Search results for "GT"

Arthur Hayes's latest article: After Trump's "colonization" of Venezuela, he will start the crazy money printing machine. Last year's biggest loss was PUMP

Arthur Hayes

Translated by: Yuliya, PANews

Imagine a video call between U.S. President Donald Trump and Venezuelan President Pepe Maduro, as Maduro was flying from Caracas to New York.

> Trump: "Pepe Maduro, you're a bad guy. The oil in your country is now mine. Long live America!"

>

> Pepe Maduro: "Trump, you crazy!"

>

>

Note: Arthur Hayes refers to the Venezuelan president as "Pepe Maduro" instead of his real name Nicolás Maduro. "Pepe" is a Spanish term

PANews·9h ago

Gate Research Institute: Year-End Effect Drives Recovery | Solana to Receive Major Update

Cryptocurrency Asset Overview

BTC (+1.85% | Current Price 92,898.3 USDT)

BTC has completed a high-level platform -> volume breakout -> accelerated rally in the past 24 hours, forming a bullish trend structure. On the macro level, recent fluctuations in US bond yields have stabilized, and the market's pessimistic expectations for rate cuts have been temporarily digested. Overall, risk assets are in a recovery window. Technically, short-term moving averages (MA5, MA10) have turned steep again and are forming a stable bullish alignment with MA30. In the short term, BTC is expected to maintain strong oscillations within the 92,000–93,500 USD range. If it tests support at 91,500 USD without breaking below, the upward target may further point to the 94,000–94,500 USD region.

ETH (+1.2% | Current Price 3,184.56 USDT)

ETH

GateResearch·01-05 07:34

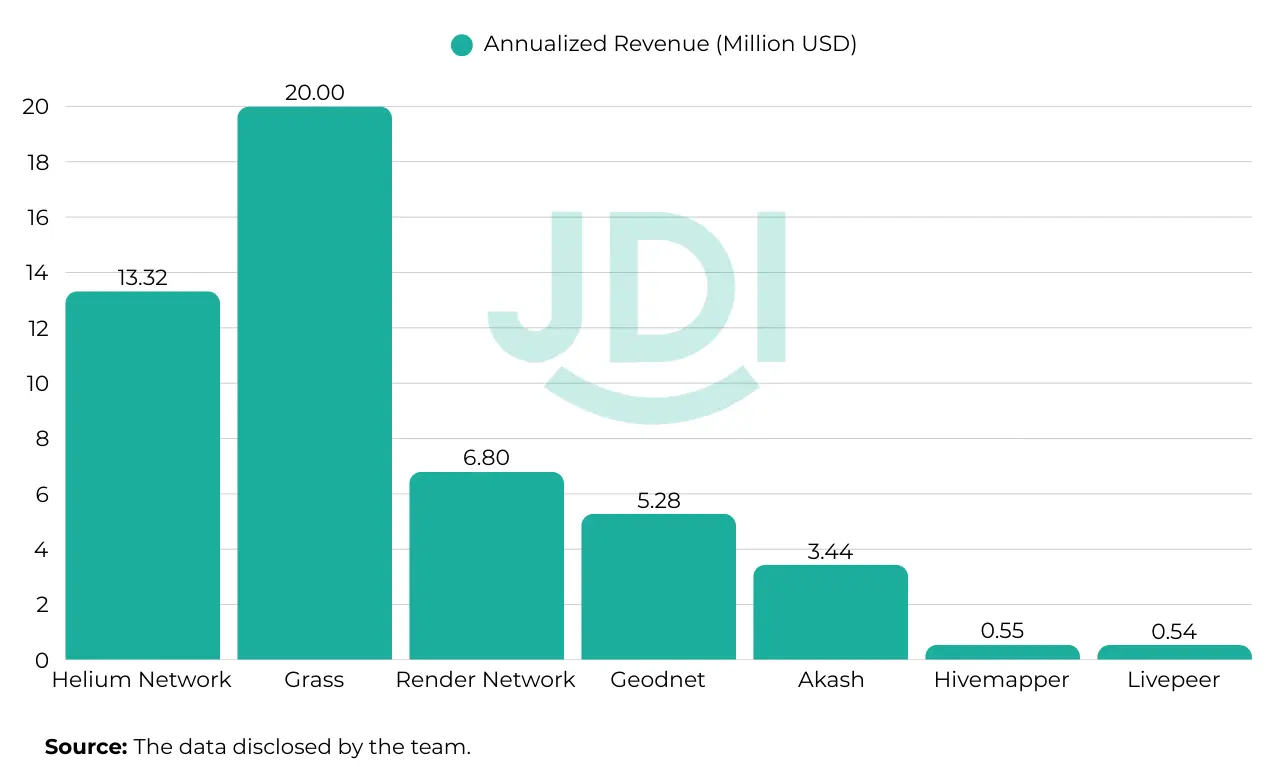

2025 DePIN Annual Review: From Concept Validation to Scalable Breakthrough

> From Concept Validation to Scalable Breakthroughs

Decentralized Physical Infrastructure Networks (DePIN) are an innovative network architecture that combines blockchain technology with physical infrastructure. By leveraging blockchain's token incentive mechanisms, it attracts individuals and enterprises to contribute physical resources such as storage space, computing power, and network bandwidth, building a distributed shared infrastructure network. Its application scenarios broadly cover fields like distributed storage, wireless networks, and AI computing support. Unlike traditional centralized infrastructure models, DePIN offers low-cost, scalable advantages, breaking the monopoly of giants over core physical resources and forming a unique "co-construction and sharing" industrial ecosystem.

The concept of DePIN has gradually taken shape alongside the penetration of blockchain technology into the real economy. The early milestone was marked by Helium in 2013, which began deployment and gradually launched distributed wireless network projects. This project through

PANews·2025-12-31 03:08

Meta announces acquisition of AI agent unicorn Manus, unlocking productivity potential for FB, IG, and Thread

Meta announces acquisition of Singapore AI startup Manus, marking the company's third-largest deal in history, highlighting its ambitions in the general Agent competition.

(Background: The popular Chinese AI agent "Manus" received a $75 million investment from Silicon Valley Benchmark, with a valuation surpassing $500 million)

(Additional context: Grok4 intelligence score beats OpenAI o3 and Gemini 2.5 Pro! Is the multi-competition shifting to the political arena?)

M

eta announced a few hours ago that it has acquired Singapore AI startup Manus, becoming the third-largest acquisition after WhatsApp and ScaleAI. Manus founder Xiao Hong will also join Meta as Vice President.

