#Bitcoin2026PriceOutlook 📈 | Patience Over Predictions

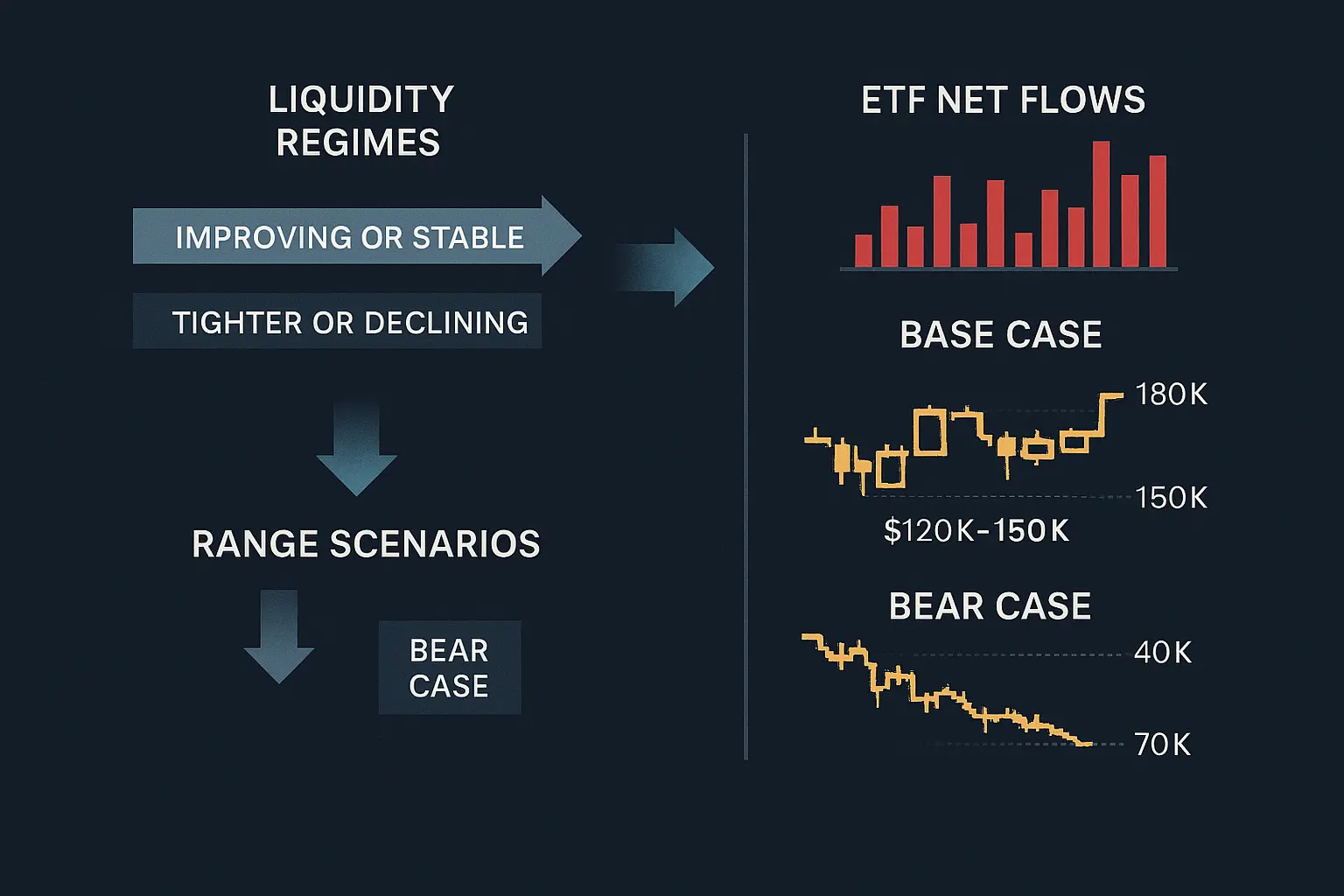

Instead of chasing extreme price targets, my Bitcoin outlook for 2026 is built on structure, adoption, and liquidity — not hype.

Bitcoin has already proven one thing clearly:

it survives cycles, emotions, and narratives — and consistently returns stronger.

