Search results for "EPIC"

Memecoin sector rotation: In early 2026, market capitalization surged by $8 billion, with PEPE and BONK leading the counterattack

Entering 2026, the long-dormant Memecoin market has made a powerful comeback at an astonishing speed. According to CryptoQuant data, the total market capitalization of this sector has surged by over $8 billion since the beginning of the year, with PEPE up 65% year-to-date, BONK increasing 49%, and FLOKI recording a 40% surge.

This rebound began after the sector hit a historic low in December 2025, accounting for only 3.2% of the altcoin market, which is eerily similar to the market structure before the epic bull run at the end of 2020. Meanwhile, Jesse Pollak, founder of Coinbase's Layer 2 network Base, highly praised the value of Memecoin as a "community coordination point," with the total market cap of on-chain Memecoin rising 14% in a single day to surpass $600 million. This frenzy, driven by community culture, platform infrastructure, and market cycles, is once again testing the boundaries between "utility" and "meme" in the crypto market.

MarketWhisper·57m ago

Diamond Hands Pay Off as Insider Whale Recovers $88M Swing in Unrealized Crypto Profits

One of the most epic turns in the unrealized profit-and-loss moves has taken place with a closely monitored insider whale, which has made headlines in the crypto community after sailing through one of the most dramatic swings in the last few months. On-chain data provided by Satoshi Stacker have

Coinfomania·21h ago

2025 Global Crypto Regulatory Map: The Beginning of the Integration Era, a Year of "Convergence" between Crypto and TradFi

Author: imToken

Objectively speaking, for Crypto/Web3, 2025 will definitely be the most transformative year in the past decade.

If the past ten years have been the "wild growth" of the crypto industry on the fringes of mainstream finance, then 2025 marks the first year of this species' official "legalization evolution":

From stablecoins to RWA, from policy U-turns in Washington to regulatory frameworks in Hong Kong and the EU, the global regulatory logic is undergoing an epic paradigm shift.

1. United States: Crypto Enters a Period of Institutional Recognition

For a considerable period, US regulation of the crypto industry has resembled a tug-of-war lacking consensus.

Among them, the US Securities and Exchange Commission (SEC) under Gary Gensler has been particularly active, frequently using enforcement actions to define the legal boundaries of crypto assets, filing lawsuits,

PANews·2025-12-30 12:11

Silver ranks as the best performing asset in 2025, with the author of "Currency Wars" predicting it could reach $200

The silver market in 2025 experienced epic volatility. Driven by multiple shocks including the US Trump administration's economic policies, geopolitical turmoil, and supply chain tightening, silver surged from a supporting role to the top performer of the year, even reaching a historic high of over $80 per ounce at the end of December, nearly tripling its value from the previous year. However, as market sentiment overheated and liquidity shifted, silver prices recently saw a significant decline. Looking ahead to 2026, industrial demand and the trend toward monetary decentralization will continue to support silver. Jim Rickards, author of "Currency Wars," even predicted in a recent interview that silver prices will reach $200 in 2026.

Since the beginning of 2025, silver has gained as much as 150%, making it the best-performing asset of 2025.

2025 has been a highly dramatic year for silver, with gains of up to 150% since the start of the year, surpassing gold to become the top asset of 202

RWA3.8%

ChainNewsAbmedia·2025-12-30 04:44

A roundup of the absurd news in the crypto world in 2025: founders faking death, stablecoin companies issuing 300 trillion USD are just small cases

The extraordinary crypto market of 2025, from the US President issuing coins to epic liquidations, this article reviews the most outrageous and absurd moments of the year, including founders going missing, hackers getting hacked, fake death scams, and other laughable incidents.

(Previous summary: 2 million USD evaporated in 45 days: an OG's darkest moment and rebirth declaration)

(Additional background: Scam victims mocked by police "how are you still alive," mother and daughter devastated and took their own lives! Behind it is an old jewelry merchant laundering USDT)

Table of Contents

On TGE day, the founder went missing, claiming to have lost the main coin multi-signature in northern Myanmar

zkLend hacker mistakenly clicked on a phishing site, leading to a second theft of stolen funds, hacker requests cooperation with zkLend to recover the funds

Zerebro founder faked death and released a timed farewell letter

Previously stole project funds, Clanker partner revealed offline at a conference and dropped their vest

動區BlockTempo·2025-12-29 03:20

Bitcoin whales collectively awaken in 2025: an unprecedented "wealth transfer"

In 2025, as Bitcoin's price broke through $100,000 and hit a record high of $126,000, the dormant "whales" of Bitcoin began an epic collective action. On-chain data shows that these early investors, holding over 1,000 BTC and some having been dormant for 10 to 14 years, launched multiple rounds of large-scale sell-offs this year, totaling hundreds of billions of dollars. Among them, a mysterious transaction from the "Satoshi era" transferred 80,000 BTC in a single move, cashing out approximately $9 billion. This whale activity, dubbed the "Great Reallocation" by analysts, is counteracting the new demand from spot ETFs and the asset sheets of listed companies, profoundly reshaping the structure of Bitcoin holders and potentially indicating that the traditional four-year market cycle is undergoing a fundamental change.

BTC1.41%

MarketWhisper·2025-12-29 02:28

Smart money enters the market: Gold breaks through $4,500, silver surges 150%. Why are precious metals the "trading of the year" in 2025?

In 2025, gold and silver have become the most dazzling stars in global asset allocation. After hitting over 50 all-time highs within the year, gold prices recently broke the $4,500 per ounce mark; silver surged by 150%, surpassing the $70 level. Both are expected to record their strongest annual performance since 1979. This epic rally is driven by multiple factors including sustained central bank gold purchases, a weakening US dollar, declining interest rate expectations, and industrial demand. Analysts point out that this signals investors are becoming "smarter," diversifying their portfolios with precious metals as strategic assets. Despite the market enthusiasm, seasoned strategists also issue warnings, reminding investors not to forget to "take profits" amid the frenzy.

BTC1.41%

MarketWhisper·2025-12-29 02:13

Crypto Coach Says 2026 Will Be Epic for XRP, “Locked In”

Market commentator Coach JV has joined a growing list of analysts shifting their focus from XRP’s current struggles to 2026 as a potential turning point.