> Manus has built one of the leading autonomous general agents capable of independently executing tasks.

動區BlockTempo·2025-12-30 02:00

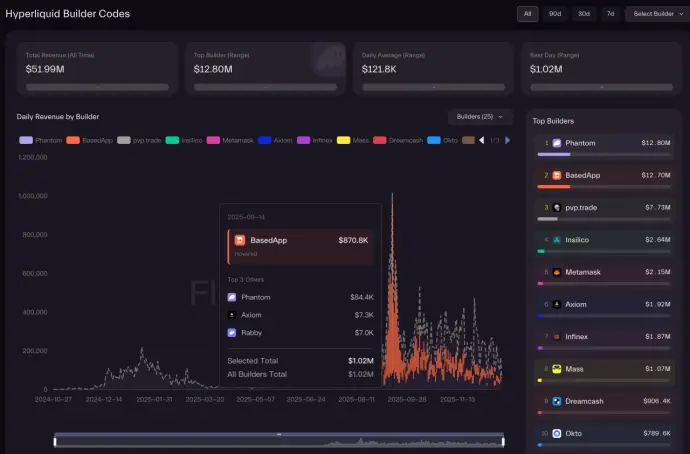

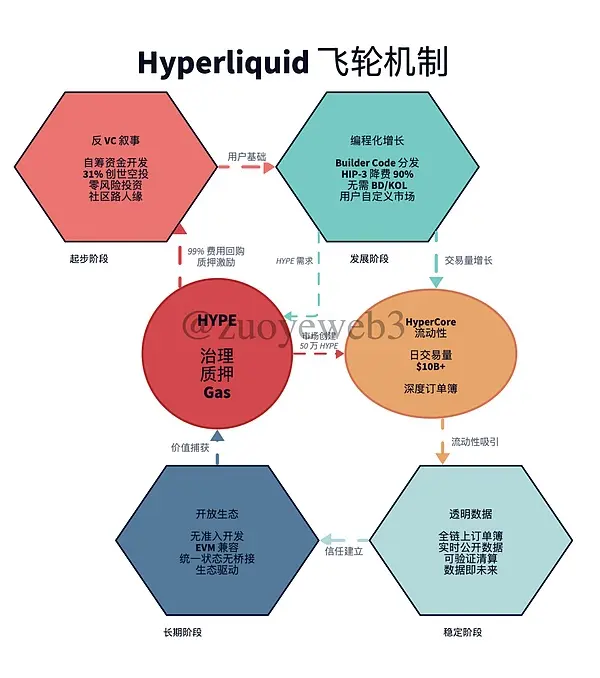

2025 Crypto Wallet Dark Battle: Is Competing to Connect to Hyperliquid a Good Business?

The previous wallet track was a quiet battle behind the scenes of Tee's underlying infrastructure. Many viewers' grandpas are urging for updates backstage, so the Fourteen Lord will make another splash in 2025.

Hyperliquid is undoubtedly the hottest topic of the year. This time, let's take an insider's look to connect the dots—examining wallets, exchanges, DEXs, and AI trading to see how they are all vying for dominance here!

1. Background

In 2025, I have basically studied all the Perps-type (perpetual trading platforms) available on the market. I witnessed the hype market’s 5x growth and peak halving (9->50+->25). Amidst the ups and downs, is it really that competitors have left it behind? Or is it due to its hip3 and builder?

PANews·2025-12-29 06:03

Coinbase Bitcoin negative premium has lasted over 14 days. Is now a good time to buy the dip?

Coinbase Bitcoin premium has turned negative for 14 consecutive days since mid-December, reflecting increasing selling pressure in the US and ETF outflows occurring simultaneously.

(Previous context: Coinbase launches stock trading, prediction markets, perpetual contracts! Integrates Kalshi, Solana DEX upgrades to "Universal Exchange")

(Additional background: x402 upgrades to V2 "supporting single-format cross-chain," how is Coinbase creating fully automated payments for AI agents?)

According to Cryptoquant's Coinbase Bitcoin Premium Index, the platform's BTC quote has been below the global average for 14 consecutive days, with the latest reading at -0.0825%. This indicates that US traders are selling at prices below the market rather than rushing in.

When the premium is positive (>0), it indicates Coinbase prices are higher than the global market.

動區BlockTempo·2025-12-28 07:20

Flow Flash Crash Update » Foundation confirms hacking of $3.9 million, network is being rebooted

Public blockchain Flow execution layer vulnerability leads to $3.9 million outflow, with the official stating that user balances are unaffected and has initiated freezing and patching.

(Background: FLOW "flash crash" over 30%! Suspected major cybersecurity incident, Upbit suspends deposits and withdrawals)

(Additional context: Flow has transitioned into DeFi, the former NFT top-tier confidence and dilemma)

The veteran public blockchain FLOW experienced a flash crash last night (27th), with a drop of over 30% within just a few hours, and its market value temporarily evaporated by approximately $100 million. The Flow Foundation also confirmed that it is investigating an incident that "may impact network security."

Earlier this morning, the foundation released the latest information:

> On December 27, 2025, an attacker exploited a vulnerability in the Flow execution layer and, before the validator execution coordination shutdown, transferred approximately

FLOW6.3%

動區BlockTempo·2025-12-28 02:30

Woke up to find the account balance remaining at $0.01! Polymarket confirms that some users were hacked due to third-party vulnerabilities.

In response to recent incidents where users' assets were stolen by hackers, decentralized prediction market platform Polymarket confirmed on Tuesday that the breach was caused by security vulnerabilities in a third-party authentication service provider.

Not clicking on phishing links or enabling two-factor authentication, yet accounts were emptied

This cybersecurity incident has been brewing since the beginning of this week, with many users posting救援 messages on Reddit and X, describing in detail the nightmare of their account assets disappearing. One user pointed out in a Reddit discussion:

> This morning, when I opened my eyes, I saw a notification on my phone indicating three login attempts to Polymarket. My device wasn't hacked, and there were no anomalies with my Google account, but when I quickly logged into Polymarket to check, I found all my trades had been closed out, and my account balance was only $0.01.

In the comments

ETH1.07%

区块客·2025-12-24 13:31

Bitcoin this year has plummeted 50% compared to the NASDAQ! VanEck: Deep declines are bullish, and next year will be the "performance king"

For crypto investors who firmly believe in the theme of "anti-inflation," 2025 has undoubtedly been a disappointing year. Bitcoin, which was originally expected to benefit from the currency depreciation wave, not only underperformed the "safe-haven king" gold but was also far behind the Nasdaq 100 index.

