TianWenmouLooksAtThe

No content yet

TianWenmouLooksAtThe

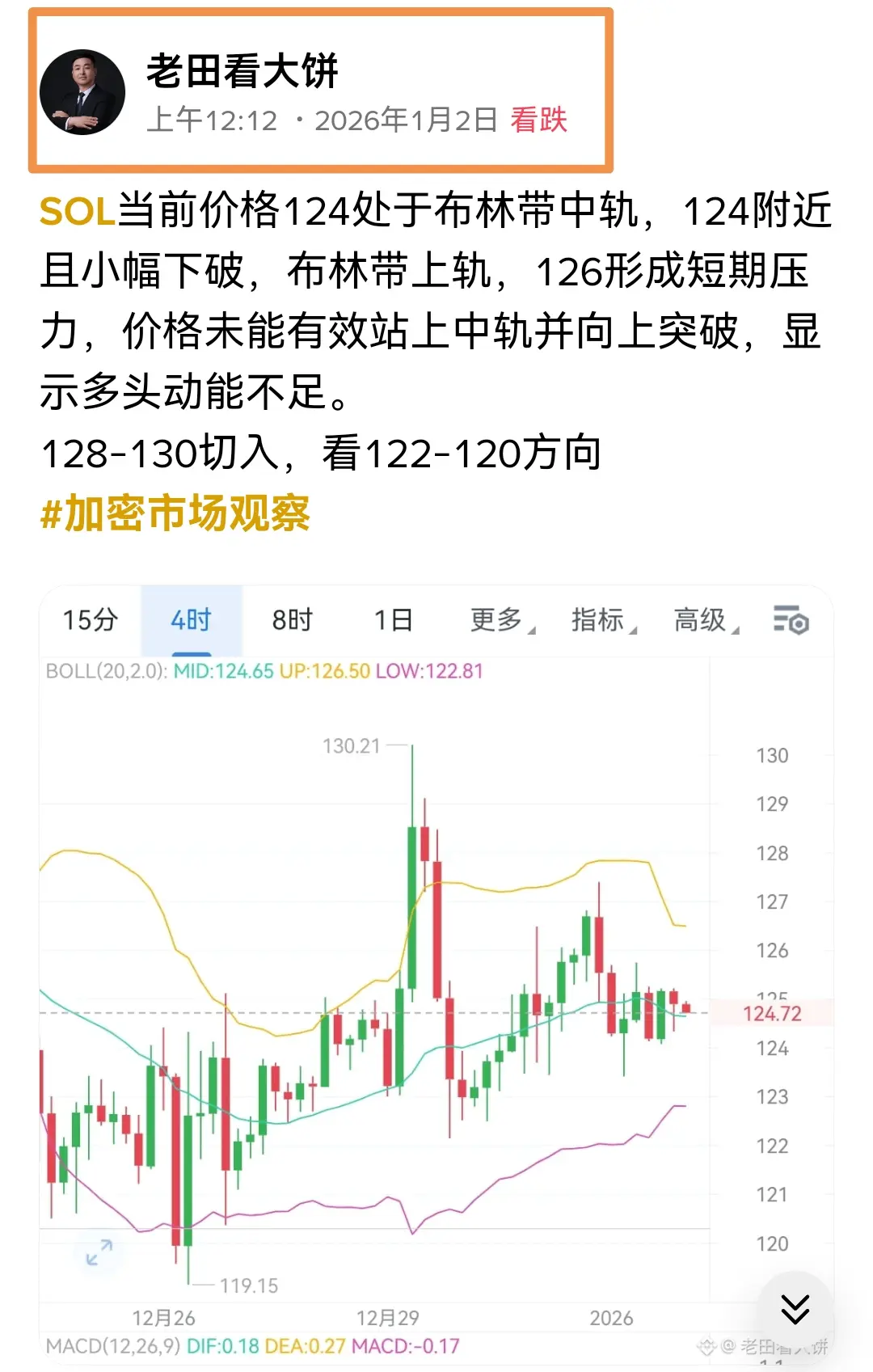

Sunday early morning Bitcoin and Ethereum market analysis and intraday summary

The weekend crypto market trading is light, and the market is stuck in a consolidation phase, with bulls and bears continuously testing market patience. Looking back at yesterday's trading session, Bitcoin dipped to a low of 89,380 before stabilizing and rebounding, with an intraday high reaching around 90,200; Ethereum's movement was synchronized, with a low of 3,074, and the rebound in the evening was blocked near 3,114, with overall volatility narrowing.

