Sykodelicc

No content yet

Sykodelicc

This is a very important chart.

Above we have the PSCF, which represents the performance, price movements, and market trends of the Invesco S&P SmallCap Financials ETF.

This essentially represents small-capitalisation U.S companies in the financial services and real estate sectors.

Basically, the companies that are the most sensitive to liquidity, borrowing, interest rates, credit etc. Small cap financials and regional banks.

This performs well in times of economic expansion and easing liquidity and badly in times of contractions. It is a lot more sensitive than that of the main S&P500 for ex

Above we have the PSCF, which represents the performance, price movements, and market trends of the Invesco S&P SmallCap Financials ETF.

This essentially represents small-capitalisation U.S companies in the financial services and real estate sectors.

Basically, the companies that are the most sensitive to liquidity, borrowing, interest rates, credit etc. Small cap financials and regional banks.

This performs well in times of economic expansion and easing liquidity and badly in times of contractions. It is a lot more sensitive than that of the main S&P500 for ex

BTC-1.33%

- Reward

- 2

- Comment

- Repost

- Share

Alts are starting breakout against Bitcoin.

The last two times this happened Alts outperformed against Bitcoin for:

2016- 574 days

2019- 770 days

Now, in 2026, they have broken the weekly trend and already put in 5 green weekly candles against Bitcoin.

This is not what has ever happened within traditional bear markets.

You can very clearly see that in every bear market since OTHERS has existed, this chart enters a steep and aggressive downtrend against Bitcoin.

And right now, its been consolidating and now breaking higher as Bitcoin has been dropping.

I'm not saying we are going to get 770 day

The last two times this happened Alts outperformed against Bitcoin for:

2016- 574 days

2019- 770 days

Now, in 2026, they have broken the weekly trend and already put in 5 green weekly candles against Bitcoin.

This is not what has ever happened within traditional bear markets.

You can very clearly see that in every bear market since OTHERS has existed, this chart enters a steep and aggressive downtrend against Bitcoin.

And right now, its been consolidating and now breaking higher as Bitcoin has been dropping.

I'm not saying we are going to get 770 day

BTC-1.33%

- Reward

- like

- Comment

- Repost

- Share

There will never be another alt szn...

Is all you hear, everywhere.

Alts have never been declared more dead than they are today.

And yet, while that is happening, a 100% hit rate signal for alt szn has just flashed.

This has predicted 6 out 6 alt szns, and it's happening right now.

Just as everyone thinks they're done and has bought metals.

It will never change.

Every single time the 3W MACD has flipped bullish, it has sparked an alt szn...

And for at least 6 months.

Call me delusional, retard, whatever...

This is just what the chart says... and i tend to listen to those over braindead reply g

Is all you hear, everywhere.

Alts have never been declared more dead than they are today.

And yet, while that is happening, a 100% hit rate signal for alt szn has just flashed.

This has predicted 6 out 6 alt szns, and it's happening right now.

Just as everyone thinks they're done and has bought metals.

It will never change.

Every single time the 3W MACD has flipped bullish, it has sparked an alt szn...

And for at least 6 months.

Call me delusional, retard, whatever...

This is just what the chart says... and i tend to listen to those over braindead reply g

- Reward

- like

- Comment

- Repost

- Share

It’s pretty simple.

Rates are coming down

Clarity act will be passed

Money will be very cheap

The tokens will send.

In 2022 after we topped we had

- 9% inflation

- had expanded the money supply by $3tn

- been in business cycle expansion for 18 months

Contraction was imminent.

Today, inflation is 2.4%, we finished the longest period of QT ever and the business cycle has just started expanding again.

The situation we are in could not be more different to 2022 and to expect this year to play out the same way, is folly.

The underlying market foundation could not be more different to las

Rates are coming down

Clarity act will be passed

Money will be very cheap

The tokens will send.

In 2022 after we topped we had

- 9% inflation

- had expanded the money supply by $3tn

- been in business cycle expansion for 18 months

Contraction was imminent.

Today, inflation is 2.4%, we finished the longest period of QT ever and the business cycle has just started expanding again.

The situation we are in could not be more different to 2022 and to expect this year to play out the same way, is folly.

The underlying market foundation could not be more different to las

- Reward

- like

- Comment

- Repost

- Share

This is something that most people will never be able to manage.

You make the most money when fewer people agree with you.

Most people simply move with the herd, finding comfort in the majority.

But the majority lose in this game.

For example, In this cycle, No one expected a new ATH before the halving.