In response, asset management firm VanEck believes that Bitcoin is brewing an epic "comeback," and in 2026, it is expected to follow gold and stage a "breakout rally."

David Schassler, head of Multi-Asset Solutions at VanEck, stated in the latest "2026 Investment Outlook" that Bitcoin's weakness this year is actually the biggest bullish signal for next year:

> Since the beginning of this year, Bitcoin's performance has lagged about 50% behind the Nasdaq 100 index. This extreme "price dislocation" suggests that Bitcoin is poised to become the top performer in 2026.

区块客·2025-12-24 08:50

The 2026 Financial Year Opens: Prediction Markets Are Becoming the Next Fertile Ground for DeFi

Since the article "Where Should the Chinese Prediction Market Explore Next," prediction markets have entered the mainstream worldwide. Referencing Bitcoin and stablecoins, crypto products that achieve PMF will be recognized by the market as a new track, receiving continuous funding.

Thanks to the inherent platform monopoly effect of prediction markets, surrounding services have become a consensus within the community, aiming to cultivate it into a natural incubator for capturing external ecosystems, thereby constructing a hierarchical ecosystem of core—peripheral—outer layers.

After outlining the basic pattern and direction of prediction markets above, let's attempt to analyze their existing peripheral services. Besides imitation platforms, tools, and rebate programs, what other directions can support high-market-value peripheral business models?

Premature Prediction Markets

>

> The world may end, but progress marches on.

>

>

>

Prediction markets are deterministic

PANews·2025-12-24 08:08

Traders suffer from "address poisoning attack"! Nearly 50 million USDT handed over to hackers for free.

The seemingly simple yet repeatedly successful "Address Poisoning Attack" has been occurring frequently lately. Recently, a cryptocurrency trader fell into such a trap, losing nearly 50 million USD in just half an hour. Although a "white hat bounty" of 1 million USD was offered afterward to urge the attacker to return the assets, the hope of recovery is slim as the stolen assets have already flowed into mixing platforms.

According to the on-chain data analysis platform Lookonchain, this incident occurred on December 20th, when the victim was withdrawing assets from Binance and intended to transfer them to a personal wallet.

> A victim (0xcB80) lost $50M due to a copy-paste Address

区块客·2025-12-23 09:49

The merits of inferior currency - Turkish Lira, shorting in the crypto world, and the narrative of buybacks

Author: encryption Veda; Source: X, @thecryptoskanda

I first heard about the "Graham's Law" in middle school:

> Under the condition that the legal exchange rate remains unchanged, currencies with lower actual value (bad money) will drive out currencies with higher actual value (good money) from circulation, causing the market to be flooded with bad money.

> It is what we often refer to as 'bad money drives out good money'.

>

>

But what I was thinking at the time was:

Since the free market emphasizes supply and demand, if bad money can drive out good money, isn't it true that bad money is more powerful?

After work, I realized that this matter is essentially determined by position + microstructure.

In the workplace: In grassroots teams, sycophants and slacker drive away the doers. Because under the microstructure lacking complex KPIs, the management cost for supervisors is the lowest.

In DEX: Speculating on new coins eliminates long-cycle projects. Because for DEX, the fee income is higher than everything, and directly through

金色财经_·2025-12-23 07:06

Traders fall victim to "address poisoning attack"! Nearly 50 million USDT given away to hackers.

The seemingly simple yet frequently successful "Address Poisoning Attack" has been occurring often lately. Recently, a crypto assets trader fell into this type of trap, losing nearly 50 million USD in just half an hour. Although a "white hat bounty" of 1 million USD was offered afterward to request the attacker to return the assets, the hope of recovery is bleak as the stolen assets have already flowed into mixed coin platforms.

According to on-chain data analysis platform Lookonchain, this incident occurred on December 20, when the victim was withdrawing assets from Binance and intended to transfer them to a personal wallet.

> A victim (0xcB80) lost $50M due to a copy-paste Address

区块客·2025-12-22 09:44

In 2025, losses from cryptocurrency theft exceeded $3.4 billion! Chainalysis: Personal wallets have become the latest disaster zone.

According to the latest statistics from blockchain intelligence firm Chainalysis, the total amount of crypto assets stolen globally has exceeded $3.4 billion in 2025. Despite the efforts of various sectors in the market to strengthen cybersecurity this year, the industry still faces a severe security situation due to North Korean hackers' "precision strikes" on large exchanges and widespread attacks on individual users.

According to statistics, the Bybit hack alone in February of this year resulted in a theft of $1.5 billion, accounting for approximately 44% of the total losses for the year; the top three theft cases collectively accounted for 69% of the losses.

What is more alarming is that Chainalysis found that by 2025, the focus of hacker attacks has clearly shifted towards "personal crypto wallets" and private keys, with a remarkable growth rate. The report states:

> The proportion of personal wallets that have been compromised has significantly increased, rising from just 7.3% of the total stolen amount in 2022.

DEFI-3.97%

区块客·2025-12-21 10:19

AA Proficient in BTC 3rd Edition Intensive Reading 03

The second and third paragraphs of the "Introduction" chapter provide a concise introduction to Bitcoin (i.e., bitcoin with a lowercase 'b') as a unit of currency. The author AA writes as follows:

> Users can transfer Bitcoin over the network, achieving nearly all the functions of traditional currencies, including buying and selling goods, remitting to individuals or institutions, and providing credit services. Users can buy and sell Bitcoin on professional currency exchanges or exchange it for other currencies. It can be said that Bitcoin is the ideal form of currency in the internet era - it has fast transaction speeds, high security, and is not restricted by national borders.

It can be seen that the author AA mainly discusses the practicality of BTC as a value transfer medium here, without mentioning its ability as a value store. This actually deviates from the core value proposition that currently supports the value consensus of BTC.

Of course, considering that this book mainly presents BTC as a type of

BTC-0.84%

金色财经_·2025-12-21 09:41

White House encryption czar David Sacks: The "Digital Asset Market Clarity Act" will begin deliberations in January next year.

US Crypto Assets regulatory legislation has moved forward again. White House AI and Crypto Assets Czar David Sacks stated on Thursday that the highly anticipated Digital Asset Market Clarity Act is set to undergo its final markup in January next year, symbolizing that this key piece of legislation is one step closer to formal enactment.

David Sack posted on social media platform X, stating: "Today we had a very positive call with Senate Banking Committee Chairman Tim Scott and Agriculture Committee Chairman John Boozman, who confirmed that the Clarity Act will be reviewed in January."

