楚凡fly

No content yet

楚凡fly

ETH Strategy Analysis: Relying on resistance, planning for pullback

Market Analysis: Ethereum has recently shown a pattern of oscillating convergence, with volatility continuously narrowing, indicating a direction is about to be chosen. Combining this with the overall technical structure, the upward momentum is weakening, leaning towards shorting on rallies.

· Entry Area: 3015 - 3040

· Stop loss setting: 3080 (If it effectively breaks above this level, the strategy becomes invalid)

· Target levels: First target 2950, second target 2900, key support 2870, ultimate target 2800

Risk control remin

Market Analysis: Ethereum has recently shown a pattern of oscillating convergence, with volatility continuously narrowing, indicating a direction is about to be chosen. Combining this with the overall technical structure, the upward momentum is weakening, leaning towards shorting on rallies.

· Entry Area: 3015 - 3040

· Stop loss setting: 3080 (If it effectively breaks above this level, the strategy becomes invalid)

· Target levels: First target 2950, second target 2900, key support 2870, ultimate target 2800

Risk control remin

ETH1,25%

- Reward

- like

- Comment

- Repost

- Share

Brothers, BTC! Get ready to do some short orders.

· In the range of 91,500-92,000, you can consider entering short orders in batches.

· Place the stop loss above 92,700, and if it breaks, then admit the mistake and exit.

· The target is first to look at the 90,000 level, and if it goes smoothly, continue to look down at 89,000 or even 88,000. $BTC #十二月降息预测

· In the range of 91,500-92,000, you can consider entering short orders in batches.

· Place the stop loss above 92,700, and if it breaks, then admit the mistake and exit.

· The target is first to look at the 90,000 level, and if it goes smoothly, continue to look down at 89,000 or even 88,000. $BTC #十二月降息预测

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Ethereum has risen sharply from the low of 2990, currently facing resistance at the key level near 3100. Today's strategy is to plan short orders in the range of 3000-3040, with the stop loss set at 3080. The targets below are sequentially set at 2930, 2850, and around 2800. $ETH

ETH1,25%

- Reward

- like

- Comment

- Repost

- Share

Brothers, the essence of a volatile market is to buy low, sell high! Here is a clear short order strategy:

Strategy: Relying on the upper pressure of the 90700-91200 range to place a short order.

Risk control: Set the stop loss uniformly above 91900.

Target Outlook: The primary goal below is 89500, further looking around 88500, with considerable space. $BTC

Strategy: Relying on the upper pressure of the 90700-91200 range to place a short order.

Risk control: Set the stop loss uniformly above 91900.

Target Outlook: The primary goal below is 89500, further looking around 88500, with considerable space. $BTC

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Ethereum has strongly rebounded from the low point of 2620, now breaking through the 3000 level and the long-term downtrend line. The daily chart MACD has formed a golden cross pattern with higher trade volumes, and the moving averages are in a long positions arrangement, with 2800 now serving as strong support. The trend has turned bullish, and the market is expected to challenge the 3200-3500 range.

Operation suggestions:

Long positions in the range of 2980-3020, risk control at 2940, target at 3100-3180-3260-3340. At each target, you can take profits freely. $BTC

View OriginalOperation suggestions:

Long positions in the range of 2980-3020, risk control at 2940, target at 3100-3180-3260-3340. At each target, you can take profits freely. $BTC