Indeed, XRP has failed to meet bullish expectations in 2025. However, several factors are now aligning to support the view that the next year

TheCryptoBasic·2025-12-25 10:38

比特幣今年慘輸那指 50%!VanEck:跌深就是利多、明年將是「績效王」

For crypto investors who firmly believe in the theme of "hedging against inflation," 2025 has undoubtedly been a disappointing year. Bitcoin, which was originally expected to benefit from the currency depreciation wave, not only underperformed the "safe haven king" gold but was also far behind the Nasdaq 100 index.

In response, asset management firm VanEck believes that Bitcoin is brewing an epic "comeback," and in 2026, it is expected to follow gold and stage a "breakout rally."

David Schassler, head of Multi-Asset Solutions at VanEck, stated in the latest "2026 Investment Outlook" that Bitcoin's weakness this year is actually the biggest bullish signal for next year:

Since the beginning of this year, Bitcoin's performance has lagged about 50% behind the Nasdaq 100 index. This extreme "price dislocation" suggests that Bitcoin is poised to become the best-performing asset in 2026.

区块客·2025-12-25 09:00

Christmas Ethereum Surprise: Almost 1,000,000% Profit Triggers Epic Whale Awakening - U.Today

On Christmas Eve, a dormant Ethereum wallet holding 2,000 ETH reawakened after 10 years, leading to speculation about its future movements. With a significant price increase, the transaction could influence the market, especially in a low-volume period.

ETH1.86%

UToday·2025-12-24 13:37

Bitcoin's four-year cycle is intact! VanEck: After 2026's consolidation year, an epic breakout awaits

VanEck Multi-Asset Solutions Head David Schassler states that Bitcoin has lagged behind the Nasdaq 100 index by about 50% this year, making it a potential best-performing asset in 2026. Digital Asset Research Head Matthew Sigel says the four-year cycle remains intact, and 2026 is more likely to be a year of consolidation. The current decline reflects temporary liquidity pressures, and Schassler openly admits he has been buying.

MarketWhisper·2025-12-24 09:10

Bitcoin this year has plummeted 50% compared to the NASDAQ! VanEck: Deep declines are bullish, and next year will be the "performance king"

For crypto investors who firmly believe in the theme of "anti-inflation," 2025 has undoubtedly been a disappointing year. Bitcoin, which was originally expected to benefit from the currency depreciation wave, not only underperformed the "safe-haven king" gold but was also far behind the Nasdaq 100 index.

In response, asset management firm VanEck believes that Bitcoin is brewing an epic "comeback," and in 2026, it is expected to follow gold and stage a "breakout rally."

David Schassler, head of Multi-Asset Solutions at VanEck, stated in the latest "2026 Investment Outlook" that Bitcoin's weakness this year is actually the biggest bullish signal for next year:

> Since the beginning of this year, Bitcoin's performance has lagged about 50% behind the Nasdaq 100 index. This extreme "price dislocation" suggests that Bitcoin is poised to become the top performer in 2026.

区块客·2025-12-24 08:50

12.20 AI Daily Cryptocurrency Industry Development Outlook for 2025: Stricter Regulations, Ecosystem Upgrades, Global Deployment

AI today discovered 1. Federal Reserve Chair Powell signals hawkish stance, causing Bitcoin and other cryptocurrencies to plummet 2. Japan plans to impose a 20% flat tax on cryptocurrency transactions to revitalize the domestic market 3. Hong Kong Securities and Futures Commission approves cryptocurrency exchange application, officially regulating cryptocurrencies in Hong Kong 4. The largest US cryptocurrency exchange Coinbase lays off 20%, industry winter intensifies 5. The EU approves epic-level cryptocurrency legislation, which will have a profound impact on the industry

GateUser-26c36996·2025-12-20 10:05

Altcoin Experts Shed Light on Cardano and ADA, Epic Price Rally in the Works?

Altcoin experts shed light on Cardano and ADA.

The popular altcoin could see a massive price rally soon.

How high can ADA go this altseason and set a new ATH?

As Bitcoin and Ethereum prices continue to trade in a steady sideways movement at price ranges between $89,000 and $90,000

CryptoNewsLand·2025-12-18 06:36

The Federal Reserve's independence collapses! The US dollar's monetary trust wavers, and Bitcoin faces an epic boon

Before the Federal Reserve announced a 25 basis point rate cut in December, Trump's economic advisor and the frontrunner for Federal Reserve Chair, Kevin Hasset, publicly "precisely predicted" a 25 basis point cut. Financial experts point out that the collapse of this independence is more frightening than the rate cut itself, describing it as the first domino to topple "Dollar Hegemony." For Bitcoin, this is a historic opportunity: when central bank credit wavers, the value proposition of decentralized currencies is strengthened like never before.

MarketWhisper·2025-12-12 06:14

The biggest fraud case in crypto history has been cracked! Do Kwon sentenced to 15 years for the $40 billion Terra collapse

The Southern District of New York Federal Court officially sentenced Terraform Labs co-founder Do Kwon to 15 years in prison for his fraudulent activities that led to the loss of up to $40 billion in market value. Presiding Judge Paul Engelmayer stated in court that this case is an "epic fraud of a generation," with the sentence even exceeding the 12 years recommended by prosecutors. This ruling marks a milestone in the over two-year Terra/UST crash event and the chain reaction crisis it triggered, signifying the U.S. judicial system's strict stance against malicious fraud in the cryptocurrency industry.

LUNA-1.93%

MarketWhisper·2025-12-12 01:40

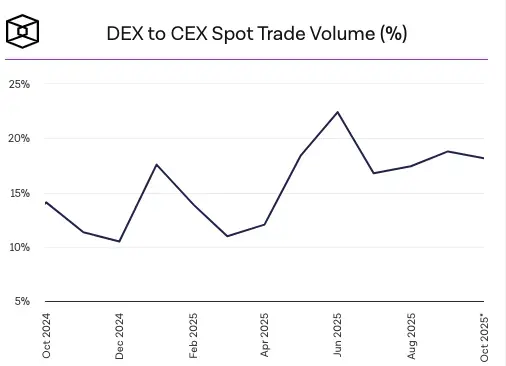

Hyperliquid and the Year of Explosive Growth in Perpetual Contracts

Author: David Christopher Source: Bankless Translation: Shan Ouba, Golden Finance

Looking back at the growth trajectory of the cryptocurrency market in 2025, Hyperliquid has always been a core topic that cannot be ignored.