From a technical perspective, on the 4-hour chart, after re

View OriginalThe weekend crypto market trading is light, and the market is stuck in a consolidation phase, with bulls and bears continuously testing market patience. Looking back at yesterday's trading session, Bitcoin dipped to a low of 89,380 before stabilizing and rebounding, with an intraday high reaching around 90,200; Ethereum's movement was synchronized, with a low of 3,074, and the rebound in the evening was blocked near 3,114, with overall volatility narrowing.

From a technical perspective, on the 4-hour chart, after re

- Reward

- 1

- 2

- Repost

- Share

GateUser-7b7efae7 :

:

Happy New YearView More

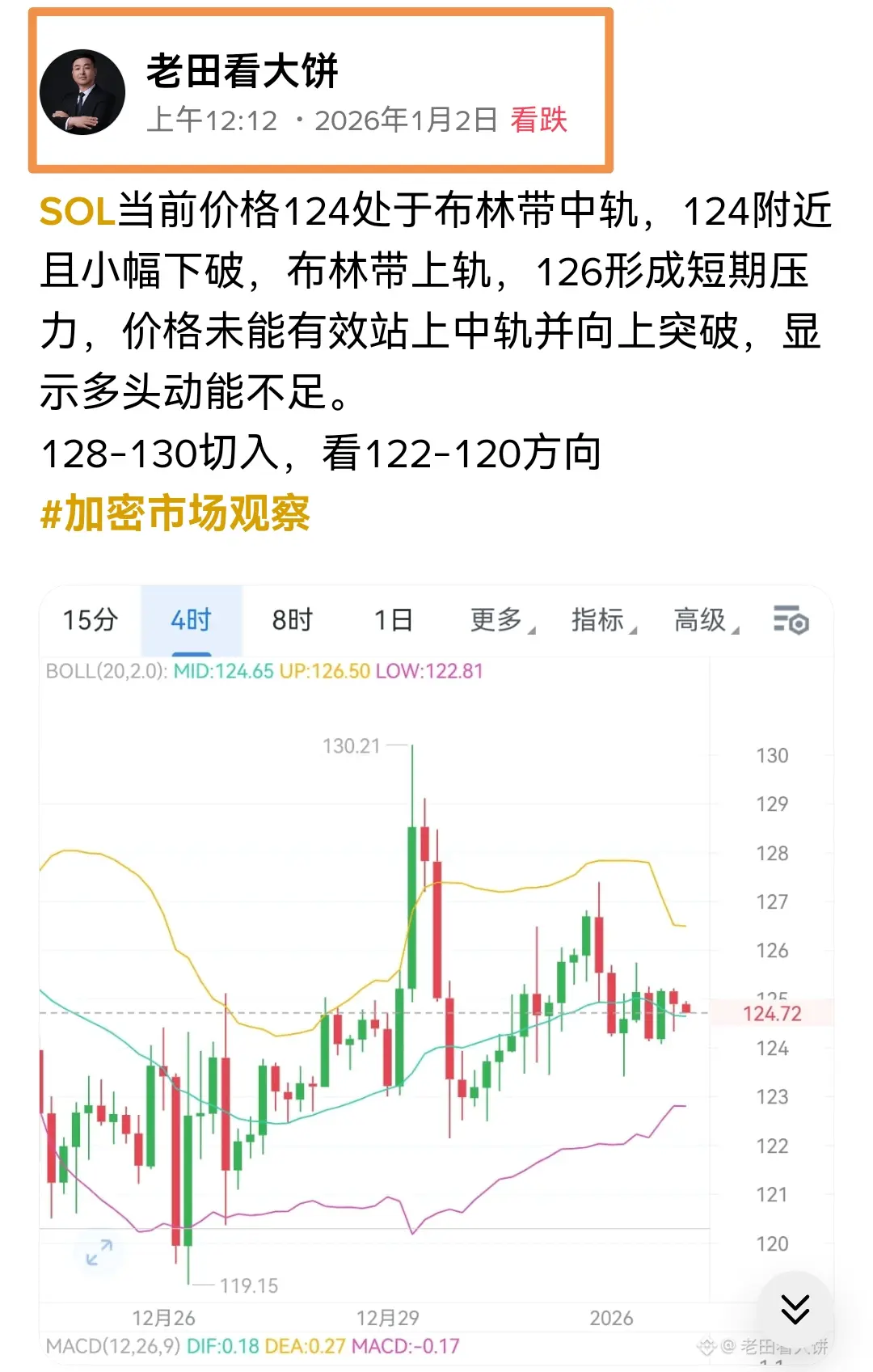

Bitcoin rebounded to the $91,000 resistance level last night but was blocked, closing at a neutral position. The Bollinger upper band pressure continues to be evident. Influenced by news factors, it is recommended to focus on short positions around the $90,000 area in the short term, playing the downward space.