But that’s exactly what we got.

Hardly anyone would believe it before it happened, but it did.

And there will be many other things that happen for the first time.

So If your entire investment strategy is based on only things that have happened before, you’ll always be one step behind.

You make the most money when fewer people agree with you.

Most people simply move with the herd, finding comfort in the majority.

But the majority lose in this game.

For example, In this cycle, No one expected a new ATH before the halving.

But that’s exactly what we got.

Hardly anyone would believe it before it happened, but it did.

And there will be many other things that happen for the first time.

So If your entire investment strategy is based on only things that have happened before, you’ll always be one step behind.

- Reward

- like

- Comment

- Repost

- Share

This is most severe its ever been.

OTHERS is at its most oversold position that it has ever been in.

Right now, OTHERS is -2.5+ standard deviations from the mean value.

There are only two other times in history that this has been reached.

1. COVID on a wick

2. 2022 Bear market low on a wick

But right now, we have a candle sitting on this level, which explains the horrendous sentiment around alts.

This kind of overextension has literally never happened...

And people think alts are gonna drop by another 50% here?

No chance.

OTHERS never even expanded this cycle, which is why this correction has

OTHERS is at its most oversold position that it has ever been in.

Right now, OTHERS is -2.5+ standard deviations from the mean value.

There are only two other times in history that this has been reached.

1. COVID on a wick

2. 2022 Bear market low on a wick

But right now, we have a candle sitting on this level, which explains the horrendous sentiment around alts.

This kind of overextension has literally never happened...

And people think alts are gonna drop by another 50% here?

No chance.

OTHERS never even expanded this cycle, which is why this correction has

- Reward

- like

- Comment

- Repost

- Share

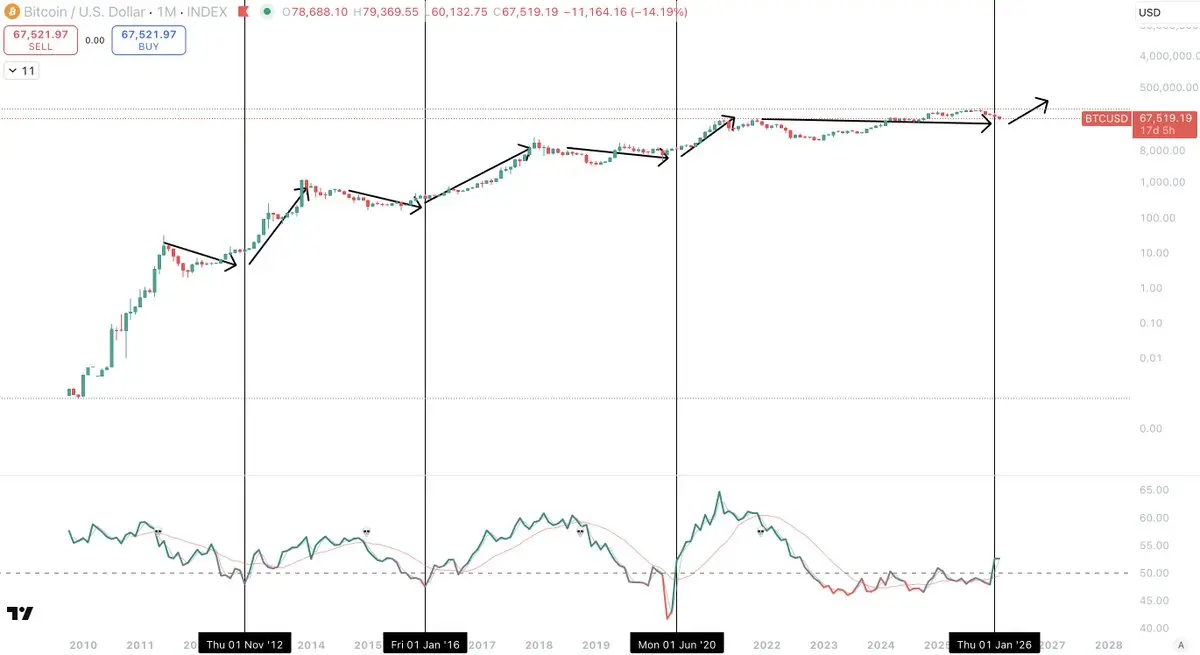

There has never been a bigger gap.

Right now, there are two camps on this app.