This exchange attracted the attention of many users on the crypto Twitter platform through an epic airdrop at the end of 2024 and impressive price movements, prompting them to re-evaluate this product. By the end of 2025, it had completed a stunning transformation — ranking fourth in the cryptocurrency industry's revenue list, with annual revenue exceeding $650 million, and its perpetual contract trading volume once accounted for up to 70%, making it a truly phenomenon-level platform.

Data source: Token Terminal

If you haven't closely followed Hyperliquid's developments before, you might think it

HYPE1.12%

金色财经_·2025-12-11 08:15

The hottest trading crash in the crypto world! Stock prices of 138 treasury companies halved, the MicroStrategy myth shattered

Bloomberg reported on December 7 that the crypto industry's craziest investment strategy of the year is undergoing an epic collapse. In the first half of 2025, more than 138 publicly listed companies in the US and Canada transformed into "digital asset treasuries," borrowing over $45 billion to purchase Bitcoin and other tokens. However, Bloomberg data shows that the median stock price of these listed companies emulating MicroStrategy has already dropped 43% this year, while Bitcoin has only fallen 6%.

MarketWhisper·2025-12-08 06:17

Is the "iPhone moment" for cryptocurrency coming? Venture capitalists and traders reveal crypto investment strategies for the next decade

The crypto market is quietly entering a moment that many venture capitalists, researchers, and traders consider a “historic turning point.” Paradigm founder Matt Huang describes the current upheaval as an “iPhone moment,” while some believe that the institutional adoption wave will completely invalidate the four-year cycle. With the rise of AI, this article compiles opinions from several industry leaders to give readers a clear view of the present and future of the crypto market.

The iPhone Moment Arrives? Paradigm Welcomes a “Crypto Epic Adoption Cycle”

Paradigm founder Matt Huang recently wrote that the current era for crypto is like the “Netscape era for the Internet, the iPhone moment for smartphones,” and that we have reached a true breakout stage:

Cryptocurrencies are more vibrant than ever, far exceeding our most

ChainNewsAbmedia·2025-12-08 05:53

LUNC Soars 70% Against the Trend: Doomsday Machine Reboot or Flash in the Pan?

Against the backdrop of a general pullback in the global cryptocurrency market, LUNC—the token that emerged after the collapse of the Terra ecosystem—has staged an eye-popping countertrend rally, with a single-day increase at one point nearing 80%. The catalyst for this surge is widely believed by the market to be a chance event at a recent industry conference, which has reignited attention on this "epic" failed project. Meanwhile, founder Do Kwon is set to face sentencing in the US on December 11, adding a layer of drama to this sudden price spike. However, several market experts have issued urgent warnings, pointing out that this rally lacks solid liquidity support and looks more like wash trading by exchange bots, reminding investors to remain vigilant and view this "doomsday chariot" anomaly with rational caution.

MarketWhisper·2025-12-08 01:42

“Backed by nothing?” inside the epic Bitcoin battle between Changpeng Zhao and Peter Schiff

CZ and Peter Schiff spar over Bitcoin and tokenized gold, exposing a deeper fight about utility, trust, and what really backs the money of the future.

Summary

Peter Schiff argues tokenized, fully allocated gold is superior money, calling Bitcoin a faith based asset backed by nothing.

CZ

Cryptonews·2025-12-05 11:36

Japan's government bond auction "sold out in seconds", interest rates slightly retreated, and the market is certain that there will be a rate hike by the end of the year.

The 10-year Japanese government bond auction has successfully concluded, but interest rate hikes and fiscal stimulus are pushing the Japanese bond market towards a new normal of dramatic fluctuations (Background: Rich Dad: Japan's 30-year "spread trading ends" epic bubble is coming, I will teach you ten tips for survival) (Additional background: A Japanese netizen's father passed away, and the "Bitcoin inheritance" is worth 100 million yen, and he needs to pay 62 million yen in taxes?) On Tuesday afternoon in Tokyo, the 10-year Japanese government bonds were successfully traded amid the market's initial concerns about selling pressure, with bid multiples rebounding and tail spreads narrowing, temporarily suppressing the flames of yields soaring to a new 17-year high. However, the real storm is about to arrive: In two weeks, it is almost certain that Bank of Japan Governor Kazuo Ueda will initiate the first interest rate hike since 2007, while Prime Minister Fumio Kishida is simultaneously presenting a 21 trillion yen stimulus plan. The world's third-largest bond market is reassessing prices, and both Wall Street and Silicon Valley are feeling the liquidity gates slowly closing. The auction held firm, and short positions temporarily retreated. This time.

動區BlockTempo·2025-12-02 05:35

Japan established the DOGE government efficiency department, Katayama Satsuki: supporting Takagi Sanae's proactive and responsible fiscal policies.

Japan has established a government efficiency department DOGE, with Minister Katayama Satsuki hoping to reduce waste through minimally invasive methods to gain market trust for Prime Minister Takashi's massive stimulus plan (Background: Rich Dad: Japan's 30-year "end of interest rate differential trading" epic bubble is approaching, I will teach you ten survival skills) (Supplementary background: A Japanese netizen's father passed away, and the "Bitcoin inheritance" is worth 100 million yen, needing to pay 62 million yen in taxes?) As Tokyo's winter night deepens, investors are turning their attention to an experiment jokingly referred to as the "Japanese version of DOGE." On Tuesday (December 2), Finance Minister Katayama Satsuki announced the establishment of the "Government Efficiency Department" (DOGE), aimed at reviewing subsidy and tax measures, performing a "minimally invasive surgery" on public finances with limited manpower. At a time when Prime Minister Takashi has just introduced over 10 trillion yen in new debt, whether this surgical knife can soothe market concerns about the yen has become a key focus. The dilemma of Takashi's economics.

