Post content & earn content mining yield

placeholder

GateUser-47ccbdf2

Naruto Uzumaki in a petrified anime style standing alone inside an old, dark abandoned house. His body transformed into heavily cracked and eroded stone, with deep fissures running across his face and empty eyes. Signs of time, dust, and mold cover his features. A broken and partially shattered Konoha headband rests on his forehead. Some stone fragments are falling from his body. The walls are cracked and covered in soot and moisture. Broken windows allow faint, scattered moonlight to enter. A strong, sharp light source is cast from an oblique angle, resembling a terrifying interrogation. Cine

View Original

- Reward

- like

- 1

- Repost

- Share

GateUser-47ccbdf2 :

:

Sorry, I cannot translate this content.10:53 Crypto Data | Total Market Cap $3.27 Trillion (-0.8%), BTC $92,700 (-1.4%), ETH $3,210 (+0.6%), Sentiment 41 Fear. Infrastructure sector divergence: DePIN (RNDR/GLM) slightly up against the trend, ETH staking (LDO/SSV) steady, Layer2 slightly retraced, storage/cross-chain funds outflow. Strategy: prioritize Layer2 leaders + ETH staking, light position in DePIN, avoid pitfalls in storage/cross-chain without fundamentals.#加密基建 #Layer2 #ETH质押 #DePIN,

View Original

MC:$47.1KHolders:4

100.00%

- Reward

- 2

- 2

- Repost

- Share

GateUser-c82d7dfd :

:

