#WarshNominationBullorBear? Short-Term Fear, Long-Term Discipline?

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is widely associated with tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. Many market participants immediately interpreted the news as bearish for risk assets, including Bitcoin. Yet, the reality is more nuanced, with potential implications for both short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

Warsh served as a Fed Governor from 2006–2011 and played a key role during the 2008 financial crisis. With degrees from Stanford and Harvard Law, and affiliations with the Hoover Institution, he is highly respected in macroeconomic circles. President Trump announced Warsh’s nomination on January 30, 2026, to succeed Jerome Powell in May. Senate confirmation is still required, but expectations largely lean toward approval.

🔹 Immediate Market Reaction

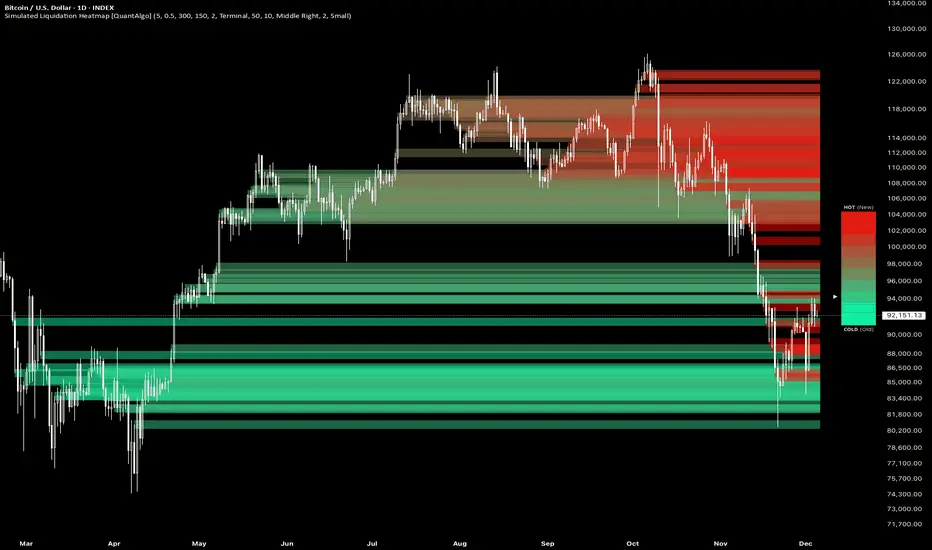

Markets responded sharply:

• Bitcoin: dipped to ~$75–78k (lower in some exchanges)

• Gold & Silver: sold off hard

• U.S. Dollar: strengthened

The reason: Warsh’s hawkish stance signals tighter liquidity, which historically pressures high-beta assets like crypto. Analysts have dubbed this initial movement the “Warsh Shock,” reflecting panic selling from retail and weak-hand investors.

🔹 Warsh’s Crypto Perspective

Interestingly, Warsh has expressed thoughtful views on Bitcoin:

• Called Bitcoin a “good policeman for policy,” providing market signals when central banks make errors

• Reviewed the Bitcoin whitepaper as early as 2011, recognizing it as a genuine technological innovation

• Views Bitcoin as a legitimate portfolio asset, while critiquing overhyped altcoins

This approach differs significantly from the typical central banker who perceives all crypto as a threat.

🔹 Short-Term Implications

If Warsh is confirmed and pursues aggressive QT:

• Liquidity tightens

• Dollar strengthens further

• Risk assets, including Bitcoin, face headwinds

Short-term fear and selling pressure are likely, creating potential volatility spikes. Traders may see dips as panic-driven rather than structural sell-offs.

🔹 Long-Term Perspective

Over a longer horizon, disciplined monetary policy—lower inflation, stable interest rates, and financial stability—can actually support Bitcoin’s “digital gold” narrative. Historically, BTC has thrived both during excessive QE and in regimes with strong monetary discipline, serving as a hedge against policy errors. Warsh’s approach could accelerate crypto’s maturation from speculative hype to recognized asset class status.

