51QuantitativeStrategy

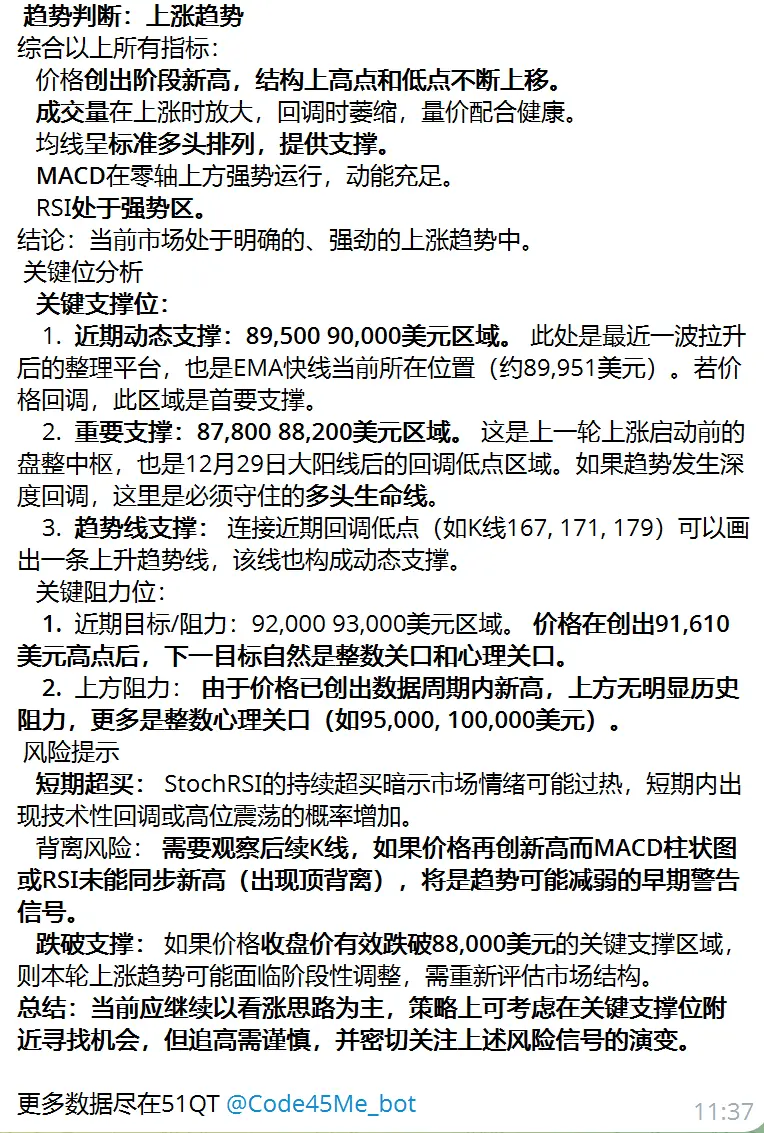

January 4, 2026 $ETH 4-hour level is in a strong upward trend.

Market condition: In the short term, it is in an extremely overbought state, and market sentiment is exuberant. This usually does not immediately lead to a trend reversal but increases the probability of a short-term pullback or high-level consolidation.

Future outlook:

Most likely path (healthy trend): Price consolidates at a high level or makes a slight pullback around the current position (3100-3170) to digest overbought indicators and profit-taking, while waiting for the EMA system to move upward to provide support. After co

Market condition: In the short term, it is in an extremely overbought state, and market sentiment is exuberant. This usually does not immediately lead to a trend reversal but increases the probability of a short-term pullback or high-level consolidation.

Future outlook:

Most likely path (healthy trend): Price consolidates at a high level or makes a slight pullback around the current position (3100-3170) to digest overbought indicators and profit-taking, while waiting for the EMA system to move upward to provide support. After co

ETH1,12%