Search results for "LUNA"

Who is the real culprit behind the LUNA coin crash? Terra liquidators accuse Jump Trading of behind-the-scenes trading and file a lawsuit seeking $4 billion.

The Terra crash has triggered a new storm, with the bankruptcy administrator suing Jump Trading for manipulating the UST Market Stabilization for profit, claiming $4 billion in damages and attempting to hold them accountable for the $40 billion crash.

LUNA-0.4%

CryptoCity·2025-12-22 08:40

File a claim for 4 billion USD! Terra liquidator accuses Jump Trading of "behind-the-scenes trading" triggering the crash

The Terra (LUNA) crash in 2022, which shocked the world and caused $40 billion to evaporate overnight, has now reignited a legal storm. The bankruptcy liquidation administrator of Terraform Labs has recently filed lawsuits against top quantitative trading giant Jump Trading and its executives, aiming to hold the company responsible for Terra's collapse and seeking civil compensation amounting to $4 billion.

According to The Wall Street Journal, Todd Snyder, the bankruptcy liquidation administrator of Terraform Labs, has filed a lawsuit in court. The defendants include not only Jump Trading but also co-founder William DiSomma and former President Kanav Kariya, who stepped down in 2024.

Terra

LUNA-0.4%

区块客·2025-12-20 11:55

Jump Trading Faces $4 Billion Lawsuit Over Its Role in the TerraUSD and LUNA Collapse

The liquidator of Terraform Labs, Todd Snyder, has filed a sweeping $4 billion lawsuit against trading giant Jump Trading and senior executives William DiSomma and Kanav Kariya, alleging that their actions materially contributed to the catastrophic collapse of the Terra ecosystem in 2022.

The lawsui

LUNA-0.4%

Moon5labs·2025-12-19 17:02

Claiming $4 billion! Terraform Labs bankruptcy administrator sues Jump Trading: directly responsible for the LUNA collapse!

According to The Wall Street Journal, Todd Snyder, the bankruptcy trustee of Terraform Labs (a cryptocurrency company founded by Do Kwon), has filed a lawsuit in the U.S. District Court in Illinois, accusing high-frequency trading firm and crypto market maker Jump Trading and its executives, including co-founder William DiSomma and former head of the crypto division Kanav Kariya, seeking damages of up to $4 billion.

(Previous background: Arthur Hayes: Big names are in trouble—"Full liquidation of crypto," is Jump Trading the culprit behind the crash?)

(Additional background: Terra claims innocence but is betrayed! Files a "short UST report" against Jump Trading in court)

LUNA-0.4%

動區BlockTempo·2025-12-19 13:30

Jump Trading Sued for $4B Over Alleged Terra Manipulation

Terraform Labs' bankruptcy administrator is suing Jump Trading for $4 billion, alleging market manipulation during the 2022 Terra collapse, including secret deals to buy LUNA at a steep discount while misrepresenting its stability.

TheNewsCrypto·2025-12-19 13:01

File a claim for 4 billion USD! Terra liquidator accuses Jump Trading of "behind-the-scenes trading" triggering the crash

The Terra (LUNA) crash in 2022, which shocked the world and caused $40 billion to evaporate overnight, has now reignited a legal storm. The bankruptcy liquidation administrator of Terraform Labs has recently filed lawsuits against top quantitative trading giant Jump Trading and its executives, aiming to hold the company responsible for Terra's collapse and seeking civil compensation amounting to $4 billion.

According to The Wall Street Journal, Todd Snyder, the bankruptcy liquidation administrator of Terraform Labs, has filed a lawsuit in court. The defendants include not only Jump Trading but also co-founder William DiSomma and former President Kanav Kariya, who stepped down in 2024.

Terra

LUNA-0.4%

区块客·2025-12-19 11:51

LUNA Defends $0.16, Eyeing Potential 50% Upside in Next Leg

LUNA defends $0.16 support, signaling bullish momentum and short-term buying opportunities.

Technical indicators suggest potential Upside toward $0.283 and $0.34 in the next rally.

Minor pullbacks may occur, but the overall trend favors bulls with sustained buying pressure.

Terra — LUNA,

LUNA-0.4%

CryptoNewsLand·2025-12-17 08:41

LUNA Trades Near $0.1456 As Breakout Redefines Short-Term Market Levels

LUNA confirmed a breakout above a long-term falling wedge, pushing price to $0.1456 after a sharp 42.4% daily move.

The asset maintains strong distance above the $0.09896 support, which now anchors the lower boundary of the short-term structure.

The level of resistance at $0.1501 is still

LUNA-0.4%

CryptoNewsLand·2025-12-12 17:35

Morning Minute: Do Kwon Gets 15 Years for $40B Terra Luna Fraud

Decrypt's Art, Fashion, and Entertainment Hub.

Discover SCENE

Morning Minute is a daily newsletter written by Tyler Warner . The analysis and opinions expressed are his own and do not necessarily reflect those of Decrypt. Subscribe to the Morning Minute on Substack .

GM!

