PrincessQingyue

As a seasoned veteran who has been navigating the crypto world for 7 years, today I want to share some "counterintuitive" truths with you.

I'm a post-80s, starting from just 10,000 copies of Jing Yi to now reaching this scale. Along the way, I had no insider information, no shortcuts, and certainly no overwhelming luck. The only thing I did right was: using the simplest methods to survive longer than others.

Many people ask me: why can some stay in the market long-term, while others disappear after just one cycle? The answer is simple— they understand the rhythm of the big players and cont

View OriginalI'm a post-80s, starting from just 10,000 copies of Jing Yi to now reaching this scale. Along the way, I had no insider information, no shortcuts, and certainly no overwhelming luck. The only thing I did right was: using the simplest methods to survive longer than others.

Many people ask me: why can some stay in the market long-term, while others disappear after just one cycle? The answer is simple— they understand the rhythm of the big players and cont

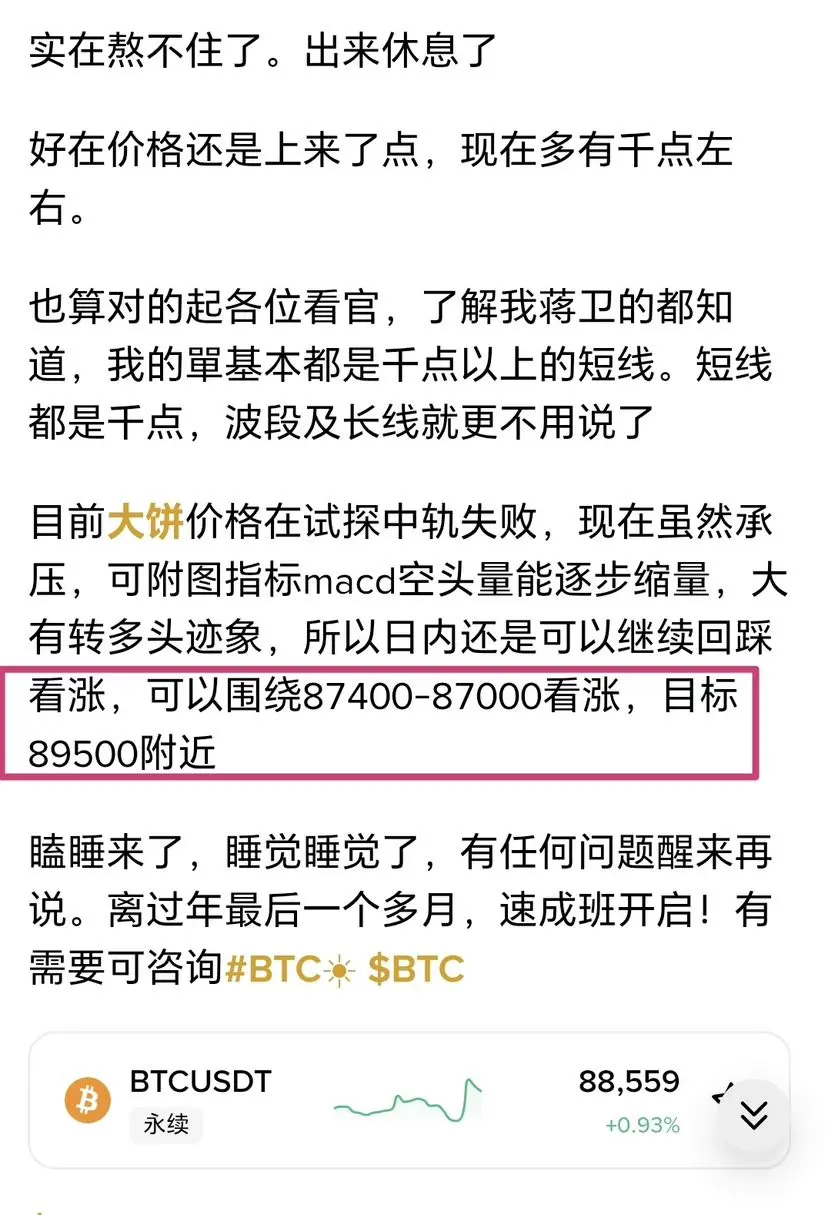

[The user has shared his/her trading data. Go to the App to view more.]