Technically, on the hourly level, the RSI indicator remains in the neutral zone, but the MACD momentum histogram shows signs of crossing below zero, indicating a gathering of bearish strength. The upper boundary of the previous oscillation range at $91,000 has become a key resistance le

View OriginalTechnically, on the hourly level, the RSI indicator remains in the neutral zone, but the MACD momentum histogram shows signs of crossing below zero, indicating a gathering of bearish strength. The upper boundary of the previous oscillation range at $91,000 has become a key resistance le

- Reward

- like

- Comment

- Repost

- Share

During the early trading session, Bitcoin rebounded from a low of 89,850 to 90,456 before facing resistance and pulling back, with the overall trend entering a correction phase. Ethereum followed suit, rising to 3,134 before oscillating downward, with a low near 3,078.

From the current structure, the 4-hour timeframe remains in a stair-step upward trend. The price previously touched the upper Bollinger Band but failed to break through effectively, followed by a long bearish candle pulling back toward the middle band, indicating that resistance in the upper band area remains significant. In ter

View OriginalFrom the current structure, the 4-hour timeframe remains in a stair-step upward trend. The price previously touched the upper Bollinger Band but failed to break through effectively, followed by a long bearish candle pulling back toward the middle band, indicating that resistance in the upper band area remains significant. In ter

- Reward

- like

- Comment

- Repost

- Share

The technical map is clearly outlined, with the upper pressure level like a boulder across, exerting significant suppression. The bullish attack has been repeatedly thwarted. The bearish forces are gathering strength, with the downward trajectory now clearly pointing downward, and the trend pattern cannot be ignored. In view of this, we should closely follow the market pulse, focus on high points, with Gao Kong as the main, patiently waiting for the flowering of profits to bloom amidst caution and boldness.

Bitcoin: Range around 90300-90800, with a supplement at 91500, and support at 89500-883

Bitcoin: Range around 90300-90800, with a supplement at 91500, and support at 89500-883

BTC1,24%

- Reward

- like

- Comment

- Repost

- Share

The current market remains in a high-level consolidation pattern, with rebound momentum clearly weakening and overall sentiment turning cautious. From a four-hour perspective, Bitcoin briefly tested recent highs again in the evening but was met with significant selling pressure, with the candlestick showing a long upper shadow, indicating strong resistance above and accumulating downside pressure. Ethereum's movement is relatively independent, showing a structural rebound, but its overall direction is still constrained by Bitcoin and has not yet achieved an effective breakout. As Bitcoin faces

View Original

- Reward

- like

- Comment

- Repost

- Share

Friday Night Bitcoin and Ethereum Market Analysis and Trading Recommendations

The market's testing trend continues, with the early pressure levels currently in a repeated testing phase. In the afternoon, Bitcoin briefly surged to around 89,900, while Ethereum simultaneously climbed to a high of 3,068. Subsequently, the market again fell into a stalemate, with bullish rebound momentum encountering resistance, and the pressure pattern re-emerging.

From the four-hour chart analysis, prices continue to oscillate around the upper band of the Bollinger Bands. Although multiple attempts have been mad

View OriginalThe market's testing trend continues, with the early pressure levels currently in a repeated testing phase. In the afternoon, Bitcoin briefly surged to around 89,900, while Ethereum simultaneously climbed to a high of 3,068. Subsequently, the market again fell into a stalemate, with bullish rebound momentum encountering resistance, and the pressure pattern re-emerging.