> We have never been so close to passing this cryptocurrency market structure bill, which has also been personally endorsed by President Trump.

> We had a

区块客·2025-12-21 07:30

2025 Crypto theft losses exceed $3.4 billion! Chainalysis: Personal wallets become the latest hotspot

According to the latest statistics from blockchain intelligence firm Chainalysis, the total amount of crypto stolen worldwide in 2025 has exceeded $3.4 billion. Despite efforts across the market to strengthen cybersecurity this year, the industry still faces a severe security situation due to North Korean hackers "precisely targeting" large exchanges and "widespread" attacks on individual users.

Statistics show that just in February this year, the Bybit hack resulted in $1.5 billion stolen, accounting for about 44% of the total annual losses; the top three thefts combined account for 69%.

What is even more alarming is that Chainalysis found that in 2025, the focus of hacker attacks has clearly shifted to "personal crypto wallets" and private keys, with astonishing growth rates. The report states:

> The proportion of personal wallet intrusions has increased significantly, from only 7.3% of all thefts in 2022, climbing steadily

DEFI-3.97%

区块客·2025-12-20 10:19

White House Crypto Czar David Sacks: "Digital Asset Market Clarity Act" to Begin Review in January Next Year

U.S. Cryptocurrency Regulatory Legislation Moves Forward Again. White House AI and Crypto czar David Sacks announced on Thursday that the highly anticipated Digital Asset Market Clarity Act has been scheduled for final markup in January next year, bringing this key legislation one step closer to official enactment.

David Sacks posted on social platform X: "Today, we had a very positive call with Senate Banking Committee Chairman Tim Scott and Agriculture Committee Chairman John Boozman. They confirmed that the Clarity Act will enter markup in January."

> We have never been this close to passing this crypto market structure bill, which President Trump personally endorsed.

> We had a

区块客·2025-12-20 07:28

2025 Crypto theft losses exceed $3.4 billion! Chainalysis: Personal wallets become the latest hotspot

According to the latest statistics from blockchain intelligence firm Chainalysis, the total amount of crypto stolen worldwide in 2025 has exceeded $3.4 billion. Despite efforts across the market to strengthen cybersecurity this year, the industry still faces a severe security situation due to North Korean hackers "precisely targeting" large exchanges and "widespread" attacks on individual users.

Statistics show that just in February this year, the Bybit hack resulted in $1.5 billion stolen, accounting for about 44% of the total annual losses; the top three thefts combined account for 69%.

What is even more alarming is that Chainalysis found that in 2025, the focus of hacker attacks has clearly shifted to "personal crypto wallets" and private keys, with astonishing growth rates. The report states:

> The proportion of personal wallet intrusions has increased significantly, from only 7.3% of all thefts in 2022, climbing steadily

DEFI-3.97%

区块客·2025-12-19 10:17

White House Crypto Czar David Sacks: "Digital Asset Market Clarity Act" to Begin Review in January Next Year

U.S. Cryptocurrency Regulatory Legislation Moves Forward Again. White House AI and Crypto czar David Sacks announced on Thursday that the highly anticipated Digital Asset Market Clarity Act has been scheduled for final markup in January next year, bringing this key legislation one step closer to official enactment.

David Sacks posted on social platform X: "Today, we had a very positive call with Senate Banking Committee Chairman Tim Scott and Agriculture Committee Chairman John Boozman. They confirmed that the Clarity Act will enter markup in January."

> We have never been this close to passing this crypto market structure bill, which President Trump personally endorsed.

> We had a

区块客·2025-12-19 07:21

Tom Lee is confident that "Ethereum has bottomed out"! BitMine invests an additional $112 million to buy up.

The second-largest cryptocurrency reserve company in the world, BitMine Immersion (stock ticker: BMNR), continues to increase its holdings, earlier today adding approximately $112 million worth of Ethereum.

According to on-chain analyst EmberCN (@EmberCN) monitoring, BitMine bought 33,504 ETH through the trading platform FalconX around 6 a.m. this morning.

> The largest Ethereum treasury company, Bitmine (BMNR), continued to increase its ETH holdings today:

> 2 hours ago, received 33,504 ETH from FalconX ($112 million).

>

> ———————————————————

> This article is sponsored by @Bitget|Bitget

ETH1.07%

区块客·2025-12-18 07:29

Vitalik Buterin: "Simplifying" the Ethereum protocol so everyone can understand! Only then can decentralization be promoted.

Ethereum co-founder Vitalik Buterin has recently elaborated on the "The Purge" roadmap. He stated that protocols on Ethereum should remain "simple" to allow more people to verify the "entire protocol."

(Background: Ethereum core developer Péter Szilágyi angrily criticizes: ETH Foundation's unfair compensation and centralized power around Vitalik Buterin...)

(Additional context: Vitalik Buterin's long article: What is a cyber nation? And my views on building a cyber nation)

Ethereum's leader Vitalik Buterin recently posted that "over-complexity" is the enemy of decentralization. If only a few experts can verify the code, trustlessness will break down.

He said:

> An important but often underestimated aspect of "trustlessness"

ETH1.07%

動區BlockTempo·2025-12-18 07:05

Visa partners with Circle and Solana to provide USDC settlement services to US banks

Global payments giant Visa announced on Tuesday the official launch of stablecoin settlement services in the United States, symbolizing that traditional financial institutions' interest in blockchain payment channels has shifted from "wait-and-see" to "practical application."

According to Visa's statement, this service allows U.S. financial institutions to use the USD stablecoin USDC issued by Circle for backend cash flow and clearing operations on the Solana blockchain. The initial participating banks include Cross River Bank, known for its fintech services, and Lead Bank, which has received investment from well-known venture capital firm a16z.

Visa also announced that this service will continue to expand in scale through 2026. Rubail Birwadker, Head of Global Growth Products and Strategic Partnerships at Visa, stated:

> The reason Visa is expanding its stablecoin settlement business is because

SOL1.66%

区块客·2025-12-18 05:54

Compliance Starting Point: Clarifying the Legal Classification of Smart Contracts in Different Scenarios

Author: Bennett Ma

> Faced with the complexity of smart contract applications, we should abandon the simplistic thinking of "code is law" and instead adopt a more nuanced and pragmatic "scenario-based analysis" perspective. Only in this way can we embrace technological innovation while clearly defining rights and responsibilities, managing benefits and risks.

>

>

Introduction

The concept of "Smart Contract" originally described a digital agreement capable of automatic execution. However, when the concept is implemented in practice, people find that this code, which can run automatically, can serve not only as a "contract" but also as rules for organizational governance, channels for asset transfer, and even tools for illegal activities.