Today's top news:

LUNA-0.4%

Decrypt·2025-12-12 13:54

Do Kwon sentenced to 15 years in prison, why is it 10 years less than SBF? LUNA price soars 200% then pulls back

Terraform Labs Co-Founder Do Kwon was sentenced to 15 years in prison by a federal court in the United States for orchestrating a fraud scheme that resulted in a $40 billion loss. Despite causing nearly four times the financial damage of FTX founder SBF ($11 billion), the sentence is 10 years shorter than that of the latter. The key difference lies in Do Kwon’s courtroom admission of guilt, apology to the victims, and cooperative attitude, in stark contrast to SBF’s evasive defense and lack of remorse during his trial. After the verdict was announced, the LUNA token price experienced extreme volatility, initially surging 200% before sharply falling back, highlighting the market’s irrational speculative sentiment in extreme events.

LUNA-0.4%

MarketWhisper·2025-12-12 06:56

What Is Do Kwon Sentenced to 15 Years in U.S. Prison for Terraform Collapse

U.S. District Judge Paul Engelmayer (Southern District of New York) sentenced Terraform Labs co-founder Do Kwon to 15 years in federal prison after Kwon pleaded guilty to wire fraud and conspiracy to defraud in connection with the 2022 Terra/Luna collapse that erased roughly $40 billion in market value.

LUNA-0.4%

CryptopulseElite·2025-12-12 05:59

Do Kwon sentenced to 15 years, judge: only harsh punishment can prevent the next $40 billion LUNA disaster

Terraform Labs Co-Founder Do Kwon is sentenced to 15 years in prison in New York after admitting to two felonies: "conspiracy to commit fraud" and "wire fraud."

(Background: U.S. prosecutors seek a 12-year sentence for Do Kwon: TerraUSD's $40 billion collapse is "unprecedented," verdict expected on 12/11)

(Additional context: Do Kwon pleads guilty but requests a lighter sentence of "within 5 years"! Is it possible? TerraUSD initially evaporated $40 billion)

Terraform Labs Co-Founder Do Kwon was sentenced to 15 years in the Southern District Federal Court in New York on the 11th, a sentence longer than the prosecutor's recommended 12 years. Judge Paul

動區BlockTempo·2025-12-12 01:55

Terra Case: Do Kwon Sentenced to 15 Years, Justice and Controversy After the $40 Billion Collapse

In 2022, the Terra/Luna collapse severely damaged the global cryptocurrency market, evaporating over $40 billion in funds and leaving tens of thousands of investors financially ruined. Now, Terraform Labs co-founder Do Kwon has finally been sentenced to 15 years in prison by a U.S. court. Although this sentence is longer than the prosecution's recommended term, it still sparks debate within the crypto community: with such a massive financial disaster, is 15 years too lenient?

Do Kwon Arrested and Sentenced After Two Years: U.S. Court Hands Down 15-Year Sentence

Inner City Press reports that U.S. District Judge Paul Engelmayer of the Southern District of New York announced on Thursday that Do Kwon was convicted of wire fraud and conspiracy to commit fraud, and was sentenced to 15 years in prison, exceeding the prosecution's recommended 12-year sentence.

The judge pointed out that K

LUNA-0.4%

ChainNewsAbmedia·2025-12-12 01:14

Do Kwon sentenced to 15 years, LUNA surges 222%! Speculation or a turnaround?

Terraform Labs co-founder Do Kwon admits to telecommunications fraud and conspiracy to commit fraud, and is sentenced to 15 years in prison in the Southern District of New York Federal Court. The 2022 Terra crash resulted in approximately $40 billion in market cap evaporation, but the LUNA price has skyrocketed 222% since early December, mainly due to the v2.18 upgrade. Technical analysis indicates that breaking through the Fibonacci range could lead to a surge up to $2.

LUNA-0.4%

MarketWhisper·2025-12-12 00:35

Terra (LUNA) To Rise Further? This Emerging Bullish Fractal Setup Saying Yes!

The cryptocurrency market is experiencing retracements, but Terra (LUNA) surged 52% today, mirroring a breakout pattern from ICP. This suggests a potential further rise if LUNA breaks its upper resistance, projecting an 81% increase.

CoinsProbe·2025-12-11 08:58

Top 3 altcoins with notable trends today - December 11

Terra (LUNA), MemeCore (M), and XDC Network (XDC) stand out as the top performers in the past 24 hours. LUNA leads with an impressive surge of 40%, while MemeCore and XDC continue their positive momentum on Thursday, following previous gains of 6% and 3%, respectively. However, in terms of

TapChiBitcoin·2025-12-11 08:08

Do Kwon's verdict day Terra (LUNA) surges 40%, is it ecological rebirth or doomsday celebration?

As the sentencing date for founder Do Kwon approaches, the Terra ecosystem token LUNA has experienced a remarkable price rebound. In the past 24 hours, LUNA's price surged nearly 40%, reaching a high of $0.243, with weekly gains once approaching 200%. This surge was mainly driven by market speculation on the verdict outcome, while recent ecosystem technical upgrades and governance proposals also provided slight support. However, analysts generally warn that this is a typical event-driven rally, and after the verdict is announced on December 11, the market may face sharp profit-taking and a price correction.