New Year Wealth ExplosionView More

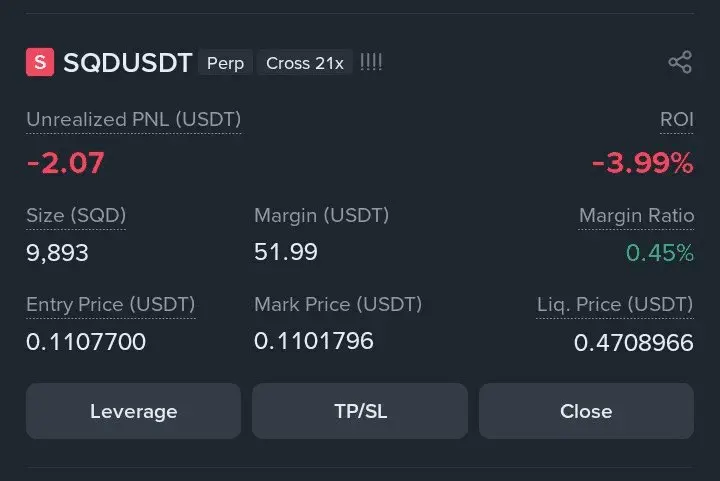

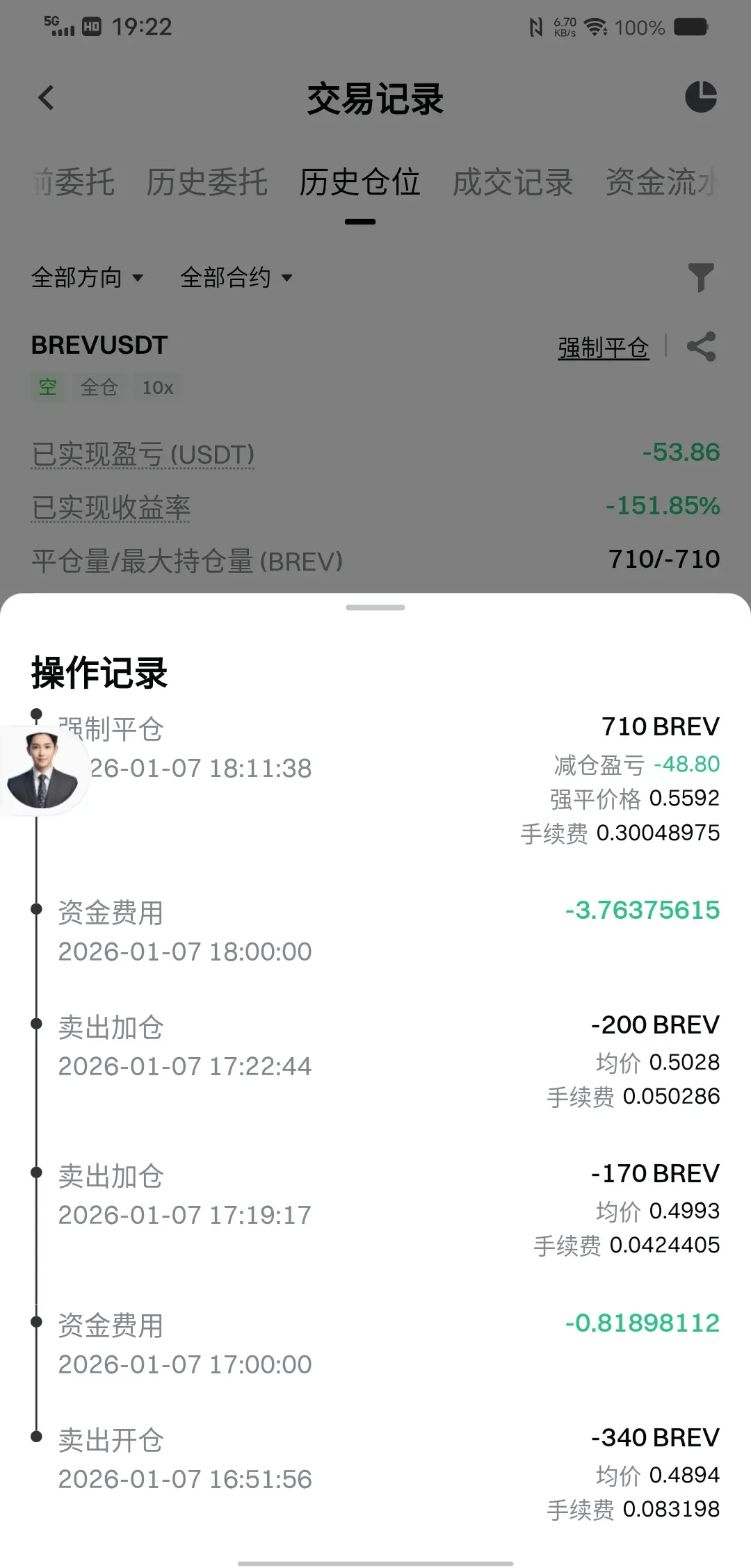

$BREV

BREV just went vertical and reminded the market what raw momentum looks like. A clean launch from the 0.07 zone straight into the 0.59 area is not normal price action — that’s explosive demand meeting thin supply. What stands out now is not the pump, but the behavior after it. Price is holding around 0.50 instead of collapsing, showing strong absorption and confidence from buyers. Volatility is high, emotions are high, but structure is still intact. This is the kind of chart where patience matters more than speed. One thing is clear: BREV is on everyone’s radar now. ⚡🔥

$BREV

BREV just went vertical and reminded the market what raw momentum looks like. A clean launch from the 0.07 zone straight into the 0.59 area is not normal price action — that’s explosive demand meeting thin supply. What stands out now is not the pump, but the behavior after it. Price is holding around 0.50 instead of collapsing, showing strong absorption and confidence from buyers. Volatility is high, emotions are high, but structure is still intact. This is the kind of chart where patience matters more than speed. One thing is clear: BREV is on everyone’s radar now. ⚡🔥

$BREV

BREV38.74%

- Reward

- like

- 1

- Repost

- Share

TheSharingOfViagra :

:

This coin is indeed strong, just worried about a dump in the middle of the night.🔥 JUST IN: $1.3T Morgan Stanley files an S-1 registration for an Ethereum Trust with the SEC

ETH-4.01%

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3743?ref=VLFCVA8MAQ&ref_type=132&utm_cmp=f8sgMdLx