動區BlockTempo·2025-12-02 03:33

Wintermute founder discusses "1011 Night of Terror" and market predictions.

Author: The Block, Translated by: Azuma

Editor's note: On October 11, the cryptocurrency market experienced an epic crash. Although a week has passed since then, discussions surrounding the reasons for that crash and its subsequent impacts have not ceased.

On October 15, Evgeny Gaevoy, founder and CEO of the industry's leading market maker Wintermute (which was rumored to have collapsed on the day of the crash, but has since refuted these claims), participated in a podcast episode by The Block, sharing his views on the "1011" incident.

The following are the main points of the podcast, with some content omitted for reading fluency.

An hour of complete chaos

Host: Let's get straight to the point. What happened on October 11th was very shocking for the entire market. Can you take us back to that day?

金色财经_·2025-12-02 00:05

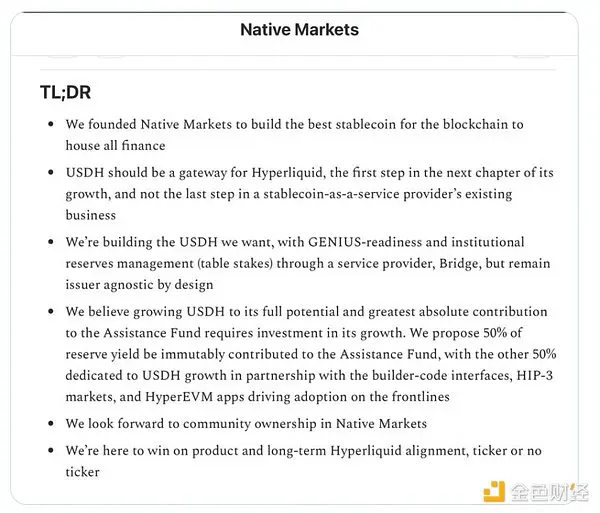

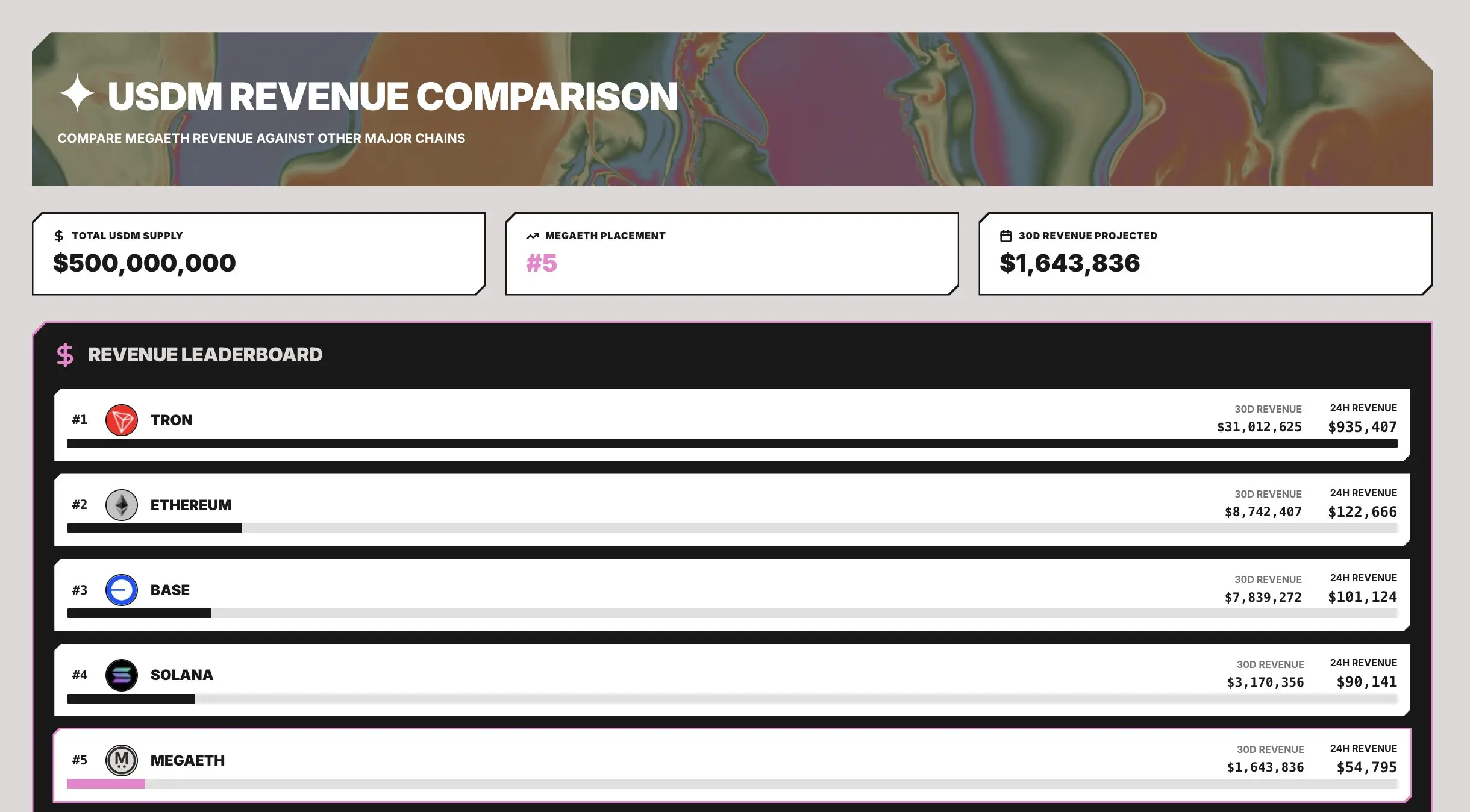

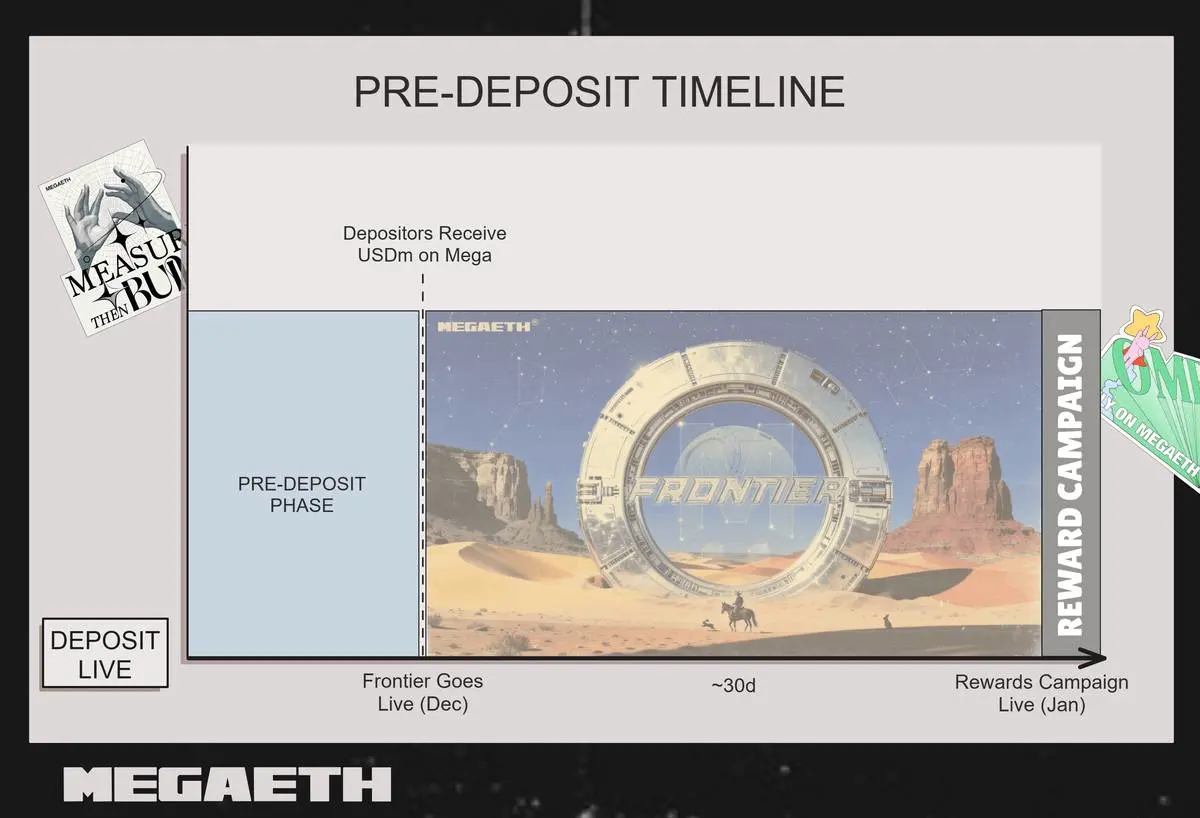

MegaETH's $500M Pre-Deposit Nightmare: Epic Launch Fiasco Forces Total Refund and Mainnet Delay

MegaETH pre-deposit refund has turned one of crypto's most hyped launches into a full-blown disaster, with the team announcing a complete unwind of its $500 million fundraising bridge after a cascade of technical blunders and operational chaos.

CryptopulseElite·2025-12-01 06:02

MegaETH Epic Disaster! Error in Contract Ruins $500 Million Pre-sale All Refunded

MegaETH will refund all funds deposited by users into its pre-release "Pre-storage Bridge", thereby reversing the previous activity aimed at pre-loading liquidity for USDm, which has evolved into one of the most chaotic financing attempts of the year. The team stated that the execution was "very sloppy", and users' expectations of a $250 million cap were inconsistent with its internal target for pre-injected collateral. All deposits will be refunded through a new smart contracts that is currently undergoing auditing.

MarketWhisper·2025-12-01 01:57

Rich Dad: The epic bubble of Japan's 30-year "end of interest rate differential trading" is coming, and I will teach you ten ways to save your life.

