#USGovernmentShutdownRisk

A US government shutdown occurs when Congress fails to pass the annual budget or a continuing resolution to fund federal operations. The US government operates almost entirely on federal appropriations, which are approved each fiscal year. When funding is not approved by the deadline, non-essential government departments and programs temporarily halt operations, while essential services like national security, law enforcement, and Social Security continue.

Why shutdowns happen:

Political gridlock between Congress and the President.

Disagreements over spending priorities or debt ceilings.

Failure to pass temporary funding measures (continuing resolutions) when the full budget is delayed.

Even partial shutdowns can create uncertainty. Historically, short shutdowns last a few days to a week, while prolonged ones can stretch into weeks or even a month, affecting both domestic and global markets.

Impact on Federal Operations and Economy

Non-essential services paused:

Federal agencies responsible for public parks, visa and passport processing, regulatory approvals, research grants, and inspections often stop operating.

This reduces economic activity in sectors relying on these services, such as tourism, transportation, and regulated industries.

Federal employees furloughed:

Hundreds of thousands of federal workers may be temporarily sent home without pay.

This lowers consumer spending temporarily, affecting sectors like retail, housing, and services dependent on government employees.

Public programs delayed:

Federal grants, subsidies, and social programs may be postponed.

Delays in healthcare programs, education funding, and federal contracts impact businesses that rely on government payments.

Macro ripple effects:

Consumer confidence often drops.

Short-term GDP growth may decline by 0.1–0.3% for brief shutdowns.

Uncertainty can slow capital allocation and investment decisions, creating risk-off sentiment across financial markets.