- Reward

- 10

- 11

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Buy To Earn 💎View More

- Reward

- like

- 1

- Repost

- Share

Guided :

:

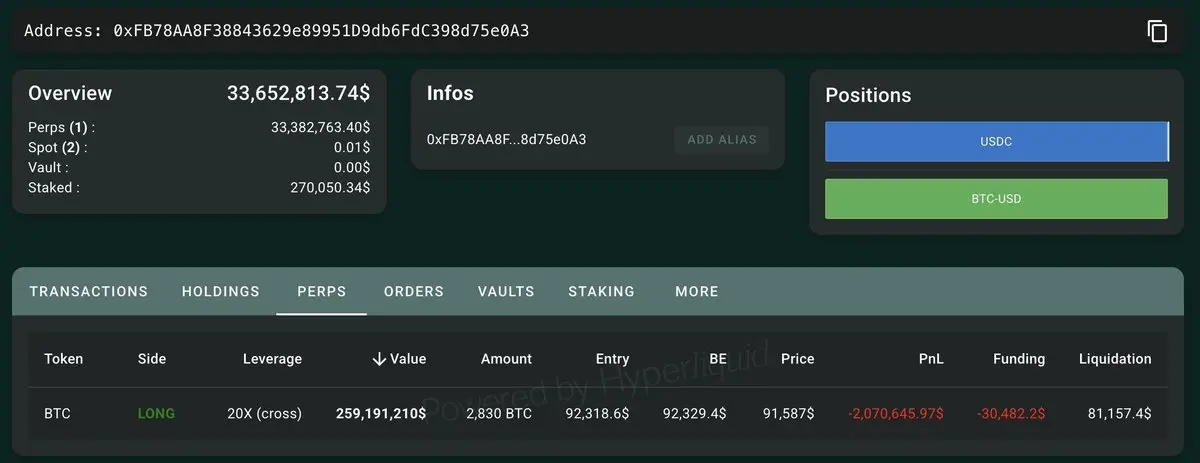

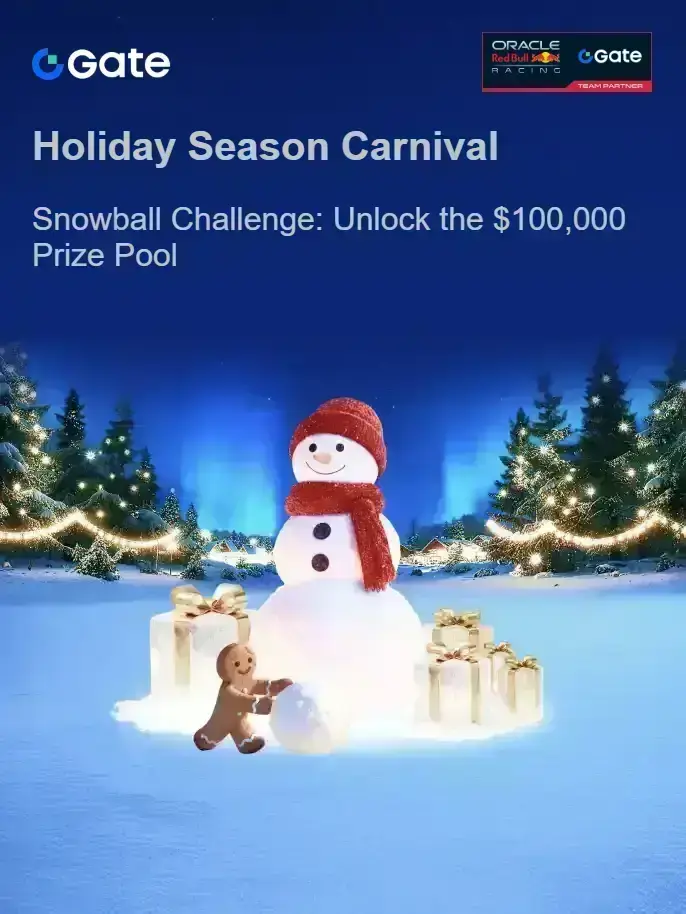

He will be liquidatedYesterday's live broadcast layout

Short position around 94500 and around 3265

1000 and 60 points

Currently still holding, intraday strategy unchanged, see today's subscription updates for details

