Search results for "ICE"

Here’s Why the XRP Price Pump May Be on Thin Ice

XRP's price surged over 30% at the start of the year, driven by a risk-on crypto market but raised concerns about fragile support, as the rally lacked strong buying momentum. Analysts warn that without genuine demand, the gains may reverse.

XRP-1,75%

CaptainAltcoin·01-07 08:35

TechCrunch highlights the top 5 most impactful new products at CES 2026: Holographic Assistants, AI Pandas, Ultrasonic Kitchen Knives...

CES 2026 will showcase five innovative products in Las Vegas, including a cute AI panda baby robot, Razer's holographic anime partner, a silent AI ice maker, an ultrasonic chef's knife, and a music-playing lollipop, demonstrating unlimited creativity and experimentation in technology.

動區BlockTempo·01-07 02:50

Is the Bitcoin surge a "phantom"? Spot trading volume drops to a 2-year low, liquidity faces a cold snap

Since entering 2026, the cryptocurrency market has been climbing steadily, but behind the prosperity, it may still be "walking on thin ice." According to the well-known on-chain analysis firm Glassnode, although the market appears lively, liquidity conditions seem to be very weak, with spot trading volume dropping to a new low in over 2 years.

Glassnode data shows that despite Bitcoin prices continuing to rise, the total spot trading volume of Bitcoin and competing coins has fallen to the lowest point since November 2023. This typical "price rise with declining volume" divergence usually indicates a decrease in market participation and weak buying momentum, with the rally lacking solid support.

The so-called "spot trading volume" measures the actual buying and selling activity of real money on exchanges and is a key indicator of the market's true heat.

In a healthy traditional bull market, price increases should be accompanied by expanding trading volume, indicating continuous inflow of new funds for turnover.

区块客·01-06 06:45

From a peak of 270 billion to a flash crash, DeFi ventures into the deep waters of financial infrastructure

Author: Jae, PANews

In 2025, the DeFi (Decentralized Finance) market experienced a thrilling roller coaster ride. At the beginning of the year, driven by explosive Layer 2 performance and institutional capital inflows, TVL (Total Value Locked) skyrocketed from $182.3 billion to a historic peak of $277.6 billion, making a trillion-dollar ecosystem seem within reach.

However, in the fourth quarter, an unexpected 10/11 flash crash poured cold water on the market, causing TVL to sharply shrink to $189.3 billion, erasing the year's gains to a negligible 3.86%. This intense volatility revealed the true fabric behind the glamorous narrative of DeFi: on one side, deep evolution in sectors like staking, lending, and RWA; on the other, the fragility and governance fractures caused by leverage accumulation.

This has been a crucible of ice and fire. The market witnessed Lido's dominance in the staking sector.

DEFI7,89%

PANews·01-06 02:41

The trillion-dollar IPO myth will unfold in 2026, but the "small unicorns" have already collapsed

The past 2025 has showcased an unprecedented "Tech Ice and Fire Show" in the capital markets.

On one side are the newly listed tech giants, whose stock prices have plummeted like a kite with a broken string. Once hot star companies have seen their market values evaporate by billions of dollars within months, with some cases experiencing declines of over 50%. The market's "coldness" has quickly spread, causing many star companies planning to go public to become fearful and repeatedly postpone their IPO plans.

On the other side, the "hot pursuit" of capital is burning fiercely.

A brand-new "Trillion-Dollar Club" is gathering outside the gates of the capital market. From Elon Musk's space empire SpaceX to Sam Altman's OpenAI, and the emerging giants like Anthropic, they are preparing with valuations often reaching hundreds of billions or even trillions, gearing up for the next wave of technological advancement.

PANews·01-06 01:30

Editorial Year-End Reflection | What did we gain in 2025? What are we looking forward to in 2026?

Writing: Foresight News Editorial Team

Looking back from the intersection of 2025 and 2026, every legal change, token fluctuation, and narrative rise and fall in the crypto space has become a silent epic etched into the memories of industry practitioners. Over the past year, the industry has been navigating through fire and ice: digital asset custody institutions have continuously emerged, and key legislation has been enacted one after another; at the same time, project failures and shattered narratives have repeatedly played out. Some see the dawn of new life amid the ruins, while others exhaust their last faith in the wave of speculation. As 2026 approaches, it may be a period of silent accumulation. The industry needs to rediscover its scattered original intentions, gather strength in calmness, and wait for the next true breakthrough.

At the end of 2025, we asked all editors and reporters of Foresight News four questions: 1. Looking back at 2025, this

TechubNews·2025-12-31 09:05

From on the brink of bankruptcy to a global computing power powerhouse, how many more interesting stories does this "Crypto Land of Ice and Fire" have?

Iceland relies on 100% renewable energy to build low-cost mining infrastructure, attracting numerous mining farms. However, as the strain on the power grid increases, the government suspended new mining farm licenses in 2021. In 2024, MICA regulation was implemented to strengthen compliance requirements for crypto companies and promote the industry's transition toward stable and innovative development.

PANews·2025-12-29 10:07

Gold frenzy vs. crypto silence: Is it a victory for TradFi, or the eve of a new cycle?