MarketWhisper·2025-12-11 07:22

Do Kwon on the eve of trial, $1.8 billion is gambling on his sentence

LUNA tokens skyrocketed to $1.8 billion in 24-hour contract trading volume without any technical upgrades or positive news. The market is betting real money on Do Kwon's sentencing outcome, yet the fundamentally dead project has become the most active speculative target. (Previous background: US prosecutors seek a 12-year sentence for Do Kwon: TerraUSD $40 billion crash 'unprecedented', verdict expected on 12/11) (Additional background: Do Kwon pleads guilty but seeks a light sentence 'within 5 years'! Is it possible? TerraUSD initially evaporated $40 billion) As of the evening of December 10, you might not have noticed that the contract data for LUNA tokens is extremely abnormal. Without any technical upgrades or positive ecosystem news, the LUNA series contracts (including LUNA and LUNA2) across the market...

動區BlockTempo·2025-12-10 13:04

Before Do Kwon's trial, $1.8 billion is betting heavily on his prison sentence

The article analyzes the abnormal trading activity of the LUNA token contract ahead of Do Kwon's upcoming sentencing hearing. Despite LUNA lacking fundamentals, the market's high trading volume reflects speculative sentiment about its future verdict. Investors are clearly paying attention to the legal developments of the event, creating a new market norm based on emotion and financial game theory. Regardless of the outcome, the value and volatility of LUNA will continue to be driven by market sentiment, showcasing the harshness and maturity of the crypto market.

DeepFlowTech·2025-12-10 12:39

Terra Luna Classic Surges 90%: What’s Behind LUNC’s Rapid Rise?

Short Liquidations: Massive LUNC short positions liquidated, accelerating price surge and bullish momentum.

Token Burns: Weekly burns exceeded 427 billion LUNC, reducing supply and supporting upward movement.

Technical Breakout: LUNC broke the descending trend channel, showing strong bullish

CryptoNewsLand·2025-12-10 08:45

3 Altcoins to Watch for the Next Market Rally: DOT, AVAX, and LUNA

Polkadot: Multi-chain architecture enables interoperability and custom blockchain development with seamless upgrades.

Avalanche: High-speed, scalable platform supports dApps, DeFi, and near-instant transactions at low cost.

