# RiskManagement

9.47K

Dark_Angel

#StrategyBitcoinPositionTurnsRed

#StrategyBitcoinPositionTurnsRed

Bitcoin positions are turning red for many traders after the recent pullback, but this phase is more about strategy than panic.

When BTC retraces sharply, weak hands exit — while disciplined traders reassess risk, size, and key levels.

Historically, red positions during high-volatility phases often become opportunities if risk management is respected.

Key strategic points right now:

• Avoid over-leveraging during unstable momentum

• Focus on strong support zones instead of chasing rebounds

• Red positions don’t mean wrong posit

#StrategyBitcoinPositionTurnsRed

Bitcoin positions are turning red for many traders after the recent pullback, but this phase is more about strategy than panic.

When BTC retraces sharply, weak hands exit — while disciplined traders reassess risk, size, and key levels.

Historically, red positions during high-volatility phases often become opportunities if risk management is respected.

Key strategic points right now:

• Avoid over-leveraging during unstable momentum

• Focus on strong support zones instead of chasing rebounds

• Red positions don’t mean wrong posit

BTC-2,99%

- Reward

- 1

- Comment

- Repost

- Share

#FedLeadershipImpact 🌍 Macro Expectations Are Back in Focus

Inflation data, interest rate signals, and liquidity trends are once again shaping market sentiment — and crypto is feeling it.

At this stage, macro doesn’t decide every trade for me, but it clearly sets the context: • Liquidity tells me when to be aggressive or defensive

• Rates & dollar strength influence risk appetite

• Macro trends help separate short-term noise from structural moves

📊 My approach:

I let macro guide position sizing & patience, while price action and structure decide entries.

💬 How much weight do you give macro

Inflation data, interest rate signals, and liquidity trends are once again shaping market sentiment — and crypto is feeling it.

At this stage, macro doesn’t decide every trade for me, but it clearly sets the context: • Liquidity tells me when to be aggressive or defensive

• Rates & dollar strength influence risk appetite

• Macro trends help separate short-term noise from structural moves

📊 My approach:

I let macro guide position sizing & patience, while price action and structure decide entries.

💬 How much weight do you give macro

- Reward

- 1

- Comment

- Repost

- Share

#FedLeadershipImpact 🌍 Macro Expectations Are Back in Focus

Inflation data, interest rate signals, and liquidity trends are once again shaping market sentiment — and crypto is feeling it.

At this stage, macro doesn’t decide every trade for me, but it clearly sets the context: • Liquidity tells me when to be aggressive or defensive

• Rates & dollar strength influence risk appetite

• Macro trends help separate short-term noise from structural moves

📊 My approach:

I let macro guide position sizing & patience, while price action and structure decide entries.

💬 How much weight do you give macro

Inflation data, interest rate signals, and liquidity trends are once again shaping market sentiment — and crypto is feeling it.

At this stage, macro doesn’t decide every trade for me, but it clearly sets the context: • Liquidity tells me when to be aggressive or defensive

• Rates & dollar strength influence risk appetite

• Macro trends help separate short-term noise from structural moves

📊 My approach:

I let macro guide position sizing & patience, while price action and structure decide entries.

