#FedLeadershipImpact

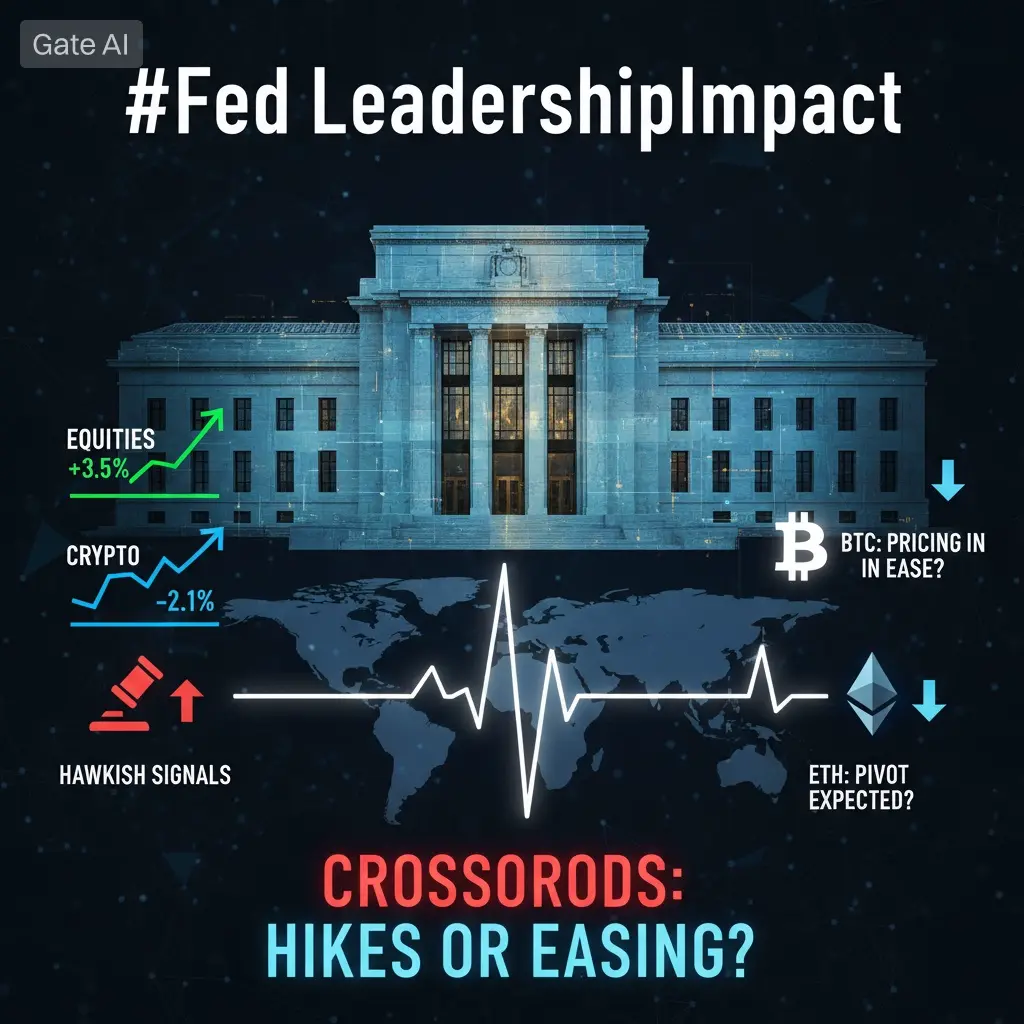

Trump’s nomination of Kevin Warsh as the next Federal Reserve Chair has sent shockwaves across the crypto market, driving intense volatility and fierce debate about what’s coming next for Bitcoin and digital assets.

What Just Happened?

In early February 2026, US President Donald Trump chose Kevin Warsh, a former Fed governor known for his hawkish monetary views, to succeed Jerome Powell as Fed Chair. Within hours, the crypto market reacted sharply:

Bitcoin plunged below $78,000, representing a ~7–9% decline from pre-announcement levels and marking a two-month low. The move was fast but controlled, signaling macro repricing rather than panic selling.

Total crypto market capitalization fell by ~6%, while high-beta altcoins experienced 10–18% drawdowns within 24–48 hours.

Spot trading volume across crypto dropped ~30–35%, showing traders stepped back instead of aggressively exiting.

The US dollar index strengthened by ~1.2–1.5%, triggering broad risk-off behavior.