From the four-hour chart analysis, prices continue to oscillate around the upper band of the Bollinger Bands. Although multiple attempts have been mad

- Reward

- like

- Comment

- Repost

- Share

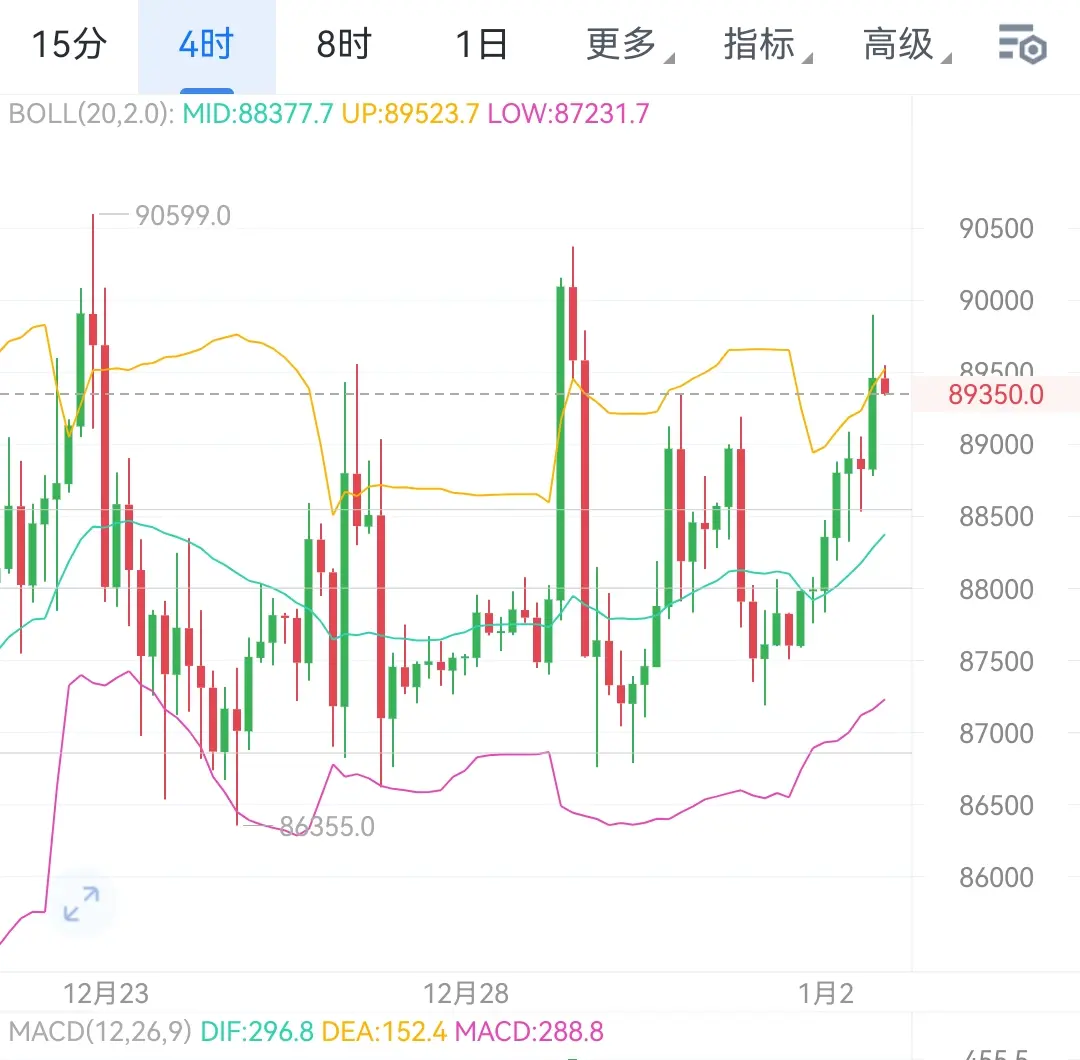

From the daily chart, it can be seen that after fluctuating for so many days, it has finally stabilized above the middle band of the Bollinger Bands. Additionally, a bullish engulfing pattern has appeared. This indicates a further strengthening of the bullish momentum. It was previously mentioned that the market is likely to break out around the New Year's holiday. Currently, the Bollinger Bands are about to narrow, indicating a breakout condition. Therefore, the intraday strategy remains primarily to buy on dips.

Focus around 88500-88000.

Look up to 90500-91000, and then 93000.

View OriginalFocus around 88500-88000.

Look up to 90500-91000, and then 93000.

- Reward

- like

- Comment

- Repost

- Share

Reviewing yesterday, Bitcoin powerfully broke through and consolidated above the 88,000 key resistance level in the early morning. This important level has successfully transformed into a support base for subsequent upward movement. The price then further climbed above 88,500, demonstrating a healthy breakout trend with trading volume and price rising in sync.

