LightOfDawnFeige

💥 Fei Ge officially joins the 【Gate exchange square】!

Hello friends, everyone! I am Fei Ge!

Starting today, Brother Fei officially enters this strategic high ground of the crypto world, hoping to work with everyone to penetrate the market's fog and find certainty that transcends cycles!

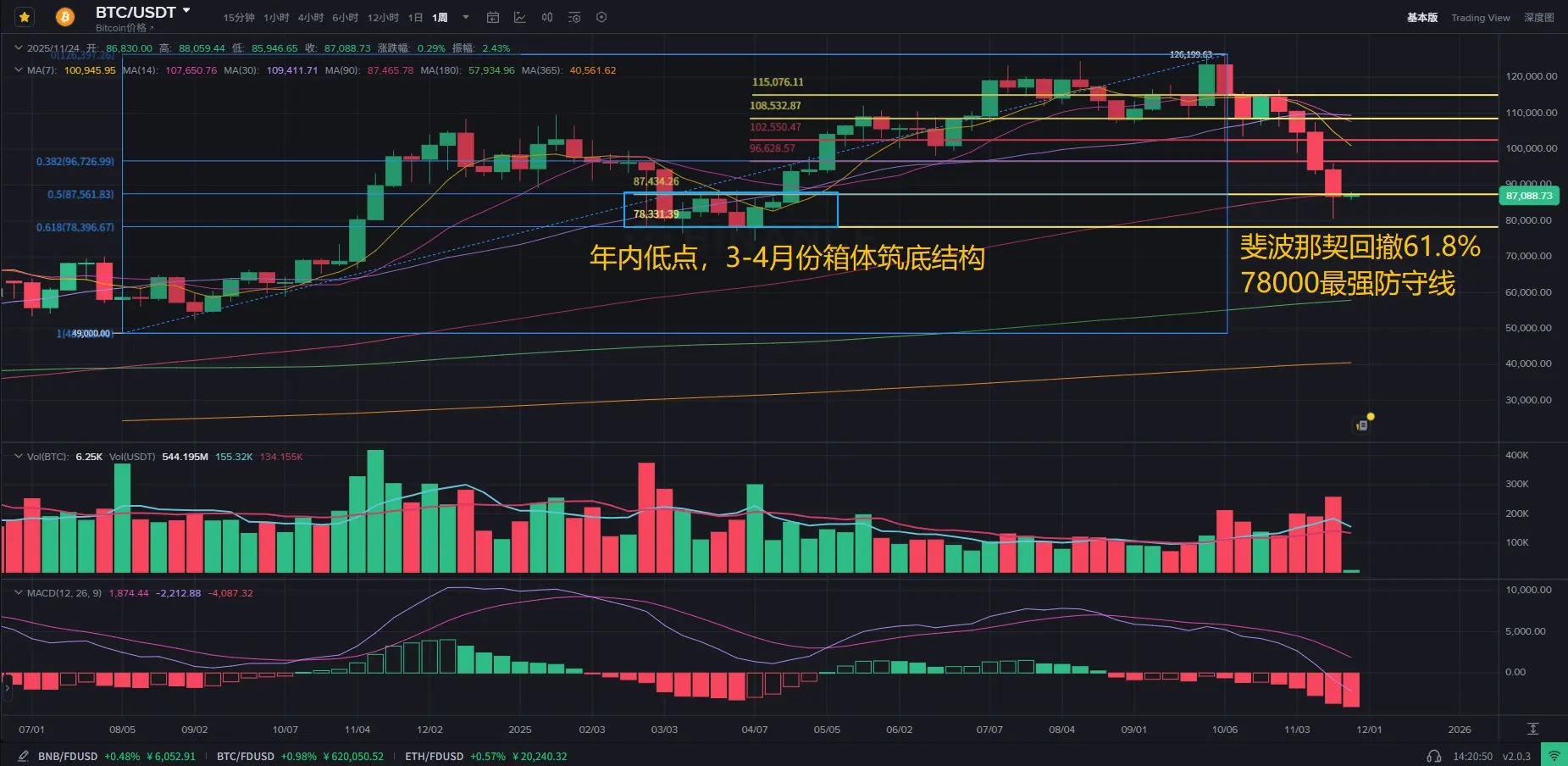

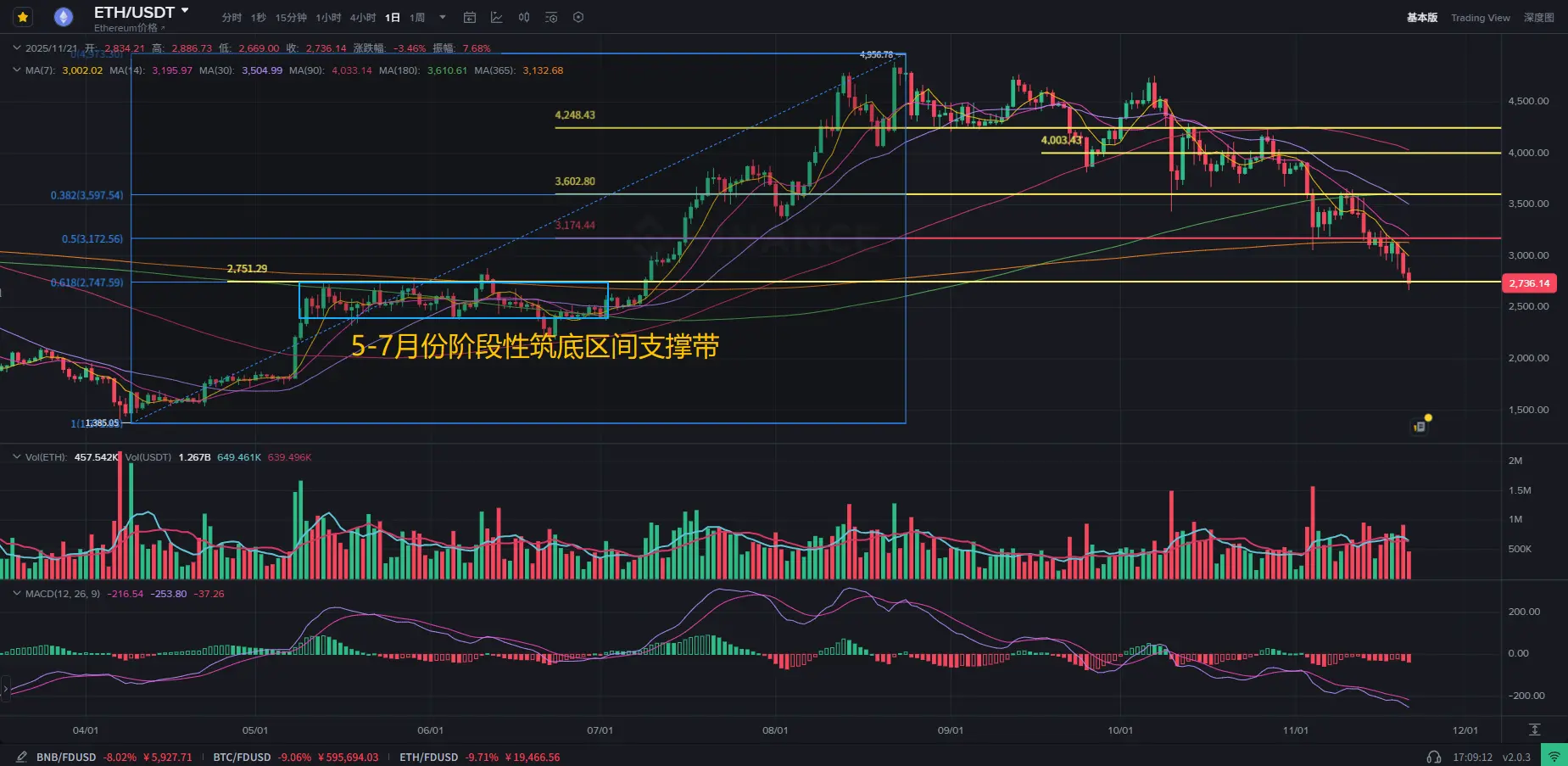

The current market is experiencing an unprecedented divergence between "macro fear" and "underlying value explosion." The macro hawks are tightening their grip, but infrastructure such as RWA, AI, and ETH EIL is being built at lightning speed.

Our goal is simple: to stay clear-headed in chaos and to plan f

View OriginalHello friends, everyone! I am Fei Ge!

Starting today, Brother Fei officially enters this strategic high ground of the crypto world, hoping to work with everyone to penetrate the market's fog and find certainty that transcends cycles!

The current market is experiencing an unprecedented divergence between "macro fear" and "underlying value explosion." The macro hawks are tightening their grip, but infrastructure such as RWA, AI, and ETH EIL is being built at lightning speed.

Our goal is simple: to stay clear-headed in chaos and to plan f