# BTC

37.66M

Crypto_Exper

#WhenWillBTCRebound? Most traders are asking the wrong question.

They keep asking “When will Bitcoin rebound?”

What they should be asking is:

“What conditions must be met before a rebound is even possible?”

Because markets don’t rebound on hope.

They rebound on exhaustion, liquidity, and positioning.

Let’s cut the noise.

1️⃣ Rebounds don’t start when fear appears — they start when fear gets boring

Right now, fear is loud. Too loud.

Every dip is being live-tweeted. Every candle is being dramatized.

That’s not capitulation.

That’s attention.

Real bottoms form when:

Volatility compresses

Volume d

They keep asking “When will Bitcoin rebound?”

What they should be asking is:

“What conditions must be met before a rebound is even possible?”

Because markets don’t rebound on hope.

They rebound on exhaustion, liquidity, and positioning.

Let’s cut the noise.

1️⃣ Rebounds don’t start when fear appears — they start when fear gets boring

Right now, fear is loud. Too loud.

Every dip is being live-tweeted. Every candle is being dramatized.

That’s not capitulation.

That’s attention.

Real bottoms form when:

Volatility compresses

Volume d

BTC-2,86%

- Reward

- 1

- Comment

- Repost

- Share

BTC Options Market Is Speaking — Are You Listening? 👀📊

Gate Research data shows BTC implied volatility has surged to the 81st percentile over the past year, signaling rising expectations for near-term price movement.

🔍 What stands out:

• BTC IV ~50% | ETH IV ~70%

• 25-delta skew stays negative → downside hedging demand rising

• Short-term curve steepening, while mid-long term remains stable

• Put spreads dominating large block trades — protection, not panic

📉 Institutions aren’t betting on a crash — they’re defending short-term risk while waiting for clearer direction.

💡 To help traders a

Gate Research data shows BTC implied volatility has surged to the 81st percentile over the past year, signaling rising expectations for near-term price movement.

🔍 What stands out:

• BTC IV ~50% | ETH IV ~70%

• 25-delta skew stays negative → downside hedging demand rising

• Short-term curve steepening, while mid-long term remains stable

• Put spreads dominating large block trades — protection, not panic

📉 Institutions aren’t betting on a crash — they’re defending short-term risk while waiting for clearer direction.

💡 To help traders a

- Reward

- 1

- 2

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

#WhenWillBTCRebound? 📈🤔

Bitcoin has pulled back hard — but the real question isn’t “Why did it drop?”

It’s “When does momentum return?”

Right now BTC is stabilizing around key demand zones after heavy liquidations and macro-driven selling pressure. Historically, rebounds begin when three things align:

1️⃣ Support Holds Strong – If BTC continues defending the $75K–$78K zone, confidence builds.

2️⃣ Fear Peaks – Extreme Fear often marks local bottoms. Smart money accumulates when retail hesitates.

3️⃣ Macro Stabilizes – Dollar strength cools, ETF outflows slow, and liquidity improves.

🔎 What t

Bitcoin has pulled back hard — but the real question isn’t “Why did it drop?”

It’s “When does momentum return?”

Right now BTC is stabilizing around key demand zones after heavy liquidations and macro-driven selling pressure. Historically, rebounds begin when three things align:

1️⃣ Support Holds Strong – If BTC continues defending the $75K–$78K zone, confidence builds.

2️⃣ Fear Peaks – Extreme Fear often marks local bottoms. Smart money accumulates when retail hesitates.

3️⃣ Macro Stabilizes – Dollar strength cools, ETF outflows slow, and liquidity improves.

🔎 What t

BTC-2,86%

- Reward

- 5

- 8

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

#WhenWillBTCRebound? 📉 BTC Market Update – Rebound Still Unconfirmed

BTC is moving sideways around key support, showing weak bounces while facing persistent selling pressure below major resistance. This price behavior suggests the market is still in a wait-and-watch phase, not a confirmed reversal yet.

🔎 What would confirm a real rebound?

I’d look for these signals before trusting upside:

✔️ Clear break & close above major resistance

✔️ Higher high + higher low (structure shift)

✔️ Rising volume on green candles

✔️ Momentum indicators (RSI / MACD) turning bullish

✔️ Reduction in sell-side pr

BTC is moving sideways around key support, showing weak bounces while facing persistent selling pressure below major resistance. This price behavior suggests the market is still in a wait-and-watch phase, not a confirmed reversal yet.