By the end of 2025, the global financial markets present a rare "ice and fire" landscape. Traditional precious metals represented by gold and silver continue to surge, with gold futures prices breaking through 4,550 per ounce, setting over 50 historical records within the year. Silver's annual increase even reaches an astonishing 150%. Meanwhile, the once highly anticipated cryptocurrency market has dimmed in comparison, with Bitcoin down about 6% year-to-date, and Ethereum down approximately 12%, facing a consecutive three-month decline. This extreme divergence has led to rampant discussions that "cryptocurrencies are dead, switch to gold." However, a closer look at the market structure reveals that profound changes are taking place beneath the surface: capital from TradFi (traditional finance), centered around ETF channels, is pouring into the crypto market on an unprecedented scale and with greater discipline. This is not simply capital fleeing, but more like a prelude to asset reallocation driven by macro narratives and microstructures alike.

MarketWhisper·2025-12-29 03:50

Sberbank of Russia Breaks the Ice! The First Cryptocurrency Collateral Loan is Released

Sberbank, the Russian Federation Savings Bank, has completed the country's first corporate loan collateralized with cryptocurrency, with the borrower being mining company Intelion Data, secured through Rutoken hardware custody of digital assets. Vice President Anatoly Popov stated that in conjunction with the legalization of cross-border payments in 2025 and the institutionalization of exchanges in 2026, the bank is studying ways to expand its applications.

MarketWhisper·2025-12-29 02:01

Crypto Market Dips As ‘Fear’ Overwhelms Year-End Breakout Speculations

The crypto market has experienced a notable decline, with a total market cap of $2.95T, mainly due to Bitcoin and Ethereum's drops. Despite some gainers like $BOME and $MAGA, NFT sales have plummeted. JPMorgan has frozen accounts tied to sanctions, while ICE plans a significant investment in MoonPay.

BlockChainReporter·2025-12-27 16:04

Blockchain for DApps steps into the spotlight with new updates: AMA recap with ION

Sponsored Content

Decentralized applications (DApps) are what unlock myriad of use cases for blockchain. As a layer-1 blockchain for DApps, Ice Open Network is currently having a key moment in its journey. ICE is being phased out, with ION rolling out as the new token, while the project

Cointelegraph·2025-12-23 15:27

Bipartisan lawmakers in the U.S. join forces to break the ice: The cryptocurrency tax bill draft sends key signals.

Recently, bipartisan members of the U.S. House of Representatives proposed a discussion draft titled the "Digital Asset PARITY Act," aimed at establishing a clear and fair tax framework for digital assets. The core of the draft includes providing a tax-free safe harbor for small stablecoin transactions, allowing staking and Mining rewards to enjoy five years of tax deferral, and introducing the wash sale rules from the securities sector into Crypto Assets. This move marks a crucial step in the U.S. cryptocurrency tax policy transitioning from ambiguity to institutionalization, intending to alleviate the compliance burden on ordinary users while responding to the industry's long-standing core demands, and is expected to inject significant policy certainty into the market.

ETH-1,72%

MarketWhisper·2025-12-22 01:43

Pantera Partner: Crypto VC Returns to Professionalism and Rationality, Where is the Next Investment Hotspot?

Pantera Capital

Compiled & Edited by Yuliya, PANews

Recently, two partners of the top venture capital firm Pantera Capital, Paul Veradittakit and Franklin Bi, analyzed the current state and changes in the crypto investment market in their first podcast episode. They reviewed the speculative wave of altcoins over the past few years, analyzed the "ice and fire" phenomenon of this year’s record-high funding coupled with a significant decline in transaction volume, and debated topics such as project investment strategies, exit paths, DAT, tokenization, and zero-knowledge proofs. PANews has organized and compiled this blog post.

Crypto investment is returning to professionalism and rationality; team execution and asset appreciation are key to DAT competitiveness

Host: Today, we are going to discuss the current state of crypto venture capital. Data shows that

PANews·2025-12-19 07:19

NYSE Owner ICE in Talks to Invest in MoonPay – Potential $5 Billion Valuation for Crypto Payments Firm

Intercontinental Exchange Inc. (ICE)—the parent company of the New York Stock Exchange—is reportedly in discussions to invest in cryptocurrency payments fintech MoonPay as part of an upcoming funding round, according to sources familiar with the matter.

CryptopulseElite·2025-12-19 05:52

New York Stock Exchange talks about investment! $5 billion valuation to acquire MoonPay's Crypto gateway

Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, is in talks to acquire a stake in crypto payment provider MoonPay, raising its valuation target for this round to $5 billion, a 47% increase from $3.4 billion in 2021. This is its latest move following its investment in the prediction market Polymarket, valued at up to $2 billion, and the institutional-grade trading platform Bakkt.

PYUSD-0,03%

MarketWhisper·2025-12-19 03:40

NYSE Parent Company Considers Investing in Crypto-Focused MoonPay: Report

Intercontinental Exchange in Talks to Invest in Crypto Payment Platform MoonPay

Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, is reportedly in discussions to invest in MoonPay, a prominent crypto payments infrastructure provider. This move highlights the

BTC-0,06%

CryptoDaily·2025-12-19 02:56

$5 billion valuation! NYSE parent company ICE in talks to invest in crypto payment giant MoonPay

According to sources familiar with the matter, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, is engaged in in-depth negotiations to invest in the crypto payment company MoonPay. This move could become another landmark event as traditional financial giants venture into the digital asset space. In this funding round, MoonPay's valuation aims to reach as high as **$5 billion**, a significant jump from its $3.4 billion valuation at the peak of the 2021 bull market. This development occurs amid a more favorable regulatory climate under President Trump, along with increasing Wall Street capital interest in cryptocurrency infrastructure. Additionally, MoonPay's active expansion through acquisitions and the launch of stablecoin services signals that the crypto payment sector is entering a new phase of capital consolidation and value re-evaluation.

