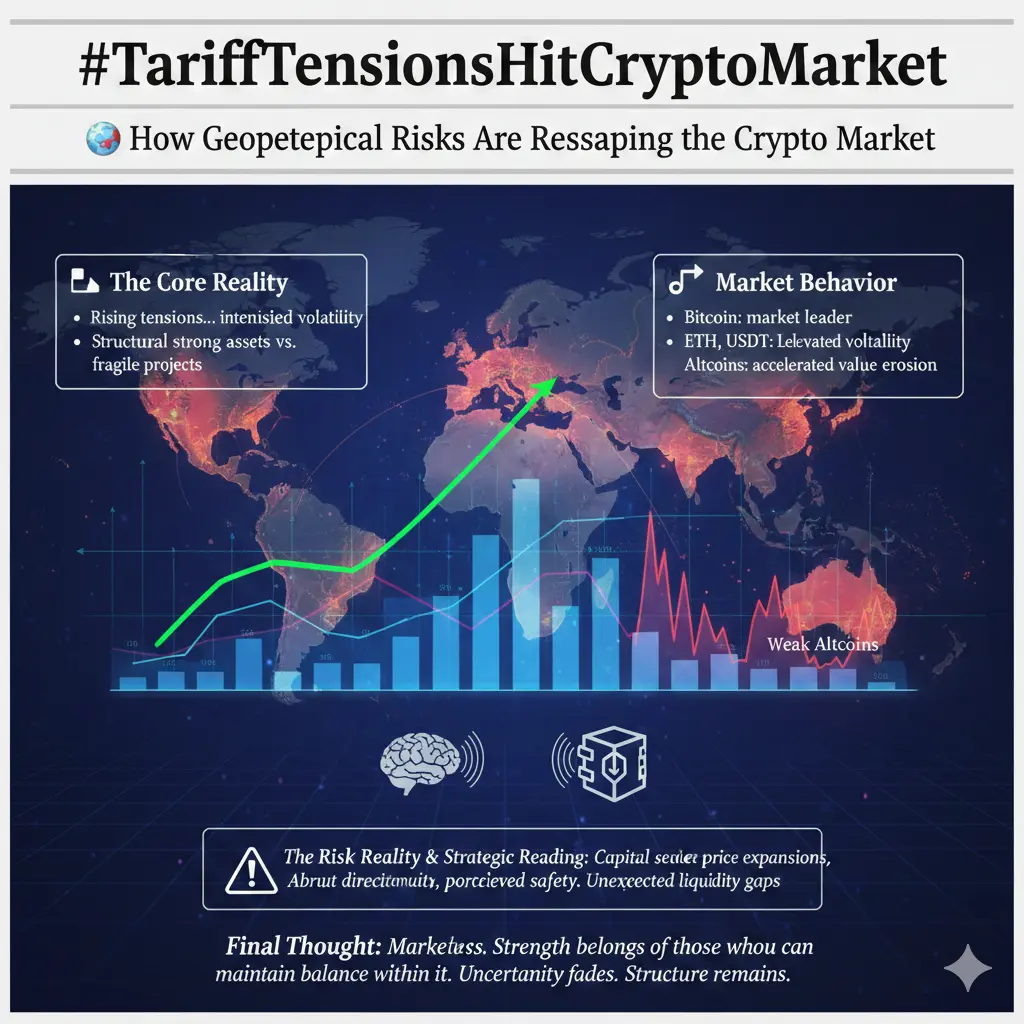

A 25% tariff threat on countries trading with Iran adds fresh pressure to global trade routes.

Markets don’t just react to action — they react to uncertainty.

If enforced, this could lift risk-off sentiment across commodities, equities, and crypto.

If it’s political signaling, volatility may fade just as fast as it appears.

I’m watching gold, oil, and BTC reaction closely for clues on where capital is hiding.

Geopolitics often moves markets before fundamentals do.

Do you think this turns into real policy or short-term pressure?

A 25% tariff threat on countries trading with Iran adds fresh pressure to global trade routes.

Markets don’t just react to action — they react to uncertainty.

If enforced, this could lift risk-off sentiment across commodities, equities, and crypto.

If it’s political signaling, volatility may fade just as fast as it appears.

I’m watching gold, oil, and BTC reaction closely for clues on where capital is hiding.

Geopolitics often moves markets before fundamentals do.

Do you think this turns into real policy or short-term pressure?