🔹 What Supports BTC in 2026

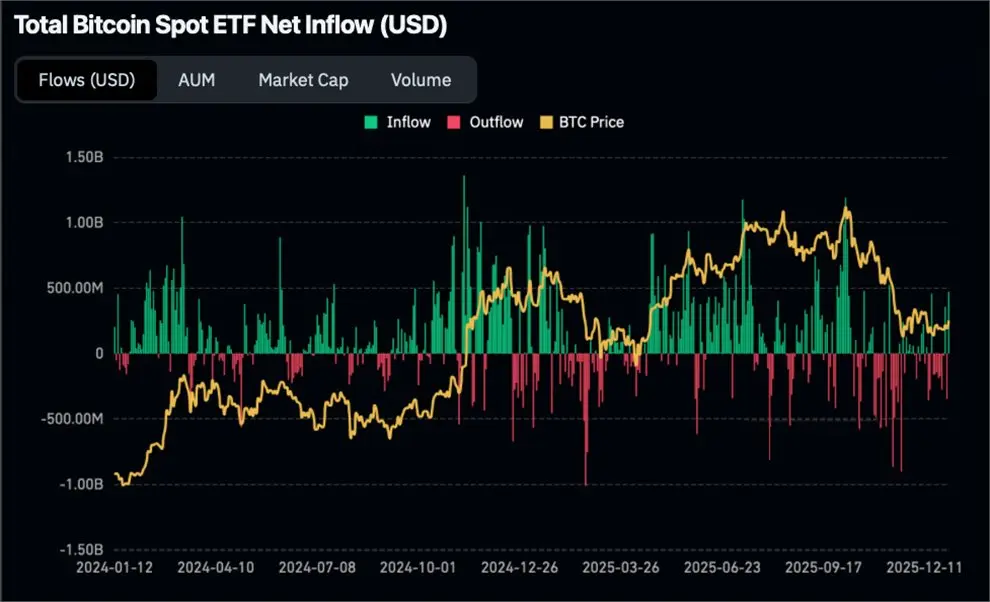

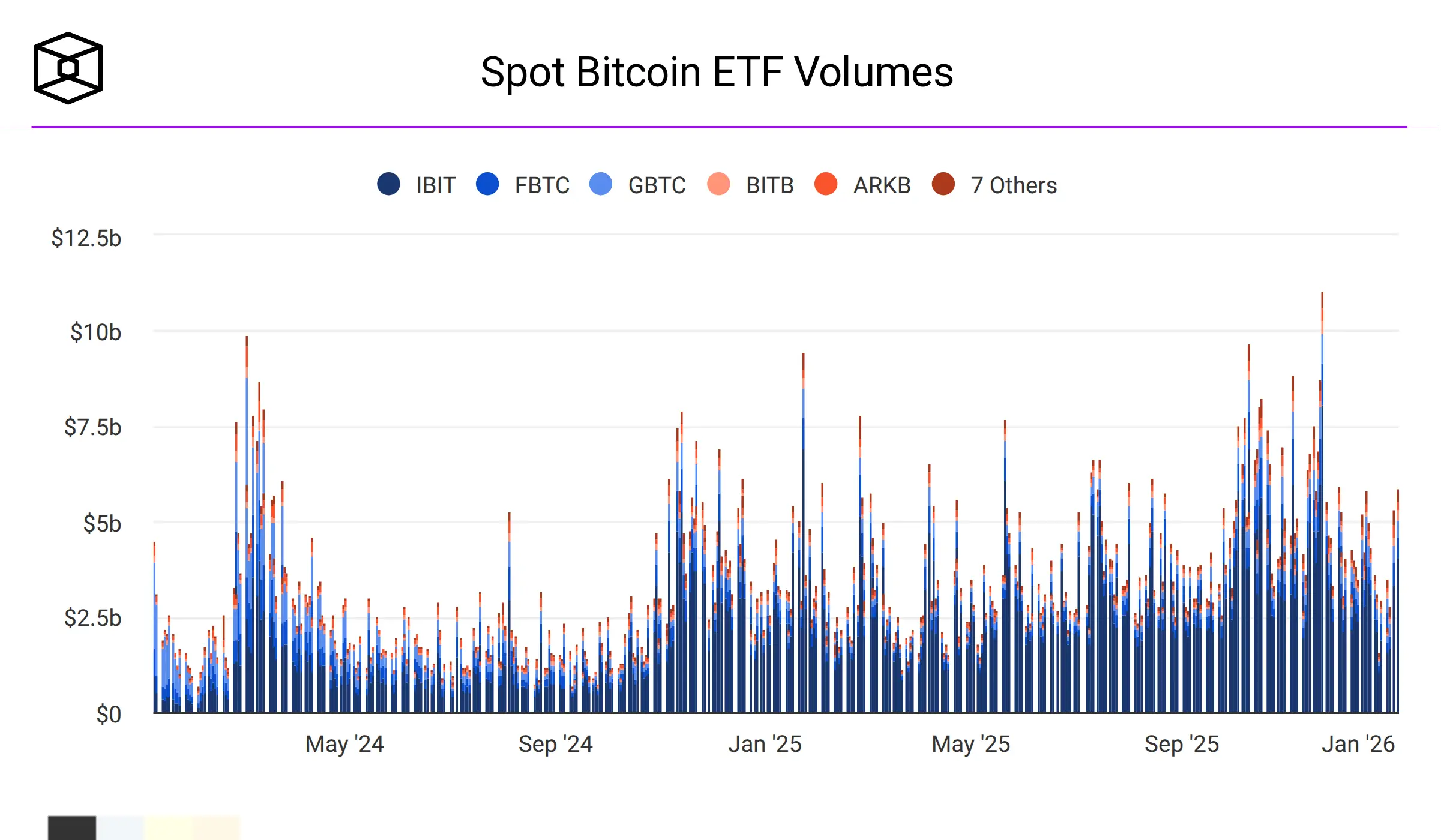

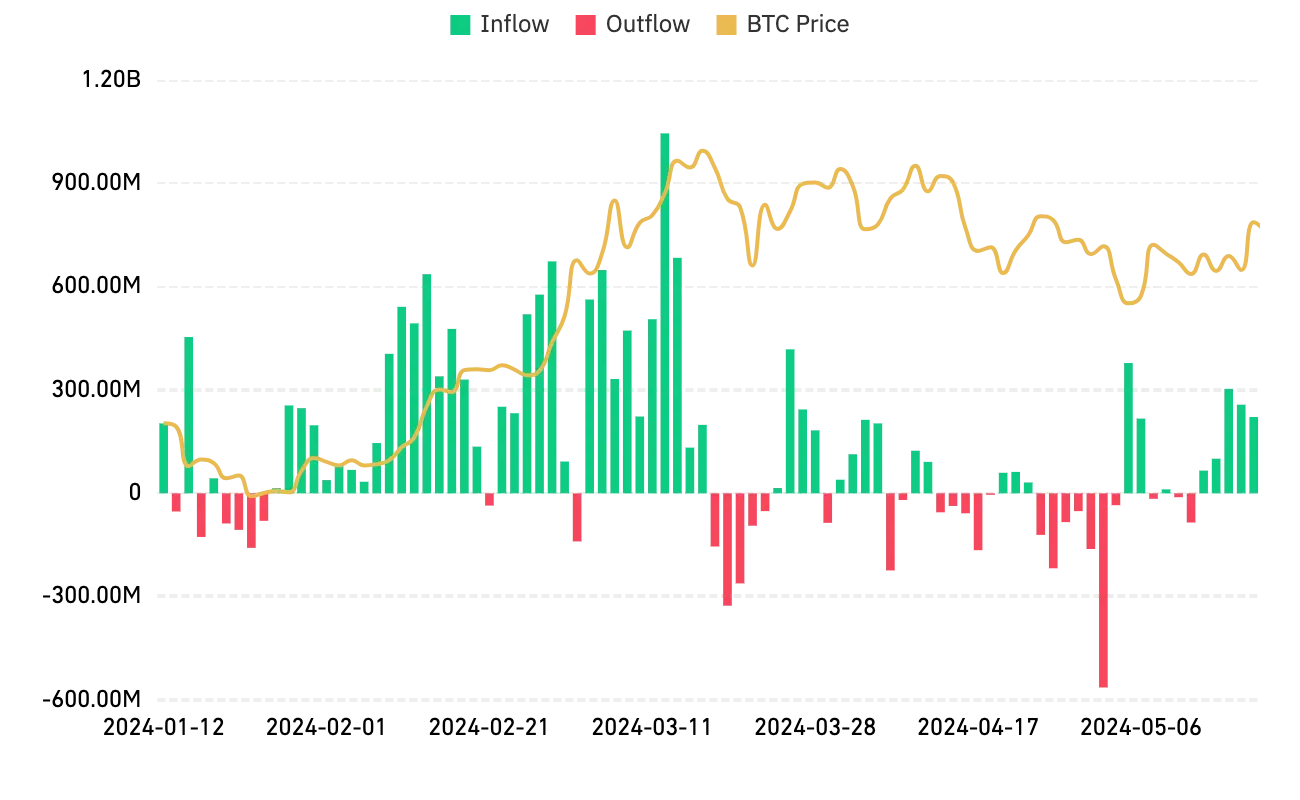

• Growing institutional exposure

• Spot ETFs improving access and liquidity

• Reduced supply pressure following the halving

• Increasing use as a long-term store of value

🔹 What Could Slow It Down

• Macroeconomic tightening

• Short-term over-leverage

• Emot

Instead of chasing extreme price targets, my Bitcoin outlook for 2026 is built on structure, adoption, and liquidity — not hype.

Bitcoin has already proven one thing clearly:

it survives cycles, emotions, and narratives — and consistently returns stronger.

🔹 What Supports BTC in 2026

• Growing institutional exposure

• Spot ETFs improving access and liquidity

• Reduced supply pressure following the halving

• Increasing use as a long-term store of value

🔹 What Could Slow It Down

• Macroeconomic tightening

• Short-term over-leverage

• Emot

BTC-1,81%