MarketWhisper·2025-12-19 01:23

Intercontinental Exchange Inc. (ICE) is negotiating an investment in Moonpay with an estimated valuation of approximately $5 billion.

According to Bloomberg, Intercontinental Exchange Inc. (ICE), the parent company of the New York Stock Exchange, is in advanced negotiations to invest in MoonPay Inc., a major cryptocurrency payment platform. According to knowledgeable sources, this potential investment is part of a funding round.

TapChiBitcoin·2025-12-19 00:19

ICE invests 2 billion, valuation of 8 billion USD. How does Polymarket justify this valuation?

Intercontinental Exchange (ICE) announces an investment of up to $2 billion in Polymarket, valuing the company at $8 billion. This is the largest private equity investment from traditional Wall Street and will position Polymarket as a global distributor of event-driven data, potentially launching the POLY token. The investment marks a turning point for Polymarket and its founders, as ICE plans to boost revenue through data services while exploring the path to productize information.

金色财经_·2025-12-17 13:49

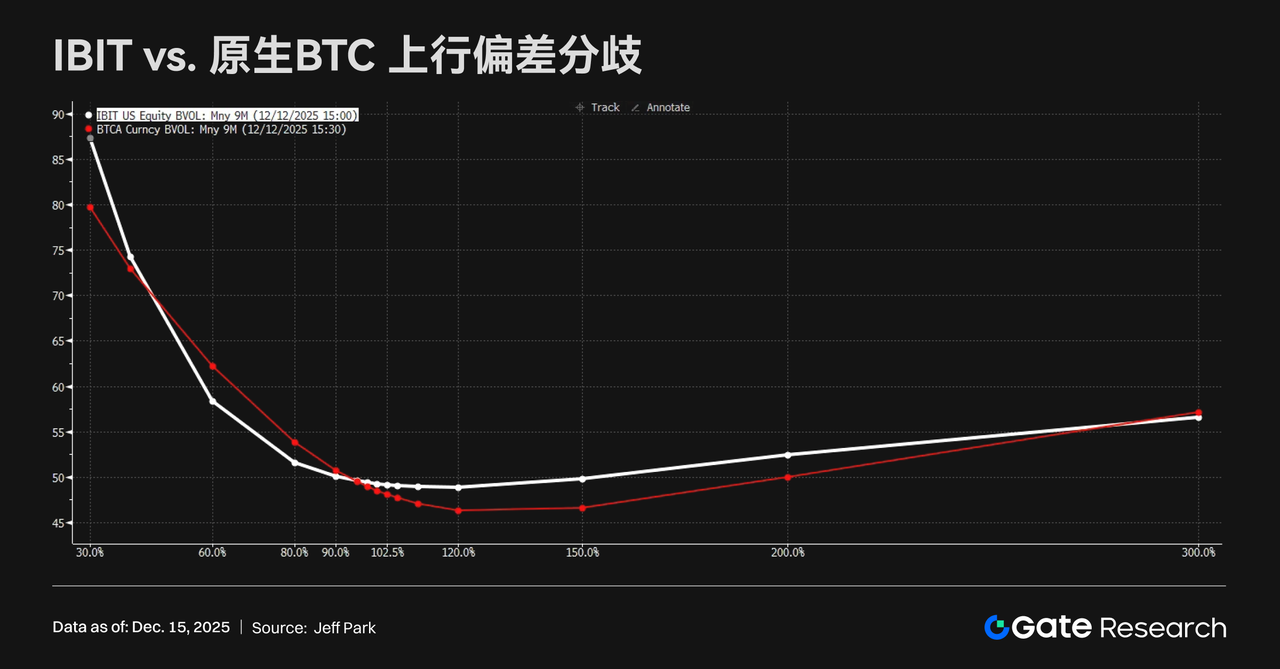

Gate Research Institute: Market Under Pressure and Consolidation | BTC Upward Momentum Restricted by Options Structure

Gate Research Institute Daily Report: December 15 — The overall crypto market continues to face pressure, with BTC and ETH maintaining low-level consolidation, while GT shows relative resilience. Under the weak performance of mainstream coins, tokens such as FHE, ICE, and BAS have reversed trends and strengthened amid catalysts like privacy computing collaborations with Chainlink, token migrations and mainnet transitions, as well as ERC-8004 protocol upgrades, reflecting a concentrated battle for structural opportunities among funds. The structural selling pressure in the options market still suppresses BTC upside momentum. The divergence between ETF bullish demand and OG holders selling volatility suggests that BTC is more likely to remain in short-term consolidation rather than make rapid breakthroughs; Ant International is reconstructing corporate treasury management systems through blockchain, AI, and tokenized deposits; after the mainnet launch of Stable, on-chain activity has been below expectations, highlighting ongoing challenges for the differentiated implementation of stablecoin public chains.

GateResearch·2025-12-15 05:40

Interpreting CoinShares 2026 Outlook Report: Cryptocurrencies Say Goodbye to Speculative Narratives and Embrace the Year of Practicality

CoinShares has released a 77-page 2026 outlook report predicting that digital assets will shift from being primarily driven by speculation to being driven by practical value. The report highlights the rise of hybrid finance, accelerated institutional adoption, and clearer regulatory frameworks, marking a pivotal year for the mainstreaming of the cryptocurrency industry. This article is sourced from a CoinShares publication, compiled, edited, and written by TechFlow.