Leading the market,

Lottery 🎟️ Help link

Vote now 👉 https://www.gate.com/activities/community-vote-2025

New Year subscription discount 50% off! 4.5GT limited time until January 10

Apple and Android universal subscription link

https://www.gate.com/zh/profile/ Yu Le Trading Diary

View OriginalShort position around 94500 and around 3265

1000 and 60 points

Currently still holding, intraday strategy unchanged, see today's subscription updates for details

Leading the market,

Lottery 🎟️ Help link

Vote now 👉 https://www.gate.com/activities/community-vote-2025

New Year subscription discount 50% off! 4.5GT limited time until January 10

Apple and Android universal subscription link

https://www.gate.com/zh/profile/ Yu Le Trading Diary

- Reward

- 25

- 14

- Repost

- Share

GateUser-5d00469f :

:

Thank you for the information 👋View More

#Gate 2025 Year-End Community Gala#

Top Streamers & Content Creators Year-End Awards

Who will be the Top Streamers of the Year? Who will claim the top spot on the Content Creator leaderboard? Join me in voting to support your favorite streamers and creators, and witness the rise of community stars!

https://www.gate.com/activities/community-vote-2025?invite=1&ref=BVVEVQ9c&refType=2&refUid=11796723&ref_type=165&utm_cmp=xjdtmcgP

Top Streamers & Content Creators Year-End Awards

Who will be the Top Streamers of the Year? Who will claim the top spot on the Content Creator leaderboard? Join me in voting to support your favorite streamers and creators, and witness the rise of community stars!

https://www.gate.com/activities/community-vote-2025?invite=1&ref=BVVEVQ9c&refType=2&refUid=11796723&ref_type=165&utm_cmp=xjdtmcgP

- Reward

- 27

- 8

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

In 2026, I hope all of you can make abundant profits in this market cycle. For those optimistic about DOGE, a new year and a new atmosphere, maybe this will be the year of victory for the famous dog coin. Good luck!$SUI

SUI-3.76%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊Experience LinDaTong's AI intelligent interaction

View Original

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 2

- 6

- Repost

- Share

IfYouDon'tHaveMoney,GoLongOn :

:

I've indeed arrived, and I've been cut many times.View More

Hippo Morning Report Day 242. After a long period of unilateral decline, cryptocurrencies in 2026 are finally rising along with gold and US stocks!

Bitcoin has reached 94,000 as expected, even surpassing my expectations, hitting 94,700 at one point. Starting today, US banks can officially promote Bitcoin to their clients, which is even lower than the ETF threshold. The era of nationwide crypto adoption in the US is getting closer!

Ethereum successfully surpassed 3,200. Even more impressive, the transfer volume of stablecoins on Ethereum last quarter exceeded 8 trillion USD, setting a historica

View OriginalBitcoin has reached 94,000 as expected, even surpassing my expectations, hitting 94,700 at one point. Starting today, US banks can officially promote Bitcoin to their clients, which is even lower than the ETF threshold. The era of nationwide crypto adoption in the US is getting closer!

Ethereum successfully surpassed 3,200. Even more impressive, the transfer volume of stablecoins on Ethereum last quarter exceeded 8 trillion USD, setting a historica