Crypto Market Implications

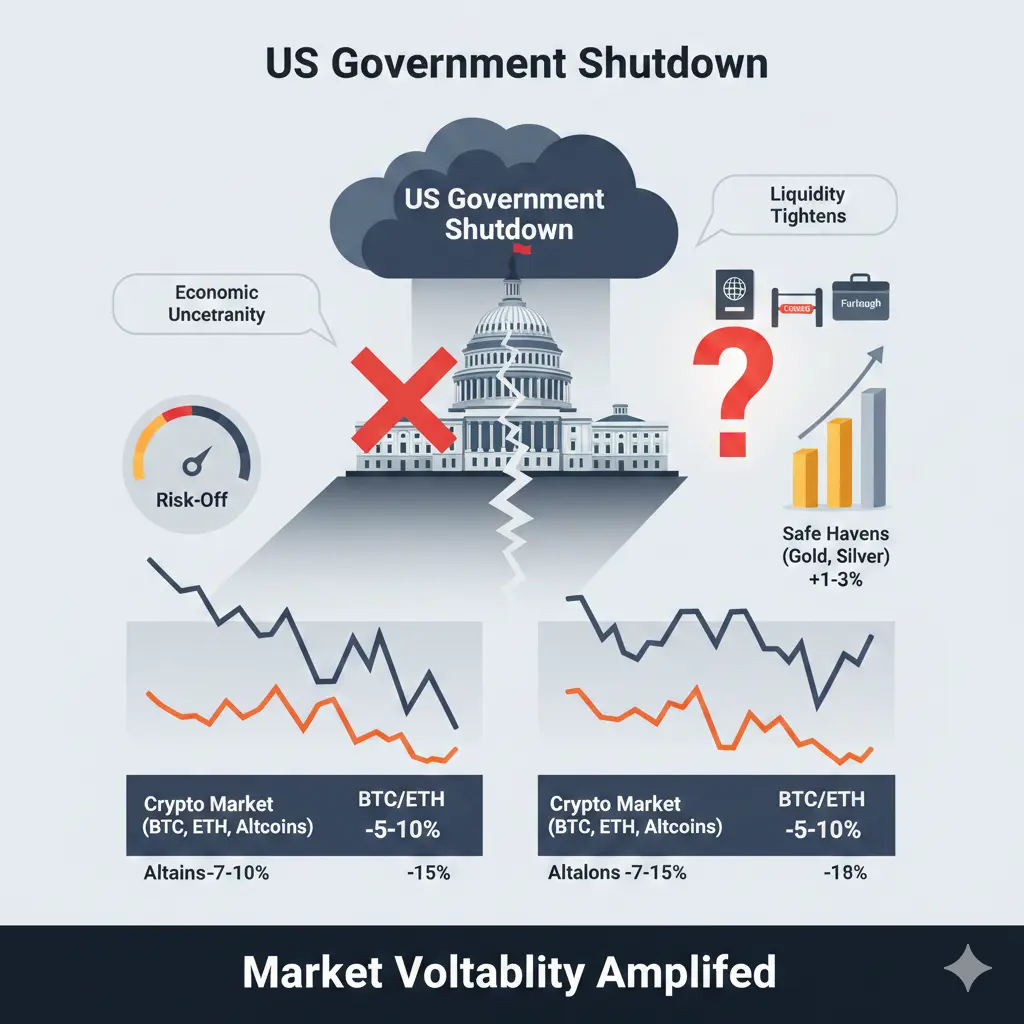

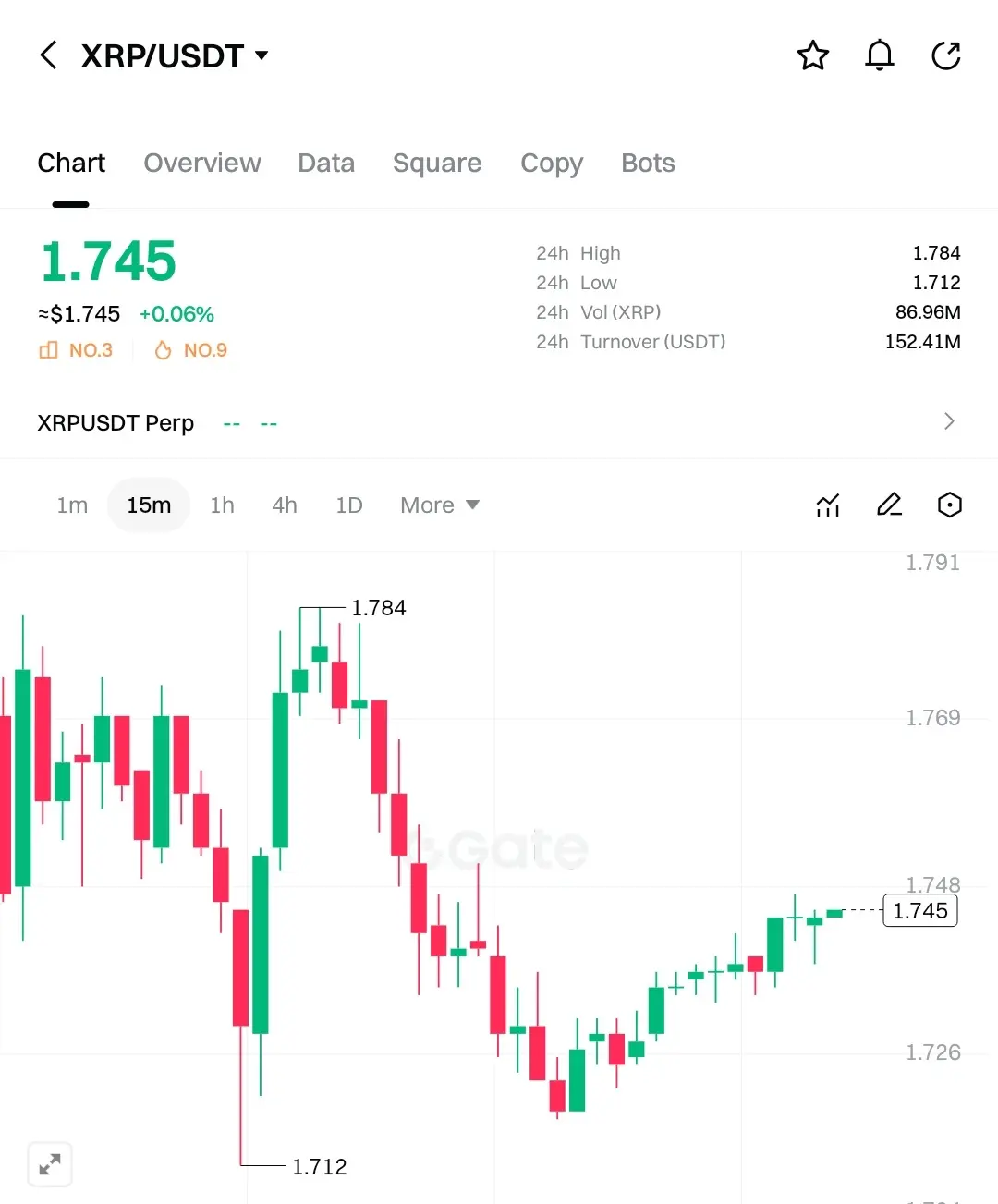

The crypto market is sensitive to macro uncertainty. A government shutdown can trigger:

BTC (Bitcoin):

Short-term volatility of 5–10% is possible.

Liquidity may tighten as institutional investors delay large transactions.

Trading volumes often rise 10–15% as traders react to uncertainty and hedge positions.

Prices may dip 3–7% depending on market reaction.

ETH (Ethereum):

Higher intraday swings, often 5–10%, due to network congestion and technical sensitivity.

Whale and institutional flows can partially stabilize ETH liquidity, but price swings are amplified if panic trading occurs.

Altcoins:

Lower-liquidity coins are most affected. Prices can swing 7–15%, and volumes may spike initially before dropping if uncertainty persists.

Precious Metals & Safe-Haven Assets

Gold: Typically rises 1–3%, as investors seek stability.