(Previous context: a16z: 17 Major Potential Trends in Crypto for 2026)

(Additional background: Token Sales Shakeup: 10 New Trends for 2026)

Table of Contents

1. Core Theme: The Dawn of Practicality Year

2. Macroeconomic Fundamentals and Market Outlook

Economic Environment: Soft Landing on Thin Ice

The Gradual Erosion of the US Dollar Reserve Status

3.

動區BlockTempo·2025-12-14 04:35

Gold's "Long Bull" Meets Silver's "Soaring": A "Stress Test" Revealing the Future of Assets

The precious metals market is currently showcasing a thought-provoking "ice and fire" scenario. After the Federal Reserve's internal split on rate cuts, gold prices slightly retreated to around $4,210.72 due to uncertainties about future easing paths. Meanwhile, silver disregarded macro uncertainties, surging to a historic high of $62.88 on December 11, with an annual increase of up to 113%. This divergence coincides with a significant prediction from top investment bank Goldman Sachs, which believes that core drivers such as central bank gold purchases and private wealth allocation will push gold to $4,900 by 2026. This internal "stress test" of traditional safe-haven assets may serve as a crucial mirror for understanding the unique logic of cryptocurrencies like Bitcoin in a complex macro environment.

MarketWhisper·2025-12-11 05:48

Why prediction markets really aren't gambling platforms

Author: Planet Xiaohua

In the past two years, prediction markets have rapidly moved from a fringe concept in the crypto space into the mainstream spotlight of tech venture capital and financial investment.

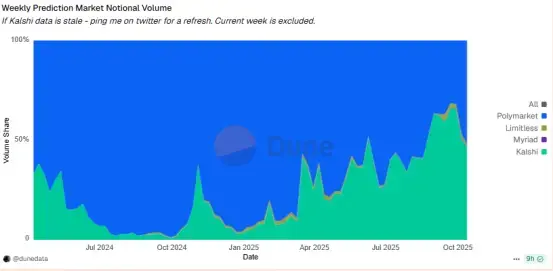

The compliance-focused newcomer Kalshi recently completed a $1 billion Series E round, raising its post-money valuation to $11 billion. Its roster of investors includes top names such as Paradigm, Sequoia, a16z, Meritech, IVP, ARK Invest, CapitalG, and Y Combinator.

Meanwhile, industry leader Polymarket secured a strategic investment from ICE at a $9 billion valuation, and then reached a $12 billion valuation through investment led by Founders.

金色财经_·2025-12-04 06:22

Why do people say that prediction markets are really not gambling platforms?

Original Title: "Why Prediction Markets Really Aren't Gambling Platforms"

Author: Planet Xiaohua

Source:

Reprinted from: Mars Finance

Over the past two years, prediction markets have rapidly moved from a fringe concept in the crypto world into the mainstream spotlight of tech entrepreneurship and financial capital.

The compliance-focused rising star Kalshi recently completed a $1 billion Series E financing round, bringing its post-money valuation to $11 billion. Its investor lineup includes industry heavyweights such as Paradigm, Sequoia, a16z, Meritech, IVP, ARK Invest, CapitalG, and Y Combinator.

Meanwhile, the industry leader Polymarket secured a strategic investment from ICE at a $9 billion valuation, and later reached a $12 billion valuation with...