💬 How much weight do you give macro

- Reward

- 5

- 3

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

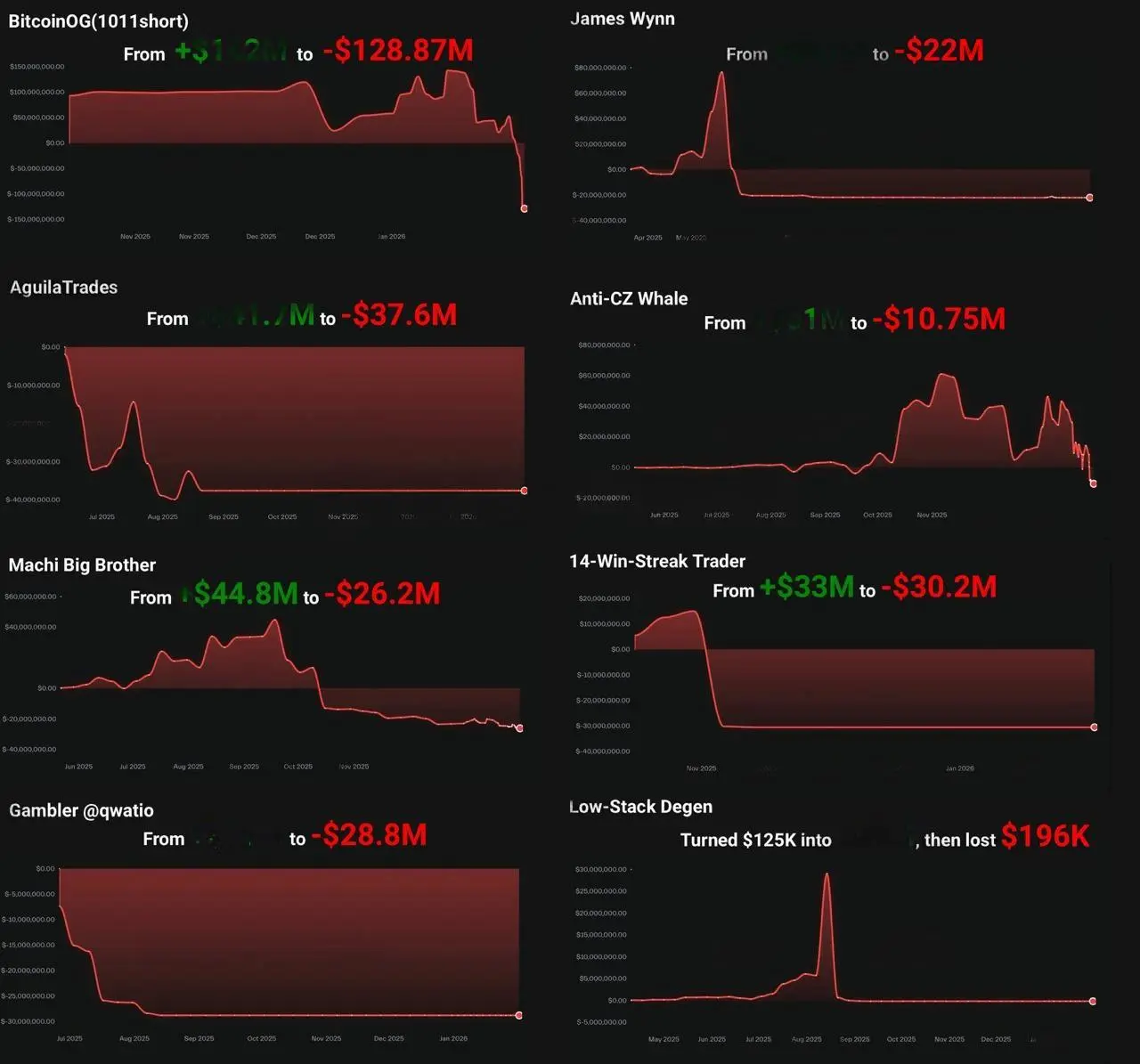

The market doesn't care about your past wins. 📉💀

This image is a brutal reminder that in crypto, your "streak" means nothing if you don't manage risk. From BitcoinOG losing $128M to a 14-win-streak trader ending up -$30M in the hole.

The Lesson:

Realized profits > Paper gains.

Leverage is a double-edged sword that eventually cuts deep.

The market can stay irrational longer than you can stay solvent.

Don't become a chart in someone else's "Rekt" compilation. Stay humble or the market will do it for you. 🏛️💸

#Crypto #TradingTips #Rekt #RiskManagement #Bitcoin

This image is a brutal reminder that in crypto, your "streak" means nothing if you don't manage risk. From BitcoinOG losing $128M to a 14-win-streak trader ending up -$30M in the hole.

The Lesson:

Realized profits > Paper gains.

Leverage is a double-edged sword that eventually cuts deep.

The market can stay irrational longer than you can stay solvent.

Don't become a chart in someone else's "Rekt" compilation. Stay humble or the market will do it for you. 🏛️💸

#Crypto #TradingTips #Rekt #RiskManagement #Bitcoin

BTC-2,99%

- Reward

- 2

- 2

- Repost

- Share

BitcoinEyes :

:

2026 GOGOGO 👊View More

$SOL BUY / LONG 🎯

Entry: 99 – 103

Take Profit: 107 – 108

Stop: Risk 3–5% of portfolio

Simple. Clean. No noise.

Defined risk, clear invalidation, solid R:R.

Manage your own position size.

Stick to your plan.

Over and out 🫡

#SOL #CryptoTrade #LongSetup #RiskManagement

Entry: 99 – 103

Take Profit: 107 – 108

Stop: Risk 3–5% of portfolio

Simple. Clean. No noise.

Defined risk, clear invalidation, solid R:R.

Manage your own position size.

Stick to your plan.