- Reward

- like

- Comment

- Repost

- Share

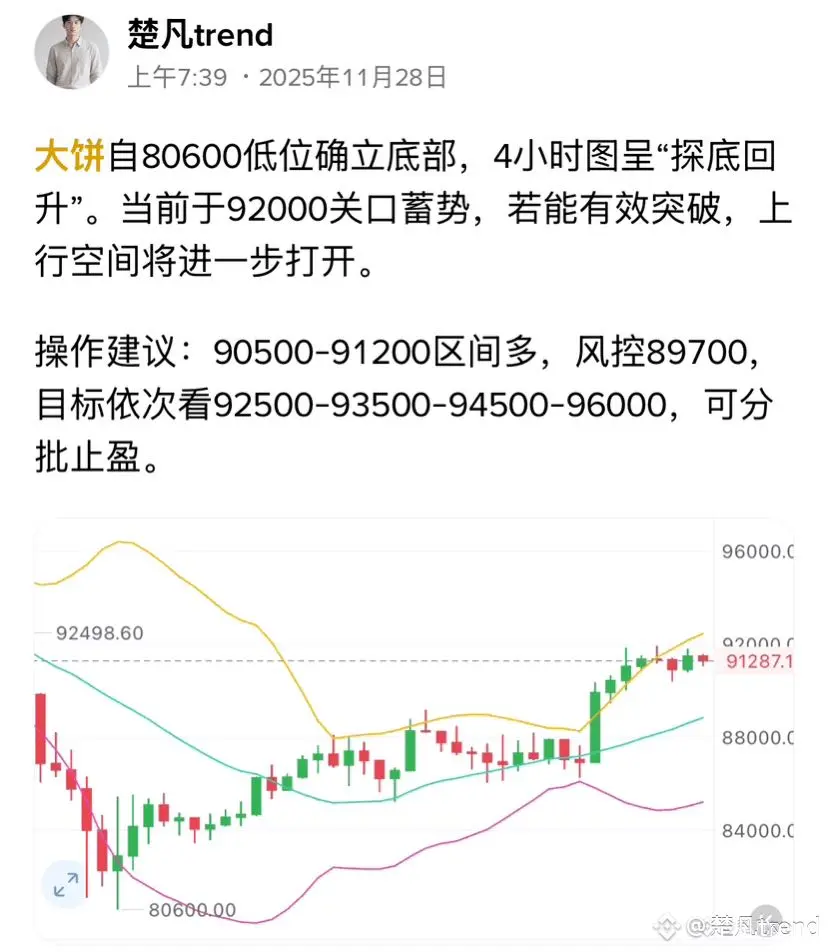

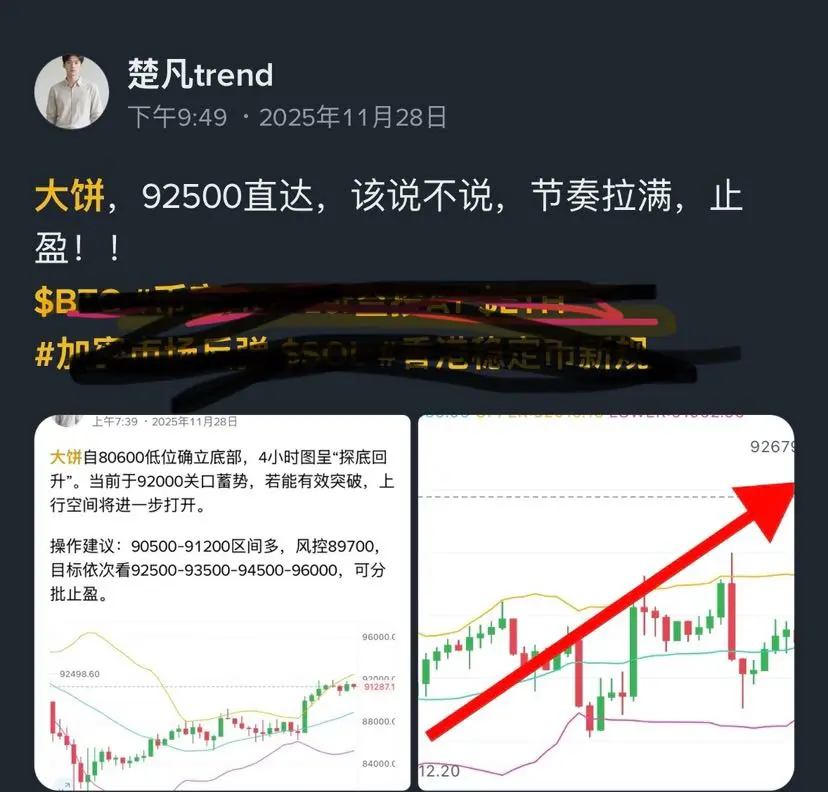

Analysis: BTC has established a bottom since the low of 80300, and the 4-hour chart shows a "bottoming out and rebounding" pattern. Currently, it is consolidating around the 92000 level, and if it can effectively break through, the upward space will further open up.

