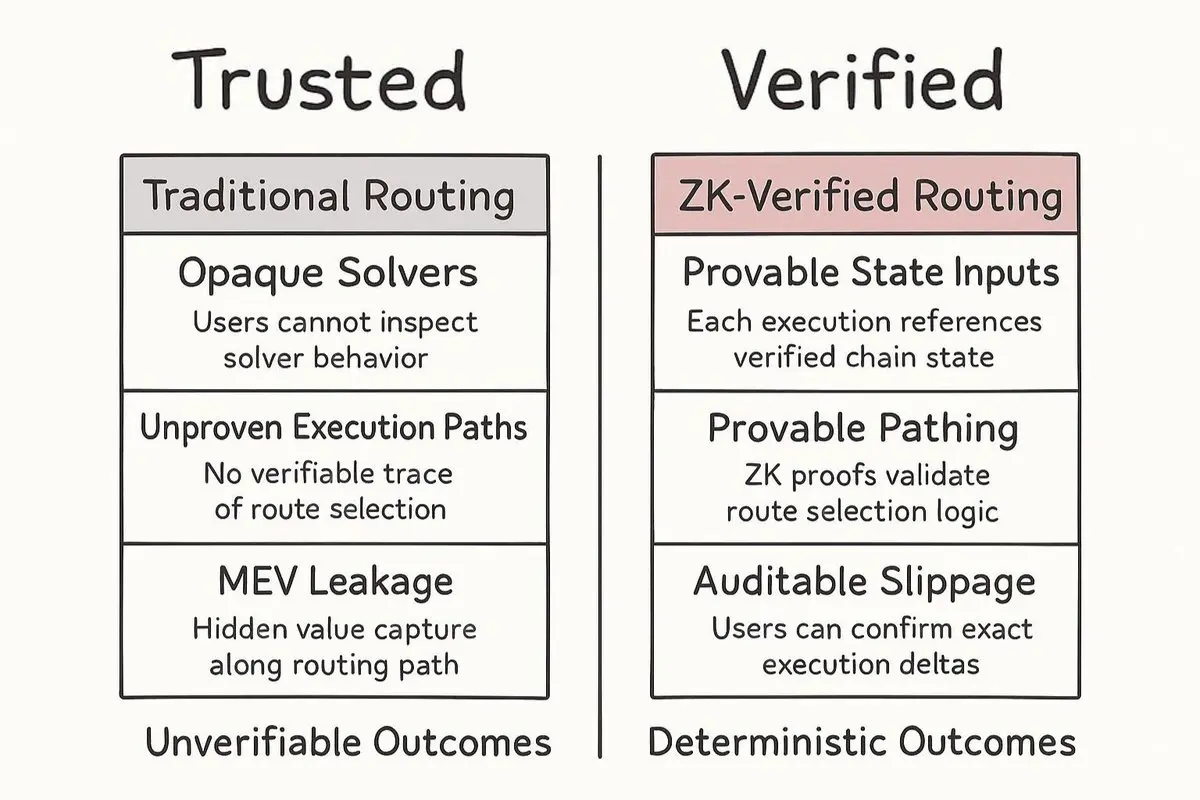

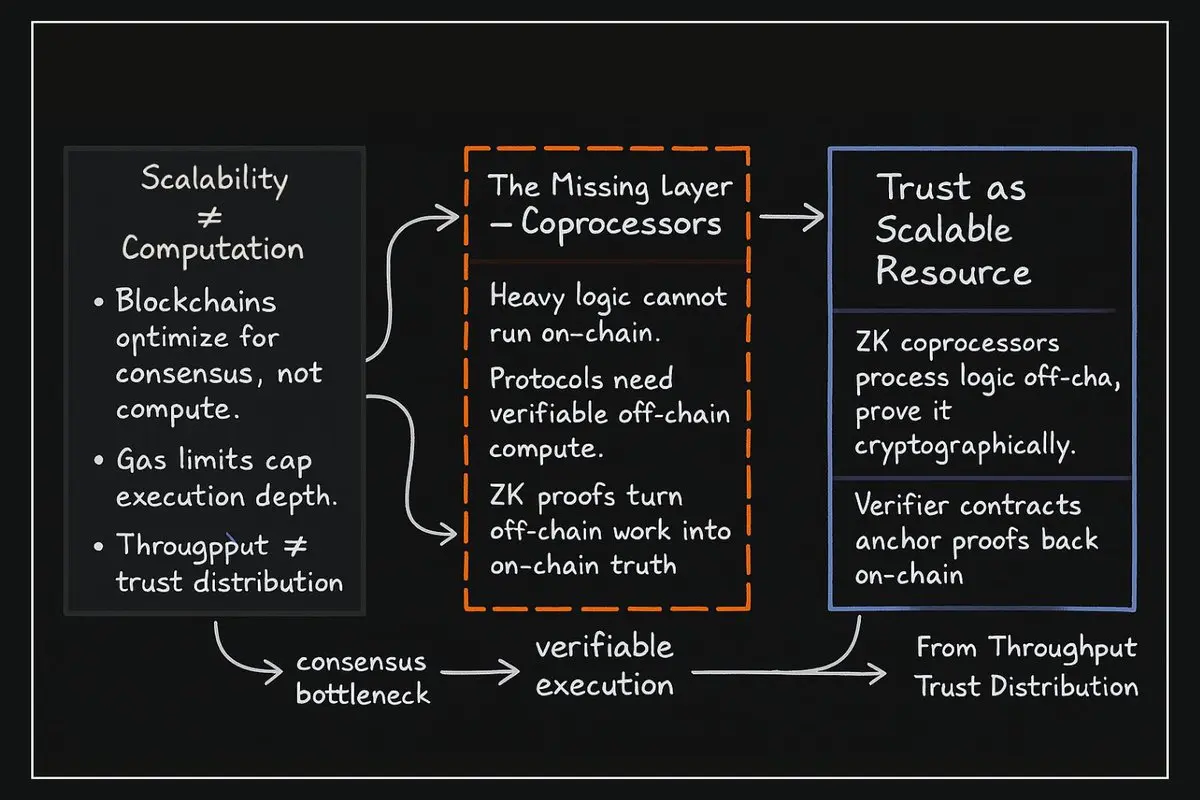

The real unlock in ZK isn’t cheaper transactions.

It’s that proofs are becoming fast enough to validate any computation, not just block execution.

That shift turns @brevis_zk into a compute-verification layer, not a scaling tool.

Scaling lowers fees.

Verification rewires the stack.

----

Why This Unlocks Real Value

Blockchains can’t run real workloads: portfolio models, agent logs, multi-chain histories, cross-DEX analytics, intent simulations.

Those run off-chain today; inside APIs, scripts, bots, indexers with zero verifiability.

@brevis_zk makes that entire surface area provable:

• compute o

It’s that proofs are becoming fast enough to validate any computation, not just block execution.

That shift turns @brevis_zk into a compute-verification layer, not a scaling tool.

Scaling lowers fees.

Verification rewires the stack.

----

Why This Unlocks Real Value

Blockchains can’t run real workloads: portfolio models, agent logs, multi-chain histories, cross-DEX analytics, intent simulations.

Those run off-chain today; inside APIs, scripts, bots, indexers with zero verifiability.

@brevis_zk makes that entire surface area provable:

• compute o