From a technical perspective, this breakout indicates the formation of a new upward trend, with the overall market focus shifting upward. In the short term, the market is expected to rely on the new support level around 88,000 to continu

View OriginalFrom a technical perspective, this breakout indicates the formation of a new upward trend, with the overall market focus shifting upward. In the short term, the market is expected to rely on the new support level around 88,000 to continu

- Reward

- 1

- Comment

- Repost

- Share

From the 4-hour timeframe, although the 3000 integer level has formed short-term resistance, Ethereum remains within a consolidation upward channel overall. Technical indicators show that the middle band of the Bollinger Bands continues to provide support, and price pullbacks are consistently supported; the MACD green momentum bars are steadily expanding, indicating that bullish momentum is still accumulating; the KDJ is in the neutral zone and shows initial signs of a golden cross. Overall, the moving average system has preliminarily formed a bullish alignment, and the trend direction has not

ETH0,96%

- Reward

- 1

- Comment

- Repost

- Share

Thursday Early Morning Bitcoin and Ethereum Market Analysis and Intraday Summary

The pressure during early morning monitoring, the anxiety of profit-taking, and the regret of missing the opportunity are often normal parts of market participation. After a brief correction in the afternoon, the market gradually rebounded, testing the 89,000 level in the evening, then faced resistance and pulled back. Currently, it is consolidating around 88,700, and the overall trend remains consistent with our expectation of a oscillating upward movement. Although the rebound has not fully reached the anticipat

View OriginalThe pressure during early morning monitoring, the anxiety of profit-taking, and the regret of missing the opportunity are often normal parts of market participation. After a brief correction in the afternoon, the market gradually rebounded, testing the 89,000 level in the evening, then faced resistance and pulled back. Currently, it is consolidating around 88,700, and the overall trend remains consistent with our expectation of a oscillating upward movement. Although the rebound has not fully reached the anticipat

- Reward

- like

- Comment

- Repost

- Share

From the market perspective, Bitcoin failed to continue its upward trend after breaking through 89,000, instead pulling back for consolidation, indicating that selling pressure near this level still exists. However, support below remains clear, and the overall market is in a phase of accumulation of both bulls and bears, with the fluctuation range gradually narrowing. Structurally, the price is oscillating around the 88,000 level, with the short-term moving averages gradually converging and flattening, suggesting that the market is likely to continue consolidating in the short term. The smalle

View Original

- Reward

- like

- 1

- Repost

- Share

LittleCrispySnack :

:

From the market perspective, Bitcoin failed to continue its upward trend after breaking through 89,000, instead pulling back for consolidation, indicating that selling pressure near this level still exists. However, support below remains clear, and the overall market is in a phase of accumulation of both bulls and bears, with the fluctuation range gradually narrowing. Structurally, the price is oscillating around the 88,000 level, with the short-term moving averages gradually converging and flattening, suggesting that the market is likely to continue consolidating in the short term. The smalle

View Original

- Reward

- like

- Comment

- Repost

- Share

Bitcoin encounters resistance on the upside with a slight pullback. The 4-hour Bollinger Bands are opening upward, and the price remains above the middle band, with the bulls still in control. Although it retraced to the middle band, it quickly rebounded upon contact, indicating solid support below. The market is like the lingering echo at the year's end, pausing briefly but still retaining momentum. In terms of strategy, continue to favor long positions at low levels, patiently awaiting the start of a new chapter.

BTC1,24%

- Reward

- like

- Comment

- Repost

- Share

Wednesday Early Morning Bitcoin and Ethereum Market Analysis and Intraday Summary

In the intraday market, bullish momentum remains dominant. Bitcoin rebounded to around 89,355 in the evening, then entered a slow correction phase in the early morning. The overall trend shows resilience, with pullbacks mainly serving as a time-for-space correction. Ethereum also surged to 3,008 before experiencing a pullback, but the retracement was limited, aligning with expected technical corrections. The bullish pattern remains intact, and short-term pullbacks have not caused any substantial breakdown. Multip

View OriginalIn the intraday market, bullish momentum remains dominant. Bitcoin rebounded to around 89,355 in the evening, then entered a slow correction phase in the early morning. The overall trend shows resilience, with pullbacks mainly serving as a time-for-space correction. Ethereum also surged to 3,008 before experiencing a pullback, but the retracement was limited, aligning with expected technical corrections. The bullish pattern remains intact, and short-term pullbacks have not caused any substantial breakdown. Multip

