12.31 Bitcoin Auntie's Operation Strategy

Currently facing resistance on the upside with a slight pullback, the 4-hour Bollinger Bands are opening upward, and the price is holding steady at the middle band. The rebound upon testing the support indicates strong support, and the bullish dominance remains unchanged. As the year-end market takes a brief rest, the momentum is still there. Strategy: Focus on low buys, patiently wait for a new upward trend.

Bitcoin 87800-87300 buy, target 89500-90500

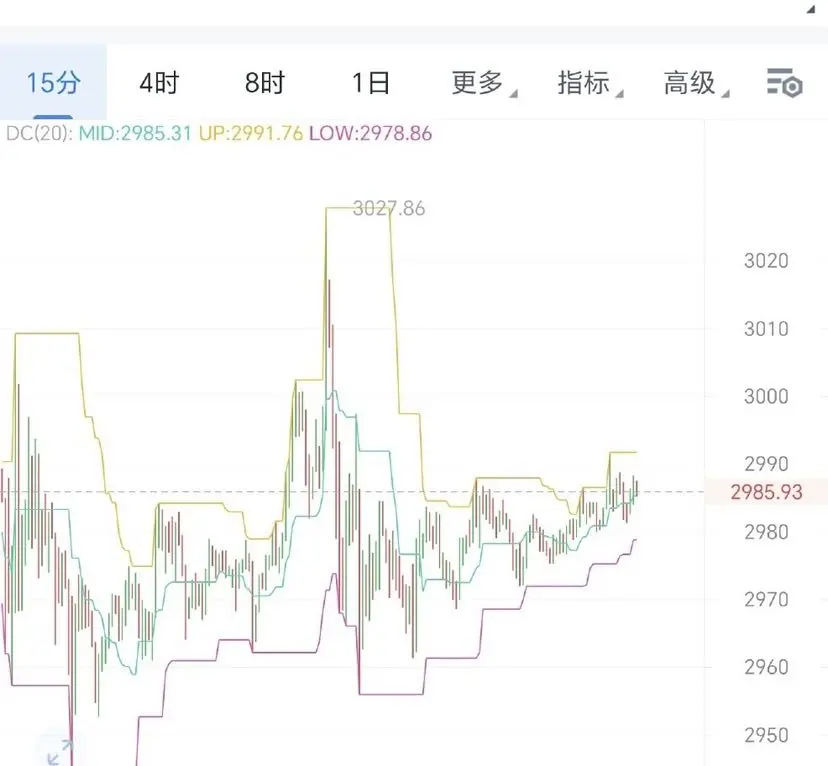

Auntie 2930-2900 buy, target 3000-3050 #加密行情预测

Currently facing resistance on the upside with a slight pullback, the 4-hour Bollinger Bands are opening upward, and the price is holding steady at the middle band. The rebound upon testing the support indicates strong support, and the bullish dominance remains unchanged. As the year-end market takes a brief rest, the momentum is still there. Strategy: Focus on low buys, patiently wait for a new upward trend.

Bitcoin 87800-87300 buy, target 89500-90500

Auntie 2930-2900 buy, target 3000-3050 #加密行情预测

ETH0,83%