Although smart contracts are not used as "contracts" in many scenarios, everyone still collectively refers to them as "smart contracts." It is evident that "smart contract" is not a legal concept.

STORM1.05%

金色财经_·2025-12-17 04:54

Tradoor suspected rug pull! Token plummets, team disappears, former employees owe wages, rumors of shell company sale emerge..

TON/BNB Ecosystem Perp Trading Platform Tradoor Rumored to Be a Victim of Malicious Rug Pull

(Background: From Sahara to Tradoor, a review of recent scam coin "fancy decline" tactics)

(Additional context: Bitcoin 70% of dark web trading volume suddenly evaporates: Abacus Market suspected of rug pull)

According to community insiders who leaked to Dongqu, the TON/BNB ecosystem Perp trading platform Tradoor is suspected of experiencing a team rug pull. The insider claims that Tradoor manipulated the self-issued token $TRADOOR through malicious trading, violently pumping and dumping, dropping from $2.4 to $0.7 within two weeks, then violently pumping again to $6.6 to attract buying interest.

> Tradoor

TRADOOR8.74%

動區BlockTempo·2025-12-16 10:40

The governance crisis of ENS: Decentralization = Low quality and inefficiency

On November 18, 2025, ENS founder Nick Johnson wrote the following on the forum:

> "Political struggles within the working group have already taken a toll on the ENS DAO, driving away many dedicated contributors—and even more will leave by the end of this term. As things stand, we are heading toward a situation where all serious, focused, and capable people are either pushed out or prevented from participating, resulting in the DAO's leadership falling into the hands of those who are either inexperienced, too stubborn to leave, or have external incentives that conflict with the protocol."

He then added:

> "If you're worried I'm talking about you, no, of course not—you are one of the good ones."

This statement seems to be a reassurance, but in fact, it is the most biting sarcasm. In an organization that claims to be "decentralized,"

ENS1.57%

PANews·2025-12-16 07:03

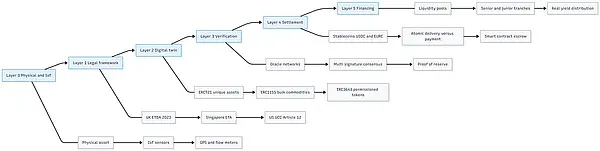

$16 Trillion Revolution: How Tokenization is Reshaping Global Trade

When a cargo-filled container ship moves faster than the transfer of its ownership documents, it indicates that something is fundamentally broken. Here is how blockchain technology addresses a 70-year-old problem—and why the race to build this infrastructure will define the future of finance over the next decade.

Imagine you are transporting $40 million worth of crude oil across the Atlantic. The oil tanker sails smoothly at 14 knots, but who has the paperwork proving ownership of the oil? It’s caught in a relay race of courier services, bank processing queues, and manual verification checks. By the time the documents catch up with the ship, weeks have passed, millions of dollars are frozen, and sometimes, as in the case of an unfortunate vessel docked outside a port for two months, the documents are simply lost.

> This is not a story from the 1950s. This is global trade in 2024.

LINK-0.17%

金色财经_·2025-12-15 11:27

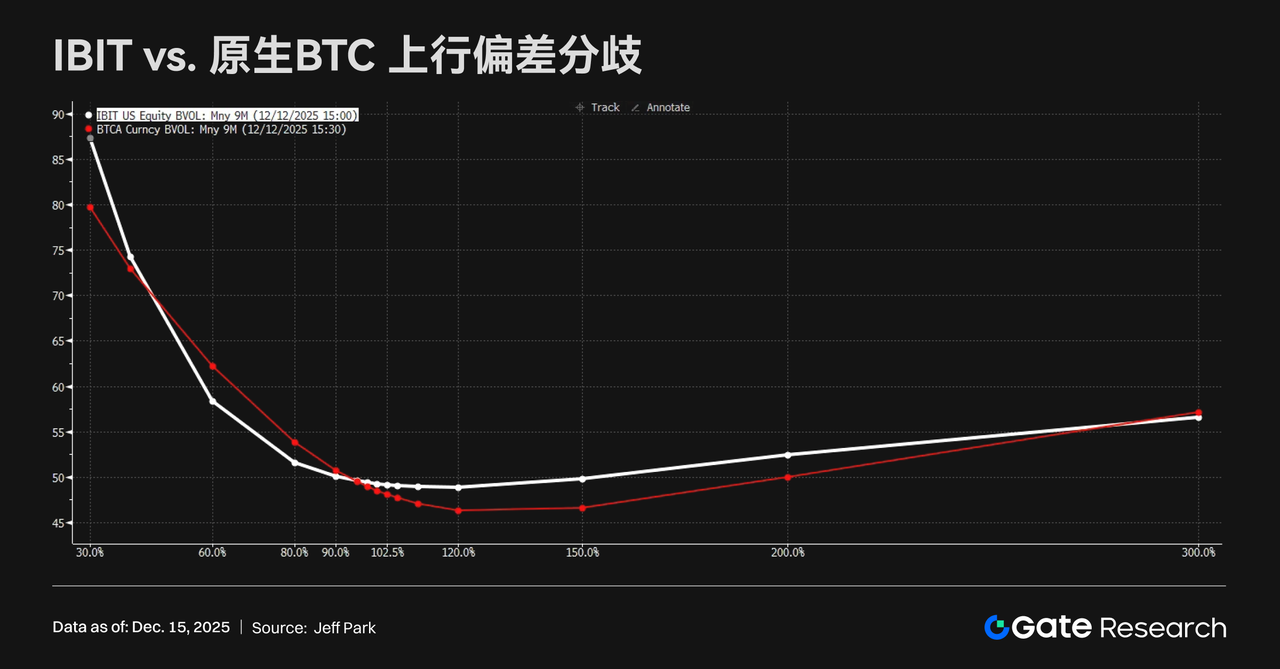

Gate Research Institute: Market Under Pressure and Consolidation | BTC Upward Momentum Restricted by Options Structure

Gate Research Institute Daily Report: December 15 — The overall crypto market continues to face pressure, with BTC and ETH maintaining low-level consolidation, while GT shows relative resilience. Under the weak performance of mainstream coins, tokens such as FHE, ICE, and BAS have reversed trends and strengthened amid catalysts like privacy computing collaborations with Chainlink, token migrations and mainnet transitions, as well as ERC-8004 protocol upgrades, reflecting a concentrated battle for structural opportunities among funds. The structural selling pressure in the options market still suppresses BTC upside momentum. The divergence between ETF bullish demand and OG holders selling volatility suggests that BTC is more likely to remain in short-term consolidation rather than make rapid breakthroughs; Ant International is reconstructing corporate treasury management systems through blockchain, AI, and tokenized deposits; after the mainnet launch of Stable, on-chain activity has been below expectations, highlighting ongoing challenges for the differentiated implementation of stablecoin public chains.