- Reward

- 1

- Comment

- Repost

- Share

The overall market remains in a range-bound consolidation pattern. Although the smaller time frame technical structure of Bitcoin is in a rebound correction cycle, the rebound momentum has already significantly weakened. In the short term, focus on the resistance at 88,800. If a breakout occurs, we can look further up to the previously emphasized high-pressure zone of 89,500-90,500. At that point, consider positioning for a short position within that range, with proper stop-losses on smaller time frames. The initial target below remains at 87,500, and if it breaks further down, watch the suppo

View Original

- Reward

- 2

- Comment

- Repost

- Share

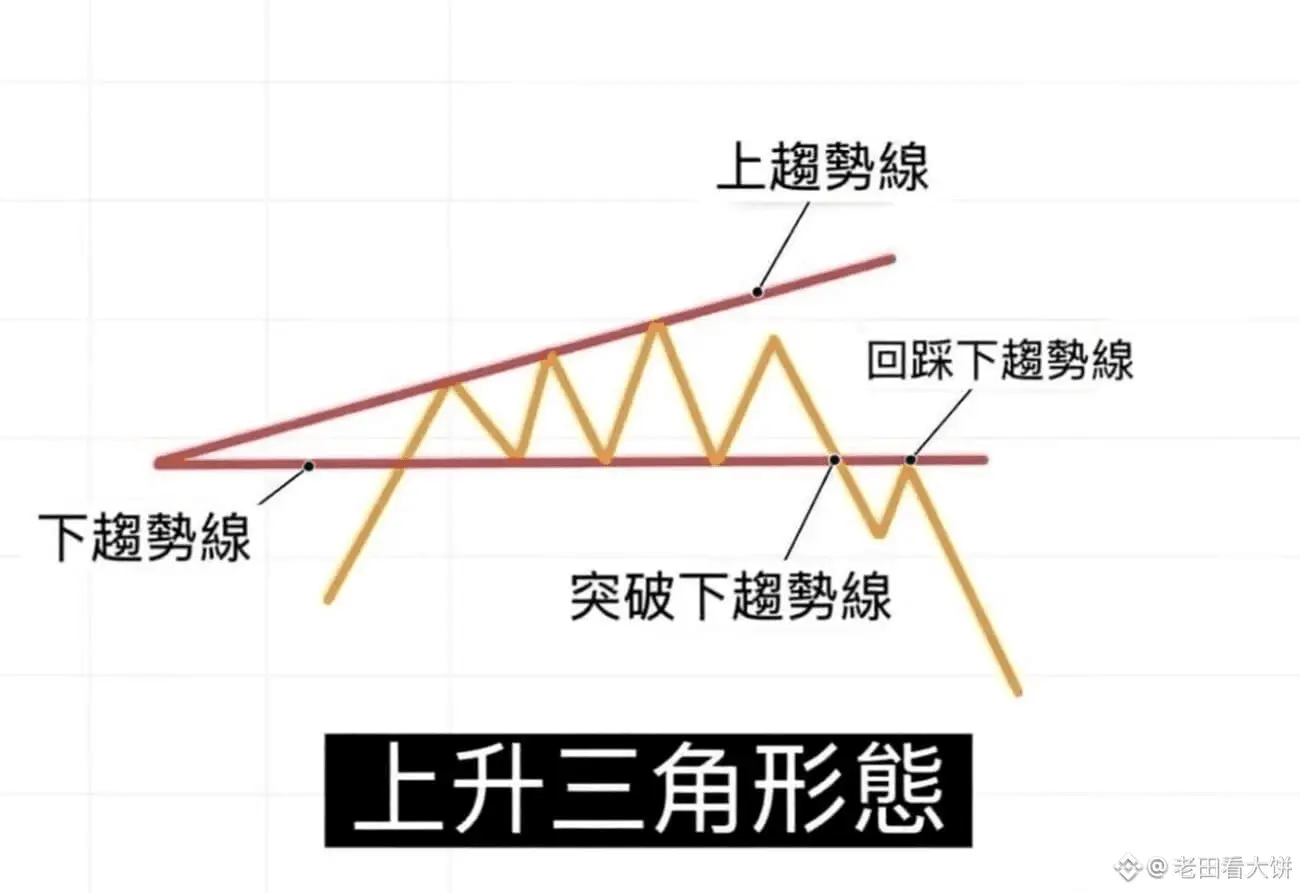

Candlestick Pattern: Rising Expanding Triangle

The rising expanding triangle is a relatively rare bearish pattern, typically appearing in an uptrend, reflecting increased market volatility and emotional divergence. This pattern consists of two diverging trendlines, forming a shape similar to an upward-slanting and expanding triangle.