- Reward

- like

- Comment

- Repost

- Share

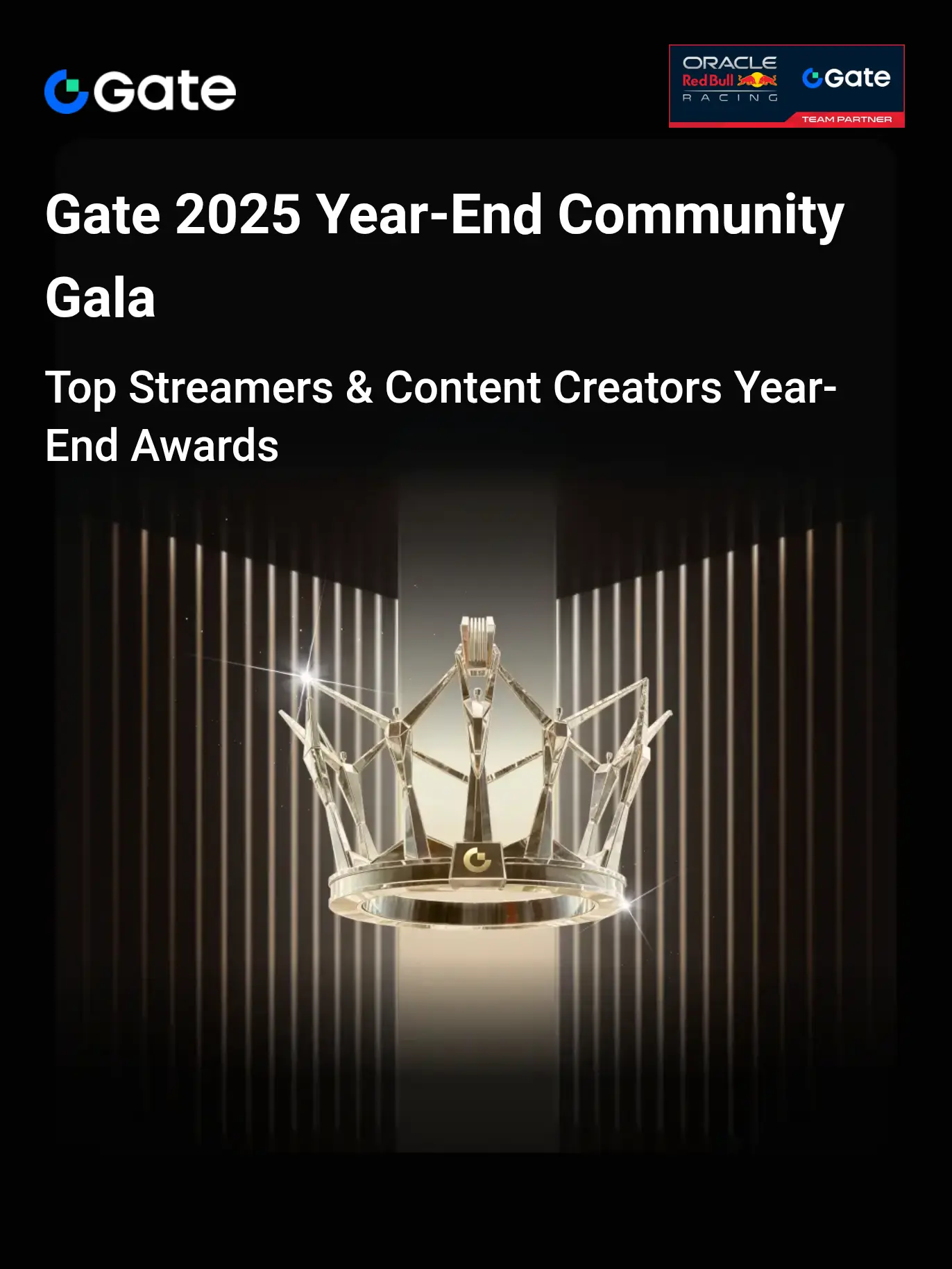

🚨WHALE RELOADS ON MAX-LEVERAGE LONGS

LookOnChain flagged a trader with LONG positions 4 hours ago across multiple assets:

500 BTC ($46.8M), 5,000 ETH ($16.1M), 134,278 SOL ($18.5M), 4.95B PUMP ($12.1M), 19.04M FARTCOIN ($8.4M), 14,154 ZEC ($7.2M).

High conviction. High risk!