1. 4 year cycle, 75% correction, Bottom October Q4 1064 days

2. Macro and business cycle, currently a mid cycle top with expansion into new highs this year

What makes it even more interesting is that up until this very moment, the 4 year cycle theory has held weight.

And to add to that even more, this is the first time these cycles have diverged.

But what is more important to a liquidity asset like Bitcoin?

A time-based theory that leans on nothing but that... just time?

Or a macro framework that is based on the ac

Right now, there are two camps on this app.

1. 4 year cycle, 75% correction, Bottom October Q4 1064 days

2. Macro and business cycle, currently a mid cycle top with expansion into new highs this year

What makes it even more interesting is that up until this very moment, the 4 year cycle theory has held weight.

And to add to that even more, this is the first time these cycles have diverged.

But what is more important to a liquidity asset like Bitcoin?

A time-based theory that leans on nothing but that... just time?

Or a macro framework that is based on the ac

BTC-1.33%

- Reward

- like

- Comment

- Repost

- Share

Even if it’s not the bottom…

The amount of Spot buying volume at that level was very positive.

We had the second largest cluster of spot volume ever step in at that level.

Second only to the Trump pump top.

Safe to say that smart money likes Bitcoin at $60k, and I think any time spent revisiting there will be short lived.

We have had record breaking capitulation and the second highest spot volume spike…

Smells like capitulation to me.

The amount of Spot buying volume at that level was very positive.

We had the second largest cluster of spot volume ever step in at that level.

Second only to the Trump pump top.

Safe to say that smart money likes Bitcoin at $60k, and I think any time spent revisiting there will be short lived.

We have had record breaking capitulation and the second highest spot volume spike…

Smells like capitulation to me.

- Reward

- like

- Comment

- Repost

- Share

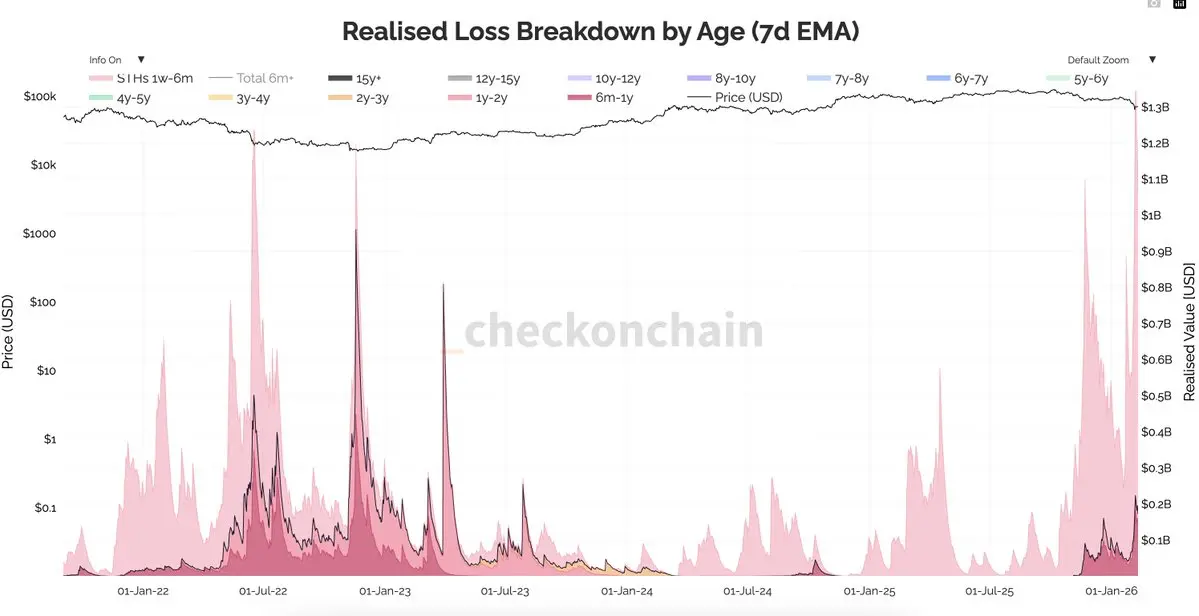

There is a very high chance $60k was our bottom.

I readily hold my hands up and admit that I got the previous $80k low wrong...

But after going over a wide variety of onchain charts, it is painfully clear just how much of a severe capitulation we had last Friday.

We set a new record for short term holder realised losses at a staggering $1.5bn.

Higher than any other period in Bitcoins history.

I thought the November 22 capitulation was high, but this has dwarfed it.

After such an insanely large realised loss figure we can see just how many people capitulated at the bottom...