MarsBitNews·2025-12-04 06:20

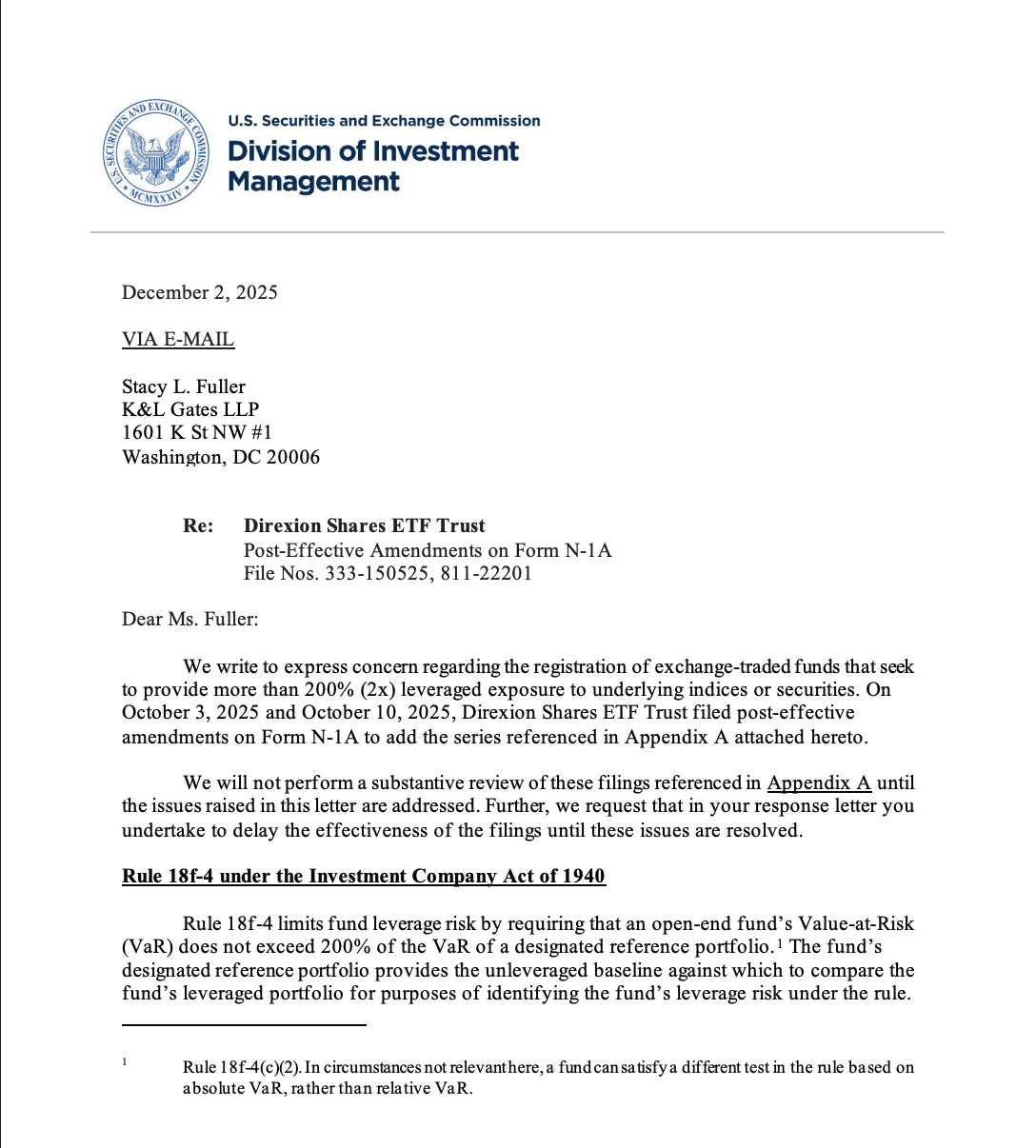

SEC Cracks Down on Ultra-Leveraged ETFs: 3x–5x Crypto Funds Put on Ice

The U.S. Securities and Exchange Commission has quietly halted the rollout of a new wave of ultra-leveraged crypto ETFs after sending formal deficiency letters to issuers including Direxion, ProShares, and Tidal Investments.

CryptopulseElite·2025-12-04 03:49

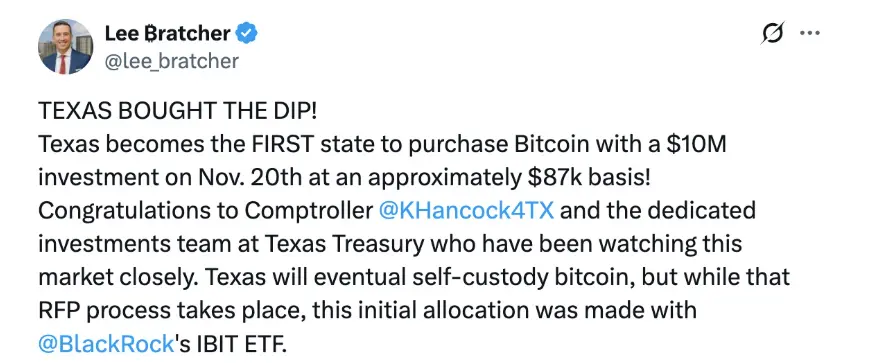

Texas purchases $5 million in BlackRock IBIT: Can SBR take the baton and reignite after DAT goes silent?

Author: Yangz, Techub News

After experiencing two consecutive "Black Friday" crashes, Bitcoin has nearly erased the gains of the past six months, and the market has plunged into a bone-chilling cold. However, the warming forces seem to be coming from all directions: from the continued warming of expectations for interest rate cuts in December to the successive approvals of various altcoin ETFs, this wave of warmth has now extended to the state-level "Strategic Bitcoin Reserve" (SBR) in the United States.

Early this morning, Lee Bratcher, chairman of the Texas Blockchain Association, announced that the state has officially launched a Bitcoin Reserve Program and has completed its first purchase of a $5 million BlackRock Bitcoin Spot ETF (IBIT). At this moment, the cold market sentiment seems to have heard the crisp echo of ice cracking.

Texas Breaks the Ice: $5 Million "Leads" Bitcoin Reserves Strategy Among U.S. States

When the market is still short

BTC-0,06%

PANews·2025-11-27 11:12

Polymarket Obtains CFTC License Breakthrough: Prediction Market Officially Included in the U.S. Regulatory Framework

In November 2025, the decentralized prediction market platform Polymarket received a revised order from the Commodity Futures Trading Commission (CFTC), officially obtaining the qualification to operate as an exchange in the United States. The platform will be able to directly accept U.S. brokers and clients, and access traditional financial market infrastructure through an intermediary trading model. This groundbreaking regulatory approval opens a compliance channel for the $100 billion prediction market. After receiving a $2 billion investment from ICE, the parent company of the New York Stock Exchange, Polymarket's valuation has soared to $9 billion, and it plans to issue the native Token POLY. As of November 2025, Polymarket is negotiating with investors to seek a new round of financing at a valuation of $12 billion to $15 billion.

MarketWhisper·2025-11-26 02:18

Or at risk of index delisting? Strategy is deeply trapped in a "fourfold strangulation" crisis.

Original Title: "MicroStrategy Faces a Major Test of Confidence: Nasdaq Delisting Risk, Motivations for Selling Coins and Repurchase, Executives Dumping"

Original author: Nancy

Source:

Reprint: Mars Finance

The crypto market is in a state of anxiety, with Bitcoin's weakness dragging the overall market down and accelerating the clearing of bubbles, making investors feel like they are walking on thin ice. As one of the important indicators in the crypto space, the leading company DAT (Crypto Treasury) Strategy (MicroStrategy) is facing multiple pressures, including a significant convergence of mNAV premium, weakened coin accumulation, executives selling stocks, and the risk of index delisting, putting market confidence to a severe test.