Liquidity tightened unevenly:

BTC spot liquidity declined ~10–15%

Altcoin liquidity thinned ~30–40%, especially in mid and small caps

Market analysts quickly flagged Warsh as a monetary policy hawk, suggesting he’s likely to dial back easy money policies and place tighter control on future liquidity expansion.

Why Does This Matter for Crypto?

1. Monetary Policy Uncertainty

Hawkish stance:

Warsh has emphasized monetary discipline, potentially supporting higher real interest rates and a leaner Fed balance sheet.

Liquidity impact:

Reduced expectations for rate cuts

Lower leverage deployment

Declining speculative inflows

Historically, Bitcoin performs best during periods of expanding liquidity. In contrast, tightening expectations usually result in:

Lower volume participation

Compressed volatility

Slower upside momentum

This is exactly what February price action reflected.

2. Crypto Regulation Signals

Warsh is not viewed as anti-crypto, but rather system-stability focused.

Market impact:

Speculative tokens see volume contraction of 40–50%

Infrastructure-focused assets experience smaller drawdowns (15–25%)

Liquidity concentrates in BTC, ETH, and compliant large-caps

Regulatory clarity tends to reduce chaos while also filtering out excess speculation.

3. Institutional & Trading Impact

Fed leadership uncertainty directly affects institutional behavior.

Observed effects:

ETF inflows slowed or flattened

Derivatives open interest dropped ~20–25%

Funding rates normalized, indicating reduced leverage

Short-term traders face volatility spikes with thin liquidity, while long-term investors reassess positioning based on macro timelines rather than narratives.

This environment favors capital preservation over aggressive expansion.

4. Market Sentiment

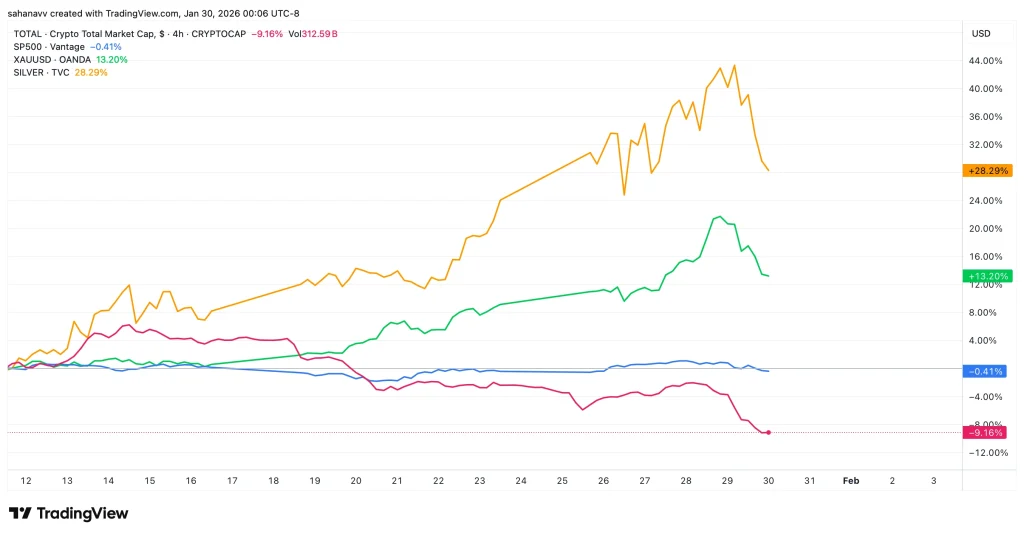

The simultaneous decline in:

Bitcoin

Gold

Silver

…alongside a rising US dollar confirms a classic flight-to-safety move, not an anti-crypto event.

Sentiment indicators show:

Fear-driven selling subsided quickly

No volume capitulation

Price stabilizing as liquidity re-balances

This reflects caution, not panic.

What Are the Risks and Opportunities?

Risks

If Warsh accelerates tightening, crypto could face extended range-bound price action.

Continued volume compression (30–40% below average) may delay trend reversals.

Altcoins remain vulnerable to liquidity drain if BTC dominance rises another 4–6%.

Opportunities

Fear-driven repricing often creates high-quality accumulation zones.

If liquidity stabilizes instead of contracting further, BTC historically rebounds strongly from such macro-driven pullbacks.

Regulatory clarity may unlock long-term institutional liquidity, even if short-term volume remains subdued.