Robert Kiyosaki predicted that the global asset bubble would burst due to Japan ending its 30-year interest rate differential trading in his book "Rich Dad Poor Dad." He plans to provide ten investment recommendations to help ordinary investors grow wealth amid market fluctuations, and has already proposed the first recommendation: invest in the energy industry. Kiyosaki emphasized that there are still opportunities to get rich even in economic difficulties.

ETH1.86%

動區BlockTempo·2025-11-30 08:02

From "Subscription Hell" to Precision Pricing: A History of the Evolution of Online Pricing Models

When machines become the primary users, why are we still paying for human habits? From subscription models to x402 payment standards, this article explores how online pricing has evolved from meeting human habits to adapting to the sudden transaction demands of machine-to-machine interactions. This article is based on a piece by AididiaoJP, Sumanth Neppalli, and Nishil Jain, compiled and written by ForesightNews. (Background: Netflix partners with Epic to enter the "video game subscription model": using mobile phones as controllers, threatening the three giants of Microsoft, Nintendo, and Sony?) (Background information: The short seller Michael

動區BlockTempo·2025-11-27 09:57

Cross The Ages Rolls Out Alpha Phase For ‘Arise’ RPG On Epic Games Store

In Brief

Cross The Ages has launched the alpha phase of its Arise RPG on the Epic Games Store, expanding its transmedia Web3 universe with immersive gameplay.

Transmedia Sci-Fi fantasy Web3 universe Cross The Ages (CTA) announced the launch of the alpha testing phase for its highly

CTA120.86%

MpostMediaGroup·2025-11-26 15:32

Under the ban, China's Bitcoin mining computing power is recovering, returning to the world's third largest mining country?

In the torrent of history, some chapters seem to be predetermined, yet they always reappear in unexpected ways. In 2021, the Chinese government, with a thunderous momentum and out of dual considerations for financial stability and energy security, comprehensively banned cryptocurrency mining activities. This ban caused China's mining industry, which once held half of the global Bitcoin computing power, to fall silent in an instant, with millions of mining rigs extinguishing their indicator lights overnight, resulting in an epic "great migration of computing power." However, four years later, a surprising reality is quietly emerging: not only has Bitcoin mining activity in China not disappeared, but it has also revived in a secretive and resilient manner, with its computing power share climbing to the third place globally.