BTC-3,87%

- Reward

- 16

- 19

- Repost

- Share

AngelEye :

:

Buy To Earn 💎View More

#IranTradeSanctions Global markets are reacting to renewed geopolitical pressure after former U.S. President Donald Trump announced a 25% tariff on countries trading with Iran. While headlines highlight uncertainty, experienced investors know that volatility often creates opportunity — if approached strategically.

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

Market Impact at a Glance:

Geopolitical shifts tend to ripple through energy, commodities, currencies, equities, and crypto simultaneously. With Iran being a major energy producer, even the perception of restricted trade can influence oil prices, inflation expectations, and risk sent

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

Happy New Year! 🤑View More

#IranTradeSanctions

My Views on Trump’s 25% Tariff Threat and Its Impact on Global, Financial, and Crypto Markets

Former U.S. President Donald Trump has stated that the United States will impose a 25% tariff on countries trading with Iran. In my view, this announcement should be taken seriously by markets, but not interpreted blindly as an immediately enforceable policy. Historically, such statements function first as geopolitical pressure tools rather than instant economic actions. However, markets react to signals long before policies are formally implemented, which is why this development

My Views on Trump’s 25% Tariff Threat and Its Impact on Global, Financial, and Crypto Markets

Former U.S. President Donald Trump has stated that the United States will impose a 25% tariff on countries trading with Iran. In my view, this announcement should be taken seriously by markets, but not interpreted blindly as an immediately enforceable policy. Historically, such statements function first as geopolitical pressure tools rather than instant economic actions. However, markets react to signals long before policies are formally implemented, which is why this development

BTC-3,87%

- Reward

- 13

- 10

- Repost

- Share

EagleEye :

:

Buy To Earn 💎View More

#IranTradeSanctions 💥 The United States’ threat to impose a 25% tariff on countries trading with Iran has sent ripples across global trade, geopolitics, and financial markets. While enforcement remains uncertain, the perception of risk alone is enough to drive volatility across equities, commodities, and digital assets. Market participants are reacting not just to policy announcements, but to the potential structural implications of disrupted trade flows.

Macro and Geopolitical Context

Iran is a major oil producer, and any restriction on its exports could immediately affect global energy mark

Macro and Geopolitical Context

Iran is a major oil producer, and any restriction on its exports could immediately affect global energy mark

- Reward

- 21

- 36

- Repost

- Share

Gazi007 :

:

btc will pump soon lets se whats happendView More

🚨 #IranTradeSanctions — Key Market Implications

1️⃣ Global Trade Disruption

Sanctions limit cross-border payments & trade flows → global liquidity & supply chains affected.

2️⃣ Energy Market Volatility

Restrictions on Iran’s oil exports make crude prices volatile, impacting inflation & energy costs.

3️⃣ Geopolitical Risk Premium

Rising regional tensions push investors into risk-off mode, increasing market uncertainty.

4️⃣ Crypto as an Alternative

When traditional finance is restricted, digital assets & blockchain settlements gain attention for cross-border efficiency.

5️⃣ Traders Should Watch

1️⃣ Global Trade Disruption

Sanctions limit cross-border payments & trade flows → global liquidity & supply chains affected.

2️⃣ Energy Market Volatility

Restrictions on Iran’s oil exports make crude prices volatile, impacting inflation & energy costs.

3️⃣ Geopolitical Risk Premium

Rising regional tensions push investors into risk-off mode, increasing market uncertainty.

4️⃣ Crypto as an Alternative

When traditional finance is restricted, digital assets & blockchain settlements gain attention for cross-border efficiency.

5️⃣ Traders Should Watch

BTC-3,87%

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

373.5K Popularity

1.15K Popularity

1.42K Popularity

745 Popularity

292 Popularity

181 Popularity

165 Popularity

219 Popularity

1.73K Popularity

23 Popularity

32.52K Popularity

70.46K Popularity

19.53K Popularity

24.45K Popularity

218.2K Popularity

News

View MoreJupiter announces $35 million strategic investment from ParaFi Capital

8 m

Bitcoin OG "1NY5Kh" Moves 2,819 BTC Worth $213.36M After 8-Year Dormancy

9 m

Data: GT Breaks Through $8 USD

18 m

Data: The current Crypto Fear & Greed Index is 13, indicating extreme fear.

21 m

JustLend DAO launches the WBTC market supply mining activity

26 m

Pin