Over and out 🫡

#SOL #CryptoTrade #LongSetup #RiskManagement

SOL-4,65%

- Reward

- 3

- Comment

- Repost

- Share

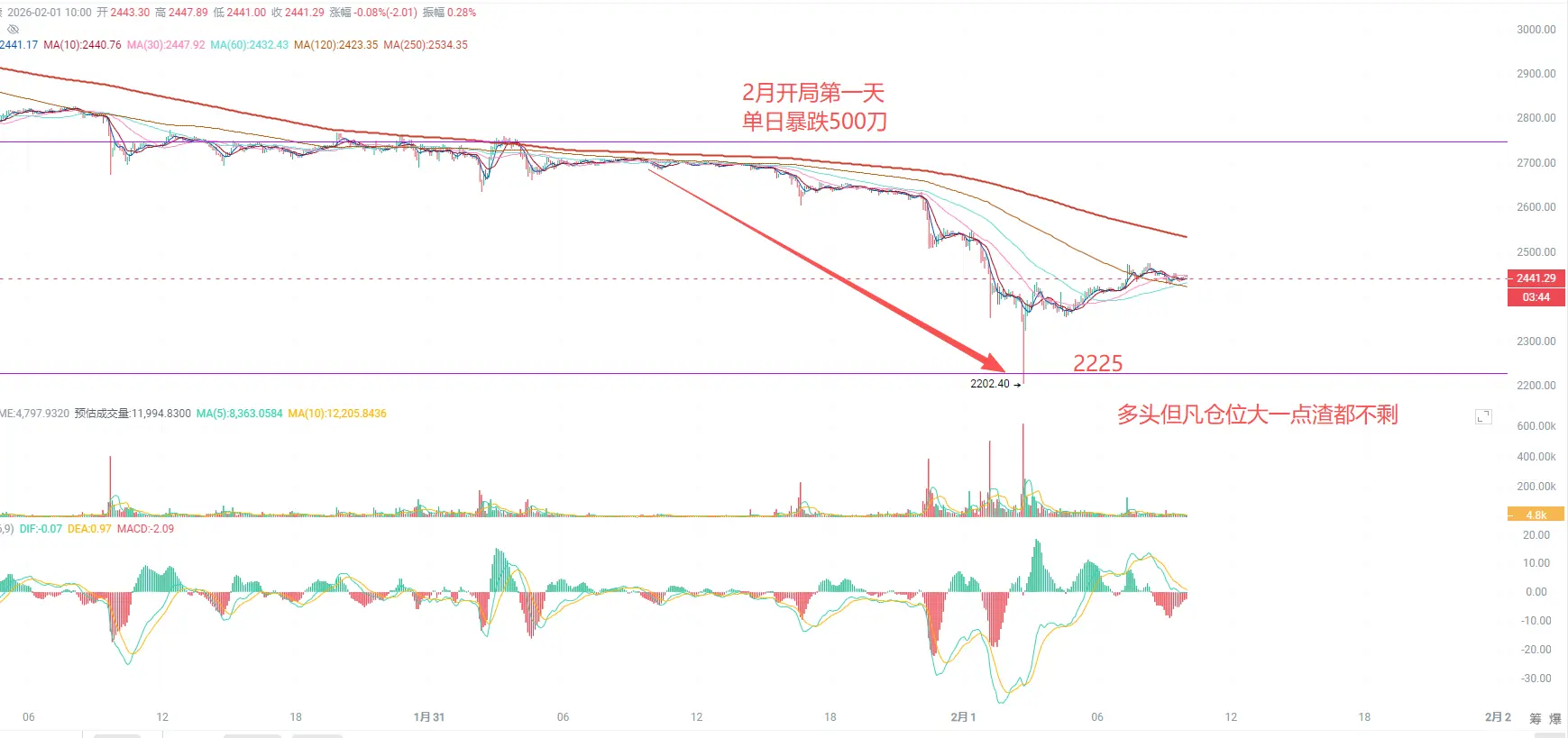

#CryptoMarketPullback #MarketVolatility ⚡

The crypto market is facing one of its toughest stress tests of early 2026.

Bitcoin has slipped below $80K, briefly touching the $75K–$78K zone — its weakest structure since mid-2025. Ethereum followed, sliding toward $2,400 as leveraged positions were aggressively flushed. Billions in liquidations erased over the weekend.

This isn’t just a random dip.

Macro pressure is building:

• Geopolitical instability

• Stronger U.S. dollar

• Fed uncertainty

• Risk-off capital rotation

Bitcoin is behaving like a high-beta tech asset — not digital gold — in this en

The crypto market is facing one of its toughest stress tests of early 2026.

Bitcoin has slipped below $80K, briefly touching the $75K–$78K zone — its weakest structure since mid-2025. Ethereum followed, sliding toward $2,400 as leveraged positions were aggressively flushed. Billions in liquidations erased over the weekend.

This isn’t just a random dip.

Macro pressure is building:

• Geopolitical instability

• Stronger U.S. dollar

• Fed uncertainty

• Risk-off capital rotation

Bitcoin is behaving like a high-beta tech asset — not digital gold — in this en

ETH-2,96%

- Reward

- 10

- 14

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#GT $BTC BTC $ETH我的周末交易计划#RiskManagement

One of the largest single-day liquidation events in crypto history has just been recorded, ranking inside the top ten of all time.