Trading suggestion: Buy in the range of 90500-91200, risk control at 89700, with targets sequentially at 92500-93500-94500-96000, can take profits in batches. $BTC

Trading suggestion: Buy in the range of 90500-91200, risk control at 89700, with targets sequentially at 92500-93500-94500-96000, can take profits in batches. $BTC

BTC1,59%

- Reward

- 2

- 1

- Repost

- Share

GateUser-64480bbb :

:

thanks, 🙏In simple terms, SOL currently has stronger bearish momentum and the short-term trend is somewhat weak.

· Current momentum: Several key technical indicators show that selling pressure outweighs buying pressure, and the price may continue to decline.

· Trading strategy:

· If you are more aggressive, consider shorting around 165.

· If you prefer a more cautious approach, wait further; if the price rebounds to the 168-172 range, it could be a more secure shorting opportunity.

· Risk management:

· Regardless of the approach, set a stop loss with 175 as the final line of defense. If the price

· Current momentum: Several key technical indicators show that selling pressure outweighs buying pressure, and the price may continue to decline.

· Trading strategy:

· If you are more aggressive, consider shorting around 165.

· If you prefer a more cautious approach, wait further; if the price rebounds to the 168-172 range, it could be a more secure shorting opportunity.

· Risk management:

· Regardless of the approach, set a stop loss with 175 as the final line of defense. If the price

SOL1,97%

- Reward

- like

- Comment

- Repost

- Share

Here's a brief overview of the midnight market:

First, look at the big picture. The weekly chart has already confirmed a bearish candle, and several key indicators suggest that the downtrend is not over yet. Overall, the bearish forces still dominate.

Although there is a rebound on the daily chart, this is normal during a downtrend. It can be understood as "a breather after a sharp decline" or "a transit point on the way down."

Regarding specific operations, there are two scenarios:

1. If you are a short-term trader and want to avoid floating losses:

· You can try short positions lightly in

First, look at the big picture. The weekly chart has already confirmed a bearish candle, and several key indicators suggest that the downtrend is not over yet. Overall, the bearish forces still dominate.

Although there is a rebound on the daily chart, this is normal during a downtrend. It can be understood as "a breather after a sharp decline" or "a transit point on the way down."

Regarding specific operations, there are two scenarios:

1. If you are a short-term trader and want to avoid floating losses:

· You can try short positions lightly in

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

Current Time: Early morning, November 7

The short positions around 104,600 for Bitcoin and 3,480 for Ether that I mentioned yesterday are now ripe for harvest—it's time to reap the rewards!

At the time of writing, Bitcoin has reached 100,600, and Ether has hit 3,250—targets fully achieved.

Take immediate action: exit all positions and enjoy the gains! For those willing to take a risk, consider partial profit-taking to lock in profits and prevent the opportunity from slipping away.

Tomorrow’s Non-Farm Payroll report is like a suspense thriller.

The market’s biggest concern right now is: Wil

The short positions around 104,600 for Bitcoin and 3,480 for Ether that I mentioned yesterday are now ripe for harvest—it's time to reap the rewards!

At the time of writing, Bitcoin has reached 100,600, and Ether has hit 3,250—targets fully achieved.

Take immediate action: exit all positions and enjoy the gains! For those willing to take a risk, consider partial profit-taking to lock in profits and prevent the opportunity from slipping away.

Tomorrow’s Non-Farm Payroll report is like a suspense thriller.

The market’s biggest concern right now is: Wil

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

Ether on the four-hour level has continuously formed long bearish candles, with the price breaking below multiple short-term moving average supports such as MA5, MA20, and MA60, indicating a clear shift to a short position trend. After the MACD's high position death cross, the fast line has crossed below the zero axis, and the short positions' momentum continues to increase, showing that the adjustment has not yet ended.

No positions established: can try shorting lightly near 3480, add to short positions on a rebound to 3560, with unified risk control set above 3600.

Already held short

No positions established: can try shorting lightly near 3480, add to short positions on a rebound to 3560, with unified risk control set above 3600.

Already held short

ETH1,25%

- Reward

- like

- Comment

- Repost

- Share

The Bit hourly chart shows a double long wick candle bottoming pattern at 98888, but this does not indicate a trend reversal. The current market sentiment is shifting, making short positions more difficult to maneuver, and being trapped in short-term positions is a normal situation. Any rebound should be viewed as "picking up passengers on a reverse trip," rather than a trend reversal; it is still too early to assert a reversal.

If no position is established, you can try shorting with a light position at 104600, add to the short at 105600, and set a uniform stop loss above 106000.