This is not only a test of the policy red line, but also a complex game woven together by economic incentives, local tacit agreements, and technological realities.

Computing Power Landscape Reversion

According to the professional analysis agency Hashrate In

BTC1.41%

LinkFocus·2025-11-26 09:55

Bull run terminator? Once the financing flywheel breaks, miners may trigger the next round of epic dumping.

Original compilation: Luke, Mars Finance

Are you tired of the doomsday posts circulating on Crypto Twitter (CT) lately? What frustrates me even more is the contradictory views people have on the future of the crypto market. Some are writing obituaries for the great bull market we are experiencing, while others insist that this is just another minor episode in the grand drama of market cycles. I'm fed up with all of this. As always, everyone has their own theory.

Some signs suggest that this time might really be different. The ETF has recorded a net outflow of $1 billion for three consecutive days for the first time since its establishment, the funding rate for BTC has reversed, and the sentiment of "buying the dip" has mainly turned into memes on CT. However, there have been instances in the past where BTC has pulled back by 25-30%, only to reach new all-time highs within a few months. Who can determine this time?

BTC1.41%

MarsBitNews·2025-11-26 03:19

Last night, the U.S. stock market opened with an "epic" high and then plummeted, with Nvidia going over the mountain.

U.S. stocks opened higher on the dual favourable information of Nvidia's better-than-expected earnings report and non-farm payroll data, but quickly encountered a sharp decline, with both the S&P 500 and Nasdaq experiencing a big dump, indicating market concerns over the AI valuation bubble. Analysts believe that the market reversal signals a bearish outlook, and Nvidia's strong performance has not alleviated investors' worries.

BTC1.41%

DeepFlowTech·2025-11-21 01:32

Filecoin Epic Infrastructure Upgrade: Filecoin Onchain Cloud will globally launch on November 18, potentially rewriting the on-chain cloud landscape.

Filecoin will launch Filecoin Onchain Cloud (FOC) in Argentina on November 18, marking its transition from "Decentralization storage" to "on-chain trusted cloud infrastructure." The core capabilities of FOC include ownership, verifiability, and Programmability, emphasizing the trustworthiness and public nature of future clouds. This move signifies an important re-evaluation of Filecoin's value in the global cloud market.

FIL5.8%

DeepFlowTech·2025-11-18 03:26

Arthur Hayes' new article: He has increased his holdings in stablecoins and is waiting for an "epic" buy the dip opportunity at $80,000!

Original author: Arthur Hayes

Original Title: Snow Forecast

Original compilation: Luke, Mars Finance

Snow forecast

It’s that time again when I become a "keyboard meteorologist." Concepts like La Niña and El Niño are flooding into my vocabulary. Predicting the wind direction of a snowstorm is just as important as forecasting snowfall amounts, as it directly affects where I should go skiing. With my limited weather knowledge, I express opinions on when autumn ends and winter begins in Hokkaido, Japan. I also discuss with other local ski bums my dreams of an early start to the powder season. However, the app I check most frequently on my phone isn't my favorite cryptocurrency chart app, but the Snow-Forecast app.

As data points arrive one after another

BTC1.41%

MarsBitNews·2025-11-18 01:10

The Return of L2 Kings? The Three Arrows and Breaking Points of the Arbitrum Renaissance

Although Optimism was the first TGE on L2, Arbitrum is the true pioneer of the L2 wave. In the first half of 2023, Korean Whales were live trading contracts on GMX, while DeFi Degens used GLP Lego combinations for Yield Farming, and grassroots communities banded together to hype ancient cat and dog Meme coins. Arbitrum was one of the brightest zones in the spring market of 2023.

However, this ecological prosperity, like a blooming flower brocade, has dimmed after the epic TGE and airdrop of Arbitrum's native token ARB.

Looking back at this point in time in November 2025, there are three main reasons for this situation.

--The huge positive externality generated by Arbitrum's epic airdrop has been seized by competitors ZkSync, Starknet, and Linea;

--At that time, the king-level L

PANews·2025-11-13 13:19

Data: Multiple tokens have experienced a sharp rise and fall, SOL has hit a new low today.

According to Mars Finance news, the market is polarized, with significant falls in coins such as ARDR, LPT, ADX, and DIA, while LUMIA, EPIC, and DASH are rising against the trend, and SOL has reached a new low.

SOL2.57%

MarsBitNews·2025-11-12 03:49

Gate on-chain observation (November 11): UNI buyback proposal sparks DeFi celebration; James Wynn loses over $22 million

On November 11th, the cryptocurrency market showed a clear sector differentiation pattern. Uniswap activated its fee switch and proposed burning 100 million UNI tokens from the treasury, causing the token to surge over 50% in a single day and triggering a capital influx into the DeFi sector. An epic long position appeared on the Ethereum chain, with a major whale investing a total of 892 million USDT to purchase 267,000 ETH within a week, and beginning to use leverage to double down on their bets.

In the Bitcoin market, institutional movements were mixed, with Matrixport significantly withdrawing funds while BlackRock took profits. The ZEC long-short battle entered a brutal harvest phase, forcing former bullish leaders to cut losses and exit. The current market core contradiction lies in the coexistence of improved fundamentals expectations and high leverage risks. Investors should be cautious of the fragility of extreme positions amid increasing volatility.

MarketWhisper·2025-11-11 11:30

Seafood company Nocera secures up to $300 million in private funding: supporting digital asset strategies and strategic acquisitions

Nocera (NCRA) successfully completed a private placement financing agreement worth up to $300 million, with plans to invest the funds in digital asset strategies and corporate acquisitions. This move presents both opportunities and challenges in the current volatile market. The key point is that the company has not yet deployed the funds, maintaining strategic flexibility to "attack or defend" in future markets, waiting for the optimal investment timing. (Background: A global trend of "virtual asset reserves" is emerging, with listed company DAT's strategy becoming a new investment focus.) (Additional context: After the epic liquidation in the "1011" crypto market, how are DAT companies' stocks holding up?) Nocera, Inc. (NASDAQ: NCRA) announced an agreement with a U.S. institutional investor for a securities purchase, involving a private placement of senior secured convertible notes totaling up to $300 million. Nocera (NASDAQ: NCRA) is a dynamic, ...

