🔄 Altcoin Performance Diverges — Step Back or Observe?

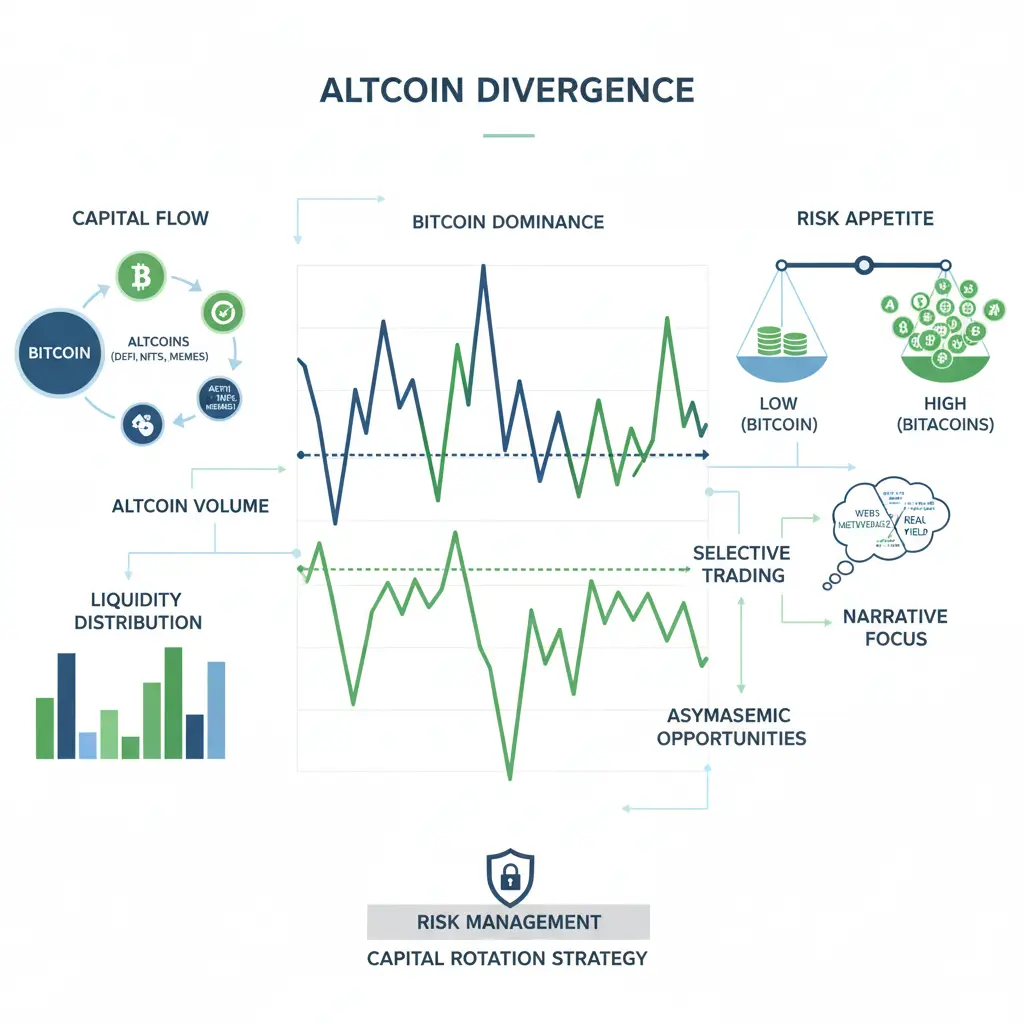

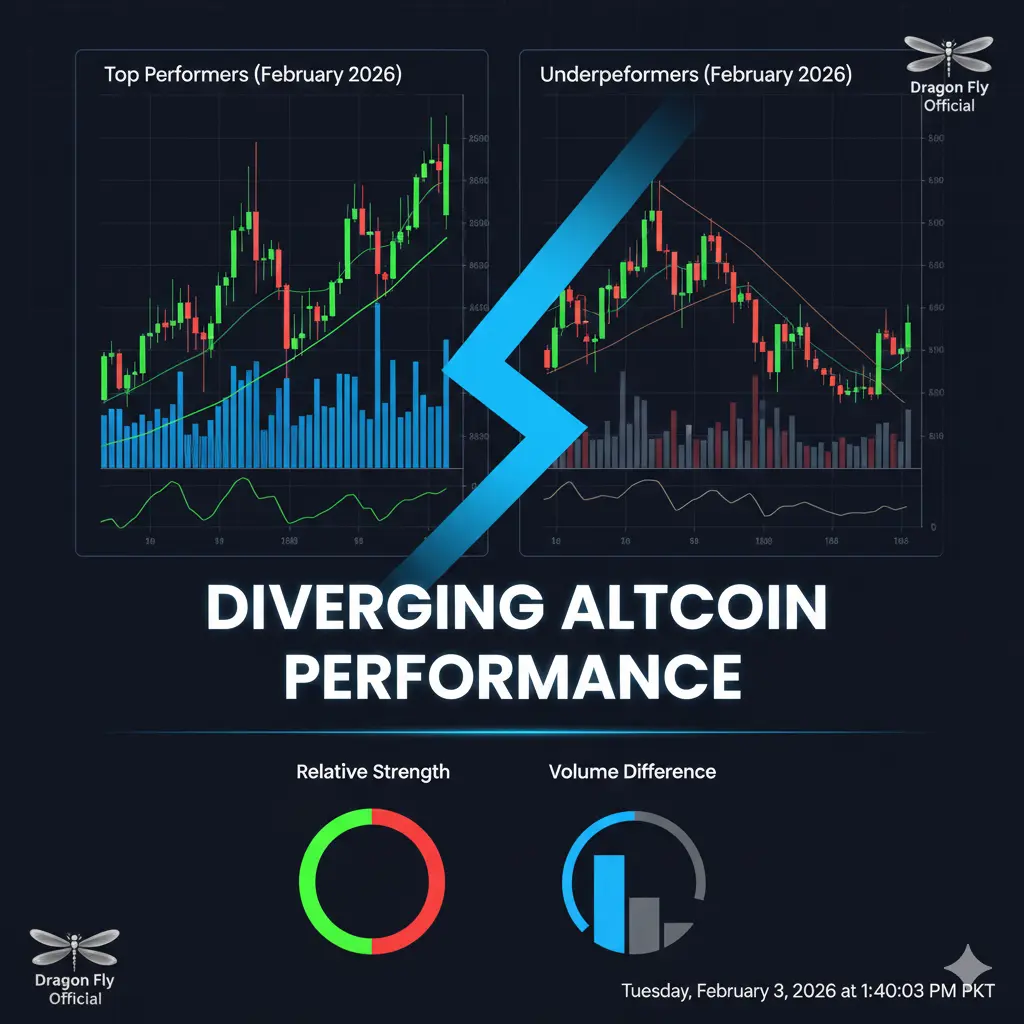

Altcoins are showing increasing divergence: some are outperforming Bitcoin and Ethereum, while others lag despite broader market recovery. This creates both risk and opportunity for traders and investors.

1️⃣ Observing Relative Strength

Coins like SOL, MATIC, and L2-linked tokens are holding up better, driven by adoption, ecosystem activity, and real use cases.

Other smaller-cap altcoins face price pressure and low liquidity, making them vulnerable in market pullbacks.

Using relative strength (RSI vs. BTC/ETH) helps identify which altcoins are genuinely outperforming versus those temporarily inflated by hype.

2️⃣ Market Behavior Insight

Institutions are selectively increasing exposure to high-quality altcoins with strong fundamentals.

Retail participants tend to follow trends blindly, which can exaggerate volatility in lower-cap projects.

This divergence signals a maturing market, where selective observation is more profitable than broad-based speculation.

3️⃣ Strategic Takeaways

Step back: When uncertainty rises, avoid chasing weak performers and reduce exposure to low-volume coins.

Selective observation: Focus on altcoins with real utility, strong communities, and proven adoption metrics.

Monitor on-chain activity, staking metrics, and developer engagement — these are early indicators of sustainable strength.

Dragon Fly Official Insight

Altcoin divergence is normal in a maturing market.

Long-term alpha comes from analyzing relative strength, adoption, and liquidity, not just price action.