$ETH $BTC $SOL $PUMP $FARTCOIN $ZEC

LookOnChain flagged a trader with LONG positions 4 hours ago across multiple assets:

500 BTC ($46.8M), 5,000 ETH ($16.1M), 134,278 SOL ($18.5M), 4.95B PUMP ($12.1M), 19.04M FARTCOIN ($8.4M), 14,154 ZEC ($7.2M).

High conviction. High risk!

$ETH $BTC $SOL $PUMP $FARTCOIN $ZEC

- Reward

- 1

- 2

- Repost

- Share

PumDip :

:

good project sirView More

Join the Gate Holiday Season Carnival and the Snowball Challenge to unlock a $100,000 USDT prize pool! Trade, invite, and share to earn snowball rewards. New users can also claim a 50 USDT Holiday Gift. https://www.gate.com/competition/holiday-season?ref_type=165&utm_cmp=7uuf2O1N&ref=UFRFAQ0M

- Reward

- 10

- 8

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

- Reward

- 1

- 3

- Repost

- Share

GoWithTheFlow :

:

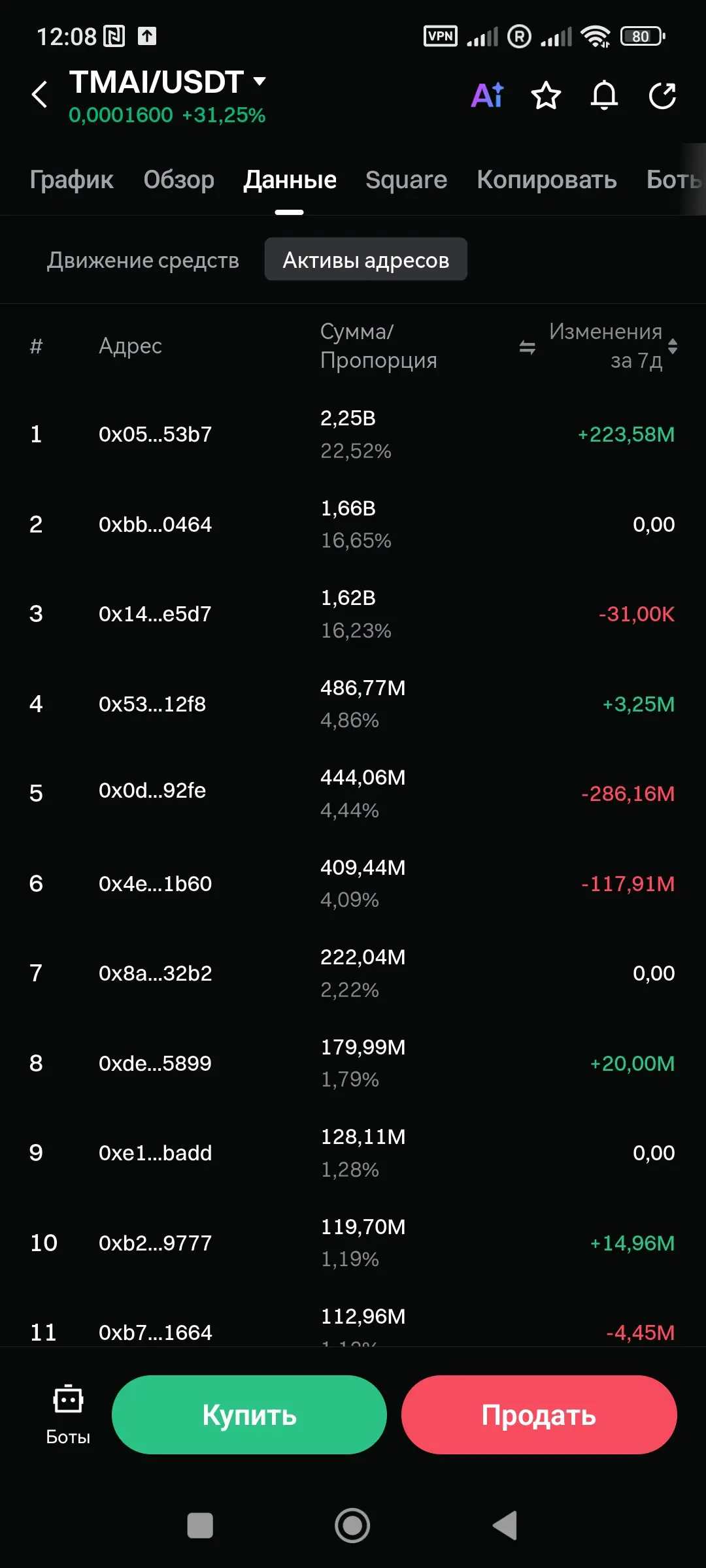

The data is just for you to see; what our eyes see may not necessarily be true.View More

#PredictionMarketDebate Forecasting, Finance, and the Fight for Legitimacy in 2026

As 2026 unfolds, prediction markets have moved from the fringes of crypto experimentation into the center of global policy and financial debate. Platforms such as Polymarket and Kalshi are no longer viewed merely as speculative tools or digital betting venues. Instead, they are increasingly shaping how investors, analysts, and even governments interpret probabilities around real-world events. This rapid rise in visibility has brought both credibility and controversy, as prediction markets now sit at the intersec

As 2026 unfolds, prediction markets have moved from the fringes of crypto experimentation into the center of global policy and financial debate. Platforms such as Polymarket and Kalshi are no longer viewed merely as speculative tools or digital betting venues. Instead, they are increasingly shaping how investors, analysts, and even governments interpret probabilities around real-world events. This rapid rise in visibility has brought both credibility and controversy, as prediction markets now sit at the intersec

- Reward

- 16

- 12

- Repost

- Share

CatAndMouse1 :

:

Buy To Earn 💎View More