ETH1.86%

動區BlockTempo·2025-11-05 17:12

What Is Epic Chain: The 2025 Guide to RWA Tokenization on XRP Ledger

As the blockchain industry matures, the tokenization of real-world assets (RWA) emerges as the next trillion-dollar opportunity. At the forefront of this revolution stands Epic Chain, a groundbreaking project building a global RWA superstructure on the XRP Ledger. For anyone wondering **what ****is Epic** and why it matters, this comprehensive guide explores how this innovative platform is bridging traditional finance with Web3, making everything from real estate to rare collectibles accessible,

MarketWhisper·2025-10-30 08:49

SOL is on the Cusp of an Epic Move: Network Activity EXPLODES as Key Signal Flashes Green!

Solana (SOL), currently trading at $192, is showing the first major signs of breaking free from its recent bearish confinement. A historic surge in network participation, coupled with a rare technical indicator on the verge of confirming a Bullish Crossover, suggests that the altcoin is preparing f

SOL2.57%

Coinstagess·2025-10-26 12:02

Epic Oolong: Paxos accidentally issued 300 trillion PYUSD, CEO argues it is a "Blockchain transparency proof"?

Last week, stablecoin issuer Paxos accidentally minted $3 trillion worth of PYUSD tokens due to an "internal technical error," and quickly destroyed them 24 minutes later. This "blunder," which exceeded the global GDP by more than double, did not leave its internal systems, but coincided with Paxos seeking a national trust license from the OCC, raising market concerns about Paxos' operational standards and systemic risks. Paxos CEO Charles Cascarilla characterized the incident at Wednesday's Fed encryption roundtable as a testament to the transparency of Blockchain rather than a system failure.

MarketWhisper·2025-10-23 06:23

XRP, Cardano, and BNB are poised for a surge: AI predicts an "epic" rebound by the end of the year, with XRP possibly reaching 10 dollars!

Artificial intelligence (AI) models, including Perplexity AI and Claude AI, have made bold predictions: by the end of the year, mainstream alts such as XRP, Cardano, and BNB are expected to experience an unusual price rebound. Despite the previous impact of the "Black October" event, where the U.S. President announced a 100% tariff on Chinese imports, the crypto market faced a sharp dumping, but seasoned analysts believe that the pullback is healthy and can lay the groundwork for more sustainable long-term growth. AI models predict that, driven by favourable information from regulations and ecosystem expansion, BNB is expected to reach $1600, XRP may soar to $6.20, and even touch $10 in a bull run scenario.

MarketWhisper·2025-10-23 01:13

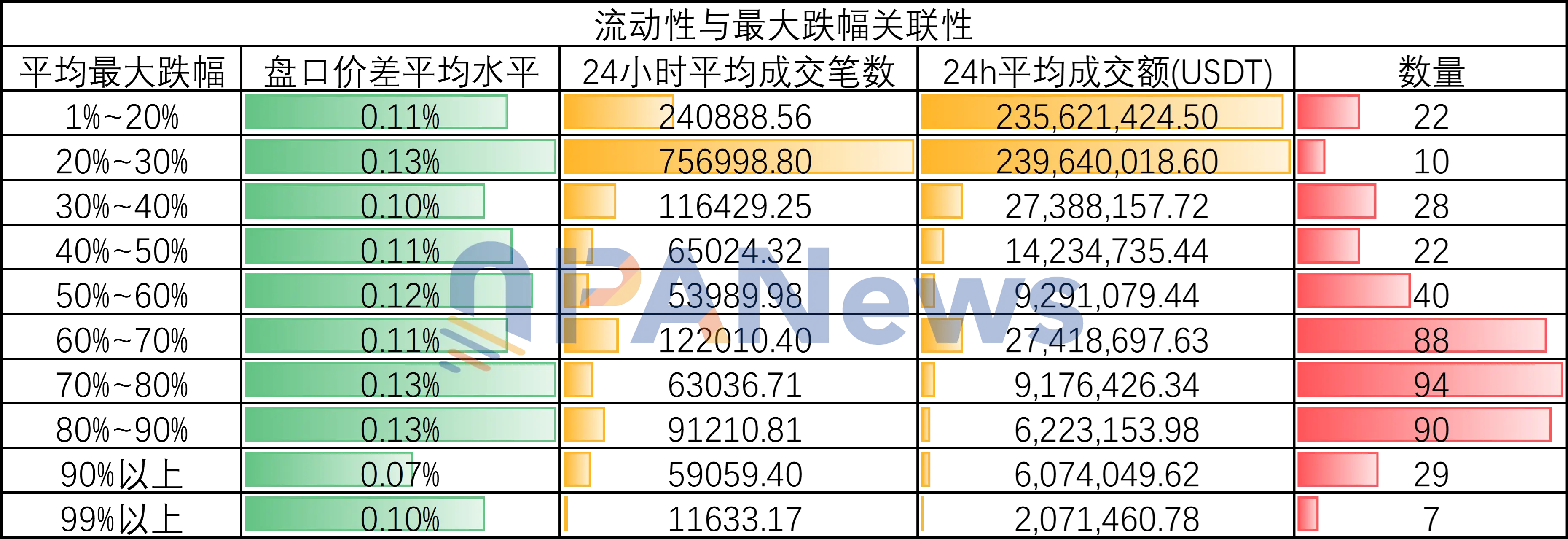

October 11 Data Observation After the Flash Crash: Liquidity and the Severity of the Big Dump Are Proportional, Prices Have Generally Recovered 80%

Author: Frank, PANews

Although more than ten days have passed, the flash crash on October 11th still leaves the marketplace unsettled. On that day, the prices of many tokens approached "zero" in a very short period, only to then experience violent rebounds of a thousand or even ten thousand times, causing extreme market panic.