Which is exactly wh

I readily hold my hands up and admit that I got the previous $80k low wrong...

But after going over a wide variety of onchain charts, it is painfully clear just how much of a severe capitulation we had last Friday.

We set a new record for short term holder realised losses at a staggering $1.5bn.

Higher than any other period in Bitcoins history.

I thought the November 22 capitulation was high, but this has dwarfed it.

After such an insanely large realised loss figure we can see just how many people capitulated at the bottom...

Which is exactly wh

- Reward

- like

- Comment

- Repost

- Share

Bitcoin volume is telling.

On the nuke to $60k we hit the 4th most large volume period since the 2022 bottom.

Each period since then that has recorded volume to this degree has marked a key pivot in price direction.

The last time volume was this high was just as Trump was elected and we pivoted from consolidation to expansion.

What do you think, was $60k the bottom?

On the nuke to $60k we hit the 4th most large volume period since the 2022 bottom.

Each period since then that has recorded volume to this degree has marked a key pivot in price direction.

The last time volume was this high was just as Trump was elected and we pivoted from consolidation to expansion.

What do you think, was $60k the bottom?

BTC-1.33%

- Reward

- 1

- Comment

- Repost

- Share

My conviction grows in this every day.

- What we have just been through is a mid cycle top

- This is now a mid cycle bottom

- We will go on to make new highs this year

- Those waiting for October bottom at $40k will miss

I think we are about to enter a period in time of Bitcoins existence that shocks everyone, even the most staunch of bulls.

It is my view that we have just finalised an expanded flat correction patter, that will lead us into new highs within this year.

After this deep breakdown, the timing of this has been pushed back somewhat, but definitely, if it plays out, new highs will be

- What we have just been through is a mid cycle top

- This is now a mid cycle bottom

- We will go on to make new highs this year

- Those waiting for October bottom at $40k will miss

I think we are about to enter a period in time of Bitcoins existence that shocks everyone, even the most staunch of bulls.

It is my view that we have just finalised an expanded flat correction patter, that will lead us into new highs within this year.

After this deep breakdown, the timing of this has been pushed back somewhat, but definitely, if it plays out, new highs will be

BTC-1.33%

- Reward

- like

- Comment

- Repost

- Share

Imagine.Bitcoin V shapes, gets back above $74k this month and continues to rally.I think it would probably be the most brutal 3 month period that this space would have ever seen.Utter devastation on both sides.

BTC-1.33%

- Reward

- like

- Comment

- Repost

- Share

Are these a good price?Asking for a friend.

- Reward

- like

- Comment

- Repost

- Share

Bought a truck load of $SOL just now…For the first time ever. 1W RSI at same level it was at $8 in 2022.3D RSI a bit lower than it was at $8Generational loading opportunity and no one will take it. Doesn’t matter how many times it happens, everyone will find reasons to not buy, until it goes higher again.

SOL-2.84%

- Reward

- like

- 1

- Repost

- Share

XiaoYu'sLife :

:

The entire 26 years should have been a decline 😂😂This is surging this week. And the clarity act being signed into law is the perfect narrative for market makers to use to go back up and rekt all the shorts. Decent chance we see this happen in Feb and it marks the bottom.

- Reward

- like

- Comment

- Repost

- Share

Everyone needs to understand this. The fact that Gold and Silver put in mammoth daily red candles after insane parabolic moves, with record breaking RSI levels never seen before…On the day the new FED Chair was announced…Is not a coincidence. Metals thrive in times of uncertainty…Now we have certainty. Even if it’s not the certainty some people wanted, it’s a certainty nonetheless.

- Reward

- like

- Comment

- Repost

- Share

Today is a big FOMC day. I think that we will go…UpDownUp a bit Down a bit more Up a bit more Down a little bit CT will change their bias 5 times in 6 hours and then we will continue up anyway.

- Reward

- like

- Comment

- Repost

- Share

Timeline on life support once more…On a Sunday…. As we swiped the main liquidity area. It’s always the same. I honestly read the timeline and physically laugh at the pathetic energy I read sometimes. Price goes down, everyone panics and starts posting lower. Price goes up, everyone chills and starts believing a bit again. If your thesis changes based on a daily candle you don’t have a thesis. If we get a decent green candle tomorrow everyone will be looking at higher again. The hardest fact about this game is that the majority are doomed to fail.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More202.59K Popularity

9.49K Popularity

43.45K Popularity

84.32K Popularity

848.25K Popularity

Pin