Terra Luna: Stablecoin-focused ecosystem ensures financial stability,

CryptoNewsLand·2025-12-09 15:43

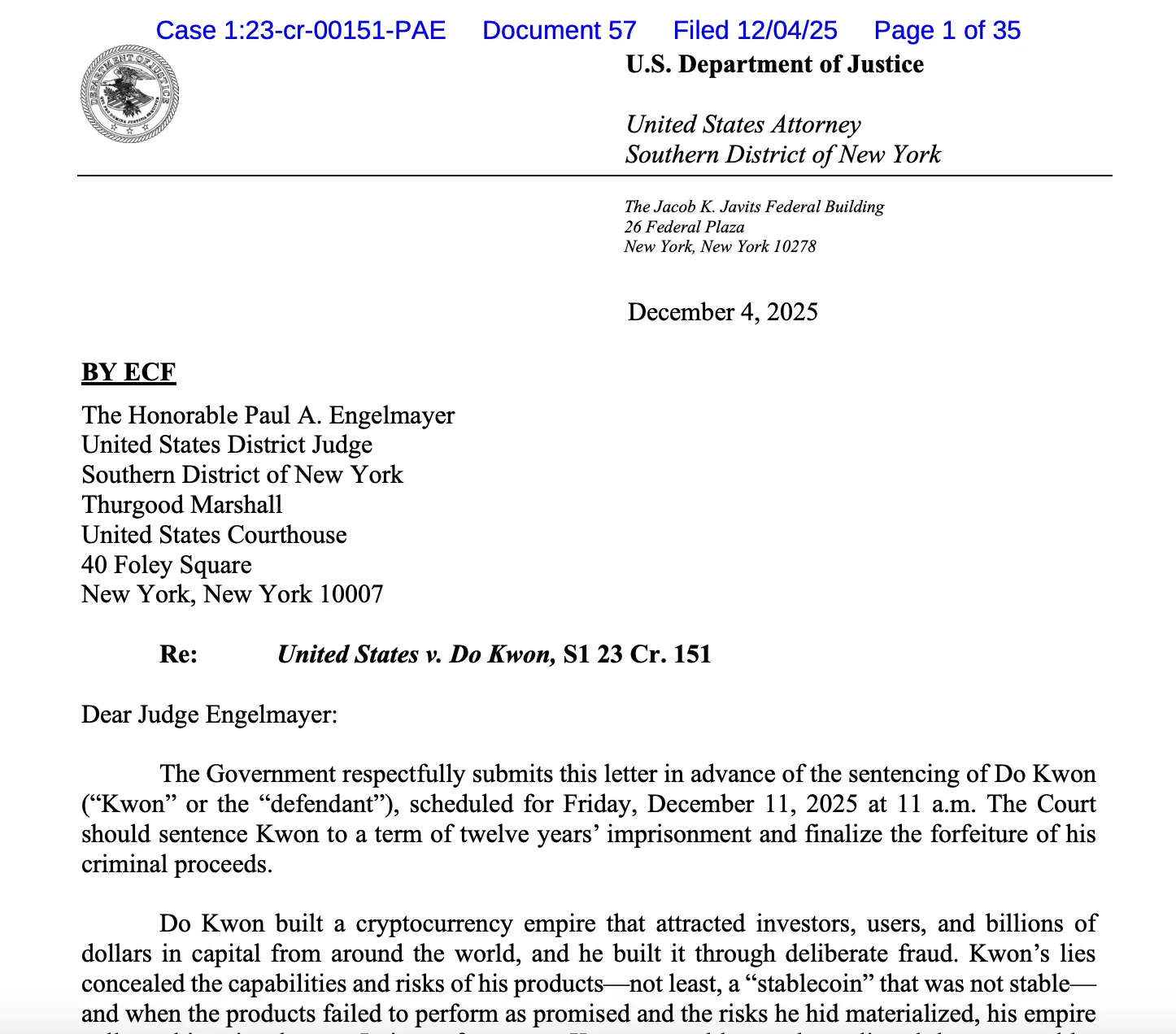

Luna crash mastermind Do Kwon to be sentenced this week! U.S. seeks 12-year sentence, $4 billion evaporated

U.S. federal prosecutors have formally submitted a sentencing recommendation to the Southern District Court of New York, requesting that Terraform Labs co-founder Do Kwon be sentenced to 12 years in prison and forfeit his criminal proceeds. The reason cited is that his actions caused nearly $40 billion in market value to evaporate instantly and triggered a global market shock in 2022. The verdict is set to be announced on December 11.

MarketWhisper·2025-12-08 02:48

Terra Luna Classic (LUNC) surges 90% in 24 hours: Causes and latest developments

In the past 24 hours, Terra Luna Classic (LUNC) has recorded an explosive increase of over 90% at the time of writing, extending its price rally into the second consecutive session. This strong breakout has also quickly propelled LUNC to the second position on the list of trending tokens.

TapChiBitcoin·2025-12-07 01:11

LUNC SOARS 100% AFTER VIRAL T-SHIRT MOMENT | WHY MARKET NOSTALGIA TRUMPS FUNDAMENTALS?

Terra Luna Classic (LUNC) has staged a spectacular, purely narrative-driven rally, surging by nearly 100% in a single day. The shocking catalyst for this explosion was not a major network upgrade or corporate deal, but the viral image of a CoinDesk journalist wearing a vintage Terra Luna logo

Coinstagess·2025-12-07 00:01

Why Are Terra LUNA and LUNC Pumping Today?

LUNA and LUNC prices spiked significantly amid renewed interest in Terra, driven by Do Kwon's upcoming sentencing and the v2.18 chain upgrade, bolstered by Binance support.

BitcoincomNews·2025-12-06 07:15

Bitcoin Holds a 3-Year Pattern As 200DMA and 50DMA Map Market Cycles

The chart shows a steady Bitcoin rise from 16K to 125K within a three year rhythm without major shocks.

Events like COVID and the China ban and the Luna crash formed cycle lows that aligned with the same trend.

Bitcoin held a strong pattern where three years moved up then one year moved down witho