Pattern Components:

Upper Trendline: Connects the higher highs in price fluctuations, sloping upward.

Lower Trendline: Connects the lower lows in price fluctuations, also sloping upward but gradually diverging from the upper trendline.

Expansion Characteristics: T

View OriginalThe rising expanding triangle is a relatively rare bearish pattern, typically appearing in an uptrend, reflecting increased market volatility and emotional divergence. This pattern consists of two diverging trendlines, forming a shape similar to an upward-slanting and expanding triangle.

Pattern Components:

Upper Trendline: Connects the higher highs in price fluctuations, sloping upward.

Lower Trendline: Connects the lower lows in price fluctuations, also sloping upward but gradually diverging from the upper trendline.

Expansion Characteristics: T

- Reward

- like

- Comment

- Repost

- Share

Yesterday, we indicated that the market is expected to first rebound within the 90500-89500 range and then face resistance and decline. The actual market movement was in line with expectations, initially surging to around 90373, then falling to a low of 86760, basically reaching our suggested target zone. The daily chart currently still shows weak signals, maintaining a consolidation structure overall. Trading strategies can continue to follow the high-low swing approach, reducing frequent trades and waiting for key level confirmations. On the four-hour chart, the price is trading below the mi

View Original

- Reward

- 2

- Comment

- Repost

- Share

Tuesday Early Morning Bitcoin and Ethereum Market Analysis and Intraday Summary

From the current chart, the 1-hour timeframe shows a rally to 90370 followed by a pullback, forming a clear long upper shadow, indicating strong resistance around the 90000 level. Regarding technical indicators, the three lines of KDJ are converging at low levels, not yet forming a clear golden or death cross, suggesting short-term bullish and bearish momentum are balancing; RSI is below the neutral 50 line, indicating that the bearish force has a slight advantage but is not in oversold territory. The MACD shows a

View OriginalFrom the current chart, the 1-hour timeframe shows a rally to 90370 followed by a pullback, forming a clear long upper shadow, indicating strong resistance around the 90000 level. Regarding technical indicators, the three lines of KDJ are converging at low levels, not yet forming a clear golden or death cross, suggesting short-term bullish and bearish momentum are balancing; RSI is below the neutral 50 line, indicating that the bearish force has a slight advantage but is not in oversold territory. The MACD shows a

- Reward

- like

- Comment

- Repost

- Share

BNB trend rises sharply then pulls back, repeatedly oscillating around the key level of 850, with the fluctuation range always confined within a 30-point interval. The previously indicated Bollinger Band breakout opportunity has also yet to materialize.

Control around 870-860, with a downside target of 840-835

#2025Gate年度账单 #加密行情预测 #比特币与黄金战争

Control around 870-860, with a downside target of 840-835

#2025Gate年度账单 #加密行情预测 #比特币与黄金战争

BNB1,53%

- Reward

- like

- Comment

- Repost

- Share

Monday Afternoon Bitcoin and Ethereum Market Analysis and Trading Suggestions

During the morning session, Bitcoin started a volatile upward movement from around 87,402 points, reaching a key resistance level at 90,373 points before experiencing a slight pullback; Ethereum moved in tandem, rebounding from a low of 2,922 points and rising to around 3,056 points. We capitalized on the trend in the morning, establishing two rounds of Bitcoin long positions, with a total gain of over 2,000 points; Ethereum long positions were also followed up, with a single profit of over 60 points, successfully re

View OriginalDuring the morning session, Bitcoin started a volatile upward movement from around 87,402 points, reaching a key resistance level at 90,373 points before experiencing a slight pullback; Ethereum moved in tandem, rebounding from a low of 2,922 points and rising to around 3,056 points. We capitalized on the trend in the morning, establishing two rounds of Bitcoin long positions, with a total gain of over 2,000 points; Ethereum long positions were also followed up, with a single profit of over 60 points, successfully re

- Reward

- like

- Comment

- Repost

- Share