How severe was this epic crash? Which categories of tokens were hit the hardest? Behind the astonishing rebound data, has the marketplace's "true" trauma already healed?

More importantly, is the widely speculated "liquidity exhaustion" truly the root cause of this crisis? To clarify the truth, PANews conducted a detailed data analysis of 430 spot trading pairs on Binance from October 10th to October 20th. This article will reveal the facts behind this extreme market condition through multi-dimensional data, layer by layer.

This data analysis uses Binance from October

PANews·2025-10-22 01:59

Analysis of the Epic Big Dump of Crypto Assets "1011": The Truth of the Market Collapse and Future Insights from Wintermute's Perspective

On October 11, 2025, the crypto assets market experienced an epic big dump, with Bitcoin rapidly falling from a high of $117,000, dropping below the critical psychological level of $110,000 in just a few hours. Ethereum saw a daily decline of up to 16%, while more alts experienced declines of 80% to 90% during extreme periods. This big dump led to the liquidation of $19 billion in crypto assets, with actual liquidation data potentially reaching $30-40 billion, far exceeding public statistics. As a central figure in this storm, Wintermute's founder and CEO Evgeny Gaevoy revealed the deep mechanisms behind the big dump and the true situation of market makers during extreme market conditions in a post-event interview.

MarketWhisper·2025-10-21 05:27

Cold Reflection After 10.11: How do exchanges balance "relative fairness" and "absolute transparency"?

Original: Odaily Odaily Daily

Author: Golem

Although the epic drop on "10.11" has come to an end and the market is gradually recovering, the single-day historical highest liquidation ($19.3 billion) created by this drop still casts a shadow over the market. Many investors believe that the outspoken Trump should take the blame, while others point fingers at Binance, insisting that the decoupling of USDE, BNSOL, and WBETH prices is the main reason for the further decline in the market.

Binance officials explained the decoupling issue as a temporary technical failure of some platform modules due to the overall market setback. As for the extreme low price situation in certain spot trading pairs, it was mainly caused by historical limit orders being triggered under one-sided liquidity, UI display precision issues, and other reasons.

Binance has taken responsibility for the platform, compensating users for the losses from collateral liquidation caused by the depegging of USDE, BNSOL, and WBETH.

HYPE1.12%

PANews·2025-10-16 01:05

Why did USDe survive while LUNA dropped to zero, despite both being stablecoins that lost their peg?

Original author: Mai Tong MSX Research Institute

The decoupling event in October 2025 and the intersection with Hayek's prophecy

On October 11, 2025, panic in the crypto market triggered an extreme shock to the synthetic stablecoin USDe — during the "epic crash" where Bitcoin plummeted from $117,000 to $105,900 (a single-day drop of 13.2%), and Ethereum fell sharply by 16% in one day, USDe briefly dropped to around $0.65 on October 11, 2025 (a decrease of about 34% compared to the $1 exchange rate), before recovering within a few hours. During the same period, the global crypto market saw a 24-hour liquidation amount surge to $19.358 billion, with 1.66 million traders forced to close positions, marking the largest single-day liquidation record in history.

From the perspective of micro market performance, the decentralized exchange Uni

MarsBitNews·2025-10-13 11:37

Trump TACO trading rescue! Taiwan stock market 26K defense battle, Nvidia bottleneck, full analysis of crypto world getting liquidated.

Trump threatened to impose a 100% tariff but suddenly softened, igniting a rebound in U.S. stock index futures with "TACO Trading" (Trump Always Chickens Out). After the long weekend, the Taiwan stock market faces pressure to fill the gap on Black Monday, with experts warning that the battle to defend 26,000 points has begun. Meanwhile, the Taipei City Government is working hard to retain NVIDIA's headquarters, China's rare earth controls are escalating, the Netherlands is freezing assets of Wentech, and there’s an epic Get Liquidated in the crypto world, causing the global market to be caught in multiple shocks.

MarketWhisper·2025-10-13 06:28

Epic market reversal after leveraged liquidation: funding rate falls to Bear Market low, Bitcoin and Ethereum stage a "short squeeze" spectacle.

Following the escalation of the China-US trade conflict last Friday, which triggered the largest ever $19 billion leveraged liquidation, the funding rates in the Crypto Assets derivatives market plummeted to the lowest levels seen during the Bear Market of 2022. On-chain analytics provider Glassnode reported that this is "one of the most severe leverage resets in crypto history." However, the ultra-low funding rates indicate that short positions have accumulated excessively, creating conditions for a subsequent "V-shaped" Rebound. As of Monday, Bitcoin has risen over 5% from its lows, while Ether has surged by as much as 12%, with market sentiment shifting to bullish, and the Long-Short Ratio has turned bullish dominant.

MarketWhisper·2025-10-13 04:04

Epic rebound! The total market capitalization of encryption returns to 4 trillion USD, SNX rises over 100%, and market optimism returns.

The cryptocurrency market has experienced a strong rebound after last Friday's nearly $500 billion market capitalization big dump. Last Sunday, the total market capitalization surged back to over $4 trillion. This round of rebound was led by mainstream blue-chip coins: Ethereum (ETH), BNB, and Dogecoin all saw daily rises of over 10%. Among them, Synthetix (SNX) even surged over 100%, breaking the price before the big dump and setting a new high for 2025. The trigger for this big dump was U.S. President Trump announcing a 100% tariff on Chinese goods. However, after Trump stated "not to worry about China," market sentiment quickly eased, and analysts are generally optimistic that this lays the foundation for Bitcoin to surge towards $200,000 by the end of 2025.

MarketWhisper·2025-10-13 01:24

Zcash (ZEC) Price Defies the Crash – the Real Reasons Behind Its Epic Run

Zcash price has been on an absolute tear. While most of the crypto market is still bleeding after last week’s $19 billion crash, ZEC is up more than 21% today, trading around $280 and climbing. It’s one of the few coins that seems completely unfazed by the chaos.

As trader @Toknex\_xyz put it

CaptainAltcoin·2025-10-12 12:34

Load More