BTC3.4%

CryptoNewsLand·2025-12-04 18:44

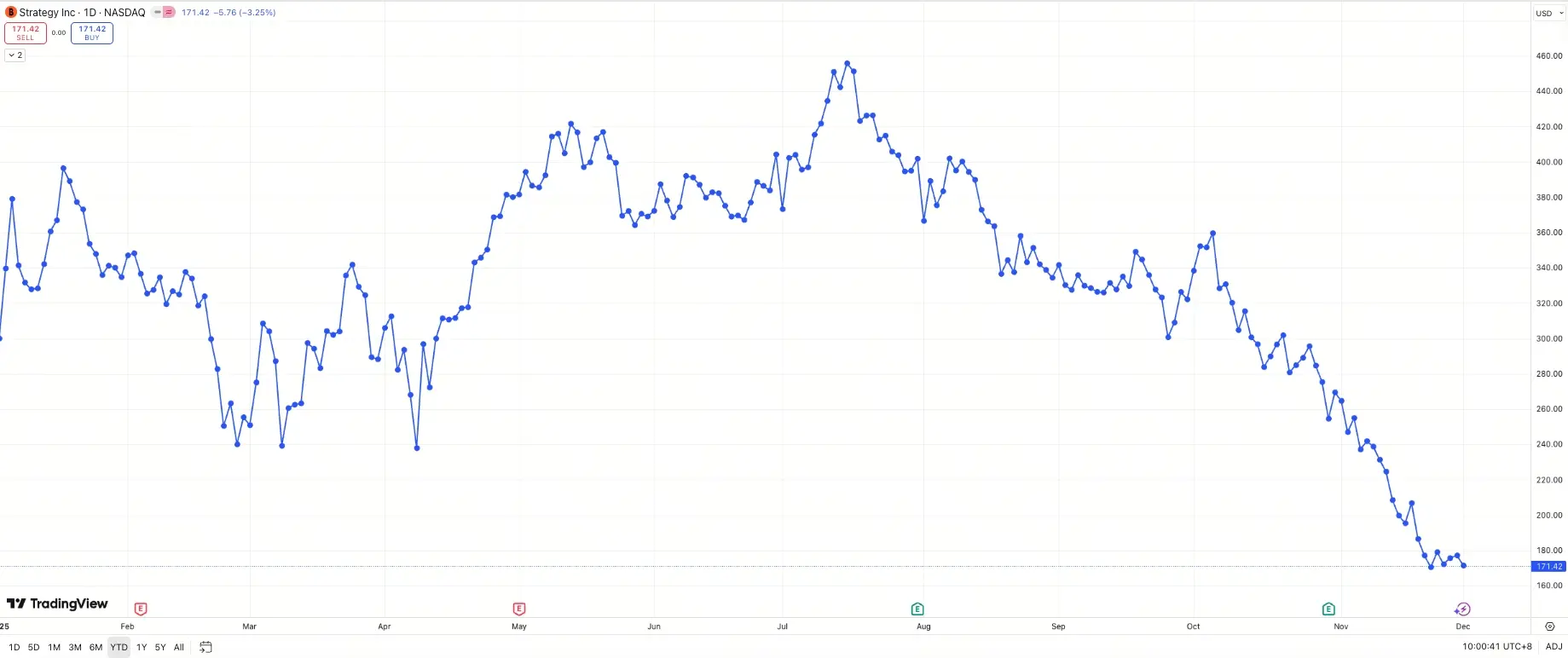

MicroStrategy’s Bear Market Survival Tactics: From Insolvency to Restarting the Bitcoin Flywheel—Can Strategy Weather the Downturn This Time?

Bitcoin Reserve Strategy Pioneer MicroStrategy (, originally named MicroStrategy), has seen its stock price slump recently. After Bitcoin pulled back 36% from its all-time high and has yet to reclaim the $100,000 mark, many investors are questioning whether the Bitcoin flywheel effect has failed. This article will use data from the previous bear market to explore how MicroStrategy can weather this storm.

(The software company delayed by Bitcoin—what exactly is MicroStrategy’s strategy?)

How did MicroStrategy survive the last bear market?

We define the last bear market as the year following the Luna crash in April 2022, when Bitcoin fell from $47K in April to $15K.

For easier data retrieval, we use September 30, 2022, as the financial report cutoff date.

The price of Bitcoin was around $19,320.

The price of MSTR was 2

ChainNewsAbmedia·2025-12-03 02:53

MicroStrategy may become the next LUNA! Polygon CEO warns that 650,000 BTC is trapped in a death spiral.

Polygon CEO Sandeep Nailwal warned that MicroStrategy could become the "LUNA of this cycle," as MSTR stock is falling faster than Bitcoin. MicroStrategy's stock price plummeted nearly 10% to $159.77, down an astonishing 66% from a high of about $473 in July. The 650,000 Bitcoins held by MicroStrategy account for 3.1% of the total supply, facing the risk of a "death spiral."

MarketWhisper·2025-12-02 02:01

Bitcoin (BTC) Flashes Deepest Oversold Signal Ever

The Bitcoin (BTC) price just triggered one of the strongest oversold signals in its entire history – even deeper than the 2018 bottom and the 2022 capitulation during the FTX and LUNA crashes. Analyst Michaël van de Poppe says BTC has never printed a reading this extreme before.

The funny part?

CaptainAltcoin·2025-11-28 07:23

Do Kwon requests a maximum five-year prison sentence as the $40 billion Terra fraud case reaches its final verdict.

The founder of Terraform Labs, Do Kwon, has officially requested the U.S. court to limit his prison term to five years. This move is in response to the collapse of the Terra-Luna ecosystem in May 2022, which resulted in a loss of $40 billion in market capitalization. In a 23-page legal document submitted on November 26, the defense attorney emphasized that Do Kwon's criminal behavior was not driven by personal greed but rather by the "arrogance and decision-making errors of a young founder." The case will be sentenced on December 11, while the South Korean prosecution is still seeking a 40-year prison term for him. This ruling will become a landmark case for regulatory enforcement in the Crypto Assets domain.

LUNA-0.4%

MarketWhisper·2025-11-28 03:38

Do Kwon pleads guilty but seeks a lighter sentence of "5 years in prison"! Is that possible? TerraUSD initially evaporated 40 billion USD.

Terra founder Do Kwon pleaded guilty in the US seeking a "sentence of less than five years." He claims that his imprisonment in Montenegro has already paid the price, while South Korean prosecutors still demand a 40-year sentence, with a ruling set for December 11 this year. (Background: Do Kwon admitted to fraud: I deceived investors who bought UST/LUNA, I am very sorry.. hoping for a significant reduction in sentence) (Context: Do Kwon reportedly will plead guilty! After the collapse of LUNA, he faces charges of fraud, money laundering, and other nine serious crimes) Three years ago, the algorithmic stablecoin TerraUSD collapsed, evaporating 40 billion USD, and now the main figure in the incident, Do Kwon, walks into the federal court in Manhattan, New York, aiming to persuade the judge to reduce his sentence to less than five years. He emphasized that his nearly three years of detention in Montenegro has "already paid the price" and agreed to the prosecution.