Bottom Line

Trump’s pick of Kevin Warsh is a liquidity-timing shock, not a crypto rejection.

Prices corrected before fundamentals changed

Volume fell because risk was reduced, not because capital exited

Liquidity rotated defensively rather than disappearing

This signals a recalibration phase, not the end of the cycle.

The next few months may remain volatile, but once Fed policy direction becomes clearer, markets typically price certainty aggressively. For crypto, this moment could define whether it fully transitions from speculative asset to mature macro instrument.

Trump’s nomination of Kevin Warsh as the next Federal Reserve Chair has sent shockwaves across the crypto market, driving intense volatility and fierce debate about what’s coming next for Bitcoin and digital assets.

What Just Happened?

In early February 2026, US President Donald Trump chose Kevin Warsh, a former Fed governor known for his hawkish monetary views, to succeed Jerome Powell as Fed Chair. Within hours, the crypto market reacted sharply:

Bitcoin plunged below $78,000, representing a ~7–9% decline from pre-announcement levels and marking a two-month low. The move was fast but controlled, signaling macro repricing rather than panic selling.

Total crypto market capitalization fell by ~6%, while high-beta altcoins experienced 10–18% drawdowns within 24–48 hours.

Spot trading volume across crypto dropped ~30–35%, showing traders stepped back instead of aggressively exiting.

The US dollar index strengthened by ~1.2–1.5%, triggering broad risk-off behavior.

Liquidity tightened unevenly:

BTC spot liquidity declined ~10–15%

Altcoin liquidity thinned ~30–40%, especially in mid and small caps

Market analysts quickly flagged Warsh as a monetary policy hawk, suggesting he’s likely to dial back easy money policies and place tighter control on future liquidity expansion.

Why Does This Matter for Crypto?

1. Monetary Policy Uncertainty

Hawkish stance:

Warsh has emphasized monetary discipline, potentially supporting higher real interest rates and a leaner Fed balance sheet.

Liquidity impact:

Reduced expectations for rate cuts

Lower leverage deployment

Declining speculative inflows

Historically, Bitcoin performs best during periods of expanding liquidity. In contrast, tightening expectations usually result in:

Lower volume participation

Compressed volatility

Slower upside momentum

This is exactly what February price action reflected.

2. Crypto Regulation Signals

Warsh is not viewed as anti-crypto, but rather system-stability focused.

Market impact:

Speculative tokens see volume contraction of 40–50%

Infrastructure-focused assets experience smaller drawdowns (15–25%)

Liquidity concentrates in BTC, ETH, and compliant large-caps

Regulatory clarity tends to reduce chaos while also filtering out excess speculation.

3. Institutional & Trading Impact

Fed leadership uncertainty directly affects institutional behavior.

Observed effects:

ETF inflows slowed or flattened

Derivatives open interest dropped ~20–25%

Funding rates normalized, indicating reduced leverage

Short-term traders face volatility spikes with thin liquidity, while long-term investors reassess positioning based on macro timelines rather than narratives.

This environment favors capital preservation over aggressive expansion.

4. Market Sentiment

The simultaneous decline in:

Bitcoin

Gold

Silver

…alongside a rising US dollar confirms a classic flight-to-safety move, not an anti-crypto event.

Sentiment indicators show:

Fear-driven selling subsided quickly

No volume capitulation

Price stabilizing as liquidity re-balances

This reflects caution, not panic.

What Are the Risks and Opportunities?

Risks

If Warsh accelerates tightening, crypto could face extended range-bound price action.

Continued volume compression (30–40% below average) may delay trend reversals.

Altcoins remain vulnerable to liquidity drain if BTC dominance rises another 4–6%.

Opportunities

Fear-driven repricing often creates high-quality accumulation zones.

If liquidity stabilizes instead of contracting further, BTC historically rebounds strongly from such macro-driven pullbacks.

Regulatory clarity may unlock long-term institutional liquidity, even if short-term volume remains subdued.

Bottom Line

Trump’s pick of Kevin Warsh is a liquidity-timing shock, not a crypto rejection.

Prices corrected before fundamentals changed

Volume fell because risk was reduced, not because capital exited

Liquidity rotated defensively rather than disappearing

This signals a recalibration phase, not the end of the cycle.

The next few months may remain volatile, but once Fed policy direction becomes clearer, markets typically price certainty aggressively. For crypto, this moment could define whether it fully transitions from speculative asset to mature macro instrument.