GateResearch·2025-12-15 05:40

The US SEC walks you through how to custody cryptocurrency assets

Note: On December 12th, the U.S. SEC officially issued a document providing basic knowledge on accepting cryptocurrency custody for retail investors, helping retail investors decide how to hold cryptocurrencies in the best way. Gold Finance compiled:

The U.S. SEC Investor Education and Assistance Office released this investor notice to help retail investors understand the ways to hold cryptocurrencies. This notice outlines types of crypto asset custody and offers some tips and questions to help you determine the best way to hold your crypto assets.

1. What is cryptocurrency custody?

Cryptocurrency "custody" refers to the methods and locations where you store and access your crypto assets. You typically access your crypto assets through a device or computer program called a crypto wallet. Crypto wallets themselves do not store crypto assets; instead, they store the "private keys" or passwords that give you access to your assets.

> Crypto assets. Crypto assets refer to digital assets that utilize blockchain or similar distributed technologies.

金色财经_·2025-12-15 05:24

The governance crisis of ENS

Author: Chao Source: @chaowxyz

On November 18, 2025, ENS founder Nick Johnson wrote the following on a forum:

> "Political struggles within the working group have already taken a toll on the ENS DAO, driving away many dedicated contributors—and even more will leave by the end of this term. As things stand, we are heading toward a situation where all serious, focused, and capable individuals are either pushed out or prevented from participating, resulting in the DAO's leadership falling into the hands of those who are either inexperienced, too stubborn to leave, or have external incentives that conflict with the protocol."

>

>

He then added:

> "If you're worried I'm talking about you, no, of course not—you are one of the good ones."

>

>

This statement seems to be a reassurance, but in reality, it is the most biting sarcasm. In a so-called

ENS1.57%

金色财经_·2025-12-12 10:06

Gate Research Institute: LIGHT Surges Over 40% in 24 Hours | JPMorgan Launches USCP Token on Solana

Gate Research Institute: On December 12, BTC's short-term trend clearly turned stronger; ETH price surged then pulled back within the past 24 hours, showing a high-level oscillation structure; GT price is generally in a phase of oscillation and recovery; LIGHT became the focus with a surge of up to +41.61%. JPMorgan launched the USCP token on Solana to help Galaxy complete a milestone on-chain debt issuance; Blockstream plans to acquire TradFi hedge fund Corbiere Capital to expand institutional investment; El Salvador, in partnership with Musk’s xAI, is implementing the Grok AI education program nationwide.

GateResearch·2025-12-12 07:47

Gate Institute: BTC short-term trend turns stronger | JELLYJELLY 24-hour increase exceeds 38%

Gate Research Institute: On December 12, BTC's short-term trend clearly turned stronger; ETH price surged then pulled back within the past 24 hours, showing a high-level oscillation structure; GT price is generally in a phase of oscillation and recovery; LIGHT became the focus with a surge of up to +41.61%. JPMorgan launched the USCP token on Solana to help Galaxy complete a milestone on-chain debt issuance; Blockstream plans to acquire TradFi hedge fund Corbiere Capital to expand institutional investment; El Salvador, in partnership with Musk’s xAI, is implementing the Grok AI education program nationwide.

GateResearch·2025-12-12 07:24

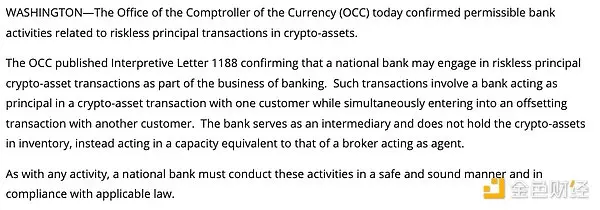

OCC confirms major news: Banks can directly provide crypto intermediary services to customers

Written by: 0xjs

The Office of the Comptroller of the Currency (OCC) in the United States issued Interpretive Letter 1188 on December 9, 2025, confirming that national banks may participate in cryptocurrency transactions as "riskless principal" intermediaries.

> The Office of the Comptroller of the Currency (OCC) issued Interpretive Letter 1188, confirming that national banks can engage in riskless cryptocurrency principal transactions as part of their banking activities. Such transactions involve the bank acting as an agent for a customer to conduct a cryptocurrency trade, while simultaneously executing a hedge with another customer. The bank, as an intermediary, does not hold the cryptocurrency but acts in a manner similar to a broker or agent.

>

>

This means that banks can purchase cryptocurrencies from one client and immediately resell them.

金色财经_·2025-12-11 10:11

I don't regret dedicating eight years of my life to the crypto industry.

Author: Nic Carter, Partner at Castle Island Ventures; Translation by: Golden Finance

> No one can serve two masters. Either you will hate the one and love the other, or you will be devoted to the one and despise the other. You cannot serve both God and Mammon.

>

> Matthew 6:24

>

金色财经_·2025-12-11 04:18

He Yi Interview: From "I want to try it" to Binance Co-CEO, a new management structure where "1+1>2"

In December 2025, during Dubai Blockchain Week (Binance Blockchain Week), Binance co-founder – He Yi, announced her appointment as Co-CEO of (Binance). During the interview that week, it was shown that she will take on the responsibility of the world's largest crypto exchange and also attempt to lead Binance towards a sustainable long-term vision through organizational reform, technological innovation, and value investing principles. Below is a summary of some interview content.

Why did Binance implement a co-CEO structure? A new management framework where "1+1>2"

Under the new personnel arrangement, CEO Richard Teng leverages his compliance background and global regulatory communication, while He Yi focuses on corporate culture, human resources, and user experience. She stated that this dual leadership system has precedents in traditional financial institutions like JPMorgan Chase and can achieve professional division of labor and institutional efficiency.

She emphasizes that, as early as

GT-0.84%

ChainNewsAbmedia·2025-12-10 10:56

Dissecting the reverse logic behind the "Fear Index": The lower the value, the more you should buy?

When the "Fear and Greed Index" remains in an unsettlingly low zone for an extended period, the market is often shrouded in fear and uncertainty.