LUNA-0.4%

動區BlockTempo·2025-11-27 09:24

Luna coin 2025 Investment Strategy and Gate.com platform Analysis

[LUNA](https://www.gate.com/post/topic/LUNA) [COM](https://www.gate.com/post/topic/COM) [Blockchain Technology](https://www.gate.com/post/topic/AreaCodeTechnology) In the ever-changing Crypto Assets market, mastering effective Crypto Assets investment strategies is crucial. LUNA coin, due to its unique Blockchain technology, has increasingly become the focus of investors' attention. Through in-depth LUNA coin price predictions and risk analyses, we will assist you in understanding its market dynamics and potential investment opportunities. When comparing LUNA coin trading platforms, Gate.com stands out due to its liquidity.

LUNA-0.4%

幣圈動態·2025-11-27 00:00

Data: The total market capitalization of stablecoins continues to decrease, marking the largest monthly fall since the Luna crash.

According to Mars Finance news and DefiLlama data, the total market capitalization of stablecoins continues to decline, decreasing by 0.33% over the past week, currently reported at 302.837 billion USD. This figure has dropped by over 6 billion USD from the previous peak of 309 billion USD, marking the largest monthly fall since the Luna crash in May 2022.

LUNA-0.4%

MarsBitNews·2025-11-24 09:08

Koreans have already turned Cryptocurrency Trading into esports.

Young people in South Korea once viewed cryptocurrency trading as a springboard for life, even holding live Futures Trading competitions. However, after the big dump of LUNA, they began to collectively withdraw from the crypto world and shifted to the South Korean stock market. South Koreans did not stop speculating; they simply changed the gambling table from the crypto world to the stock market. (Background: Upbit's parent company Dunamu was fined 35.2 billion won, receiving the most expensive fine in South Korean cryptocurrency history) (Additional background: Upbit's volume fell by 80%, are even South Koreans no longer trading coins?) Over a month ago, I came across a video online. The familiar dim stage lights, coupled with the audience's deafening cheers, made one think it was an offline esports competition for League of Legends. But as the camera zoomed in, I realized: wait, this wall isn’t a game, isn’t that a K-line chart! Indeed, South Koreans have really turned cryptocurrency trading into an esports competition.

動區BlockTempo·2025-11-24 08:08

Luna coin trend analysis: Understanding the future development of the Terra ecosystem

[LUNA]() [Blockchain]() [Investment Strategy]() As the trend of the Crypto Assets market continues to change, the price prediction and investment strategy of Luna coin have become the focus of investors. In 2025, the development of the Terra ecosystem is rebuilding trust and innovating through the prospects of Blockchain projects. The Fluctuation analysis of Crypto Assets shows that mastering the correct Luna investment strategy is crucial for entering high-risk markets. This article will explore these key topics and provide professional insights and analysis to help you make informed investment decisions.

After the collapse of the Terra ecosystem in May 2022, Luna coin has shown remarkable resilience. Currently, the price of Luna coin is around $0.08, with a total market capitalization of $54,644,146.08. Although it is far from its historical peak, it indicates that the ecosystem is in a rebuilding phase. The Terra team is restructuring governance.

LUNA-0.4%

幣圈動態·2025-11-16 17:05

Dragonfly Managing Partner: Although the current crypto market prices have seen a fall, the fundamentals remain strong.

According to Deep Tide TechFlow news, on November 14, Dragonfly Managing Partner Haseeb Qureshi posted on social media that this is the easiest Bear Market he has ever seen.

Haseeb Qureshi reviewed the market conditions of 2022, when Luna collapsed, followed by the failures of Three Arrows Capital (3AC), FTX, Genesis, and BlockFi, and the Axie and NFT markets also faced issues, causing the entire industry to be on the verge of collapse like a house of cards. After these collapses, the banking sector also faced a crisis, stablecoins lost their peg, and regulators attempted to crack down on almost all companies in the industry.

In contrast, Haseeb Qureshi believes the current market situation is much better. Although prices have dropped, the fundamentals are strong, and cryptocurrencies are functioning normally. He suggests

LUNA-0.4%

DeepFlowTech·2025-11-14 04:46

6.4 Trillion LUNC “Burned”: Legit Luna Classic Burn Or Hoax?

Several social media accounts and crypto media outlets have very recently posted LUNC news claiming that a whopping 6.4 trillion Luna Classic tokens were burned. A chart from LUNC Tech, a popular Terra Luna Classic chain validator, showed this figure on October 20, 2025, raising some eyebrows

DailyCoin·2025-11-13 02:08

LUNA AI Meme Coin on BNB Chain: Virtuals Protocol's Luna.fun Launch and Price Surge

LUNA AI meme coin on BNB Chain is making waves with its recent launch via Virtuals Protocol's Luna.fun, the world's first AI-generated content (AIGC) meme launchpad.