Use this phase to identify gems rather than follow market noise.

#AltcoinDivergence

Altcoins are showing increasing divergence: some are outperforming Bitcoin and Ethereum, while others lag despite broader market recovery. This creates both risk and opportunity for traders and investors.

1️⃣ Observing Relative Strength

Coins like SOL, MATIC, and L2-linked tokens are holding up better, driven by adoption, ecosystem activity, and real use cases.

Other smaller-cap altcoins face price pressure and low liquidity, making them vulnerable in market pullbacks.

Using relative strength (RSI vs. BTC/ETH) helps identify which altcoins are genuinely outperforming versus those temporarily inflated by hype.

2️⃣ Market Behavior Insight

Institutions are selectively increasing exposure to high-quality altcoins with strong fundamentals.

Retail participants tend to follow trends blindly, which can exaggerate volatility in lower-cap projects.

This divergence signals a maturing market, where selective observation is more profitable than broad-based speculation.

3️⃣ Strategic Takeaways

Step back: When uncertainty rises, avoid chasing weak performers and reduce exposure to low-volume coins.

Selective observation: Focus on altcoins with real utility, strong communities, and proven adoption metrics.

Monitor on-chain activity, staking metrics, and developer engagement — these are early indicators of sustainable strength.

Dragon Fly Official Insight

Altcoin divergence is normal in a maturing market.

Long-term alpha comes from analyzing relative strength, adoption, and liquidity, not just price action.

Use this phase to identify gems rather than follow market noise.

#AltcoinDivergence