Silver: Gains 1–2% on safe-haven inflows.

Treasuries & Bonds: Yields may fall slightly as investors move funds from risk assets to government-backed securities.

These assets act as a hedge against uncertainty in crypto and equity markets.

Overall Market Sentiment & Liquidity

Investor sentiment: Risk-off dominates; traders prefer safer positions, reducing appetite for speculative crypto trades.

Liquidity: May temporarily tighten in BTC and altcoins, while derivatives positions may help smooth price swings for BTC and ETH.

Volume: Short-term volume spikes as traders react to news but may decline if the shutdown persists.

Equities: US stock indices could drop 2–4%, mirroring crypto risk-off behavior.

Key Takeaways

A US government shutdown is a temporary but significant disruption in federal operations, creating macroeconomic and market uncertainty.

BTC and ETH may experience 5–10% short-term volatility, altcoins 7–15%, and liquidity may tighten.

Gold and silver act as safe havens, typically rising 1–3% during these events.

Market participants should adopt risk-managed strategies, monitor macro developments, and consider liquidity constraints in crypto and other risk assets.

While a shutdown may only last days or weeks, its psychological and financial impact can amplify short-term market volatility, affecting crypto, altcoins, equities, and precious metals alike.

A US government shutdown occurs when Congress fails to pass the annual budget or a continuing resolution to fund federal operations. The US government operates almost entirely on federal appropriations, which are approved each fiscal year. When funding is not approved by the deadline, non-essential government departments and programs temporarily halt operations, while essential services like national security, law enforcement, and Social Security continue.

Why shutdowns happen:

Political gridlock between Congress and the President.

Disagreements over spending priorities or debt ceilings.

Failure to pass temporary funding measures (continuing resolutions) when the full budget is delayed.

Even partial shutdowns can create uncertainty. Historically, short shutdowns last a few days to a week, while prolonged ones can stretch into weeks or even a month, affecting both domestic and global markets.

Impact on Federal Operations and Economy

Non-essential services paused:

Federal agencies responsible for public parks, visa and passport processing, regulatory approvals, research grants, and inspections often stop operating.

This reduces economic activity in sectors relying on these services, such as tourism, transportation, and regulated industries.

Federal employees furloughed:

Hundreds of thousands of federal workers may be temporarily sent home without pay.

This lowers consumer spending temporarily, affecting sectors like retail, housing, and services dependent on government employees.

Public programs delayed:

Federal grants, subsidies, and social programs may be postponed.

Delays in healthcare programs, education funding, and federal contracts impact businesses that rely on government payments.

Macro ripple effects:

Consumer confidence often drops.

Short-term GDP growth may decline by 0.1–0.3% for brief shutdowns.

Uncertainty can slow capital allocation and investment decisions, creating risk-off sentiment across financial markets.

Crypto Market Implications

The crypto market is sensitive to macro uncertainty. A government shutdown can trigger:

BTC (Bitcoin):

Short-term volatility of 5–10% is possible.

Liquidity may tighten as institutional investors delay large transactions.

Trading volumes often rise 10–15% as traders react to uncertainty and hedge positions.

Prices may dip 3–7% depending on market reaction.

ETH (Ethereum):

Higher intraday swings, often 5–10%, due to network congestion and technical sensitivity.

Whale and institutional flows can partially stabilize ETH liquidity, but price swings are amplified if panic trading occurs.

Altcoins:

Lower-liquidity coins are most affected. Prices can swing 7–15%, and volumes may spike initially before dropping if uncertainty persists.

Precious Metals & Safe-Haven Assets

Gold: Typically rises 1–3%, as investors seek stability.

Silver: Gains 1–2% on safe-haven inflows.

Treasuries & Bonds: Yields may fall slightly as investors move funds from risk assets to government-backed securities.

These assets act as a hedge against uncertainty in crypto and equity markets.

Overall Market Sentiment & Liquidity

Investor sentiment: Risk-off dominates; traders prefer safer positions, reducing appetite for speculative crypto trades.

Liquidity: May temporarily tighten in BTC and altcoins, while derivatives positions may help smooth price swings for BTC and ETH.

Volume: Short-term volume spikes as traders react to news but may decline if the shutdown persists.

Equities: US stock indices could drop 2–4%, mirroring crypto risk-off behavior.

Key Takeaways

A US government shutdown is a temporary but significant disruption in federal operations, creating macroeconomic and market uncertainty.

BTC and ETH may experience 5–10% short-term volatility, altcoins 7–15%, and liquidity may tighten.

Gold and silver act as safe havens, typically rising 1–3% during these events.

Market participants should adopt risk-managed strategies, monitor macro developments, and consider liquidity constraints in crypto and other risk assets.

While a shutdown may only last days or weeks, its psychological and financial impact can amplify short-term market volatility, affecting crypto, altcoins, equities, and precious metals alike.