CryptopulseElite·2025-11-11 10:02

The burning of 1.1B LUNC reignites the Luna Classic frenzy.

In November, the Terra Luna Classic (LUNC) community saw over 1.18 billion tokens burned within three days, led by Binance. Despite this, LUNC’s price fell sharply, leading to skepticism among go long investors about ambitious price targets.

TapChiBitcoin·2025-11-04 02:10

LUNA Price Steadies Near $0.098 Amid Tight Trading Range and Flat Momentum

Terra (LUNA) currently trades at $0.09859, down 1.2% daily, within a tight range supported by $0.09776 and resisted at $0.1019. The market shows cautious stability, with moderate trading volume and liquidity, reflecting balanced buyer-seller dynamics.

CryptoNewsLand·2025-10-23 04:54

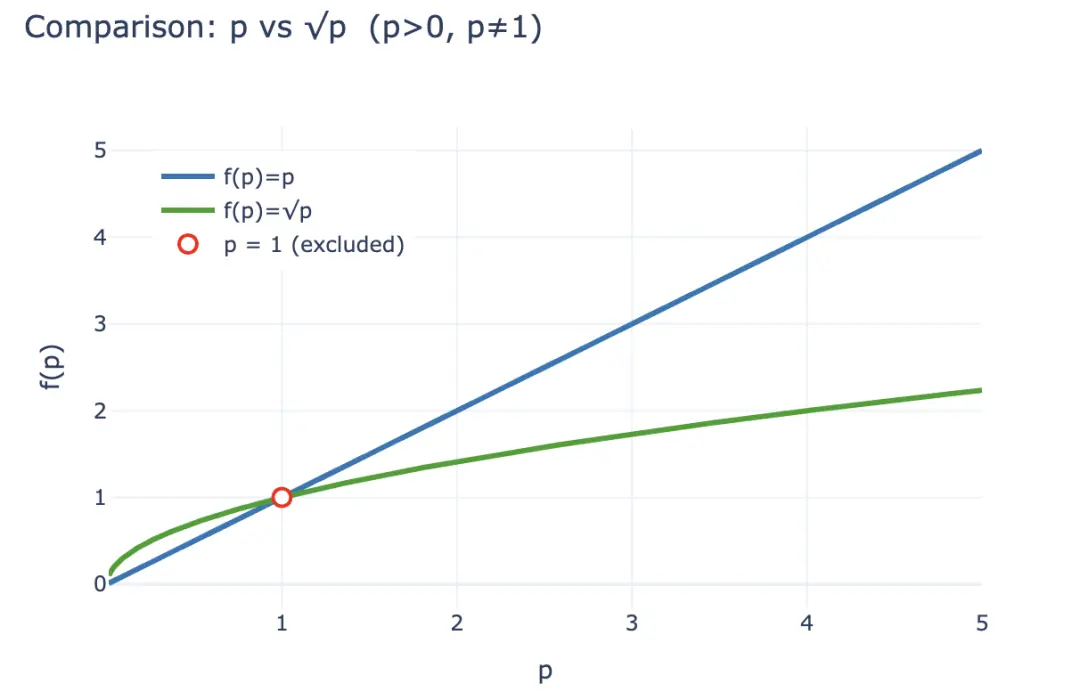

What is Yield Basis (YB)? Curve's new creation eliminates Impermanent Loss or reenacts the Luna crash.

Curve Finance founder Michael Egorov launched Yield Basis (YB) in early 2025, claiming to eliminate Impermanent Loss in AMM through a 2x leverage mechanism, allowing LPs to utilize $500 worth of BTC to achieve a $1000 market-making effect.

MarketWhisper·2025-10-15 08:40

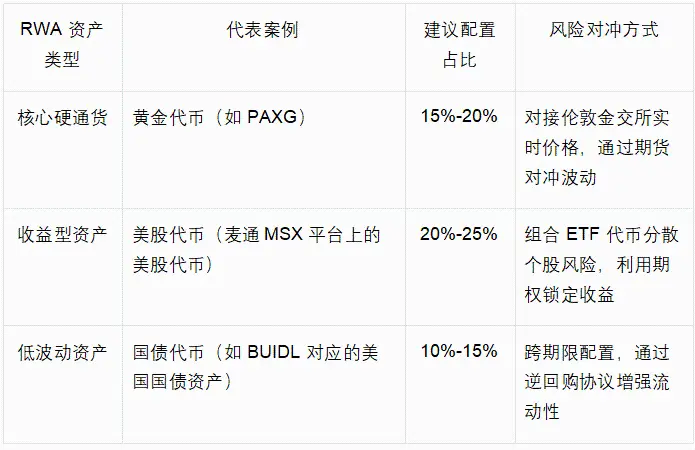

Why did USDe survive while LUNA dropped to zero, despite both being stablecoins?

Author: MSX Research Institute

The decoupling event in October 2025 intersects with Hayek's prophecy.