Strategy encounters a trust crisis, or faces index delisting?

Currently, the DAT track is facing its darkest hour. As the price of Bitcoin continues to decline, the premium rates of multiple DAT companies have significantly dropped across the board, stock prices remain under pressure, and the behavior of increasing holdings has slowed down or even stagnated, putting the business model under strain.

BTC-0,06%

MarsBitNews·2025-11-24 03:21

MicroStrategy Faces Confidence Test: Nasdaq Delisting Risk, Selling Coins for Buybacks, Executives Selling Off

Author: Nancy, PANews

The crypto market is filled with uncertainty, with Bitcoin's weakness dragging the overall market down, accelerating the clearing of bubbles, and making investors feel like they are walking on thin ice. As one of the key crypto indicators, the leading DAT (Crypto Treasury) company Strategy (MicroStrategy) is facing multiple pressures: a significant narrowing of the mNAV premium, weakened coin accumulation efforts, senior executives selling stocks, and risks of being delisted from the index. Market confidence is under severe test.

Strategy faces a trust crisis, or risk of being delisted from the index?

Currently, the DAT sector is experiencing its darkest hour. As Bitcoin prices continue to decline, the premium rates of many DAT companies have plummeted across the board, stock prices are under continuous pressure, accumulation actions have slowed or even halted, and business models are undergoing survival tests. Strategy has not been spared, falling into a trust crisis.

mNAV (Market Net Asset Value Multiple) is one of the important indicators to measure market sentiment.

BTC-0,06%

PANews·2025-11-21 07:48

The crypto market fear index hits a freezing point, are whales buying the dip in the golden zone? Bitcoin Hyper is attracting capital against the trend, breaking 28 million dollars.

(This article is sponsored content aimed at introducing a Memecoin project. Memecoins have extremely high fluctuation and risk, and their token prices can experience dramatic fluctuations in a short period of time, even dropping to zero. Any projected figures mentioned in the article, such as percentage increases or target prices, are expectations and potential possibilities from the project party, and not achieved or guaranteed results. Investors should fully understand and bear all potential risks, and must conduct thorough independent research and consult with professional financial advisors before making any investment decisions. The information contained in this article does not constitute any investment advice.)

The cryptocurrency market is experiencing a typical case of "emotional misjudgment." In November, the Fear and Greed Index plummeted to 9, returning to the ice point range seen during the pandemic crash in 2020. Bitcoin has fallen below the psychological level of $100,000, even touching below $90,000, making the situation extremely terrifying. However, experienced investors...

ChainNewsAbmedia·2025-11-21 07:34

ICE invests $2 billion, valuing Polymarket at $8 billion. How does Polymarket justify this valuation?

Intercontinental Exchange (ICE) announced an investment of up to $2 billion in Polymarket, with a valuation of $8 billion. This is the largest private sale investment on traditional Wall Street, which will make Polymarket a global distributor of event-driven data, potentially launching POLY Token. The investment marks a turning point for Polymarket and its founders, as ICE plans to enhance revenue through data services while exploring the path of information productization.

金色财经_·2025-11-14 09:23

Ice and Fire in the Crypto World: Collapse, Stagnation, and Opportunities

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.46 trillion, with Bitcoin accounting for 59%, totaling $2.04 trillion. The stablecoin market cap is $305.4 billion, decreasing by 0.63% over the past 7 days. Notably, the number of stablecoins has experienced negative growth for two consecutive weeks, with USDT making up 60.08%.

Among the top 200 projects on CoinMarketCap, most have declined while a few have increased, including: ICP with a 7-day increase of 199.52%, FIL with a 7-day increase of 122.46%, DASH

DeepFlowTech·2025-11-10 07:28

Wall Street giant breaks the ice! BlackRock executives praise Ripple, XRP community finally receives official "validation"?

At the 2025 Ripple Swell conference, BlackRock Digital Asset team executive Maxwell Stein publicly praised Ripple's contributions to demonstrating the real-world financial utility of blockchain and stated that Ripple's infrastructure will soon be capable of transferring trillions of dollars on-chain. This statement was seen by the XRP community as the long-awaited official recognition from the world's largest asset management company, marking a significant shift in traditional finance (TradFi) attitude towards blockchain. However, legal experts questioned the official nature of this comment, injecting caution into the market's exuberant sentiment.

XRP-1,75%

MarketWhisper·2025-11-07 11:24

Google Finance integrates prediction market data: Kalshi and Polymarket join the mainstream financial ecosystem

On November 6, 2025, Google Finance quietly integrated real-time data from U.S. prediction market platforms Kalshi and Polymarket. Users can now view probability forecasts for major events such as elections, inflation reports, and cryptocurrency regulation over the coming weeks.

This move comes amid investment negotiations between Intercontinental Exchange (ICE) and Kalshi, as well as the Chicago Mercantile Exchange (CME) preparing to launch prediction products. It marks a shift toward traditional financial data systems beginning to incorporate decentralized market information. Although regulatory classification and liquidity issues remain unresolved, the value of prediction markets as sentiment indicators is gaining mainstream recognition.

MarketWhisper·2025-11-07 02:16

Google Finance Integrates Prediction Market Data From Kalshi and Polymarket

Google Finance to show real-money prediction probabilities from Kalshi and Polymarket in coming weeks.