Portfolios are bleak, headlines are filled with doomsday predictions, and instinct drives you to flee the market.

But history tells a different story.

>

> Moments when panic reaches its peak and everyone surrenders can, for a few disciplined investors, become an opportunity to create wealth.

>

>

This article will focus on whether contrarian investment strategies are worth considering in the current market environment.

1. Market Sentiment Indicator

The market, especially high-volatility markets like cryptocurrencies, is not solely driven by fundamentals and balance sheets.

Participant psychology, including the emotions of holders, buyers, or panic sellers, is equally crucial.

"Market sentiment" essentially refers to the overall prevailing mood of investors toward an asset at any given time.

BTC-0.84%

PANews·2025-12-10 10:04

The Future Economy of AI Agents: Why Cryptocurrency is Needed as "Verifiable Infrastructure"?

Author: Pan, Founder of TP Wallet

For AI Agents to truly become "widely deployable autonomous software," there are two core capabilities:

1. Composability

2. Verifiability

These two capabilities are exactly what traditional Web2 cannot provide, but what cryptocurrency systems inherently possess.

1. AI requires composability, and composability must be built on top of verifiability

The future of AI Agents is not about a single model, but rather:

- Automatically invoking other services

- Composing with other Agents

- Automatically writing code

- Automatically testing

- Automatically executing decisions (including actions involving funds)

This is called Agentic Composability.

Here comes the question:

>

> If an Agent

PANews·2025-12-08 06:03

Trump Account: How "Helicopter Equity" Is Reshaping American Wealth and Inequality

“Trump Account”: A National Gamble Reshaping American Wealth and the Future

In the rapidly changing global economic landscape, a program called the “Trump Account” is quietly emerging. It is not just a welfare policy, but a grand social experiment that profoundly changes our understanding of wealth, inequality, and even the future of the nation. It represents a shift from the traditional “helicopter money” to the disruptive “helicopter equity,” closely linking the next generation’s economic destiny to the performance of the capital markets.

> If this policy is implemented properly, it will continue to provide liquidity to the US stock market from now until 18 years later. In the short term, it’s definitely a positive for the market.

>

From “Helicopter Money” to “Helicopter Equity”

Over the past half-century, government intervention in the economy has been common. From Keynesian demand-side management to quantitative easing during financial crises, the federal government seems accustomed to

金色财经_·2025-12-08 04:57

Gate Research Institute: ETH Leads the Rally | Macro Improvements and Fusaka Upgrade as Catalysts

Panorama of Crypto Assets

BTC (+1.63% | Current Price 93,452.5 USDT)

BTC experienced two phases in the past day: a strong rebound followed by consolidation at a high level. After hitting a low of $83,828 on December 2, the price began a strong V-shaped rebound, mainly driven by a shift in policy and macro expectations, including improved SEC regulatory outlook and renewed expectations for a Fed rate cut. After reaching a high of $94,189.8, the price entered a phase of high-level consolidation. Currently, the three moving averages show a standard bullish alignment of MA 5 > MA 10 > MA 30, and the overall trend remains bullish. As long as the price stays above the MA 30 and maintains the bullish alignment, the trend remains in an upward consolidation structure. After this high-level consolidation, another breakout attempt at $...

GateResearch·2025-12-04 06:20

Tether's Decade-Long Gamble: How Did It Evolve from a "Stablecoin" to the "Shadow Central Bank" of the Crypto World?

Author: BlockWeeks

What supports the $2.6 trillion crypto market’s liquidity is not the sovereign credit of any nation, but a private company that moved its headquarters from Hong Kong to Switzerland, and ultimately settled in El Salvador—Tether. Its issued US dollar stablecoin, USDT, holds over 70% of the market share. Over the past decade, it has expanded amid crises and doubts, and is now attempting to define the industry's boundaries with its profits.

However, a recent “weak” rating from S&P Global has once again revealed the core contradiction of this grand experiment: a currency tool designed to be “stable” is itself becoming the system’s greatest point of risk.

>

> It’s like an elephant dancing on a tightrope, with a base of hundreds of billions of dollars in US Treasury bonds, but taking adventurous steps into AI, brain-computer interfaces, and Argentine farmland. — This is how the BlockWeeks editorial team describes it.

>

Part I

PANews·2025-12-04 02:06

Dragonfly Partners: Encryption has fallen into financial cynicism, and those who value public chains with PE have already lost.

Author: Haseeb >|<

Compiled by: ShenChao TechFlow

Rebranding "The Defense of Exponential Growth"

In the past, I often told entrepreneurs that the reaction you receive after launching a project will not be "hate," but rather "indifference." Because by default, no one will care about the new blockchain you launched.

But now, I have to stop saying that. This week, Monad just launched, and I have never seen a newly launched blockchain provoke so much "hatred". I have been a professional investor in the crypto space for over 7 years. Before 2023, almost every new chain I had seen upon launch was met with either enthusiasm or indifference.

However, now, whenever a new chain is born, it will be surrounded by the "hated" chorus of voices. The number of critics I have seen for projects like Monad, Tempo, MegaETH — even before their mainnets were launched —

DeepFlowTech·2025-11-28 09:13

Forbes 2026 Crypto Trend Predictions: Where Will It Go After the Drop in Fluctuation?

> Original Title: 5 Crypto Predictions For 2026: Breaking Cycles And Crossing Borders

> Original author: Alexander S. Blume, Forbes

> Compiled by: Peggy, BlockBeats

>

>

Editor's note: As digital assets gradually enter the mainstream, the industry is undergoing profound changes. After the fluctuations and adjustments of 2025, the crypto market remains sluggish, with investor sentiment cautious, and the industry faces a critical moment of consolidation and reshaping. However, stagnation does not mean a halt; it is a prelude to the next stage of innovation and maturity.

In the author's view, with the acceleration of institutional trends and the gradual clarification of regulatory frameworks, 2026 is expected to be another strong year for the development of digital assets.

COINVOICE(链声)·2025-11-28 03:08

Gate Research Institute: Crypto market overall rebounds | Ethena Q3 fee revenue hits record high

Gate Research Institute: On November 24, the current price of BTC has fallen to around $86,600. If it continues to lose support from the short-term moving averages, it will face the risk of further testing the support range of $85,800–$84,500; the short-term trend of ETH shows a weak oscillation pattern, with the price encountering resistance and falling back after reaching around $2,840, currently consolidating around the $2,780 level; the price of GT formed a phase low around $9.24 after a rapid decline earlier, followed by a wide oscillation stabilizing and slowly climbing along the MA30. Furthermore, TNSR (+53.24%), PARTI (+41.58%), and DYM (+23.68%) have shown significant rises, indicating a noticeable increase in market enthusiasm for high-elasticity assets in the short term. Ethena's Q3 fee revenue reached a historic high, surpassing $150 million; the video sharing platform Rumble has launched the Rumble Wallet, supporting tipping functions for BTC, XAUT, and USDT; Wormhole Labs has launched Sunrise, bringing assets like MON into the Solana ecosystem.