🔹 Strategic Takeaways for Investors

• Short-term: Expect volatility, potential dip buying opportunities

• Medium/Long-term: A pragmatic Warsh could stabilize markets, reinforcing Bitcoin’s store-of-value case

• Investor Mindset: Avoid panic; focus on macro alignment, liquidity conditions, and institutional accumulation trends

🔹 Bottom Line

The nomination is neither purely bullish nor purely bearish. Short-term fear may dominate, but execution and policy nuance will determine the next leg for both traditional and crypto markets. Patient investors might view this as an accumulation window, especially for Bitcoin holders who understand its role in correcting central bank errors.

📌 Key Question: Will this be a bottom for BTC, or is more downside ahead? The answer depends on Warsh’s actual policy path, Senate confirmation, and market liquidity reaction.

Kevin Warsh’s nomination for Federal Reserve Chair has sent ripples through financial and crypto markets. Known as an inflation hawk, Warsh is widely associated with tighter monetary policy—balance sheet reduction (QT), higher real interest rates, and disciplined macro oversight. Many market participants immediately interpreted the news as bearish for risk assets, including Bitcoin. Yet, the reality is more nuanced, with potential implications for both short-term volatility and long-term market structure.

🔹 Who Is Kevin Warsh?

Warsh served as a Fed Governor from 2006–2011 and played a key role during the 2008 financial crisis. With degrees from Stanford and Harvard Law, and affiliations with the Hoover Institution, he is highly respected in macroeconomic circles. President Trump announced Warsh’s nomination on January 30, 2026, to succeed Jerome Powell in May. Senate confirmation is still required, but expectations largely lean toward approval.

🔹 Immediate Market Reaction

Markets responded sharply:

• Bitcoin: dipped to ~$75–78k (lower in some exchanges)

• Gold & Silver: sold off hard

• U.S. Dollar: strengthened

The reason: Warsh’s hawkish stance signals tighter liquidity, which historically pressures high-beta assets like crypto. Analysts have dubbed this initial movement the “Warsh Shock,” reflecting panic selling from retail and weak-hand investors.

🔹 Warsh’s Crypto Perspective

Interestingly, Warsh has expressed thoughtful views on Bitcoin:

• Called Bitcoin a “good policeman for policy,” providing market signals when central banks make errors

• Reviewed the Bitcoin whitepaper as early as 2011, recognizing it as a genuine technological innovation

• Views Bitcoin as a legitimate portfolio asset, while critiquing overhyped altcoins

This approach differs significantly from the typical central banker who perceives all crypto as a threat.

🔹 Short-Term Implications

If Warsh is confirmed and pursues aggressive QT:

• Liquidity tightens

• Dollar strengthens further

• Risk assets, including Bitcoin, face headwinds

Short-term fear and selling pressure are likely, creating potential volatility spikes. Traders may see dips as panic-driven rather than structural sell-offs.

🔹 Long-Term Perspective

Over a longer horizon, disciplined monetary policy—lower inflation, stable interest rates, and financial stability—can actually support Bitcoin’s “digital gold” narrative. Historically, BTC has thrived both during excessive QE and in regimes with strong monetary discipline, serving as a hedge against policy errors. Warsh’s approach could accelerate crypto’s maturation from speculative hype to recognized asset class status.

🔹 Strategic Takeaways for Investors

• Short-term: Expect volatility, potential dip buying opportunities

• Medium/Long-term: A pragmatic Warsh could stabilize markets, reinforcing Bitcoin’s store-of-value case

• Investor Mindset: Avoid panic; focus on macro alignment, liquidity conditions, and institutional accumulation trends

🔹 Bottom Line

The nomination is neither purely bullish nor purely bearish. Short-term fear may dominate, but execution and policy nuance will determine the next leg for both traditional and crypto markets. Patient investors might view this as an accumulation window, especially for Bitcoin holders who understand its role in correcting central bank errors.

📌 Key Question: Will this be a bottom for BTC, or is more downside ahead? The answer depends on Warsh’s actual policy path, Senate confirmation, and market liquidity reaction.