On October 11, 2025, panic in the crypto market triggered an extreme shock to the synthetic stablecoin USDe - during a "historic crash" where Bitcoin plummeted from $117,000 to $105,900 (a single-day drop of 13.2%) and Ethereum fell by 16% in one day, USDe briefly fell to about $0.65 on October 11, 2025 (down about 34% compared to the $1 exchange rate), before recovering within hours. At the same time, the global crypto market saw a liquidation amount surge to $19.358 billion in 24 hours, with 1.66 million traders forced to close their positions, setting a record for the largest single-day liquidation in history.

From the perspective of micro-market performance, the decentralized exchange Uniswap

PANews·2025-10-14 04:06

Why did USDe survive while LUNA dropped to zero, despite both being stablecoins that lost their peg?

Original author: Mai Tong MSX Research Institute

The decoupling event in October 2025 and the intersection with Hayek's prophecy

On October 11, 2025, panic in the crypto market triggered an extreme shock to the synthetic stablecoin USDe — during the "epic crash" where Bitcoin plummeted from $117,000 to $105,900 (a single-day drop of 13.2%), and Ethereum fell sharply by 16% in one day, USDe briefly dropped to around $0.65 on October 11, 2025 (a decrease of about 34% compared to the $1 exchange rate), before recovering within a few hours. During the same period, the global crypto market saw a 24-hour liquidation amount surge to $19.358 billion, with 1.66 million traders forced to close positions, marking the largest single-day liquidation record in history.

From the perspective of micro market performance, the decentralized exchange Uni

MarsBitNews·2025-10-13 11:37

The most intense leverage reset in history and a change of hands among buyers: Can the crypto market rise more easily after the bloodbath?

Described by the crypto community as the "crypto world version of Black Friday," the flash crash event on October 11 caused the crypto market to lose $450 billion in market capitalization in a single day, making it the most intense leverage washout in history. However, on-chain data analysts point to another interpretation: this is not the end of the bull run, but rather a good opportunity to confirm whether the real participants still remain in the market.

( The season of scams has ended! The crypto market evaporated 450 billion dollars in a single day, trader Eugene: goodbye digital asset reserve companies )

From the Luna crash to the flash crash on 10/11: Has the crypto market grown up?

According to analyst Murphy, the scale and nature of this crash are completely different from the Luna collapse in 2022. Back then, the confidence in the crypto world completely collapsed, and investors rushed to exchanges to cash out in panic, with Binance averaging over 50,000 BTC transacted daily that week.

BTC3.4%

ChainNewsAbmedia·2025-10-13 10:04

Coordinated Sell-Off Triggers Questions Over Exchange Systems and Margin Design

Ran Neuner cited synchronized oracle failures and data outages as signs of a coordinated market event.

Wu Blockchain said Binance’s unified margin system and timing of oracle changes created a vulnerability window.

Mindao Yang compared the USDE-led fallout to LUNA, citing high collateral ratios an

CryptoFrontNews·2025-10-12 13:40

From Luna to USDe, why do algorithmic stablecoins repeat the "death spiral"?

The collapse of USDe highlights the significant risks behind the high yields of Algorithmic Stablecoins. Due to market panic and liquidation mechanisms, the price of USDe quickly deviated, triggering a chain reaction, with the liquidation scale reaching hundreds of billions of USD, leaving many investors severely impacted by erroneous risk assessments.

動區BlockTempo·2025-10-12 05:08

LUNC Price Swings 195% in 24 Hours As Terra Luna Classic Faces Massive Volatility

The Terra Luna Classic (LUNC) declined by 30.8 percent within 24 hours after which it steeply recovered with a high level of volatility and increase in volume.

It hit the token tested support of $0.00001937 and momentarily hit resistance of $0.00005417 in a 195% intraday reversal.

Volume of

CryptoNewsLand·2025-10-11 17:34

Why did algorithmic stablecoins repeat the "death spiral" from Luna to USDe?

October 11, 2025, is a nightmare day for global encryption investors.

The price of Bitcoin plummeted from a high of $117,000, falling below $110,000 within hours. Ethereum's decline was even more severe, reaching 16%. Panic spread through the market like a virus, with many altcoins crashing 80% to 90% instantaneously; although there was a slight rebound afterwards, they still generally fell by 20% to 30%.

In just a few hours, the global encryption market has evaporated by hundreds of billions of dollars.

On social media, wails rise and fall, with languages from around the world converging into the same mournful song. Yet beneath the surface of panic, the true transmission chain is far more complex than it appears.

The starting point of this crash was a statement from Trump.

On October 10, President Trump announced through his social media that he plans to start from November.

PANews·2025-10-11 12:03

XRP, SOL, and BTC Crash: the Painful Story Behind the Biggest Crypto Meltdown in History

The crypto market just witnessed a day unlike any other. In less than 24 hours, around $19 billion worth of positions were liquidated, the largest single-day wipeout in crypto history. Bigger than the collapse of LUNA, bigger than the COVID crash, and even bigger than the FTX fallout.

Bitcoin

CaptainAltcoin·2025-10-11 07:13

Load More