GateResearch·2025-11-24 06:16

Out of Sync: Ethereum Bleeding, Hyperliquid Losing Momentum

Hyperliquid’s Ecosystem Fractures

> “Wishing every day for a @YBSBarker technical co-founder to appear.

When fortune comes, everything works together; when luck fades, even heroes are powerless.

Binance launches Aster to attack Hyperliquid’s OI and trading volume, $JELLYJELLY and $POPCAT consecutively attack HLP, but these are merely minor ailments;

Amidst the booming HIP-3 Growth Mode, the rumored BLP (lending protocol), and $USDH ’s proactive staking of 1,000,000 tokens

金色财经_·2025-11-23 07:47

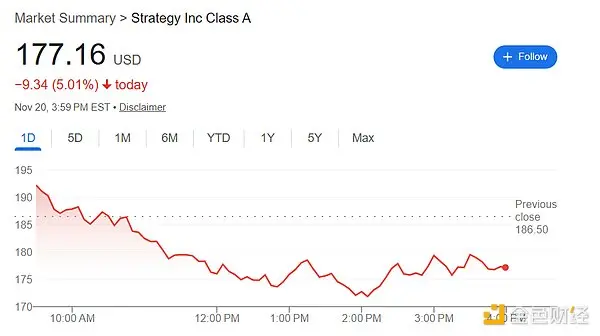

Strategy may be excluded from the NASDAQ 100 and other indices, fearing a loss of tens of billions of dollars.

Bao Yilong, Wall Street Insights

Michael Saylor's Strategy is facing the risk of being removed from mainstream benchmark indices such as the MSCI US Index and the Nasdaq 100 Index.

This week, JPMorgan analyst Nikolaos Panigirtzoglou warned in a report that the Strategy company may lose its position in benchmark indexes such as MSCI USA and Nasdaq 100. The research report pointed out:

> Although active managers are not obligated to follow index changes, being removed from a major index will undoubtedly be viewed as a negative signal by market participants.

>

>

According to the report, if MSCI decides to remove it, this alone could lead to a capital outflow of up to $2.8 billion, and if other index providers follow suit, the scale of the outflow will further expand. Currently, the passive fund exposure related to the company has been opened.

BTC-0.84%

金色财经_·2025-11-21 01:19

Gate GUSD minting limited-time rewards: deposit to enjoy up to 50% annualized returns

Gate GUSD minting limited-time task rewards are now available: net deposit to enjoy an annualized 50%.

Image: [https://www.gate.com/staking/GUSD](https://www.gate.com/staking/GUSD)

The GUSD minting activity on the Gate platform has been upgraded, with new time-limited task rewards. From November 14, 2025, to November 28, 2025, users who complete a net deposit >= 5,000 USDT can enjoy generous annualized returns of 50%.

This activity not only offers users up to 50% additional rewards but also supports using GUSD holdings for various financial products, such as

GUSD0.02%

GateLearn·2025-11-20 01:37

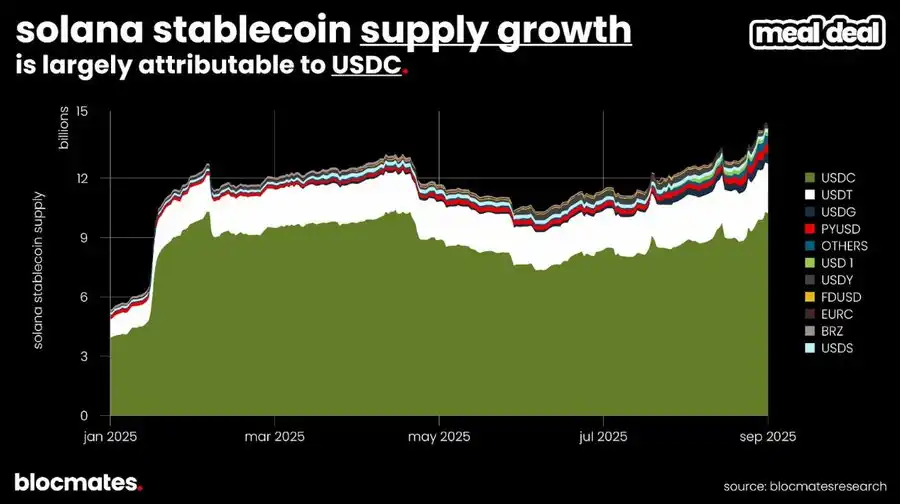

Has SOL reached its limit? Multidimensional data reveals the true picture of Solana.

> Original Title: Time to Call the SOL Bottom?

>

>

> Original author: blocmates

> Original compilation: Dingdang, Odaily Planet Daily

>

>

In the third quarter of 2025, it is a "two-sided story on the same chain" for Solana. On the surface, the "Meme retreat" has brought a significant cooling effect: daily active addresses are declining, and the user dominance is gradually being eroded by competitors. However, beneath the surface, the fundamentals of this chain are becoming increasingly solid. The Solana core team has consistently maintained high-frequency iterations, continuously advancing one of the most ambitious technology roadmaps in the crypto industry; at the same time, its

SOL1.66%

COINVOICE(链声)·2025-11-19 02:28

Why BTC has given back all its rise while alts are deep underwater: the truth is coming to light.

Source: Retrospectively Obvious; Compiled by Golden Finance

Everyone in the crypto space is focused on the same headlines:

ETF has been launched

Real economy enterprises are integrating stablecoins.

Regulatory agencies are increasingly friendly.

Everything we once hoped for has now come true.

Why did the price suddenly drop?

Why has Bitcoin given back all its gains, while the US stock market has risen 15%-20% this year? Why, even though "cryptocurrency is no longer a scam" has become a mainstream consensus, are your favorite altcoins still deeply underwater?

Let's have a good talk about this matter.

adoption ≠ price increase

There is a deep-rooted assumption in the crypto Twitter sphere:

> "Once institutions enter, once regulation clarifies, once JPMorgan issues tokens... everything will be over, and we will take off."

>

>

Today, institutions are coming.

金色财经_·2025-11-18 06:21

Load More