🔎 What would confirm a real rebound?

I’d look for these signals before trusting upside:

✔️ Clear break & close above major resistance

✔️ Higher high + higher low (structure shift)

✔️ Rising volume on green candles

✔️ Momentum indicators (RSI / MACD) turning bullish

✔️ Reduction in sell-side pr

BTC-2,86%

- Reward

- 1

- Comment

- Repost

- Share

🇨🇦 Canadian Investment Regulator Announces New Rules for Crypto Assets! Here Are the Details

The Investment Regulatory Authority of Canada (CIRO), one of Canada’s top regulatory bodies in the investment sector, has announced new rules for cryptocurrency custody services.

The newly published “Digital Asset Custody Framework” sets clear standards for how member brokerage firms operating cryptocurrency trading platforms (CTPs) should protect client assets.

CIRO stated that the new framework aims to prevent losses resulting from hacking attacks, fraud, and inadequate corporate governance. The ru

The Investment Regulatory Authority of Canada (CIRO), one of Canada’s top regulatory bodies in the investment sector, has announced new rules for cryptocurrency custody services.

The newly published “Digital Asset Custody Framework” sets clear standards for how member brokerage firms operating cryptocurrency trading platforms (CTPs) should protect client assets.

CIRO stated that the new framework aims to prevent losses resulting from hacking attacks, fraud, and inadequate corporate governance. The ru

BTC-2,86%

- Reward

- 1

- 2

- Repost

- Share

MrKing :

:

Buy To Earn 💎View More

#WhenWillBTCRebound? Most traders are asking the wrong question.

They keep asking “When will Bitcoin rebound?”

What they should be asking is:

“What conditions must be met before a rebound is even possible?”

Because markets don’t rebound on hope.

They rebound on exhaustion, liquidity, and positioning.

Let’s cut the noise.

1️⃣ Rebounds don’t start when fear appears — they start when fear gets boring

Right now, fear is loud. Too loud.

Every dip is being live-tweeted. Every candle is being dramatized.

That’s not capitulation.

That’s attention.

Real bottoms form when:

Volatility compresses

Volume d

They keep asking “When will Bitcoin rebound?”

What they should be asking is:

“What conditions must be met before a rebound is even possible?”

Because markets don’t rebound on hope.

They rebound on exhaustion, liquidity, and positioning.

Let’s cut the noise.

1️⃣ Rebounds don’t start when fear appears — they start when fear gets boring

Right now, fear is loud. Too loud.

Every dip is being live-tweeted. Every candle is being dramatized.

That’s not capitulation.

That’s attention.

Real bottoms form when:

Volatility compresses

Volume d

BTC-2,86%

- Reward

- 5

- 3

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

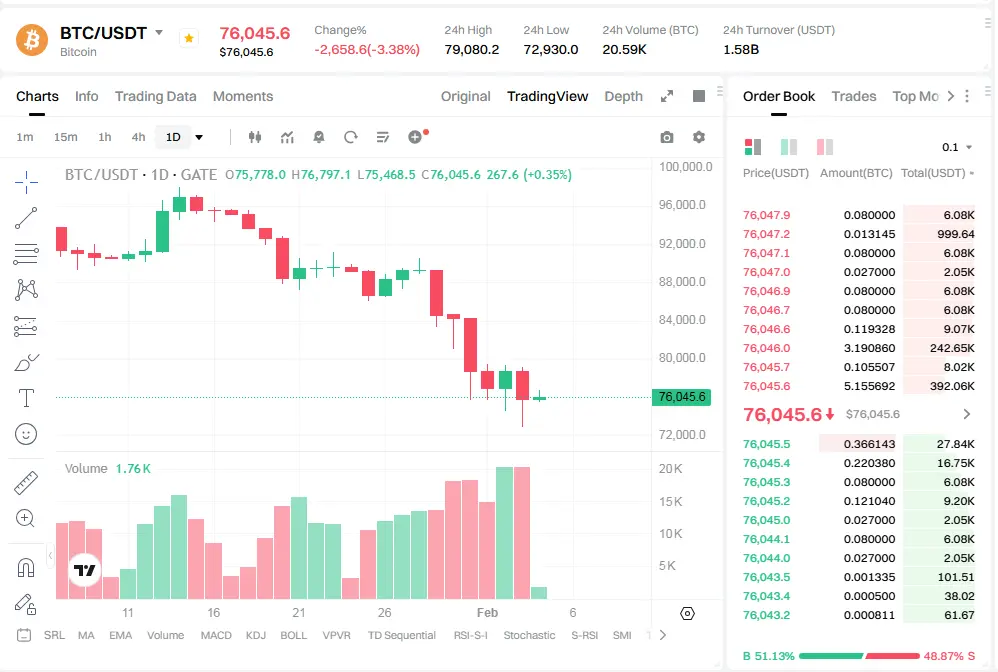

Digital financial markets and core assets as of the morning of February 4, 2026.

📉 Bitcoin (BTC): A "Roller Coast" After the Liquidity Shock

The Bitcoin market is experiencing extremely volatile hours, marking its lowest point since the US election more than a year ago.

24-hour volatility: BTC witnessed a fierce sell-off from a high of $79,180, plummeting to the $72,900 region before a slight recovery.

Opening price this morning: BTC started the day at $75,770. The fact that the price held above $75,000 after the sharp drop shows that "bottom-buying" is still present, but market sentiment rem

📉 Bitcoin (BTC): A "Roller Coast" After the Liquidity Shock

The Bitcoin market is experiencing extremely volatile hours, marking its lowest point since the US election more than a year ago.

24-hour volatility: BTC witnessed a fierce sell-off from a high of $79,180, plummeting to the $72,900 region before a slight recovery.

Opening price this morning: BTC started the day at $75,770. The fact that the price held above $75,000 after the sharp drop shows that "bottom-buying" is still present, but market sentiment rem

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

📊 BTC Market Snapshot — Downside Pressure Remains

Bitcoin declined by approximately 2.5% over the last 24 hours, falling to the 76,888 USDT area. Market sentiment remains fragile, with the Fear & Greed Index at 17, signaling Extreme Fear across the crypto market.

🔎 Key Metrics

24h Price Change: –2.5%

Daily High / Low: 79,287.9 / 76,693.0 USDT

Key Support Zone: ~76,946 USDT

Key Resistance Zone: ~78,420 USDT

RSI (14): 33.1 (near oversold territory)

MACD: Bearish signal, negative momentum

🧠 Technical Overview

Price action remains below all short-term moving averages (MA5–MA50), indicating stro

Bitcoin declined by approximately 2.5% over the last 24 hours, falling to the 76,888 USDT area. Market sentiment remains fragile, with the Fear & Greed Index at 17, signaling Extreme Fear across the crypto market.

🔎 Key Metrics

24h Price Change: –2.5%

Daily High / Low: 79,287.9 / 76,693.0 USDT

Key Support Zone: ~76,946 USDT

Key Resistance Zone: ~78,420 USDT

RSI (14): 33.1 (near oversold territory)

MACD: Bearish signal, negative momentum

🧠 Technical Overview

Price action remains below all short-term moving averages (MA5–MA50), indicating stro

BTC-2,86%

- Reward

- 16

- 26

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

10.65K Popularity

7.47K Popularity

6.46K Popularity

2.71K Popularity

4.2K Popularity

3.37K Popularity

3.25K Popularity

24.27K Popularity

16.41K Popularity

10.95K Popularity

1.05K Popularity

8.74K Popularity

21.26K Popularity

17.7K Popularity

227.65K Popularity

News

View MoreBeijing Business Daily: Hong Kong stablecoin license review enters final stages, industry warns of regulatory policy differences with mainland China

2 m

The police reveal a new scam method, where gold cash-out combined with virtual currency circulation creates a money laundering cycle.

5 m

BTC and ETH have rebounded from their recent lows and are temporarily stabilizing, while the trend of de-risking in derivatives continues.

5 m

Sichuan Buxue County, China, issues notice: "Prohibition of Virtual Currency Mining Activities"

7 m

The Ministry of Public Security's draft on Internet Crime Prevention and Control Law includes illegal virtual currency transactions.

11 m

Pin