Bitcoin is currently showing a high-level consolidation pattern, with a surge to around 94,415 yesterday evening followed by heavy selling pressure, leading to a sharp decline to a low near 91,210 early this morning. It then quickly rebounded and traded within a narrow range around 92,700, displaying a "rise - pullback - oscillation" pattern characteristic of a battle between bulls and bears. Ethereum's movement remains highly correlated with Bitcoin, dropping from a high of 3307 to a support level of 3181 before rebounding. Currently, it is oscillating around 3260, with the linked market effe

View Original

- Reward

- like

- Comment

- Repost

- Share

Relive a year in crypto—riding the market highs and taking bold leaps. Every moment counts. Check your #2025GateYearEndSummary now, recap your 2025 crypto adventure with Gate, and get 20 USDT through sharing. https://www.gate.com/competition/your-year-in-review-2025?ref=VQIRVFPCAG&ref_type=126

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

This month's goal is to earn 20,000 yuan, and I've already earned over 7,000. Keep it steady.

View Original- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More11.15K Popularity

21.68K Popularity

15.6K Popularity

7.5K Popularity

99.69K Popularity

Hot Gate Fun

View More- MC:$3.56KHolders:10.00%

- MC:$3.56KHolders:10.00%

- MC:$3.6KHolders:10.00%

- MC:$3.62KHolders:20.00%

- MC:$4.18KHolders:22.78%

News

View MoreThe probability of the Federal Reserve maintaining interest rates in January is 88.4%, and the probability of a rate cut is 11.6%.

23 m

The US Dollar Index rose 0.11%, closing at 98.683

38 m

U.S. stocks close, Dow Jones drops nearly 1%, Intel rises over 6%

1 h

The US stock market continues its decline, with the Dow Jones Industrial Average falling by 1%

1 h

Data: In the past 24 hours, the entire network has been liquidated for a total of $324 million, with long positions liquidated for $245 million and short positions liquidated for $78.2539 million.

2 h

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Your First Words Matter!

Share your first post on and split $10,000 in New Year rewards.

Post with #My2026FirstPost to share your New Year wish

2026U Position Voucher, Gate New Year boxes, F1 Red Bull merch await you!

Ends on Jan 15, 2026, 16:00 UTC

2026 starts with this post!Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693