If you have

If no position is established, you can try shorting with a light position at 104600, add to the short at 105600, and set a uniform stop loss above 106000.

If you have

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

Liquidity tightening has led to a "water shortage" in the market, large orders can easily trigger a sharp fall, regardless of unfavourable information related to the fundamentals.

After a sharp fall, it is often an opportunity to buy low. Pay close attention to whether the daily line can recover the 5-day moving average; if it stabilizes, it is expected to quickly rebound and reach new highs.

106000 layout, 105000 add position, 104000 stop loss

Short-term view 107500 → 109800

Long term view 116000$BTC

After a sharp fall, it is often an opportunity to buy low. Pay close attention to whether the daily line can recover the 5-day moving average; if it stabilizes, it is expected to quickly rebound and reach new highs.

106000 layout, 105000 add position, 104000 stop loss

Short-term view 107500 → 109800

Long term view 116000$BTC

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

If the current momentum can be sustained, ZEC is likely to start a new round of upward movement. The key technical aspect lies in the effectiveness of the trend line support; as long as this foundation holds, the bullish bias remains unchanged.

It is recommended to pay attention to entry opportunities around 400, with an upward target looking towards the 440 area.

It is recommended to pay attention to entry opportunities around 400, with an upward target looking towards the 440 area.

ZEC-0,43%

- Reward

- like

- Comment

- Repost

- Share

BNB Midnight Analysis

MACD: A golden cross has formed above the zero axis, and the histogram bars continue to expand, indicating that short-term upward momentum is strengthening.

RSI: Has healthily fallen back from the overbought zone to the level of 58, leaving ample room for subsequent upward movement.

The price has successfully broken through the middle track resistance, with a preliminary expansion of the range, indicating that volatility may increase and upward space is expected to open.

It is recommended to gradually build long positions in the range near 960.

Set the stop loss below 970

MACD: A golden cross has formed above the zero axis, and the histogram bars continue to expand, indicating that short-term upward momentum is strengthening.

RSI: Has healthily fallen back from the overbought zone to the level of 58, leaving ample room for subsequent upward movement.

The price has successfully broken through the middle track resistance, with a preliminary expansion of the range, indicating that volatility may increase and upward space is expected to open.

It is recommended to gradually build long positions in the range near 960.

Set the stop loss below 970

BNB1,32%

- Reward

- like

- Comment

- Repost

- Share

SOL Midnight Analysis

The current SOL trend has gradually converged and is at the end of an ascending wedge pattern. From the technical indicators, the RSI has strongly rebounded above 60, and the MACD is about to form a golden cross, indicating that short-term momentum has strengthened.

Radical strategy: You can try to buy with a light position around 168.

Stable Strategy: It is recommended to wait for a pullback to the 162-165 range to gradually build long positions, with a stop loss set below 158.

Target area: Sequentially looking at 180, 185, 190, and around 195, you can combine your own p

The current SOL trend has gradually converged and is at the end of an ascending wedge pattern. From the technical indicators, the RSI has strongly rebounded above 60, and the MACD is about to form a golden cross, indicating that short-term momentum has strengthened.

Radical strategy: You can try to buy with a light position around 168.

Stable Strategy: It is recommended to wait for a pullback to the 162-165 range to gradually build long positions, with a stop loss set below 158.

Target area: Sequentially looking at 180, 185, 190, and around 195, you can combine your own p

SOL1,97%

- Reward

- like

- Comment

- Repost

- Share

From the daily chart perspective, Bitcoin continues to exhibit a high-level consolidation pattern, with the previous trading day finding support near the 7-day moving average and closing with a bullish line.

After the opening of the daily chart, the fluctuations narrowed, showing an overall consolidation trend. In terms of technical indicators, the Bollinger Bands are showing slight expansion, and the short-term moving average system remains in an upward arrangement, indicating that the current market still possesses certain bullish momentum.

You can place long positions in the range of 108700

View OriginalAfter the opening of the daily chart, the fluctuations narrowed, showing an overall consolidation trend. In terms of technical indicators, the Bollinger Bands are showing slight expansion, and the short-term moving average system remains in an upward arrangement, indicating that the current market still possesses certain bullish momentum.

You can place long positions in the range of 108700

- Reward

- like

- Comment

- Repost

- Share