This level of destruction hasn’t been seen since the brutal cycles of 2021, when billions were wiped out in a matter of hours and hundreds of thousands of traders were forced out of the market.

If we review historical liquidation data, it becomes clear that bull markets are not gentle.

In fact, most of the top liquidation events happened during so-called bull runs, where leverage, greed, and overconfidence peaked at the sam

One of the largest single-day liquidation events in crypto history has just been recorded, ranking inside the top ten of all time.

This level of destruction hasn’t been seen since the brutal cycles of 2021, when billions were wiped out in a matter of hours and hundreds of thousands of traders were forced out of the market.

If we review historical liquidation data, it becomes clear that bull markets are not gentle.

In fact, most of the top liquidation events happened during so-called bull runs, where leverage, greed, and overconfidence peaked at the sam

- Reward

- 1

- Comment

- Repost

- Share

#GT $BTC BTC $ETH我的周末交易计划#RiskManagement

One of the largest single-day liquidation events in crypto history has just been recorded, ranking inside the top ten of all time.

This level of destruction hasn’t been seen since the brutal cycles of 2021, when billions were wiped out in a matter of hours and hundreds of thousands of traders were forced out of the market.

If we review historical liquidation data, it becomes clear that bull markets are not gentle.

In fact, most of the top liquidation events happened during so-called bull runs, where leverage, greed, and overconfidence peaked at the sam

One of the largest single-day liquidation events in crypto history has just been recorded, ranking inside the top ten of all time.

This level of destruction hasn’t been seen since the brutal cycles of 2021, when billions were wiped out in a matter of hours and hundreds of thousands of traders were forced out of the market.

If we review historical liquidation data, it becomes clear that bull markets are not gentle.

In fact, most of the top liquidation events happened during so-called bull runs, where leverage, greed, and overconfidence peaked at the sam

BTC-2,99%

- Reward

- 7

- 9

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

I👉 blew my first account because I traded without a plan.

Now👉 I follow one rule:

Protect capital first. Profit comes second.

Currencies don’t care about your emotions.

They reward discipline.

Support this post if you believe trading is a skill,

not a casino.

#CurrencyTrading

#RiskManagement

#TraderPsychology

#DisciplineOverEmotion

#SmartTrading

Now👉 I follow one rule:

Protect capital first. Profit comes second.

Currencies don’t care about your emotions.

They reward discipline.

Support this post if you believe trading is a skill,

not a casino.

#CurrencyTrading

#RiskManagement

#TraderPsychology

#DisciplineOverEmotion

#SmartTrading

- Reward

- 22

- 2

- Repost

- Share

GateUser-d45ffbe2 :

:

1000x VIbes 🤑View More

🚀 #RIVERUp50xinOneMonth — Momentum Surge or Speculative Spike?

RIVER’s 50x rally in 30 days has grabbed everyone’s attention. Extreme gains demand analysis, not emotion.

🔹 Why it happened:

• Low initial market cap → small inflows, huge moves

• Concentrated liquidity → amplified volatility

• Narrative & social buzz driving hype

• Speculative capital chasing high-risk plays

📊 After a parabolic run:

• Price discovery unstable

• Early investors take profits

• Late entrants face asymmetric downside

⚠️ Trader Risks:

• Thin order books → sudden multi-digit drops

• Profit-taking & hype fade → liqui

RIVER’s 50x rally in 30 days has grabbed everyone’s attention. Extreme gains demand analysis, not emotion.

🔹 Why it happened:

• Low initial market cap → small inflows, huge moves

• Concentrated liquidity → amplified volatility

• Narrative & social buzz driving hype

• Speculative capital chasing high-risk plays

📊 After a parabolic run:

• Price discovery unstable

• Early investors take profits

• Late entrants face asymmetric downside

⚠️ Trader Risks:

• Thin order books → sudden multi-digit drops

• Profit-taking & hype fade → liqui

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

62 Popularity

86 Popularity

70 Popularity

74 Popularity

78 Popularity

82 Popularity

86 Popularity

21.46K Popularity

9.03K Popularity

9.13K Popularity

1.04K Popularity

2.54K Popularity

16.07K Popularity

89 Popularity

225.69K Popularity

News

View MoreSolana co-founder changes profile picture to include Backpack elements, community speculates that Backpack TGE is approaching

1 m

Gate DEX launches Peak Experience Officer selection, with a top reward of 200 USDT

2 m

Tom Lee responds to Bitmine's $6.6 billion unrealized loss: unrealized losses are not a system flaw but part of the product design.

5 m

Base: Resolved the network outage issue on January 31 through rollback changes, caused by transaction propagation configuration changes leading to transaction delays.

5 m

Prediction Market BLUFF completes $21 million funding round, led by 1kx

20 m

Pin