Move reflects institutional interest, including ICE investment talks and CME's upcoming prediction product.

Data raises regulatory and liquidity questions as traders weigh its role in crypto

BTC-0,06%

BeInCrypto·2025-11-07 00:36

There’s still time for an altcoin rally in 2025: Sygnum

Sygnum Bank's fourth quarter outlook sees crypto markets under macro pressure, but Ethereum may be positioning for a major rally.

Summary

The crypto bull market is on thin ice, says the latest Sygnum report

Macro pressure crushed the altcoin rally that traders expected

While most are

Cryptonews·2025-11-03 21:30

Wu said October VC Monthly Report: Financing quantity rose by 21%, Coinbase acquisition of Echo

In October 2025, Crypto VC announced 75 venture capital projects with a total financing amount of $4.556 billion. CeFi and AI projects are dominant, with Ice investing $2 billion in Polymarket, Coinbase acquiring Echo, Kalshi raising $300 million, and Daylight Energy raising $75 million, among others.

WuSaidBlockchainW·2025-11-02 23:25

tZero plans to raise $200 million and go public in 2026: betting on the $400 trillion opportunity in the RWA sector.

The New York blockchain infrastructure company tZero Group officially announced plans to conduct an IPO in the United States in 2026, marking a new phase in the wave of crypto-related IPOs. As a pioneer focused on security tokens and the tokenization of real-world assets (RWA), tZero has raised approximately $200 million in funding and has received support from heavyweight investors such as the Intercontinental Exchange (ICE). This article will delve into tZero's path to listing, the $400 trillion opportunities in the tokenization market, and the future landscape of accelerated integration between blockchain finance and traditional capital markets.

MarketWhisper·2025-10-28 09:09

Prediction Market Giant Polymarket Gears up for Token Airdrop and VC Windfall

Polymarket's CMO announced plans for a token launch and airdrop while the company seeks funding, recently boosted by a $2 billion investment from ICE. These developments aim to enhance its valuation, currently targeted between $12 billion and $15 billion.

Coinpedia·2025-10-26 04:32

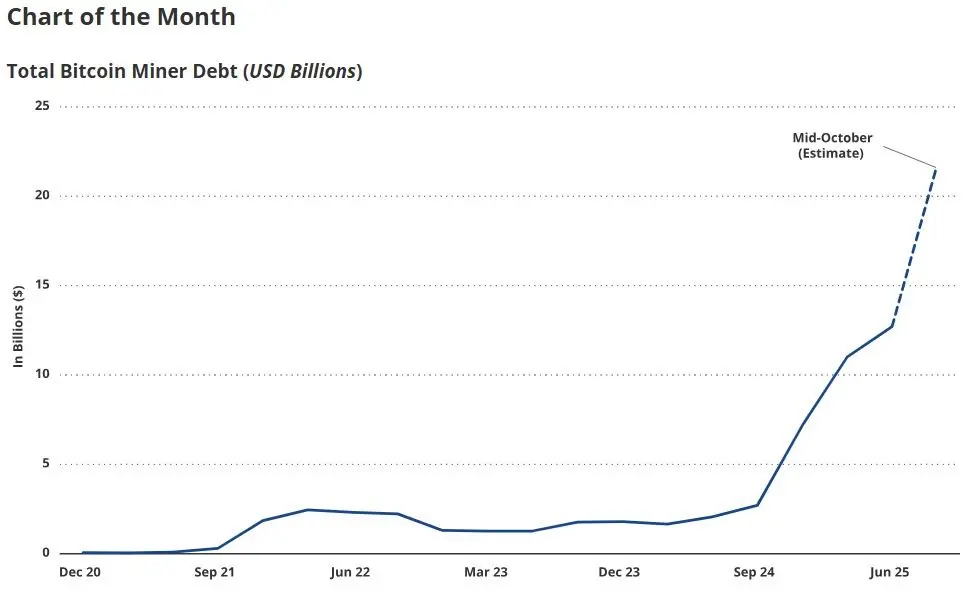

Bitcoin Miner Debt Soars 500%, Betting $12.7 Billion on AI and Hashrate

Investment giant VanEck's latest report shows that Bitcoin miners are investing in new Mining Rigs and artificial intelligence infrastructure to remain competitive in the global hashrate race, with debt skyrocketing from $2.1 billion to $12.7 billion in just 12 months, an increase of over 500%. VanEck analysts refer to this phenomenon as the "ice cube melting problem"; if miners do not continue to invest in the latest Mining Rigs, their share of the global hashrate will decline.

MarketWhisper·2025-10-24 00:47

Polymarket's valuation has increased tenfold in four months. What is the magic of prediction markets?

Prediction markets are becoming the new darlings of Wall Street.

This month, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, invested $2 billion in the decentralized prediction market Polymarket. This is not only one of the largest private financings in crypto history, but it also caused Polymarket's valuation to soar to $9 billion. Recently, there have been rumors that Polymarket is in early talks with investors and is seeking to raise funds at a valuation between $12 billion and $15 billion.

Interestingly, four months ago, Polymarket was valued at less than one-tenth of what it is today. If we go back to 2022, Polymarket was even once pursued by regulators.

The valuation of Polymarket has soared astonishingly, and the prediction market is once again in the spotlight.

When mentioning Polymarket, it comes to mind

金色财经_·2025-10-23 14:01

OwlTing's parent company OBOOK falls below $10! It has already returned 85% in a week since its listing on Nasdaq.

Odin's parent company OBOOK Holdings went public in the United States, with its stock price soaring by 580% in the first week before pulling back to the suggested issuance price. (Background: Taiwan's Odin Group had a "big pump" that triggered a circuit breaker on NASDAQ, followed by a rapid decline in price.) (Additional background: Taiwan's stablecoin infrastructure company Odin goes public in the United States! On 10/16, it directly listed on NASDAQ under the stock code OWLS.) In October, NASDAQ welcomed the new entrant from Taiwan's blockchain sector, Odin's parent company OBOOK Holdings (OWLS), which was directly listed on NASDAQ on October 16, with its stock price skyrocketing from a reference price of $10 to $68, a big pump of 580%; it closed nearly 20% lower, and over the next few days, it faced multiple 50% slumps, with the peak fading within a week. As of the deadline, pre-market pricing was $10.33. Source: Yahoo Finance. Ice after the frenzy.

動區BlockTempo·2025-10-23 13:55

Coinbase and Robinhood break the ice one after another: BNB is supported by two major platforms in the US, has the regulatory wind changed?

After Coin base added BNB to its listing roadmap and launched trading, American retail trading giant Robinhood also announced on Wednesday that it supports BNB, making it the fourth largest crypto asset available for trading by U.S. customers on its platform. This series of actions marks a significant shift in the attitude of U.S. trading platforms towards assets associated with Coin base, indicating that the perception of regulatory risk is softening and signaling that BNB is entering the mainstream of U.S. crypto trading. Although the price of BNB at the time of the announcement was about $1070, down 22.3% from its historical high of $1370 ten days ago, the opening of the U.S. market will undoubtedly enhance its legitimacy and diversify liquidity.

BNB-0,71%

MarketWhisper·2025-10-23 01:46

Betting on the real world, what business are these 8 prediction markets doing?

null

Author: Viee, Core Contributor of Biteye

Recently, the popularity of the prediction market sector has surged. At the beginning of October, the parent company of the New York Stock Exchange, ICE, announced an investment of up to $2 billion in Polymarket, with a post-investment valuation of approximately $9 billion; a few days later, the U.S. compliant prediction market Kalshi also completed a $300 million financing round, with its valuation rising to $5 billion.

With massive financing, leading platforms such as Kalshi and Polymarket have seen a surge in trading volume. Kalshi expects its annualized trading volume to reach $50 billion this year, with a global market share exceeding 60%, surpassing Polymarket for the first time.

Why has the prediction market been brought up again in the context of the cooling crypto narrative and tightening regulatory scrutiny? Has its product form really undergone a qualitative change? What new generation projects are trying to break away from the old path of "speculative games"?

to

MarsBitNews·2025-10-22 15:10

NHL Taps Polymarket and Kalshi as Official Prediction Market Partners

The National Hockey League (NHL) said it has inked landmark multiyear U.S. partnerships with Polymarket and Kalshi on Wednesday, naming the two prediction market platforms as its official partners in a move that bridges professional sports and event-based trading.

Prediction Markets Hit the Ice: N

Coinpedia·2025-10-22 14:46

ION Latest: Online+ Production Updates, Key Integrations, and More

During the past week, Ice Open Network (ION) released several updates to its Online+ platform, including production improvements, bug fixes, and new partnerships that integrate decentralized AI, trading, and freelance tools

These developments, detailed in posts from the platform’s official X

MORE-1,22%

BSCN·2025-10-22 13:46

Trillion-Level Market Transformation: Is the Prediction Market Financial Innovation or Legal Gambling? The CFTC in the US Approves Amid State Law Challenges.

Prediction markets are rapidly transforming from a niche application of Crypto Assets into a serious financial infrastructure, but their regulatory status remains undecided. The lawsuit filed by Massachusetts against Kalshi's NFL contracts highlights the significant gap between federal and state regulation, despite having previously received CFTC approval. Meanwhile, Intercontinental Exchange's (ICE) substantial investment in Polymarket has pushed this event-driven trading into the mainstream financial spotlight. The industry is in a regulatory race, trying to define when speculation ends and financial innovation begins.

MarketWhisper·2025-10-22 06:11

Bitcoin on Thin Ice: Is This a Real Reversal or Just a Fake Rally?

Bitcoin has returned to a critical technical level that has historically separated major bullish runs from sharp corrections.

The 50-week simple moving average (SMA) — often referred to as the “backbone of the bull market” — is once again the line everyone is watching.

The Line That Defines

BTC-0,06%

Moon5labs·2025-10-21 17:01

Three major questions under the explosive popularity of prediction markets: insider trading, Compliance, lack of Chinese narrative market.

null

Author: Zhou, ChainCatcher

The prediction market will continue to be booming in 2025, with Kalshi and Polymarket achieving a total trading volume of 1.44 billion USD in September, setting a historical record. Recently, both platforms announced the completion of a new round of financing: Polymarket raised 2 billion USD from its parent company, the New York Stock Exchange (ICE), increasing its valuation to 9 billion USD; Kalshi raised 300 million USD at a valuation of 5 billion USD.

However, while the prediction market sector continues to thrive, social media has raised three major questions regarding this market: Will this market breed a large amount of insider trading? What is the regulatory attitude of major national governments towards prediction markets? Why is there a general lack of Chinese narrative-type prediction events? This article discusses these questions.

Insider trading harvests retail investors

BNB-0,71%

MarsBitNews·2025-10-20 10:23

Load More